Compliance Carbon Credit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430239 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Compliance Carbon Credit Market Size

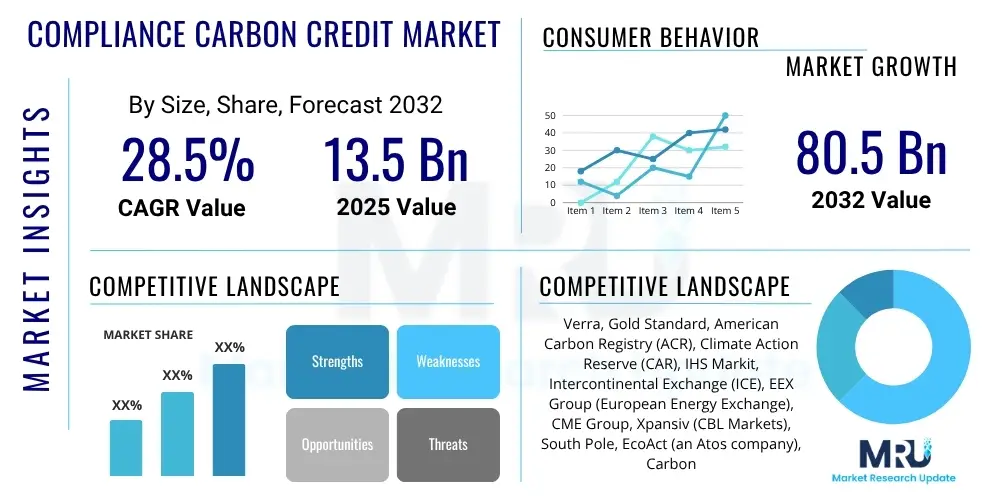

The Compliance Carbon Credit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at $13.5 Billion in 2025 and is projected to reach $80.5 Billion by the end of the forecast period in 2032.

Compliance Carbon Credit Market introduction

The Compliance Carbon Credit Market encompasses a robust and evolving system designed to regulate and mitigate greenhouse gas emissions, primarily through government-mandated programs such as cap-and-trade schemes. These credits, often termed allowances or permits, represent a right to emit one tonne of carbon dioxide equivalent (CO2e) and are typically issued by regulatory bodies. The fundamental product in this market is the carbon allowance, which regulated entities must surrender to cover their emissions, thereby creating a financial incentive to reduce their carbon footprint. This market plays a pivotal role in national and international climate change mitigation strategies, compelling industries to invest in cleaner technologies and sustainable practices to comply with emission caps.

Major applications for compliance carbon credits span a wide array of industrial sectors, including energy generation, heavy manufacturing, transportation, and various other industrial processes that are significant emitters of greenhouse gases. Entities operating within these sectors are legally obligated to hold sufficient credits to match their emissions, fostering a dynamic trading environment where credits can be bought, sold, or banked. The primary benefit of these markets lies in their ability to achieve emission reduction targets at the lowest possible economic cost, allowing polluters to choose between reducing their own emissions, purchasing credits from other compliant entities, or investing in carbon removal projects. This flexibility not only promotes innovation in abatement technologies but also ensures that environmental goals are met efficiently.

The market is predominantly driven by increasingly stringent global environmental regulations, a growing scientific consensus on climate change, and widespread governmental commitments to achieve net-zero emission targets. These factors create a sustained demand for compliance instruments. Additionally, corporate sustainability initiatives, investor pressure for environmental, social, and governance (ESG) compliance, and the expansion of existing and establishment of new compliance regimes globally further accelerate market expansion. The tangible economic benefits derived from avoiding penalties and generating revenue through credit sales also act as significant incentives for participation and investment in this critical environmental market.

Compliance Carbon Credit Market Executive Summary

The Compliance Carbon Credit Market is experiencing significant growth, propelled by the urgent need for global decarbonization and the expansion of regulatory frameworks. Business trends indicate a clear shift towards greater corporate accountability for emissions, with many multinational corporations setting ambitious internal carbon pricing mechanisms and net-zero targets that often intersect with compliance market obligations. Furthermore, the integration of advanced digital technologies for monitoring, reporting, and verification (MRV) is enhancing market transparency and efficiency, attracting broader institutional investment. Innovation in carbon capture, utilization, and storage (CCUS) technologies is also creating new avenues for credit generation, diversifying the supply side of the market and offering more robust compliance options for hard-to-abate sectors. The increasing sophistication of financial instruments tied to carbon credits further underscores the market's maturation.

Regional trends reveal a dynamic landscape, with established markets like the European Union Emissions Trading System (EU ETS) continuing to lead in terms of volume and price discovery, demonstrating robust performance and influencing global carbon pricing benchmarks. North America, particularly through California's cap-and-trade program and the Regional Greenhouse Gas Initiative (RGGI), is also showcasing steady growth and innovative policy developments. The Asia Pacific region is rapidly emerging as a significant force, spearheaded by China's national ETS, which is poised to become the largest carbon market globally, alongside developing markets in South Korea and other Southeast Asian nations. Latin America and the Middle East and Africa, while relatively nascent, are showing increasing interest and development in compliance mechanisms, often driven by international climate finance and capacity-building initiatives, particularly in renewable energy and nature-based solutions.

Segmentation trends highlight the dominance of mandatory compliance schemes, differentiating them from voluntary markets through their legally binding nature and higher price points. By end-use industry, the energy and manufacturing sectors remain the largest contributors to demand, given their high emission profiles, although aviation and shipping are gaining prominence with the implementation of sector-specific schemes like CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation). Project types focusing on renewable energy, energy efficiency, and forestry and land use continue to be crucial for generating compliance-eligible credits, reflecting global priorities in decarbonization and nature-based climate solutions. The market is increasingly witnessing the development of niche segments, such as carbon capture and storage credits, which are anticipated to grow substantially as technological capabilities advance and regulatory frameworks mature to support their deployment.

AI Impact Analysis on Compliance Carbon Credit Market

Common user questions regarding AI's impact on the Compliance Carbon Credit Market frequently revolve around how artificial intelligence can enhance accuracy in emissions monitoring, improve the efficiency of carbon trading platforms, and aid in the validation and verification of carbon projects. Users are particularly concerned with AI's potential to reduce the administrative burden of compliance, minimize instances of greenwashing through advanced data analytics, and offer predictive insights into carbon prices and market trends. Expectations are high for AI to streamline complex regulatory reporting, provide better transparency, and ultimately foster a more robust and trustworthy carbon market ecosystem. There is also significant interest in AI's role in identifying and developing high-quality carbon projects by analyzing vast datasets related to climate, land use, and industrial processes, thereby accelerating the deployment of effective climate solutions and optimizing resource allocation within the carbon market.

- AI-driven platforms enhance the precision and frequency of emissions monitoring and data reporting, ensuring greater accuracy in compliance.

- Predictive analytics models powered by AI can forecast carbon price fluctuations, enabling market participants to make more informed trading decisions.

- Automated validation and verification processes for carbon projects leveraging AI reduce human error and accelerate credit issuance, improving market efficiency.

- AI algorithms analyze satellite imagery and real-time sensor data to prevent double-counting and detect fraudulent carbon credit claims, bolstering market integrity.

- Smart contracts and blockchain technology integrated with AI can automate carbon credit transactions and record-keeping, ensuring transparency and traceability.

- AI facilitates the identification and optimization of new carbon reduction projects by analyzing complex environmental and economic data, driving innovation.

- Personalized compliance strategies and optimization recommendations for businesses can be generated by AI, reducing operational costs and improving adherence to regulations.

- Enhanced risk assessment for investors in carbon projects, using AI to evaluate project viability and environmental impact more thoroughly.

- AI supports the development of sophisticated carbon accounting and auditing tools, simplifying the complexities of environmental financial reporting.

- Improved market liquidity and accessibility through AI-powered interfaces that provide real-time market data and analytical insights to a broader range of participants.

DRO & Impact Forces Of Compliance Carbon Credit Market

The Compliance Carbon Credit Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the escalating global imperative to address climate change, manifested through international accords like the Paris Agreement and national net-zero commitments, which translate into concrete regulatory frameworks. Stricter environmental regulations, including the expansion of existing cap-and-trade systems and the introduction of new carbon taxes, compel industries to participate. Corporate sustainability strategies and increasing investor pressure for Environmental, Social, and Governance (ESG) compliance further motivate companies to manage their carbon footprints through credit acquisition. Furthermore, the growing public awareness and demand for climate action contribute significantly to the political will behind these market mechanisms, creating a sustained demand for compliance instruments.

Conversely, the market faces several significant restraints. Price volatility of carbon credits can create uncertainty for businesses and investors, hindering long-term planning and investment in abatement technologies. A persistent challenge is the lack of universal standardization across different carbon markets globally, which complicates interoperability and cross-border trading, potentially fragmenting the market. Concerns about the integrity of some carbon projects and the potential for "greenwashing" – where companies use credits to appear environmentally friendly without genuine emission reductions – undermine trust and legitimacy. The inherent complexity of developing, monitoring, reporting, and verifying (MRV) carbon projects, coupled with high transaction costs for smaller entities, also acts as a barrier to entry and full market participation, limiting the overall effectiveness and reach of these compliance schemes.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The emergence of new compliance carbon markets in developing economies and hard-to-abate sectors presents significant growth potential. Technological advancements in MRV, including the use of satellite monitoring, blockchain, and artificial intelligence, promise to enhance transparency, accuracy, and reduce costs, thereby improving market integrity and efficiency. Increased international cooperation and the establishment of global carbon pricing mechanisms could lead to larger, more interconnected markets, fostering greater liquidity and impact. Moreover, the accelerating demand from sectors like aviation and shipping for specific offsetting requirements offers new avenues for credit generation, while innovations in carbon capture and removal technologies could unlock substantial new supplies of compliance-eligible credits, further solidifying the market's role in global decarbonization efforts.

Segmentation Analysis

The Compliance Carbon Credit Market is comprehensively segmented to provide a detailed understanding of its diverse components, reflecting various regulatory mechanisms, participant types, and project characteristics. This multi-faceted segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, understand demand-supply dynamics, and assess regulatory impacts. The overarching structure typically categorizes credits based on their mandated or voluntary nature, their application across different industries, the specific types of projects that generate these credits, and the underlying compliance mechanism used by regulatory authorities. Such segmentation is crucial for policymakers to design effective climate policies, for businesses to formulate optimal compliance strategies, and for investors to identify lucrative opportunities within the evolving landscape of global carbon markets.

- By Type:

- Voluntary Carbon Credits

- Mandatory Carbon Credits (Compliance Credits)

- By End-Use Industry:

- Energy

- Manufacturing

- Transportation

- Building and Construction

- Agriculture

- Forestry and Land Use

- Waste Management

- Aviation

- Shipping

- Other Industries

- By Project Type:

- Renewable Energy

- Energy Efficiency

- Forestry and Land Use (REDD+, Afforestation/Reforestation)

- Waste Management (Methane Capture)

- Industrial Gas (HFCs, N2O)

- Carbon Capture and Storage (CCS)

- Agriculture

- By Mechanism:

- Cap-and-Trade

- Baseline-and-Credit

- Carbon Tax

Value Chain Analysis For Compliance Carbon Credit Market

The value chain for the Compliance Carbon Credit Market is intricate, involving multiple stages from project conception to credit retirement, and encompasses various stakeholders. The upstream analysis typically begins with the identification and development of emission reduction or removal projects, which can range from renewable energy installations and forestry projects to industrial process improvements and waste management initiatives. This stage involves significant technical expertise in project design, feasibility studies, and adherence to specific methodologies set by various standards bodies. Originators, project developers, and technical consultants are key players in this phase, responsible for ensuring projects meet stringent eligibility criteria and generate verifiable carbon reductions, which are then quantified and registered.

Following project development, the process moves into the verification and issuance phase, where third-party auditors (often accredited by standards like Verra or Gold Standard) independently assess the project's performance and validate the claimed emission reductions. Upon successful verification, carbon credits are issued by a registry. These credits then enter the distribution channel, which can be direct or indirect. Direct channels involve project developers selling credits directly to compliance entities or large institutional buyers through bilateral agreements. Indirect channels involve brokers, trading platforms, and financial intermediaries who aggregate credits, facilitate transactions, and provide liquidity to the market. These intermediaries often offer services such as portfolio management, risk assessment, and market insights, connecting diverse buyers and sellers efficiently.

The downstream analysis focuses on the end-users – the compliance entities (e.g., power plants, heavy industries, airlines) that are legally obligated to surrender carbon credits to cover their emissions under a specific regulatory scheme. These entities acquire credits from the primary market (newly issued credits) or the secondary market (credits traded among participants). The final stage involves the retirement of these credits on a registry, removing them from circulation to ensure they cannot be used again and thereby confirming the successful offsetting of emissions. Effective distribution channels are critical for market accessibility and price discovery, ensuring that both project developers can monetize their emission reductions and obligated entities can meet their compliance requirements efficiently and transparently.

Compliance Carbon Credit Market Potential Customers

The primary potential customers, or end-users and buyers, within the Compliance Carbon Credit Market are entities operating in sectors subject to government-mandated emission reduction schemes. These typically include large industrial facilities, power generators, cement producers, steel manufacturers, chemical companies, and entities within the transportation sector such as airlines and shipping companies, all of which are significant emitters of greenhouse gases. These businesses are legally obligated under cap-and-trade programs, carbon taxes, or other regulatory frameworks to acquire and surrender a sufficient number of carbon credits to cover their annual emissions. Their demand is non-discretionary, driven by regulatory compliance and the avoidance of substantial financial penalties, making them the foundational buyers in this market.

Beyond these direct compliance-obligated entities, other significant potential customers include financial institutions, investment funds, and specialized carbon asset managers who engage in trading and arbitrage within the carbon markets. These secondary market participants buy and sell credits speculatively, hedge against future price movements, or manage portfolios of carbon assets for their clients, providing essential liquidity and price discovery mechanisms. Furthermore, companies with ambitious internal carbon pricing schemes or voluntary net-zero commitments, even if not directly under a compliance mandate, may also look to compliance-grade credits to meet their high-quality offsetting needs, leveraging the robust verification and regulatory oversight inherent in these instruments. This diverse customer base underpins the market's liquidity and growth, connecting emission reduction project developers with a range of entities seeking to manage their carbon liabilities or invest in climate solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $13.5 Billion |

| Market Forecast in 2032 | $80.5 Billion |

| Growth Rate | CAGR 28.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verra, Gold Standard, American Carbon Registry (ACR), Climate Action Reserve (CAR), IHS Markit, Intercontinental Exchange (ICE), EEX Group (European Energy Exchange), CME Group, Xpansiv (CBL Markets), South Pole, EcoAct (an Atos company), Carbonfund.org Foundation, NativeEnergy, First Climate, Climate Neutral Group, Tradewater, Patch Technologies, Nori, Pachama, CarbonX |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compliance Carbon Credit Market Key Technology Landscape

The Compliance Carbon Credit Market is increasingly reliant on a sophisticated suite of technologies to ensure transparency, accuracy, and efficiency across its various operations, from project development and emissions monitoring to credit issuance and trading. At the forefront are advanced Monitoring, Reporting, and Verification (MRV) technologies. These include remote sensing technologies such as satellite imagery and drone surveillance, which provide highly accurate and frequent data on land-use changes, forest carbon sequestration, and industrial emissions. Coupled with real-time sensors and IoT devices deployed at industrial sites, these tools offer continuous data streams for precise emissions quantification, significantly reducing the uncertainty and manual effort traditionally associated with carbon project validation.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is transforming data analysis in the carbon market. AI can process vast amounts of environmental data, identify patterns, and predict future emission trends or project performance with greater accuracy. This not only enhances the credibility of carbon credits but also helps in identifying optimal project locations and methodologies. Blockchain technology is another disruptive innovation gaining traction, offering immutable record-keeping for carbon credit transactions, preventing double-counting, and ensuring the traceability and transparency of credits from issuance to retirement. Smart contracts built on blockchain platforms automate transactions and compliance processes, thereby minimizing human intervention and potential for fraud, while also improving market liquidity and trust.

Beyond these, specialized software platforms for carbon accounting, portfolio management, and trading are becoming indispensable. These platforms provide sophisticated tools for market participants to manage their carbon assets, conduct risk assessments, and execute trades efficiently. Digital marketplaces and exchanges are also leveraging these technologies to provide robust trading infrastructure, offering advanced analytics and connectivity to various registries and regulatory bodies. The continuous development and adoption of these key technologies are crucial for scaling the compliance carbon credit market, enhancing its integrity, and ultimately enabling it to effectively contribute to global climate change mitigation goals by creating a more robust, reliable, and accessible mechanism for carbon pricing and trading.

Regional Highlights

- Europe: The European Union Emissions Trading System (EU ETS) remains the largest and most liquid carbon market globally, serving as a benchmark for carbon pricing. The region drives innovation in market design and integrity, with strong regulatory oversight and increasing auction volumes. Countries like Germany, France, and the UK (with its own ETS) are leaders in both compliance and corporate decarbonization efforts, attracting significant investment in green technologies and carbon abatement projects. The EU ETS covers power generation, heavy industry, and aviation, continually expanding its scope and ambition, cementing Europe's role as a global leader in compliance carbon markets.

- North America: This region features several well-established compliance markets, notably California's Cap-and-Trade program and the Regional Greenhouse Gas Initiative (RGGI) in the northeastern United States. Canada also operates a federal carbon pricing system across its provinces. North America demonstrates strong corporate engagement in carbon management, often exceeding regulatory minimums, driven by sustainability goals and investor demands. The market is characterized by diverse project types, including forestry, methane capture, and industrial efficiency, alongside significant technological advancements in MRV. Political developments and policy shifts can significantly influence market dynamics, but the underlying commitment to climate action remains strong.

- Asia Pacific (APAC): The APAC region is rapidly emerging as a critical growth engine for compliance carbon markets. China's national ETS, although relatively new, is already the world's largest in terms of covered emissions, indicating massive potential. South Korea operates a robust ETS, and other countries like Indonesia, Vietnam, and Australia (with its safeguard mechanism) are developing or expanding their carbon pricing mechanisms. The region's significant industrial base and economic growth present both substantial emission reduction challenges and immense opportunities for carbon project development, particularly in renewable energy and energy efficiency sectors. International partnerships and climate finance are crucial for scaling these markets.

- Latin America: This region is characterized by a mix of nascent carbon markets and significant potential for nature-based solutions. Brazil is developing a federal carbon market, while Colombia already has an operational carbon tax and offset mechanism. Other countries, including Mexico and Chile, are exploring or implementing various carbon pricing instruments. The abundance of forests and agricultural lands offers immense opportunities for REDD+ (Reducing Emissions from Deforestation and Forest Degradation) and other land-use projects to generate compliance-eligible credits. Challenges include regulatory certainty and capacity building, but international support and increasing domestic awareness are fostering market development.

- Middle East and Africa (MEA): Compliance carbon markets in MEA are largely nascent but show growing interest and development, driven by international climate commitments and the potential for leveraging carbon finance. Several Gulf countries are exploring carbon pricing as part of their diversification and sustainability agendas, particularly in energy-intensive industries. In Africa, the focus is often on renewable energy projects, reforestation, and community-based initiatives that generate credits under various international standards. Partnerships with established carbon market players and access to climate finance are critical for accelerating market maturity and realizing the vast emission reduction potential in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compliance Carbon Credit Market.- Verra

- Gold Standard

- American Carbon Registry (ACR)

- Climate Action Reserve (CAR)

- IHS Markit

- Intercontinental Exchange (ICE)

- EEX Group (European Energy Exchange)

- CME Group

- Xpansiv (CBL Markets)

- South Pole

- EcoAct (an Atos company)

- Carbonfund.org Foundation

- NativeEnergy

- First Climate

- Climate Neutral Group

- Tradewater

- Patch Technologies

- Nori

- Pachama

- CarbonX

Frequently Asked Questions

What are compliance carbon credits?

Compliance carbon credits are legally mandated permits or allowances that grant the holder the right to emit one tonne of carbon dioxide equivalent (CO2e). They are issued by governmental or regulatory bodies under specific cap-and-trade or carbon tax schemes, requiring obligated entities in high-emission sectors to acquire and surrender these credits to cover their greenhouse gas emissions, thereby ensuring adherence to climate regulations.

How do compliance carbon markets work?

Compliance carbon markets operate by setting a cap on total emissions for regulated entities. Companies receive or purchase allowances, and those that reduce emissions below their allocation can sell surplus credits, while those exceeding their cap must buy additional credits. This creates a market price for carbon, incentivizing emission reductions where most cost-effective, with regulatory bodies overseeing issuance, trading, and retirement of credits.

What is the difference between compliance and voluntary carbon credits?

The primary distinction lies in their regulatory backing. Compliance carbon credits are legally required instruments for entities operating under government-mandated emission reduction schemes. Voluntary carbon credits, conversely, are purchased by companies or individuals voluntarily to offset their carbon footprint, typically driven by corporate social responsibility or sustainability goals, and are not tied to legal mandates.

Who participates in compliance carbon markets?

Participants in compliance carbon markets primarily include obligated entities such as power generators, heavy manufacturers, and transportation companies (e.g., airlines), which are legally required to manage their emissions. Additionally, financial institutions, brokers, project developers, and institutional investors also participate to facilitate trading, provide liquidity, and invest in carbon assets.

What are the key drivers for the growth of compliance carbon markets?

Key drivers include increasingly stringent global climate regulations and national net-zero commitments, growing public and investor pressure for corporate sustainability (ESG factors), and the expansion of existing and establishment of new carbon pricing mechanisms worldwide. The economic incentive to avoid penalties and monetize emission reductions also significantly propels market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager