Clean Labelled Food Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430321 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Clean Labelled Food Additives Market Size

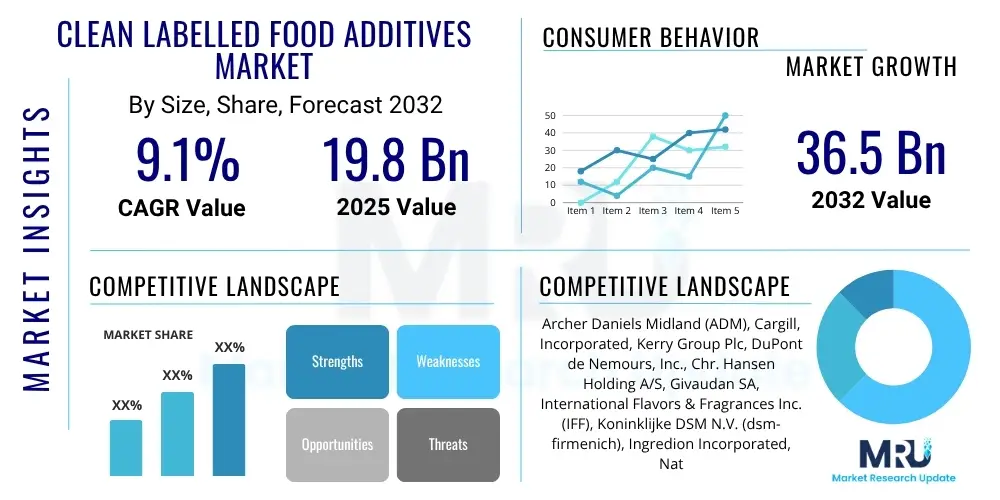

The Clean Labelled Food Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% between 2025 and 2032. The market is estimated at USD 19.8 Billion in 2025 and is projected to reach USD 36.5 Billion by the end of the forecast period in 2032.

Clean Labelled Food Additives Market introduction

The Clean Labelled Food Additives Market represents a dynamic and rapidly expanding segment within the broader food and beverage industry, driven by an escalating global consumer demand for transparent, wholesome, and minimally processed food products. A clean label typically refers to food products containing natural, familiar, and simple ingredients that are easy for consumers to recognize, understand, and pronounce. This movement emphasizes the removal of artificial ingredients, synthetic colors, flavors, preservatives, and other chemical compounds often associated with highly processed foods, replacing them with natural alternatives derived from plants, fruits, vegetables, and fermentation processes. The core principle revolves around delivering products perceived as healthier, safer, and more authentic, thereby building greater trust between manufacturers and consumers.

The product description of clean labelled food additives encompasses a wide array of ingredients that perform traditional additive functions such as preservation, coloring, flavoring, texturizing, and sweetening, but originate from natural sources. These can include natural antioxidants like rosemary extract, natural colors from beet or spirulina, natural flavors from fruit and vegetable concentrates, and functional ingredients like plant-based proteins, fibers, and starches. Major applications span nearly all food and beverage categories, from bakery and confectionery to dairy, beverages, snacks, meat products, and ready-to-eat meals. As consumers increasingly scrutinize ingredient lists, manufacturers are investing heavily in research and development to discover and scale natural alternatives that maintain product quality, shelf life, and sensory attributes without compromising the "clean" promise.

The benefits of clean labelled food additives are multifaceted, extending beyond mere consumer appeal. For consumers, these products offer peace of mind, contributing to perceived healthier diets and reducing exposure to artificial substances. For manufacturers, adopting clean label strategies can enhance brand reputation, foster consumer loyalty, and open new market opportunities in the premium and health-conscious segments. Driving factors for this market include rising health awareness, particularly concerning the long-term effects of synthetic ingredients; increasing prevalence of food allergies and intolerances leading to demand for simpler formulations; stringent regulatory pressures in some regions advocating for ingredient transparency; and significant advancements in food science enabling the extraction and stabilization of effective natural additives. The shift towards plant-based diets and sustainable sourcing also plays a crucial role, aligning perfectly with the clean label ethos.

Clean Labelled Food Additives Market Executive Summary

The Clean Labelled Food Additives Market is experiencing robust growth, primarily fueled by evolving consumer preferences for natural, transparent, and minimally processed food ingredients. This market is characterized by significant business trends including a surge in strategic collaborations, mergers, and acquisitions among ingredient suppliers and food manufacturers aiming to expand their clean label portfolios and leverage specialized expertise. Innovation remains at the forefront, with companies focusing on developing novel natural extracts, fermentation-derived ingredients, and plant-based solutions that can effectively replace synthetic counterparts without compromising product functionality or sensory profiles. Furthermore, the market is witnessing increased investment in sustainable sourcing practices and ethical production, reflecting a broader industry commitment to environmental and social responsibility, which resonates strongly with the clean label philosophy.

Regionally, North America and Europe currently dominate the clean labelled food additives market, driven by high consumer awareness, strong regulatory frameworks supporting transparency, and the early adoption of clean label trends by leading food and beverage companies. These regions are characterized by mature markets where consumers are willing to pay a premium for natural and organic products. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by rising disposable incomes, rapid urbanization, changing dietary habits, and increasing awareness of health and wellness benefits. Countries like China, India, and Japan are witnessing a significant uptake in demand for clean label products, prompting both local and international players to expand their presence and tailor offerings to regional tastes and preferences. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as consumer education and product availability improve.

Segmentation trends reveal substantial growth across various ingredient categories and applications. Natural flavors, colors, and preservatives continue to be major revenue generators as manufacturers seek to enhance appeal and shelf life using botanical extracts and fermented ingredients. The demand for natural sweeteners, such as stevia and monk fruit, is also accelerating due to global efforts to reduce sugar consumption. In terms of applications, the bakery and confectionery, beverages, and dairy sectors are leading the adoption of clean label additives, driven by intense competition and a strong consumer focus on these everyday items. Functional ingredients like plant proteins, fibers, and prebiotics, which align with clean label principles, are also experiencing remarkable growth as consumers seek foods that offer added health benefits beyond basic nutrition. These trends underscore a holistic shift within the food industry towards healthier, more transparent, and sustainably produced food solutions.

AI Impact Analysis on Clean Labelled Food Additives Market

The integration of Artificial Intelligence (AI) is rapidly transforming various facets of the Clean Labelled Food Additives Market, addressing common user questions about efficiency, innovation, and quality. Users are keenly interested in how AI can accelerate the discovery of novel natural ingredients, optimize complex formulations, ensure stringent quality control, and predict consumer preferences for clean label products. Key themes include AI's role in speeding up R&D cycles for plant-based alternatives, enhancing supply chain transparency and traceability, and enabling personalized nutrition strategies that align with clean label principles. Concerns often revolve around the initial investment costs, the need for specialized data infrastructure, and ensuring data privacy, but the overwhelming expectation is that AI will be a critical enabler for the future growth and sustainability of the clean label movement, offering unprecedented analytical capabilities to meet consumer demand more effectively.

- AI-powered predictive analytics optimize ingredient sourcing, identifying natural raw materials with desired functional properties.

- Machine learning algorithms accelerate the discovery of new natural compounds with preservative, coloring, or flavoring capabilities.

- AI assists in complex clean label formulation, balancing sensory attributes, shelf life, and nutritional profiles with natural ingredients.

- Computer vision and sensor technologies enhance quality control of natural additives, detecting contaminants or inconsistencies.

- AI-driven consumer insights predict evolving preferences for clean label ingredients, guiding product development strategies.

- Blockchain integration with AI improves supply chain transparency and traceability for natural and organic raw materials.

- Robotics and automation, guided by AI, optimize production processes for natural additive extraction and blending.

- AI supports personalized nutrition solutions by recommending specific clean label additives tailored to individual health needs.

- Advanced data analysis helps manufacturers navigate regulatory landscapes and ensure compliance for natural ingredients.

- AI facilitates waste reduction and resource optimization in the production of clean label additives, promoting sustainability.

DRO & Impact Forces Of Clean Labelled Food Additives Market

The Clean Labelled Food Additives Market is influenced by a powerful combination of drivers, restraints, opportunities, and broader impact forces that shape its trajectory. A primary driver is the pervasive and growing consumer demand for natural and transparent food ingredients, stemming from increased health consciousness, a desire to avoid artificial chemicals, and greater scrutiny of ingredient labels. This consumer-led push is further amplified by evolving regulatory frameworks in key regions that increasingly favor clear labeling and restrict certain synthetic additives, compelling manufacturers to reformulate products. Technological advancements in extraction, fermentation, and encapsulation techniques are also crucial drivers, enabling the development and commercialization of effective natural alternatives that can match the performance of synthetic ingredients, thereby expanding the possibilities for clean label innovation across various food applications.

Despite significant growth potential, the market faces several notable restraints. One major challenge is the generally higher cost associated with sourcing, processing, and stabilizing natural ingredients compared to their synthetic counterparts. This cost premium can impact profitability and limit widespread adoption, especially in price-sensitive markets. Another restraint involves the functional limitations of some natural additives, such as their shorter shelf life, lower stability against heat or light, or less intense sensory profiles, which can make formulation challenging for manufacturers accustomed to the robustness of artificial ingredients. Supply chain volatility for natural raw materials, often subject to agricultural yields, climate conditions, and geopolitical factors, also poses a significant restraint, leading to price fluctuations and potential shortages that can disrupt production schedules for clean label products.

Opportunities within the clean label additives market are abundant and diverse. Emerging markets in Asia Pacific, Latin America, and Africa present significant untapped potential as consumer incomes rise and awareness of health and wellness trends grows. These regions offer new avenues for market penetration and expansion for ingredient suppliers and food manufacturers alike. Furthermore, continuous research and development into novel natural sources for functional ingredients, including exploring new botanical extracts, microbial fermentation products, and sustainable marine resources, promises to unlock a new generation of clean label solutions with enhanced performance. The increasing trend towards personalized nutrition and functional foods also creates a fertile ground for clean label additives that can deliver specific health benefits, such as immune support, digestive health, or cognitive enhancement, using transparent and naturally derived ingredients. The rising demand for plant-based foods further intertwines with clean label, offering synergistic growth opportunities.

The market is also shaped by several impact forces that define its competitive landscape and attractiveness. The bargaining power of buyers, primarily large food and beverage manufacturers, is moderately high due to their volume purchases and ability to switch suppliers, pressuring additive producers on price and quality. Conversely, the bargaining power of suppliers of specialized natural raw materials can be high, especially for unique or patented extracts, impacting ingredient costs and availability. The threat of new entrants is moderate, as establishing the necessary R&D, processing infrastructure, and regulatory approvals for clean label ingredients requires substantial investment and expertise. However, smaller innovative startups with novel natural solutions can carve out niches. The threat of substitute products, particularly conventional synthetic additives, remains relevant due to their cost-effectiveness and proven functionality, but consumer preference is shifting away from them. Competitive rivalry among existing players is intense, driven by continuous innovation, product differentiation, and aggressive marketing strategies to capture market share in this rapidly evolving segment.

Segmentation Analysis

The Clean Labelled Food Additives Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its intricate dynamics and diverse offerings. These segmentations are critical for identifying specific growth avenues, understanding consumer preferences within distinct categories, and enabling manufacturers to tailor their product development and marketing strategies effectively. The market is primarily analyzed by ingredient type, which encompasses the broad spectrum of natural alternatives replacing synthetic additives. Furthermore, the market is segmented by application, illustrating how these clean label ingredients are integrated into different food and beverage products, reflecting their functional utility across diverse culinary domains. Lastly, the market is often segmented by form, distinguishing between liquid and powder variations that cater to specific manufacturing processes and product requirements, offering flexibility to end-users in their formulations. This multi-faceted segmentation highlights the complexity and breadth of the clean label movement, revealing both mature and emerging sub-markets.

- By Ingredient Type

- Natural Preservatives (e.g., rosemary extract, cultured dextrose, vinegar, natural acids)

- Natural Sweeteners (e.g., stevia, monk fruit, erythritol, honey, maple syrup)

- Natural Colors (e.g., spirulina, beetroot, turmeric, annatto, fruit and vegetable extracts)

- Natural Flavors (e.g., fruit and vegetable concentrates, essential oils, botanical extracts)

- Starch & Fibers (e.g., potato starch, tapioca starch, pea fiber, chicory root fiber)

- Emulsifiers (e.g., lecithin, gum acacia, quillaja extract)

- Hydrocolloids (e.g., gellan gum, agar-agar, pectin, carrageenan, xanthan gum)

- Enzymes (e.g., amylase, lipase, protease, lactase)

- Plant-Based Proteins (e.g., pea protein, rice protein, soy protein, oat protein)

- Others (e.g., acids, antioxidants, texturizers, functional ingredients)

- By Application

- Bakery & Confectionery (e.g., breads, cakes, cookies, chocolates, candies)

- Beverages (e.g., juices, soft drinks, dairy-based drinks, alcoholic beverages, functional drinks)

- Dairy & Frozen Desserts (e.g., yogurts, cheeses, ice creams, plant-based alternatives)

- Snacks (e.g., chips, crackers, cereal bars, savory snacks)

- Meat, Poultry & Seafood (e.g., processed meats, plant-based meat alternatives, fish products)

- Sauces & Dressings (e.g., ketchups, mayonnaise, salad dressings, marinades)

- Soups & Prepared Meals (e.g., ready-to-eat meals, canned soups, frozen dinners)

- Others (e.g., baby food, sports nutrition, nutraceuticals)

- By Form

- Liquid

- Powder

- Paste

- By Source

- Plant-based

- Animal-based

- Microbial

Value Chain Analysis For Clean Labelled Food Additives Market

The value chain for the Clean Labelled Food Additives Market is a complex network involving multiple stages, from raw material sourcing to end-consumer consumption, all focused on maintaining transparency and natural integrity. The upstream analysis begins with the cultivation and harvesting of natural raw materials, which are often agricultural products such as fruits, vegetables, grains, herbs, spices, or specialized microbes for fermentation. This stage places a strong emphasis on sustainable farming practices, organic certification, and ethical sourcing, as the purity and origin of these raw materials directly impact the "clean label" promise. Key players in this segment include farmers, botanical suppliers, and specialized cultivators who ensure a consistent and high-quality supply, often engaging in direct partnerships with ingredient processors to secure traceability and quality control from the very beginning of the chain.

Following raw material procurement, the midstream segment involves the processing, extraction, and refinement of these natural ingredients into functional additives. This stage is dominated by specialized ingredient manufacturers and biotechnological companies that employ advanced technologies such as supercritical fluid extraction, enzyme technology, fermentation, and encapsulation to isolate, concentrate, and stabilize the desired compounds while adhering to clean label principles of minimal processing. These manufacturers are crucial for transforming raw agricultural products into shelf-stable, functional ingredients like natural colors, flavors, preservatives, and texturizers. Extensive research and development are conducted here to optimize ingredient performance, ensure safety, and comply with various food regulations, balancing natural origin with functional efficacy and cost-efficiency. Packaging and quality assurance are also critical midstream activities.

The downstream analysis focuses on the integration of these clean labelled food additives into final food and beverage products and their subsequent distribution to consumers. This segment primarily involves food and beverage manufacturers, ranging from large multinational corporations to niche artisanal producers, who formulate new products or reformulate existing ones to meet clean label criteria. These manufacturers leverage the additives to enhance taste, texture, appearance, and shelf life of their offerings, such as baked goods, dairy products, beverages, snacks, and prepared meals. Distribution channels for clean labelled food additives are predominantly indirect, involving a network of specialized distributors and brokers who connect ingredient suppliers with food manufacturers. Direct sales channels are also common, especially for larger ingredient suppliers who have direct relationships with major food companies. The final products then reach consumers through various retail outlets, including supermarkets, health food stores, online grocery platforms, and foodservice providers, where clear labeling and marketing emphasize the natural and transparent attributes, reinforcing the value chain's core tenets.

Clean Labelled Food Additives Market Potential Customers

The primary potential customers and end-users of clean labelled food additives are diverse entities within the vast food and beverage industry, all seeking to meet the growing consumer demand for natural and transparent product formulations. At the forefront are large-scale food and beverage manufacturers who are continually reformulating their extensive product portfolios to align with clean label trends, ranging from multinational corporations producing mass-market items to specialized companies focused on health and wellness. These manufacturers utilize clean label additives in everything from ready-to-eat meals, snacks, and confectionery to dairy products, beverages, and meat alternatives, making them the largest consumer segment. Their purchasing decisions are driven by factors such as regulatory compliance, brand reputation, market share growth, and the ability to command premium pricing for perceived healthier products, necessitating a steady supply of innovative and effective natural ingredients.

Beyond major manufacturers, a significant segment of potential customers includes small and medium-sized enterprises (SMEs), artisanal food producers, and private label brands. These entities often specialize in niche markets like organic, gourmet, or allergen-free foods, where the clean label premise is a fundamental aspect of their brand identity. Their demand is characterized by a need for flexible ingredient solutions, technical support for formulation challenges, and often smaller batch sizes. Additionally, the foodservice industry, encompassing restaurants, catering services, and institutional kitchens, is increasingly seeking clean label ingredients to respond to consumer expectations for healthier and more transparent menu options. The nutraceutical and dietary supplement industries also represent a growing customer base, as they incorporate natural functional ingredients to enhance the efficacy and appeal of their health-oriented products. The collective goal across all these customer types is to leverage clean label additives to deliver products that are not only safe and palatable but also resonate with contemporary consumer values of health, sustainability, and transparency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19.8 Billion |

| Market Forecast in 2032 | USD 36.5 Billion |

| Growth Rate | 9.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland (ADM), Cargill, Incorporated, Kerry Group Plc, DuPont de Nemours, Inc., Chr. Hansen Holding A/S, Givaudan SA, International Flavors & Fragrances Inc. (IFF), Koninklijke DSM N.V. (dsm-firmenich), Ingredion Incorporated, Naturex (part of Givaudan), Brenntag SE, Sensient Technologies Corporation, Roquette Frères, Tate & Lyle PLC, Ajinomoto Co., Inc., Novozymes A/S, Corbion N.V., Jungbunzlauer Suisse AG, Associated British Foods plc (ABF Ingredients), Lonza Group AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clean Labelled Food Additives Market Key Technology Landscape

The Clean Labelled Food Additives Market is underpinned by a sophisticated and evolving technological landscape, crucial for extracting, processing, and stabilizing natural ingredients to meet functional requirements without compromising their "clean" status. One of the paramount technologies involves advanced extraction methods, such as supercritical fluid extraction (SFE) and subcritical water extraction, which utilize solvents like CO2 or pressurized water to isolate desired compounds from botanicals without leaving harmful residues, ensuring a purer and more natural end product. Membrane filtration techniques, including microfiltration, ultrafiltration, and nanofiltration, are also widely employed for purifying and concentrating natural extracts, enabling the production of high-quality ingredients like natural colors and flavors with enhanced stability and sensory profiles. These technologies are instrumental in overcoming the challenges associated with the inherent variability and instability of natural raw materials, providing consistency and efficacy for food manufacturers.

Biotechnology and fermentation play an increasingly vital role in the clean label technology landscape, offering innovative solutions for producing natural additives. Precision fermentation allows for the targeted production of specific enzymes, proteins, and flavor compounds by microorganisms, offering a sustainable and scalable alternative to traditional chemical synthesis or plant extraction. This technology is particularly transformative for creating ingredients like natural preservatives, specific amino acids, and complex flavor molecules that align perfectly with clean label principles. Enzyme technology is also critical, utilizing specific enzymes to modify natural starches and proteins to create clean label texturizers, emulsifiers, and functional ingredients, enhancing their performance in food applications without requiring synthetic modifications. These biotechnological approaches not only provide novel ingredients but also often result in more environmentally friendly production processes, aligning with broader sustainability goals within the food industry.

Furthermore, encapsulation and delivery systems are key technological advancements crucial for protecting sensitive natural ingredients and ensuring their controlled release in food products. Microencapsulation techniques, using natural carriers like gums, proteins, or carbohydrates, shield delicate flavors, colors, and active compounds from degradation caused by heat, light, oxygen, or pH changes, thereby extending shelf life and maintaining potency. This is particularly important for natural flavors and colors, which can be less stable than their synthetic counterparts. Technologies such as high-pressure processing (HPP) and pulsed electric fields (PEF) are also being explored for their ability to extend the shelf life of food products while minimizing the need for synthetic preservatives, thereby supporting clean label formulations at the finished product level. The continuous innovation in these diverse technological areas is essential for the clean label market to overcome inherent functional limitations of natural ingredients and to meet the ever-increasing demand for transparent and minimally processed food solutions.

Regional Highlights

- North America: This region is a leading market for clean labelled food additives, driven by high consumer awareness regarding health and wellness, a strong preference for natural and organic products, and increasing prevalence of food intolerances. Regulatory bodies like the FDA in the United States, while not explicitly defining "clean label," encourage ingredient transparency, which supports market growth. Significant research and development investments by key players in the U.S. and Canada focus on plant-based and fermented ingredients, and a proactive approach by major food manufacturers to reformulate products ensures sustained leadership in this segment. The region's robust innovation ecosystem and strong purchasing power contribute significantly to its market dominance.

- Europe: Europe stands as another dominant force in the clean labelled food additives market, characterized by strict regulatory frameworks (e.g., EU food labeling regulations, EFSA guidelines) that heavily influence ingredient choice and transparency. Consumers in countries like Germany, the UK, and France are highly health-conscious and prioritize natural, sustainably sourced, and ethically produced food products. The strong presence of organic food movements, coupled with an emphasis on allergen reduction and nutrient enhancement, drives the demand for a wide array of natural colors, flavors, and preservatives. European manufacturers are leaders in developing advanced fermentation and extraction technologies for clean label ingredients, with a focus on regional botanical sources.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for clean labelled food additives, fueled by rapid urbanization, rising disposable incomes, and increasing awareness of health benefits associated with natural ingredients, particularly in countries like China, India, and Japan. While traditional food cultures in some parts of APAC inherently favor natural ingredients, the modernization of food processing and evolving consumer lifestyles are creating new demand for convenient yet clean label products. The region presents immense opportunities for both local and international players to introduce innovative natural solutions tailored to diverse local palates and dietary preferences, with a particular focus on natural flavors and colors derived from indigenous botanicals.

- Latin America: The Latin American market for clean labelled food additives is experiencing steady growth, primarily influenced by growing health consciousness among consumers and increasing exposure to global food trends. Countries such as Brazil, Mexico, and Argentina are witnessing a shift towards healthier eating habits, with consumers actively seeking products free from artificial ingredients. While economic factors can sometimes constrain premium product adoption, the demand for natural colors, flavors, and preservatives in staple food items and beverages is notably increasing. Local manufacturers are gradually adopting clean label strategies to cater to this evolving consumer base, often leveraging the region's rich biodiversity for novel ingredient sourcing.

- Middle East and Africa (MEA): The MEA region is an emerging market for clean labelled food additives, with growth driven by increasing health awareness, rising disposable incomes in certain economies, and a growing expatriate population influencing food trends. The demand for healthier, halal-certified, and transparent food products is on the rise, particularly in urban centers. Countries in the GCC (Gulf Cooperation Council) are showing significant interest in clean label products, leading to increased imports and local production initiatives. Challenges include varying regulatory landscapes and consumer education, but opportunities are substantial as the food processing industry in the region expands and modernizes to meet the diverse needs of its growing population.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clean Labelled Food Additives Market.- Archer Daniels Midland (ADM)

- Cargill, Incorporated

- Kerry Group Plc

- DuPont de Nemours, Inc.

- Chr. Hansen Holding A/S

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Koninklijke DSM N.V. (dsm-firmenich)

- Ingredion Incorporated

- Naturex (part of Givaudan)

- Brenntag SE

- Sensient Technologies Corporation

- Roquette Frères

- Tate & Lyle PLC

- Ajinomoto Co., Inc.

- Novozymes A/S

- Corbion N.V.

- Jungbunzlauer Suisse AG

- Associated British Foods plc (ABF Ingredients)

- Lonza Group AG

Frequently Asked Questions

What defines a "clean label" in the food industry?

A "clean label" primarily refers to food and beverage products made with natural, familiar, and simple ingredients that consumers can easily recognize, understand, and pronounce. It emphasizes the absence of artificial additives, synthetic colors, flavors, preservatives, and genetically modified organisms (GMOs). The core philosophy promotes transparency, minimal processing, and a focus on ingredients derived from natural sources, aligning with growing consumer desires for healthier and more authentic food choices.

Why is the demand for clean labelled food additives increasing globally?

The demand for clean labelled food additives is surging due to several interconnected factors. Primarily, heightened consumer awareness regarding health and wellness, coupled with a desire to avoid artificial ingredients and potential allergens, drives this trend. Increased media scrutiny of food ingredients, coupled with evolving regulatory pressures for greater transparency in labeling, compels manufacturers to reformulate. Furthermore, advancements in food science enable the development of effective natural alternatives that meet functional requirements, making the transition to clean label more feasible and attractive for the food industry.

What are the main challenges in formulating with clean labelled food additives?

Formulating with clean labelled food additives presents several challenges for manufacturers. Natural ingredients often come at a higher cost compared to their synthetic counterparts, impacting production expenses and potentially retail prices. They can also exhibit functional limitations, such as shorter shelf life, reduced stability to heat, light, or pH variations, and sometimes less intense sensory profiles. Ensuring consistent supply and quality of natural raw materials, which can be subject to agricultural variability, also poses a significant hurdle. Balancing taste, texture, appearance, shelf life, and cost while adhering to clean label principles requires extensive research and development expertise.

How do regulatory bodies influence the clean labelled food additives market?

Regulatory bodies play a crucial role in shaping the clean labelled food additives market by establishing guidelines for ingredient approval, labeling requirements, and allowable usage levels. While most regulatory agencies do not have a formal legal definition for "clean label," their emphasis on transparency, clear allergen labeling, and restrictions on certain artificial ingredients indirectly promotes the adoption of natural alternatives. Regulations also impact what claims can be made on packaging, pushing manufacturers to ensure that their "natural" or "free-from" statements are verifiable and do not mislead consumers, thereby driving industry standards towards genuine clean label practices.

What are the key technological advancements driving innovation in clean label additives?

Key technological advancements are crucial for the continuous innovation within the clean label additives market. These include advanced extraction techniques like supercritical fluid extraction, which yields purer natural compounds without harsh solvents. Biotechnology, particularly precision fermentation, allows for the sustainable production of specific enzymes, proteins, and flavor molecules from microbial sources. Encapsulation technologies protect sensitive natural ingredients from degradation and ensure controlled release, enhancing their stability and efficacy. Furthermore, high-pressure processing (HPP) and enzymatic modification techniques enable the development of new functional ingredients and extend shelf life with minimal processing, all while adhering to clean label principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager