Ceramic Adhesive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428212 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ceramic Adhesive Market Size

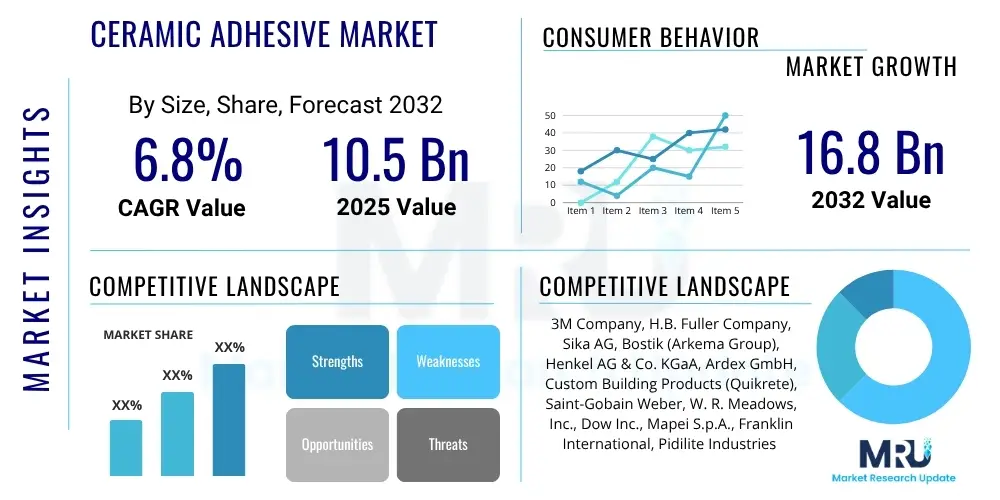

The Ceramic Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 10.5 Billion in 2025 and is projected to reach USD 16.8 Billion by the end of the forecast period in 2032. This sustained growth is primarily driven by expanding construction activities globally, particularly in residential and commercial sectors, coupled with increasing demand for aesthetic and durable flooring and walling solutions.

Ceramic Adhesive Market introduction

The Ceramic Adhesive Market encompasses a wide range of bonding agents specifically designed for the installation of ceramic tiles, porcelain tiles, natural stone, and other similar materials onto various substrates. These adhesives are formulated to provide strong, durable bonds, resisting moisture, temperature fluctuations, and mechanical stresses, thereby ensuring the longevity and structural integrity of tiled surfaces. The product spectrum includes cement-based adhesives, epoxy adhesives, polyurethane adhesives, and acrylic adhesives, each tailored for specific application requirements and environmental conditions. Their essential role in modern construction makes them indispensable for both new builds and renovation projects.

Major applications for ceramic adhesives span across numerous sectors, including residential buildings for kitchens, bathrooms, and living areas; commercial establishments like shopping malls, hotels, and offices; and industrial facilities requiring high-performance, chemical-resistant, and heavy-duty flooring. Furthermore, their use extends to specialized applications such as swimming pools, facades, and external cladding where resistance to extreme weather and water immersion is crucial. The versatility of ceramic adhesives allows for their application on a diverse array of substrates, including concrete, plywood, drywall, and existing tiled surfaces, significantly broadening their market utility.

The inherent benefits of high-quality ceramic adhesives include enhanced adhesion, improved flexibility, reduced installation time, and superior durability, contributing to lower long-term maintenance costs. Key driving factors influencing the market's trajectory include the global surge in urbanisation and population growth, leading to increased demand for housing and commercial infrastructure. Additionally, growing consumer preferences for aesthetically pleasing and low-maintenance interior and exterior finishes, coupled with rising disposable incomes in developing economies, are further propelling market expansion. Technological advancements in adhesive formulations, such as quick-setting and environmentally friendly options, also contribute significantly to market growth.

Ceramic Adhesive Market Executive Summary

The Ceramic Adhesive Market is currently experiencing robust growth, fueled by several overarching business trends. A significant trend is the increasing adoption of sustainable and low-VOC (Volatile Organic Compound) adhesive solutions, driven by stringent environmental regulations and a heightened awareness of indoor air quality. Manufacturers are investing heavily in research and development to offer eco-friendly products that meet global green building standards. Furthermore, the market is witnessing a shift towards ready-to-use and pre-mixed adhesives, which offer ease of application and reduced labor time, appealing to both professional contractors and DIY enthusiasts. The expansion of e-commerce platforms has also played a pivotal role in market accessibility and product distribution, especially for smaller projects and specialized products.

Regional trends exhibit diverse growth dynamics. The Asia Pacific region stands out as the largest and fastest-growing market, primarily due to rapid urbanization, massive infrastructure development projects, and a booming residential construction sector in countries like China, India, and Southeast Asian nations. North America and Europe, while more mature markets, are experiencing growth driven by renovation and remodeling activities, a strong emphasis on high-performance and specialty adhesives, and a robust demand for premium and aesthetically superior tiling solutions. Latin America and the Middle East & Africa regions are also showing promising growth, attributed to increasing foreign investments in real estate, tourism-related construction, and a growing middle-class population that demands modern housing and commercial spaces.

Segment-wise, the market sees distinct trends. Cement-based adhesives continue to dominate due to their cost-effectiveness and widespread use in traditional tiling applications, but epoxy and polyurethane-based adhesives are gaining traction in specialized, high-performance, and industrial applications requiring superior chemical resistance and strength. The residential sector remains the largest end-use segment, propelled by new housing starts and extensive renovation activities. However, the commercial and infrastructure sectors are demonstrating strong growth, driven by large-scale projects like airports, hospitals, and shopping complexes that demand durable and long-lasting tiling solutions. Innovation in application technologies, such as large format tile adhesives and flexible formulations, is also shaping segment growth, catering to evolving architectural and design preferences.

AI Impact Analysis on Ceramic Adhesive Market

The integration of Artificial Intelligence (AI) into the Ceramic Adhesive Market is prompting a paradigm shift across various operational facets, addressing user questions related to efficiency, quality, and innovation. Common inquiries revolve around AI's ability to optimize material formulations, predict market demand, enhance supply chain logistics, and automate quality control processes. Users are keen to understand how AI can lead to more sustainable adhesive products, reduce waste, and improve the consistency and performance of ceramic adhesives. There's also a significant interest in AI's role in personalized product development, where adhesives can be tailored to specific project requirements or environmental conditions, alongside its potential to streamline manufacturing and reduce operational costs. The overarching expectation is that AI will introduce unprecedented levels of precision, responsiveness, and strategic foresight into the industry, allowing for more informed decisions and accelerated product cycles.

- AI-driven Predictive Analytics: Optimizing adhesive formulations by analyzing vast datasets of material properties, environmental conditions, and performance metrics to predict the best composition for specific applications, reducing trial-and-error in R&D.

- Automated Quality Control: Implementing AI-powered vision systems and sensors on production lines to detect defects, inconsistencies, and ensure precise mixing ratios, leading to higher product quality and reduced waste.

- Supply Chain Optimization: Utilizing AI algorithms for demand forecasting, inventory management, and logistics planning, minimizing lead times, reducing storage costs, and ensuring timely delivery of raw materials and finished products.

- Personalized Product Development: AI tools can analyze customer needs, project specifications, and environmental data to recommend or design custom adhesive solutions, catering to niche markets and unique architectural demands.

- Smart Manufacturing Processes: AI-controlled robotic systems for precise mixing, packaging, and handling of ceramic adhesives, improving production efficiency, reducing human error, and ensuring worker safety in hazardous environments.

- Sustainable Formulation Innovation: AI can accelerate the development of eco-friendly adhesives by identifying sustainable raw material alternatives and optimizing formulations to reduce VOC emissions and enhance biodegradability, aligning with green building standards.

- Market Trend Analysis: AI algorithms can process and interpret vast amounts of market data, including consumer preferences, competitor activities, and economic indicators, to provide accurate insights for strategic decision-making and product positioning.

DRO & Impact Forces Of Ceramic Adhesive Market

The Ceramic Adhesive Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. A primary driver is the burgeoning global construction industry, particularly the rapid pace of urbanization and infrastructure development in emerging economies. This sustained construction boom fuels demand for vast quantities of ceramic tiles and, consequently, the adhesives required for their installation. Furthermore, increasing consumer emphasis on home aesthetics, renovation activities, and the growing preference for durable and visually appealing tiling solutions in both residential and commercial spaces are significantly propelling market expansion. Technological advancements leading to improved adhesive performance, such as enhanced flexibility, faster setting times, and superior bond strength, also act as strong drivers, meeting the evolving demands of modern construction practices.

However, the market faces several significant restraints that could impede its growth. Fluctuations in raw material prices, particularly for petrochemical derivatives and cement, pose a considerable challenge, impacting manufacturing costs and, subsequently, product pricing. Stringent environmental regulations pertaining to VOC emissions and hazardous substances in adhesive formulations necessitate substantial R&D investments to develop compliant, eco-friendly products, which can increase production costs. Additionally, the availability of skilled labor for precise and efficient tile installation, particularly for large format tiles and complex designs, remains a persistent challenge in many regions, potentially slowing down project completion and indirectly affecting adhesive demand. Economic downturns or geopolitical instabilities can also temper construction activities, thereby dampening market growth.

Despite these challenges, the Ceramic Adhesive Market is abundant with opportunities for innovation and expansion. The increasing focus on green building initiatives and sustainable construction practices presents a lucrative avenue for manufacturers to develop and market bio-based, low-VOC, and energy-efficient adhesive solutions. The growing trend of smart cities and the demand for high-performance building materials create new niches for specialized adhesives that can withstand extreme conditions and offer enhanced durability. Furthermore, the expanding DIY (Do-It-Yourself) market, driven by accessible instructional content and user-friendly adhesive products, offers significant potential for market penetration. Geographical expansion into untapped emerging markets and strategic collaborations for technological advancements also represent substantial growth opportunities for industry players. The continuous need for repair and renovation in aging infrastructure across developed nations also provides a steady demand for ceramic adhesives.

Segmentation Analysis

The Ceramic Adhesive Market is highly segmented, providing a comprehensive view of its intricate structure based on various intrinsic and extrinsic factors. This segmentation allows for a detailed analysis of market dynamics, consumer preferences, and technological advancements across different product types, end-use industries, applications, and technologies. Understanding these segments is crucial for stakeholders to identify key growth areas, formulate targeted marketing strategies, and allocate resources effectively. The market's diverse applications and the evolving demands of construction and renovation projects necessitate a granular approach to market analysis, highlighting the unique contributions and growth trajectories of each segment.

- By Resin Type

- Epoxy-based: Known for superior chemical resistance, high bond strength, and durability, ideal for industrial and heavy-duty applications.

- Polyurethane-based: Offers excellent flexibility, adhesion to various substrates, and water resistance, suitable for outdoor and high-movement areas.

- Acrylic-based: Provides good adhesion, ease of use, and quick drying properties, often preferred for residential and light commercial tiling.

- Silicone-based: Characterized by extreme flexibility, weather resistance, and sealing properties, typically used for expansion joints and demanding exterior applications.

- Cementitious-based: The most common type, offering high compressive strength and cost-effectiveness, widely used for traditional tile installation.

- Others: Includes polymer-modified cementitious adhesives, reactive resin adhesives, and specialty formulations for niche applications.

- By End-Use Industry

- Residential: Encompasses new housing constructions, individual home renovations, and interior design projects for kitchens, bathrooms, and living spaces.

- Commercial: Includes offices, retail spaces, shopping malls, hotels, restaurants, and educational institutions, demanding durable and aesthetic flooring.

- Industrial: Covers factories, warehouses, laboratories, and processing plants requiring high-performance, chemical-resistant, and heavy-duty flooring solutions.

- Infrastructure: Involves public spaces such as airports, railway stations, hospitals, and public utilities where longevity and slip resistance are paramount.

- By Application

- Floor & Wall Tiling: The largest application segment, covering standard and large format tile installation on various internal and external surfaces.

- Countertops & Surfaces: Specialized adhesives for bonding ceramic and stone slabs in kitchen countertops, vanity tops, and other custom surface applications.

- Façades: High-performance adhesives designed for exterior cladding and facade applications, requiring resistance to weather, temperature, and structural movement.

- Repair & Renovation: Adhesives used for fixing loose tiles, patching, and restoration of existing tiled surfaces in both residential and commercial settings.

- Others: Includes applications in swimming pools, decorative elements, mosaics, and other specialized architectural features.

- By Technology

- Water-based: Environmentally friendly, easy to clean up, and low VOC, suitable for various indoor applications.

- Solvent-based: Offers strong initial grab and quick drying, though often associated with higher VOCs and more stringent safety precautions.

- Reactive: Two-component systems (e.g., epoxy, polyurethane) that cure through a chemical reaction, providing exceptional strength and durability.

- Hot-melt: Thermoplastic adhesives applied in a molten state, offering rapid bonding and often used in pre-fabrication or specific industrial processes.

Value Chain Analysis For Ceramic Adhesive Market

The value chain for the Ceramic Adhesive Market is a complex network of interconnected activities, beginning with the sourcing of raw materials and culminating in the end-user application. This intricate chain involves various stages, each adding value and contributing to the final product's quality and market availability. Upstream analysis focuses on the acquisition and processing of essential raw materials such as cement, polymers, resins (epoxy, polyurethane, acrylic), additives, and fillers. Key suppliers in this stage include chemical manufacturers, mineral extractors, and petroleum derivatives producers. The quality and cost of these raw materials significantly impact the final adhesive product, making strong supplier relationships and efficient procurement crucial. Innovations in sustainable raw material sourcing, such as recycled content or bio-based polymers, are increasingly influencing this upstream segment, driven by environmental mandates and consumer preferences.

Midstream activities involve the manufacturing and formulation of ceramic adhesives. This stage encompasses blending, mixing, and processing raw materials into finished adhesive products, which can range from dry-mix cementitious powders to ready-to-use liquid formulations. Manufacturers invest heavily in research and development to enhance product performance, improve application characteristics, and comply with evolving industry standards and environmental regulations. Quality control, packaging, and branding are also integral parts of this stage, ensuring product consistency and market appeal. The choice of manufacturing technology, automation levels, and adherence to certifications play a critical role in determining production efficiency, cost-effectiveness, and product differentiation within the competitive landscape.

Downstream analysis covers the distribution channels and the ultimate sale and application of ceramic adhesives. Products typically move from manufacturers to distributors, wholesalers, and then to retailers such as hardware stores, tile showrooms, and construction material suppliers. The market also features direct and indirect distribution models. Direct channels involve manufacturers selling directly to large construction companies, government contractors, or specialized industrial clients, often for large-scale projects, allowing for customized solutions and technical support. Indirect channels, which are more prevalent, leverage a network of intermediaries to reach a broader customer base, including small contractors, individual homeowners, and DIY enthusiasts. Effective logistics, warehousing, and strong retailer relationships are paramount for ensuring widespread product availability and market penetration. Post-sales support, technical guidance, and applicator training also contribute significantly to customer satisfaction and brand loyalty.

Ceramic Adhesive Market Potential Customers

The Ceramic Adhesive Market caters to a diverse range of potential customers, spanning across various sectors and user segments, each with unique needs and purchasing behaviors. Primarily, the market targets construction companies and professional contractors specializing in tiling, flooring, and interior/exterior finishing. These customers prioritize high-performance adhesives that offer durability, reliability, ease of application, and compliance with building codes and project specifications. Their purchasing decisions are often influenced by project scale, material compatibility, installation timelines, and the need for specialized adhesives for specific substrates or environmental conditions, such as waterproof adhesives for bathrooms or flexible adhesives for facades. Building strong relationships with these professional users through technical support and bulk purchasing options is crucial for manufacturers.

Another significant segment of potential customers includes architects, interior designers, and real estate developers. While not direct end-users of the adhesive, their specifications and material choices heavily influence the demand for certain types and brands of ceramic adhesives. Architects and designers often select adhesives based on aesthetic considerations, performance requirements for large format tiles or unique designs, and sustainability credentials. Developers, on the other hand, are driven by cost-effectiveness, speed of installation, and long-term durability to ensure property value and minimize maintenance. Manufacturers engage with these influencers through product presentations, samples, and by providing comprehensive technical data to ensure their products are specified in project designs.

The retail sector, encompassing hardware stores, home improvement centers, and tile showrooms, targets individual homeowners, DIY enthusiasts, and small-scale contractors. These customers typically seek user-friendly, versatile, and readily available adhesive solutions for smaller renovation projects, repairs, or home improvement tasks. Factors such as ease of use, clear instructions, competitive pricing, and brand reputation play a significant role in their purchasing decisions. The growing trend of DIY projects, supported by online tutorials and accessible product information, has expanded this customer base. Additionally, industrial clients, such as factories and processing plants, represent a niche but important customer group, requiring highly specialized adhesives that can withstand harsh chemical exposure, heavy machinery traffic, and extreme temperatures, emphasizing performance and safety above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10.5 Billion |

| Market Forecast in 2032 | USD 16.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, H.B. Fuller Company, Sika AG, Bostik (Arkema Group), Henkel AG & Co. KGaA, Ardex GmbH, Custom Building Products (Quikrete), Saint-Gobain Weber, W. R. Meadows, Inc., Dow Inc., Mapei S.p.A., Franklin International, Pidilite Industries Ltd., Terraco Group, CEMIX, C-Tec (The Original CT1), KeraKoll S.p.A., LATICRETE International, Inc., PPG Industries, Inc., BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Adhesive Market Key Technology Landscape

The technology landscape of the Ceramic Adhesive Market is characterized by continuous innovation aimed at enhancing performance, improving sustainability, and simplifying application processes. A significant technological focus is on developing advanced polymer modification techniques for cementitious adhesives. This involves incorporating specialized polymers, such as redispersible polymer powders, into cement-based formulations to improve flexibility, adhesion, water resistance, and workability. These advancements enable cementitious adhesives to meet the demands of modern tiling, including large format tiles, porcelain, and installations over challenging substrates like gypsum board or existing tiles, which require greater deformability and bond strength than traditional mortars. The goal is to combine the cost-effectiveness of cement with the high-performance attributes typically found in more expensive resin-based systems.

Another crucial area of technological advancement is in reactive adhesive systems, particularly epoxy and polyurethane-based formulations. Innovations here are geared towards faster curing times, lower VOC content, and enhanced resistance to chemicals, moisture, and extreme temperatures. Manufacturers are developing multi-component systems that offer extended open times for ease of application but cure rapidly once applied, addressing the needs of time-sensitive construction projects. Furthermore, research is focusing on improving the thixotropic properties of these adhesives, allowing for better slump resistance on vertical surfaces while maintaining ease of spread. The development of hybrid technologies, combining the benefits of different resin types, is also gaining traction, offering tailor-made solutions for highly demanding and specialized applications.

The push for sustainability is a strong driver of technological innovation, leading to the development of eco-friendly ceramic adhesives. This includes formulating low-VOC and formaldehyde-free products to comply with stringent environmental regulations and green building certifications, improving indoor air quality. Bio-based adhesives, utilizing renewable resources, are an emerging area of research, aiming to reduce the reliance on petroleum-derived raw materials. Furthermore, technologies that enable adhesives to be applied more efficiently, reducing material waste during installation, and those that contribute to the overall energy efficiency of buildings (e.g., adhesives for thermal insulation panels) are also part of this evolving landscape. The integration of nanotechnology to enhance adhesive properties, such as strength, durability, and crack resistance at a microscopic level, represents another frontier in ceramic adhesive technology, promising next-generation performance for a wide array of applications.

Regional Highlights

- North America: The Ceramic Adhesive Market in North America is driven primarily by a robust residential renovation and remodeling sector, coupled with steady commercial construction activity. Consumers increasingly prefer high-quality, durable, and aesthetically pleasing tiling solutions, boosting demand for advanced adhesive formulations. Strict environmental regulations encourage the adoption of low-VOC and sustainable products, pushing manufacturers towards green adhesive technologies. The DIY segment also plays a significant role, supported by accessible products and home improvement trends. Major investments in infrastructure upgrades further contribute to market growth, particularly for specialized, high-performance adhesives suitable for challenging climatic conditions and diverse substrates.

- Europe: Europe is a mature market characterized by a strong emphasis on sustainability, stringent environmental protection laws, and a preference for high-quality, long-lasting building materials. Growth is fueled by renovation projects in aging urban infrastructure, coupled with new construction adhering to energy-efficient and green building standards. The demand for technologically advanced adhesives, including flexible, fast-setting, and waterproof variants, is high due to evolving architectural designs and the widespread use of large-format tiles. Germany, France, and the UK are key contributors, with a focus on product innovation and adherence to European Union regulations, driving market towards eco-friendly and high-performance solutions.

- Asia Pacific (APAC): The Asia Pacific region represents the largest and fastest-growing market for ceramic adhesives, propelled by unprecedented urbanization, rapid population growth, and massive infrastructure development projects, particularly in China, India, and Southeast Asian countries. The burgeoning middle-class population and increasing disposable incomes are fueling a surge in residential and commercial construction, leading to high demand for tiling materials. While cost-effectiveness remains a key factor, there has been a growing shift towards higher quality and performance adhesives for improved durability and aesthetics. Government initiatives supporting affordable housing and smart city projects further stimulate market expansion.

- Latin America: The Ceramic Adhesive Market in Latin America is witnessing steady growth, largely attributed to increasing investments in residential and commercial construction, coupled with growing tourism infrastructure projects. Economic development and urbanization in countries like Brazil, Mexico, and Argentina are leading to increased demand for modern housing and commercial spaces, driving the adoption of ceramic tiles and their adhesives. While the market is price-sensitive, there is a gradual shift towards better quality and performance products as construction standards improve. Infrastructure development projects, including transportation networks and public buildings, also contribute significantly to regional market expansion.

- Middle East and Africa (MEA): The MEA region's Ceramic Adhesive Market is expanding due to substantial investments in tourism, hospitality, and commercial infrastructure projects, particularly in the GCC countries. Diversification efforts away from oil economies, coupled with population growth, are driving numerous large-scale construction ventures. The demand for premium and specialized adhesives, capable of withstanding extreme climatic conditions and meeting high aesthetic standards for luxury developments, is prominent. In Africa, urbanization and increasing housing demand are creating significant growth opportunities, with a rising focus on durable and cost-effective tiling solutions. Regulatory changes aimed at improving building safety and efficiency are also shaping market dynamics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Adhesive Market.

- 3M Company

- H.B. Fuller Company

- Sika AG

- Bostik (Arkema Group)

- Henkel AG & Co. KGaA

- Ardex GmbH

- Custom Building Products (Quikrete)

- Saint-Gobain Weber

- W. R. Meadows, Inc.

- Dow Inc.

- Mapei S.p.A.

- Franklin International

- Pidilite Industries Ltd.

- Terraco Group

- CEMIX

- C-Tec (The Original CT1)

- KeraKoll S.p.A.

- LATICRETE International, Inc.

- PPG Industries, Inc.

- BASF SE

Frequently Asked Questions

What are the primary types of ceramic adhesives and their main applications?

The primary types of ceramic adhesives include cement-based, epoxy-based, polyurethane-based, acrylic-based, and silicone-based. Cement-based adhesives are widely used for traditional tiling in residential and commercial spaces due to their cost-effectiveness. Epoxy adhesives offer superior chemical resistance and strength for industrial and heavy-duty applications. Polyurethane adhesives provide excellent flexibility and water resistance for outdoor and high-movement areas, while acrylics are preferred for their ease of use in light commercial and residential settings. Silicone adhesives are typically used for expansion joints and demanding exterior sealing applications, offering extreme flexibility and weather resistance. Each type is formulated to cater to specific substrate requirements, environmental conditions, and performance demands.

Which industries are the largest consumers of ceramic adhesives, and why?

The largest consumers of ceramic adhesives are the residential and commercial construction industries. The residential sector drives demand through new housing construction, home renovations, and interior design projects for kitchens, bathrooms, and living areas, where ceramic tiles are a popular choice for durability and aesthetics. The commercial sector, encompassing offices, retail spaces, hotels, and educational institutions, also generates significant demand due to the need for durable, high-traffic flooring and wall solutions. These industries are major consumers because ceramic adhesives are essential for the reliable and long-lasting installation of a vast array of ceramic, porcelain, and natural stone tiles, meeting both functional and aesthetic requirements in modern building designs.

How do environmental regulations affect the ceramic adhesive market?

Environmental regulations significantly influence the ceramic adhesive market by driving the demand for sustainable, low-VOC (Volatile Organic Compound), and eco-friendly products. These regulations aim to reduce harmful emissions and promote better indoor air quality, compelling manufacturers to invest heavily in research and development to formulate adhesives that comply with stringent standards such such as LEED certification requirements. This push for green building materials leads to innovations in bio-based adhesives, water-based formulations, and products free from hazardous substances. While compliance can increase production costs, it also creates new market opportunities for companies that successfully develop and market environmentally responsible adhesive solutions, gaining a competitive edge and meeting the growing consumer and industry demand for sustainable construction practices.

What technological advancements are shaping the ceramic adhesive industry?

Technological advancements are profoundly shaping the ceramic adhesive industry, focusing on enhanced performance, sustainability, and ease of application. Key innovations include advanced polymer modification techniques for cementitious adhesives, improving flexibility, adhesion, and water resistance for modern tiling needs like large format tiles. Reactive adhesive systems (epoxy, polyurethane) are evolving with faster curing times, lower VOC content, and superior resistance to chemicals and extreme temperatures. There's also a significant trend towards hybrid adhesive technologies that combine the benefits of different resin types for specialized applications. Furthermore, the development of eco-friendly, bio-based adhesives, along with smart manufacturing processes leveraging AI for formulation optimization and quality control, are defining the future landscape of the ceramic adhesive market.

What are the key drivers for market growth in emerging economies?

The key drivers for market growth in emerging economies, particularly in the Asia Pacific, Latin America, and parts of the MEA region, include rapid urbanization, robust population growth, and massive infrastructure development. Increased disposable incomes and a burgeoning middle class lead to a higher demand for modern housing, commercial spaces, and improved living standards, fueling extensive construction activities. Government investments in infrastructure projects like transportation networks, smart cities, and public utilities further stimulate demand for building materials, including ceramic tiles and their adhesives. While cost-effectiveness remains a crucial factor, a growing awareness of product quality and aesthetics is also contributing to the adoption of more advanced and specialized ceramic adhesive solutions in these rapidly developing markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager