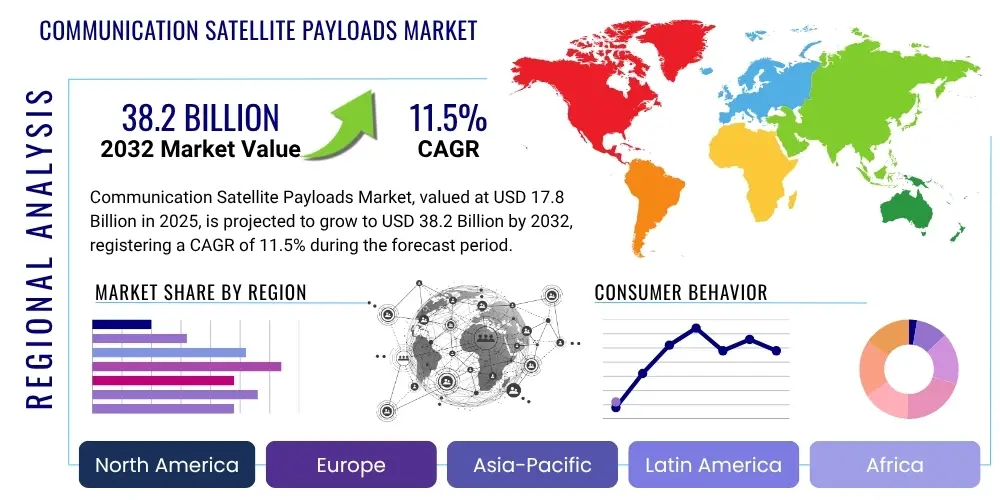

Communication Satellite Payloads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428913 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Communication Satellite Payloads Market Size

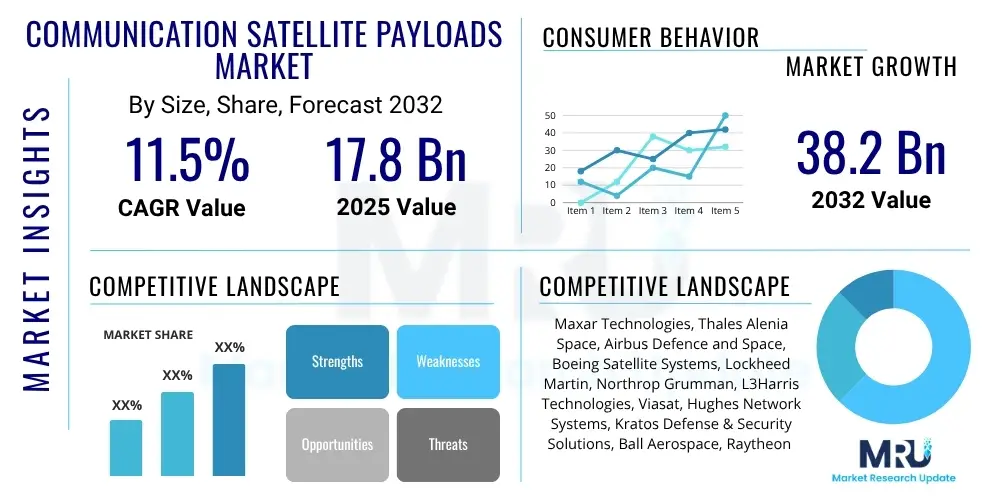

The Communication Satellite Payloads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 17.8 Billion in 2025 and is projected to reach USD 38.2 Billion by the end of the forecast period in 2032.

Communication Satellite Payloads Market introduction

The communication satellite payloads market encompasses the critical hardware and software systems integral to satellites that facilitate telecommunication services. These payloads are sophisticated assemblies, including transponders, antennas, processors, and associated electronics, designed to transmit and receive various forms of data, voice, and video signals across vast distances. Their primary function is to serve as a relay for communications, enabling global connectivity and supporting a multitude of applications for both commercial and governmental entities.

Major applications span diverse sectors such as direct-to-home broadcasting, mobile satellite services, broadband internet access, enterprise networking, and secure governmental or military communications. The significant benefits derived from these payloads include their ability to provide ubiquitous coverage, reliability in remote or underserved areas, and high bandwidth capabilities, which are crucial for modern digital economies. The market is currently experiencing robust growth, primarily driven by the escalating global demand for high-speed connectivity, the proliferation of 5G networks, and the expansion of the Internet of Things (IoT) ecosystem.

Further propelling this growth is the increasing deployment of mega-constellations in Low Earth Orbit (LEO) and Medium Earth Orbit (MEO), which promise lower latency and enhanced network resilience compared to traditional Geostationary Earth Orbit (GEO) satellites. Technological advancements in payload miniaturization, reconfigurability, and on-board processing are also significant drivers, leading to more efficient, adaptable, and cost-effective satellite communication solutions. These innovations are reshaping the competitive landscape and expanding the accessibility of satellite-based communication services worldwide.

Communication Satellite Payloads Market Executive Summary

The communication satellite payloads market is undergoing transformative shifts, marked by several key business, regional, and segment trends. Technologically, there is a pronounced move towards software-defined payloads and reconfigurable satellite architectures, allowing for greater flexibility and adaptability in orbit. Commercialization of space is a dominant business trend, with private sector investment driving innovation in design, manufacturing, and launch services, significantly lowering barriers to entry and fostering competition. Furthermore, the push for miniaturization and cost-effectiveness is leading to the development of smaller, more powerful payloads suitable for large LEO constellations, fundamentally altering traditional satellite design and operational paradigms.

Regionally, North America continues to lead in research and development, driven by substantial government and private investment in advanced satellite technologies, particularly for defense and commercial broadband. Europe is also a significant player, supported by strong national space agencies and collaborative European Space Agency (ESA) programs focused on innovative payload development and environmental monitoring. The Asia Pacific region is emerging as a critical growth engine, characterized by rapidly expanding economies, increasing demand for communication services, and ambitious national space programs in countries like China, India, and Japan, which are investing heavily in domestic satellite capabilities. The Middle East, Africa, and Latin America are focused on leveraging satellite technology to bridge digital divides and enhance connectivity in remote areas, driving demand for cost-effective and robust communication payload solutions.

In terms of segments, High Throughput Satellites (HTS) payloads are experiencing unprecedented demand due to their superior bandwidth capabilities, catering to the burgeoning needs for internet connectivity and data services. The C-band, Ku-band, and Ka-band remain vital frequency segments, with Ka-band seeing particular growth for broadband applications. There is also increasing interest in higher frequency bands like Q-band and V-band for future high-capacity systems. The shift from traditional fixed-service satellites to mobile satellite services and the increasing integration of satellite communication into terrestrial 5G networks are reshaping application-specific payload requirements, emphasizing flexibility, spectral efficiency, and enhanced processing power to support diverse end-user demands across various market verticals.

AI Impact Analysis on Communication Satellite Payloads Market

User inquiries concerning AI's influence on communication satellite payloads frequently revolve around how artificial intelligence can enhance operational efficiency, enable advanced capabilities, and address complex challenges in space. Common questions explore AI's role in optimizing resource allocation, improving data processing and analytics on board, facilitating autonomous operations, and ensuring the security and resilience of satellite networks. Users are keen to understand the practical applications of AI, from predictive maintenance to intelligent signal processing and adaptive beamforming, and how these innovations translate into tangible benefits like reduced latency, increased throughput, and more dynamic service delivery. There is also significant interest in the potential of AI to automate complex decision-making processes, thereby minimizing human intervention and enabling more robust and responsive satellite systems. The overarching theme is an expectation that AI will be a cornerstone for the next generation of highly autonomous, flexible, and efficient communication satellites, despite concerns regarding computational power requirements and the reliability of AI algorithms in mission-critical space environments.

- Enhanced On-board Processing: AI algorithms enable real-time data analysis, compression, and intelligent routing, significantly reducing reliance on ground stations and improving latency.

- Dynamic Resource Allocation: AI-driven systems can optimize transponder usage, power consumption, and frequency allocation based on real-time demand and environmental conditions, maximizing payload efficiency.

- Predictive Maintenance and Anomaly Detection: Machine learning models analyze telemetry data to anticipate hardware failures, detect anomalies, and suggest preventive measures, increasing satellite lifespan and reliability.

- Autonomous Operations: AI facilitates autonomous navigation, station-keeping, and orbital maneuvers, reducing operational costs and risks associated with human error.

- Adaptive Beamforming and Interference Mitigation: AI allows antennas to dynamically adjust beam patterns, optimize signal strength, and mitigate interference, enhancing communication quality and spectral efficiency.

- Cybersecurity and Resilience: AI algorithms can detect and respond to cyber threats in real time, enhancing the security of satellite communication links and onboard systems.

- Software-Defined Satellite (SDS) Capabilities: AI is crucial for the intelligence layer of SDS, enabling rapid reconfigurability and adaptability of payload functions in response to evolving mission requirements.

DRO & Impact Forces Of Communication Satellite Payloads Market

The communication satellite payloads market is profoundly shaped by a confluence of driving factors, persistent restraints, and significant opportunities, all underpinned by powerful impact forces. A primary driver is the insatiable global demand for connectivity, fueled by the rapid expansion of 5G networks, the pervasive growth of the Internet of Things (IoT), and the increasing need for broadband access in remote and underserved areas worldwide. Defense and government applications also continue to drive demand for secure and resilient satellite communication, alongside the burgeoning small satellite market that necessitates compact and high-performance payloads. These factors collectively push for innovation and investment in advanced payload technologies, accelerating market expansion and technological evolution.

However, the market faces several formidable restraints. High launch costs, despite recent reductions, remain a significant barrier, influencing the economic viability of satellite missions and payload deployment. Stringent regulatory hurdles and spectrum allocation complexities pose challenges for satellite operators and payload developers, requiring extensive compliance and coordination. Concerns about space debris, particularly with the proliferation of mega-constellations, necessitate careful operational planning and impact design choices. Furthermore, geopolitical tensions can disrupt supply chains and limit market access, while the long development cycles inherent in aerospace projects can delay the introduction of new technologies. These restraints collectively contribute to a complex operating environment that demands strategic planning and robust risk mitigation.

Amidst these challenges, substantial opportunities are emerging that promise to reshape the market landscape. The continued development and deployment of mega-constellations in LEO and MEO orbits offer immense potential for providing global, low-latency internet services, driving demand for innovative, mass-producible payloads. The advent of reconfigurable payloads and software-defined satellites presents an opportunity for unparalleled flexibility and adaptability, allowing in-orbit modifications to address evolving market needs. Advanced technologies such as quantum communication and optical communication (lasercom) hold the promise of ultra-secure and high-capacity links, opening new frontiers for satellite applications. The deepening integration of AI and machine learning into payload design and operation further enhances efficiency, autonomy, and capability, positioning the market for sustained growth and technological advancement in the coming decades.

Segmentation Analysis

The Communication Satellite Payloads Market is meticulously segmented across various critical dimensions, including orbit type, frequency band, application, payload type, and end-user. This comprehensive segmentation provides a granular view of the market's dynamics, allowing for a detailed understanding of demand patterns, technological preferences, and growth trajectories within specific niches. Each segment is influenced by distinct technological advancements, regulatory frameworks, and market needs, contributing uniquely to the overall market landscape. Understanding these segments is crucial for stakeholders to identify key growth areas and formulate effective market strategies, addressing the diverse requirements of modern satellite communication systems.

- By Orbit:

- Geostationary Earth Orbit (GEO)

- Medium Earth Orbit (MEO)

- Low Earth Orbit (LEO)

- By Frequency:

- C-band

- Ku-band

- Ka-band

- X-band

- S-band

- V-band

- Q-band

- Other Bands (e.g., L-band, UHF)

- By Application:

- Telecommunication

- Broadcasting

- Internet & Broadband Services

- Enterprise Communication

- Mobile Satellite Services (MSS)

- Government & Defense Communication

- Navigation Augmentation

- Scientific Research

- By Type:

- Transponders

- Antennas (Reflector, Phased Array)

- Processors & Digital Signal Processing Units

- Receivers & Transmitters

- Power Amplifiers

- Telemetry, Tracking, and Command (TT&C) Systems

- Inter-Satellite Links (ISL) Systems

- By End-User:

- Commercial Operators

- Government & Military Organizations

- Research & Academic Institutions

- Broadcasting Companies

- Telecommunication Service Providers

Value Chain Analysis For Communication Satellite Payloads Market

The value chain for the Communication Satellite Payloads Market is a complex ecosystem involving multiple stages, from foundational research and component manufacturing to satellite integration, launch, and subsequent service delivery. The upstream segment primarily involves suppliers of raw materials such as specialized alloys, composite materials, and high-performance ceramics, along with manufacturers of critical electronic components like semiconductors, integrated circuits, and advanced optical elements. These suppliers provide the foundational building blocks that enable the intricate functionalities of payloads. Research and development institutions also play a crucial upstream role, pushing the boundaries of miniaturization, power efficiency, and signal processing capabilities, which are essential for next-generation payloads.

Moving downstream, the midstream segment is dominated by payload manufacturers and satellite integrators. Payload manufacturers specialize in the design, assembly, and rigorous testing of transponders, antennas, processors, and other complex systems, ensuring they meet stringent performance and reliability standards for space environments. These payloads are then integrated by satellite manufacturers into the overall satellite bus structure. This phase involves intricate engineering to ensure compatibility, power management, thermal control, and structural integrity. Distribution channels in this phase are predominantly direct, with payload manufacturers supplying directly to satellite prime contractors or government space agencies through competitive bidding processes and long-term contracts, often involving highly customized solutions.

The furthest downstream involves satellite operators and end-user service providers. Satellite operators, both commercial and governmental, purchase and launch satellites equipped with these payloads, managing their orbital operations and ground infrastructure. They then lease transponder capacity or provide direct communication services to a wide array of end-users. These include telecommunication companies for voice and data, broadcasting corporations for television and radio, internet service providers for broadband connectivity, and defense organizations for secure communications. The distribution in this segment involves direct service agreements, wholesale capacity leasing, and partnerships, forming a critical link that translates technological capabilities into tangible communication services for global consumption.

Communication Satellite Payloads Market Potential Customers

Potential customers for communication satellite payloads encompass a diverse array of organizations with critical needs for robust, reliable, and high-capacity space-based communication solutions. These primary end-users or buyers include large commercial satellite operators who acquire payloads for their extensive fleets, ranging from geostationary to LEO constellations, to offer services such as direct-to-home television, broadband internet, and mobile satellite communication. Telecommunication companies and internet service providers represent another significant customer base, relying on satellite payloads to expand their network reach, especially in rural and underserved areas, and to provide backhaul for terrestrial networks, supporting the global demand for seamless connectivity.

Government and military organizations are critical customers, requiring advanced payloads for secure communications, intelligence, surveillance, and reconnaissance (ISR), navigation augmentation, and battlefield communication. Their demand often focuses on highly resilient, encrypted, and specialized frequency band capabilities. Broadcasting corporations also procure payloads to ensure global distribution of their content, reaching audiences across continents with television and radio signals. Furthermore, scientific and research institutions frequently utilize specialized payloads for earth observation, climate monitoring, and deep space communication, contributing to various scientific endeavors and data collection. These diverse needs drive continuous innovation and customization within the communication satellite payloads market, catering to specific performance, security, and operational requirements across a broad spectrum of applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 17.8 Billion |

| Market Forecast in 2032 | USD 38.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maxar Technologies, Thales Alenia Space, Airbus Defence and Space, Boeing Satellite Systems, Lockheed Martin, Northrop Grumman, L3Harris Technologies, Viasat, Hughes Network Systems, Kratos Defense & Security Solutions, Ball Aerospace, Raytheon Technologies, BAE Systems, Teledyne Technologies, Comtech Telecommunications, Cobham Advanced Electronic Solutions, General Dynamics Mission Systems, Honeywell Aerospace, SAAB AB, Mynaric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Communication Satellite Payloads Market Key Technology Landscape

The communication satellite payloads market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of higher data rates, greater flexibility, and enhanced efficiency. One of the most significant advancements is the proliferation of High Throughput Satellites (HTS) and their associated payloads, which utilize advanced spot-beam technology and frequency reuse techniques to deliver significantly more bandwidth per satellite than traditional designs. Complementing this is the development of Software-Defined Radios (SDR) and Software-Defined Satellites (SDS), allowing for in-orbit reconfigurability of payload functionalities, enabling operators to adapt to changing mission requirements or market demands dynamically. This paradigm shift from fixed-function hardware to flexible, software-driven systems is revolutionizing satellite operations.

On-board processing capabilities have also seen substantial improvements, with payloads incorporating advanced digital signal processors that can perform complex routing, switching, and data manipulation directly on the satellite. This reduces the reliance on ground stations, minimizes latency, and allows for more efficient use of bandwidth. Furthermore, the integration of Phased Array Antennas, which can electronically steer beams and generate multiple simultaneous beams without mechanical movement, significantly enhances flexibility and coverage. Emerging technologies such as Optical Communication (Lasercom) payloads are gaining traction for inter-satellite links and ground-to-satellite high-bandwidth data transfer, promising significantly higher data rates and enhanced security compared to traditional radio frequency links.

Miniaturization and modular design principles are key to the growth of mega-constellations, allowing for smaller, lighter, and more cost-effective payloads without compromising performance. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is enabling autonomous operations, intelligent resource management, predictive maintenance, and enhanced interference mitigation capabilities within payloads. Moreover, advancements in quantum cryptography and secure communication protocols are being explored for future payloads, addressing the growing need for ultra-secure satellite communication channels, particularly for government and defense applications. These technological innovations collectively define the cutting edge of communication satellite payloads, pushing the boundaries of what is possible in space-based communication.

Regional Highlights

- North America: This region is a dominant force in the communication satellite payloads market, driven by robust investments in defense, commercial broadband, and next-generation space technologies. The presence of major aerospace and defense contractors, along with a thriving private space industry, fosters continuous innovation. Government initiatives from agencies like NASA and the Department of Defense significantly fuel research and development in advanced payload capabilities, particularly in areas like secure communications, high-throughput systems, and autonomous operations.

- Europe: Europe represents a significant market, characterized by strong governmental support for space programs through organizations like the European Space Agency (ESA) and national space agencies. Countries like France, Germany, and the UK are at the forefront of payload manufacturing and R&D, focusing on sophisticated telecommunication payloads, earth observation instruments, and inter-satellite communication technologies. There is a strong emphasis on international collaboration and developing resilient, sovereign space capabilities.

- Asia Pacific (APAC): The APAC region is experiencing rapid growth due to increasing demand for broadband connectivity, expanding telecommunication infrastructure, and ambitious national space programs in countries such as China, India, and Japan. These nations are heavily investing in indigenous satellite development and launch capabilities, driving demand for both commercial and government payloads. The region's large population and growing digital economy present immense opportunities for satellite communication services.

- Latin America: This region is a developing market with significant potential, primarily driven by the need to bridge the digital divide and provide connectivity to remote and underserved areas. Governments and commercial operators are increasingly leveraging satellite communication to expand internet access, improve broadcasting services, and support agricultural and resource management activities. The demand focuses on cost-effective and robust payloads suitable for enhancing regional connectivity.

- Middle East and Africa (MEA): The MEA region is witnessing substantial growth in the communication satellite payloads market, propelled by efforts to develop digital infrastructure, enhance broadcasting capabilities, and provide essential communication services across vast and often challenging terrains. Countries in the Gulf Cooperation Council (GCC) are investing heavily in advanced satellite technologies, while the broader African continent is relying on satellite solutions to provide internet and mobile connectivity to its rapidly growing population.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Communication Satellite Payloads Market.- Maxar Technologies

- Thales Alenia Space

- Airbus Defence and Space

- Boeing Satellite Systems

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- Viasat

- Hughes Network Systems

- Kratos Defense & Security Solutions

- Ball Aerospace

- Raytheon Technologies

- BAE Systems

- Teledyne Technologies

- Comtech Telecommunications

- Cobham Advanced Electronic Solutions

- General Dynamics Mission Systems

- Honeywell Aerospace

- SAAB AB

- Mynaric

Frequently Asked Questions

What defines a communication satellite payload and its primary function?

A communication satellite payload refers to the core set of equipment on a satellite, including transponders, antennas, and processors, specifically designed to transmit and receive communication signals. Its primary function is to act as a relay station in space, facilitating global telecommunication services such as broadcasting, internet access, and mobile communications by receiving signals from Earth, amplifying them, and retransmitting them to designated areas.

How do LEO satellites impact the communication satellite payloads market?

LEO satellites significantly impact the market by enabling mega-constellations that offer lower latency and higher bandwidth compared to traditional GEO satellites. This drives demand for smaller, more cost-effective, and mass-producible payloads that are optimized for high-volume manufacturing and frequent launches, supporting new services like global broadband internet from space.

What are the key technological advancements transforming communication satellite payloads?

Key technological advancements include High Throughput Satellites (HTS), Software-Defined Radios (SDR) and Software-Defined Satellites (SDS) for in-orbit reconfigurability, advanced on-board processing, phased array antennas for dynamic beam steering, and the integration of AI/ML for autonomous operations and enhanced efficiency. Optical communication (Lasercom) is also emerging for high-capacity inter-satellite links.

What role does AI play in modern communication satellite payloads?

AI plays a crucial role by enabling dynamic resource allocation, real-time data processing, predictive maintenance, autonomous navigation, and adaptive beamforming. This integration enhances operational efficiency, improves signal quality, extends satellite lifespan, and allows for more flexible and responsive communication services, reducing reliance on extensive ground control.

Who are the primary end-users of communication satellite payloads?

Primary end-users include commercial satellite operators providing global telecommunication services, government and military organizations requiring secure and resilient communication for defense and intelligence, broadcasting corporations for content distribution, internet service providers extending broadband access, and research institutions for scientific data collection and exploration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager