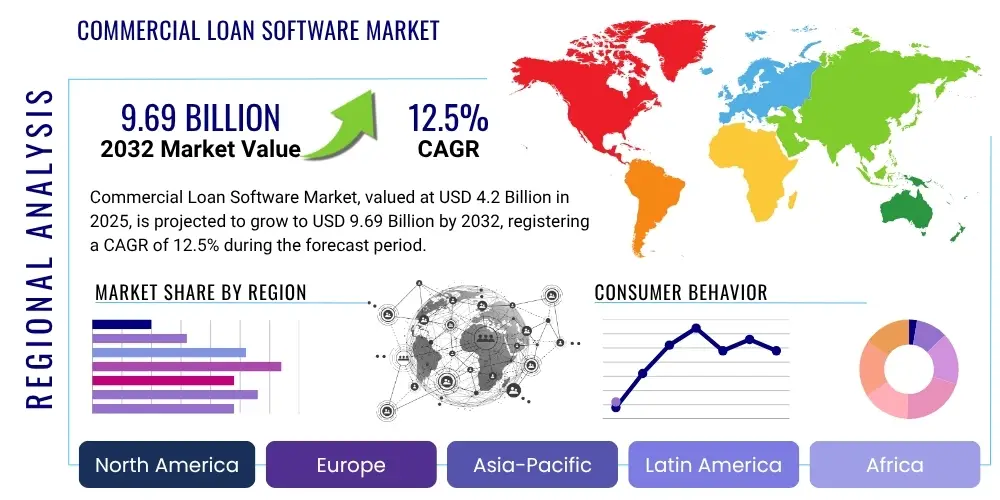

Commercial Loan Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428574 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Loan Software Market Size

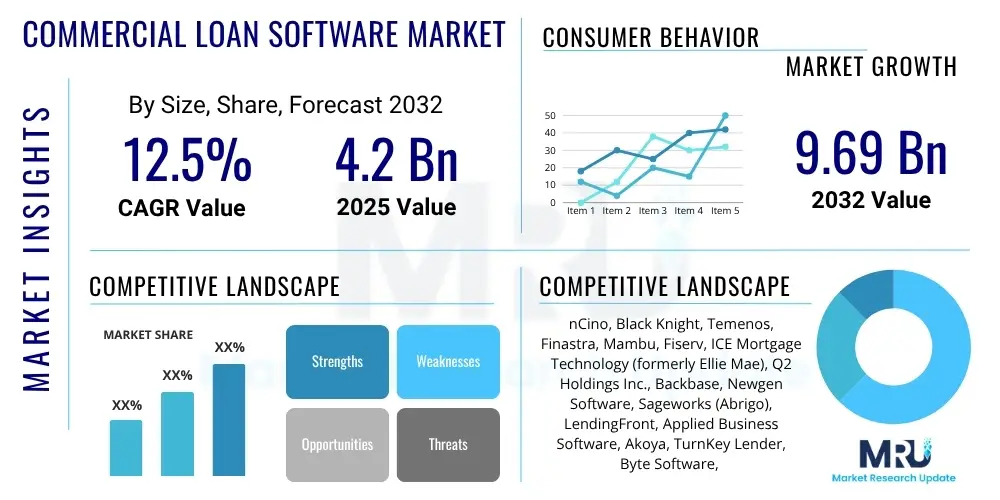

The Commercial Loan Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 9.69 Billion by the end of the forecast period in 2032.

Commercial Loan Software Market introduction

The Commercial Loan Software Market encompasses advanced technological solutions designed to streamline and automate the entire lifecycle of commercial lending, from origination and underwriting to servicing and collections. These sophisticated platforms serve as critical tools for financial institutions, enhancing efficiency, ensuring compliance, and mitigating risks inherent in complex commercial financing. The software aims to digitalize traditionally manual and paper-intensive processes, thereby improving accuracy, reducing processing times, and delivering a superior experience for both lenders and borrowers.

Major applications of commercial loan software span across diverse financial entities, including large commercial banks, regional banks, credit unions, non-bank lenders, and emerging fintech companies. The software's benefits are multifaceted, providing functionalities such as automated credit assessment, comprehensive document management, robust compliance checks, and real-time portfolio monitoring. Driving factors for market growth include the accelerating pace of digital transformation within the financial sector, increasing regulatory pressures demanding greater transparency and accountability, and a highly competitive landscape that necessitates faster and more agile loan processing capabilities to meet evolving customer expectations.

Commercial Loan Software Market Executive Summary

The Commercial Loan Software Market is experiencing robust growth driven by a pervasive shift towards digitalization in financial services, coupled with intense competitive pressures and stringent regulatory environments. Business trends indicate a strong inclination towards cloud-based solutions and the integration of artificial intelligence and machine learning to enhance decision-making and operational efficiency. Furthermore, there is a growing demand for modular and customizable software that can adapt to the unique needs of various lending portfolios and organizational structures, emphasizing scalability and interoperability.

Regionally, North America and Europe continue to hold significant market shares due to early adoption of advanced financial technologies and the presence of numerous large financial institutions. However, the Asia Pacific and Latin American markets are demonstrating the highest growth rates, fueled by expanding economies, increasing access to credit, and a burgeoning fintech ecosystem. These regions are rapidly investing in digital lending infrastructure to cater to a diverse range of businesses, particularly small and medium-sized enterprises (SMEs).

Segment trends reveal that the cloud-deployment model is outpacing on-premise solutions, primarily owing to its cost-effectiveness, scalability, and ease of deployment. Large enterprises are increasingly investing in comprehensive, end-to-end platforms that offer extensive integration capabilities, while SMEs are opting for more agile, subscription-based models that provide essential functionalities without significant upfront capital expenditure. The emphasis across all segments is on solutions that deliver enhanced automation, improved risk management, and superior customer engagement throughout the loan lifecycle.

AI Impact Analysis on Commercial Loan Software Market

Users frequently inquire about AI's transformative potential in commercial lending, focusing on its ability to revolutionize credit assessment, mitigate fraud, and personalize client interactions. Key themes include the expectation of significant improvements in efficiency, accuracy, and speed of loan processing, alongside concerns about data privacy, algorithmic bias, and the ethical implications of automated decision-making. There is a strong desire for AI to not only automate routine tasks but also to provide deeper insights into borrower risk profiles and market trends, thereby enabling more strategic lending decisions and offering a competitive edge to financial institutions. Users also seek clarity on how AI can integrate seamlessly with existing legacy systems and what specialized skills might be required to manage these advanced tools.

- Automated underwriting processes for faster decision-making.

- Enhanced credit risk assessment through predictive analytics and alternative data sources.

- Improved fraud detection capabilities with real-time pattern recognition.

- Personalized loan product recommendations based on borrower behavior and needs.

- Operational efficiency gains through intelligent automation of repetitive tasks.

- Advanced portfolio management and early warning systems for loan defaults.

- Regulatory compliance assistance through automated monitoring and reporting.

- Natural Language Processing (NLP) for efficient document analysis and contract review.

DRO & Impact Forces Of Commercial Loan Software Market

The Commercial Loan Software Market is propelled by several potent drivers, chief among them being the widespread adoption of digitalization across the financial services industry. Financial institutions are increasingly recognizing the imperative to automate manual processes to reduce operational costs, enhance accuracy, and accelerate loan approval times. Regulatory bodies worldwide are also imposing stricter compliance requirements, which commercial loan software can help address through integrated frameworks for anti-money laundering (AML), know your customer (KYC), and data privacy. The intensely competitive lending landscape further compels institutions to adopt advanced software to offer superior customer experiences and innovative product offerings, thereby retaining existing clients and attracting new ones.

However, significant restraints temper this growth. The high initial investment costs associated with implementing comprehensive commercial loan software solutions, particularly for smaller institutions, can be a major barrier. Concerns regarding data security and privacy, especially with cloud-based deployments, remain prevalent, necessitating robust cybersecurity measures. Furthermore, the complexities of integrating new software with diverse legacy systems and the potential resistance to change from employees accustomed to traditional processes pose considerable challenges for market expansion.

Opportunities abound for market players willing to innovate and adapt. The untapped potential in emerging economies, coupled with the increasing demand for lending to small and medium-sized enterprises (SMEs), presents lucrative growth avenues. The integration of cutting-edge technologies like blockchain for secure transactions and smart contracts, alongside the development of hyper-personalized lending experiences, offers new frontiers for product differentiation. The continued shift towards Software-as-a-Service (SaaS) models also lowers entry barriers for new adopters, fostering broader market penetration and sustained revenue streams for providers.

Segmentation Analysis

The Commercial Loan Software Market is broadly segmented based on its various components, deployment models, organizational sizes, and application areas, each reflecting distinct operational needs and technological preferences within the financial industry. This segmentation provides a granular view of market dynamics, enabling both providers and consumers to understand specific market niches and growth opportunities. The differentiation across these segments is critical for tailoring solutions that effectively address the diverse requirements of commercial lenders, from large multinational banks to local credit unions and agile fintech startups.

- By Component:

- Solution

- Services (Implementation, Consulting, Support & Maintenance)

- By Deployment:

- On-premise

- Cloud (Public, Private, Hybrid)

- By Organization Size:

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Loan Origination

- Loan Underwriting & Approval

- Loan Servicing

- Loan Collections & Recovery

- Risk Management & Compliance

- Portfolio Management

Value Chain Analysis For Commercial Loan Software Market

The value chain for the Commercial Loan Software Market begins with upstream activities involving technology providers and software developers. Upstream participants include companies specializing in core banking systems, artificial intelligence and machine learning frameworks, cloud infrastructure services (such as AWS, Azure, Google Cloud), big data analytics tools, and secure communication protocols. Data vendors supplying essential market intelligence, credit data, and alternative data sources also form a crucial part of the upstream segment, enabling sophisticated risk assessment and underwriting capabilities within the software solutions. These entities provide the foundational technologies and raw data that are integrated and processed to create the final commercial loan software products.

Moving downstream, the value chain extends to the direct consumers and end-users of these software solutions, primarily financial institutions and lending organizations. This includes commercial banks, regional and community banks, credit unions, mortgage lenders, non-bank financial institutions, and the rapidly growing sector of fintech companies. These downstream players leverage the software to manage their commercial lending operations, improve efficiency, ensure compliance, and enhance customer experience. The effectiveness of the software is ultimately measured by its ability to optimize the lending process for these end-users, leading to faster loan approvals, reduced default rates, and increased profitability.

The distribution channel for commercial loan software involves both direct and indirect approaches. Direct sales typically involve software vendors engaging directly with large enterprise clients, often through dedicated sales teams, offering tailored solutions, and extensive implementation support. This approach allows for deep customization and direct client relationship management. Indirect channels, conversely, involve partnerships with resellers, value-added resellers (VARs), system integrators, and consulting firms. These partners extend the market reach of software providers, especially to SMEs or specific regional markets, providing localized support, integration services, and industry-specific expertise, thereby broadening the market footprint and facilitating broader adoption of the software solutions.

Commercial Loan Software Market Potential Customers

The primary potential customers and end-users for Commercial Loan Software are diverse financial institutions and organizations actively involved in providing commercial credit. This includes a broad spectrum of entities, from established players to emerging fintechs, all seeking to enhance their lending operations, improve risk management, and deliver a more efficient customer experience. The overarching goal for these buyers is to leverage technology to gain a competitive edge in a dynamic and often complex lending environment, ensuring compliance while driving growth and profitability.

Specifically, key buyers include large commercial banks that require robust, scalable solutions to manage extensive loan portfolios and complex regulatory mandates across multiple geographies. Regional and community banks are also significant customers, often looking for flexible, cost-effective solutions that can be quickly implemented and integrated with existing systems to serve local businesses effectively. Credit unions, seeking to expand their commercial lending activities while maintaining member-centric services, represent another important segment, driven by the need for efficiency and regulatory adherence.

Beyond traditional banking, non-bank financial institutions, mortgage lenders, and an increasing number of fintech companies also form a crucial customer base. Fintechs, in particular, are early adopters of advanced commercial loan software, leveraging cloud-native platforms and AI capabilities to offer innovative and often hyper-specialized lending products. Private equity firms and alternative lenders involved in direct lending to businesses further contribute to the customer pool, seeking agile tools for due diligence, deal management, and portfolio monitoring.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2032 | USD 9.69 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | nCino, Black Knight, Temenos, Finastra, Mambu, Fiserv, ICE Mortgage Technology (formerly Ellie Mae), Q2 Holdings Inc., Backbase, Newgen Software, Sageworks (Abrigo), LendingFront, Applied Business Software, Akoya, TurnKey Lender, Byte Software, Wipro Limited, Capgemini SE, Tata Consultancy Services (TCS), Infosys Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Loan Software Market Key Technology Landscape

The Commercial Loan Software Market is continuously evolving, driven by the integration of sophisticated technologies aimed at enhancing efficiency, security, and decision-making capabilities within the lending ecosystem. At the forefront is cloud computing, which provides the scalable, flexible, and accessible infrastructure necessary for modern loan management platforms. Cloud-native solutions enable financial institutions to reduce IT overheads, deploy updates rapidly, and ensure high availability, making them particularly attractive for both established banks and agile fintech startups. The shift towards multi-cloud and hybrid-cloud strategies offers additional benefits in terms of data residency, disaster recovery, and workload optimization.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal in transforming various aspects of commercial lending. These technologies power advanced analytics for credit risk assessment, allowing lenders to process vast amounts of structured and unstructured data to derive more accurate borrower profiles and predict potential defaults with greater precision. AI-driven automation streamlines document processing, reduces manual errors, and accelerates the underwriting process, significantly cutting down loan approval times. Robotic Process Automation (RPA) further contributes to operational efficiency by automating repetitive, rule-based tasks across the loan lifecycle, freeing up human resources for more complex, value-added activities.

Big Data Analytics forms the backbone for informed decision-making, enabling commercial loan software to ingest, process, and analyze massive datasets from various sources, including financial records, market trends, social media, and alternative credit data. This allows for comprehensive risk modeling, portfolio optimization, and the identification of new lending opportunities. Furthermore, robust Application Programming Interfaces (APIs) are crucial for interoperability, facilitating seamless integration with existing core banking systems, third-party data providers, and various financial tools, creating a cohesive and interconnected lending environment. Enhanced cybersecurity measures, including advanced encryption, multi-factor authentication, and blockchain technology, are also becoming standard to protect sensitive financial data and ensure compliance with stringent data protection regulations.

Regional Highlights

- North America: This region maintains a dominant position in the Commercial Loan Software Market, characterized by early adoption of advanced financial technologies, significant investments in digital transformation by major financial institutions, and a highly competitive lending landscape. The presence of numerous large commercial banks and a thriving fintech sector drives continuous innovation and demand for sophisticated, integrated solutions. Strict regulatory frameworks also necessitate robust software for compliance and risk management.

- Europe: The European market demonstrates substantial growth, primarily influenced by ongoing digital modernization initiatives within the banking sector and a strong emphasis on regulatory compliance, particularly with GDPR and other data privacy laws. Countries like the UK, Germany, and France are leading the adoption of cloud-based and AI-driven lending solutions, driven by competitive pressures and the need to serve a diverse range of businesses across various economic sectors.

- Asia Pacific (APAC): Positioned as the fastest-growing market, the APAC region is experiencing rapid digitalization across its financial sector, fueled by expanding economies, increasing access to credit for SMEs, and a burgeoning number of digital-native banks and fintech startups. Countries like China, India, Australia, and Singapore are witnessing significant investments in commercial loan software to cater to their vast and underserved business populations, with a strong focus on mobile-first and cloud-based solutions.

- Latin America: This region is an emerging market with significant growth potential, driven by increasing foreign investment in financial technology and a growing recognition among local banks and financial institutions of the need for digital transformation. Governments and private entities are investing in modernizing infrastructure, leading to increased adoption of commercial loan software to improve operational efficiency, expand access to credit, and enhance risk management in a rapidly evolving economic landscape.

- Middle East and Africa (MEA): The MEA market is showing promising growth, particularly in the Gulf Cooperation Council (GCC) countries and South Africa, driven by government initiatives to diversify economies away from oil and gas, leading to increased investment in financial services infrastructure. The demand for commercial loan software is propelled by efforts to modernize banking operations, improve transparency, and adhere to international financial standards, with a focus on adopting secure and scalable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Loan Software Market.- nCino

- Black Knight

- Temenos

- Finastra

- Mambu

- Fiserv

- ICE Mortgage Technology

- Q2 Holdings Inc.

- Backbase

- Newgen Software

- Abrigo (formerly Sageworks)

- LendingFront

- Applied Business Software

- Akoya

- TurnKey Lender

- Byte Software

- Wipro Limited

- Capgemini SE

- Tata Consultancy Services (TCS)

- Infosys Limited

Frequently Asked Questions

Analyze common user questions about the Commercial Loan Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is commercial loan software?

Commercial loan software is a specialized technology solution designed to automate and manage the entire lifecycle of commercial lending, including origination, underwriting, servicing, and collections, for financial institutions. It streamlines processes, enhances accuracy, ensures compliance, and mitigates risks.

How does commercial loan software benefit financial institutions?

It provides numerous benefits such as increased operational efficiency, reduced processing times, improved accuracy in credit assessments, enhanced compliance with regulations, better risk management, and a superior customer experience through digitized and automated workflows.

What are the key features to look for in commercial loan software?

Essential features include automated loan origination, robust underwriting tools, comprehensive loan servicing capabilities, integrated risk management and compliance modules, seamless integration with existing systems, advanced reporting, and a scalable, secure architecture, preferably cloud-based.

Is cloud-based commercial loan software secure?

Modern cloud-based commercial loan software employs advanced security protocols, including end-to-end encryption, multi-factor authentication, regular security audits, and adherence to industry-standard compliance certifications. Reputable providers prioritize data privacy and robust cybersecurity measures to protect sensitive financial information.

How does AI enhance commercial loan software?

AI significantly enhances commercial loan software by enabling automated underwriting, predictive analytics for more accurate credit risk assessment, advanced fraud detection, personalized loan product recommendations, and increased operational efficiency through the automation of repetitive tasks and intelligent insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager