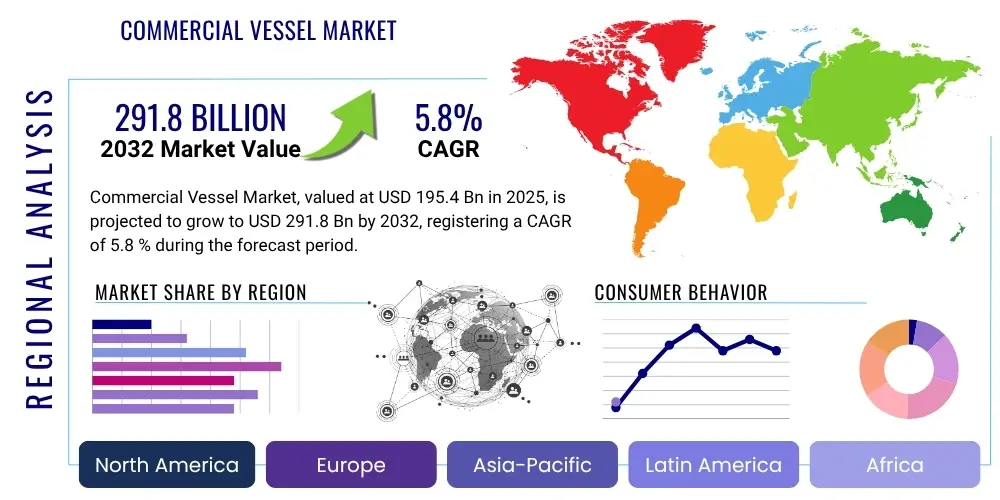

Commercial Vessel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427854 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Vessel Market Size

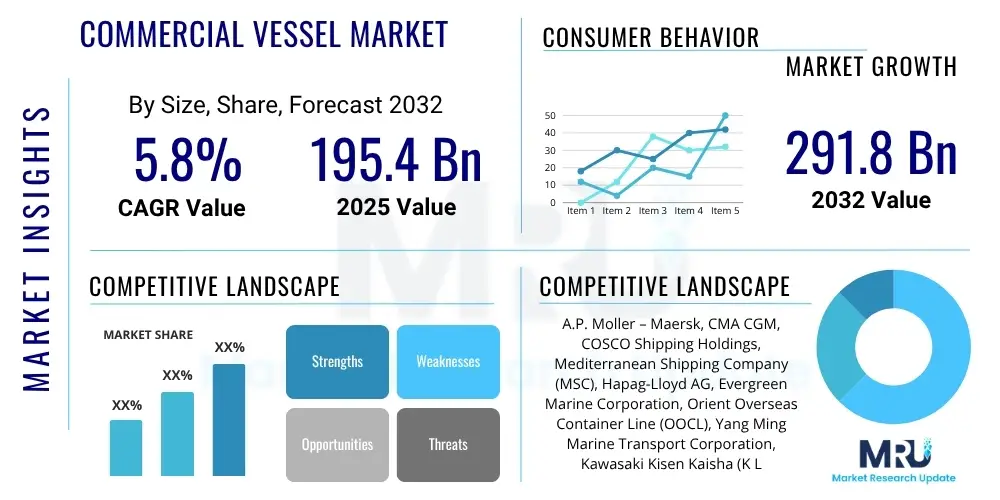

The Commercial Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 195.4 Billion in 2025 and is projected to reach USD 291.8 Billion by the end of the forecast period in 2032.

Commercial Vessel Market introduction

The commercial vessel market encompasses a diverse range of ships designed and operated for economic purposes, facilitating global trade, transportation, and various offshore activities. These vessels are the backbone of international commerce, responsible for moving vast quantities of raw materials, finished goods, and passengers across oceans and inland waterways. The market's robust nature is underpinned by the essential role these vessels play in the global supply chain, supporting industries from manufacturing and energy to tourism and fisheries.

Product descriptions within this sector span from massive container ships, crude oil tankers, and bulk carriers that form the arteries of global logistics, to sophisticated passenger cruise liners and ferries connecting communities and catering to tourism. Offshore support vessels, fishing trawlers, and specialized research ships further diversify this landscape, each meticulously engineered for specific operational demands. Major applications include intercontinental cargo transport, regional and international passenger travel, exploration and production in the oil and gas sector, sustainable fishing, and scientific research. These applications collectively drive significant economic value and connectivity worldwide.

The benefits derived from a well-functioning commercial vessel market are manifold, including reduced shipping costs, enhanced efficiency in global trade, and the provision of essential services that foster economic growth and development. Key driving factors influencing this market's expansion include the relentless forces of globalization, the surge in e-commerce necessitating efficient logistics solutions, a persistent global demand for energy and raw materials, and the burgeoning maritime tourism industry. Furthermore, ongoing technological advancements aimed at improving fuel efficiency, safety, and environmental performance are significantly shaping the market's trajectory and investment landscape.

Commercial Vessel Market Executive Summary

The commercial vessel market is currently experiencing dynamic shifts driven by a confluence of global economic trends, regulatory pressures, and technological innovations. Business trends are largely characterized by a push towards decarbonization, with increasing investments in alternative fuels and propulsion systems, alongside a rapid adoption of digitalization and automation technologies to enhance operational efficiency and safety. The maritime industry is also witnessing significant fleet modernization efforts as operators strive to meet stringent environmental standards and leverage advanced navigation and logistics systems. This modernization extends to incorporating smart shipping solutions and predictive maintenance to reduce downtime and operational costs, fundamentally reshaping business models within shipping.

Regional trends indicate a continued dominance of the Asia-Pacific (APAC) region, primarily due to its robust manufacturing capabilities, burgeoning trade routes, and significant shipbuilding capacities, particularly in countries like China, South Korea, and Japan. Europe remains a hub for innovation, especially in green shipping technologies and advanced vessel design, with strong regulatory frameworks often setting global benchmarks. North America focuses on modernizing its port infrastructure and optimizing coastal and inland waterway transport, driven by evolving trade dynamics and an emphasis on logistics efficiency. Emerging economies in Latin America, the Middle East, and Africa are increasingly contributing to market growth through infrastructure development and expanding intra-regional trade, alongside significant investments in oil and gas related offshore fleets.

Segmentation trends highlight the enduring importance of container shipping, bolstered by global supply chain demands and e-commerce expansion, despite occasional disruptions. Tankers and bulk carriers continue to be critical for the transport of essential commodities, with market dynamics heavily influenced by geopolitical factors and global resource demand. The passenger vessel segment, including cruise ships and ferries, is rebounding strongly post-pandemic, driven by renewed tourism and leisure activities, alongside continued investment in modern, environmentally friendly designs. The offshore vessel sector is adapting to the energy transition, with a growing emphasis on renewable energy support vessels, while traditional oil and gas support remains vital, albeit with fluctuating demand based on energy prices and exploration activities.

AI Impact Analysis on Commercial Vessel Market

User inquiries concerning AI's influence on the commercial vessel market frequently revolve around its potential to revolutionize operational efficiency, enhance safety protocols, and pave the way for autonomous navigation. There is considerable interest in how AI can optimize route planning, fuel consumption, and predictive maintenance, thereby reducing operational costs and environmental impact. Concerns also emerge regarding the integration challenges, cybersecurity risks associated with increasingly automated systems, and the implications for human roles and workforce retraining. Users are keen to understand AI's tangible benefits in mitigating human error, improving decision-making through real-time data analysis, and ensuring compliance with evolving maritime regulations. The overarching themes include the dual promise of unprecedented efficiency gains and the complex hurdles of implementation and regulatory adaptation.

- Enhanced predictive maintenance and fault detection for critical vessel components, minimizing unexpected breakdowns.

- Optimized route planning and navigation systems, leading to significant fuel savings and reduced transit times.

- Automation of repetitive tasks and operations, improving crew efficiency and allowing focus on higher-level decision-making.

- Improved cargo loading and unloading efficiency through intelligent planning and autonomous equipment.

- Advanced collision avoidance systems and enhanced situational awareness, elevating maritime safety standards.

- Real-time monitoring and analysis of environmental conditions, enabling more sustainable and compliant operations.

- Streamlined supply chain management and port operations through better coordination and predictive analytics.

- Development of semi-autonomous and fully autonomous vessels, fundamentally transforming maritime logistics.

- Intelligent surveillance and security systems for enhanced vessel protection against piracy and other threats.

- Data-driven insights for strategic business decisions, fleet management, and market forecasting.

DRO & Impact Forces Of Commercial Vessel Market

The commercial vessel market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. Primary drivers include the continuous expansion of global trade, catalyzed by economic growth in developing nations and the increasing volume of e-commerce transactions that demand efficient and reliable sea transport. The sustained global demand for energy resources and raw materials, such as oil, gas, minerals, and agricultural products, inherently necessitates a robust fleet of tankers and bulk carriers. Furthermore, technological advancements focused on fuel efficiency, digitalization, and automation are stimulating fleet modernization and new vessel orders, while the resurgence of maritime tourism is bolstering demand for passenger vessels, particularly cruise ships and ferries.

Conversely, the market faces significant restraints. Geopolitical tensions and trade protectionism can disrupt shipping routes, elevate insurance costs, and create unpredictable demand patterns. Stringent environmental regulations, particularly those aimed at decarbonization and reducing emissions (e.g., IMO 2020, EEXI, CII), impose substantial investment burdens on shipowners for compliance, including retrofitting existing vessels or investing in more expensive, greener newbuilds. High operational costs, encompassing fuel prices, maintenance, and insurance, alongside persistent challenges like port congestion and a global shortage of skilled maritime labor, further constrain market growth. The significant capital investment required for new vessel acquisition also presents a barrier to entry and expansion for many companies.

Opportunities within the sector are primarily driven by the imperative for decarbonization, fostering innovation in alternative fuels (e.g., LNG, ammonia, hydrogen, methanol) and electric propulsion systems, creating new market segments for green technology providers and specialized vessel types. The ongoing digitalization trend presents opportunities for enhancing operational efficiency, safety, and supply chain visibility through the adoption of IoT, big data analytics, and AI. The development of autonomous shipping technologies, while nascent, promises long-term transformative potential for operational models. Moreover, the growth of trade in emerging economies and the development of new maritime routes, such as those through the Arctic, present unique expansion opportunities. External impact forces, such as global pandemics, geopolitical conflicts, and significant shifts in climate policy, can exert sudden and profound effects on shipping volumes, freight rates, and supply chain stability, requiring rapid adaptation from market participants.

Segmentation Analysis

The commercial vessel market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation typically categorizes vessels based on their primary type, the application they serve, and the end-use industry they cater to. Such a structured analysis allows for a granular view of market trends, competitive landscapes, and investment opportunities across various niches within the broad maritime sector, reflecting specialized operational requirements and technological integration specific to each segment.

- By Type

- Tankers

- Crude Oil Tankers

- Product Tankers

- Chemical Tankers

- Liquefied Natural Gas (LNG) Carriers

- Liquefied Petroleum Gas (LPG) Carriers

- Container Ships

- Feeder Vessels

- Panamax Vessels

- Post-Panamax Vessels (Neo-Panamax, Ultra Large Container Vessels - ULCV)

- Bulk Carriers

- Capesize

- Panamax

- Handymax

- Handysize

- Passenger Ships

- Cruise Ships

- Ferries (Ro-Ro Passenger Ships)

- Yachts and Leisure Boats

- Offshore Vessels

- Offshore Support Vessels (OSVs)

- Platform Supply Vessels (PSVs)

- Anchor Handling Tug Supply (AHTS) Vessels

- Offshore Construction Vessels (OCVs)

- Dredgers

- Special Purpose Vessels

- Fishing Vessels

- Research Vessels

- Tugs and Towing Vessels

- Naval Auxiliary Vessels

- Tankers

- By Application

- Cargo Transport (including dry bulk, liquid bulk, and containerized cargo)

- Passenger Transport

- Offshore Exploration & Production Support

- Fishing and Aquaculture

- Leisure and Tourism

- Research and Survey

- By End-Use Industry

- Oil & Gas Industry

- Manufacturing & Retail (consumer goods, automotive, electronics)

- Mining & Metals Industry

- Agriculture & Food Industry

- Leisure & Tourism Industry

- Fishing Industry

- Government & Defense (non-combatant support)

Value Chain Analysis For Commercial Vessel Market

The value chain for the commercial vessel market is an intricate network of interconnected stages, beginning with the foundational activities of raw material extraction and component manufacturing, extending through the shipbuilding process, and culminating in the operation, maintenance, and eventual recycling of vessels. This comprehensive chain highlights the various stakeholders and processes that contribute to the creation and delivery of maritime transport services. Understanding this value chain is critical for identifying areas of efficiency improvement, potential bottlenecks, and opportunities for technological integration and sustainable practices.

Upstream analysis focuses on the sourcing and supply of essential raw materials such as steel, aluminum, and specialized alloys, along with a vast array of sophisticated components. This includes the production of marine engines, propulsion systems, navigation and communication electronics, safety equipment, and various internal systems. Key players at this stage are metallurgy companies, engine manufacturers, and specialized electronics and equipment suppliers, who are crucial for the quality and performance of the final vessel. Research and development in these upstream sectors drive innovation in fuel efficiency, emission reduction, and system reliability, directly impacting the capabilities and environmental footprint of commercial vessels.

The core of the value chain involves shipbuilding, where shipyards transform raw materials and components into functional vessels. This complex process includes design, engineering, construction, outfitting, and rigorous testing. Once built, vessels enter the operational phase, which constitutes the downstream segment. This involves shipping companies, logistics providers, and port operators who manage the transportation of goods and passengers, handle cargo, and ensure efficient port calls. The distribution channel for commercial vessels primarily involves direct sales from shipyards to shipping companies or other end-users, often facilitated by brokers for complex transactions. Indirect channels may involve leasing companies or financial institutions providing purchase capital. After their operational lifespan, vessels enter the recycling stage, where materials are recovered and reused, completing the circularity aspect of the value chain. This entire ecosystem relies on a robust network of direct engagements between buyers and sellers, supported by indirect services such as financing, insurance, and regulatory compliance.

Commercial Vessel Market Potential Customers

The potential customers for commercial vessels represent a broad spectrum of industries and organizations that rely on maritime transport for their core operations. These end-users are primarily driven by the necessity to move goods, transport people, or conduct specialized offshore activities efficiently, safely, and economically. Their purchasing decisions are influenced by factors such as cargo type, transport volume, operational routes, regulatory requirements, and the need for specialized vessel capabilities to support specific industrial applications. Understanding these diverse customer segments is crucial for shipbuilders, technology providers, and service companies looking to tailor their offerings and penetrate the market effectively.

The largest customer base typically includes major shipping lines and logistics companies that operate extensive global fleets of container ships, bulk carriers, and tankers to facilitate international trade. These entities are constantly seeking new, more efficient, and environmentally compliant vessels to modernize their fleets and maintain competitive advantage. Beyond cargo, cruise operators and ferry companies constitute significant buyers within the passenger vessel segment, focusing on comfort, safety, and increasingly, sustainable propulsion. The energy sector, particularly oil and gas companies, along with emerging renewable energy developers, are key customers for offshore support vessels, platform supply vessels, and specialized construction vessels required for exploration, production, and wind farm installation and maintenance. Furthermore, fishing enterprises invest in a variety of fishing vessels, while government agencies, including coast guards, navies (for auxiliary roles), and research institutions, procure specialized commercial vessels for patrol, transport, and scientific purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 195.4 Billion |

| Market Forecast in 2032 | USD 291.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.P. Moller – Maersk, CMA CGM, COSCO Shipping Holdings, Mediterranean Shipping Company (MSC), Hapag-Lloyd AG, Evergreen Marine Corporation, Orient Overseas Container Line (OOCL), Yang Ming Marine Transport Corporation, Kawasaki Kisen Kaisha (K Line), Mitsui O.S.K. Lines (MOL), Hyundai Merchant Marine (HMM), China Merchants Energy Shipping, Frontline Ltd., Euronav NV, Teekay Tankers Ltd., Royal Caribbean Group, Carnival Corporation & plc, Norwegian Cruise Line Holdings Ltd., Damen Shipyards Group, Fincantieri S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Vessel Market Key Technology Landscape

The commercial vessel market is undergoing a profound technological transformation, driven by imperatives for increased efficiency, enhanced safety, and stringent environmental compliance. This evolving landscape is characterized by the rapid integration of digital solutions and advanced engineering, aiming to optimize every facet of maritime operations. From vessel design and construction to navigation and cargo management, technology is reshaping the capabilities and sustainability of global shipping fleets. Innovation is paramount for stakeholders seeking competitive advantages and adherence to a rapidly changing regulatory environment, particularly concerning emissions and operational security.

Among the most influential technologies, artificial intelligence (AI) and the Internet of Things (IoT) are at the forefront, enabling predictive maintenance, route optimization, and real-time performance monitoring. Big data analytics plays a crucial role in processing vast amounts of operational data to provide actionable insights for fuel efficiency and operational decision-making. The advent of autonomous systems, ranging from remote-controlled vessels to fully self-navigating ships, represents a paradigm shift, promising reduced human error and enhanced operational flexibility. These advancements are supported by sophisticated sensor technologies and advanced communication systems that ensure reliable data exchange and control.

Furthermore, the drive for decarbonization has significantly accelerated the development and adoption of alternative propulsion systems and fuels. This includes the increasing use of Liquefied Natural Gas (LNG) as a transitional fuel, alongside burgeoning research and pilot projects for zero-emission fuels such as ammonia, hydrogen, and methanol, coupled with electric and hybrid propulsion solutions. Digitalization extends to smart port technologies, improving vessel turnaround times and overall supply chain efficiency. Advanced navigation and communication technologies, including satellite systems and enhanced cyber-physical security measures, are also critical components, ensuring safer and more secure maritime operations in an increasingly connected world. The confluence of these technologies is not only improving current operations but also laying the groundwork for the next generation of intelligent and sustainable commercial vessels.

Regional Highlights

- North America: This region exhibits a strong focus on inland waterway transport, coastal shipping, and offshore energy support vessels. The market is driven by robust trade with Asia and Europe, significant oil and gas exploration activities in the Gulf of Mexico, and increasing investments in port infrastructure modernization. Technological adoption in navigation systems and environmental compliance is a key trend, alongside a rising demand for specialized vessels supporting offshore wind projects.

- Europe: A hub for maritime innovation, Europe leads in the development and adoption of green shipping technologies, including alternative fuels and electric propulsion systems. Stringent environmental regulations and a strong emphasis on decarbonization are primary market drivers. The region also boasts a significant market for specialized vessels like cruise ships, ferries, and offshore support vessels for both traditional and renewable energy sectors, with leading shipbuilders and technology providers.

- Asia Pacific (APAC): Dominating the global commercial vessel market, APAC is characterized by massive shipbuilding capacities, particularly in China, South Korea, and Japan. The region benefits from booming international trade, especially with raw materials and manufactured goods, and a rapidly expanding e-commerce sector. High demand for container ships, bulk carriers, and tankers fuels market growth, complemented by significant investments in port infrastructure and a growing domestic maritime tourism industry.

- Latin America: This region's market is primarily influenced by commodity exports (e.g., agricultural products, minerals, oil) and increasing intra-regional trade. Investments in port expansion and modernization are underway to accommodate larger vessels and improve logistics efficiency. Demand for bulk carriers and tankers remains strong, alongside a developing market for offshore support vessels, particularly in countries with significant oil and gas reserves.

- Middle East and Africa (MEA): The MEA region's commercial vessel market is heavily influenced by its pivotal role in global oil and gas supply chains, driving demand for tankers and offshore support vessels. Strategic geographical location makes it a crucial transit hub, necessitating robust port infrastructure. Investments in economic diversification and trade route development are also stimulating demand for various vessel types, coupled with emerging opportunities in maritime tourism and renewable energy projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Vessel Market.- A.P. Moller – Maersk

- CMA CGM

- COSCO Shipping Holdings

- Mediterranean Shipping Company (MSC)

- Hapag-Lloyd AG

- Evergreen Marine Corporation

- Orient Overseas Container Line (OOCL)

- Yang Ming Marine Transport Corporation

- Kawasaki Kisen Kaisha (K Line)

- Mitsui O.S.K. Lines (MOL)

- Hyundai Merchant Marine (HMM)

- China Merchants Energy Shipping

- Frontline Ltd.

- Euronav NV

- Teekay Tankers Ltd.

- Royal Caribbean Group

- Carnival Corporation & plc

- Norwegian Cruise Line Holdings Ltd.

- Damen Shipyards Group

- Fincantieri S.p.A.

Frequently Asked Questions

Analyze common user questions about the Commercial Vessel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Commercial Vessel Market?

The primary drivers include expanding global trade volumes, accelerated by e-commerce, sustained demand for energy and raw materials, continuous technological advancements enhancing efficiency, and the resurgence of maritime tourism.

How do environmental regulations impact the commercial vessel industry?

Environmental regulations significantly impact the industry by mandating investments in greener fuels, propulsion systems, and emissions reduction technologies, leading to fleet modernization and increased operational costs for compliance.

What role does Artificial Intelligence play in modern commercial vessels?

AI is increasingly crucial for optimizing route planning, enabling predictive maintenance, enhancing autonomous navigation capabilities, improving cargo management, and boosting overall operational efficiency and safety across the fleet.

Which regions are leading in the Commercial Vessel Market?

Asia Pacific (APAC) leads in terms of shipbuilding capacity and trade volume. Europe is a frontrunner in green shipping technologies and specialized vessel design, while North America focuses on logistics efficiency and offshore energy support.

What are the major challenges faced by the Commercial Vessel Market?

Key challenges include geopolitical instability, fluctuating fuel prices, stringent environmental regulations requiring substantial investment, persistent port congestion, and a growing shortage of skilled maritime personnel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager