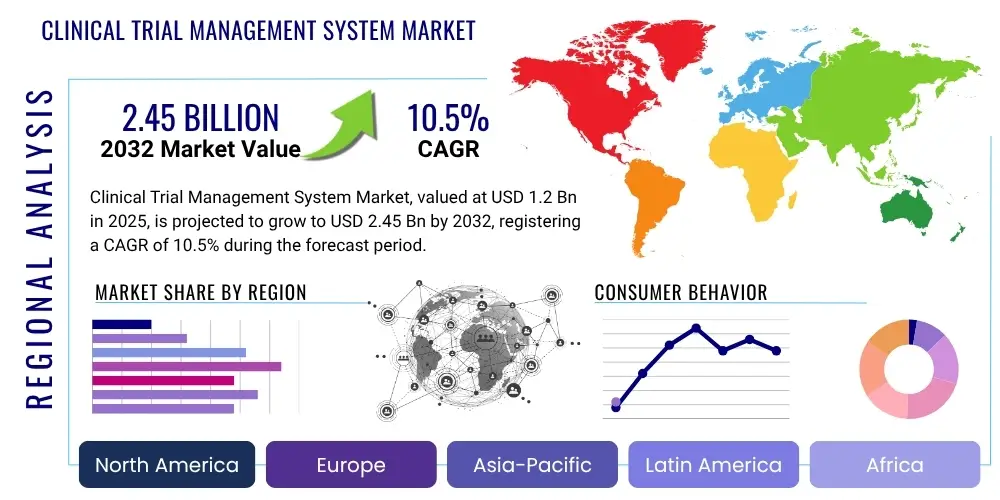

Clinical Trial Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429630 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Clinical Trial Management System Market Size

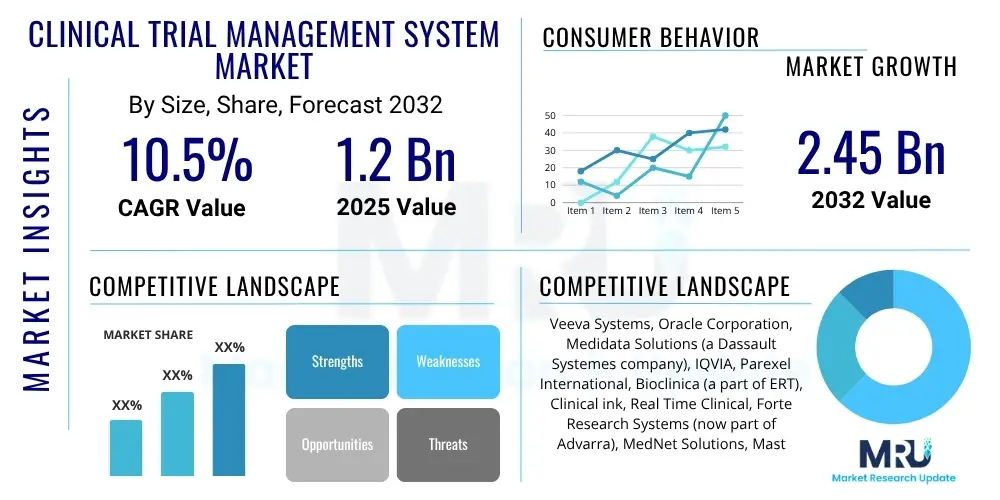

The Clinical Trial Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2032.

Clinical Trial Management System Market introduction

The Clinical Trial Management System (CTMS) market encompasses sophisticated software solutions designed to streamline and manage the entire lifecycle of clinical trials, from initial planning and setup through execution, monitoring, analysis, and reporting. These systems are crucial for pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and medical device manufacturers to enhance operational efficiency, ensure regulatory compliance, and accelerate drug development processes. A CTMS provides a centralized platform for managing diverse trial aspects, including patient enrollment, site management, budget tracking, data collection, and adverse event reporting, thereby mitigating complexities inherent in large-scale clinical research.

The product, a CTMS, typically integrates various functionalities such as study design, investigator and site management, electronic data capture (EDC) integration, regulatory document tracking, and comprehensive reporting tools. Its major applications span across all phases of clinical development, supporting both investigator-initiated and industry-sponsored trials. Benefits of adopting a CTMS include improved data accuracy and integrity, enhanced real-time visibility into trial progress, reduced operational costs through automation, better resource allocation, and strict adherence to global regulatory standards such as Good Clinical Practice (GCP). The system’s ability to standardize workflows and provide a single source of truth for trial data is invaluable for complex, multi-center studies.

Driving factors for the robust growth of the CTMS market include the escalating volume and complexity of clinical trials worldwide, particularly with the rise of precision medicine and rare disease research. Increased research and development (R&D) expenditure by pharmaceutical and biotechnology companies, coupled with a heightened demand for efficient data management and regulatory compliance, further propel market expansion. Moreover, the shift towards decentralized clinical trials and the growing adoption of cloud-based solutions are significantly contributing to the market’s upward trajectory, enabling greater flexibility and accessibility for trial stakeholders across different geographical locations.

Clinical Trial Management System Market Executive Summary

The Clinical Trial Management System market is experiencing significant expansion, driven by a confluence of technological advancements, increasing global clinical trial activity, and stringent regulatory landscapes. Key business trends include the widespread adoption of Software-as-a-Service (SaaS) models for CTMS, offering enhanced scalability, reduced upfront costs, and easier maintenance. There is also a pronounced trend towards integrating CTMS with other clinical research technologies, such as Electronic Data Capture (EDC), Electronic Trial Master Files (eTMF), and pharmacovigilance systems, to create comprehensive, interoperable ecosystems. The market is also seeing a surge in demand for solutions that support decentralized clinical trials (DCTs), enabling remote patient monitoring and virtual site visits, which has gained significant traction following global health events.

From a regional perspective, North America and Europe continue to dominate the CTMS market, primarily due to high R&D spending, well-established pharmaceutical industries, and advanced healthcare infrastructure that facilitates the early adoption of innovative clinical trial solutions. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by increasing investments in clinical research, a growing patient pool, lower operational costs for trials, and government initiatives promoting medical tourism and drug development. Latin America and the Middle East & Africa also present significant untapped potential, driven by rising healthcare expenditures and the increasing globalization of clinical trials.

Segmentation trends highlight that the cloud-based deployment model is projected to witness the fastest growth, favored for its flexibility, accessibility, and cost-effectiveness compared to on-premise solutions. Among end-users, pharmaceutical and biotechnology companies consistently represent the largest segment, driven by their extensive R&D pipelines and continuous need for efficient trial management. Contract Research Organizations (CROs) are also significant contributors, increasingly adopting advanced CTMS to manage a diverse portfolio of studies for their clients. The market is observing a shift towards more modular and configurable CTMS platforms, allowing users to customize functionalities according to specific study requirements and organizational needs, further optimizing their clinical development processes.

AI Impact Analysis on Clinical Trial Management System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Clinical Trial Management System (CTMS) market frequently revolve around its potential to revolutionize efficiency, data analysis, and decision-making throughout the clinical trial lifecycle. Common questions highlight expectations for AI to expedite patient recruitment, enhance data quality and integrity, predict potential trial risks, and automate routine tasks within CTMS platforms. Concerns often touch upon data privacy and security, the ethical implications of AI in clinical settings, the challenges of integrating AI seamlessly into existing CTMS infrastructure, and the need for robust validation frameworks to ensure AI-driven insights are reliable and compliant. Users seek clarity on how AI can move beyond simple automation to truly augment human capabilities, leading to faster, more cost-effective, and ultimately more successful clinical trials, while also understanding the necessary safeguards and regulatory considerations for its widespread adoption.

- AI enhances patient identification and recruitment through predictive analytics, matching patient profiles with trial criteria more accurately and rapidly.

- Automated data cleaning and validation processes powered by AI reduce manual effort and improve data quality, minimizing errors and discrepancies.

- AI algorithms predict potential risks such as patient dropout rates, site non-compliance, or adverse events, enabling proactive risk mitigation strategies.

- Optimization of trial design and protocol development through AI-driven simulations and data analysis, leading to more efficient and targeted studies.

- Real-time monitoring and anomaly detection in clinical data, providing immediate insights into trial progress and potential issues.

- Streamlined document management and regulatory compliance through AI-powered classification, search, and audit trail capabilities.

- Improved resource allocation and budget management by forecasting resource needs and optimizing financial expenditure throughout the trial.

- Acceleration of drug discovery and development by integrating CTMS data with preclinical and discovery-phase AI tools, identifying potential candidates faster.

- Enhanced personalization of clinical trial experiences for patients through AI-driven insights into patient preferences and engagement patterns.

- Facilitation of decentralized clinical trials by processing and interpreting large volumes of remote patient monitoring data efficiently.

DRO & Impact Forces Of Clinical Trial Management System Market

The Clinical Trial Management System (CTMS) market is propelled by significant drivers, including the escalating number of clinical trials globally, fueled by robust investments in pharmaceutical R&D, particularly in oncology, rare diseases, and chronic conditions. The increasing complexity of trial designs, involving multi-center, multi-country studies and sophisticated data collection methodologies, mandates advanced management systems for efficient oversight. Furthermore, stringent regulatory requirements from bodies like the FDA and EMA for data integrity, patient safety, and transparency necessitate the adoption of CTMS to ensure compliance and reduce the risk of costly delays or non-approvals. The imperative for faster drug development cycles and cost containment also drives CTMS adoption, as these systems offer automation and streamlined workflows that enhance operational efficiency.

Conversely, the market faces several restraints. High initial implementation costs, particularly for on-premise solutions and comprehensive integrations, can be a significant barrier for smaller organizations or those with limited IT budgets. Data security and privacy concerns, especially with sensitive patient health information (PHI) and the need to comply with regulations like GDPR and HIPAA, pose a continuous challenge for CTMS providers and users. Moreover, the lack of skilled personnel capable of effectively operating and maximizing the capabilities of advanced CTMS platforms can hinder adoption and optimal utilization. Resistance to change within organizations, coupled with the complexities of migrating legacy data, also represents a notable impediment to market growth.

Despite these restraints, substantial opportunities exist within the CTMS market. The integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, automated data validation, and enhanced patient recruitment offers significant growth avenues. The increasing trend towards decentralized clinical trials (DCTs), accelerated by global health imperatives, creates demand for CTMS solutions capable of managing remote patient data, virtual visits, and remote monitoring. Emerging markets in Asia Pacific, Latin America, and the Middle East and Africa present untapped potential due to their growing healthcare sectors, expanding clinical research activities, and improving regulatory frameworks. Additionally, the continuous evolution of personalized medicine and orphan drug development necessitates more adaptive and specialized CTMS functionalities, fostering innovation and market expansion. The overarching impact forces include rapid technological advancements, evolving regulatory landscapes, global healthcare expenditure trends, and the increasing focus on patient-centric trial designs, all collectively shaping the demand and development within the CTMS market.

Segmentation Analysis

The Clinical Trial Management System market is comprehensively segmented across various dimensions, providing a granular view of its diverse landscape. These segmentations are critical for understanding market dynamics, identifying specific growth areas, and tailoring solutions to meet varied industry needs. The key categories include deployment model, end-user, component, and type, each revealing distinct adoption patterns and growth trajectories shaped by technological preferences, organizational structures, and operational requirements. Analyzing these segments helps stakeholders strategically position their offerings and invest in areas with the highest potential returns, reflecting the evolving needs of the clinical research ecosystem.

- By Deployment Model:

- On-premise CTMS: Traditionally hosted and managed within an organization's internal IT infrastructure, offering higher control over data but requiring substantial upfront investment and maintenance.

- Cloud-based CTMS (SaaS): Hosted by third-party providers and accessed via the internet, offering flexibility, scalability, reduced IT burden, and lower operational costs, driving rapid adoption.

- By End-User:

- Pharmaceutical & Biotechnology Companies: The largest segment, driven by extensive drug development pipelines and the need for efficient trial management to accelerate time-to-market.

- Contract Research Organizations (CROs): Increasingly adopting CTMS to manage a growing number of diverse clinical trials for their clients, enhancing efficiency and compliance.

- Medical Device Companies: Utilizing CTMS to manage trials for new medical devices, ensuring regulatory adherence and product efficacy.

- Academic Research Institutions: Leveraging CTMS for investigator-initiated trials and academic studies, supporting complex research protocols.

- Other End-Users: Includes government research organizations and other healthcare providers engaged in clinical research.

- By Component:

- Software: Core CTMS application modules for trial planning, site management, patient tracking, budgeting, and reporting.

- Services: Implementation, integration, training, maintenance, support, and consulting services provided by CTMS vendors.

- By Type:

- Enterprise CTMS: Comprehensive solutions designed for large organizations with extensive clinical trial portfolios, offering robust features and scalability.

- Site-based CTMS: Tailored for individual clinical trial sites, focusing on site-specific operational needs, patient management, and data collection.

Value Chain Analysis For Clinical Trial Management System Market

The value chain for the Clinical Trial Management System (CTMS) market is intricate, involving several critical stages that contribute to the final delivery and utility of the solution. It commences with upstream activities, where technology providers play a foundational role. These include software development companies that design and build the core CTMS platforms, often incorporating advanced functionalities such as artificial intelligence, machine learning, and big data analytics capabilities. Cloud infrastructure providers (e.g., AWS, Azure, Google Cloud) are also vital upstream players, supplying the scalable and secure hosting environments necessary for cloud-based CTMS solutions. Additionally, providers of interoperability tools and integration platforms are essential for ensuring seamless data flow between CTMS and other clinical research systems like Electronic Data Capture (EDC) and Electronic Trial Master Files (eTMF).

Midstream activities primarily involve CTMS vendors who package these technologies into comprehensive solutions, offering various deployment models (on-premise, cloud-based), and adding specialized features for specific therapeutic areas or trial phases. These vendors are responsible for product development, customization, quality assurance, and ongoing maintenance. The distribution channel is multifaceted, primarily encompassing direct sales channels where CTMS providers directly engage with end-user organizations through their sales teams, offering tailored solutions and professional services. Indirect channels include partnerships with system integrators, value-added resellers (VARs), and consulting firms that help implement and optimize CTMS solutions for diverse clients, extending market reach and providing specialized expertise.

Downstream analysis focuses on the end-users and beneficiaries of CTMS. Pharmaceutical and biotechnology companies represent the largest segment, leveraging CTMS to manage their extensive R&D pipelines. Contract Research Organizations (CROs) are also major downstream users, utilizing CTMS to efficiently manage multi-sponsor, multi-study environments. Medical device companies and academic research institutions further utilize these systems to streamline their specific trial requirements. The ultimate beneficiaries are the patients, as efficient CTMS deployment contributes to faster drug development, improved patient safety, and better clinical outcomes. This robust value chain ensures that the complex demands of modern clinical trials are met with advanced, integrated, and reliable management solutions, enhancing overall research efficiency and effectiveness.

Clinical Trial Management System Market Potential Customers

The Clinical Trial Management System (CTMS) market primarily serves a broad spectrum of end-users and buyers within the life sciences industry, all of whom are engaged in the meticulous planning, execution, and oversight of clinical trials. The largest and most prominent customer base comprises pharmaceutical companies, ranging from large multinational corporations to emerging biopharmaceutical startups. These entities are consistently investing heavily in research and development, necessitating robust CTMS solutions to manage their extensive pipelines, ensure regulatory compliance, and accelerate the development of new drugs. Their complex trial designs, often spanning multiple therapeutic areas and geographies, demand sophisticated systems that can provide real-time data visibility, streamline workflows, and mitigate operational risks effectively.

Another significant segment of potential customers includes biotechnology firms, which, similar to pharmaceutical companies, require efficient systems to manage their often novel and complex biological product trials. These companies frequently focus on niche therapeutic areas, requiring CTMS solutions that can be adapted to highly specialized protocols and regulatory demands. Contract Research Organizations (CROs) form a crucial customer segment, as they manage clinical trials on behalf of various sponsors, including pharmaceutical, biotech, and medical device companies. CROs benefit immensely from CTMS by achieving operational efficiencies across multiple concurrent studies, standardizing processes, and ensuring consistent data quality and regulatory adherence for their diverse clientele. The ability of a CTMS to handle multi-sponsor environments and provide comprehensive reporting is particularly valuable for CROs.

Medical device companies also represent a vital customer group, needing CTMS to manage trials for their innovative devices, which often involve unique patient safety considerations and regulatory pathways. Academic research institutions and university hospitals are increasingly adopting CTMS to manage investigator-initiated trials, observational studies, and public health research, seeking to improve data management and compliance in non-commercial research settings. Lastly, government research organizations and public health agencies, involved in large-scale studies and disease surveillance, are also potential buyers, requiring robust systems to manage extensive datasets and ensure scientific rigor. The collective demand from these diverse entities underscores the critical role CTMS plays in advancing global health and medical innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 2.45 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veeva Systems, Oracle Corporation, Medidata Solutions (a Dassault Systemes company), IQVIA, Parexel International, Bioclinica (a part of ERT), Clinical ink, Real Time Clinical, Forte Research Systems (now part of Advarra), MedNet Solutions, MasterControl, Inc., IBM Watson Health, Merge Healthcare (a part of IBM), DZS Clinical Services, Bio-Optronics (Clinical Conductor), ArisGlobal, Advarra, eClinical Solutions, OpenClinica, Florence Healthcare |

| Regions Covered | North America (United States, Canada, Mexico), Europe (Germany, United Kingdom, France, Italy, Spain, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Rest of APAC), Latin America (Brazil, Argentina, Rest of Latin America), Middle East, and Africa (South Africa, GCC Countries, Rest of MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Trial Management System Market Key Technology Landscape

The Clinical Trial Management System (CTMS) market is continuously evolving, driven by advancements in core technologies that enhance efficiency, data integrity, and collaboration in clinical research. Cloud computing remains a foundational technology, enabling CTMS providers to offer Software-as-a-Service (SaaS) solutions that deliver scalability, accessibility, and cost-effectiveness. This allows for global access to trial data and functionalities, supporting multi-national studies and remote workforces. The shift to cloud infrastructure minimizes the need for extensive on-premise hardware and IT maintenance, making advanced CTMS more attainable for a wider range of organizations. Furthermore, robust data security measures within cloud environments, including encryption and compliance certifications, are crucial for protecting sensitive patient information and intellectual property.

Big data analytics and business intelligence (BI) tools are integral to modern CTMS platforms, allowing organizations to process and derive meaningful insights from vast quantities of clinical trial data. These technologies enable real-time tracking of trial progress, identification of trends, risk assessment, and performance optimization across various study parameters. By integrating data from multiple sources such as Electronic Health Records (EHRs), Electronic Data Capture (EDC) systems, and wearable devices, CTMS platforms equipped with advanced analytics provide a holistic view of the trial. This capability supports data-driven decision-making, helping sponsors and CROs to make timely adjustments to trial protocols, improve resource allocation, and forecast outcomes more accurately. The increasing sophistication of these analytical tools is transforming raw data into actionable intelligence, enhancing the strategic value of CTMS.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly emerging as transformative technologies within the CTMS landscape. AI algorithms are being deployed to automate mundane tasks, such as data entry and validation, significantly reducing human error and freeing up resources for more critical activities. ML models are employed for predictive analytics, optimizing patient recruitment by identifying eligible candidates more efficiently and forecasting potential roadblocks like patient dropout rates or site performance issues. Beyond automation and prediction, AI can enhance risk management by proactively flagging anomalies in trial data or operational metrics, ensuring proactive intervention. Additionally, mobile technologies and interoperability standards (e.g., CDISC) are crucial, enabling remote data collection, patient engagement, and seamless integration with other clinical research systems, supporting the growing trend towards decentralized and patient-centric clinical trials. Blockchain technology is also being explored for enhancing data integrity, transparency, and auditability within the CTMS ecosystem, promising a new layer of security and trust.

Regional Highlights

- North America: This region dominates the Clinical Trial Management System market due to its robust pharmaceutical and biotechnology industries, significant R&D investments, and advanced healthcare infrastructure. The presence of a large number of key market players, stringent regulatory frameworks (e.g., FDA), and a high adoption rate of advanced technologies further contribute to its leading position. The United States, in particular, is a major hub for clinical research, driving continuous demand for sophisticated CTMS solutions.

- Europe: Europe represents another substantial market for CTMS, driven by strong government support for clinical research, a growing number of clinical trials, and strict regulatory guidelines (e.g., EMA, GDPR) that necessitate efficient data management and compliance. Countries like Germany, the United Kingdom, and France are at the forefront of pharmaceutical innovation and clinical development, fostering a high demand for integrated CTMS platforms.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth in the CTMS market during the forecast period. This growth is attributed to increasing investments in clinical research by both domestic and international pharmaceutical companies, a vast and diverse patient pool, and lower operational costs for conducting trials. Countries such as China, India, Japan, and South Korea are rapidly expanding their clinical trial activities, supported by improving healthcare infrastructure and favorable government policies, making it an attractive destination for clinical development.

- Latin America: This region is experiencing steady growth in the CTMS market, driven by expanding healthcare sectors, increasing prevalence of chronic diseases, and a rising number of clinical trials. Countries like Brazil, Mexico, and Argentina are emerging as important locations for clinical research, attracting investments from global pharmaceutical players seeking diverse patient populations and cost-effective trial execution.

- Middle East and Africa (MEA): The MEA market for CTMS is in its nascent stages but shows promising growth potential. Factors contributing to this include increasing healthcare expenditure, growing awareness of advanced clinical research methodologies, and government initiatives aimed at developing local pharmaceutical industries. The adoption of modern CTMS solutions is expected to accelerate as the region strengthens its research capabilities and focuses on addressing prevalent local health challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Trial Management System Market.- Veeva Systems

- Oracle Corporation

- Medidata Solutions (a Dassault Systemes company)

- IQVIA

- Parexel International

- Bioclinica (a part of ERT)

- Clinical ink

- Real Time Clinical

- Forte Research Systems (now part of Advarra)

- MedNet Solutions

- MasterControl, Inc.

- IBM Watson Health

- Merge Healthcare (a part of IBM)

- DZS Clinical Services

- Bio-Optronics (Clinical Conductor)

- ArisGlobal

- Advarra

- eClinical Solutions

- OpenClinica

- Florence Healthcare

Frequently Asked Questions

Analyze common user questions about the Clinical Trial Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Clinical Trial Management System (CTMS) and why is it important?

A CTMS is a software solution designed to manage and track the planning, execution, and reporting of clinical trials. It centralizes critical trial data, streamlining workflows, ensuring regulatory compliance, and enhancing operational efficiency for pharmaceutical companies, CROs, and other research organizations. Its importance lies in improving data accuracy, providing real-time visibility into trial progress, and accelerating the drug development lifecycle, ultimately leading to faster and safer delivery of new treatments to patients.

What are the key benefits of implementing a CTMS?

Implementing a CTMS offers numerous benefits, including enhanced operational efficiency through automation of tasks like patient enrollment, site monitoring, and regulatory document tracking. It improves data quality and integrity by providing a single source of truth for all trial-related information, reducing manual errors. CTMS also ensures robust regulatory compliance with global standards, minimizes risks, and offers real-time visibility into trial progress, enabling proactive decision-making and better resource allocation. Ultimately, it helps reduce overall trial costs and accelerate time-to-market for new therapies.

How is AI impacting the CTMS market?

AI is significantly impacting the CTMS market by introducing capabilities such as predictive analytics for optimized patient recruitment and risk assessment. AI automates data cleaning and validation, enhances real-time monitoring, and can identify patterns that accelerate trial design and protocol development. These advancements lead to greater efficiency, improved data accuracy, and proactive identification of potential issues, thereby shortening trial timelines and improving overall success rates. However, ethical considerations and data privacy remain key areas of focus for AI integration.

What are the main challenges faced by the CTMS market?

The CTMS market faces challenges such as high initial implementation costs, particularly for comprehensive on-premise solutions that require significant IT investment and maintenance. Data security and privacy concerns are paramount, requiring strict adherence to regulations like GDPR and HIPAA. Additionally, the lack of adequately skilled personnel to operate and maximize the advanced features of CTMS platforms can hinder adoption. Organizational resistance to change and the complexities of migrating legacy data from older systems also pose significant hurdles to widespread CTMS integration.

Which deployment models are prevalent in the CTMS market?

The two primary deployment models in the CTMS market are on-premise and cloud-based (SaaS). On-premise CTMS involves hosting the software on an organization's internal servers, offering high data control but requiring substantial upfront investment and internal IT management. Cloud-based CTMS, delivered as a Software-as-a-Service, is hosted by a third-party provider and accessed via the internet. This model offers greater flexibility, scalability, reduced IT burden, and lower operational costs, making it increasingly popular and the fastest-growing segment due to its accessibility and ease of use for distributed clinical trial teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager