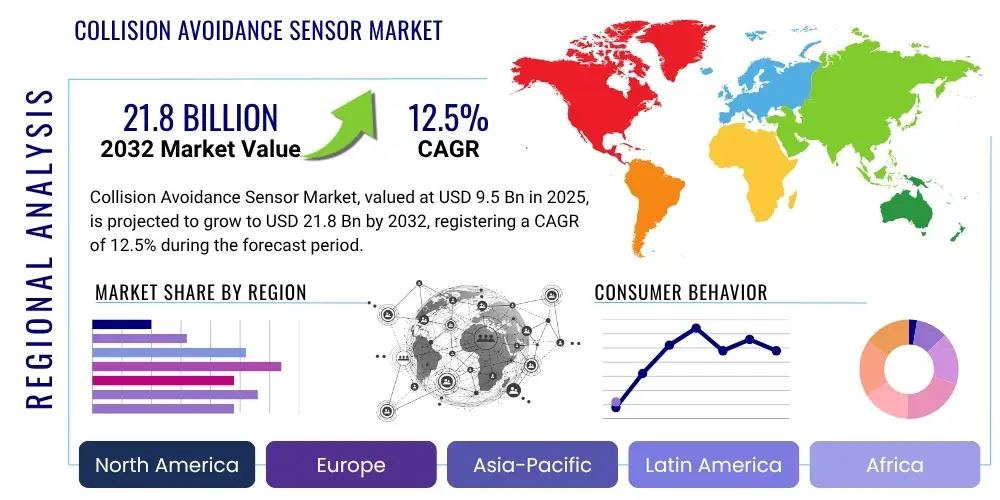

Collision Avoidance Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429731 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Collision Avoidance Sensor Market Size

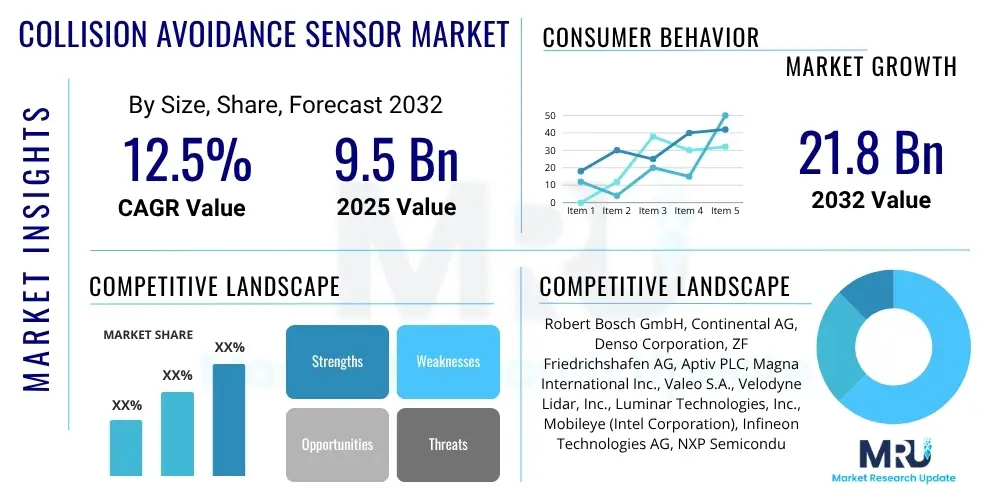

The Collision Avoidance Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 9.5 Billion in 2025 and is projected to reach USD 21.8 Billion by the end of the forecast period in 2032.

Collision Avoidance Sensor Market introduction

The Collision Avoidance Sensor Market encompasses advanced technologies designed to detect potential obstacles and warn operators or autonomously intervene to prevent collisions. These sophisticated systems leverage various sensor types, including radar, lidar, cameras, and ultrasonic, to gather real-time environmental data. The primary objective is to significantly enhance safety across diverse applications, mitigating the risk of accidents and associated damages, ultimately leading to improved operational efficiency and reduced liabilities.

Products within this market range from simple ultrasonic proximity sensors used in parking assistance systems to complex multi-sensor fusion platforms integral to advanced driver-assistance systems (ADAS) and autonomous driving. Major applications span the automotive sector for passenger and commercial vehicles, industrial automation with robotics and heavy machinery, aerospace and defense for UAVs and military vehicles, and marine vessels. The benefits are multifaceted, extending beyond immediate safety improvements to include reduced insurance costs, optimized traffic flow, and enhanced worker protection in hazardous environments, thereby underpinning a strong impetus for market expansion.

The market's growth is predominantly driven by increasingly stringent safety regulations mandated by governments worldwide, compelling manufacturers to integrate advanced safety features into their products. Concurrently, the rising consumer demand for safer vehicles equipped with ADAS features, coupled with the rapid proliferation of industrial automation and robotics across manufacturing and logistics, further propels adoption. Continuous technological advancements, particularly in sensor accuracy, processing capabilities, and data fusion techniques, are also pivotal in expanding the market's reach and effectiveness.

Collision Avoidance Sensor Market Executive Summary

The Collision Avoidance Sensor Market is experiencing robust growth fueled by several converging business trends. These include significant investments in research and development by key players, a wave of strategic collaborations and partnerships focused on sensor fusion and AI integration, and a growing emphasis on developing cost-effective, high-performance sensor solutions suitable for mass-market adoption. The automotive industry remains a primary driver, with regulatory pressures for enhanced vehicle safety leading to the ubiquitous inclusion of collision avoidance features in new models. Beyond automotive, the industrial sector's push for automation and workplace safety is creating substantial demand for these sensors in robotics, material handling equipment, and construction machinery, marking a diversification of revenue streams for market participants.

Regional trends indicate that Asia Pacific is emerging as the fastest-growing market, largely due to its expanding automotive manufacturing base, increasing consumer disposable income, and governmental initiatives promoting smart infrastructure and industrial modernization in countries like China, India, and Japan. North America and Europe continue to be mature markets, characterized by early adoption of ADAS technologies, stringent safety mandates, and a strong presence of leading automotive and industrial players. These regions are also at the forefront of autonomous vehicle development, which inherently relies heavily on advanced collision avoidance systems, thus driving further innovation and market penetration.

Segmentation trends highlight a strong demand for radar and camera-based sensors due to their reliability and cost-effectiveness, while lidar technology is gaining traction, particularly for higher levels of autonomous driving, despite its current higher cost. The automotive application segment is anticipated to maintain its dominance, though industrial and robotics applications are projected to exhibit the highest growth rates over the forecast period. Furthermore, the aftermarket segment is showing steady expansion as vehicle owners seek to upgrade their existing cars with advanced safety features, complementing the growth in original equipment manufacturer (OEM) installations. The integration of artificial intelligence and machine learning algorithms is profoundly impacting all segments, enhancing sensor data interpretation, predictive capabilities, and overall system accuracy.

AI Impact Analysis on Collision Avoidance Sensor Market

User inquiries regarding AI's influence on the Collision Avoidance Sensor Market frequently center on how artificial intelligence fundamentally enhances sensor performance, data processing capabilities, and the overall intelligence of collision prevention systems. Key themes revolve around AI's ability to improve the accuracy of object detection and classification, enable more sophisticated predictive analytics for potential collision scenarios, and facilitate real-time decision-making in complex environments. Users are particularly interested in how AI contributes to sensor fusion, allowing data from multiple sensor types to be processed holistically for a more comprehensive understanding of the surroundings, thereby addressing limitations inherent in single sensor modalities. Expectations also include AI's role in driving the evolution towards fully autonomous systems, requiring robust and highly reliable collision avoidance mechanisms, while concerns sometimes touch upon the computational demands, algorithm reliability in unforeseen conditions, and the ethical implications of autonomous decision-making.

- AI significantly enhances the accuracy and reliability of object detection and classification by processing vast amounts of sensor data and identifying patterns that traditional algorithms might miss.

- Enables advanced sensor fusion, seamlessly integrating data from radar, lidar, cameras, and ultrasonic sensors to create a comprehensive and robust environmental model, minimizing false positives and negatives.

- Facilitates predictive collision avoidance, allowing systems to anticipate potential hazards based on object trajectories, speeds, and behavioral patterns, leading to proactive warnings and interventions.

- Drives real-time decision-making and adaptive responses in dynamic environments, crucial for autonomous driving and complex industrial automation where rapid and accurate judgments are paramount.

- Supports the development of self-learning systems that continuously improve performance over time by analyzing past events and refining their perception and response algorithms.

- Improves system robustness against adverse weather conditions and varying lighting by leveraging AI models trained on diverse datasets, enhancing sensor performance where traditional methods struggle.

- Optimizes resource allocation and processing efficiency, allowing for more complex computations to be performed on edge devices with lower latency, which is critical for safety-critical applications.

DRO & Impact Forces Of Collision Avoidance Sensor Market

The Collision Avoidance Sensor Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and competitive forces. Key drivers include the escalating global demand for enhanced safety across various sectors, particularly within the automotive industry where stringent government regulations and rising consumer awareness regarding ADAS features compel manufacturers to integrate sophisticated collision avoidance systems. The rapid advancements in industrial automation and the proliferation of robotics in manufacturing, logistics, and healthcare also fuel demand, as these systems inherently require robust obstacle detection and prevention capabilities for safe and efficient operation. Furthermore, the continuous technological evolution leading to more accurate, smaller, and cost-effective sensors contributes significantly to market expansion.

Conversely, several restraints impede the market's growth trajectory. High initial costs associated with advanced multi-sensor systems, particularly lidar, can be a barrier to adoption for some applications and consumer segments. Technical limitations, such as the performance degradation of sensors in adverse weather conditions (heavy rain, fog, snow) or extreme lighting, pose challenges for widespread deployment and reliability in all scenarios. Data privacy and security concerns related to the collection and processing of environmental data by these sensors also represent a restraint, as do the ethical implications and liability issues surrounding autonomous decision-making by collision avoidance systems, particularly as they evolve towards higher levels of autonomy.

Despite these challenges, significant opportunities exist for market players. The burgeoning market for autonomous vehicles, from passenger cars to delivery robots and drones, represents a long-term growth avenue requiring increasingly sophisticated and redundant collision avoidance solutions. The integration of these sensors with the Internet of Things (IoT) and smart city infrastructure opens new possibilities for connected safety systems and intelligent traffic management. Furthermore, the development of solid-state lidar and next-generation radar technologies promises to address current cost and performance limitations, unlocking new applications and broader market penetration. Emerging markets, with their growing industrial bases and increasing vehicle sales, offer substantial untapped potential for both OEM and aftermarket installations.

The market is also shaped by intense competitive rivalry, driven by continuous innovation in sensor technologies and system integration. The bargaining power of buyers, particularly large automotive OEMs, is considerable, leading to price pressures and demands for highly customized solutions. The bargaining power of suppliers, particularly for specialized components like semiconductor chips and advanced optics, is moderate to high, depending on the exclusivity of their technology. The threat of new entrants is moderate, as significant capital investment, technical expertise, and established supply chains are required. The threat of substitute products is relatively low in safety-critical applications, as dedicated collision avoidance sensors offer unique and superior performance compared to alternative safety measures, though improvements in driver awareness technologies could indirectly impact demand.

Segmentation Analysis

The Collision Avoidance Sensor Market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for precise analysis of market dynamics, growth drivers, and opportunities across various technological implementations, end-use industries, and geographic regions. The market's complexity is best understood by dissecting it into distinct categories based on the underlying sensor technology, the specific applications where these systems are deployed, the type of end-user or buyer, and the key components that constitute these advanced safety systems. This multi-dimensional approach highlights the nuanced demands and competitive landscape present within the collision avoidance sector.

- By Technology

- Radar

- Lidar

- Camera

- Ultrasonic

- Infrared

- Others (e.g., thermal, magnetic)

- By Application

- Automotive

- Passenger Vehicles

- Commercial Vehicles (Trucks, Buses, Vans)

- Industrial

- Robotics (Industrial Robots, Collaborative Robots)

- Heavy Machinery (Construction, Mining, Agriculture)

- Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs)

- Aerospace & Defense

- Unmanned Aerial Vehicles (UAVs)/Drones

- Aircraft (Commercial, Military)

- Military Vehicles & Naval Vessels

- Robotics (Service Robotics, Logistics Robotics)

- Marine (Commercial Ships, Autonomous Vessels)

- Others (e.g., Smart Infrastructure, Rail Transport)

- Automotive

- By End-Use

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Component

- Hardware

- Sensors (Transmitters, Receivers)

- Electronic Control Units (ECUs)

- Processors (Microcontrollers, FPGAs, ASICs)

- Actuators

- Software (Algorithms, Firmware, Operating Systems)

- Hardware

Value Chain Analysis For Collision Avoidance Sensor Market

The value chain for the Collision Avoidance Sensor Market is intricate, beginning with upstream activities focused on raw material sourcing and component manufacturing. This initial stage involves the production of specialized semiconductor materials, optical components, acoustic transducers, and advanced electronic circuitry that form the foundational elements of various sensor technologies like radar, lidar, camera, and ultrasonic sensors. Key players in this segment are often large semiconductor companies and specialized component suppliers, whose innovations directly impact the performance, cost, and miniaturization of the final sensor units. The quality and availability of these upstream components are critical determinants of overall system reliability and cost-effectiveness for the broader market.

Moving downstream, the value chain progresses through sensor module integration, system development, and ultimately, deployment into final applications. Sensor manufacturers integrate individual components into complete sensor units, often incorporating proprietary algorithms and processing capabilities. These sensor modules are then supplied to system integrators or directly to Original Equipment Manufacturers (OEMs) in automotive, industrial, and aerospace sectors. These OEMs or integrators are responsible for developing complete collision avoidance systems, which involve sensor fusion, sophisticated software algorithms for perception and decision-making, and integration with the vehicle's or machinery's control systems. This stage also includes rigorous testing, calibration, and validation to meet stringent safety standards and performance requirements.

Distribution channels for collision avoidance sensors and systems are primarily bifurcated into direct and indirect routes. Direct sales are common for large-volume transactions with major automotive OEMs, industrial automation integrators, and defense contractors, where bespoke solutions and long-term partnerships are prevalent. Indirect channels involve a network of distributors, value-added resellers (VARs), and aftermarket retailers who cater to smaller OEMs, custom builders, and end-users seeking aftermarket upgrades for their existing equipment or vehicles. The choice of distribution channel often depends on the scale of the customer, the complexity of the product, and the geographic reach desired by the sensor manufacturers. Effective post-sales support, including installation, maintenance, and software updates, also forms a crucial part of the downstream value chain, ensuring sustained product performance and customer satisfaction.

Collision Avoidance Sensor Market Potential Customers

The primary potential customers for collision avoidance sensors span a wide array of industries, driven by the universal need for enhanced safety, improved operational efficiency, and regulatory compliance. Within the automotive sector, major car manufacturers (OEMs) represent a significant customer base, integrating these sensors as standard features or optional upgrades in their passenger and commercial vehicles to support advanced driver-assistance systems (ADAS) such and autonomous driving capabilities. Beyond OEMs, the automotive aftermarket also constitutes a growing segment, with vehicle owners and fleet operators seeking to equip their existing fleets with advanced safety features for accident reduction and insurance benefits.

In the industrial domain, a diverse range of end-users are keen buyers. This includes manufacturers of industrial robotics and collaborative robots (cobots), where collision avoidance is paramount for worker safety and preventing damage to expensive machinery. Heavy equipment manufacturers for construction, mining, and agriculture also represent a substantial customer segment, integrating sensors into excavators, bulldozers, and tractors to prevent collisions in dynamic and often hazardous work environments. Furthermore, companies deploying Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) in warehouses and logistics centers rely heavily on these sensors for navigation and obstacle avoidance to ensure smooth and safe operations.

Other significant potential customers include aerospace and defense contractors developing unmanned aerial vehicles (UAVs) or drones, as well as manned aircraft and military ground vehicles, where precise obstacle detection is critical for mission success and personnel safety. Marine vessel operators, especially those exploring autonomous shipping, also require robust collision avoidance systems. Additionally, smart city developers and infrastructure planners are emerging as customers, utilizing these sensors for intelligent traffic management, pedestrian safety, and smart parking solutions. The breadth of applications underscores the wide-ranging appeal and necessity of collision avoidance technologies across virtually all sectors involved with automated movement or human-machine interaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2032 | USD 21.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Aptiv PLC, Magna International Inc., Valeo S.A., Velodyne Lidar, Inc., Luminar Technologies, Inc., Mobileye (Intel Corporation), Infineon Technologies AG, NXP Semiconductors N.V., Hella GmbH & Co. KGaA, Renesas Electronics Corporation, Sensata Technologies, Autoliv Inc., Cruise LLC (General Motors), Waymo LLC (Alphabet Inc.), Baidu Inc. (Apollo), Nvidia Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Collision Avoidance Sensor Market Key Technology Landscape

The Collision Avoidance Sensor Market is characterized by a dynamic and rapidly evolving technology landscape, with continuous innovations enhancing sensor capabilities and system intelligence. Radar technology, particularly 24 GHz for short-range and 77 GHz for long-range applications, remains a cornerstone due to its robustness in adverse weather conditions, providing accurate speed and distance measurements. Lidar systems are gaining significant traction, with solid-state lidar emerging as a promising development to overcome the cost and mechanical complexity of traditional scanning lidar, offering high-resolution 3D mapping capabilities crucial for autonomous navigation. Camera-based systems, including monocular, stereo, and thermal cameras, provide rich visual information for object recognition, lane keeping, and traffic sign detection, often complemented by advanced image processing algorithms.

Ultrasonic sensors continue to be essential for short-range proximity detection, commonly used in parking assistance and low-speed obstacle avoidance. The convergence of these individual sensor modalities through sensor fusion technologies is a pivotal trend, leveraging AI and machine learning algorithms to combine data from multiple sensors. This fusion process creates a more comprehensive and reliable perception of the environment, compensating for the limitations of any single sensor type and improving overall system accuracy and robustness. The increasing sophistication of these fusion platforms, often powered by high-performance Electronic Control Units (ECUs) and dedicated processors (FPGAs, ASICs), is enabling higher levels of autonomous functionality.

Furthermore, the development of Vehicle-to-Everything (V2X) communication technologies is set to profoundly impact the collision avoidance landscape, allowing vehicles to communicate with each other (V2V), with infrastructure (V2I), pedestrians (V2P), and the network (V2N). This connectivity enables anticipatory collision avoidance by sharing critical safety messages beyond the line of sight of on-board sensors, providing an additional layer of protection. Edge computing is also becoming increasingly relevant, facilitating faster data processing closer to the source, reducing latency, and enabling quicker decision-making crucial for safety-critical applications. These technological advancements collectively drive the market towards more reliable, intelligent, and proactive collision avoidance solutions.

Regional Highlights

- North America: This region is a mature and significant market for collision avoidance sensors, characterized by early adoption of advanced driver-assistance systems (ADAS) and stringent safety regulations. The presence of major automotive OEMs and a strong focus on autonomous vehicle research and development initiatives drive consistent demand. Countries like the United States and Canada are witnessing increasing integration of these sensors in both passenger and commercial vehicles, supported by a robust industrial automation sector and a proactive regulatory environment promoting road safety.

- Europe: Europe stands as a leading region for collision avoidance technologies, primarily due to its stringent automotive safety standards (e.g., Euro NCAP requirements) and continuous innovation in vehicle safety systems. Countries such as Germany, France, and the UK are at the forefront of adopting advanced sensor technologies in luxury and premium vehicle segments, alongside significant investments in industrial robotics and smart factory initiatives. Research and development in autonomous driving and intelligent transport systems also contribute substantially to market growth in this region.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, driven by the expanding automotive industries in China, India, Japan, and South Korea, coupled with rapidly increasing disposable incomes and consumer demand for safer vehicles. Government support for smart infrastructure, industrial automation, and the proliferation of robotics across manufacturing and logistics sectors further fuels demand. China, in particular, is a dominant force with its large vehicle production and a burgeoning market for electric and autonomous vehicles, while Japan and South Korea lead in technological innovation and high-tech manufacturing adoption.

- Latin America: This region represents an emerging market for collision avoidance sensors, with gradual but steady adoption driven by improving road safety standards and increasing vehicle production. Countries like Brazil and Mexico are witnessing a rising awareness of vehicle safety features, alongside growing investments in industrial modernization. While adoption rates may lag compared to more developed regions, the long-term potential for growth is significant as economic development and regulatory pressures intensify.

- Middle East and Africa (MEA): The MEA region is experiencing nascent growth in the collision avoidance sensor market, supported by substantial infrastructure investments, particularly in smart cities and transportation networks in the GCC countries. Increasing vehicle sales, coupled with a growing focus on industrial automation and safety in sectors like oil and gas, are driving demand. While still a smaller market, ongoing urbanization and diversification efforts away from traditional economies are expected to stimulate future growth and adoption of these advanced safety technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Collision Avoidance Sensor Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Aptiv PLC

- Magna International Inc.

- Valeo S.A.

- Velodyne Lidar, Inc.

- Luminar Technologies, Inc.

- Mobileye (Intel Corporation)

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Hella GmbH & Co. KGaA

- Renesas Electronics Corporation

- Sensata Technologies

- Autoliv Inc.

- Cruise LLC (General Motors)

- Waymo LLC (Alphabet Inc.)

- Baidu Inc. (Apollo)

- Nvidia Corporation

Frequently Asked Questions

What is a collision avoidance sensor?

A collision avoidance sensor is a device or system designed to detect obstacles or potential hazards in the environment around a vehicle, robot, or machinery, providing warnings to operators or initiating automatic interventions to prevent impacts and enhance safety. These sensors utilize various technologies such as radar, lidar, cameras, and ultrasonics to monitor surroundings.

How does AI improve collision avoidance systems?

AI significantly enhances collision avoidance systems by enabling more accurate object detection and classification, facilitating sophisticated sensor fusion for a comprehensive environmental understanding, and powering predictive analytics for proactive hazard anticipation. AI algorithms also drive real-time decision-making, allowing systems to adapt to dynamic conditions and continuously improve performance through machine learning.

What are the main applications of collision avoidance sensors?

The main applications for collision avoidance sensors are primarily in the automotive sector for passenger and commercial vehicles, supporting ADAS and autonomous driving functionalities. They are also crucial in industrial automation for robotics and heavy machinery, aerospace and defense for UAVs and military vehicles, and marine applications to prevent accidents and improve navigation safety.

What technologies are commonly used in collision avoidance sensors?

Common technologies used in collision avoidance sensors include radar (for speed and distance), lidar (for 3D mapping and high-resolution imaging), cameras (for object recognition and lane detection), and ultrasonic sensors (for short-range proximity detection). Sensor fusion, which combines data from multiple technologies, is increasingly employed to create more robust and reliable systems.

What are the future trends in the Collision Avoidance Sensor Market?

Future trends in the Collision Avoidance Sensor Market include the widespread adoption of solid-state lidar for cost-effectiveness and improved performance, deeper integration of AI and machine learning for enhanced perception and predictive capabilities, and the proliferation of V2X communication for cooperative safety. Further miniaturization, improved weather resilience, and expanding applications in smart cities and logistics are also expected.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager