Companion Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429761 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Companion Diagnostics Market Size

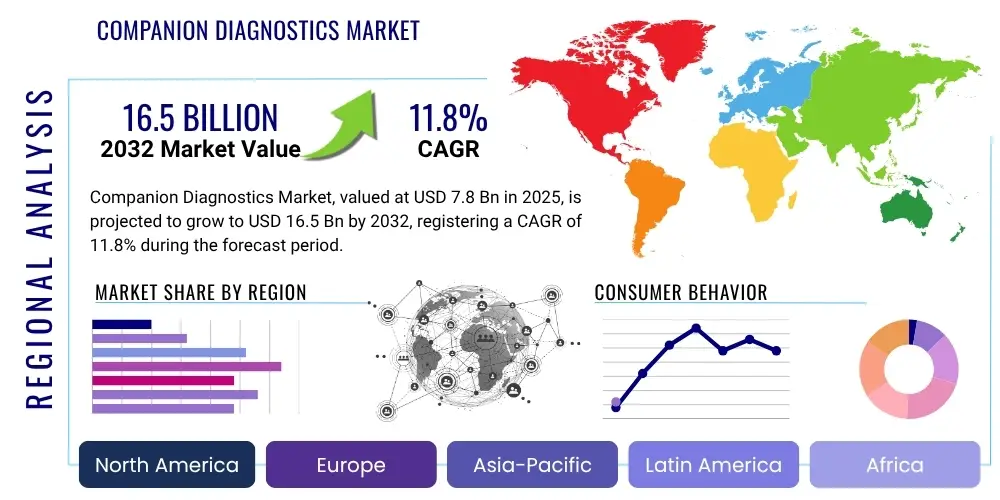

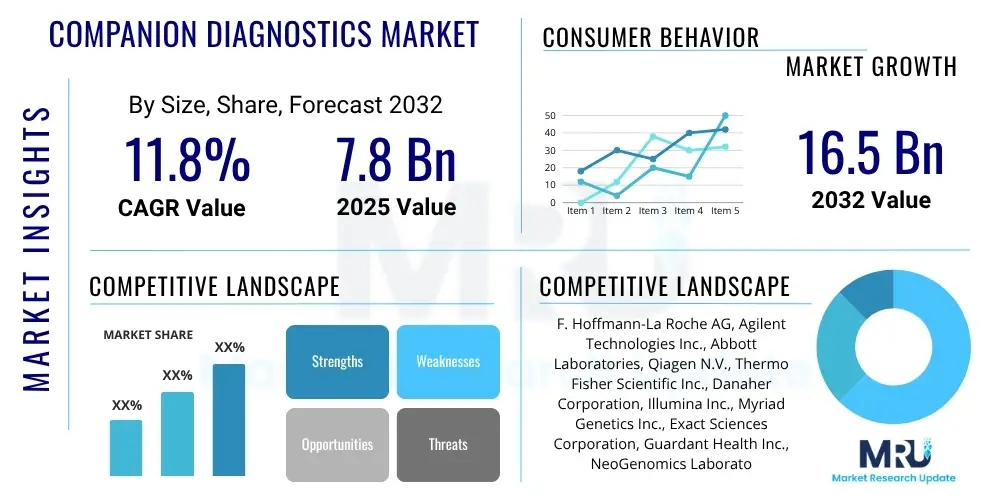

The Companion Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2025 and 2032. The market is estimated at $7.8 billion in 2025 and is projected to reach $16.5 billion by the end of the forecast period in 2032.

Companion Diagnostics Market introduction

The Companion Diagnostics market is a pivotal segment within the broader personalized medicine landscape, driving advancements in patient care by linking specific diagnostic tests to particular therapeutic agents. These diagnostic tools are essential for identifying patients who are most likely to respond positively to a targeted therapy, as well as those who may be at a higher risk of adverse reactions. This integration ensures that treatments are tailored to an individual's unique molecular and genetic profile, moving away from a one size fits all approach to medicine. The primary objective is to enhance therapeutic efficacy and patient safety, especially in complex disease areas such as oncology, autoimmune diseases, and infectious diseases.

Companion Diagnostics products typically involve assays that detect biomarkers, which can be genetic mutations, protein expressions, or other molecular alterations, indicative of disease presence or progression and responsiveness to certain drugs. For instance, in oncology, companion diagnostics are crucial for identifying specific gene mutations like EGFR, HER2, or BRAF, which then guide the selection of targeted cancer therapies. Major applications extend across various therapeutic areas, with oncology currently dominating due to the high incidence of cancer and the increasing development of targeted cancer drugs. Beyond cancer, applications are expanding into neurological disorders, cardiovascular diseases, and inflammatory conditions, reflecting the growing understanding of disease heterogeneity.

The benefits of companion diagnostics are manifold. For patients, they lead to more effective treatments, reduced side effects, and improved health outcomes. For healthcare providers, they enable informed decision making, optimized resource allocation, and a pathway to precision medicine. For pharmaceutical companies, companion diagnostics facilitate drug development by identifying patient populations more likely to benefit, accelerating clinical trials, and enhancing drug commercialization. Key driving factors include the rising global incidence of chronic and complex diseases, significant advancements in genomics and proteomics, increasing investment in personalized medicine research and development, and a growing emphasis on regulatory approvals that often mandate companion diagnostics for novel targeted therapies. The synergistic relationship between drug development and diagnostic innovation continues to propel this market forward.

Companion Diagnostics Market Executive Summary

The Companion Diagnostics market is experiencing robust growth, primarily fueled by the accelerating shift towards personalized medicine and the increasing development of targeted therapies across various disease indications. Business trends indicate a strong emphasis on strategic collaborations between pharmaceutical companies and diagnostic developers, essential for co-developing drugs and their corresponding diagnostic tests. There is also a notable trend towards consolidation and acquisition activities as larger players seek to expand their diagnostic portfolios and technological capabilities. Furthermore, an increasing focus on real world evidence and integrated data platforms is enhancing the utility and adoption of companion diagnostics, driving demand for more sophisticated and comprehensive testing solutions. The market is also seeing a rise in demand for multiplex assays capable of detecting multiple biomarkers simultaneously, thereby offering more holistic insights into a patient's disease profile.

Regional trends highlight North America as the dominant market, attributed to its advanced healthcare infrastructure, high adoption rates of personalized medicine, significant R&D investments, and favorable regulatory landscape for companion diagnostics. Europe follows, driven by similar factors, alongside growing healthcare expenditures and increasing awareness among clinicians and patients. The Asia Pacific region is emerging as the fastest growing market, propelled by its large patient population, improving healthcare access, rising incidence of chronic diseases, and increasing government initiatives supporting precision medicine. Latin America and the Middle East and Africa also present significant growth opportunities, albeit from a smaller base, as healthcare systems in these regions continue to evolve and adopt advanced diagnostic technologies.

In terms of segment trends, oncology remains the largest application area, consistently driving a substantial portion of market revenue due to the high number of targeted cancer therapies and the critical need for patient stratification. However, other therapeutic areas such as neurology, infectious diseases, and cardiovascular diseases are demonstrating increasing traction, indicating a diversification of companion diagnostics applications. Technology wise, next generation sequencing NGS is experiencing rapid adoption owing to its ability to detect multiple genetic alterations efficiently, positioning it as a key growth segment. Polymerase Chain Reaction PCR based tests continue to hold a significant market share due to their established reliability and cost effectiveness. The end user segment is largely dominated by diagnostic laboratories, followed by hospitals and research institutes, reflecting where these advanced tests are primarily conducted and utilized in clinical practice and drug development.

AI Impact Analysis on Companion Diagnostics Market

Users frequently inquire about the transformative potential of Artificial Intelligence in revolutionizing companion diagnostics, particularly concerning its ability to enhance diagnostic accuracy, accelerate biomarker discovery, and streamline clinical workflows. There is significant interest in how AI can overcome current challenges such as the complexity of multi omic data analysis, the time consuming nature of traditional biomarker identification, and the need for more efficient patient stratification. Users also express expectations regarding AI's role in improving the predictive power of companion diagnostics, enabling more precise treatment recommendations, and fostering the development of novel, highly specific diagnostic tests. Concerns often revolve around data privacy, regulatory complexities for AI driven diagnostics, the interpretability of AI models, and the integration of AI solutions into existing healthcare IT infrastructures, balancing innovation with practicality and ethical considerations.

- AI accelerates biomarker discovery by analyzing vast genomic, proteomic, and clinical datasets.

- Improves diagnostic accuracy and efficiency by identifying subtle patterns often missed by human analysis.

- Facilitates personalized treatment selection by predicting patient response to specific therapies.

- Optimizes clinical trial design through advanced patient stratification and recruitment.

- Enhances data interpretation from complex assays like Next Generation Sequencing NGS.

- Streamlines regulatory processes by aiding in the validation and verification of diagnostic algorithms.

- Enables the development of novel multiplex and multimodal diagnostic platforms.

- Reduces costs associated with trial and error prescribing by ensuring targeted therapy delivery.

- Addresses data integration challenges by synthesizing information from disparate sources for comprehensive patient profiles.

- Supports real world evidence generation and post market surveillance of companion diagnostics.

DRO & Impact Forces Of Companion Diagnostics Market

The Companion Diagnostics market is propelled by a confluence of robust drivers, notably the escalating prevalence of chronic and complex diseases, especially various forms of cancer, which necessitate precise treatment strategies. The continuous advancements in genomic research and the burgeoning field of personalized medicine are creating an imperative for companion diagnostics to identify specific patient subsets. Furthermore, increased pharmaceutical R&D spending focused on targeted therapies, often requiring co-development with a diagnostic test, significantly fuels market expansion. Regulatory bodies are increasingly mandating companion diagnostics for the approval of new targeted drugs, thereby embedding them firmly within the drug development lifecycle. The growing awareness and adoption of personalized healthcare approaches among healthcare professionals and patients alike also contribute to the market's upward trajectory.

Conversely, the market faces several significant restraints that could impede its growth. High development and commercialization costs associated with companion diagnostics, coupled with complex and lengthy regulatory approval processes, particularly for novel technologies, pose substantial barriers. Reimbursement challenges and varying policies across different healthcare systems can also limit market access and adoption. The lack of standardized protocols for biomarker validation and the scarcity of skilled professionals capable of interpreting complex genetic data further constrain market expansion. Additionally, ethical concerns surrounding genetic data privacy and the potential for diagnostic test failures or misinterpretations present ongoing challenges that require meticulous attention and robust solutions.

Despite these restraints, ample opportunities exist for market players to capitalize on. The untapped potential in emerging economies, characterized by improving healthcare infrastructures and increasing disposable incomes, represents a significant growth avenue. The integration of advanced technologies such as Artificial Intelligence and machine learning into diagnostic development promises enhanced accuracy and efficiency. The expansion of companion diagnostics beyond oncology into other therapeutic areas, including neurology, infectious diseases, and autoimmune disorders, offers diversification opportunities. Furthermore, the increasing demand for multiplex assays that can simultaneously detect multiple biomarkers, providing a more comprehensive diagnostic profile, presents a lucrative area for innovation and market penetration. The evolving landscape of precision medicine continues to create novel niches for companion diagnostic innovation.

Segmentation Analysis

The Companion Diagnostics market is broadly segmented based on several critical factors including product and service type, technology employed, therapeutic area of application, and end user. This segmentation provides a granular understanding of market dynamics, revealing specific growth drivers and competitive landscapes within each category. The diversity in diagnostic approaches and their application across a wide array of diseases underscores the complexity and specialization within this sector. Each segment reflects unique technological demands, regulatory considerations, and market adoption patterns, contributing to the overall strategic planning for market participants.

Understanding these segments is crucial for stakeholders to identify key areas of investment, target specific customer bases, and develop tailored product offerings. For instance, the dominance of oncology within therapeutic areas highlights the significant need for highly specific and sensitive tests in cancer treatment. Similarly, the rapid growth of Next Generation Sequencing NGS technology points towards a shift in technological preference due to its high throughput and comprehensive genomic profiling capabilities. These distinct segments illustrate the market's multifaceted nature and its continuous evolution driven by scientific breakthroughs and clinical needs.

- By Product & Services

- Assays Kits & Reagents

- Services

- By Technology

- Immunohistochemistry IHC

- In Situ Hybridization ISH

- Polymerase Chain Reaction PCR

- Next-Generation Sequencing NGS

- Other Technologies Microarray, Flow Cytometry, etc.

- By Therapeutic Area

- Oncology

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Melanoma

- Leukemia

- Other Cancers

- Neurology

- Cardiovascular Disease

- Infectious Disease

- Inflammation & Autoimmune Disease

- Other Therapeutic Areas

- Oncology

- By End User

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic Laboratories

- Hospitals & Clinics

- Research & Academic Institutes

Value Chain Analysis For Companion Diagnostics Market

The value chain for the Companion Diagnostics market is intricate, involving a collaborative ecosystem stretching from upstream research and development to downstream patient care. Upstream activities primarily focus on basic scientific research, biomarker discovery, and the development of novel diagnostic technologies. This stage is heavily reliant on academic institutions, biotechnology startups, and research intensive pharmaceutical companies that invest in identifying genetic and molecular targets associated with specific diseases and drug responses. The critical output here is the identification and validation of biomarkers that can serve as reliable indicators for therapeutic effectiveness or toxicity, laying the foundational science for companion diagnostic tests. This phase also includes the rigorous process of assay design and initial prototyping.

Midstream in the value chain involves the development, manufacturing, and regulatory approval of the companion diagnostic test kits and instruments. This phase is dominated by specialized diagnostic companies that convert validated biomarkers into commercializable tests. It includes meticulous assay optimization, analytical and clinical validation, and navigating complex regulatory pathways, often in close coordination with pharmaceutical partners whose drugs the diagnostic test will accompany. Manufacturing capabilities, quality control, and supply chain management for reagents and instruments are critical at this stage. These companies also engage in educational initiatives for healthcare providers to ensure proper utilization and interpretation of the tests.

Downstream activities encompass the distribution, commercialization, and actual utilization of companion diagnostics in clinical settings. Distribution channels are diverse, including direct sales forces, distributors, and third party logistics providers, reaching end users such as diagnostic laboratories, hospitals, and specialized clinics. Direct and indirect channels both play significant roles. Direct channels involve manufacturers selling directly to large laboratories or hospital networks, offering dedicated support and technical expertise. Indirect channels utilize distributors to reach a broader market, especially smaller labs and clinics. Post market surveillance, continuous training for end users, and comprehensive reimbursement strategies are crucial for successful adoption and sustained market presence. The ultimate goal is the seamless integration of these diagnostics into routine clinical practice to guide personalized treatment decisions, thereby realizing their full therapeutic potential for patients.

Companion Diagnostics Market Potential Customers

Potential customers and end users of companion diagnostics span a wide spectrum within the healthcare ecosystem, reflecting the diverse applications and benefits of these specialized tests. Primarily, these include diagnostic laboratories, both independent and hospital based, which perform the majority of companion diagnostic testing. These labs require reliable, high throughput, and accurate tests to provide actionable insights for patient treatment. They are keenly interested in platforms that offer automation, integration with existing lab infrastructure, and comprehensive panels that can detect multiple biomarkers, streamlining their workflow and improving diagnostic efficiency. The increasing volume of complex molecular testing drives their demand for advanced companion diagnostic solutions.

Another significant customer segment comprises pharmaceutical and biopharmaceutical companies. These entities are not just developers of targeted therapies but also key drivers of companion diagnostic co development. They rely on companion diagnostics to identify eligible patient populations for their drugs during clinical trials and post market commercialization. Their interest lies in diagnostics that are robust, can be integrated early into drug development pipelines, and meet stringent regulatory requirements. Collaborations with diagnostic developers are crucial for them to bring both the drug and its companion diagnostic to market simultaneously, ensuring optimal prescribing and patient outcomes. The trend towards precision oncology and other targeted treatments amplifies their demand for these tools.

Furthermore, hospitals and specialized clinics, particularly those with oncology, neurology, or infectious disease departments, represent direct end users. Clinicians in these settings utilize companion diagnostics to make informed treatment decisions, personalize patient management, and monitor therapeutic responses. Their needs revolve around easy accessibility to tests, timely and accurate results, and clear interpretation guidelines. Academic and research institutes also constitute a vital customer base, using companion diagnostics for biomarker discovery, validation studies, and advancing the understanding of disease mechanisms and drug action. These diverse customer groups collectively underscore the foundational role of companion diagnostics in advancing personalized medicine and improving patient care across various therapeutic domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $7.8 Billion |

| Market Forecast in 2032 | $16.5 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche AG, Agilent Technologies Inc., Abbott Laboratories, Qiagen N.V., Thermo Fisher Scientific Inc., Danaher Corporation, Illumina Inc., Myriad Genetics Inc., Exact Sciences Corporation, Guardant Health Inc., NeoGenomics Laboratories Inc., Sysmex Corporation, Bio-Rad Laboratories Inc., Siemens Healthineers AG, Dako A/S an Agilent Technologies Company, Foundation Medicine Inc. a Roche company, Hologic Inc., Invitae Corporation, Personal Genome Diagnostics Inc., LabCorp Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Companion Diagnostics Market Key Technology Landscape

The technological landscape of the Companion Diagnostics market is dynamic and continuously evolving, characterized by a shift towards more sensitive, specific, and high throughput methodologies. Historically, Immunohistochemistry IHC and In Situ Hybridization ISH have been foundational technologies, widely used for detecting protein expression and gene amplifications, respectively, especially in oncology. These methods remain crucial for their cost effectiveness and established utility in pathology labs globally. IHC, in particular, is vital for assessing protein biomarkers like HER2 in breast cancer or PD-L1 in various solid tumors, guiding the use of corresponding targeted therapies and immunotherapies. ISH is often employed for detecting gene amplifications or deletions directly within tissue samples.

More recently, nucleic acid based technologies, primarily Polymerase Chain Reaction PCR and Next Generation Sequencing NGS, have gained significant traction due to their superior sensitivity and ability to detect a broader range of genetic alterations. PCR based techniques, including quantitative PCR qPCR and real time PCR, are highly efficient for detecting specific mutations, gene fusions, or viral loads with rapid turnaround times and high accuracy, making them indispensable for many companion diagnostic applications. NGS, however, represents a paradigm shift, allowing for simultaneous sequencing of millions of DNA fragments, enabling comprehensive genomic profiling from a single sample. This capability is particularly beneficial for identifying multiple actionable mutations or biomarkers in complex diseases like cancer, where treatment decisions often depend on a panel of genetic markers rather than a single one.

Beyond these core technologies, the landscape also includes advanced molecular diagnostics such as microarrays, array comparative genomic hybridization aCGH, and various liquid biopsy techniques. Liquid biopsy, which involves analyzing circulating tumor DNA ctDNA, circulating tumor cells CTCs, or other biomarkers from blood, offers a non invasive alternative for monitoring disease progression and therapeutic response, circumventing the need for repeat tissue biopsies. Furthermore, advancements in bioinformatics and computational biology are integral to processing and interpreting the vast amounts of data generated by NGS and other high throughput methods. The integration of artificial intelligence and machine learning is also emerging as a key technology, enhancing biomarker discovery, improving diagnostic algorithms, and accelerating data interpretation, further solidifying the technological sophistication of the companion diagnostics market.

Regional Highlights

The global Companion Diagnostics market exhibits distinct regional variations in terms of adoption, growth drivers, and market maturity. These differences are influenced by factors such as healthcare infrastructure, regulatory environments, prevalence of target diseases, R&D investments, and patient awareness. Understanding these regional nuances is critical for market players to tailor their strategies and investments effectively, ensuring optimal market penetration and sustainable growth across diverse geographies.

North America, particularly the United States, stands as the undisputed leader in the Companion Diagnostics market. This dominance is primarily attributable to a highly developed healthcare system, significant investments in biomedical research and personalized medicine, and a strong presence of key market players and research institutions. The region also benefits from a robust regulatory framework that supports the co development and approval of targeted therapies and companion diagnostics. High disease prevalence, especially of cancer, coupled with increasing awareness and acceptance of personalized treatment approaches among clinicians and patients, further fuels market growth. The rapid adoption of advanced genomic technologies like Next Generation Sequencing NGS also contributes significantly to this region's leading position.

Europe represents the second largest market for Companion Diagnostics, driven by similar factors to North America, including a growing emphasis on personalized medicine, rising healthcare expenditure, and a well established pharmaceutical and biotechnology industry. Countries like Germany, France, and the United Kingdom are at the forefront, actively investing in precision medicine initiatives and fostering a supportive regulatory environment. Asia Pacific is poised for the fastest growth, propelled by its enormous patient population, improving healthcare infrastructure, increasing government support for genomic research, and rising disposable incomes in emerging economies like China and India. The increasing incidence of chronic diseases and a growing awareness of advanced diagnostics are key catalysts for this region's expansion. Latin America and the Middle East and Africa MEA, while smaller in market share, offer significant untapped potential. These regions are experiencing gradual improvements in healthcare access and infrastructure, leading to increased adoption of advanced diagnostic technologies, albeit at a slower pace compared to developed regions.

- North America: Dominant market share due to advanced healthcare infrastructure, high R&D investment, and favorable regulatory landscape.

- Europe: Second largest market, driven by increasing adoption of personalized medicine and growing healthcare expenditure.

- Asia Pacific APAC: Fastest growing region, fueled by large patient pool, improving healthcare access, and rising prevalence of chronic diseases.

- Latin America: Emerging market with increasing healthcare investments and improving awareness of advanced diagnostics.

- Middle East and Africa MEA: Developing market with significant growth potential as healthcare systems modernize and expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Companion Diagnostics Market.- F. Hoffmann-La Roche AG

- Agilent Technologies Inc.

- Abbott Laboratories

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Illumina Inc.

- Myriad Genetics Inc.

- Exact Sciences Corporation

- Guardant Health Inc.

- NeoGenomics Laboratories Inc.

- Sysmex Corporation

- Bio-Rad Laboratories Inc.

- Siemens Healthineers AG

- Dako A/S an Agilent Technologies Company

- Foundation Medicine Inc. a Roche company

- Hologic Inc.

- Invitae Corporation

- Personal Genome Diagnostics Inc.

- LabCorp Holdings Inc.

Frequently Asked Questions

What are Companion Diagnostics?

Companion Diagnostics are medical devices or in vitro diagnostic tests designed to provide information essential for the safe and effective use of a corresponding therapeutic product. They help identify patients who are most likely to benefit from a particular treatment, or those at increased risk of serious adverse reactions, by detecting specific biomarkers.

How do Companion Diagnostics benefit patients?

Companion Diagnostics significantly benefit patients by enabling personalized medicine. They ensure that patients receive the most effective treatments tailored to their unique genetic or molecular profile, reducing the likelihood of ineffective therapies, minimizing adverse drug reactions, and ultimately improving treatment outcomes and quality of life.

Which therapeutic area primarily uses Companion Diagnostics?

Oncology is the leading therapeutic area for Companion Diagnostics. These tests are crucial for stratifying cancer patients based on specific genetic mutations or protein expressions, guiding the selection of targeted cancer therapies and immunotherapies, which are increasingly central to cancer treatment protocols.

What technologies are commonly used in Companion Diagnostics?

Common technologies include Immunohistochemistry IHC, In Situ Hybridization ISH, Polymerase Chain Reaction PCR, and Next-Generation Sequencing NGS. NGS is rapidly gaining prominence due to its ability to perform comprehensive genomic profiling, detecting multiple biomarkers simultaneously for highly personalized treatment strategies.

What is the role of AI in the Companion Diagnostics market?

AI is transforming the Companion Diagnostics market by accelerating biomarker discovery, enhancing diagnostic accuracy through advanced data analysis, improving patient stratification for clinical trials, and optimizing treatment selection. It helps interpret complex genomic and proteomic data more efficiently, leading to more precise diagnostic insights and faster development of new tests.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager