Computer Microchips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430313 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Computer Microchips Market Size

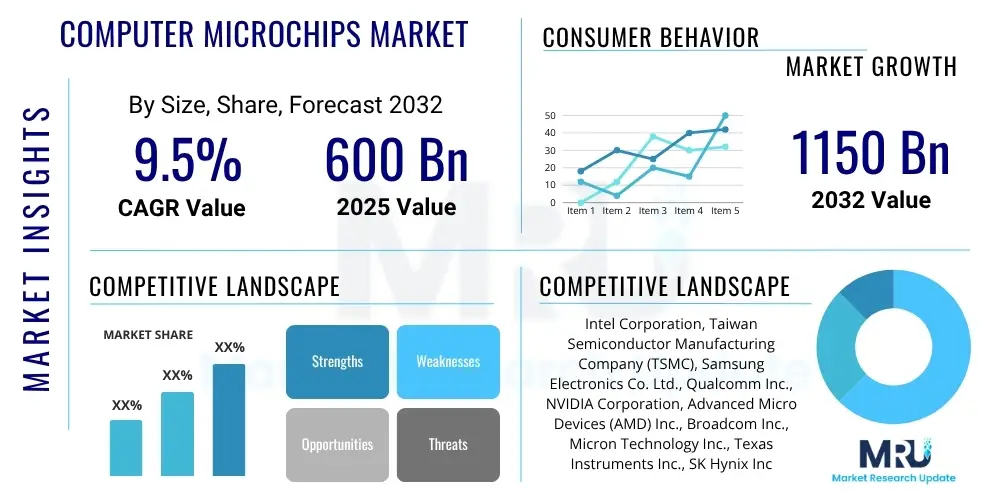

The Computer Microchips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 600 billion in 2025 and is projected to reach USD 1150 billion by the end of the forecast period in 2032.

Computer Microchips Market introduction

The computer microchips market stands as the foundational pillar of the modern digital economy, encompassing a vast array of integrated circuits that power virtually every electronic device. These sophisticated components, often referred to as semiconductors, are miniaturized electronic circuits fabricated on a substrate material, typically silicon, designed to perform specific functions ranging from basic logic operations to complex computations. Their primary function is to process and store information, enabling the functionality of everything from personal computers and smartphones to advanced automotive systems and vast data centers. The relentless demand for faster, more efficient, and smaller electronic devices continually fuels innovation and expansion within this critical industry.

Key products within this market include Microprocessor Units (MPUs), which act as the central brain for computers; Graphics Processing Units (GPUs), vital for rendering graphics and accelerating AI workloads; Memory Chips such as DRAM and NAND flash for data storage; and Application Specific Integrated Circuits (ASICs) and Field Programmable Gate Arrays (FPGAs) designed for specialized tasks. These microchips are indispensable across numerous applications, including consumer electronics like laptops and wearables, the burgeoning automotive sector for infotainment and autonomous driving, industrial automation, telecommunications infrastructure, and advanced healthcare devices. The benefits derived from these components are pervasive, offering unparalleled processing power, energy efficiency, compact design, and the ability to drive continuous technological advancements across diverse industries, fostering new capabilities and enhancing existing ones.

The market's expansion is predominantly driven by several macroeconomic and technological factors. The accelerating pace of digitalization across industries, coupled with the widespread adoption of artificial intelligence and machine learning, significantly increases the demand for high-performance computing capabilities. The proliferation of the Internet of Things (IoT) devices, the rollout of 5G networks, and the continued growth of cloud computing infrastructure further amplify this demand. Additionally, advancements in the automotive sector, particularly the shift towards electric vehicles and autonomous driving technologies, necessitate increasingly complex and robust microchips. These intertwined factors create a robust and dynamic environment for sustained market growth, pushing the boundaries of innovation and manufacturing capacity.

Computer Microchips Market Executive Summary

The computer microchips market is currently experiencing significant transformative business trends, marked by intensified geopolitical considerations impacting supply chain resilience and increased governmental investment in domestic semiconductor manufacturing capabilities. Leading industry players are dedicating substantial resources to research and development, particularly in advanced process technologies and novel architectures like chiplets and heterogeneous integration, to meet the escalating performance demands of AI and high-performance computing. Mergers and acquisitions continue to reshape the competitive landscape, as companies seek to consolidate market share, acquire critical intellectual property, and enhance their vertical integration strategies. The imperative for sustainable manufacturing practices and the development of more energy-efficient chips is also gaining traction, driven by both regulatory pressures and corporate social responsibility initiatives, influencing operational strategies and investment decisions across the board.

Regionally, the market exhibits distinct patterns and concentrations of activity. Asia Pacific continues its dominance as the global manufacturing hub for semiconductors, with Taiwan and South Korea leading in advanced foundry services and memory production, while China aggressively expands its domestic capabilities and consumption. North America remains a powerhouse for semiconductor design, research, and development, particularly for cutting-edge AI and data center chips, with significant venture capital flowing into innovative startups. Europe is carving out a strong niche in automotive and industrial microchips, leveraging its robust manufacturing base and strong engineering expertise. Emerging markets in Latin America, the Middle East, and Africa are showing growth potential, driven by increasing digitalization, infrastructure development, and a rising demand for consumer electronics, though they primarily remain consumption-focused rather than production-heavy at present.

Segmentation trends within the computer microchips market highlight the rapid ascent of specialized chips. AI-specific accelerators, including advanced GPUs and custom ASICs optimized for machine learning workloads, are experiencing exponential growth, becoming a primary driver of market value. The automotive chip segment is also undergoing a profound transformation, fueled by the accelerating adoption of electric vehicles, advanced driver-assistance systems (ADAS), and fully autonomous driving technologies, requiring sophisticated microcontrollers, sensors, and power management ICs. While memory chip markets (DRAM and NAND) historically experience cyclical fluctuations, the long-term demand for data storage and processing in cloud computing and edge devices ensures their fundamental importance. Furthermore, the increasing complexity of System-on-Chips (SoCs) that integrate multiple functionalities onto a single die is a pervasive trend across consumer electronics and specialized applications, showcasing the industry's drive towards higher integration and efficiency.

AI Impact Analysis on Computer Microchips Market

Common user questions regarding AI's impact on the computer microchips market frequently revolve around how AI is influencing chip demand, what new types of chips are emerging to support AI workloads, and the challenges faced by manufacturers in producing these advanced components. Users are keen to understand the implications for chip design, energy consumption, and the long-term strategic direction of semiconductor companies. The overarching theme is a strong expectation that AI will be a primary growth catalyst, but also a source of significant technical and manufacturing hurdles. There is also considerable interest in how AI itself can be leveraged in the chip design and manufacturing process to improve efficiency and reduce time-to-market for increasingly complex designs.

Based on these insights, the impact of Artificial Intelligence on the computer microchips market is profound and multifaceted, acting as a pivotal driver for innovation, demand, and technological shifts. AI applications, from large language models and generative AI to computer vision and autonomous systems, necessitate unprecedented levels of computational power and data processing capabilities, directly fueling the demand for highly specialized and high-performance microchips. This has shifted the focus from general-purpose CPUs to dedicated AI accelerators, such as advanced GPUs, custom ASICs, and neuromorphic chips, which are optimized for parallel processing and machine learning algorithms. Consequently, chip manufacturers are investing heavily in research and development to create architectures that offer superior performance-per-watt and can handle vast datasets efficiently, driving advancements in process technology and packaging solutions to meet these rigorous requirements. The implications extend to the entire value chain, from design tools to foundry capacity, as the industry races to keep pace with the rapidly evolving AI landscape.

- Increased demand for specialized AI accelerators (GPUs, custom ASICs, TPUs) for training and inference workloads.

- Shift in chip architecture focus towards parallel processing, memory bandwidth optimization, and lower latency.

- Intensified R&D investment in advanced packaging technologies like 3D stacking and chiplets to integrate diverse functionalities.

- Development of neuromorphic and in-memory computing architectures for greater energy efficiency in AI processing.

- Significant growth in demand for edge AI chips capable of performing AI tasks locally on devices with reduced power consumption.

- Challenges related to power consumption and heat dissipation for high-performance AI chips.

- Pressure on manufacturing capacities and supply chains for advanced nodes required for AI chip production.

- Integration of AI into electronic design automation (EDA) tools to accelerate chip design and verification.

- Opportunities for new materials and transistor technologies to overcome silicon-based limitations for future AI hardware.

DRO & Impact Forces Of Computer Microchips Market

The computer microchips market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, all subject to various impact forces that shape its trajectory. Key drivers include the exponential growth in demand for artificial intelligence and machine learning applications, which necessitate increasingly powerful and specialized processors. The pervasive expansion of the Internet of Things (IoT) across consumer, industrial, and smart city applications, along with the global rollout of 5G telecommunication networks, further propels the need for diverse and high-performance microchips. Cloud computing infrastructure continues its robust expansion, demanding advanced server processors and memory solutions, while the transformative shift in the automotive industry towards electric vehicles and autonomous driving significantly elevates the complexity and quantity of required semiconductor components. Furthermore, the overarching trend of global digitalization, accelerated by remote work and digital transformation initiatives across all sectors, consistently fuels a fundamental demand for microelectronic components.

Despite robust growth drivers, the market faces notable restraints. The exceptionally high costs associated with research and development for next-generation process technologies and chip designs act as a significant barrier to entry and a continuous burden for existing players. Geopolitical tensions and trade disputes have introduced considerable uncertainty and supply chain vulnerabilities, leading to pressures for regionalization and diversification of manufacturing bases. The inherent complexity of semiconductor manufacturing, involving highly specialized equipment and precise fabrication processes, poses continuous challenges in scaling production and maintaining yields. A persistent shortage of skilled labor, particularly in advanced engineering and manufacturing roles, further constrains growth. Moreover, increasing environmental regulations and the growing emphasis on sustainable practices within the industry necessitate significant investments in eco-friendly manufacturing, adding to operational costs and complexity.

Opportunities for growth are abundant and diverse. The burgeoning field of edge AI, which involves processing AI workloads closer to the data source rather than in centralized clouds, presents a massive market for low-power, high-efficiency microchips. The nascent but rapidly evolving domain of quantum computing, though still in its early stages, offers long-term potential for entirely new types of computing architectures and specialized hardware. Advancements in advanced packaging technologies, such as 3D stacking and heterogeneous integration, enable higher performance and smaller form factors without relying solely on shrinking transistor sizes. The development of chiplet architectures allows for greater flexibility and modularity in chip design, reducing costs and accelerating development cycles for complex SoCs. Furthermore, silicon photonics, integrating optical components with electronic circuits, holds promise for ultra-fast data transmission within and between chips, addressing critical bandwidth limitations. These areas collectively define the strategic investment landscape for future market expansion.

Segmentation Analysis

The computer microchips market is extensively segmented to reflect the diverse range of products, applications, and end-users that characterize this essential industry. This categorization allows for a granular understanding of market dynamics, identifying specific areas of growth, competition, and technological focus. The primary segmentation criteria include the type of microchip, the applications they serve, and the end-user industries that integrate these components into their final products. Each segment possesses unique technological requirements, market drivers, and competitive landscapes, collectively forming a comprehensive overview of the market's structure and operational intricacies.

- By Type

- Microprocessor Units (MPUs)

- Microcontroller Units (MCUs)

- Memory Chips

- DRAM (Dynamic Random-Access Memory)

- NAND Flash Memory

- NOR Flash Memory

- SRAM (Static Random-Access Memory)

- Emerging Memory Technologies (MRAM, PCM, ReRAM)

- Application Specific Integrated Circuits (ASICs)

- Field Programmable Gate Arrays (FPGAs)

- Graphics Processing Units (GPUs)

- System-on-Chips (SoCs)

- Analog Integrated Circuits

- Mixed-Signal Integrated Circuits

- Digital Signal Processors (DSPs)

- Power Management Integrated Circuits (PMICs)

- Sensor Chips (CMOS Image Sensors, MEMS)

- By Application

- Consumer Electronics

- Smartphones

- Laptops and PCs

- Wearables

- Home Appliances

- Gaming Consoles

- Automotive

- Infotainment Systems

- Advanced Driver-Assistance Systems (ADAS)

- Engine Control Units (ECUs)

- Powertrain

- Body Electronics

- Autonomous Driving

- Industrial

- Industrial Automation

- Robotics

- Process Control

- Power Tools

- Data Processing

- Data Centers

- Servers

- Cloud Infrastructure

- Enterprise Storage

- Telecommunication

- 5G Infrastructure

- Networking Equipment

- Base Stations

- Optical Communication

- Healthcare

- Medical Imaging

- Wearable Medical Devices

- Diagnostic Equipment

- Remote Patient Monitoring

- Military & Aerospace

- Avionics

- Defense Systems

- Satellite Communication

- Consumer Electronics

- By End-User

- Original Equipment Manufacturers (OEMs)

- Tier 1 Suppliers

- Electronics Manufacturing Services (EMS) Providers

- Design Houses

- Research Institutions

Value Chain Analysis For Computer Microchips Market

The value chain for the computer microchips market is an intricate global network spanning numerous specialized stages, from raw material extraction to final product distribution. The upstream segment primarily involves the foundational steps of material sourcing and design. This begins with the procurement and purification of critical raw materials, most notably silicon wafers, alongside other essential elements like rare earth metals. Following material preparation, the intellectual property (IP) design phase involves highly specialized firms and in-house design teams creating the architectural blueprints and circuit layouts for microchips, often leveraging sophisticated Electronic Design Automation (EDA) software. This stage also includes the manufacturing of highly advanced and capital-intensive equipment used in fabrication, such as lithography machines, etching systems, and deposition tools, dominated by a few key global players.

The midstream segment of the value chain is dominated by fabrication, or "foundry" services, where raw silicon wafers are transformed into integrated circuits through a complex series of processes including photolithography, etching, deposition, and doping in highly controlled cleanroom environments. This is followed by assembly, testing, and packaging (ATP), where individual chips are cut from the wafer, packaged into protective casings, and rigorously tested for functionality, performance, and reliability. This critical stage ensures that the manufactured chips meet stringent quality standards before being integrated into larger electronic systems. The precision and technological sophistication required at each step of fabrication and ATP highlight the immense investment and expertise necessary to participate in this core part of the value chain.

The downstream segment focuses on the distribution and sale of finished microchips to various end-users. Distribution channels are typically categorized into direct and indirect methods. Direct channels involve semiconductor manufacturers selling directly to large Original Equipment Manufacturers (OEMs) who require vast quantities of specific chips for their products, such as major smartphone or automotive companies. This allows for closer collaboration, customized solutions, and streamlined logistics. Indirect channels involve distributors, value-added resellers, and online marketplaces that serve a broader customer base, including smaller manufacturers, design houses, and electronics assembly firms. These intermediaries provide logistical support, technical assistance, and inventory management, making a diverse range of microchips accessible to a wider market. The choice of distribution channel often depends on customer size, geographical reach, product complexity, and required levels of technical support, ensuring efficient market penetration and product availability globally.

Computer Microchips Market Potential Customers

The computer microchips market serves a vast and diverse ecosystem of potential customers, ranging from global technology conglomerates to specialized niche manufacturers, each with unique demands and requirements. At the forefront are the major Original Equipment Manufacturers (OEMs) in consumer electronics, such as Apple, Samsung, Huawei, and Xiaomi, which require billions of microchips annually for their smartphones, tablets, laptops, and smart devices. These customers often drive innovation in chip design, seeking increasingly powerful, energy-efficient, and compact solutions to differentiate their products. Similarly, leading PC and server manufacturers like Dell, HP, Lenovo, and Cisco are significant buyers, demanding high-performance CPUs, GPUs, and memory for their enterprise and personal computing offerings, forming a consistent base demand for general-purpose and specialized processing units.

Another rapidly expanding segment of potential customers includes automotive manufacturers, exemplified by Tesla, BMW, Mercedes-Benz, and General Motors, as well as their Tier 1 suppliers like Bosch, Continental, and ZF. The ongoing electrification and push towards autonomous driving technologies have transformed vehicles into sophisticated computing platforms, necessitating a vast array of microcontrollers, power management ICs, sensors, and AI accelerators. These customers prioritize reliability, safety, and long-term supply agreements due to the critical nature of their applications. Furthermore, cloud service providers and hyperscale data center operators, including Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, represent a colossal segment, continuously investing in high-end server CPUs, specialized AI chips, and massive quantities of memory and storage solutions to power their global computing infrastructure and AI workloads.

Beyond these dominant sectors, a multitude of other industries constitute significant potential customers. Industrial automation companies like Siemens, ABB, and Rockwell Automation rely on robust microcontrollers and ASICs for programmable logic controllers (PLCs), robotics, and industrial IoT devices, prioritizing durability and real-time processing capabilities. Telecommunications equipment providers such as Ericsson, Nokia, and Huawei are crucial buyers for chips powering 5G base stations, networking gear, and optical fiber systems, demanding high-speed and efficient data processing. Moreover, the healthcare sector, with companies developing medical imaging devices, wearable health monitors, and diagnostic equipment, increasingly integrates specialized microchips for data acquisition, processing, and connectivity. Even governmental and defense agencies procure high-reliability, often ruggedized, microchips for aerospace, military communication, and advanced surveillance systems, making the customer base for microchips exceptionally broad and critical to nearly every aspect of modern technology and infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 600 billion |

| Market Forecast in 2032 | USD 1150 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intel Corporation, Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics Co. Ltd., Qualcomm Inc., NVIDIA Corporation, Advanced Micro Devices (AMD) Inc., Broadcom Inc., Micron Technology Inc., Texas Instruments Inc., SK Hynix Inc., NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Kioxia Corporation, Renesas Electronics Corporation, Marvell Technology Inc., MediaTek Inc., GlobalFoundries Inc., Western Digital Corporation, Analog Devices Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer Microchips Market Key Technology Landscape

The technological landscape of the computer microchips market is characterized by relentless innovation aimed at pushing the boundaries of performance, efficiency, and integration, driven largely by the escalating demands of artificial intelligence, high-performance computing, and ubiquitous connectivity. At the forefront are advancements in semiconductor manufacturing process nodes, with companies continually developing smaller transistor geometries (e.g., 3nm, 2nm and beyond) to pack more transistors onto a single chip, leading to increased processing power and energy efficiency. This is complemented by sophisticated lithography techniques, such as Extreme Ultraviolet (EUV) lithography, which are essential for patterning these minute features with precision. The industry is also witnessing significant progress in materials science, exploring alternatives to traditional silicon, such as Gallium Nitride (GaN) and Silicon Carbide (SiC) for power electronics and high-frequency applications, which offer superior electron mobility and breakdown voltage.

Beyond traditional planar scaling, the market is rapidly embracing advanced packaging technologies and architectural innovations. Three-dimensional (3D) stacking, or Vertical Integration, allows for multiple layers of chips (e.g., logic, memory) to be stacked vertically, drastically reducing interconnect distances and improving bandwidth, as seen in High Bandwidth Memory (HBM). Heterogeneous integration and chiplet architectures are gaining prominence, enabling designers to combine multiple specialized chiplets (e.g., CPU, GPU, I/O) from different process technologies or even different vendors onto a single package. This modular approach offers greater flexibility, improves yield, and allows for optimized performance and cost for complex System-on-Chips (SoCs). These methods address the challenges of monolithic chip design at advanced nodes, allowing for custom solutions that optimize specific functionalities and reduce overall system size and power consumption, crucial for diverse applications from data centers to edge devices.

Emerging and disruptive technologies are also shaping the future of microchips. Neuromorphic computing, inspired by the human brain, aims to achieve ultra-low power and high-efficiency processing for AI workloads by integrating memory and processing closer together, or even co-locating them. Silicon photonics is another transformative area, integrating optical components directly onto silicon chips to enable high-speed data transfer using light, significantly reducing power consumption and increasing bandwidth over traditional electrical interconnects, which is vital for data centers and telecommunications. Furthermore, the long-term prospects of quantum computing hardware, though still in early research phases, promise to fundamentally change computational capabilities, demanding new types of cryogenic control chips and qubit integration technologies. These technological advancements collectively underscore the dynamic nature of the microchips market, constantly evolving to meet the demands of an increasingly interconnected and intelligent world.

Regional Highlights

- North America: This region stands as a global leader in semiconductor design, research, and development, particularly for high-end microprocessors, AI accelerators, and data center chips. The presence of major technology giants, significant venture capital investments, and a robust ecosystem of universities and research institutions foster continuous innovation. The United States, in particular, is a hub for fabless design companies and boasts considerable investment in leading-edge process technology development, despite having a smaller share of global manufacturing capacity compared to Asia. Demand is strong from cloud computing, automotive, and defense sectors.

- Europe: Europe exhibits a strong focus on specialized microchips, especially for the automotive, industrial IoT, and telecommunications sectors. Countries like Germany, France, and the Netherlands have significant R&D and manufacturing capabilities in areas such as power semiconductors, microcontrollers, and sensor technologies. The region is actively working to bolster its domestic semiconductor production capabilities through initiatives like the European Chips Act, aiming to reduce reliance on external supply chains and foster innovation in niche, high-value markets.

- Asia Pacific (APAC): APAC is the indisputable epicenter of global semiconductor manufacturing and a dominant consumer market. Taiwan and South Korea lead the world in advanced foundry services (TSMC, Samsung Foundry) and memory chip production (Samsung, SK Hynix). China is rapidly expanding its domestic semiconductor industry, aiming for self-sufficiency across the value chain, driven by massive government investment and an enormous domestic market for consumer electronics, automotive, and industrial applications. Japan also remains a key player, particularly in semiconductor equipment and specialized materials. The region's vast electronics manufacturing base ensures sustained high demand for microchips across all segments.

- Latin America: This region represents an emerging market for semiconductor consumption, primarily driven by increasing digitalization, expanding consumer electronics markets, and growing industrial automation. While manufacturing capabilities are relatively limited, countries like Brazil and Mexico serve as important assembly hubs for electronic devices, generating demand for imported microchips. Infrastructure development and government initiatives to boost local tech industries offer future growth potential for both consumption and potentially, in the longer term, localized design and manufacturing capabilities for specific applications.

- Middle East and Africa (MEA): The MEA region is witnessing increasing adoption of digital technologies, smart city initiatives, and diversification away from oil-dependent economies, which are boosting the demand for microchips in telecommunications, data centers, and consumer electronics. Governments in the UAE, Saudi Arabia, and Israel are investing in advanced technologies and digital infrastructure, fostering a nascent but growing market for semiconductor solutions. While local manufacturing is minimal, the region is a significant consumer, and investments in AI and IoT infrastructure promise future demand growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer Microchips Market.- Intel Corporation

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Samsung Electronics Co. Ltd.

- Qualcomm Inc.

- NVIDIA Corporation

- Advanced Micro Devices (AMD) Inc.

- Broadcom Inc.

- Micron Technology Inc.

- Texas Instruments Inc.

- SK Hynix Inc.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Kioxia Corporation

- Renesas Electronics Corporation

- Marvell Technology Inc.

- MediaTek Inc.

- GlobalFoundries Inc.

- Western Digital Corporation

- Analog Devices Inc.

Frequently Asked Questions

What are the primary growth drivers for the computer microchips market?

The primary growth drivers for the computer microchips market include the escalating adoption of Artificial Intelligence (AI) and Machine Learning (ML), the widespread expansion of the Internet of Things (IoT), the global rollout of 5G networks, the continuous growth of cloud computing infrastructure, and the transformative advancements in the automotive sector, particularly electric vehicles and autonomous driving. These factors collectively fuel demand for higher performance, greater efficiency, and specialized microchip solutions across various industries.

How is AI impacting microchip design and demand?

AI is profoundly impacting microchip design and demand by driving the need for specialized accelerators like GPUs and ASICs optimized for parallel processing and machine learning workloads. This leads to architectural innovations, increased investment in advanced packaging, and a focus on energy efficiency. AI also elevates overall chip demand due to its pervasive integration across data centers, edge devices, and various applications, necessitating more powerful and intelligent silicon.

What are the biggest challenges facing microchip manufacturers?

Key challenges for microchip manufacturers include extremely high research and development costs for next-generation process technologies, persistent geopolitical tensions affecting global supply chains and trade, the immense complexity and capital intensity of advanced manufacturing processes, a critical shortage of skilled talent, and increasing pressure to adopt sustainable and environmentally friendly production methods.

Which regions are leading in microchip production and consumption?

Asia Pacific, particularly Taiwan and South Korea, leads globally in advanced microchip manufacturing and foundry services, while China is a dominant consumer and rapidly growing producer. North America excels in chip design and R&D for high-end processors and AI, with Europe focusing on automotive and industrial microchips, leveraging its niche expertise and aiming to bolster domestic production.

What emerging technologies are shaping the future of microchips?

Emerging technologies shaping the future of microchips include advanced packaging (e.g., 3D stacking, chiplets, heterogeneous integration) for improved performance and density, neuromorphic computing for brain-inspired AI processing, silicon photonics for ultra-fast optical data transfer, and quantum computing hardware which promises entirely new computational paradigms, driving innovation beyond conventional silicon scaling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager