Chromatography Reagents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430491 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Chromatography Reagents Market Size

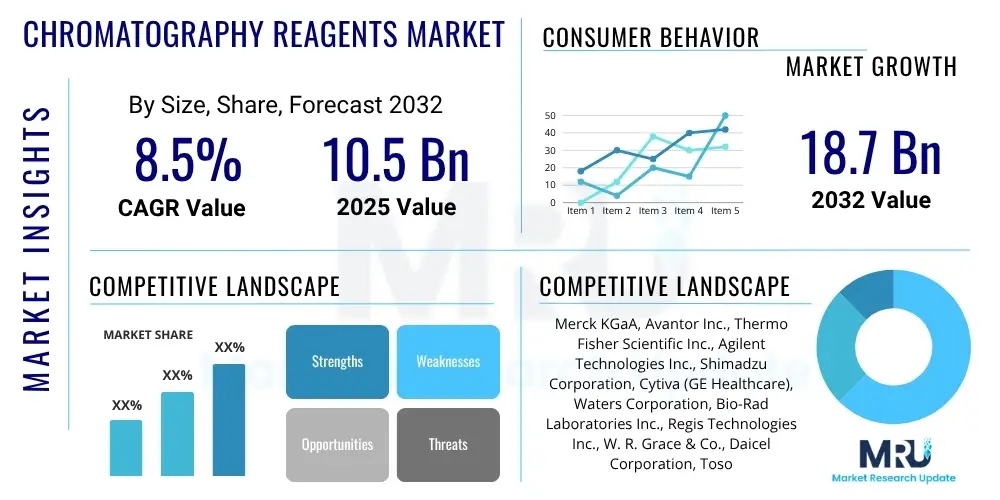

The Chromatography Reagents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $10.5 Billion in 2025 and is projected to reach $18.7 Billion by the end of the forecast period in 2032.

Chromatography Reagents Market introduction

The Chromatography Reagents Market encompasses a wide array of chemical substances essential for various chromatographic techniques, including High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), and Thin-Layer Chromatography (TLC). These reagents, which include solvents, buffers, derivatization agents, and adsorbents, play a critical role in the separation, identification, and quantification of components within complex mixtures across diverse industries. The market is driven by increasing research and development activities in the pharmaceutical and biotechnology sectors, growing demand for food safety and environmental testing, and advancements in analytical techniques requiring high-purity and specialized reagents for optimal performance and accurate results.

Chromatography reagents are the backbone of modern analytical science, enabling the precise analysis of samples ranging from drug compounds to environmental pollutants. Their primary benefit lies in facilitating highly sensitive and selective separations, crucial for quality control, drug discovery, and diagnostics. The continuous evolution of chromatography instrumentation necessitates parallel advancements in reagent purity, specificity, and innovative formulations, leading to enhanced detection limits and improved analytical workflows. The market is further propelled by stringent regulatory requirements for product quality and safety across industries, which mandate the use of reliable and certified analytical methods.

Key applications span pharmaceutical analysis, where reagents are indispensable for drug purity assessment and impurity profiling; biotechnology, for protein purification and biomolecule analysis; food and beverage for contaminant detection and quality assurance; and environmental testing for monitoring pollutants. Benefits include enhanced analytical accuracy, reproducibility, and efficiency, which are critical for scientific advancement and industrial compliance. Driving factors include the escalating global demand for advanced analytical instruments, increasing investments in life science research, and the expansion of the biopharmaceutical industry requiring sophisticated separation techniques.

Chromatography Reagents Market Executive Summary

The Chromatography Reagents Market is experiencing robust growth, primarily fueled by significant advancements in the pharmaceutical and biotechnology sectors, coupled with an increasing focus on food safety and environmental monitoring. Business trends indicate a strong emphasis on developing high-purity and specialized reagents, including those tailored for UHPLC and LC-MS applications, to meet the demand for enhanced analytical sensitivity and precision. Consolidations and strategic partnerships among key players are common, aimed at expanding product portfolios and regional outreach, particularly in emerging markets. There is also a growing trend towards sustainable manufacturing processes for reagents and the development of eco-friendly alternatives to traditional solvents.

Regionally, North America and Europe continue to dominate the market due to well-established pharmaceutical industries, robust R&D infrastructure, and stringent regulatory frameworks that mandate extensive analytical testing. However, the Asia Pacific region is rapidly emerging as a significant growth hub, driven by increasing healthcare expenditure, expanding pharmaceutical manufacturing capabilities, and rising government investments in scientific research in countries like China, India, and Japan. Latin America and the Middle East & Africa are also showing potential, albeit at a slower pace, as their analytical testing capabilities and research activities gradually expand.

From a segmentation perspective, solvents, particularly HPLC grade and ultra-pure solvents, command a substantial market share due to their widespread use across various chromatography techniques. The demand for advanced stationary phases and columns, which are often pre-packed with specialized reagents, is also surging, driven by the need for faster and more efficient separations. Applications in pharmaceutical and biotechnology research remain the largest segment, with significant growth anticipated in drug discovery, clinical trials, and quality control. The market is also witnessing a shift towards automated chromatography systems, further influencing the demand for compatible and high-quality reagents.

AI Impact Analysis on Chromatography Reagents Market

User inquiries about AI's impact on the Chromatography Reagents Market frequently revolve around automation, data analysis, and predictive capabilities. Common questions include how AI can optimize reagent usage, enhance method development, improve data interpretation, and potentially lead to the discovery of novel reagents. Users are keen to understand if AI will reduce the need for manual expertise, accelerate analytical workflows, and contribute to more sustainable laboratory practices. There is an overarching expectation that AI will bring about a paradigm shift in chromatography, making processes more efficient, cost-effective, and data-driven, while also addressing concerns about data security and the initial investment required for AI integration.

The integration of Artificial Intelligence (AI) and machine learning (ML) is poised to significantly transform the Chromatography Reagents Market by optimizing every stage of the analytical process. AI algorithms can analyze vast datasets from past experiments to predict optimal reagent combinations, concentrations, and flow rates, drastically reducing the time and resources traditionally spent on method development and optimization. This predictive capability not only enhances efficiency but also minimizes reagent waste, aligning with sustainability goals. Furthermore, AI can aid in the rapid identification of impurities and unexpected compounds, improving the accuracy and reliability of analytical results, which is crucial in sensitive applications like drug discovery and environmental monitoring.

Beyond optimization, AI is also impacting reagent quality control and supply chain management. By analyzing real-time data from manufacturing processes, AI can detect subtle deviations that might affect reagent purity or consistency, enabling proactive adjustments and ensuring higher quality products. In terms of supply chain, AI-driven analytics can forecast demand for specific reagents with greater accuracy, optimizing inventory levels, reducing lead times, and preventing stockouts. This allows suppliers to better anticipate market needs and offers end-users a more reliable supply of essential reagents, ultimately fostering greater innovation and efficiency across the chromatography landscape.

- AI-driven optimization of chromatography method development, reducing reagent consumption and experimental time.

- Enhanced data analysis and interpretation, improving the accuracy of compound identification and quantification.

- Predictive modeling for reagent stability and shelf-life, optimizing inventory management and reducing waste.

- Development of smart chromatography systems that automatically adjust reagent parameters based on real-time sample analysis.

- Facilitation of personalized medicine by rapidly characterizing complex biological samples with AI-assisted chromatography.

- Improved quality control and consistency in reagent manufacturing through AI-powered process monitoring.

DRO & Impact Forces Of Chromatography Reagents Market

The Chromatography Reagents Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. Key drivers include the escalating demand from pharmaceutical and biotechnology companies for precise analytical solutions in drug discovery, development, and quality control. Simultaneously, stringent regulatory mandates regarding product safety and quality across food, environmental, and clinical sectors compel industries to adopt advanced chromatography techniques, thereby fueling the need for high-quality reagents. However, the market faces restraints such as the high initial cost of chromatography instrumentation and specialized reagents, coupled with the availability of alternative analytical techniques that might offer perceived cost advantages for certain applications. Impact forces, such as technological advancements and globalization, further intensify the competitive dynamics, pushing for innovation and market expansion into untapped regions.

The primary drivers propelling the market include the significant increase in R&D investments within the life sciences, particularly in areas like personalized medicine and biopharmaceuticals, which heavily rely on sophisticated separation and purification processes. The global rise in food safety concerns and the need for robust environmental monitoring programs also contribute substantially, as chromatography reagents are indispensable for detecting contaminants, adulterants, and pollutants. Furthermore, continuous technological advancements in chromatography instruments, leading to ultra-high performance and increased automation, directly translate into a higher demand for compatible and specialized reagents designed to maximize the efficiency and resolution of these new systems.

Conversely, several restraints impede market expansion. The substantial capital investment required for state-of-the-art chromatography equipment and the ongoing expenditure on high-purity reagents can be prohibitive, especially for smaller laboratories or those in developing economies. The emergence of alternative analytical methods, such as mass spectrometry standalone or advanced spectroscopic techniques, which might offer different advantages in specific scenarios, also poses a competitive threat. Additionally, the complexity of regulatory approvals for new reagent formulations and the challenges associated with developing universally applicable, sustainable reagents can slow down innovation and market entry. Opportunities, however, abound in emerging economies with developing healthcare infrastructures, the burgeoning biosimilars market, and the integration of automation and AI in laboratory workflows.

- Drivers:

- Increasing R&D expenditure in pharmaceutical and biotechnology sectors.

- Growing concerns regarding food safety and quality control.

- Stringent environmental regulations mandating contaminant analysis.

- Technological advancements in chromatography instrumentation (e.g., UHPLC, LC-MS).

- Rising demand for personalized medicine and biopharmaceuticals.

- Restraints:

- High cost associated with advanced chromatography reagents and equipment.

- Availability of alternative analytical techniques.

- Complexity and time-consuming nature of method development.

- Challenges in ensuring universal purity and consistency of reagents.

- Opportunities:

- Expansion into emerging economies with growing research infrastructure.

- Development of greener, more sustainable chromatography reagents.

- Integration of automation and Artificial Intelligence (AI) in analytical workflows.

- Growth in the biosimilars and biologics market requiring advanced purification.

- Innovations in sample preparation techniques reducing reagent use.

- Impact Forces:

- Technological advancements driving demand for specialized reagents.

- Regulatory changes influencing market standards and product development.

- Globalization of pharmaceutical and food industries increasing quality control needs.

- Economic factors affecting R&D investments and laboratory budgets.

- Environmental sustainability concerns prompting demand for eco-friendly solutions.

Segmentation Analysis

The Chromatography Reagents Market is comprehensively segmented by type, technology, and application, providing a granular view of its diverse landscape. This segmentation allows for a deeper understanding of market dynamics, identifying key areas of growth, evolving consumer preferences, and technological shifts. The type segment categorizes reagents based on their chemical nature and function within the chromatography process, ranging from common solvents to highly specialized derivatization agents. The technology segment distinguishes reagents based on the specific chromatography technique they are designed for, reflecting the wide array of analytical methods employed across laboratories. Furthermore, the application segment highlights the varied end-use industries that rely on chromatography for their analytical needs, from life sciences to environmental monitoring, showcasing the broad utility and indispensable nature of these reagents.

Each segment possesses unique characteristics and growth drivers. For instance, within the type segment, the demand for high-purity solvents, particularly those suitable for mass spectrometry (MS) applications, is consistently strong due to their critical role in achieving sensitive and accurate results. Buffers and mobile phase additives are also seeing increasing adoption as researchers fine-tune separation conditions for complex biological samples. In the technology segment, liquid chromatography, encompassing HPLC and UHPLC, remains the largest due to its versatility and widespread application in pharmaceutical and biotech industries, demanding a broad spectrum of compatible reagents. Gas chromatography, while niche, continues to require specific high-purity carrier gases and derivatization reagents for volatile compound analysis.

The application segment clearly illustrates the market's reach. The pharmaceutical and biotechnology industry stands out as the largest consumer of chromatography reagents, driven by extensive drug discovery, development, and quality control processes, including the analysis of small molecules, biologics, and biosimilars. The food and beverage sector utilizes these reagents for quality assurance, contaminant detection, and nutritional analysis, while environmental testing relies on them for monitoring pollutants in water, air, and soil. Academic research and clinical diagnostics also represent significant application areas, underscoring the reagents' fundamental role across scientific and healthcare domains.

- By Type:

- Solvents (e.g., Acetonitrile, Methanol, Water, Isopropanol)

- Buffers (e.g., Phosphate Buffers, Acetate Buffers)

- Adsorbents (e.g., Silica Gel, Alumina, Polymeric Resins)

- Ion-Exchange Resins (e.g., Cation Exchange, Anion Exchange)

- Derivatization Reagents (e.g., Alkylating Agents, Acylating Agents)

- Other Reagents (e.g., Mobile Phase Additives, Column Packing Materials)

- By Technology:

- Liquid Chromatography

- High-Performance Liquid Chromatography (HPLC)

- Ultra-High Performance Liquid Chromatography (UHPLC)

- Liquid Chromatography-Mass Spectrometry (LC-MS)

- Gas Chromatography

- Gas Chromatography-Mass Spectrometry (GC-MS)

- Supercritical Fluid Chromatography (SFC)

- Thin-Layer Chromatography (TLC)

- Other Chromatography Technologies

- Liquid Chromatography

- By Application:

- Pharmaceutical & Biotechnology Industry (Drug Discovery, Development, QC)

- Food & Beverage Testing (Quality Control, Contaminant Detection)

- Environmental Testing (Pollutant Monitoring)

- Cosmetics & Personal Care (Ingredient Analysis, Purity)

- Academics & Research Institutions

- Clinical Diagnostics & Forensics

- Chemical & Petrochemical Industry

- Other Industrial Applications

Value Chain Analysis For Chromatography Reagents Market

The value chain for the Chromatography Reagents Market is a complex network involving raw material suppliers, manufacturers, distributors, and end-users, each playing a crucial role in bringing the final product to market. Upstream activities involve the procurement of high-purity chemicals, solvents, and specialized materials like silica, polymers, and ion-exchange resins from various chemical suppliers. The quality and consistency of these raw materials are paramount, as they directly influence the performance and reliability of the final chromatography reagents. Manufacturers then process these raw materials through rigorous purification, synthesis, and formulation steps, often adhering to strict quality standards and certifications like ISO or USP guidelines, to produce a diverse range of chromatography-grade reagents.

Midstream in the value chain, the manufactured reagents are channeled through various distribution networks. This includes both direct sales channels, where manufacturers sell directly to large institutional clients, government laboratories, or large pharmaceutical companies, and indirect channels, which involve a network of specialized distributors and resellers. These distributors often have extensive logistics capabilities, technical support teams, and regional warehousing to efficiently serve a wide array of customers, including smaller laboratories, academic institutions, and contract research organizations (CROs). The choice of distribution channel often depends on the manufacturer's market strategy, the geographic reach required, and the specific needs of the customer base.

Downstream activities focus on the end-users who utilize these reagents in their analytical and preparative chromatography applications. This encompasses a broad spectrum of industries, including pharmaceutical and biotechnology companies for drug development and quality control, food and beverage industries for safety and quality testing, environmental agencies for pollutant monitoring, and academic and research institutions for scientific discovery. The efficacy and purity of the reagents directly impact the accuracy and reproducibility of the end-user's analytical results. Feedback from these end-users is crucial for manufacturers to innovate, improve existing products, and develop new reagents that meet evolving analytical challenges and regulatory demands, thereby closing the loop in the value chain and driving continuous improvement.

Chromatography Reagents Market Potential Customers

The Chromatography Reagents Market serves a diverse and expansive customer base, primarily comprised of entities engaged in scientific research, quality control, product development, and regulatory compliance across various industries. The predominant end-users are pharmaceutical and biotechnology companies, which extensively utilize chromatography reagents for every stage of drug discovery, development, and manufacturing, including active pharmaceutical ingredient (API) analysis, impurity profiling, biologics characterization, and quality assurance of finished products. These customers prioritize high-purity, consistency, and traceability of reagents to meet stringent regulatory requirements and ensure the integrity of their scientific data.

Beyond the life sciences, a significant customer segment includes food and beverage industries, where chromatography reagents are vital for ensuring product safety, detecting contaminants like pesticides and mycotoxins, authenticating ingredients, and performing nutritional analysis. Environmental testing laboratories are another critical customer group, employing these reagents to monitor pollutants in water, air, and soil samples, adhering to environmental protection standards. The need for precise and reliable analytical results in these sectors drives a consistent demand for a wide range of chromatography-grade chemicals and specialized solutions.

Furthermore, academic and research institutions constitute a substantial portion of potential customers, utilizing chromatography reagents for fundamental scientific studies, educational purposes, and method development across various scientific disciplines. Clinical diagnostics and forensics laboratories also rely on these reagents for separating and identifying biomarkers, drugs of abuse, or toxicological compounds in biological samples. The chemical and petrochemical industries use chromatography for process monitoring and product quality control. Each of these end-user categories has specific requirements regarding reagent type, purity, volume, and packaging, necessitating a diverse product portfolio from manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $10.5 Billion |

| Market Forecast in 2032 | $18.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor Inc., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Shimadzu Corporation, Cytiva (GE Healthcare), Waters Corporation, Bio-Rad Laboratories Inc., Regis Technologies Inc., W. R. Grace & Co., Daicel Corporation, Tosoh Corporation, Restek Corporation, Kanto Chemical Co. Inc., Honeywell International Inc., J.T.Baker (Macron Fine Chemicals), FUJIFILM Wako Pure Chemical Corporation, YMC Co. Ltd., Pickering Laboratories. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromatography Reagents Market Key Technology Landscape

The Chromatography Reagents Market is deeply intertwined with advancements in chromatography technologies, with innovations primarily focusing on enhancing purity, specificity, and efficiency. Modern chromatography techniques demand reagents that are not only of ultra-high purity but also specifically formulated to optimize resolution, sensitivity, and reproducibility. A key technological trend is the development of mass spectrometry (MS) grade reagents, including solvents and mobile phase additives, which are essential for applications like LC-MS and GC-MS. These reagents must be free from impurities that could interfere with ionization or cause background noise, directly impacting the detection limits and accuracy of highly sensitive MS detectors. This push for higher purity and lower detection limits drives continuous innovation in reagent manufacturing processes.

Another significant area of technological evolution is the development of specialized stationary phases and column packing materials, which, while not always considered "reagents" in the liquid sense, are critical components chemically interacting with samples. Advances in silica chemistry, polymeric materials, and chiral stationary phases allow for more selective and efficient separations, particularly for complex mixtures and enantiomeric compounds. Furthermore, the development of green chemistry principles is influencing reagent technology, leading to a focus on more environmentally friendly solvents, reduced solvent consumption, and the use of supercritical fluids (SFC) which employ CO2 as a primary mobile phase, significantly cutting down on organic solvent waste. This technological shift addresses both performance requirements and environmental sustainability.

The integration of automation and microfluidics in chromatography systems also necessitates the development of compatible reagents designed for smaller volumes and faster analysis times. Reagents for micro- and nano-LC systems, for instance, must be highly concentrated and stable in small quantities. Additionally, advancements in derivatization reagents are enabling the analysis of compounds that are otherwise difficult to detect, expanding the scope of chromatography applications in metabolomics, proteomics, and clinical diagnostics. The overall technology landscape is characterized by a relentless pursuit of enhanced analytical performance, improved efficiency, reduced environmental impact, and seamless integration with evolving instrumentation and automated workflows.

Regional Highlights

North America holds a substantial share in the Chromatography Reagents Market, driven by its well-established pharmaceutical and biotechnology industries, robust research and development infrastructure, and the presence of numerous leading analytical instrument manufacturers. The United States, in particular, contributes significantly due to extensive government funding for scientific research, stringent regulatory standards from agencies like the FDA for drug and food safety, and a high adoption rate of advanced analytical technologies in both academic and industrial settings. The region's emphasis on personalized medicine and biopharmaceutical innovation continues to fuel the demand for high-purity and specialized chromatography reagents.

Europe represents another dominant market, characterized by strong economies, significant investments in life sciences, and a proactive approach to environmental protection and food safety. Countries such as Germany, the UK, France, and Switzerland are at the forefront of pharmaceutical manufacturing and scientific research, leading to a consistent demand for chromatography reagents. The presence of major reagent manufacturers and research institutions collaborating on new analytical techniques further strengthens the European market. Stringent European Union regulations for quality control in various industries also mandate the widespread use of chromatography for compliance and product authentication.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period, primarily due to rapid economic development, increasing healthcare expenditures, and expanding pharmaceutical and biotechnology sectors in countries like China, India, and Japan. These nations are becoming global hubs for pharmaceutical manufacturing, contract research, and clinical trials, leading to a surge in demand for analytical testing and chromatography reagents. Government initiatives to improve healthcare infrastructure and increase funding for scientific research further contribute to the market expansion in APAC, along with a growing focus on food safety and environmental monitoring as industrialization progresses.

- North America: Dominant market share driven by robust pharmaceutical R&D, strong regulatory framework, and high adoption of advanced analytical technologies. Key contributors include the United States and Canada.

- Europe: Significant market presence due to well-established life science industries, stringent quality control regulations, and leading research institutions. Germany, UK, France, and Switzerland are key markets.

- Asia Pacific (APAC): Fastest-growing region owing to increasing healthcare investments, expanding pharmaceutical manufacturing, and rising R&D activities in China, India, and Japan.

- Latin America: Emerging market with growing investments in healthcare infrastructure and increasing adoption of modern analytical techniques, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Gradual market expansion driven by developing healthcare sectors, increasing focus on food safety, and growing research initiatives in countries like Saudi Arabia and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromatography Reagents Market.- Merck KGaA

- Avantor Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Shimadzu Corporation

- Cytiva (GE Healthcare)

- Waters Corporation

- Bio-Rad Laboratories Inc.

- Regis Technologies Inc.

- W. R. Grace & Co.

- Daicel Corporation

- Tosoh Corporation

- Restek Corporation

- Kanto Chemical Co. Inc.

- Honeywell International Inc.

- J.T.Baker (Macron Fine Chemicals)

- FUJIFILM Wako Pure Chemical Corporation

- YMC Co. Ltd.

- Pickering Laboratories

Frequently Asked Questions

What are chromatography reagents and why are they important?

Chromatography reagents are specialized chemical substances, including solvents, buffers, and adsorbents, used in chromatography techniques to separate, identify, and quantify components in complex mixtures. They are crucial for achieving accurate, reproducible, and highly sensitive analytical results across various scientific and industrial applications, making them indispensable for quality control, research, and diagnostics.

Which industries are the primary consumers of chromatography reagents?

The primary consumers of chromatography reagents include the pharmaceutical and biotechnology industries for drug discovery and quality control, food and beverage companies for safety and quality testing, environmental testing laboratories for pollutant monitoring, and academic and research institutions for scientific studies and method development.

What factors are driving the growth of the Chromatography Reagents Market?

Key growth drivers for the Chromatography Reagents Market include increasing global R&D investments in pharmaceuticals and biotechnology, rising concerns over food safety, stringent environmental regulations, and continuous technological advancements in chromatography instrumentation that demand higher purity and specialized reagents.

How is AI impacting the Chromatography Reagents Market?

AI is impacting the Chromatography Reagents Market by optimizing method development, predicting optimal reagent usage, enhancing data analysis and interpretation, improving quality control in manufacturing, and streamlining supply chain management. This leads to increased efficiency, reduced waste, and more accurate analytical outcomes.

What are the key types of chromatography reagents available in the market?

The key types of chromatography reagents include solvents (e.g., acetonitrile, methanol), buffers (e.g., phosphate, acetate), adsorbents (e.g., silica gel, alumina), ion-exchange resins, and derivatization reagents. Each type serves a specific function in optimizing the separation and detection of target compounds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chromatography Reagents Market Size Report By Type (Ion Pair Reagents, Derivatization Reagents, Chromatography Solvents, Other), By Application (Pharmaceutical, Life Sciences, Food & Beverage Testing, Environmental Testing, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chromatography Reagents Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Solvents, Buffers, Derivatization Reagents, Ion Pair Reagents), By Application (Life Sciences, Environmental Testing, Food & Beverage Testing, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager