Cloud FinOps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431215 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Cloud FinOps Market Size

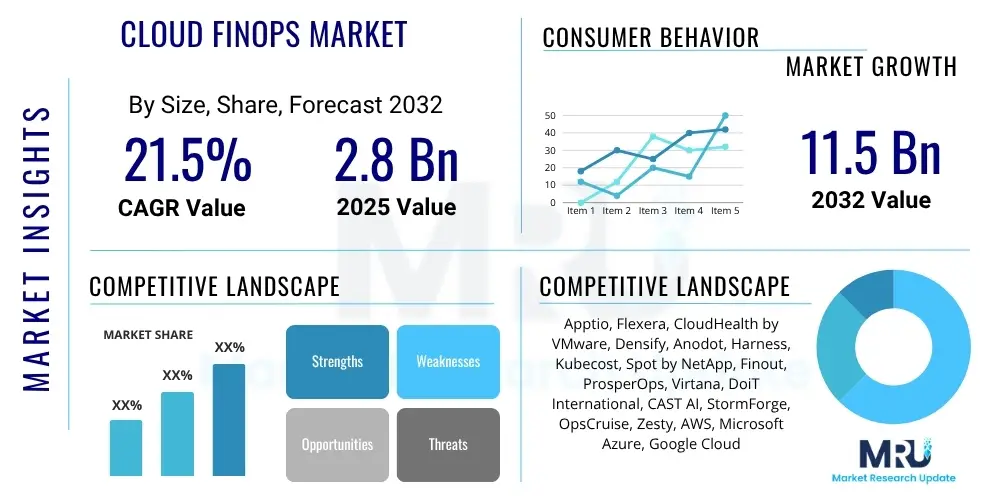

The Cloud FinOps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2025 and 2032. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2032.

Cloud FinOps Market introduction

The Cloud FinOps Market encompasses the methodologies, tools, and cultural practices designed to bring financial accountability to the variable spend model of cloud computing. It empowers organizations to understand cloud costs, make data-driven decisions, and maximize business value. The core product offering revolves around platforms and services that provide visibility, optimize resource utilization, and automate financial governance across various cloud environments.

Major applications include real-time cost monitoring, budget management, anomaly detection, resource rightsizing, and establishing a collaborative framework between engineering, finance, and business teams. The primary benefits derived are significant cost savings, improved operational efficiency, enhanced financial transparency, and better alignment of cloud investments with business objectives. These factors collectively drive the market's expansion as more enterprises migrate to and scale their operations within the cloud.

The driving forces behind the widespread adoption of Cloud FinOps include the exponential growth in cloud infrastructure adoption, the inherent complexity and variability of cloud billing, and the increasing need for robust cost control and financial governance in dynamic cloud environments. As organizations grapple with escalating cloud expenditures and the demand for greater financial insight, FinOps provides a structured approach to manage these challenges effectively.

Cloud FinOps Market Executive Summary

The Cloud FinOps market is experiencing robust growth, driven by an accelerating shift towards cloud-native architectures and multi-cloud strategies across industries. Business trends indicate a strong emphasis on achieving cloud cost efficiency without compromising innovation or performance, making FinOps an indispensable discipline for enterprises seeking sustainable cloud operations. Organizations are increasingly investing in dedicated FinOps platforms and consulting services to establish mature cost management practices, moving beyond basic monitoring to proactive optimization.

Regionally, North America continues to dominate the market due to early cloud adoption and a high concentration of technology providers and large enterprises. However, the Asia Pacific (APAC) and European regions are demonstrating significant growth, spurred by rapid digital transformation initiatives and an increasing awareness of the strategic value of cloud financial management. Emerging economies are also recognizing the imperative for FinOps to manage their nascent but rapidly expanding cloud footprints, indicating future growth potential.

Segment trends reveal a rising demand for comprehensive FinOps solutions that integrate seamlessly with existing cloud infrastructure and IT service management tools. The services segment, particularly consulting and managed FinOps services, is seeing strong traction as organizations seek expert guidance to navigate the complexities of implementation and cultural transformation. Furthermore, there is a growing demand for specialized tools catering to specific cloud platforms and for solutions that incorporate advanced analytics and automation to enhance decision-making and operational efficiency.

AI Impact Analysis on Cloud FinOps Market

Users frequently inquire about how Artificial intelligence (AI) can transcend traditional cloud cost management, particularly regarding automation, predictive capabilities, and identifying obscure optimization opportunities. Common questions revolve around AI's ability to autonomously detect spending anomalies, forecast future cloud costs with greater accuracy, and recommend optimal resource configurations in real-time. Concerns often touch upon the explainability of AI-driven recommendations, the data privacy implications of feeding extensive cloud usage data into AI models, and the complexity of integrating advanced AI solutions into existing FinOps frameworks. Users expect AI to move FinOps beyond reactive reporting to proactive, intelligent financial governance.

- Automated anomaly detection and alert generation for unusual spend patterns.

- Predictive analytics for accurate cloud cost forecasting and budgeting.

- Intelligent resource rightsizing and optimization recommendations.

- Autonomous identification of waste and idle resources.

- Proactive identification of cost-saving opportunities through pattern recognition.

- Enhanced reporting and visualization of financial data for deeper insights.

- Streamlined policy enforcement and governance through AI-driven automation.

- Personalized recommendations for cost allocation and chargeback models.

DRO & Impact Forces Of Cloud FinOps Market

The Cloud FinOps Market is propelled by several key drivers, primarily the continuous surge in global cloud adoption and the inherent complexity of managing diverse cloud environments, especially in multi-cloud and hybrid cloud setups. As cloud spending escalates across organizations of all sizes, the imperative to gain complete visibility and control over these variable costs becomes paramount. Economic pressures, coupled with the need for digital transformation and business agility, further amplify the demand for robust FinOps practices to optimize investment and maximize business value from cloud resources. The increasing maturity of cloud infrastructure also creates an environment where finer financial controls are both necessary and achievable.

Despite significant growth, the market faces certain restraints. A critical challenge is the persistent shortage of skilled FinOps professionals who possess a blend of financial acumen, cloud engineering knowledge, and cultural change management capabilities. Organizational silos, where finance, operations, and engineering teams operate independently, often hinder effective FinOps implementation, preventing a unified approach to cloud cost management. Additionally, the initial investment required for FinOps tools and the complexity of integrating these solutions with existing IT infrastructure can be a barrier for some organizations, particularly smaller enterprises or those with legacy systems.

Opportunities for market expansion are abundant, with the growing adoption of AI and Machine Learning (ML) offering advanced capabilities for predictive analytics, automated optimization, and anomaly detection in cloud spending. The expansion into niche areas such as Kubernetes cost management and serverless computing FinOps presents new avenues for specialization. Furthermore, the increasing focus on sustainability within cloud operations offers an opportunity for FinOps to evolve into "Green FinOps," optimizing not just cost but also environmental impact. The development of more accessible and user-friendly FinOps platforms tailored for Small and Medium-sized Enterprises (SMEs) is also a significant growth opportunity.

Segmentation Analysis

The Cloud FinOps market is comprehensively segmented to address the diverse needs of organizations navigating cloud financial management. This segmentation allows for targeted solution development and strategic market positioning, reflecting the various ways enterprises approach cloud cost optimization. Key segments typically include differentiations by components offered, the deployment models utilized, the size of the organizations served, and the specific industry verticals that adopt these practices, ensuring that solutions are tailored to specific operational and financial requirements.

- By Component:

- Solutions

- Cost Optimization Tools

- Reporting & Analytics

- Security & Compliance

- Performance Monitoring

- Services

- Consulting

- Implementation

- Training & Support

- Solutions

- By Deployment:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Organization Size:

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Manufacturing

- Media & Entertainment

- Government & Public Sector

Value Chain Analysis For Cloud FinOps Market

The value chain for the Cloud FinOps market commences with upstream activities involving cloud service providers such as AWS, Azure, and Google Cloud, who establish the foundational infrastructure and billing mechanisms that FinOps aims to optimize. Additionally, independent software vendors (ISVs) develop specialized tools for cost visibility, anomaly detection, and resource management, forming a crucial part of the upstream technology stack. These vendors provide the raw data and initial analysis capabilities upon which FinOps practices are built.

In the midstream, FinOps platforms and consulting services integrate data from various cloud providers and enterprise systems, offering advanced analytics, optimization recommendations, and automation capabilities. This stage involves the transformation of raw cloud usage and billing data into actionable financial insights. Companies specializing in FinOps platforms or offering professional FinOps consulting services play a pivotal role here, helping organizations implement FinOps frameworks and cultural changes.

Downstream analysis involves the direct application of FinOps principles and tools by end-user organizations, ranging from large enterprises to SMEs, to manage their cloud spending effectively. This includes financial teams, engineering teams, and business units collaborating to optimize cloud costs, improve forecasting, and align cloud investments with strategic objectives. Distribution channels are varied, encompassing direct sales from FinOps solution providers, partnerships with cloud hyperscalers, and indirect channels through managed service providers (MSPs) and value-added resellers (VARs) who bundle FinOps solutions with broader cloud services, extending market reach and supporting implementation for diverse customer segments.

Cloud FinOps Market Potential Customers

The primary potential customers and end-users of Cloud FinOps solutions and services are organizations across all industry verticals that utilize cloud computing extensively. This includes any business, from rapidly scaling startups to established multinational corporations, that has adopted public, private, or hybrid cloud environments for their operations. A key indicator of a potential customer is significant or growing cloud spend, coupled with a desire for greater financial control, transparency, and efficiency in their cloud investments. Organizations facing challenges with unpredictable cloud bills, resource sprawl, or a lack of collaboration between finance and engineering teams are prime candidates for FinOps adoption.

Specifically, large enterprises with complex multi-cloud deployments often require sophisticated FinOps platforms to manage heterogeneous environments, ensuring consistent cost optimization and governance across various cloud providers. Small and Medium-sized Enterprises (SMEs), while perhaps having smaller initial cloud budgets, also represent a substantial customer base as they seek to maximize value from every dollar spent on cloud resources, often relying on simplified FinOps tools or managed FinOps services. Industries such as BFSI, IT & Telecom, Healthcare, Manufacturing, and Retail, which are heavily reliant on cloud infrastructure for digital transformation, constitute significant demand segments for FinOps solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2032 | USD 11.5 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apptio, Flexera, CloudHealth by VMware, Densify, Anodot, Harness, Kubecost, Spot by NetApp, Finout, ProsperOps, Virtana, DoiT International, CAST AI, StormForge, OpsCruise, Zesty, AWS, Microsoft Azure, Google Cloud |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cloud FinOps Market Key Technology Landscape

The Cloud FinOps market is underpinned by a robust and evolving technological landscape that enables effective financial governance of cloud resources. At its core, the technology stack includes advanced cloud cost management platforms that provide granular visibility into spending across various cloud providers. These platforms leverage APIs and native integrations with hyperscalers (AWS, Azure, Google Cloud) to ingest billing data, usage metrics, and resource configuration information in real-time, offering a unified view of an organization's cloud financial posture.

Further enhancing these platforms are sophisticated data analytics and visualization tools, which process vast amounts of cloud data to identify trends, anomalies, and optimization opportunities. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are increasingly being integrated to power predictive analytics, automate anomaly detection, and provide intelligent recommendations for resource rightsizing, purchasing commitments (e.g., reserved instances), and workload scheduling. These AI/ML capabilities allow for more proactive and less manual optimization efforts, driving greater efficiency.

Automation technologies, including Infrastructure as Code (IaC) and policy-as-code engines, play a crucial role in operationalizing FinOps recommendations by automatically implementing changes such as rightsizing instances, deleting unused resources, or enforcing spending policies. Furthermore, integration capabilities with existing enterprise resource planning (ERP) systems, IT service management (ITSM) tools, and financial software are critical for seamless data flow and embedding FinOps into broader organizational workflows, fostering collaboration between finance, operations, and engineering teams.

Regional Highlights

- North America: The leading region in Cloud FinOps adoption, characterized by a high concentration of cloud service providers, early and extensive enterprise cloud migration, and a strong culture of technological innovation. This region sees significant investment in FinOps tools and services, driven by large enterprises seeking to optimize substantial cloud expenditures.

- Europe: Demonstrates rapid growth in FinOps adoption, influenced by stringent data privacy regulations (like GDPR) driving responsible cloud usage and a growing awareness among businesses of the financial benefits of cloud optimization. Countries like the UK, Germany, and the Nordics are at the forefront, fostering strong FinOps communities and technological development.

- Asia Pacific (APAC): Emerging as a high-growth market due to aggressive digital transformation initiatives, increasing cloud infrastructure investments, and a burgeoning number of startups and tech-savvy enterprises. Countries such as Japan, Australia, Singapore, and India are key contributors, with rising demand for FinOps solutions to manage scaling cloud environments.

- Latin America: Witnessing a steady increase in cloud adoption and, consequently, a growing need for FinOps practices. Economic uncertainties in some countries further emphasize the importance of cost control, driving demand for efficient cloud financial management tools and expertise among local businesses.

- Middle East and Africa (MEA): Represents an nascent but rapidly expanding market for Cloud FinOps. Government-led digital initiatives and increasing private sector investment in cloud technologies are fueling demand for solutions that provide financial visibility and optimize cloud spending across diverse industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud FinOps Market.- Apptio

- Flexera

- CloudHealth by VMware

- Densify

- Anodot

- Harness

- Kubecost

- Spot by NetApp

- Finout

- ProsperOps

- Virtana

- DoiT International

- CAST AI

- StormForge

- OpsCruise

- Zesty

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

Frequently Asked Questions

What is Cloud FinOps?

Cloud FinOps is a cultural practice that brings financial accountability to the variable spend model of cloud, enabling organizations to make data-driven decisions and achieve cost optimization. It combines the principles of finance, operations, and engineering to enhance cloud financial management.

Why is Cloud FinOps important for businesses?

Cloud FinOps is crucial for businesses as it provides transparency into cloud spending, helps optimize cloud costs, improves financial forecasting, and fosters collaboration between technical and financial teams. This leads to greater efficiency, significant cost savings, and better alignment of cloud investments with business goals.

How does AI impact the Cloud FinOps market?

AI significantly impacts FinOps by enabling automated anomaly detection, providing predictive analytics for forecasting, offering intelligent recommendations for resource optimization, and automating routine tasks. This shifts FinOps from reactive reporting to proactive, data-driven financial governance, enhancing efficiency and accuracy.

What are the main challenges in implementing Cloud FinOps?

Key challenges in implementing Cloud FinOps include a shortage of skilled professionals, overcoming organizational silos between finance and engineering teams, the initial investment required for FinOps tools, and the complexity of integrating diverse cloud and enterprise data sources.

Which industries are adopting Cloud FinOps most rapidly?

Industries rapidly adopting Cloud FinOps include BFSI, IT & Telecom, Healthcare & Life Sciences, and Manufacturing. These sectors leverage extensive cloud infrastructure and benefit significantly from optimized spending, improved financial visibility, and enhanced operational efficiency in their cloud environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager