Cast Elastomer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427312 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Cast Elastomer Market Size

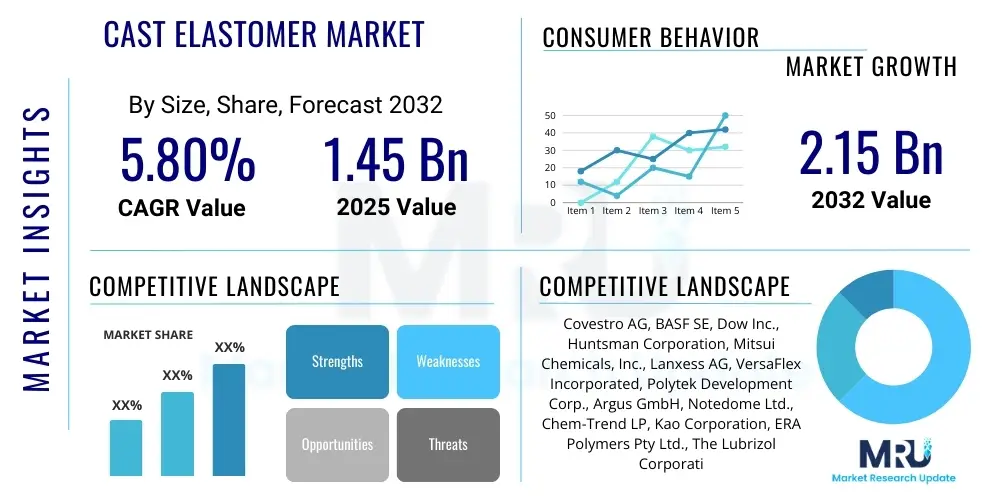

The Cast Elastomer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.45 billion in 2025 and is projected to reach USD 2.15 billion by the end of the forecast period in 2032. This growth trajectory underscores the increasing global demand for high-performance materials across diverse industrial applications, reflecting expanding manufacturing capabilities and the continuous need for durable and resilient components capable of operating in challenging environments. The markets expansion is further fueled by technological advancements in material science, leading to the development of new formulations with enhanced properties and broader applicability, contributing significantly to its upward valuation over the coming years.

Cast Elastomer Market introduction

Cast elastomers are a class of thermosetting polyurethane or polyurea polymers renowned for their exceptional physical properties, including superior abrasion resistance, high load-bearing capacity, excellent tear and cut resistance, and remarkable resilience. These materials are processed in a liquid state, poured into molds, and cured to form solid, durable components. Their unique combination of mechanical strength and elasticity makes them indispensable in demanding industrial environments where other materials typically fail. The versatility of cast elastomers allows for their formulation into various hardnesses and physical properties, catering to a broad spectrum of application requirements from soft, flexible components to rigid, high-strength parts. This adaptability ensures their continued relevance across numerous sectors globally.

Cast Elastomer Market Executive Summary

The global cast elastomer market is experiencing robust expansion, primarily driven by accelerated industrialization in emerging economies, alongside persistent demand from well-established sectors in developed regions. Business trends indicate a strong focus on sustainability and performance optimization, with manufacturers investing heavily in bio-based materials and advanced formulations that offer extended product lifecycles and reduced environmental impact. Regional trends highlight Asia-Pacific as the leading growth hub, propelled by its burgeoning manufacturing and infrastructure development, while North America and Europe continue to prioritize high-value, specialized applications that leverage the unique attributes of cast elastomers. The markets segmentation by product type, application, and end-use industry reveals a diversified landscape, with polyether-based systems gaining traction due to their enhanced hydrolytic stability and dynamic performance. Overall, the market is poised for sustained growth, underpinned by innovation, strategic partnerships, and a global shift towards more durable and efficient industrial solutions.

AI Impact Analysis on Cast Elastomer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the cast elastomer market frequently explore its potential to revolutionize material discovery, optimize manufacturing processes, and enhance product performance prediction. Common themes include the acceleration of R&D cycles through AI-driven molecular modeling, the improvement of quality control via real-time data analytics, and the streamlining of supply chain logistics. Concerns often revolve around the significant initial investment required for AI integration, the complexity of data management, and the necessity for specialized expertise to effectively implement and manage AI solutions within traditional manufacturing environments. Despite these challenges, there is a strong expectation that AI will be a transformative force, leading to the development of novel elastomer formulations with unprecedented properties, more efficient production, and ultimately, a more competitive and innovative market landscape. This anticipation stems from AIs capability to process vast datasets, identify complex patterns, and generate actionable insights far beyond human capacity, thereby unlocking new possibilities for material innovation and application.

- AI-driven material discovery: Accelerating the identification and design of new cast elastomer formulations with enhanced properties, reducing time-to-market for innovative products.

- Predictive analytics for performance: Utilizing machine learning to forecast material degradation, optimize lifespan, and tailor elastomer properties for specific operational conditions, improving product reliability.

- Manufacturing process optimization: Implementing AI algorithms to fine-tune casting parameters, such as temperature, pressure, and curing times, leading to reduced waste, increased efficiency, and consistent product quality.

- Supply chain and inventory management: Leveraging AI for demand forecasting, raw material procurement, and logistics optimization, minimizing lead times and mitigating supply chain disruptions.

- Automated quality control and inspection: Deploying AI-powered vision systems for real-time defect detection and quality assurance, ensuring compliance with stringent industry standards and reducing manual inspection efforts.

- Simulation and virtual prototyping: Employing AI to simulate the performance of cast elastomer components under various stress conditions, facilitating rapid design iterations and minimizing the need for physical prototypes.

DRO & Impact Forces Of Cast Elastomer Market

The cast elastomer market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory and competitive dynamics. Key drivers include the escalating demand from heavy industries such as mining, construction, and oil & gas, which require durable and high-performance components to withstand extreme operating conditions and extend equipment lifespan. The automotive sectors continuous evolution, particularly in electric vehicles, also drives demand for lighter, more resilient, and vibration-damping materials. Additionally, the inherent benefits of cast elastomers, such as their superior abrasion, impact, and chemical resistance, coupled with their excellent load-bearing capabilities, make them preferred materials over traditional rubbers and plastics in a multitude of critical applications. This inherent material superiority positions them favorably for sustained market expansion as industrial requirements become more rigorous and specialized.

Despite the strong growth drivers, the market faces several notable restraints. Fluctuations in the prices of key raw materials, including polyols and isocyanates, which are often derived from petrochemicals, can significantly impact manufacturing costs and profit margins. Geopolitical instabilities and supply chain disruptions can exacerbate these price volatilities, introducing uncertainty for market players. Furthermore, stringent environmental regulations pertaining to the handling and disposal of certain precursor chemicals, particularly some isocyanates, pose challenges for manufacturers, necessitating investments in compliance and the development of greener alternatives. The specialized processing techniques required for cast elastomers also present a barrier to entry for new players, limiting competition and potentially hindering rapid innovation.

Opportunities within the cast elastomer market are emerging from various technological advancements and evolving market demands. The development of bio-based and sustainable cast elastomer formulations, utilizing renewable feedstocks, represents a significant growth avenue, aligning with global efforts towards environmental responsibility and offering a competitive edge. Advancements in additive manufacturing (3D printing) for elastomeric materials are opening up new possibilities for customized components with intricate geometries, enabling rapid prototyping and specialized applications. Moreover, the increasing adoption of automation and robotics in manufacturing processes, combined with the integration of smart materials, offers potential for enhanced efficiency and new product development. The exploration of new application areas in sectors such as renewable energy, medical devices, and advanced consumer goods also presents substantial untapped market potential for cast elastomer manufacturers.

Segmentation Analysis

The cast elastomer market is comprehensively segmented to reflect the diverse nature of its products, applications, and end-use industries, providing a granular view of market dynamics and growth potential within specific niches. This segmentation allows for a detailed understanding of how different material types, performance characteristics, and industry-specific demands influence market trends and investment strategies. The primary segmentation categories typically include product type, which differentiates between various chemical formulations like MDI-polyether and TDI-polyester, each offering distinct advantages in terms of properties and processing. Further segmentation by end-use industry, such as mining, automotive, and construction, highlights the critical sectors driving demand, while application-based segmentation, like wheels, rollers, seals, and gaskets, identifies specific component needs. These detailed breakdowns are crucial for strategic market analysis and product development.

- By Product Type:

- MDI-Polyether: Known for excellent hydrolytic stability, good dynamic performance, and low-temperature flexibility, suitable for seals, wheels, and rollers in wet environments.

- TDI-Polyether: Offers a balance of mechanical properties, good resilience, and processing ease, often used in general industrial applications and wear parts.

- MDI-Polyester: Provides superior abrasion resistance, high tensile strength, and good heat resistance, ideal for mining screens, scraper blades, and heavy-duty industrial components.

- TDI-Polyester: Characterized by very high abrasion resistance and tear strength, making it suitable for tough applications like solid tires, cutting pads, and impact absorption components.

- Aliphatic Isocyanates: Utilized for applications requiring excellent UV stability and non-yellowing properties, often in outdoor or aesthetic applications.

- By End-Use Industry:

- Industrial: Encompasses a broad range of general manufacturing and machinery, utilizing cast elastomers for various functional components.

- Automotive: Employed in suspension systems, bushings, seals, and noise/vibration dampening components due to durability and resilience.

- Mining: Critical for wear parts, conveyor belts, screen decks, and impact absorption pads due to extreme abrasion resistance.

- Oil & Gas: Used in seals, gaskets, pipeline pigs, and risers requiring chemical resistance and high-pressure tolerance.

- Construction: Applied in concrete molds, vibration pads, heavy-duty tires for equipment, and sealing applications for durability.

- Agriculture: Utilized in components for farm machinery requiring wear resistance and resilience in demanding outdoor conditions.

- Consumer Goods: Niche applications requiring specific tactile properties, durability, or aesthetic appeal.

- By Application:

- Wheels and Rollers: For forklifts, conveyors, and heavy-duty industrial equipment, benefiting from high load capacity and abrasion resistance.

- Seals and Gaskets: Critical for preventing leaks and maintaining integrity in hydraulic systems, engines, and industrial machinery.

- Wear Parts: Components subjected to high friction and impact, such as scraper blades, chutes, and liners in mining and industrial settings.

- Bearings: Used in specialized bearing applications where quiet operation, low friction, and high load capacity are required.

- Linings: Protective linings for chutes, hoppers, and tanks to prevent wear and corrosion.

- Solid Tires: For industrial vehicles like forklifts, offering puncture resistance and high load capacity.

- By Raw Material:

- Polyols (Polyester, Polyether): Form the soft segment of the elastomer, determining flexibility, resilience, and hydrolytic stability.

- Isocyanates (MDI, TDI): Form the hard segment, influencing hardness, strength, and chemical resistance.

Cast Elastomer Market Value Chain Analysis

The cast elastomer markets value chain is a complex ecosystem beginning with the meticulous sourcing of raw materials, primarily polyols (both polyester and polyether varieties) and isocyanates (such as MDI and TDI), from specialized chemical suppliers. This upstream segment is critical, as the quality and consistency of these precursors directly influence the final properties and performance of the cast elastomer. Key raw material suppliers invest heavily in research and development to produce high-grade chemicals, often offering a diverse portfolio to meet specific formulation requirements across various applications. Effective supplier relationships and robust supply chain management are paramount to ensure stable supply, control costs, and maintain production continuity for elastomer manufacturers, particularly given the volatility of petrochemical-derived raw material prices.

Moving downstream, manufacturers specialize in formulating and producing diverse cast elastomer systems, often tailored to specific application requirements. This stage involves blending, reaction, and casting processes, resulting in a wide array of products with varying hardness, resilience, and chemical resistance. Manufacturers leverage proprietary technologies and expertise to optimize these formulations for performance, durability, and processing efficiency. This stage adds significant value through proprietary formulations and manufacturing know-how, transforming raw chemicals into high-performance materials.

Distribution channels for cast elastomers are multifaceted, encompassing both direct sales to large industrial end-users and indirect channels through specialized distributors, agents, and fabricators. Direct engagement allows for close technical support and customized solutions, while indirect networks ensure broader market penetration and efficient supply to smaller or geographically dispersed customers. These channels are crucial for connecting the specialized product with diverse industrial applications globally. The efficiency and collaboration across these value chain segments are vital for overall market effectiveness and customer satisfaction.

Cast Elastomer Market Potential Customers

The cast elastomer market serves a broad and diverse spectrum of potential customers, predominantly within heavy industrial sectors that require materials capable of withstanding extreme operational conditions and providing superior durability. A significant segment comprises manufacturers and operators in the mining industry, who utilize cast elastomer components for wear parts in excavators, linings for chutes and hoppers, conveyor belt systems, and screen decks. These customers seek solutions that offer exceptional abrasion resistance, impact absorption, and extended service life to reduce downtime and maintenance costs in harsh, abrasive environments. Similarly, the oil and gas sector represents a critical customer base, relying on cast elastomers for high-performance seals, gaskets, pipeline pigs, and anti-corrosion linings due to their chemical resistance, high-pressure tolerance, and reliability in demanding upstream and downstream applications.

Beyond the resource extraction industries, the automotive and transportation sectors are substantial consumers, particularly for specialized applications. Manufacturers of heavy-duty vehicles, industrial trucks, and passenger cars employ cast elastomers in suspension bushings, engine mounts, noise and vibration dampening components, and solid tires for material handling equipment. These customers prioritize materials that provide excellent dynamic properties, resilience, fatigue resistance, and the ability to enhance ride comfort and vehicle longevity. The construction industry also forms a key customer segment, utilizing cast elastomers for concrete molds, vibration isolation pads for heavy machinery, specialized seals, and protective coatings, where robust performance and resistance to environmental factors are paramount for infrastructural durability.

Furthermore, general industrial machinery manufacturers, agricultural equipment producers, and companies involved in material handling and logistics are significant potential customers. They integrate cast elastomer components such as industrial wheels, rollers, drive couplings, and protective linings into their products to improve efficiency, reduce wear, and extend the operational life of their equipment. The versatility of cast elastomers, coupled with their customizability in terms of hardness, color, and specific properties, allows them to address highly niche requirements across a multitude of manufacturing and service industries. Customers are increasingly focused on total cost of ownership, making the long-lasting and high-performance attributes of cast elastomers a compelling value proposition across all these diverse end-user applications.

Cast Elastomer Market Key Technology Landscape

The cast elastomer market is underpinned by a dynamic and evolving technology landscape, driven by continuous innovation aimed at enhancing material performance, improving manufacturing efficiency, and addressing sustainability mandates. A primary area of technological advancement involves novel polyol and isocyanate chemistries. This includes the development of bio-based polyols derived from renewable resources, which offer a greener alternative to petroleum-based precursors, reducing the environmental footprint of cast elastomers. Concurrently, advancements in low-free MDI (methylene diphenyl diisocyanate) and other specialty isocyanates are leading to safer processing environments and products with reduced toxicity profiles, catering to stringent health and safety regulations. These innovations in foundational chemistries are critical for pushing the boundaries of material properties, such as hydrolytic stability, temperature resistance, and dynamic performance, enabling cast elastomers to meet increasingly demanding application requirements.

Processing technologies also represent a significant area of innovation within the cast elastomer sector. Advances in automated metering, mixing, and dispensing equipment ensure greater precision in component ratios, leading to more consistent product quality and reduced material waste. High-speed mixing heads and vacuum degassing systems are becoming more sophisticated, allowing for the efficient production of void-free parts with superior mechanical properties. Furthermore, innovations in mold design and release agents contribute to faster demolding times and improved surface finishes, streamlining the overall manufacturing process. The integration of real-time monitoring and control systems, often leveraging sensor technology, enables manufacturers to precisely manage reaction kinetics and curing profiles, thereby optimizing production cycles and ensuring consistent output for high-volume or complex component manufacturing.

Emerging technologies, particularly in the realm of advanced manufacturing and digital integration, are poised to further transform the cast elastomer market. Additive manufacturing (3D printing) of castable polyurethane and polyurea formulations is gaining traction, offering unprecedented design freedom for complex geometries and custom-tailored parts. This technology enables rapid prototyping, on-demand production of specialized components, and the creation of parts with integrated functionalities that were previously impossible to achieve with conventional casting methods. Additionally, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive material design, process optimization, and quality assurance is becoming more prevalent. These digital tools enable faster R&D, more efficient manufacturing, and enhanced product performance prediction, fundamentally altering how cast elastomers are conceived, produced, and deployed in diverse industrial applications, driving the market towards greater innovation and efficiency.

Regional Highlights

- Asia-Pacific: Dominates the global cast elastomer market, driven by rapid industrialization, robust manufacturing growth, and significant infrastructure development across countries like China, India, Japan, and South Korea. The regions expanding automotive, mining, and construction sectors create a substantial demand for durable and high-performance materials. Government initiatives supporting manufacturing and urbanization further fuel market expansion, making it a key focus area for investment and technological advancement in elastomer production.

- North America: Represents a mature yet steadily growing market, characterized by advanced industrial applications, particularly in the automotive, aerospace, oil & gas, and mining industries. The region emphasizes high-performance, specialty, and customized cast elastomer solutions that meet stringent quality and environmental standards. Investments in research and development, alongside a strong focus on advanced manufacturing techniques, ensure sustained demand for innovative elastomer products.

- Europe: A significant market for cast elastomers, propelled by stringent environmental regulations, a strong emphasis on sustainability, and continuous innovation in material science. Countries such as Germany, the UK, and France are leaders in automotive, industrial machinery, and renewable energy sectors, driving demand for high-quality and eco-friendly cast elastomer solutions. The regions focus on circular economy principles encourages the development of bio-based and recyclable elastomer formulations.

- South America: An emerging market with considerable growth potential, primarily driven by expanding mining activities, agricultural sector growth, and ongoing infrastructure development, particularly in countries like Brazil and Chile. Increasing industrialization and foreign investments are boosting demand for durable components in heavy machinery and construction projects. The market is also seeing a rise in demand for specialty elastomers tailored to specific regional industrial needs.

- Middle East & Africa: Represents an evolving market for cast elastomers, largely influenced by significant investments in the oil & gas sector, ongoing construction projects, and infrastructure expansion initiatives. Countries in the GCC region are leading the demand for high-performance elastomers used in pipelines, drilling equipment, and structural components. Economic diversification efforts and increasing industrialization are expected to further propel market growth in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cast Elastomer Market.- Covestro AG

- BASF SE

- Dow Inc.

- Huntsman Corporation

- Mitsui Chemicals, Inc.

- Lanxess AG

- VersaFlex Incorporated

- Polytek Development Corp.

- Argus GmbH

- Notedome Ltd.

- Chem-Trend LP

- Kao Corporation

- ERA Polymers Pty Ltd.

- The Lubrizol Corporation

- Shanghai Huifeng New Material Co., Ltd.

- Jiangsu Feixiang Chemical Co., Ltd.

Frequently Asked Questions

What are cast elastomers and their unique properties?

Cast elastomers are high-performance thermosetting polymers, typically polyurethanes or polyureas, distinguished by their liquid processing method where components are poured into molds and cured. Their unique properties include exceptional abrasion resistance, high load-bearing capacity, excellent tear and cut resistance, superior resilience, and strong chemical resistance, making them ideal for demanding industrial applications where durability and long-term performance are paramount. These materials can be formulated to achieve a wide range of hardnesses and physical characteristics, offering versatility unmatched by many traditional rubbers or plastics.

What are the primary applications of cast elastomers across industries?

Cast elastomers find extensive applications across a multitude of heavy industries due to their robust performance attributes. Key applications include industrial wheels and rollers for material handling, conveyor systems, and forklifts; seals, gaskets, and O-rings for hydraulic systems and pipelines; wear parts such as scraper blades, chute linings, and screen decks in mining and construction; and various components in the automotive sector, including suspension bushings and engine mounts. Their ability to withstand high impact, abrasion, and chemical exposure makes them indispensable in environments where durability and operational efficiency are critical for machinery and infrastructure.

What factors are driving the growth of the global cast elastomer market?

The global cast elastomer markets growth is primarily driven by several key factors. These include the escalating demand from robust industrial sectors such as mining, construction, and oil & gas, which require high-performance, long-lasting components. Rapid industrialization and urbanization in emerging economies, particularly in Asia-Pacific, are also fueling market expansion. Furthermore, the increasing adoption of cast elastomers in automotive applications, driven by the need for lightweight and durable materials, and continuous technological advancements leading to new product developments with enhanced properties, collectively contribute to the sustained market growth. Their inherent benefits in reducing maintenance costs and extending equipment lifespan also make them highly attractive to end-users.

What are the main types of cast elastomers and their respective uses?

The main types of cast elastomers are primarily categorized by their chemical composition, including MDI-polyether, TDI-polyether, MDI-polyester, and TDI-polyester systems. MDI-polyethers are favored for their excellent hydrolytic stability and dynamic performance, suitable for seals and rollers in wet conditions. TDI-polyethers offer a balance of properties and ease of processing for general industrial uses. MDI-polyesters provide superior abrasion resistance and high tensile strength, making them ideal for mining screens and heavy-duty wear parts. TDI-polyesters are known for exceptional abrasion and tear strength, often used in solid tires and impact absorption components. Aliphatic isocyanates are employed when UV stability and non-yellowing characteristics are required, particularly for outdoor or aesthetically sensitive applications.

How is sustainability impacting the cast elastomer market and related innovations?

Sustainability is significantly impacting the cast elastomer market, driving innovation towards environmentally friendlier solutions. This includes a growing focus on developing bio-based polyols derived from renewable resources, reducing reliance on fossil fuels. Manufacturers are also exploring the use of recycled materials and designing elastomers for recyclability at the end of their lifecycle. Furthermore, advancements in processing techniques aim to minimize waste, reduce energy consumption, and lower VOC emissions during production. These sustainability efforts are responding to increasingly stringent environmental regulations, corporate responsibility goals, and growing consumer and industrial demand for greener products, fostering a shift towards more eco-conscious material science and manufacturing practices within the industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager