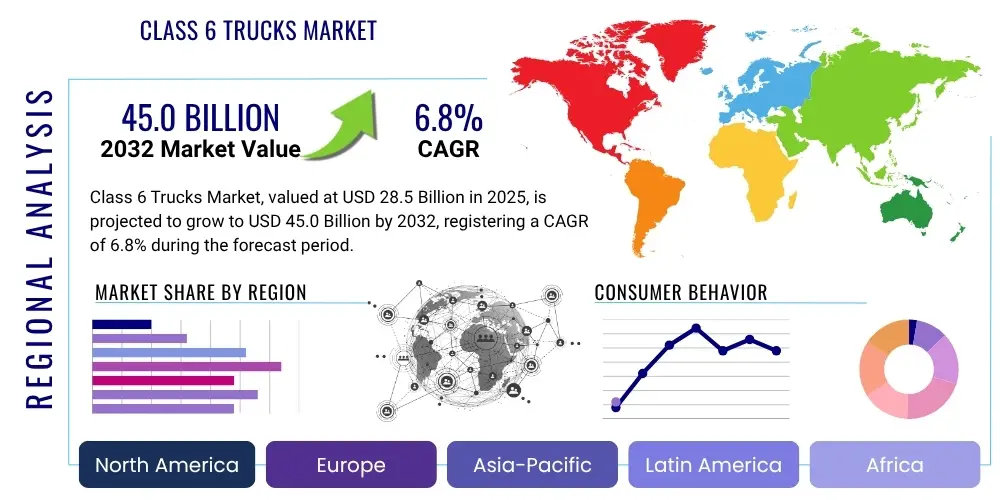

Class 6 Trucks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429002 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Class 6 Trucks Market Size

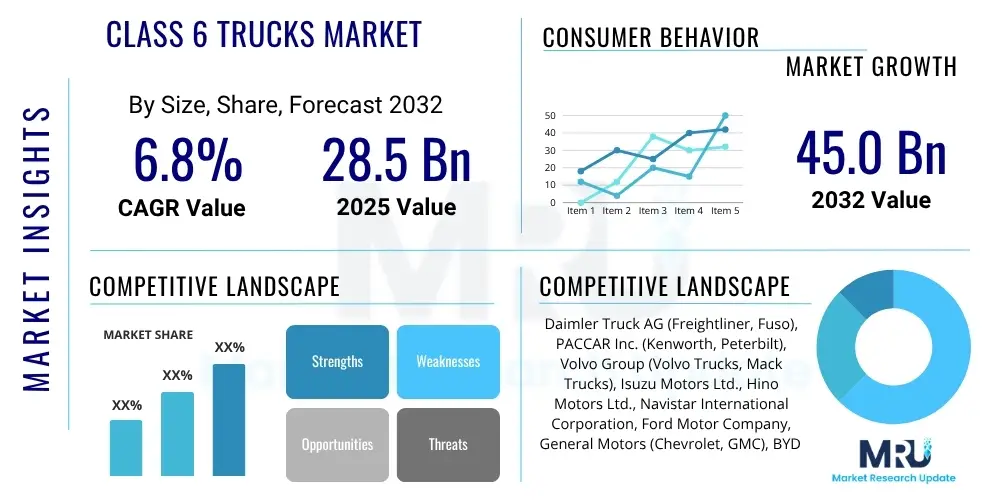

The Class 6 Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 28.5 Billion in 2025 and is projected to reach USD 45.0 Billion by the end of the forecast period in 2032.

Class 6 Trucks Market introduction

The Class 6 Trucks Market encompasses a vital segment of the commercial vehicle industry, specializing in medium-duty trucks designed for diverse operational requirements. Class 6 trucks are defined by a Gross Vehicle Weight Rating (GVWR) ranging from 19,501 to 26,000 pounds (8,846 to 11,793 kg), striking a balance between payload capacity and urban maneuverability. These versatile vehicles serve as the backbone for numerous logistical and service-oriented applications, bridging the gap between lighter delivery vans and heavy-duty transport.

Product descriptions for Class 6 trucks typically highlight robust chassis configurations, various powertrain options including traditional diesel, hybrid, and increasingly electric, and specialized body types tailored for specific tasks. Their primary benefits include enhanced payload over smaller vehicles, improved fuel efficiency compared to heavier trucks for specific routes, and better navigability in congested urban environments. The driving factors behind market growth are multi-faceted, notably the surge in e-commerce necessitating efficient last-mile and regional distribution, ongoing urbanization which increases demand for municipal and utility services, and a persistent focus on operational efficiency and environmental sustainability across industries.

Major applications for Class 6 trucks include local and regional freight delivery, food and beverage distribution, refuse collection, utility maintenance, construction support, and specialized service applications. The market is propelled by the growing need for reliable and adaptable transportation solutions that can address the evolving demands of modern logistics and service industries. As urban centers expand and consumer expectations for timely deliveries rise, the role of Class 6 trucks becomes increasingly critical, driving innovation in vehicle design, powertrain technology, and fleet management systems.

Class 6 Trucks Market Executive Summary

The Class 6 Trucks Market is experiencing dynamic shifts, driven by transformative business trends, evolving regional demands, and significant advancements across its various segments. Key business trends indicate a strong emphasis on electrification and the integration of advanced telematics and connectivity solutions aimed at optimizing fleet operations and reducing environmental impact. Enterprises are increasingly investing in Class 6 electric trucks to meet sustainability targets and comply with stricter emission regulations, leading to a burgeoning market for zero-emission vehicles, particularly in urban delivery contexts.

Regional trends reveal North America and Europe as mature markets leading the adoption of new technologies and sustainable practices, propelled by robust e-commerce growth and governmental incentives for green logistics. The Asia Pacific region is demonstrating rapid growth, fueled by industrialization, urbanization, and a burgeoning middle class driving consumer demand, albeit with varying paces of technological adoption. Latin America, the Middle East, and Africa are emerging markets, where infrastructure development and expanding logistics networks are gradually increasing the demand for reliable Class 6 truck fleets.

Segment trends underscore the gradual but accelerating transition from conventional diesel powertrains to electric and alternative fuel options, influenced by total cost of ownership considerations, range improvements, and charging infrastructure development. Applications in last-mile delivery and municipal services are seeing significant expansion, with a growing demand for customized vehicle configurations. This comprehensive evolution across business models, geographic footprints, and product offerings defines the current landscape of the Class 6 Trucks Market, positioning it for sustained innovation and expansion.

AI Impact Analysis on Class 6 Trucks Market

The integration of Artificial Intelligence (AI) into the Class 6 Trucks Market is fundamentally reshaping operational efficiencies, safety protocols, and maintenance strategies, addressing common user questions about fleet optimization, predictive analytics, and autonomous capabilities. Users frequently inquire about how AI can enhance route planning, reduce fuel consumption, minimize downtime through smart maintenance, and contribute to driver safety. The overarching expectation is that AI will create smarter, more autonomous, and significantly more efficient trucking operations, mitigating challenges associated with labor shortages, escalating operational costs, and environmental pressures.

- AI-powered predictive maintenance: Utilizes sensor data to forecast equipment failures, minimizing unexpected downtime and optimizing service schedules for Class 6 trucks.

- Advanced route optimization: AI algorithms analyze traffic, weather, and delivery schedules to identify the most efficient routes, reducing fuel consumption and delivery times.

- Enhanced driver assistance systems (ADAS): AI enables features like adaptive cruise control, lane-keeping assistance, and automatic emergency braking, improving safety and reducing driver fatigue.

- Fleet management and telematics: AI processes vast amounts of real-time data from truck fleets to provide insights into driver behavior, asset utilization, and operational performance.

- Partial autonomous driving capabilities: AI facilitates features such as platooning and automated parking, increasing efficiency and potentially reducing accident risks in controlled environments.

- Demand forecasting and inventory management: AI helps logistics companies anticipate demand for goods, optimizing load capacities and reducing empty mileage for Class 6 trucks.

- Fuel efficiency optimization: AI systems monitor driving patterns and engine performance, providing recommendations to drivers and fleet managers for improved fuel economy.

DRO & Impact Forces Of Class 6 Trucks Market

The Class 6 Trucks Market is shaped by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers include the exponential growth of e-commerce and last-mile delivery services, necessitating a robust fleet of medium-duty vehicles capable of efficient urban logistics. Furthermore, increasing urbanization and the expansion of infrastructure projects worldwide fuel demand for Class 6 trucks in municipal, utility, and construction applications. Stricter environmental regulations compelling fleets to adopt cleaner vehicles, coupled with technological advancements in electric and alternative fuel powertrains, also act as strong market catalysts, pushing innovation and fleet modernization.

However, the market faces notable restraints, such as the high initial acquisition cost associated with advanced technology trucks, particularly electric vehicles, which can deter smaller operators. The nascent and often inadequate charging and refueling infrastructure for alternative fuels presents another significant hurdle, limiting the widespread adoption of non-diesel trucks. Economic uncertainties and fluctuations in fuel prices can also impact fleet purchasing decisions and operational budgets. Moreover, the shortage of skilled drivers and technicians capable of operating and maintaining technologically advanced trucks poses a long-term challenge to market growth and operational efficiency.

Opportunities for growth are abundant, particularly in the development and deployment of electric and hydrogen fuel cell Class 6 trucks, catering to the burgeoning demand for sustainable urban logistics solutions. The integration of advanced telematics, AI, and connectivity solutions offers avenues for enhanced operational efficiency, predictive maintenance, and optimized fleet management. Emerging markets, with their rapid infrastructure development and growing consumer bases, represent untapped potential for market expansion. Impact forces such as evolving government policies and incentives for green vehicles, rapid technological disruptions in vehicle autonomy and connectivity, and shifting consumer preferences towards faster and more sustainable delivery services continue to exert a profound influence on the market's trajectory, compelling stakeholders to adapt and innovate continuously.

Segmentation Analysis

The Class 6 Trucks Market is comprehensively segmented to provide a detailed understanding of its diverse operational landscape and various influencing factors. This segmentation allows for targeted analysis of market dynamics, competitive positioning, and growth opportunities across different product types, applications, fuel sources, and end-user categories. The primary segmentation dimensions enable stakeholders to identify niche markets, assess regional preferences, and align strategic initiatives with specific industry demands. By dissecting the market into these core components, a clearer picture emerges regarding current market composition and future growth trajectories, reflecting the multifaceted nature of the medium-duty truck sector.

- By Fuel Type

- Diesel

- Electric

- Hybrid

- Natural Gas

- Hydrogen Fuel Cell

- By Application

- Delivery and Logistics (e-commerce, parcel, food & beverage)

- Municipal Services (waste management, public works)

- Construction and Vocational (dump, utility, crane)

- Utility and Telecommunications

- Rental and Leasing Fleets

- Others (emergency services, agricultural support)

- By End-User

- Fleet Owners

- Government and Public Sector

- Individual Operators

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises and Corporations

- By GVW Rating Sub-Type (within Class 6)

- 19,501-22,000 lbs

- 22,001-26,000 lbs

- By Axle Configuration

- 4x2

- 6x2

Value Chain Analysis For Class 6 Trucks Market

The value chain for the Class 6 Trucks Market is an intricate network spanning from raw material sourcing to end-user services, involving multiple stages and diverse participants. The upstream segment commences with the extraction and processing of raw materials such as steel, aluminum, rubber, and plastics, which are then supplied to various component manufacturers. These manufacturers specialize in producing engines, transmissions, axles, chassis frames, electronic control units, and advanced safety systems. Key suppliers in this stage are crucial for innovation and quality, directly influencing the performance and efficiency of the final truck product. Research and development activities also play a vital upstream role, shaping future truck designs and technologies like electric powertrains and autonomous features.

The midstream segment is dominated by Original Equipment Manufacturers (OEMs), who assemble these components into complete Class 6 trucks. OEMs are responsible for design, engineering, manufacturing, and ensuring compliance with various safety and environmental regulations. This stage involves complex supply chain management, quality control, and sophisticated assembly lines. After manufacturing, trucks move into the downstream segment, which primarily involves distribution and sales. This includes a network of authorized dealerships, distributors, and direct sales channels that connect manufacturers to end-users.

Distribution channels are multifaceted, including both direct sales from manufacturers to large fleet customers and indirect sales through extensive dealer networks that offer sales, financing, and after-sales support. Aftermarket services, including maintenance, repairs, parts supply, and technology upgrades, form a critical part of the downstream value chain, ensuring the longevity and operational efficiency of the trucks throughout their lifecycle. The interplay between these upstream and downstream activities, supported by robust distribution and after-sales services, collectively defines the robust and complex value chain of the Class 6 Trucks Market, emphasizing collaboration and efficiency at every stage to deliver value to the end customer.

Class 6 Trucks Market Potential Customers

Potential customers for Class 6 trucks represent a broad spectrum of industries and organizations that require versatile, medium-duty vehicles for their operational needs. These end-users typically prioritize factors such as payload capacity, fuel efficiency, maneuverability in urban environments, reliability, and increasingly, sustainable powertrain options. The primary customer base includes enterprises engaged in local and regional distribution, urban services, and specialized vocational tasks, all of whom rely on these trucks to perform their core business functions efficiently and effectively. Their purchasing decisions are often influenced by total cost of ownership, regulatory compliance, and the ability of the trucks to integrate with existing fleet management systems.

Key segments of potential customers include parcel and express delivery services, which are experiencing explosive growth due to e-commerce expansion, demanding large fleets of Class 6 trucks for last-mile and middle-mile logistics. Food and beverage distributors, including grocers and restaurant suppliers, also represent a significant customer group, utilizing these trucks for refrigerated and dry goods transport within metropolitan areas. Municipal and public works departments are consistent buyers, deploying Class 6 trucks for waste collection, road maintenance, utility services, and other essential civic operations. Construction companies, particularly those involved in smaller-scale projects or requiring specialized equipment transport, also constitute a vital customer segment.

Furthermore, rental and leasing companies are significant buyers, providing flexible fleet solutions to businesses that prefer not to own their vehicles outright. Utility companies, including electric, gas, and telecommunications providers, frequently employ Class 6 trucks fitted with aerial lifts and other specialized equipment for infrastructure maintenance and repair. Additionally, various niche applications, such as emergency services, agricultural support, and mobile service providers, contribute to the diverse customer base. These end-users are continually seeking durable, efficient, and technologically advanced Class 6 trucks that can enhance their operational capabilities and support their evolving business models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2032 | USD 45.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG (Freightliner, Fuso), PACCAR Inc. (Kenworth, Peterbilt), Volvo Group (Volvo Trucks, Mack Trucks), Isuzu Motors Ltd., Hino Motors Ltd., Navistar International Corporation, Ford Motor Company, General Motors (Chevrolet, GMC), BYD Auto Co. Ltd., Nikola Corporation, Xos Trucks, Lion Electric Company, Scania AB, Renault Trucks, Oshkosh Corporation, Autocar LLC, Battle Motors, EAVX (a JB Poindexter & Co. business), Cummins Inc. (engine supplier), Allison Transmission (transmission supplier) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Class 6 Trucks Market Key Technology Landscape

The Class 6 Trucks Market is at the forefront of a significant technological transformation, driven by demands for increased efficiency, reduced environmental impact, and enhanced operational safety. A pivotal shift is occurring in powertrain technology, moving beyond conventional diesel engines to embrace electric, hybrid, and hydrogen fuel cell alternatives. Electric powertrains, specifically battery electric vehicles (BEVs), are gaining considerable traction for urban delivery and municipal applications, offering zero tailpipe emissions and quieter operation. Concurrently, advancements in battery energy density, charging infrastructure, and electric motor efficiency are making these alternatives increasingly viable and attractive to fleet operators seeking to comply with stringent emissions standards and achieve sustainability targets.

Alongside powertrain innovations, the market is heavily investing in advanced driver-assistance systems (ADAS) and connectivity solutions. ADAS technologies, including adaptive cruise control, lane-keeping assistance, blind-spot monitoring, and automatic emergency braking, are becoming standard features, significantly improving driver safety and reducing accident rates. Telematics and fleet management systems are leveraging real-time data analytics, GPS tracking, and remote diagnostics to optimize routes, monitor driver behavior, manage maintenance schedules, and improve overall fleet utilization. These connected technologies provide critical insights for operational decision-making, enabling predictive maintenance and reducing unexpected downtime.

Further technological advancements include the development of lightweight materials for chassis and body construction, such as high-strength steel and aluminum alloys, which contribute to increased payload capacity and improved fuel efficiency. The integration of Artificial Intelligence (AI) and machine learning algorithms is enhancing various aspects, from predictive maintenance to autonomous driving capabilities, albeit at nascent stages for full autonomy in Class 6 trucks. These technological strides collectively aim to create a more efficient, safer, and environmentally responsible Class 6 truck fleet, addressing current operational challenges and preparing for future logistical demands.

Regional Highlights

- North America: This region stands as a significant market for Class 6 trucks, primarily driven by a robust e-commerce sector and extensive logistics networks. Strict emission regulations and increasing consumer demand for sustainable practices are accelerating the adoption of electric and alternative fuel trucks. The presence of major OEMs and a mature infrastructure also contribute to its leading position.

- Europe: Characterized by stringent environmental regulations and a strong focus on urban logistics and last-mile delivery, Europe is witnessing rapid growth in the electric Class 6 truck segment. Government incentives for zero-emission vehicles and a dense urban landscape foster innovation in compact and efficient truck designs, making it a key region for sustainable transportation solutions.

- Asia Pacific (APAC): The APAC region represents the fastest-growing market, propelled by rapid urbanization, industrialization, and booming e-commerce activities, particularly in countries like China and India. Expanding infrastructure and a growing middle class drive demand for efficient medium-duty logistics. While diesel trucks still dominate, there is a gradual shift towards cleaner technologies, influenced by local air quality concerns and policy initiatives.

- Latin America: This region presents an emerging market with substantial growth potential, albeit with diverse economic conditions and infrastructure development levels. Expanding trade, improving road networks, and growing domestic consumption are increasing the demand for Class 6 trucks, especially for regional distribution and vocational applications.

- Middle East and Africa (MEA): The MEA region is a developing market, with growth primarily driven by infrastructure development projects, increasing economic diversification, and expanding logistics requirements for industries like oil and gas, retail, and construction. Adoption of advanced truck technologies is still in early stages but is expected to accelerate with foreign investment and regional development plans.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Class 6 Trucks Market.- Daimler Truck AG (Freightliner, Fuso)

- PACCAR Inc. (Kenworth, Peterbilt)

- Volvo Group (Volvo Trucks, Mack Trucks)

- Isuzu Motors Ltd.

- Hino Motors Ltd.

- Navistar International Corporation

- Ford Motor Company

- General Motors (Chevrolet, GMC)

- BYD Auto Co. Ltd.

- Nikola Corporation

- Xos Trucks

- Lion Electric Company

- Scania AB

- Renault Trucks

- Oshkosh Corporation

- Autocar LLC

- Battle Motors

- EAVX (a JB Poindexter & Co. business)

- Cummins Inc.

- Allison Transmission

Frequently Asked Questions

What defines a Class 6 truck?

A Class 6 truck is categorized by its Gross Vehicle Weight Rating (GVWR), which ranges from 19,501 to 26,000 pounds (8,846 to 11,793 kg). These medium-duty trucks are versatile and commonly used for local and regional delivery, municipal services, and various vocational applications due to their balance of payload capacity and maneuverability.

What are the primary applications of Class 6 trucks?

Class 6 trucks are widely utilized for delivery and logistics services, including parcel delivery, food and beverage distribution, and general freight. They are also crucial for municipal services like waste collection and public works, as well as utility maintenance, construction support, and rental fleets, offering adaptable solutions for diverse operational needs.

What factors are driving the shift towards electric Class 6 trucks?

The shift towards electric Class 6 trucks is primarily driven by stringent environmental regulations, corporate sustainability goals, and the economic benefits of lower operating costs and reduced fuel dependency. Government incentives, advancements in battery technology, and the expansion of charging infrastructure also significantly contribute to this transition, especially for urban and last-mile applications.

How is AI impacting the Class 6 Trucks market?

AI is impacting the Class 6 Trucks market through enhanced fleet management, predictive maintenance, and optimized route planning, leading to greater efficiency and reduced operational costs. It also powers advanced driver-assistance systems (ADAS) for improved safety and contributes to the development of partial autonomous driving capabilities, transforming vehicle performance and reliability.

What are the key challenges facing the Class 6 Trucks market?

Key challenges for the Class 6 Trucks market include the high initial acquisition cost of advanced technology vehicles, particularly electric trucks, and the insufficient charging or refueling infrastructure for alternative fuels. Additionally, economic uncertainties, fluctuating fuel prices, and a persistent shortage of skilled drivers and technicians pose significant hurdles to sustained market growth and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager