Chemicals and Petrochemicals Electrostatic Precipitator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430923 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Chemicals and Petrochemicals Electrostatic Precipitator Market Size

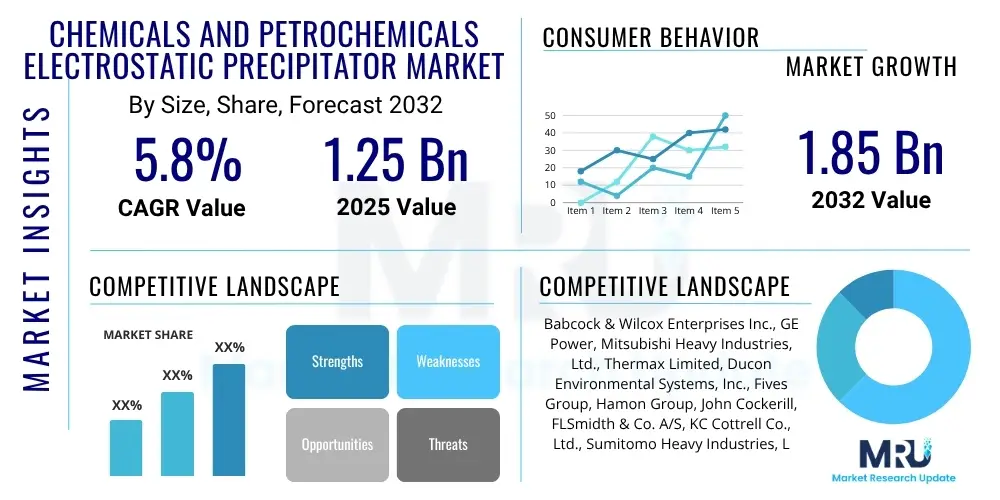

The Chemicals and Petrochemicals Electrostatic Precipitator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.25 Billion in 2025 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2032.

Chemicals and Petrochemicals Electrostatic Precipitator Market introduction

The Chemicals and Petrochemicals Electrostatic Precipitator market encompasses the sale, installation, and maintenance of electrostatic precipitator systems specifically designed for emission control in chemical processing plants and petrochemical refineries. These critical air pollution control devices are engineered to remove fine particulate matter, including dust, fumes, and aerosols, from industrial exhaust gas streams before they are released into the atmosphere. The primary function of an ESP is to meet stringent environmental regulations by ensuring cleaner air quality, thereby preventing adverse health and environmental impacts associated with industrial operations.

Electrostatic Precipitators operate on the principle of electrostatic forces. They employ a series of high-voltage electrodes to ionize particles in the gas stream, causing them to acquire an electrical charge. These charged particles are then attracted to oppositely charged collecting plates, where they adhere and are subsequently removed through various methods such as rapping or washing. The benefits of utilizing ESPs in these sectors are manifold, including high collection efficiency for submicron particles, low operating costs in terms of pressure drop, and the ability to handle high-temperature and corrosive gas streams often found in chemical and petrochemical facilities. Key driving factors for market growth include escalating global concerns over air pollution, the imperative for industries to comply with stricter emission standards, and the continuous expansion of the chemical and petrochemical manufacturing base worldwide.

Major applications for these sophisticated air pollution control systems span across various processes within the chemical and petrochemical industries. This includes catalytic cracking units, reformers, incinerators, boilers, and other process emissions where fine particulate removal is paramount. The technology offers a robust solution for industries grappling with the dual challenge of maximizing production efficiency while minimizing their environmental footprint. The inherent versatility and high performance characteristics of ESPs make them indispensable components in modern industrial air quality management strategies.

Chemicals and Petrochemicals Electrochemicals Electrostatic Precipitator Market Executive Summary

The Chemicals and Petrochemicals Electrostatic Precipitator market is poised for significant expansion, driven by intensifying global environmental regulations and the ongoing growth of industrial activities, particularly in emerging economies. Business trends highlight a shift towards advanced, energy-efficient ESP designs that integrate smart technologies for optimized performance and predictive maintenance. There is an increasing demand for customized solutions tailored to specific process conditions and emission profiles within refineries and chemical plants, moving beyond one-size-fits-all approaches. Service and maintenance contracts are also gaining prominence as operators seek to ensure long-term operational efficiency and compliance.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, propelled by rapid industrialization, burgeoning chemical production, and a growing emphasis on environmental protection policies in countries like China and India. North America and Europe, while mature markets, continue to represent substantial opportunities due to stringent existing regulations, ongoing plant modernization, and the retrofitting of older facilities to meet updated emission limits. Latin America, the Middle East, and Africa are also showing promising potential as industrial development accelerates and environmental awareness rises, leading to increased adoption of advanced pollution control technologies.

Segment trends indicate a strong demand for both dry and wet electrostatic precipitators, with the choice largely dependent on the specific characteristics of the particulate matter and gas stream. Dry ESPs remain dominant for general dust removal, while wet ESPs are gaining traction for applications involving sticky, corrosive, or high-humidity particulate matter, often encountered in certain chemical processes. Furthermore, the market is seeing a healthy balance between new installations for greenfield projects and significant investment in retrofits and upgrades for existing facilities, reflecting both expansion and modernization efforts across the chemical and petrochemical sectors to achieve enhanced environmental performance and efficiency.

AI Impact Analysis on Chemicals and Petrochemicals Electrostatic Precipitator Market

User questions regarding the impact of Artificial Intelligence on the Chemicals and Petrochemicals Electrostatic Precipitator market frequently revolve around how AI can enhance efficiency, reduce operational costs, and improve compliance. Key themes include the potential for predictive maintenance to minimize downtime, optimization of ESP performance through real-time data analysis, and the role of AI in managing energy consumption. There is also considerable interest in how AI can facilitate smarter environmental monitoring and reporting, automating data collection and analysis to ensure continuous adherence to regulatory standards. Concerns often touch upon data security, integration challenges with legacy systems, and the need for skilled personnel to manage AI-driven systems, but the overall expectation is that AI will be a transformative force, leading to more intelligent, autonomous, and cost-effective pollution control solutions.

- Predictive maintenance: AI algorithms analyze operational data from ESPs (e.g., power consumption, temperature, vibration) to predict potential component failures, enabling proactive maintenance and reducing unscheduled downtime.

- Optimized performance: Machine learning models can analyze real-time gas flow rates, particulate loading, and environmental conditions to dynamically adjust ESP parameters (e.g., voltage, current, rapping frequency) for maximum collection efficiency.

- Energy efficiency: AI can identify patterns in energy usage and recommend or automatically implement adjustments to reduce power consumption while maintaining desired particulate removal rates, leading to significant operational cost savings.

- Real-time monitoring and anomaly detection: AI-powered systems can continuously monitor ESP operation, detecting subtle deviations or anomalies that might indicate system degradation or an impending fault, allowing for immediate intervention.

- Enhanced safety and regulatory compliance: AI can assist in automated reporting of emission data, predict potential breaches of regulatory limits, and optimize operations to ensure continuous compliance, thereby mitigating environmental risks and penalties.

- Process integration and control: AI can integrate ESP operation with other plant processes, enabling a holistic approach to air quality control and overall plant efficiency, improving coordination and reducing manual intervention.

DRO & Impact Forces Of Chemicals and Petrochemicals Electrostatic Precipitator Market

The Chemicals and Petrochemicals Electrostatic Precipitator market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming its Impact Forces. Significant drivers include the global push for cleaner air and increasingly stringent environmental regulations, compelling chemical and petrochemical companies to invest in highly efficient pollution control technologies. The continuous expansion and modernization of industrial infrastructure, particularly in emerging economies, also fuels demand for new ESP installations and upgrades. Furthermore, the inherent benefits of ESPs, such as high collection efficiency for fine particulates and the ability to handle high-temperature gas streams, make them a preferred solution for complex industrial emissions.

Conversely, the market faces several restraints. The high initial capital expenditure associated with installing ESP systems can be a barrier for smaller enterprises or facilities with limited budgets. Operational challenges, including the need for specialized maintenance and the consumption of electrical power, contribute to ongoing costs. The availability and increasing adoption of alternative particulate control technologies, such as bag filters or scrubbers, although often with different operational envelopes, also present competitive pressures. Furthermore, economic downturns or fluctuations in raw material prices can delay or reduce investments in pollution control equipment, impacting market growth.

Despite these challenges, substantial opportunities exist. The growing trend of retrofitting and upgrading existing chemical and petrochemical plants to meet evolving environmental standards provides a consistent demand avenue for ESP manufacturers. Technological advancements, particularly in smart and IoT-enabled ESPs, offer pathways for improved efficiency, reduced maintenance, and enhanced data analytics, attracting new investments. The increasing focus on sustainability and corporate social responsibility among industrial players also creates a favorable environment for adopting advanced emission control solutions. These combined forces dictate the market's trajectory, emphasizing the critical role of innovation and regulatory compliance in shaping its future.

Segmentation Analysis

The Chemicals and Petrochemicals Electrostatic Precipitator market is broadly segmented based on the type of precipitator, its application across various industrial processes, and the end-use context, such as new installations or retrofits. Each segment offers unique insights into market dynamics, demand patterns, and technological preferences. Analyzing these segmentations helps stakeholders understand specific market niches, identify growth areas, and tailor product development and marketing strategies to meet diverse customer needs within the chemicals and petrochemicals sectors.

The market is characterized by a strong demand for customized solutions, given the varied and often challenging emission characteristics of chemical and petrochemical processes. This necessitates a detailed understanding of particulate size distribution, gas temperature, humidity, and chemical composition to recommend the most effective ESP type and configuration. Furthermore, the lifecycle stage of industrial facilities, whether greenfield projects or aging infrastructure, significantly influences the demand for new units versus refurbishment and upgrade services, highlighting the diverse needs within the market.

- By Type

- Dry Electrostatic Precipitators (ESPs): Primarily used for dry particulate matter, widely adopted due to high efficiency and suitability for various industrial dusts.

- Wet Electrostatic Precipitators (ESPs): Employed for sticky, corrosive, or high-humidity particulate matter, often used where fine mist or aerosols are present.

- By Application

- Refineries: For emissions from catalytic cracking, coking units, and other combustion processes.

- Chemical Plants: Across diverse chemical manufacturing processes involving particulate and aerosol generation.

- Power Generation (within Chemical/Petrochemical facilities): For boiler emissions.

- Metals & Mining (integrated with Petrochemicals for raw materials): For dust and fume control.

- Cement (related to industrial chemicals for raw materials): For clinker kiln and other process emissions.

- Others (e.g., waste incineration, fertilizers): Various specialized chemical processes.

- By End Use

- New Installations: For greenfield projects and capacity expansions.

- Retrofit/Upgrade: For modernizing existing ESPs and improving performance in older facilities.

- Maintenance & Services: Ongoing support, spare parts, and operational optimization.

Value Chain Analysis For Chemicals and Petrochemicals Electrostatic Precipitator Market

The value chain for the Chemicals and Petrochemicals Electrostatic Precipitator market is a comprehensive network involving several critical stages, from the sourcing of raw materials to the final installation and after-sales support. Upstream activities involve the procurement of essential components and materials, such as high-grade steel, various alloys for electrodes and collecting plates, specialized ceramics for insulators, and sophisticated electronic components for power supply and control systems. Suppliers of these raw materials play a crucial role in ensuring the quality and reliability of the final ESP product. Manufacturers often rely on a global network of suppliers to secure competitive pricing and access to advanced materials.

Midstream activities primarily encompass the design, engineering, manufacturing, assembly, and testing of the electrostatic precipitator units. This stage involves significant R&D investment to innovate designs, improve efficiency, and adapt to evolving regulatory requirements and customer specifications. Manufacturers typically possess specialized expertise in air pollution control technology, offering customized solutions that integrate advanced control systems and materials suitable for the corrosive and high-temperature environments found in chemical and petrochemical facilities. The precision and quality control at this stage are paramount for the performance and longevity of the ESP system.

Downstream activities focus on the distribution, installation, commissioning, and ongoing service and maintenance of the ESPs. Distribution channels include direct sales from manufacturers to large industrial clients, often facilitated by a dedicated sales force and engineering support. Indirect channels involve engineering, procurement, and construction (EPC) contractors who integrate ESPs into broader plant construction projects. Post-installation, maintenance and after-sales services, including spare parts supply, technical support, and performance optimization, are vital for ensuring the sustained operation and compliance of the ESPs, creating long-term relationships with end-users. The effective management of these direct and indirect channels is key to market penetration and customer satisfaction.

Chemicals and Petrochemicals Electrostatic Precipitator Market Potential Customers

Potential customers for Electrostatic Precipitators in the chemicals and petrochemicals market primarily consist of large industrial entities that operate facilities generating significant particulate emissions. These include major oil refineries, petrochemical complexes producing a wide array of chemicals from feedstock, and specialized chemical manufacturing plants involved in the production of fertilizers, polymers, basic chemicals, and specialty chemicals. Companies within these sectors are driven by a dual mandate of achieving operational efficiency and strict adherence to local and international environmental protection regulations. The scale of their operations necessitates robust and reliable air pollution control equipment, making them ideal candidates for ESP technology.

Beyond the core production facilities, other key end-users include independent power producers operating within or adjacent to chemical and petrochemical sites, particularly those utilizing fossil fuels, where ESPs are crucial for flue gas desulfurization and particulate removal. Engineering, Procurement, and Construction (EPC) firms also represent significant indirect customers, as they specify and procure ESP systems as part of large-scale industrial project developments for their clients. Environmental consulting firms, while not direct buyers, often influence purchasing decisions by recommending specific technologies to their clients to ensure regulatory compliance and optimize environmental performance, acting as an important conduit for market intelligence and technology adoption.

Additionally, government-owned or state-affiliated industrial enterprises in developing and emerging economies are increasingly becoming significant purchasers. As these nations strengthen their environmental policies and undergo industrial expansion, the demand for advanced air pollution control solutions like ESPs rises considerably. The buyers in this market are highly discerning, often prioritizing long-term operational costs, reliability, efficiency, and proven compliance capabilities over mere upfront cost, reflecting a strategic investment rather than a simple commodity purchase. The decision-making process typically involves multiple stakeholders, including environmental health and safety departments, engineering teams, and procurement divisions, ensuring a thorough evaluation of proposed solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.25 Billion |

| Market Forecast in 2032 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises Inc., GE Power, Mitsubishi Heavy Industries, Ltd., Thermax Limited, Ducon Environmental Systems, Inc., Fives Group, Hamon Group, John Cockerill, FLSmidth & Co. A/S, KC Cottrell Co., Ltd., Sumitomo Heavy Industries, Ltd., Clyde Bergemann Power Group, CPT Technologies, Trion Inc. (a division of Purafil), Beltran Technologies, Inc., Environmental Elements Corporation (EEC), Lenntech BV, W. L. Gore & Associates, Inc., Siemens Energy AG, Doosan Lentjes GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemicals and Petrochemicals Electrostatic Precipitator Market Key Technology Landscape

The technological landscape of the Chemicals and Petrochemicals Electrostatic Precipitator market is continuously evolving, driven by the need for higher efficiency, reduced maintenance, and improved environmental compliance. Core technologies revolve around optimizing the electrostatic charging and collection processes. This includes the development of advanced electrode designs, such as rigid discharge electrodes (RDEs) and specialized plate configurations, which enhance the electrical field uniformity and reduce re-entrainment of collected particles. Improvements in high-voltage power supplies, particularly switch-mode power supplies (SMPS) and pulse energization systems, offer better control over the corona discharge, allowing for higher collection efficiency even with difficult-to-collect dusts and reducing energy consumption by precisely matching power input to gas stream conditions.

Beyond the fundamental electrostatic principles, the integration of advanced control systems is a significant technological trend. Modern ESPs are equipped with sophisticated Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) that provide real-time monitoring and automated adjustment of operational parameters. These systems can dynamically respond to variations in gas flow, temperature, and particulate loading, ensuring optimal performance under fluctuating plant conditions. Furthermore, the adoption of IoT sensors and data analytics platforms is transforming ESP management. These technologies enable remote monitoring, predictive maintenance capabilities, and detailed performance diagnostics, moving towards an era of "smart" ESPs that can self-diagnose and optimize their operation, thereby minimizing downtime and extending equipment lifespan.

Emerging technologies and innovations also include specialized rapping systems that efficiently dislodge collected dust without significant re-entrainment, improved ash handling systems, and advanced materials for corrosion resistance in wet ESP applications. For example, the use of composite materials and specialized coatings can significantly extend the life of components in highly corrosive chemical environments. Additionally, hybrid pollution control systems that combine ESPs with other technologies, such as bag filters (e.g., in a hybrid filter design) or wet scrubbers, are gaining traction for addressing complex multi-pollutant challenges, offering comprehensive solutions for a broader range of chemical and petrochemical emission scenarios. These technological advancements collectively contribute to making ESPs more reliable, efficient, and adaptable to the demanding requirements of the chemicals and petrochemicals industries.

Regional Highlights

- North America: This region is a mature market driven by stringent environmental regulations, particularly from the EPA, and ongoing modernization of chemical and petrochemical infrastructure. High demand for retrofit and upgrade projects, coupled with a focus on energy efficiency and advanced control systems, characterizes the market. The United States and Canada are key contributors, investing in advanced ESP technologies for both new and existing facilities.

- Europe: Similar to North America, Europe is characterized by strict emission standards (e.g., EU Industrial Emissions Directive) and a strong emphasis on sustainability. Germany, the UK, France, and Italy are significant markets, focusing on technological innovation, integration of smart ESPs, and robust maintenance services. The presence of a mature industrial base leads to consistent demand for high-performance and customized solutions.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rapid industrialization, expansion of chemical and petrochemical capacities, and evolving environmental regulations in countries like China, India, Japan, and South Korea. Increased awareness regarding air pollution and government initiatives to enforce emission controls are driving significant investments in new ESP installations and capacity expansions.

- Latin America: This region presents emerging opportunities, with countries like Brazil, Mexico, and Argentina seeing growth in their industrial sectors, including chemicals and petrochemicals. While regulatory frameworks are developing, there is a rising demand for cost-effective and efficient pollution control solutions as industrial operations expand and align with global environmental standards.

- Middle East and Africa (MEA): The MEA region, particularly countries like Saudi Arabia, UAE, and Qatar, is witnessing substantial investment in petrochemicals and refining capacity, driven by abundant hydrocarbon resources. This expansion, combined with a growing focus on industrial sustainability and environmental compliance, is spurring demand for ESPs. South Africa also contributes to the market due to its significant mining and industrial activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemicals and Petrochemicals Electrostatic Precipitator Market.- Babcock & Wilcox Enterprises Inc.

- GE Power

- Mitsubishi Heavy Industries, Ltd.

- Thermax Limited

- Ducon Environmental Systems, Inc.

- Fives Group

- Hamon Group

- John Cockerill

- FLSmidth & Co. A/S

- KC Cottrell Co., Ltd.

- Sumitomo Heavy Industries, Ltd.

- Clyde Bergemann Power Group

- CPT Technologies

- Trion Inc. (a division of Purafil)

- Beltran Technologies, Inc.

- Environmental Elements Corporation (EEC)

- Lenntech BV

- W. L. Gore & Associates, Inc.

- Siemens Energy AG

- Doosan Lentjes GmbH

Frequently Asked Questions

What are Electrostatic Precipitators (ESPs) and why are they crucial in the chemicals and petrochemicals industry?

ESPs are advanced air pollution control devices that remove fine particulate matter from industrial gas streams by using electrostatic forces. They are crucial in the chemicals and petrochemicals industry to comply with stringent environmental regulations, improve air quality, and prevent harmful emissions from various processes like catalytic cracking, combustion, and chemical manufacturing, ensuring operational sustainability and reducing environmental impact.

What drives the growth of the Chemicals and Petrochemicals ESP market?

The primary drivers include escalating global environmental regulations demanding cleaner emissions, rapid industrialization and expansion of chemical and petrochemical facilities in emerging economies, and the inherent high efficiency and reliability of ESPs in handling complex industrial gas streams. The increasing focus on corporate social responsibility and sustainable industrial practices also significantly contributes to market growth.

What are the key technological advancements impacting the ESP market?

Key technological advancements include the integration of AI and IoT for predictive maintenance and real-time operational optimization, advanced high-voltage power supplies for improved energy efficiency, and sophisticated control systems for dynamic adjustment to changing process conditions. Innovations in electrode design and materials for corrosion resistance also enhance ESP performance and longevity in challenging chemical environments.

What are the primary challenges faced by the ESP market in these industries?

Major challenges include the high initial capital investment required for ESP systems, which can be a barrier for some operators. Operational and maintenance complexities, including the need for specialized personnel and consistent power supply, also pose difficulties. Competition from alternative pollution control technologies and potential economic downturns affecting industrial investments are additional market restraints.

Which geographical region leads the demand for ESPs in chemicals and petrochemicals, and why?

The Asia Pacific region currently leads the demand for ESPs in the chemicals and petrochemicals sector. This is primarily due to rapid industrial growth, significant expansion of manufacturing capacities, and the increasing implementation and enforcement of stricter environmental protection policies across countries like China and India, necessitating substantial investments in advanced air pollution control equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager