Commercial Vehicle Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429323 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Commercial Vehicle Accessories Market Size

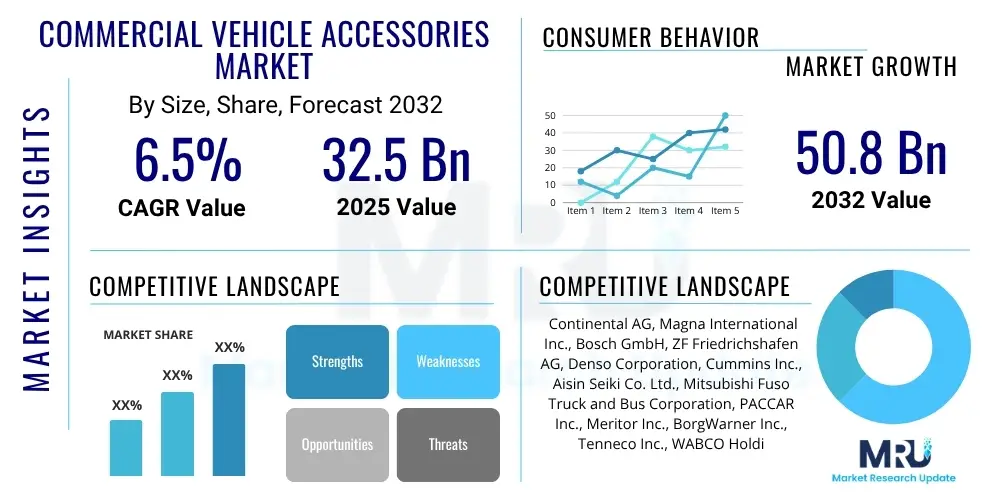

The Commercial Vehicle Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 32.5 Billion in 2025 and is projected to reach USD 50.8 Billion by the end of the forecast period in 2032. This substantial growth is driven by the increasing demand for enhanced functionality, safety, and operational efficiency across various commercial vehicle sectors, including logistics, construction, and passenger transport. The expanding global fleet of light and heavy commercial vehicles, coupled with stringent regulatory standards for vehicle safety and emissions, further propels market expansion.

Commercial Vehicle Accessories Market introduction

The Commercial Vehicle Accessories Market encompasses a diverse range of products designed to augment the performance, utility, safety, aesthetics, and comfort of light and heavy commercial vehicles such as trucks, vans, buses, and specialized vehicles. These accessories include exterior enhancements like bed liners, grille guards, running boards, and lighting solutions, as well as interior upgrades such as seating covers, floor mats, storage solutions, and advanced infotainment systems. Beyond cosmetic improvements, many accessories contribute significantly to operational efficiency, driver comfort, and cargo management, playing a crucial role in fleet optimization and reducing operational costs for businesses.

Major applications of commercial vehicle accessories span numerous industries, including logistics and transportation, construction, agriculture, mining, and public utilities, where these products enhance vehicle adaptability to specific operational demands. For instance, cargo management systems are vital for logistics firms, while heavy-duty protective accessories are indispensable for construction and mining vehicles. The primary benefits derived from these accessories include improved vehicle longevity, enhanced driver and cargo safety, increased fuel efficiency through aerodynamic designs, better driver ergonomics, and greater versatility for multi-purpose vehicle usage. Driving factors for this market's growth include the global expansion of e-commerce, necessitating robust last-mile delivery fleets, growing infrastructure development projects, and a continuous focus on regulatory compliance for vehicle safety and emissions, which often necessitates accessory upgrades.

Commercial Vehicle Accessories Market Executive Summary

The Commercial Vehicle Accessories Market is experiencing dynamic growth, propelled by evolving business trends such as the digitalization of logistics, increasing demand for customizable fleet solutions, and a heightened focus on sustainability. Businesses are investing in accessories that offer real-time data integration, fuel efficiency improvements, and enhanced driver comfort to optimize their operational workflows and attract and retain skilled drivers. The aftermarket segment continues to demonstrate robust expansion, driven by vehicle customization preferences and the need for regular upgrades and replacements, while OEM channels benefit from integrated accessory offerings at the point of sale, catering to specific industry requirements.

Regional trends indicate North America and Europe as mature markets with high adoption rates of advanced and specialized accessories, spurred by strict safety regulations and technological advancements. The Asia Pacific region is poised for significant growth, fueled by rapid industrialization, burgeoning e-commerce sectors, and increasing commercial vehicle production and sales, particularly in countries like China and India. Latin America and the Middle East & Africa also present considerable growth opportunities as their logistics and infrastructure sectors expand. Segment-wise, exterior accessories focused on protection and aerodynamics, along with electronics such as telematics and navigation systems, are witnessing strong demand due to their direct impact on operational safety and efficiency.

AI Impact Analysis on Commercial Vehicle Accessories Market

Users frequently inquire about how artificial intelligence will transform commercial vehicle accessories, focusing on themes such as predictive maintenance, smart fleet management, and the integration of autonomous driving technologies. There is a strong interest in understanding how AI can enhance vehicle safety, optimize route planning, and improve fuel efficiency through intelligent accessory systems. Concerns often revolve around data privacy, the cost of implementing AI-powered solutions, and the interoperability of different smart accessories within a unified fleet management system. Expectations are high for accessories that offer proactive solutions, reducing downtime and operational complexities while augmenting overall fleet performance.

- Predictive maintenance accessories using AI algorithms to monitor component health and anticipate failures, reducing unexpected downtime.

- AI-driven telematics systems providing real-time insights into driver behavior, route optimization, and fuel consumption for enhanced efficiency.

- Integration of advanced driver-assistance systems (ADAS) in accessories, leveraging AI for improved safety features like collision avoidance and lane keeping.

- Smart cargo management accessories employing AI for optimized load distribution, temperature control, and theft prevention, ensuring cargo integrity.

- Voice-activated and AI-powered infotainment systems enhancing driver comfort and productivity through intuitive control and personalized experiences.

- Autonomous driving component integration, where accessories are designed to support and enhance sensor arrays, communication systems, and processing units for self-driving commercial vehicles.

DRO & Impact Forces Of Commercial Vehicle Accessories Market

The Commercial Vehicle Accessories Market is significantly shaped by a confluence of drivers, restraints, and opportunities. Key drivers include the robust expansion of the logistics and transportation sector, fueled by e-commerce growth and global trade, which necessitates more efficient and specialized commercial vehicles. Regulatory mandates for vehicle safety, emissions reduction, and fuel efficiency also compel fleet owners to invest in compliant and performance-enhancing accessories. Furthermore, the increasing demand for vehicle customization to suit specific operational needs across industries, coupled with a focus on driver comfort and retention, acts as a significant market impetus.

However, the market faces several restraints, prominently including the high initial cost associated with advanced and technologically integrated accessories, which can deter small and medium-sized fleet operators. Economic uncertainties and fluctuations in commercial vehicle sales can also temper market growth. Additionally, the lack of standardization across different vehicle models and accessory manufacturers can pose compatibility challenges, while the growing complexity of electronic accessories requires specialized installation and maintenance expertise. These factors necessitate careful consideration by market participants to ensure product accessibility and ease of integration.

Opportunities in the market are abundant, particularly with the advent of electric commercial vehicles, creating a new segment for specialized charging infrastructure, lightweight aerodynamic accessories, and battery management solutions. The increasing adoption of IoT and telematics offers avenues for smart, connected accessories that provide real-time data and remote monitoring capabilities. Expansion into developing economies, where infrastructure development and logistics are rapidly growing, also presents substantial market potential. The focus on sustainable transportation further opens doors for eco-friendly materials and energy-efficient accessory designs, aligning with global environmental objectives.

Segmentation Analysis

The Commercial Vehicle Accessories Market is comprehensively segmented based on various attributes to provide a detailed understanding of its dynamics and growth prospects. These segments offer insights into product types, vehicle applications, distribution channels, materials used, and end-user adoption patterns. Understanding these distinct segments is crucial for market participants to tailor their product offerings, marketing strategies, and distribution networks effectively, ensuring they meet the diverse and evolving needs of commercial vehicle operators across different industries and geographical regions.

- Product Type

- Exterior Accessories

- Grille Guards & Bull Bars

- Running Boards & Side Steps

- Fender Flares

- Bed Liners & Mats

- Truck Caps & Tonneau Covers

- Lighting (LED bars, auxiliary lights)

- Mud Flaps & Splash Guards

- Aerodynamic Kits (spoilers, fairings)

- Chrome Accessories

- Mirrors & Camera Systems

- Interior Accessories

- Seat Covers & Floor Mats

- Storage & Organization Solutions

- Dash Kits & Interior Trim

- Steering Wheel Covers

- Sun Shades

- Custom Seating

- Electronics & Connectivity

- Infotainment & Navigation Systems

- Telematics & Fleet Management Systems

- Backup Cameras & Parking Sensors

- Dash Cams

- Charging Solutions (USB ports, inverters)

- Security Systems

- Hands-Free Kits

- Performance & Utility

- Suspension Systems

- Exhaust Systems

- Towing & Hitches

- Winches & Recovery Gear

- Air Intakes & Filters

- Fuel Tanks & Fuel System Components

- Tool Boxes & Storage Racks

- Exterior Accessories

- Vehicle Type

- Light Commercial Vehicles (LCVs)

- Vans

- Pickup Trucks

- Light-Duty Trucks

- Heavy Commercial Vehicles (HCVs)

- Heavy-Duty Trucks

- Buses & Coaches

- Construction & Mining Vehicles

- Specialty Vehicles

- Light Commercial Vehicles (LCVs)

- Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Independent Garages & Workshops

- Online Retail

- Franchised Dealerships

- Specialty Stores

- Material

- Metal (Steel, Aluminum)

- Plastics (ABS, Polypropylene)

- Rubber

- Composites (Fiberglass, Carbon Fiber)

- Leather & Fabrics

- End-Use Industry

- Logistics & Transportation

- Construction

- Mining

- Agriculture

- Public Utility & Government Fleets

- Passenger Transport

- E-commerce & Last-Mile Delivery

Value Chain Analysis For Commercial Vehicle Accessories Market

The value chain for the Commercial Vehicle Accessories Market begins with upstream activities involving raw material suppliers, who provide essential components such as various metals (steel, aluminum), plastics (ABS, polypropylene), rubber, and advanced composite materials. These suppliers play a critical role in determining the quality, durability, and cost-effectiveness of the final accessory products. Research and development activities also form a crucial part of the upstream segment, focusing on innovative designs, lightweighting solutions, and integration of smart technologies to meet evolving market demands and regulatory standards. Effective sourcing and quality control at this stage are paramount for product reliability and performance.

Midstream activities involve the manufacturing and assembly of accessories, where raw materials are transformed into finished products through processes like stamping, molding, welding, and electronic component integration. Manufacturers may specialize in certain types of accessories or cater to a broader range of products. Downstream activities encompass the distribution and sales of these accessories. The distribution channel is bifurcated into direct and indirect methods. Direct channels typically involve Original Equipment Manufacturers (OEMs) who integrate accessories into new vehicles or sell them through their authorized dealership networks. This channel ensures seamless compatibility and often comes with vehicle warranties, catering to customers seeking integrated solutions.

Indirect channels, primarily the aftermarket, involve a vast network of distributors, wholesalers, independent retailers, online platforms, and specialty shops. This segment offers a wider array of products from various brands, often at competitive prices, appealing to vehicle owners looking for customization, replacement parts, or performance upgrades post-purchase. Aftermarket distributors leverage extensive logistics networks to ensure product availability across diverse geographic locations, playing a crucial role in market penetration and customer reach. The efficiency of both direct and indirect distribution channels significantly impacts market accessibility and customer satisfaction, with online retail platforms gaining increasing prominence due to their convenience and broad selection.

Commercial Vehicle Accessories Market Potential Customers

The Commercial Vehicle Accessories Market serves a diverse range of potential customers, primarily classified by their operational needs and vehicle types. Fleet owners, ranging from large logistics corporations to small and medium-sized enterprises (SMEs) engaged in transportation, form a significant customer base. These entities seek accessories that enhance operational efficiency, ensure driver safety and comfort, improve cargo security, and comply with industry-specific regulations. Their purchasing decisions are often driven by total cost of ownership, durability, and the potential for return on investment through reduced downtime and improved performance.

Beyond traditional fleet operators, construction companies, mining operations, agricultural businesses, and public utility services represent key end-users. These industries require specialized heavy-duty accessories such as protective gear, robust storage solutions, and enhanced lighting systems to withstand harsh working conditions and improve job-site productivity. Individual commercial vehicle owners, including independent truckers, contractors, and artisans, also constitute a vital segment, often prioritizing customization, comfort, and specialized utility features to optimize their vehicles for specific tasks and personal preferences. The burgeoning e-commerce and last-mile delivery sectors are rapidly emerging as substantial customer segments, investing in accessories that facilitate efficient package handling, navigation, and vehicle security for urban and suburban delivery operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 32.5 Billion |

| Market Forecast in 2032 | USD 50.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Magna International Inc., Bosch GmbH, ZF Friedrichshafen AG, Denso Corporation, Cummins Inc., Aisin Seiki Co. Ltd., Mitsubishi Fuso Truck and Bus Corporation, PACCAR Inc., Meritor Inc., BorgWarner Inc., Tenneco Inc., WABCO Holdings Inc. (now ZF), Hendrickson International, JOST Werke AG, SAF-Holland SE, Bendix Commercial Vehicle Systems, Rostra Accessories, Yakima Products Inc., Thule Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Vehicle Accessories Market Key Technology Landscape

The Commercial Vehicle Accessories Market is rapidly evolving due to significant advancements in technology, driving innovation across various product categories. One of the most prominent technological shifts involves the integration of the Internet of Things (IoT) and telematics into accessories. These technologies enable real-time data collection on vehicle performance, driver behavior, and cargo conditions, which is crucial for predictive maintenance, route optimization, and enhanced fleet management. Smart sensors embedded in accessories monitor everything from tire pressure and brake wear to cabin temperature and door security, relaying critical information to fleet managers and drivers for proactive decision-making and operational efficiency.

Another pivotal technological area is the development and application of advanced materials. There is a growing trend towards lightweight yet durable materials such as high-strength steel alloys, aluminum composites, and carbon fiber reinforced plastics. These materials contribute to improved fuel efficiency by reducing overall vehicle weight, enhance structural integrity, and offer superior resistance to corrosion and wear, thereby extending the lifespan of accessories. Furthermore, advancements in manufacturing processes, including additive manufacturing (3D printing), allow for the creation of complex, customized accessory designs with greater precision and reduced lead times, catering to niche market demands and rapid prototyping of innovative solutions.

Connectivity and smart vehicle systems also represent a key technology landscape. Accessories are increasingly designed to be seamlessly integrated with vehicle's onboard diagnostics (OBD) and infotainment systems, offering features like advanced driver-assistance systems (ADAS), intelligent navigation, hands-free communication, and enhanced security features. Electrification of commercial vehicles is driving innovation in accessories such as specialized charging ports, battery thermal management solutions, and low-power consumption lighting. The shift towards autonomous driving also necessitates sophisticated sensor-compatible accessory designs and robust communication systems, positioning technology at the core of future market growth and product development.

Regional Highlights

- North America: A mature market characterized by high demand for advanced and heavy-duty accessories, driven by stringent safety regulations, significant e-commerce growth, and a large fleet of commercial vehicles. The presence of major automotive players and technological innovation centers fuels market expansion, with a strong emphasis on telematics, fleet management solutions, and driver comfort accessories.

- Europe: This region exhibits robust growth, primarily influenced by strict environmental regulations and a focus on sustainability, leading to demand for aerodynamic, fuel-efficient, and lightweight accessories. The adoption of electric commercial vehicles is also a significant trend, boosting demand for specialized charging infrastructure and vehicle-specific components. Germany, France, and the UK are key markets.

- Asia Pacific (APAC): Positioned as the fastest-growing market, propelled by rapid industrialization, burgeoning e-commerce, and expanding logistics networks, particularly in China, India, and Southeast Asian countries. Increasing commercial vehicle production and sales, coupled with rising disposable incomes and infrastructure development, drive demand for both basic and advanced accessories.

- Latin America: An emerging market with significant growth potential, driven by infrastructure projects, expanding trade activities, and increasing fleet modernization efforts. Brazil and Mexico are leading the adoption of commercial vehicle accessories, focusing on durability, utility, and cost-effectiveness.

- Middle East and Africa (MEA): This region is experiencing steady growth, supported by investments in infrastructure, growth in the oil and gas sector, and expanding logistics operations. Demand for robust, climate-resilient accessories, protective equipment, and specialized solutions for harsh environmental conditions is notable.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Vehicle Accessories Market.- Continental AG

- Magna International Inc.

- Bosch GmbH

- ZF Friedrichshafen AG

- Denso Corporation

- Cummins Inc.

- Aisin Seiki Co. Ltd.

- Mitsubishi Fuso Truck and Bus Corporation

- PACCAR Inc.

- Meritor Inc.

- BorgWarner Inc.

- Tenneco Inc.

- WABCO Holdings Inc. (now ZF)

- Hendrickson International

- JOST Werke AG

- SAF-Holland SE

- Bendix Commercial Vehicle Systems

- Rostra Accessories

- Yakima Products Inc.

- Thule Group

Frequently Asked Questions

Analyze common user questions about the Commercial Vehicle Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Commercial Vehicle Accessories Market?

The market is primarily driven by expanding e-commerce logistics, increasing commercial vehicle sales, stringent regulatory mandates for safety and emissions, and the growing demand for vehicle customization to enhance operational efficiency and driver comfort across various industries.

How is technological advancement impacting commercial vehicle accessories?

Technological advancements, including IoT, telematics, advanced materials, and AI integration, are transforming accessories by enabling real-time data collection, predictive maintenance, improved fuel efficiency, enhanced safety features, and greater connectivity within fleet management systems.

Which regional market is expected to show the highest growth in commercial vehicle accessories?

The Asia Pacific (APAC) region is projected to exhibit the highest growth due to rapid industrialization, significant e-commerce expansion, increasing commercial vehicle production, and substantial investments in logistics and infrastructure, particularly in emerging economies.

What are the key challenges faced by the Commercial Vehicle Accessories Market?

Key challenges include the high initial cost of advanced accessories, economic uncertainties impacting commercial vehicle sales, the lack of standardization across different vehicle models, and the growing complexity of electronic accessories requiring specialized installation and maintenance.

What role do electric commercial vehicles play in the accessories market?

Electric commercial vehicles are creating new opportunities for specialized accessories, including lightweight aerodynamic components to extend range, efficient charging solutions, battery thermal management systems, and smart energy monitoring devices, aligning with the global shift towards sustainable transportation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager