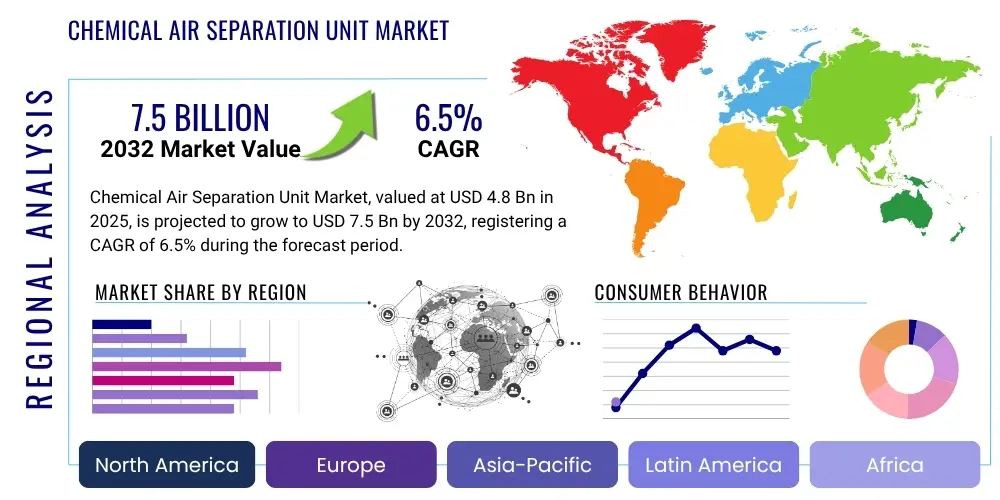

Chemical Air Separation Unit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429590 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Chemical Air Separation Unit Market Size

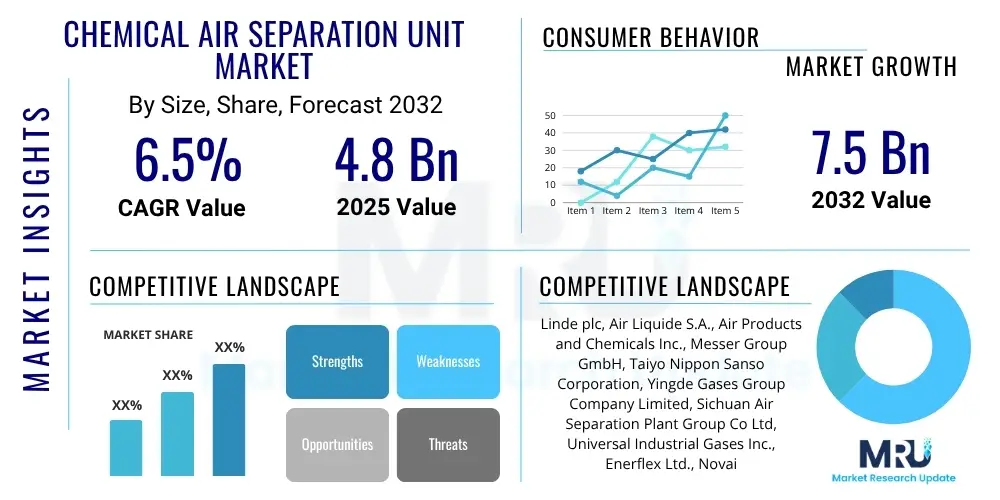

The Chemical Air Separation Unit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2032.

Chemical Air Separation Unit Market introduction

A Chemical Air Separation Unit (ASU) is an industrial facility designed to separate atmospheric air into its primary components, typically nitrogen, oxygen, and argon, as well as other rare gases like krypton and xenon. This separation is achieved primarily through cryogenic distillation, although non-cryogenic methods such as Pressure Swing Adsorption (PSA), Vacuum Pressure Swing Adsorption (VPSA), and membrane separation are also utilized, particularly for smaller scale applications or specific gas purity requirements. The fundamental product is a continuous supply of high-purity industrial gases essential across a myriad of sectors.

The major applications of these separated gases span diverse industries, including chemicals, metallurgy (steelmaking, welding), healthcare (medical oxygen), electronics (nitrogen for inert atmospheres), food and beverage (packaging, freezing), and energy (combustion enhancement, syngas production). The benefits of ASUs include their ability to produce gases at very high purities and in large volumes, offering a reliable and cost-effective source compared to traditional gas cylinder supplies. This inherent efficiency and scalability make them indispensable to modern industrial processes globally.

The market is predominantly driven by the ongoing expansion of manufacturing activities, particularly in developing economies, coupled with increasing demand for industrial gases across various end-user industries. Technological advancements aimed at enhancing energy efficiency, reducing operational costs, and developing more compact and modular units are further propelling market growth. Strict environmental regulations encouraging cleaner production processes and the push towards decarbonization also contribute to the adoption of advanced ASU technologies.

Chemical Air Separation Unit Market Executive Summary

The Chemical Air Separation Unit market is experiencing robust growth, primarily fueled by global industrial expansion and the critical demand for high-purity industrial gases across diverse sectors. Key business trends indicate a strong focus on automation, digitalization, and the development of energy-efficient and modular ASU designs to reduce operational costs and environmental impact. Strategic collaborations and mergers and acquisitions are frequently observed as companies seek to consolidate market share and enhance technological capabilities.

Regionally, Asia Pacific stands as the dominant market, driven by rapid industrialization, burgeoning chemical and metallurgical industries, and increasing investments in infrastructure in countries like China and India. North America and Europe also maintain significant market shares, characterized by advanced technological adoption, stringent environmental regulations, and a mature industrial base that continuously demands process optimization. Growth in Latin America and the Middle East and Africa is notable, spurred by emerging industrial clusters and investments in energy and petrochemical sectors.

In terms of segmentation, cryogenic separation technology continues to hold the largest share due to its capability to produce high-purity gases in large volumes. However, non-cryogenic methods, particularly PSA and VPSA, are gaining traction for medium to small-scale applications, offering flexibility and lower capital expenditure. The demand for oxygen and nitrogen remains paramount, with argon experiencing steady growth. End-use industries such as chemicals, metallurgy, and healthcare are the primary revenue contributors, with the electronics and food and beverage sectors showing promising growth trajectory.

AI Impact Analysis on Chemical Air Separation Unit Market

User inquiries regarding Artificial Intelligence (AI) in the Chemical Air Separation Unit (ASU) market frequently revolve around its potential to enhance operational efficiency, optimize production processes, and improve predictive maintenance capabilities. Key concerns often include the integration challenges with legacy systems, data security implications, and the return on investment for AI-driven solutions. Users are keen to understand how AI can minimize energy consumption, reduce downtime, and provide more precise control over gas purity and yield, ultimately leading to significant cost savings and improved reliability within complex ASU operations.

- AI-driven predictive maintenance forecasts equipment failures, reducing unplanned downtime and maintenance costs.

- Optimized process control through AI algorithms fine-tunes operational parameters, maximizing gas production efficiency and purity.

- Enhanced energy management systems powered by AI analyze consumption patterns, recommending adjustments for significant energy savings.

- Real-time data analytics from AI platforms provide actionable insights into ASU performance, enabling swift operational adjustments.

- Improved safety protocols are developed by AI through anomaly detection and risk assessment, minimizing operational hazards.

- Automated decision-making capabilities reduce human error and improve the responsiveness of ASU operations to demand fluctuations.

- Supply chain optimization through AI models ensures efficient logistics and inventory management for gas distribution.

DRO & Impact Forces Of Chemical Air Separation Unit Market

The Chemical Air Separation Unit market is significantly shaped by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, all subjected to broader impact forces. A primary driver is the accelerating industrialization across developing regions, leading to increased demand for essential industrial gases such as oxygen, nitrogen, and argon, particularly from the chemicals, metallurgy, and electronics sectors. Technological advancements focused on enhancing energy efficiency and reducing the environmental footprint of ASUs, coupled with the rising global focus on sustainability and green industrial practices, further propel market expansion. The continuous need for high-purity gases in critical applications like healthcare and specialized manufacturing also acts as a consistent demand driver.

Conversely, the market faces several notable restraints. High initial capital investment required for setting up large-scale ASU facilities can be a significant barrier to entry for new players and a challenge for existing ones looking to expand. The considerable energy consumption inherent in air separation processes leads to high operational costs, especially in regions with volatile energy prices. Furthermore, stringent environmental regulations regarding emissions and waste management, while driving innovation, can also add to the operational complexities and compliance costs for manufacturers. Geopolitical instability and fluctuations in global economic conditions also pose risks to investment and project timelines.

Opportunities for growth are abundant, particularly in the development of modular and compact ASU systems that cater to smaller-scale industrial needs and remote locations, offering greater flexibility and lower installation costs. The burgeoning market for green hydrogen production presents a significant avenue, as oxygen from ASUs can be a byproduct or directly utilized in hydrogen generation processes. Advancements in digitalization and the integration of Industry 4.0 technologies, including AI and IoT, offer pathways for enhanced operational efficiency, predictive maintenance, and overall system optimization. The expansion into emerging applications like carbon capture and utilization also provides fertile ground for market diversification and growth, positioning ASUs as critical components in the transition to a sustainable industrial future.

Segmentation Analysis

The Chemical Air Separation Unit market is comprehensively segmented to provide a detailed understanding of its various facets, enabling stakeholders to identify specific growth drivers and market trends. These segmentations typically involve categorizing the market based on the type of technology employed, the specific gas produced, the end-use industry utilizing these gases, and the operational capacity of the units. This granular analysis allows for a precise assessment of demand patterns, competitive landscapes, and technological preferences across different industrial applications and geographical regions, offering critical insights for strategic planning and investment decisions within the industrial gas sector.

- By Type

- Cryogenic Air Separation

- Non-Cryogenic Air Separation

- Pressure Swing Adsorption (PSA)

- Vacuum Pressure Swing Adsorption (VPSA)

- Membrane Separation

- By Gas

- Oxygen

- Nitrogen

- Argon

- Others (Krypton, Xenon, Neon)

- By End-Use Industry

- Chemicals

- Metallurgy

- Healthcare

- Electronics

- Food and Beverage

- Energy

- Glass

- Pulp and Paper

- Others

- By Capacity

- Small Scale (less than 200 TPD)

- Medium Scale (200-1000 TPD)

- Large Scale (more than 1000 TPD)

Value Chain Analysis For Chemical Air Separation Unit Market

The value chain for the Chemical Air Separation Unit (ASU) market begins with upstream activities involving the sourcing of critical components and raw materials necessary for manufacturing. This includes specialized equipment like compressors, expanders, heat exchangers, distillation columns, and adsorbers, along with associated instrumentation and control systems. Key players in this stage are often specialized engineering firms and component manufacturers that supply proprietary technologies and high-quality materials, ensuring the reliability and efficiency of the final ASU product. Research and development activities also play a crucial upstream role, driving innovation in separation technologies, energy efficiency, and modular designs.

Midstream operations encompass the design, engineering, fabrication, and construction of the ASU plants themselves. This phase involves complex project management, integration of various components, and rigorous testing to ensure operational integrity and compliance with safety standards. Leading industrial gas companies and specialized engineering, procurement, and construction (EPC) firms dominate this segment, leveraging their expertise to deliver customized solutions for diverse industrial clients. Their ability to manage large-scale projects and integrate advanced automation and control systems is paramount for successful plant commissioning.

Downstream activities focus on the distribution and end-use of the separated industrial gases. Once produced, oxygen, nitrogen, argon, and other gases are either piped directly to large industrial consumers situated adjacent to the ASU plant (on-site production) or transported via pipelines, cylinders, or cryogenic tanker trucks to various end-users. The distribution channels can be direct, involving long-term supply contracts between ASU operators and major industrial clients, or indirect, through third-party distributors that cater to smaller or geographically dispersed customers. End-users span a wide array of industries, including chemicals, metallurgy, healthcare, electronics, and food and beverage, each requiring specific gas purities and supply modes. The effectiveness of the downstream segment relies heavily on logistics, infrastructure, and strong customer relationships to ensure reliable and timely delivery of essential industrial gases.

Chemical Air Separation Unit Market Potential Customers

Potential customers for Chemical Air Separation Units (ASUs) are diverse and widespread, primarily comprising industrial entities that require a consistent and reliable supply of high-purity industrial gases for their core operations. These end-users span numerous critical sectors of the global economy, making ASUs an indispensable component of modern industrial infrastructure. The demand profile of these customers often dictates the scale and type of ASU technology deployed, ranging from large-scale cryogenic units for continuous, high-volume production to more flexible non-cryogenic systems for specific purity needs or smaller capacities.

Among the most prominent buyers are companies in the chemical and petrochemical industries, where oxygen and nitrogen are vital for various synthesis processes, oxidation reactions, and inerting applications. The metallurgy sector, particularly steel manufacturers and metal fabricators, extensively uses oxygen for combustion enhancement, decarbonization, and welding, while nitrogen provides inert atmospheres. Healthcare facilities, including hospitals and medical gas suppliers, are significant consumers of medical-grade oxygen, underscoring the critical nature of ASU reliability. The electronics industry relies heavily on ultra-high purity nitrogen for inert atmospheres in semiconductor manufacturing to prevent oxidation and contamination during production processes.

Other key end-users include the food and beverage industry, utilizing nitrogen for packaging, freezing, and inerting to extend product shelf-life, and the energy sector for applications like syngas production and combustion optimization in power plants. Glass manufacturing, pulp and paper production, and even emerging fields like carbon capture and green hydrogen production also represent growing segments of potential customers. The decision to invest in an ASU is typically driven by the need for economies of scale, guaranteed supply security, stringent purity requirements, and the desire to reduce long-term operational costs compared to purchasing gases from third-party suppliers, thereby establishing a direct, strategic partnership between the ASU provider and the industrial client.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde plc, Air Liquide S.A., Air Products and Chemicals Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Yingde Gases Group Company Limited, Sichuan Air Separation Plant Group Co Ltd, Universal Industrial Gases Inc., Enerflex Ltd., Novair, Gascon S.A., Hangzhou Oxygen Plant Group Co Ltd, Hubei Dali Special Automobile Co Ltd, Praxair Technology Inc, Cryotec Anlagenbau GmbH, Wuxi Huatong Air Separation Equipment Co Ltd, Suzhou Xinhang Air Separation Equipment Co Ltd, Beijing North Star Industrial Gases Co Ltd, Jiangsu Huaxi Air Separation Equipment Co Ltd, Chart Industries Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Air Separation Unit Market Key Technology Landscape

The Chemical Air Separation Unit market is characterized by a mature yet evolving technology landscape, dominated by cryogenic distillation but increasingly incorporating advanced non-cryogenic methods. Cryogenic air separation remains the gold standard for producing high-purity oxygen, nitrogen, and argon in large volumes, relying on cooling air to extremely low temperatures to liquefy and then distill its components. Continuous advancements in this area focus on improving energy efficiency through optimized heat exchanger designs, advanced refrigeration cycles, and integrated power generation systems that recover waste heat, thereby reducing operational costs and environmental impact. These large-scale units are critical for heavy industries like steel, chemicals, and petrochemicals, where consistent and voluminous gas supply is paramount.

Parallel to cryogenic technologies, non-cryogenic methods such as Pressure Swing Adsorption (PSA), Vacuum Pressure Swing Adsorption (VPSA), and membrane separation have gained significant traction, particularly for smaller to medium-scale applications and specific purity requirements. PSA and VPSA technologies utilize adsorbent materials to selectively remove nitrogen or oxygen from air under pressure, offering advantages such as lower capital expenditure, faster start-up times, and greater flexibility for on-site generation. Membrane separation, while generally offering lower purity compared to cryogenic or PSA, is valued for its simplicity, compactness, and continuous operation, often used for nitrogen generation in applications like inerting and packaging. Technological developments in these non-cryogenic segments focus on novel adsorbent materials with higher selectivity and capacity, as well as more durable and efficient membrane modules, enhancing their competitiveness and expanding their application scope.

Furthermore, the entire ASU technology landscape is being transformed by the integration of digitalization and Industry 4.0 principles. Advanced automation and control systems, powered by Artificial Intelligence (AI) and the Internet of Things (IoT), are becoming standard, enabling real-time monitoring, predictive maintenance, and optimized operational parameters for enhanced efficiency and reliability. Digital twins, sophisticated sensor networks, and big data analytics are facilitating smarter plant operations, reducing manual intervention, and providing deeper insights into performance. Energy recovery systems, such as expander-generators, are increasingly being adopted to capture and utilize waste energy, contributing to overall plant efficiency and sustainability objectives. The drive towards modular and standardized ASU designs also represents a significant technological trend, aiming to reduce installation times and costs, and providing greater adaptability for diverse industrial needs globally.

Regional Highlights

- Asia Pacific: Dominant market due to rapid industrialization, expansion of chemical, metallurgy, and electronics industries, and government initiatives supporting manufacturing growth in countries like China, India, and Southeast Asian nations.

- North America: Significant market share driven by advanced technological adoption, mature industrial base, focus on energy efficiency, and high demand from healthcare and electronics sectors, particularly in the United States and Canada.

- Europe: Characterized by stringent environmental regulations, emphasis on sustainable industrial practices, and strong demand from the chemical, automotive, and food and beverage industries, with Germany, France, and the UK as key contributors.

- Latin America: Emerging market with growth spurred by developing industrial infrastructure, increasing investments in the energy and mining sectors, and expanding manufacturing capabilities in Brazil and Mexico.

- Middle East and Africa (MEA): Growth driven by substantial investments in petrochemicals, oil and gas, and mining industries, particularly in Saudi Arabia, UAE, and South Africa, along with developing healthcare infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Air Separation Unit Market.- Linde plc

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Yingde Gases Group Company Limited

- Sichuan Air Separation Plant Group Co Ltd

- Universal Industrial Gases Inc.

- Enerflex Ltd.

- Novair

- Gascon S.A.

- Hangzhou Oxygen Plant Group Co Ltd

- Hubei Dali Special Automobile Co Ltd

- Praxair Technology Inc

- Cryotec Anlagenbau GmbH

- Wuxi Huatong Air Separation Equipment Co Ltd

- Suzhou Xinhang Air Separation Equipment Co Ltd

- Beijing North Star Industrial Gases Co Ltd

- Jiangsu Huaxi Air Separation Equipment Co Ltd

- Chart Industries Inc.

Frequently Asked Questions

What is a Chemical Air Separation Unit (ASU)?

A Chemical Air Separation Unit is an industrial facility that separates atmospheric air into its primary gaseous components, such as oxygen, nitrogen, and argon, typically for industrial and medical applications.

What are the main types of ASUs?

The primary types of ASUs are cryogenic air separation units, which use low temperatures for distillation, and non-cryogenic units, which include Pressure Swing Adsorption (PSA), Vacuum Pressure Swing Adsorption (VPSA), and membrane separation technologies.

Which industries primarily use ASU products?

Key industries include chemicals, metallurgy (steel production), healthcare (medical oxygen), electronics (nitrogen for inert atmospheres), food and beverage, and energy, all relying on high-purity industrial gases.

What drives the growth of the ASU market?

Market growth is driven by global industrialization, increasing demand for high-purity industrial gases, technological advancements in energy efficiency, and the expansion of key end-use industries.

How does sustainability impact ASU technology?

Sustainability drives innovation in ASUs by pushing for more energy-efficient designs, reduced carbon footprints, waste heat recovery systems, and the integration of these units into green hydrogen production and carbon capture processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager