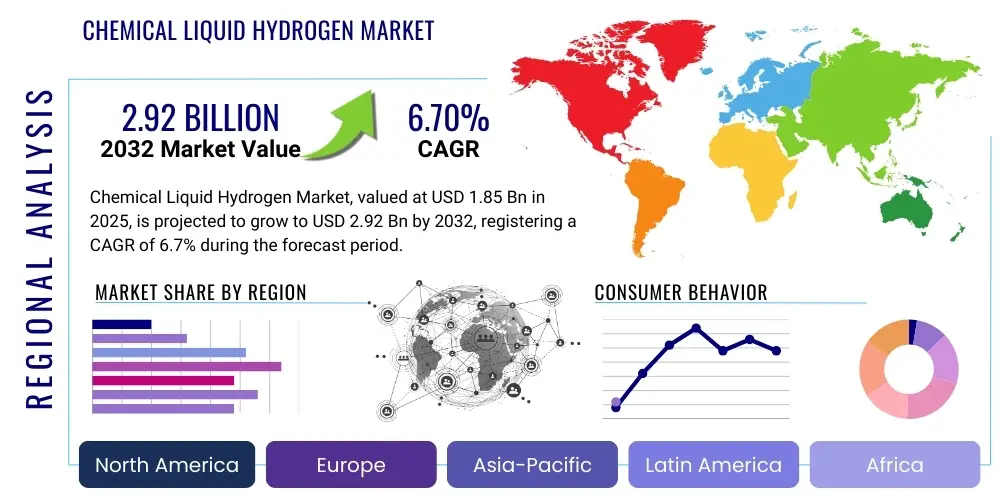

Chemical Liquid Hydrogen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427264 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Chemical Liquid Hydrogen Market Size

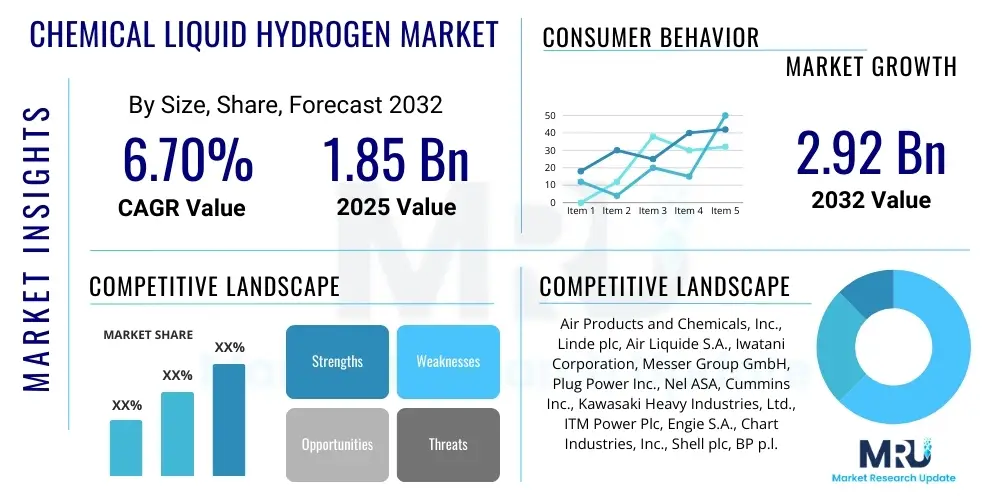

The Chemical Liquid Hydrogen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at USD 1.85 billion in 2025 and is projected to reach USD 2.92 billion by the end of the forecast period in 2032.

Chemical Liquid Hydrogen Market introduction

The Chemical Liquid Hydrogen market encompasses the production, storage, distribution, and application of hydrogen in its liquid state, a critical component in the global transition towards sustainable energy and industrial decarbonization. Liquid hydrogen (LH2) is produced by cooling gaseous hydrogen to an extremely low temperature of -253°C (-423°F), reducing its volume by approximately 800 times compared to its gaseous form, which makes it highly efficient for storage and long-distance transportation. Its high energy density by weight, clean combustion properties (producing only water when used in fuel cells or specialized combustion engines), and versatility make it an indispensable resource for a wide array of industrial, energy, and mobility applications.

Key applications for chemical liquid hydrogen span across various sectors, including its role as a clean fuel in aerospace for rocket propulsion, a crucial feedstock in chemical manufacturing for ammonia synthesis and methanol production, and an emerging energy carrier for fuel cell electric vehicles (FCEVs) and stationary power generation. Furthermore, LH2 is gaining traction as a viable solution for large-scale energy storage, enabling the integration of intermittent renewable energy sources like solar and wind power into the grid by storing excess electricity as hydrogen. The inherent benefits of liquid hydrogen, such as its high purity, volumetric energy density, and zero-emission potential, position it as a cornerstone for achieving global net-zero targets and fostering energy independence.

The markets growth is predominantly driven by escalating global efforts to mitigate climate change, strong governmental support through incentives and policy frameworks aimed at developing hydrogen infrastructure, and rapid technological advancements in hydrogen production (especially green hydrogen via electrolysis), liquefaction, and storage technologies. Increasing demand for clean energy solutions across heavy industries, the expanding deployment of hydrogen fuel cell technologies in transportation, and significant investments in hydrogen research and development are further propelling the market forward. These factors collectively underscore liquid hydrogens pivotal role in shaping a sustainable and low-carbon future economy.

Chemical Liquid Hydrogen Market Executive Summary

The Chemical Liquid Hydrogen market is experiencing robust growth, propelled by the urgent global imperative for decarbonization and the accelerating energy transition. Business trends indicate a surge in strategic partnerships, joint ventures, and significant investments across the entire hydrogen value chain, from renewable energy-powered electrolysis plants to advanced liquefaction and distribution networks. Major industrial gas companies, energy firms, and automotive manufacturers are collaborating to establish integrated hydrogen ecosystems, aiming to scale up production capacity and reduce costs. Research and development efforts are primarily focused on enhancing the efficiency and cost-effectiveness of green hydrogen production, improving cryogenic storage solutions, and developing innovative applications in diverse sectors. The emergence of hydrogen hubs and valleys globally signifies a concerted effort to create regional hydrogen economies, fostering both supply and demand.

Regional dynamics are varied but universally upward trending, with North America, Europe, and Asia Pacific leading the charge due to supportive policy environments, substantial funding initiatives, and established industrial bases. Europes "Hydrogen Strategy" and North Americas "Hydrogen Shot" initiatives are accelerating infrastructure development and technological innovation. Asia Pacific, particularly countries like Japan, South Korea, and China, is investing heavily in hydrogen production and application, aiming for energy security and industrial leadership in the hydrogen economy. These regions are witnessing rapid deployment of pilot projects and commercial ventures, showcasing liquid hydrogens potential in heavy-duty transport, industrial feedstock, and power generation. Emerging markets in the Middle East and Latin America are also exploring hydrogen production, leveraging abundant renewable energy resources to become future hydrogen exporters.

Segmentation trends highlight the growing dominance of industrial applications as a primary end-use sector, followed by mobility and power generation. Within industrial applications, the chemical and refining industries continue to be major consumers, with increasing emphasis on utilizing green liquid hydrogen to lower their carbon footprint. The mobility segment is seeing increased adoption in heavy-duty trucks, buses, and maritime shipping, driven by advancements in fuel cell technology and the development of refueling infrastructure. Power generation, including grid balancing and backup power, is also a rapidly expanding segment as utilities seek reliable and clean energy storage solutions. Production methods are shifting towards electrolysis-based green hydrogen, although blue hydrogen (from natural gas with carbon capture) still plays a significant role in the interim, reflecting a concerted move towards sustainable production pathways.

AI Impact Analysis on Chemical Liquid Hydrogen Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Chemical Liquid Hydrogen market frequently revolve around its potential to optimize production processes, enhance the safety and efficiency of storage and distribution, and accelerate research into novel hydrogen technologies. Users are keen to understand how AI can reduce the high operational costs associated with hydrogen liquefaction, predict demand fluctuations for better supply chain management, and identify potential risks in complex hydrogen infrastructure. There is also significant interest in AIs role in improving the performance and longevity of fuel cells and electrolysis units, alongside its capacity to manage the intricate data generated by large-scale hydrogen projects, ultimately aiming for a more economically viable and environmentally sustainable hydrogen economy.

AIs transformative potential in the Chemical Liquid Hydrogen market is multifaceted, offering unprecedented opportunities for efficiency gains, cost reductions, and enhanced operational safety across the entire value chain. From the initial stages of hydrogen production to its final application, AI algorithms can process vast datasets from sensors, equipment, and environmental conditions to provide real-time insights and predictive analytics. This capability allows operators to optimize energy consumption during electrolysis and liquefaction, forecast equipment failures before they occur, and dynamically adjust operational parameters to maximize yield and minimize downtime. Such intelligent automation directly addresses some of the most pressing challenges in the hydrogen sector, particularly the high energy requirements for liquefaction and the need for robust safety protocols.

Furthermore, AI significantly contributes to the advancement of research and development in hydrogen technologies. Machine learning models can analyze experimental data from new catalyst designs for electrolysis, material properties for advanced storage tanks, and even simulate the performance of novel fuel cell architectures, drastically reducing the time and resources required for innovation. In terms of supply chain optimization, AI can predict fluctuations in demand and supply, allowing for more efficient logistical planning and reduced transportation costs for liquid hydrogen. By integrating AI into monitoring systems, companies can achieve proactive maintenance, enhanced leak detection, and improved overall safety management for large-scale liquid hydrogen facilities and distribution networks, thereby fostering greater confidence in hydrogen as a reliable energy carrier. These advancements are crucial for making liquid hydrogen more competitive and widely adoptable in the global energy landscape.

- Enhanced Production Efficiency: AI optimizes electrolysis and liquefaction processes, reducing energy consumption and operational costs.

- Predictive Maintenance: AI algorithms analyze equipment data to forecast failures, preventing downtime and ensuring continuous operation.

- Supply Chain Optimization: AI improves logistics, demand forecasting, and inventory management for liquid hydrogen distribution.

- Safety and Risk Management: AI systems monitor facilities for anomalies, enabling early detection of leaks or hazards.

- Accelerated R&D: Machine learning speeds up the discovery of new catalysts, materials, and fuel cell designs.

- Quality Control: AI ensures high purity levels of liquid hydrogen by continuously monitoring production parameters.

- Energy Management: AI optimizes the integration of renewable energy sources for green hydrogen production.

DRO & Impact Forces Of Chemical Liquid Hydrogen Market

The Chemical Liquid Hydrogen market is profoundly shaped by a dynamic interplay of drivers, restraints, and opportunities, each contributing to its complex growth trajectory and overall impact forces. Key drivers include the global push for decarbonization and the urgent need to transition to cleaner energy sources, which positions hydrogen as a versatile and clean energy carrier. Significant government incentives, policy support, and funding for hydrogen projects worldwide are providing the necessary impetus for infrastructure development and technological innovation. Furthermore, the increasing demand for sustainable fuel in heavy-duty transportation, aerospace, and industrial processes, coupled with advancements in electrolysis and liquefaction technologies, are accelerating market expansion. These drivers collectively create a compelling environment for sustained investment and growth, driven by environmental mandates and energy security concerns.

Despite these strong drivers, several restraints pose significant challenges to the widespread adoption and commercial viability of chemical liquid hydrogen. The high cost associated with green hydrogen production via electrolysis, particularly the energy-intensive liquefaction process, remains a major barrier. The extensive infrastructure required for hydrogen storage, transportation, and refueling is currently underdeveloped and costly to establish, hindering broad market penetration. Safety concerns related to handling cryogenic liquid hydrogen, its flammability, and the need for specialized equipment and training also present hurdles. Additionally, competition from other clean energy alternatives and the nascent stage of the hydrogen economy in many regions contribute to market uncertainties. Addressing these restraints will necessitate substantial capital investment, technological breakthroughs, and robust regulatory frameworks.

However, the market is rife with opportunities that could significantly mitigate these restraints and unlock new growth avenues. Emerging applications in sectors such as long-duration energy storage, maritime shipping, and aviation present new demand frontiers for liquid hydrogen. Technological advancements in solid-state hydrogen storage, more efficient liquefaction cycles, and cost-effective fuel cells are poised to enhance hydrogen’s economic competitiveness. The development of international hydrogen trade corridors and the establishment of global supply chains could facilitate large-scale hydrogen deployment, particularly from regions with abundant renewable energy resources to energy-deficient industrial hubs. Furthermore, increasing corporate sustainability mandates and public-private partnerships are creating a favorable ecosystem for accelerated innovation and market adoption, fostering a future where liquid hydrogen plays a central role in a decarbonized global economy.

Segmentation Analysis

The Chemical Liquid Hydrogen market is intricately segmented to reflect the diverse applications, end-user industries, and production methods that define its landscape. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product offerings, and develop targeted strategies. The market can be broadly categorized by application, end-user industry, and production method, each exhibiting distinct growth patterns and competitive dynamics. The varied demands from industrial processes, the rapidly evolving mobility sector, and the burgeoning power generation segment dictate specific requirements for purity, quantity, and delivery logistics of liquid hydrogen. This detailed segmentation allows for a granular analysis of market trends and the forces shaping demand across different verticals, ensuring a comprehensive view of the markets structure.

Segmentation by application, for instance, delineates the primary uses of liquid hydrogen, ranging from its well-established role in industrial feedstock to its emerging significance as a clean fuel. Industrial feedstock applications, including petroleum refining, ammonia production, and steel manufacturing, represent a foundational demand segment, with a growing shift towards green hydrogen to reduce carbon emissions. In the mobility sector, liquid hydrogen is increasingly used in fuel cell electric vehicles (FCEVs), particularly heavy-duty trucks, buses, and trains, owing to its high energy density and rapid refueling capabilities. The aerospace sector remains a specialized but critical application, leveraging liquid hydrogen as rocket fuel due to its exceptional specific impulse. Power generation, encompassing grid-scale energy storage and stationary fuel cells, is another rapidly expanding application, driven by the need for reliable, clean backup power and load balancing for renewable energy grids. Each application demands specific technical specifications for purity and storage, influencing production and distribution strategies.

Further segmentation by end-user industry helps identify the key consumers and their evolving needs. This includes chemical and petrochemical industries, which rely on hydrogen for various synthesis processes; the metals industry for annealing and as a reducing agent; and the electronics industry for semiconductor manufacturing requiring ultra-high purity hydrogen. The energy sector, including utility companies and independent power producers, is a growing end-user as they integrate hydrogen into their power generation and storage portfolios. Moreover, the production method segmentation differentiates between conventional methods like steam methane reforming (SMR), often coupled with carbon capture (blue hydrogen), and electrolysis-based methods using renewable electricity (green hydrogen). This distinction is increasingly vital as environmental regulations and sustainability goals drive a preference for green hydrogen, influencing investment patterns and the long-term strategic direction of the market.

- By Application:

- Industrial Feedstock (Chemicals, Refineries, Metals)

- Mobility (Fuel Cell Electric Vehicles, Aerospace, Maritime)

- Power Generation (Stationary Fuel Cells, Grid Storage)

- Other Applications (Electronics, Glass, Food)

- By End-User Industry:

- Chemical and Petrochemical

- Manufacturing (Steel, Glass, Electronics)

- Energy & Utilities

- Automotive & Transportation

- Aerospace & Defense

- By Production Method:

- Green Hydrogen (Electrolysis powered by Renewables)

- Blue Hydrogen (Steam Methane Reforming with CCS)

- Grey Hydrogen (Steam Methane Reforming without CCS)

- Other Methods (Biomass Gasification, Nuclear)

Chemical Liquid Hydrogen Market Value Chain Analysis

The Chemical Liquid Hydrogen markets value chain is a complex, multi-stage process encompassing production, liquefaction, storage, transportation, and end-use, each stage presenting unique technological and logistical challenges. The upstream segment primarily involves the generation of hydrogen gas, predominantly through steam methane reforming (SMR) of natural gas or, increasingly, through water electrolysis using renewable electricity (green hydrogen). This stage also includes the crucial purification processes to achieve the high purity levels required for various applications. Subsequent to gas production, the hydrogen undergoes an energy-intensive liquefaction process, where it is cooled to cryogenic temperatures (-253°C) to convert it into its liquid state, significantly reducing its volume for efficient storage and transport. Investments in advanced electrolysis technologies and more energy-efficient liquefaction plants are critical upstream activities aimed at reducing overall production costs and carbon footprint.

Moving downstream, the value chain focuses on the secure and efficient handling of liquid hydrogen. This involves specialized cryogenic storage tanks, both for bulk storage at production facilities and for smaller on-site storage at distribution hubs and end-user locations. Transportation is a critical and challenging aspect, requiring highly insulated cryogenic tanker trucks, railcars, or ships for long-distance delivery. The distribution channel is evolving, with a mix of direct sales to large industrial consumers and a growing network of specialized hydrogen refueling stations for the mobility sector. Direct distribution often involves long-term contracts with major chemical plants, refineries, or aerospace companies that require consistent, high-volume supply. Indirect distribution, through a network of distributors and logistics providers, serves smaller industrial clients or nascent refueling networks, particularly in regions where hydrogen infrastructure is still developing.

The market also differentiates between direct and indirect sales, reflecting the varied needs of end-users. Direct sales typically involve large-scale transactions between hydrogen producers or liquefaction plant operators and major industrial consumers, such as ammonia producers or steel manufacturers, where hydrogen is a key feedstock. These relationships are often characterized by long-term supply agreements and integrated logistics solutions. Indirect sales, on the other hand, involve intermediaries like industrial gas distributors or logistics companies that manage the storage, transport, and delivery of liquid hydrogen to smaller businesses, research facilities, or emerging mobility hubs. The efficiency and reliability of these distribution channels are paramount for the broader adoption of liquid hydrogen, particularly as the demand from diverse sectors continues to grow and requires more flexible and widespread supply solutions.

Chemical Liquid Hydrogen Market Potential Customers

The Chemical Liquid Hydrogen market caters to a diverse range of end-users and buyers across multiple industrial and emerging sectors, all driven by the need for clean energy, industrial feedstock, or advanced fuel solutions. Historically, the primary consumers have been heavy industries that utilize hydrogen as a crucial raw material in various chemical processes. This includes the vast petrochemical industry, where hydrogen is essential for refining crude oil and producing a wide array of chemicals, and the ammonia synthesis sector, which relies heavily on hydrogen as a key input. The metals industry, particularly in steel production, also uses hydrogen for annealing processes and as a reducing agent, with a growing interest in green hydrogen for decarbonization. These traditional industrial users form the foundational demand for chemical liquid hydrogen, driven by established operational needs and the pursuit of process efficiencies.

Beyond traditional industrial applications, the automotive and transportation sectors represent a rapidly expanding customer base for liquid hydrogen, particularly for heavy-duty mobility. Fuel cell electric vehicles (FCEVs), including trucks, buses, and trains, are increasingly adopting liquid hydrogen due to its high energy density, which allows for longer ranges and quicker refueling times compared to gaseous hydrogen in many applications. The aerospace industry continues to be a critical, albeit specialized, customer for liquid hydrogen, utilizing it as a high-performance rocket fuel for space propulsion. As the world moves towards decarbonization, the maritime shipping sector is also emerging as a significant potential customer, exploring liquid hydrogen as a clean alternative fuel for vessels, which could dramatically reduce greenhouse gas emissions from international shipping.

Furthermore, the energy and utilities sector is a burgeoning customer segment, driven by the increasing integration of renewable energy sources into the grid. Utility companies and independent power producers are exploring liquid hydrogen for large-scale, long-duration energy storage, using it to store surplus renewable electricity and convert it back into power when needed, thereby stabilizing the grid. Stationary fuel cells powered by liquid hydrogen are also finding applications in providing reliable backup power for critical infrastructure and remote locations. The electronics industry, requiring ultra-high purity hydrogen for semiconductor manufacturing, and various research and development institutions also constitute a consistent segment of potential customers, each with specific purity and volume requirements, underscoring the broad and expanding utility of chemical liquid hydrogen.

Chemical Liquid Hydrogen Market Key Technology Landscape

The Chemical Liquid Hydrogen market is characterized by a dynamic and evolving technology landscape, driven by continuous innovation aimed at enhancing production efficiency, reducing costs, and improving the safety and storage of hydrogen. At the core of hydrogen production are two primary pathways: steam methane reforming (SMR) and electrolysis. SMR, a mature technology, converts natural gas into hydrogen and carbon dioxide; however, to achieve lower carbon emissions, it is increasingly being integrated with Carbon Capture and Storage (CCS) technologies to produce "blue hydrogen." Electrolysis, on the other hand, utilizes electricity to split water into hydrogen and oxygen. Within electrolysis, several technologies are advancing, including Proton Exchange Membrane (PEM) electrolyzers, Alkaline Electrolyzers, and Solid Oxide Electrolyzers (SOEC), with PEM being favored for its rapid response and compact design, and SOEC for its high efficiency at elevated temperatures, particularly when integrated with industrial waste heat. The push towards "green hydrogen," produced via electrolysis powered by renewable energy, is accelerating research and deployment in these areas.

Beyond hydrogen production, the liquefaction process itself is a critical technological frontier. Converting gaseous hydrogen to liquid requires immense energy to cool it to cryogenic temperatures (-253°C). Current liquefaction technologies predominantly rely on various refrigeration cycles, such as the Claude cycle or the pre-cooled Brayton cycle. Innovations in this area focus on developing more energy-efficient liquefaction processes, including advanced cryogenic heat exchangers, expander technologies, and multi-stage refrigeration systems, to reduce the substantial energy penalty and thus the overall cost of liquid hydrogen. Research into magnetic refrigeration and para-ortho hydrogen conversion catalysts also aims to improve liquefaction efficiency and minimize boil-off losses during storage. These technological advancements are pivotal for making liquid hydrogen a more economically viable and scalable energy carrier, directly addressing one of the major cost hurdles in the hydrogen value chain.

Storage and transportation technologies for liquid hydrogen are also undergoing significant development to ensure safety and efficiency across the supply chain. Cryogenic storage tanks, essential for holding liquid hydrogen, require highly advanced insulation and materials to minimize heat ingress and prevent boil-off. Innovations include vacuum-insulated multi-layer tanks, composite materials for lighter weight, and improved pressure management systems. For transportation, specialized cryogenic tanker trucks, railcars, and marine vessels are continuously being refined to enhance their capacity, safety features, and operational efficiency for long-distance haulage. Furthermore, advanced sensing and monitoring technologies are being integrated into hydrogen infrastructure to detect leaks and manage safety risks proactively. The development of hydrogen refueling stations, featuring on-site liquefaction or cryogenic storage, is another key aspect of the technology landscape, enabling the widespread adoption of liquid hydrogen in the mobility sector and establishing a robust distribution network.

Regional Highlights

- North America: Driven by initiatives like the U.S. "Hydrogen Shot" and significant private sector investments. The region focuses on establishing hydrogen hubs and scaling up green hydrogen production for industrial decarbonization and heavy-duty transport. Key states like California and Texas are leading in infrastructure development.

- Europe: A frontrunner with ambitious hydrogen strategies (e.g., EU Hydrogen Strategy, national strategies in Germany, France, UK). Emphasis on green hydrogen production, cross-border infrastructure, and integration into industrial clusters and maritime transport to achieve ambitious decarbonization targets.

- Asia Pacific: Emerging as a major growth engine, led by countries like Japan, South Korea, and China, which are heavily investing in hydrogen as a key energy security and decarbonization solution. Focus on fuel cell vehicle deployment, industrial applications, and developing international hydrogen supply chains.

- Middle East & Africa: Poised to become significant exporters of green and blue hydrogen due to abundant renewable energy resources (solar, wind) and natural gas reserves. Countries like Saudi Arabia and UAE are launching large-scale green hydrogen projects targeting global markets.

- Latin America: Demonstrating growing interest, particularly in countries like Chile and Brazil, leveraging their vast renewable energy potential (wind, solar) to produce green hydrogen for domestic use and export. Early-stage development with strong governmental and international support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Liquid Hydrogen Market.- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide S.A.

- Iwatani Corporation

- Messer Group GmbH

- Plug Power Inc.

- Nel ASA

- Cummins Inc.

- Kawasaki Heavy Industries, Ltd.

- ITM Power Plc

- Engie S.A.

- Chart Industries, Inc.

- Shell plc

- BP p.l.c.

- Siemens Energy AG

- HyGear (Xebec Adsorption Inc.)

- Bloom Energy

- Toshiba Energy Systems & Solutions Corporation

- Hyundai Motor Company

- Toyota Motor Corporation

Frequently Asked Questions

What is chemical liquid hydrogen and its primary uses?

Chemical liquid hydrogen is hydrogen cooled to -253°C (-423°F) for efficient storage and transport. Its primary uses include industrial feedstock (e.g., ammonia production, refining), clean fuel for mobility (fuel cell vehicles, aerospace), and large-scale energy storage for renewable power grids.

What are the main drivers for the Chemical Liquid Hydrogen market growth?

Key drivers include global decarbonization targets, government incentives for clean energy, increasing demand for sustainable fuels in heavy transport, and advancements in green hydrogen production and liquefaction technologies.

What challenges hinder the widespread adoption of liquid hydrogen?

Challenges include the high cost of green hydrogen production and liquefaction, underdeveloped infrastructure for storage and distribution, safety concerns related to cryogenic handling, and competition from alternative clean energy solutions.

How is AI impacting the Chemical Liquid Hydrogen market?

AI is significantly impacting the market by optimizing production processes, enabling predictive maintenance for equipment, enhancing supply chain logistics, improving safety protocols through real-time monitoring, and accelerating R&D for new materials and catalysts.

Which regions are leading the Chemical Liquid Hydrogen market development?

North America, Europe, and Asia Pacific are leading the market due to strong government support, significant investments in hydrogen infrastructure, and the presence of major industrial players and technological innovators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager