Class 2 Trucks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429328 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Class 2 Trucks Market Size

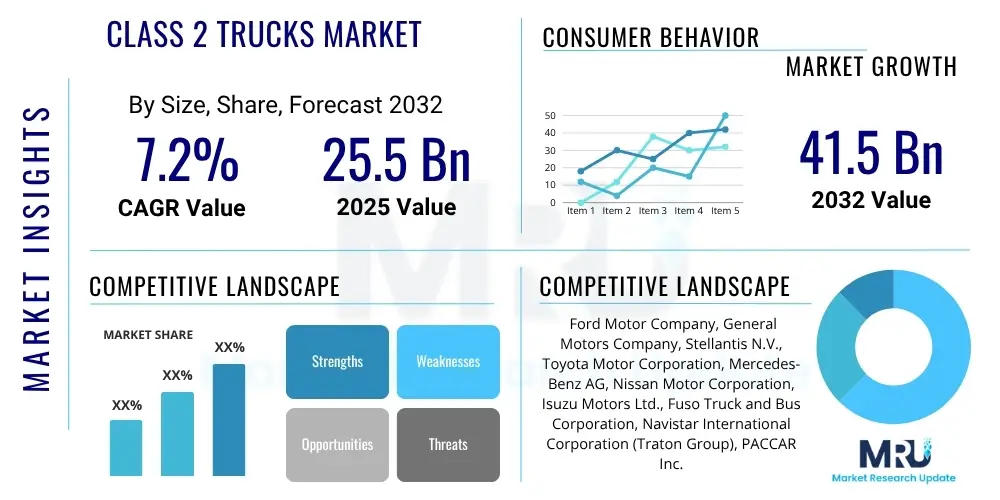

The Class 2 Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. This substantial growth is primarily driven by the expanding global logistics sector, accelerating e-commerce adoption, and increasing investments in urban infrastructure development across various key regions. The market is estimated at USD 25.5 billion in 2025, reflecting its significant economic importance and widespread utility. It is further projected to reach USD 41.5 billion by the end of the forecast period in 2032, indicating a robust trajectory of expansion. This underscores the industry's continuous adaptation to evolving consumer demands, stringent environmental regulations, and the integration of advanced technological innovations designed to enhance operational efficiencies, improve fleet safety, and promote overall sustainability, thereby solidifying its indispensable role in the modern economy.

Class 2 Trucks Market introduction

Class 2 trucks, precisely defined by a Gross Vehicle Weight Rating (GVWR) ranging from 6,001 to 10,000 pounds, constitute an indispensable and highly versatile segment within the commercial vehicle industry. This diverse category encompasses light-duty and medium-duty vehicles such as panel vans, pickup trucks, cutaway vans, and specialized utility trucks. Engineered for an optimal balance of maneuverability, fuel efficiency, and substantial payload capacity, they are ideal for a myriad of commercial and vocational applications. Their adaptability allows them to perform efficiently in dense urban environments for last-mile deliveries, as well as in suburban and rural settings for construction, maintenance, and service operations. The market is characterized by continuous innovation in advanced powertrain technologies, with a notable shift towards electrification, alongside the integration of cutting-edge safety features and advanced connectivity solutions, all designed to enhance operational performance, significantly reduce environmental impact, and meet stringent global regulatory standards, shaping the future of commercial transportation.

Major applications of Class 2 trucks span an expansive array of industries, unequivocally underscoring their vital economic significance. In logistics, they serve as foundational workhorses for parcel delivery, courier services, and local distribution, directly supporting the exponential growth of the e-commerce sector. The construction industry utilizes them for agile transportation of essential tools and materials. Utility companies, emergency services, and municipal operations widely deploy these robust trucks for vital field maintenance and rapid response duties. Key benefits include enhanced cargo volume, superior towing capabilities, and ease of customization with specialized upfits. Driving factors include the relentless growth of e-commerce platforms, rapid urbanization necessitating robust urban logistics solutions, significant investments in infrastructure development, and an accelerating worldwide push towards sustainability, leading to innovative models offering lower operating costs, reduced emissions, and advanced technological features, collectively propelling the market towards sustained growth.

Class 2 Trucks Market Executive Summary

The Class 2 Trucks Market is experiencing robust growth, primarily propelled by transformative business trends. The sustained expansion of e-commerce creates unprecedented demand for efficient last-mile delivery vehicles, with Class 2 vans and light-duty trucks benefiting directly. This is further intensified by an industry-wide shift towards fleet electrification and sustainable transportation solutions, influenced by corporate ESG objectives and stringent global emission regulations, fostering innovation in electric and hybrid powertrains. Global economic expansion, particularly in emerging markets, coupled with significant governmental infrastructure investments, bolsters demand for vocational Class 2 trucks. This convergence fosters a competitive environment among manufacturers, focusing on technological leadership, digital integration, and diversified product portfolios to secure market share and meet evolving customer needs.

From a regional perspective, North America maintains its dominance due to highly developed logistics infrastructure and major automotive manufacturers. Asia Pacific (APAC) is rapidly emerging as the fastest-growing market, propelled by accelerating urbanization, industrial expansion, and rising disposable incomes in countries like China and India. Europe shows a strong transition towards electric Class 2 trucks, influenced by stringent emission regulations and incentives for green transportation. Latin America and MEA also see steady growth from economic development and fleet modernization. Segment-wise, panel vans and pickup trucks maintain high demand for versatility. The fuel type segment is profoundly shifting, with electric powertrains gaining traction, driven by battery technology advancements, charging infrastructure, and environmental commitment. This granular understanding is critical for manufacturers to develop targeted products and services that meet nuanced customer requirements, driving market differentiation and sustained growth.

AI Impact Analysis on Class 2 Trucks Market

User inquiries and market analyses related to Artificial Intelligence (AI) in the Class 2 Trucks market frequently coalesce around themes of operational efficiency, vehicle safety, and data-driven fleet management. There is considerable interest in how AI algorithms can optimize route planning, predictive maintenance, and cargo management, reducing operational costs, minimizing fuel consumption, and improving delivery times. Concerns include integration complexity, cybersecurity risks, and ethical implications of autonomous technologies. Stakeholders are keen to understand practical applications, timelines for widespread adoption, and benefits in addressing driver shortages and improving fleet productivity within logistics and vocational service sectors.

- Enhanced Predictive Maintenance: AI analyzes vehicle data to predict component failures, reducing unexpected breakdowns, downtime, and extending operational lifespan.

- Optimized Route Planning: AI systems dynamically adjust routes based on real-time traffic, weather, and delivery priorities, leading to fuel savings, reduced emissions, and timely deliveries.

- Autonomous Driving Capabilities: AI powers advanced driver-assistance systems (ADAS) (e.g., adaptive cruise control, automatic emergency braking) and facilitates future semi-autonomous operations in controlled environments.

- Improved Fleet Management: AI provides comprehensive insights into driver behavior, fuel consumption, and vehicle health for informed decision-making and operational excellence.

- Advanced Safety Features: AI enhances active and passive safety through intelligent lighting, driver fatigue detection, and sophisticated object recognition, reducing accident severity.

- Supply Chain Optimization: AI analyzes broader logistics data to streamline inventory, warehousing, and transportation, reducing bottlenecks and improving market responsiveness.

- Personalized Customer Experiences: AI-driven systems provide precise delivery window estimates and real-time tracking, enhancing customer satisfaction and automating communication.

- Cybersecurity & Robust Data Protection: AI-driven measures detect and respond to anomalous activities and potential cyber threats in real-time, safeguarding operational data and vehicle systems.

DRO & Impact Forces Of Class 2 Trucks Market

The Class 2 Trucks market is shaped by a complex interplay of powerful driving forces, inherent restraints, and compelling emerging opportunities. Key drivers include the unprecedented expansion of e-commerce and subsequent surge in demand for efficient last-mile delivery services, necessitating agile Class 2 vehicles. Increasing global investments in critical infrastructure development further amplify demand for specialized vocational trucks. Moreover, a pervasive shift towards sustainable transportation solutions, bolstered by favorable government incentives and stringent emission regulations, accelerates the adoption of electric and alternative-fuel Class 2 trucks. These factors compel manufacturers towards continuous innovation, advanced technological development, and the creation of greener, smarter, and more efficient commercial vehicle options for an evolving market.

However, the market faces notable restraints. A substantial challenge is the relatively high initial acquisition cost of electric Class 2 trucks versus ICE counterparts, coupled with significant investment required for adequate charging infrastructure. Persistent global supply chain disruptions, including chronic semiconductor shortages and volatile raw material prices, impede production volumes and prolong delivery timelines. The complexity of integrating advanced technologies like AI and sophisticated autonomous features also presents hurdles, involving substantial R&D expenses, intricate regulatory compliance, and the critical need for workforce upskilling. These multifaceted constraints necessitate diligent strategic planning, robust supply chain resilience, and collaborative partnerships to mitigate risks and ensure sustainable growth.

Despite these challenges, compelling opportunities exist for significant expansion and innovation. A key area lies in developing highly specialized vocational vehicles, tailored to niche industries like telecommunications, municipal services, and construction trades. Furthermore, burgeoning logistics and construction sectors in rapidly developing emerging markets (APAC, Latin America, Africa) present vast untapped potential. Ongoing advancements in critical core technologies such as battery energy density, ultra-fast-charging, telematics for real-time data, and advanced vehicle connectivity offer clear pathways for creating smarter, more efficient, safer, and environmentally friendly Class 2 trucks. Additionally, the increasing popularity of subscription-based services, flexible leasing, and Vehicle-as-a-Service (VaaS) offerings represents a transformative opportunity, lowering entry barriers and accelerating modern fleet adoption, thereby fostering long-term sustainable growth.

Segmentation Analysis

The Class 2 Trucks market is meticulously segmented to provide granular understanding for precise market analysis, strategic planning, and effective product development. This segmentation is crucial for stakeholders to identify niches, understand customer preferences, assess competitive landscapes, and pinpoint growth opportunities. The framework incorporates key factors: distinct vehicle type (reflecting functional utility), payload capacity (critical performance metric), evolving fuel type (indicating technological shifts and environmental compliance), specific end-use application (highlighting specialized industry demands), and geographical distribution (accounting for regional economic disparities and regulatory environments). Each segment exhibits unique growth drivers, challenges, and competitive dynamics, influencing product development, manufacturing strategies, pricing models, and marketing approaches globally. This detailed breakdown ensures manufacturers tailor offerings to meet heterogeneous customer requirements, optimizing market penetration, customer satisfaction, and profitability.

- By Vehicle Type: Panel Vans, Pickup Trucks, Chassis Cabs, Cutaway Vans, Step Vans, Other Specialty Vehicles.

- By Fuel Type: Gasoline, Diesel, Electric, Hybrid, CNG/LPG.

- By Payload Capacity: 6,001-7,500 lbs, 7,501-10,000 lbs.

- By Application: Last-Mile Delivery, Construction, Utilities & Municipal, Food & Beverage Distribution, Retail & Wholesale, Rental & Leasing, Emergency Services, Others.

- By End-User: Fleet Owners (Large Corporations), Small & Medium Enterprises (SMEs), Government & Public Sector, Individual Owners.

Value Chain Analysis For Class 2 Trucks Market

The value chain for the Class 2 Trucks market is an intricate, global, and multi-layered ecosystem, meticulously spanning from raw material extraction to critical aftermarket support and end-of-life management. Upstream activities involve mining and processing essential raw materials (steel, aluminum, plastics, electronics). These are supplied to Tier 2 and Tier 1 component manufacturers specializing in complex systems like engines, transmissions, axles, braking systems, and advanced electronic modules. Efficient, sustainable, and ethically sourced management of these upstream processes is paramount, directly impacting production costs, vehicle quality and reliability, and overall supply chain resilience, especially in a globalized manufacturing environment susceptible to disruptions. Robust supplier relationships, diversified sourcing, and transparent traceability are vital for mitigating risks.

Midstream activities center around core manufacturing and precise assembly of Class 2 trucks by Original Equipment Manufacturers (OEMs). This pivotal stage encompasses vehicle design, advanced engineering, prototyping, and high-volume mass production, often leveraging automation and robotics. Following production, finished vehicles move through diverse distribution channels: direct (manufacturer-owned dealerships) or indirect (independent dealerships, 3PL providers). Strategic choice and optimization of these channels profoundly influence market penetration, customer acquisition costs, customer experience, and logistical efficiency, considering varied geographical and regulatory requirements.

Downstream activities focus on delivering the product to the end-user and ensuring sustained optimal performance. This segment primarily encompasses aggressive sales/marketing, accessible financing options, and crucial, proactive aftermarket services (maintenance, repairs, spare parts, software updates, technology upgrades). These are vital for customer satisfaction and long-term brand loyalty. Both direct OEM service centers and indirect networks play significant roles. Increasing adoption of advanced telematics and sophisticated connected vehicle technologies fundamentally transforms aftermarket services, enabling predictive maintenance, remote diagnostics, and proactive service scheduling, minimizing downtime. Overall efficacy and competitiveness are determined by seamless integration and collaborative coordination among stakeholders, with a strong focus on comprehensive sustainability throughout the entire chain.

Class 2 Trucks Market Potential Customers

The potential customer base for the Class 2 Trucks market is remarkably broad, highly diverse, and continually expanding, reflecting the inherent versatility and adaptive utility of these essential vehicles across a multitude of economic sectors and operational demands. Customers, ranging from individual contractors to multinational corporations and governmental bodies, prioritize a nuanced mix of factors: optimal payload capacity, superior fuel efficiency, unwavering reliability, low total cost of ownership (TCO), and extensive customization capabilities. The burgeoning e-commerce sector represents a colossal and rapidly growing demand driver, attracting logistics companies, parcel carriers, and last-mile delivery services requiring agile, efficient, and increasingly electric Class 2 vans and trucks to navigate urban distribution networks and ensure timely, cost-effective deliveries. Similarly, small and medium-sized enterprises (SMEs) across diverse sectors (e.g., plumbing, carpentry, local food distribution) form a substantial and foundational part of the customer base, relying heavily on Class 2 trucks for daily operations, valuing their robust construction, practical utility, and often lower entry cost compared to heavier commercial vehicles.

Beyond commercial enterprises, government agencies and municipal departments constitute another significant and specialized segment of buyers, deploying Class 2 trucks for critical public services like infrastructure maintenance, utility management, and emergency services. Paramount considerations for these clients include extreme durability, ease of maintenance, and seamless integration of highly specialized equipment. The rental and leasing industry also represents a key and rapidly expanding customer segment, as businesses increasingly opt for flexible fleet solutions, driven by fluctuating demand and the desire to avoid substantial upfront capital expenditures. Furthermore, the accelerating global trend of vehicle electrification attracts a new demographic of environmentally conscious businesses, public sector organizations, and entrepreneurs committed to reducing their carbon footprint and leveraging long-term operational savings. Manufacturers respond by offering broad configurations, diverse powertrain options (gasoline, diesel, hybrid, electric), cutting-edge technological features (telematics, safety packages), and extensive customization services to meet diverse demands and foster long-term customer relationships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 25.5 billion |

| Market Forecast in 2032 | USD 41.5 billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ford Motor Company, General Motors Company, Stellantis N.V., Toyota Motor Corporation, Mercedes-Benz AG, Nissan Motor Corporation, Isuzu Motors Ltd., Fuso Truck and Bus Corporation, Navistar International Corporation (Traton Group), PACCAR Inc., Rivian Automotive, Inc., Canoo Inc., Workhorse Group Inc., Lightning eMotors, BrightDrop (GM), XL Fleet Corp., Hino Motors, LLC, Volkswagen AG, Daimler Truck AG, Bollinger Motors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Class 2 Trucks Market Key Technology Landscape

The Class 2 Trucks market is undergoing an unprecedented technological transformation, driven by an urgent global mandate for increased operational efficiency, drastically reduced emissions, and enhanced vehicle safety and connectivity. A central and pivotal shift is observed in advanced powertrain technologies, with an emphatic global movement towards comprehensive vehicle electrification. This trend manifests prominently in the accelerating adoption of battery electric vehicles (BEVs) and, to a lesser extent, hybrid electric vehicles (HEVs). This profound shift is propelled by remarkable advancements in battery energy density, extended operational ranges, rapid expansion of charging infrastructure, and strong governmental incentives/corporate sustainability mandates. This transition necessitates the development and seamless integration of sophisticated battery management systems (BMS), highly efficient electric motors, advanced power electronics, and new vehicle architectures optimized for electric propulsion (e.g., modular skateboard platforms). Concurrently, traditional diesel and gasoline engines evolve with innovations focused on advanced turbocharging, precise direct injection systems, and sophisticated emission control technologies (e.g., SCR, DPFs) to meet stringent global environmental regulations and maintain competitive performance.

Beyond core powertrain innovations, the integration of advanced connectivity solutions and sophisticated telematics systems is playing an increasingly crucial role. These integrated telematics provide unparalleled real-time data, encompassing granular insights into vehicle performance, driver behavior analytics, intelligent route optimization, and critical predictive maintenance alerts. This actionable data empowers fleet managers to make informed decisions, leading to substantial improvements in operational efficiency, significant reductions in fuel consumption, proactive maintenance, and lower total cost of ownership (TCO). The burgeoning proliferation of 5G cellular networks further amplifies capabilities, facilitating faster data transmission, complex cloud-based analytical applications, and advanced vehicle-to-everything (V2X) communication. Moreover, over-the-air (OTA) updates are rapidly becoming standard, allowing for seamless remote software improvements, feature additions, and security patches, minimizing downtime. Advanced Driver-Assistance Systems (ADAS) represent another cornerstone, meticulously designed to improve active safety and reduce driver fatigue, with features like adaptive cruise control, lane-keeping assist, and automatic emergency braking becoming standard. These systems leverage interconnected sensors and AI algorithms to perceive surroundings and assist drivers, fundamentally redefining capabilities, operational profiles, safety standards, and environmental impact of Class 2 trucks.

Regional Highlights

- North America: Dominant market share driven by robust e-commerce growth, extensive logistics networks, and high adoption of advanced fleet management technologies. Characterized by a strong presence of major OEMs and a mature regulatory environment.

- Europe: Leading the transition towards electric Class 2 trucks due to stringent emission regulations (e.g., Euro 7) and strong governmental incentives for green commercial vehicles. Focus on urban logistics efficiency and sustainable last-mile delivery solutions is prominent.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapid urbanization, expanding industrialization, and increasing e-commerce penetration, particularly in economic powerhouses like China and India. Exhibits rising demand for affordable and efficient commercial vehicles for diverse applications.

- Latin America: An emerging market experiencing growth driven by economic recovery and ongoing infrastructure development. Modernization of existing commercial fleets is a key trend, though advanced technology adoption is still in earlier stages.

- Middle East & Africa (MEA): Shows steady growth influenced by significant investments in logistics infrastructure, especially within the GCC countries. Characterized by demand for robust Class 2 trucks suitable for varied terrain and challenging operational conditions, with a gradual uptake of newer technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Class 2 Trucks Market.- Ford Motor Company

- General Motors Company

- Stellantis N.V.

- Toyota Motor Corporation

- Mercedes-Benz AG

- Nissan Motor Corporation

- Isuzu Motors Ltd.

- Fuso Truck and Bus Corporation

- Navistar International Corporation (Traton Group)

- PACCAR Inc.

- Rivian Automotive, Inc.

- Canoo Inc.

- Workhorse Group Inc.

- Lightning eMotors

- BrightDrop (GM)

- XL Fleet Corp.

- Hino Motors, LLC

- Volkswagen AG

- Daimler Truck AG

- Bollinger Motors

Frequently Asked Questions

What is the projected growth rate for the Class 2 Trucks Market?

The Class 2 Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032, primarily driven by expanding e-commerce and fleet electrification initiatives.

What are the primary factors driving the Class 2 Trucks Market?

Key drivers include the booming e-commerce sector, increased demand for last-mile delivery, significant infrastructure development, and the global push towards sustainable and electric commercial vehicles, supported by favorable regulations.

How is AI impacting the Class 2 Trucks Market?

AI is significantly enhancing operational efficiency through optimized route planning, predictive maintenance, and advanced driver-assistance systems (ADAS), leading to improved safety, reduced operational costs, and better fleet management.

Which regions are key contributors to the Class 2 Trucks Market?

North America holds a dominant market share due to its developed logistics and strong economy. Asia Pacific is the fastest-growing market, while Europe leads in electric truck adoption driven by stringent emission regulations.

What are the major segments within the Class 2 Trucks Market?

The market is primarily segmented by Vehicle Type (e.g., Panel Vans, Pickup Trucks), Fuel Type (e.g., Electric, Diesel), Payload Capacity, Application (e.g., Last-Mile Delivery, Construction), and End-User (e.g., Fleet Owners, SMEs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager