Concrete Paving Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428243 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Concrete Paving Equipment Market Size

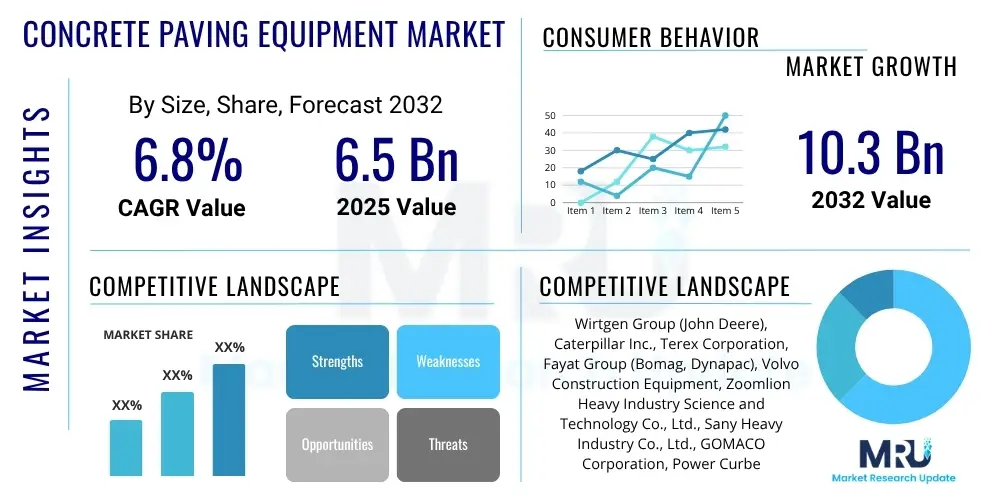

The Concrete Paving Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 6.5 Billion in 2025 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2032.

Concrete Paving Equipment Market introduction

The concrete paving equipment market encompasses a diverse range of heavy machinery and specialized tools essential for the construction, rehabilitation, and maintenance of concrete surfaces across various infrastructure projects. This equipment is designed to efficiently and precisely lay, spread, level, and finish concrete, ensuring the structural integrity, durability, and aesthetic quality of roads, highways, airport runways, industrial floors, and urban pathways. The inherent strength and longevity of concrete, coupled with advanced paving technologies, make it a preferred material for critical infrastructure, driving continuous demand for sophisticated and robust machinery globally. The market's evolution is closely tied to advancements in construction techniques, material science, and automation, all aimed at enhancing productivity and reducing project timelines while adhering to stringent quality standards.

Key product categories within this market include slipform pavers, which are central to large-scale, continuous concrete road construction; curb and gutter machines for urban landscaping and drainage; concrete screeds for leveling and finishing; road wideners; and a suite of auxiliary equipment such as texture curing machines and placers. These machines are engineered for high performance, offering capabilities for varied concrete thicknesses, widths, and designs, adapting to diverse environmental conditions and project specifications. Their primary applications span national infrastructure networks, critical transportation hubs like airports, extensive commercial developments, and vital residential areas. This broad utility underscores their foundational role in modern urban and economic development, facilitating seamless connectivity and robust structural frameworks across varied construction scales.

The overarching benefits derived from the utilization of advanced concrete paving equipment include significantly accelerated construction schedules, superior surface quality leading to enhanced vehicle safety and ride comfort, substantial reductions in labor costs due to automation, and minimized material waste through precise application. Driving factors propelling this market forward are multifaceted: significant and sustained governmental investments in global infrastructure upgrades, particularly in burgeoning economies; escalating urbanization trends necessitating new and expanded transportation and commercial facilities; continuous technological innovations fostering the development of more intelligent, fuel-efficient, and environmentally compliant machinery; and a growing preference for concrete pavements over alternative materials, primarily due to their extended lifespan, lower lifecycle maintenance costs, and improved resilience against heavy traffic and adverse weather conditions. These elements collectively reinforce the market's trajectory towards sustained expansion and innovation.

Concrete Paving Equipment Market Executive Summary

The concrete paving equipment market is currently experiencing dynamic growth, propelled by robust global infrastructure spending and a pervasive trend towards advanced construction methodologies. A notable business trend is the accelerating integration of digital technologies, including telematics, GPS-guided systems, and the Internet of Things (IoT), into paving machinery. This technological infusion is not merely about incremental improvements but represents a paradigm shift towards intelligent construction, enabling real-time performance monitoring, predictive maintenance, and optimized operational efficiency. Manufacturers are increasingly focused on developing environmentally sustainable equipment, incorporating hybrid powertrains and more fuel-efficient engines to comply with stringent global emission standards and cater to a growing demand for eco-friendly construction practices. Furthermore, the market observes a heightened demand for modular and versatile equipment that can be easily adapted for various project sizes and types, providing greater flexibility and cost-effectiveness for contractors seeking to maximize their asset utilization.

From a regional perspective, the Asia Pacific region stands out as a primary growth engine for the concrete paving equipment market, largely due to massive government-backed infrastructure projects in countries such as China, India, and Indonesia. These initiatives encompass extensive road networks, new airport constructions, and ambitious smart city developments that require large-scale, efficient paving solutions. North America and Europe, as mature markets, exhibit a steady demand for equipment aimed at the rehabilitation, upgrade, and maintenance of aging infrastructure. The focus in these regions is heavily on advanced, high-precision equipment that ensures superior quality, minimizes disruptions, and adheres to stringent environmental regulations. Latin America and the Middle East & Africa are also witnessing considerable investments in urban development and transportation infrastructure, driving moderate but consistent growth, albeit with market fluctuations often tied to commodity prices and geopolitical stability. Each region presents unique opportunities and challenges that shape market penetration strategies for global players.

Segmentation analysis reveals that slipform pavers continue to represent the largest product segment, indispensable for long-stretch road and highway construction due to their unparalleled efficiency and precision. Within the application segment, road and highway construction remains dominant, benefiting from the global impetus to enhance connectivity. However, the airport construction and industrial paving segments are showing accelerated growth, driven by the exacting standards for flatness, durability, and load-bearing capacity required for these critical infrastructures. End-user trends indicate a robust demand from large construction companies, alongside a growing reliance on equipment rental services by smaller and mid-sized contractors seeking to manage capital expenditure and access a broader range of specialized machinery. The ongoing innovation across these segments underscores a market commitment to delivering higher quality, more sustainable, and economically viable concrete paving solutions to address the evolving demands of the global construction industry and its diverse project requirements.

AI Impact Analysis on Concrete Paving Equipment Market

User questions regarding the impact of Artificial Intelligence (AI) on the concrete paving equipment market predominantly center on how this transformative technology can enhance productivity, improve precision, and significantly reduce operational costs. Users are keenly interested in practical applications of AI, such as advanced predictive maintenance systems that forecast equipment failures before they occur, thereby minimizing downtime and extending machine lifespan. There's also significant curiosity about AI-powered autonomous or semi-autonomous paving operations, which promise to address labor shortages, increase paving consistency, and enhance safety on job sites. Stakeholders also frequently inquire about AI's role in optimizing material usage through real-time adjustments based on environmental conditions and concrete properties, leading to reduced waste and improved pavement quality. The underlying expectation is for AI to usher in an era of smarter, self-optimizing paving solutions that deliver superior results with greater efficiency across various construction scenarios.

Furthermore, user concerns often revolve around the economic feasibility and implementation challenges associated with AI integration, including the substantial upfront investment required for sophisticated AI-enabled machinery and the need for specialized training for the workforce. Questions also arise concerning the cybersecurity implications of connected AI systems, ensuring data privacy, and the interoperability of AI platforms across different equipment manufacturers and existing fleet infrastructures. Despite these considerations, there is a strong anticipation for AI to revolutionize quality control through intelligent vision systems that detect surface defects instantly, and for AI to provide data-driven insights that optimize project management, scheduling, and resource allocation. The integration of AI is seen as a crucial step towards creating more resilient, sustainable, and high-performance concrete infrastructures, promising a future where paving operations are more intelligent, safer, and remarkably efficient, while also addressing environmental considerations through optimized resource utilization.

- Autonomous Paving Operations: AI enables machines to operate with minimal human intervention, enhancing precision and consistency, and effectively addressing labor shortages in the construction sector.

- Predictive Maintenance: AI algorithms analyze sensor data in real-time to forecast potential equipment failures, optimizing maintenance schedules and significantly reducing costly unscheduled downtime.

- Real-time Quality Control: AI-powered vision systems detect and correct surface defects instantaneously, ensuring superior pavement quality and adherence to stringent engineering specifications.

- Optimized Material Usage: AI adjusts material flow, mixing, and compaction based on real-time data from site conditions, minimizing waste and improving concrete mix consistency and pavement integrity.

- Enhanced Safety: AI-driven systems improve obstacle detection, predict potential hazards, and enable collision avoidance, significantly increasing safety for both workers and equipment on site.

- Data-Driven Project Management: AI processes vast amounts of operational data to provide actionable insights for better project planning, resource allocation, and dynamic scheduling, optimizing overall project efficiency and profitability.

- Fuel Efficiency Optimization: AI algorithms analyze operational patterns and environmental conditions to optimize engine performance and hydraulic systems, leading to reduced fuel consumption and lower carbon emissions, supporting sustainability goals.

DRO & Impact Forces Of Concrete Paving Equipment Market

The concrete paving equipment market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces. A primary driver is the accelerating pace of global infrastructure development, particularly in emerging economies, where governments are heavily investing in expanding and upgrading road networks, airports, and urban transportation systems to support economic growth and urbanization. This is further complemented by an increasing global population and the subsequent demand for new residential and commercial structures, all requiring robust concrete foundations and access ways. Technological advancements, including automation, precision guidance systems, and enhanced machine intelligence, also act as strong drivers, offering contractors improved efficiency, accuracy, and cost-effectiveness compared to traditional methods, thereby stimulating equipment adoption and fleet modernization across various project scales.

Conversely, several restraints impede the market's growth trajectory. The substantial initial capital outlay required for purchasing sophisticated concrete paving equipment can be a significant barrier for smaller contractors or those in regions with limited access to financing. Volatility in raw material prices, particularly for steel, cement, and critical electronic components, directly impacts manufacturing costs, which can translate into higher equipment prices and affect procurement decisions. Furthermore, stringent environmental regulations regarding emissions from heavy machinery and the carbon footprint associated with concrete production can necessitate expensive technological upgrades and compliance measures, posing additional challenges for manufacturers and operators. The perennial shortage of skilled labor capable of operating and maintaining advanced paving equipment also acts as a constraint, limiting the optimal utilization of new technologies and slowing project execution, particularly in regions facing demographic shifts.

Despite these restraints, significant opportunities are emerging within the market. The growing focus on smart city initiatives worldwide presents a substantial opportunity, as these projects demand high-quality, durable, and precisely laid concrete infrastructure for integrated urban planning and smart transportation systems. The development and adoption of specialized equipment for niche applications, such as permeable concrete for improved water management or ultra-high-performance concrete for bridges and tunnels, open new market segments. Additionally, the increasing preference for equipment rental services, offering cost flexibility and access to the latest machinery without large capital expenditures, is fostering market expansion. The long-term durability and lower lifecycle costs of concrete pavements over asphalt are also positioning concrete paving equipment favorably, as infrastructure owners increasingly prioritize longevity and reduced maintenance burdens. The collective impact forces underscore a market characterized by an urgent global need for superior infrastructure, balanced against economic challenges, and driven by a relentless pursuit of technological innovation and sustainable construction practices.

Segmentation Analysis

The concrete paving equipment market is thoroughly segmented to provide a granular understanding of its diverse landscape, reflecting the varied requirements of the global construction industry. These segmentations are crucial for identifying specific market trends, competitive dynamics, and areas ripe for innovation and strategic investment. The categorization allows for a detailed analysis of how different product types, applications, and end-user demands influence market growth and technology adoption across various geographical regions. Understanding these divisions helps stakeholders, including manufacturers, suppliers, and construction firms, to precisely target their efforts, optimize product development, and refine their market entry or expansion strategies to meet specific industry needs effectively, thereby enhancing their competitive edge and market responsiveness.

Segmentation by product type typically differentiates between high-volume machines like slipform pavers, specialized equipment such as curb and gutter machines, and finishing tools like concrete screeds. Each type addresses distinct operational requirements within a paving project, varying in scale, precision, and functionality. Application-based segmentation highlights the primary uses of this equipment, from extensive road and highway networks to specialized airport infrastructure and burgeoning residential or commercial developments. This distinction underscores the broad utility and adaptability of modern paving solutions across different infrastructure categories. Finally, end-user segmentation outlines the primary purchasers and operators of this machinery, ranging from large-scale government contractors to smaller, specialized construction firms and equipment rental agencies, each with unique procurement patterns and operational scales that collectively shape market demand and service requirements for this essential equipment.

- By Product Type:

- Slipform Pavers

- Fixed-Form Pavers

- Mobile/Tracked Pavers

- Curb and Gutter Machines (Compact, Mid-size)

- Concrete Screeds

- Vibratory Screeds

- Roller Screeds

- Laser Screeds

- Road Wideners

- Texture Curing Machines

- Concrete Spreaders and Placers

- Concrete Finishers and Polishers

- Other Auxiliary Equipment (e.g., Dowel Bar Inserters, Power Floats)

- Slipform Pavers

- By Application:

- Road and Highway Construction

- Airport Construction (Runways, Aprons, Taxiways, Maintenance Areas)

- Residential and Commercial Infrastructure (Streets, Parking Lots, Foundations)

- Industrial Paving (Warehouses, Factories, Ports)

- Specialized Projects (Canals, Tunnels, Dams, Bridges)

- By End-User:

- Construction Companies (Large-scale contractors, Local contractors)

- Government and Public Works Departments

- Equipment Rental Companies

- By Operating Mode:

- Manual/Operated

- Semi-Automatic

- Automatic/Autonomous

- By Power Source:

- Diesel

- Electric/Hybrid

- Gasoline

Value Chain Analysis For Concrete Paving Equipment Market

The value chain for the concrete paving equipment market is a sophisticated network of interconnected activities, beginning with upstream raw material sourcing and extending to downstream distribution, sales, and comprehensive after-sales support. Upstream activities are critical and involve the procurement of high-quality raw materials such as various grades of steel, iron, and specialized composites for machine frames, chassis, and structural components. Additionally, this stage includes sourcing complex components like high-performance engines from specialized industrial manufacturers, advanced hydraulic systems, sophisticated electronic control units (ECUs), and precision sensors. Strong relationships with reliable suppliers for these crucial parts are paramount, as the quality and cost of these inputs directly influence the manufacturing efficiency, final product performance, and market competitiveness. Manufacturers often engage in long-term strategic partnerships with component suppliers to ensure supply chain stability, foster innovation in component design, and maintain consistent quality standards, which are vital for producing durable and technologically advanced paving machinery that meets market demands.

Midstream activities encompass the core manufacturing and assembly processes, where innovation and engineering prowess are paramount. This stage involves extensive research and development (R&D) investment to integrate cutting-edge technologies, including advanced automation systems, telematics, GPS-guided machine control, and sophisticated sensor arrays that enable precise and efficient paving operations. Rigorous testing and quality assurance procedures are implemented at various stages to ensure that each machine meets stringent performance, safety, and environmental standards before it reaches the market. The manufacturing process often involves a high degree of customization to cater to specific regional demands or unique project requirements, showcasing the flexibility of modern production lines. Efficient manufacturing practices and lean operations are essential to control costs and shorten lead times in a competitive market environment, thereby enhancing the overall value proposition of the equipment and ensuring its timely delivery to end-users.

Downstream, the value chain focuses on market access and customer satisfaction, primarily through diverse distribution channels. These include direct sales by manufacturers for large governmental or major corporate clients, establishing strong customer relationships and offering tailored solutions, custom configurations, and comprehensive training. Authorized dealer networks form a significant indirect channel, providing localized sales, comprehensive service, spare parts availability, and technical support, which are crucial for extensive market penetration and strong customer retention, especially for smaller and medium-sized contractors. The growing segment of equipment rental companies also plays a pivotal role, offering flexibility to contractors who prefer leasing over outright purchase, thereby expanding market reach and ensuring high utilization rates of machinery across various projects. After-sales service, including routine maintenance, emergency repairs, provision of genuine spare parts, and ongoing technical training, is an indispensable component of the value chain, ensuring equipment longevity, optimal performance, and reinforcing brand loyalty, ultimately contributing significantly to the total cost of ownership and customer operational success over the lifespan of the machinery.

Concrete Paving Equipment Market Potential Customers

The concrete paving equipment market serves a diverse array of potential customers, each with distinct needs and procurement strategies that collectively drive demand across various segments. Predominantly, large-scale construction companies specializing in major infrastructure projects constitute a significant customer base. These entities are engaged in building extensive road networks, national highways, expressways, airport runways, and large commercial or industrial complexes, requiring high-capacity, robust, and technologically advanced machinery. Their purchasing decisions are primarily influenced by factors such as project scale, operational efficiency, equipment reliability, precision capabilities, and the need to comply with stringent engineering specifications and tight deadlines. These companies often seek integrated solutions that can provide automation, data analytics, and robust after-sales support to maximize productivity, minimize downtime, and ensure long-term equipment performance, often forming long-term relationships with manufacturers for ongoing fleet needs.

Government agencies and public works departments, operating at national, state, and municipal levels, represent another crucial segment of potential customers. These bodies are directly responsible for the development, maintenance, and rehabilitation of public infrastructure, ensuring connectivity and public utility. While they may sometimes acquire equipment directly for their own operational units, they more commonly influence market demand by commissioning large-scale public tenders that require private construction firms to utilize specific types of high-quality paving equipment. Their procurement decisions are often guided by budgetary considerations, long-term asset value, environmental compliance, and the societal impact of infrastructure projects, favoring durable, low-maintenance, and eco-friendly machinery that can withstand heavy public use and adverse weather conditions over many years. Investment in public infrastructure is a key driver for stable, long-term demand, often necessitating a rigorous evaluation of equipment lifecycle costs and sustainability features.

Furthermore, equipment rental companies have emerged as a rapidly growing and vital customer segment. These firms invest in a broad and varied fleet of concrete paving equipment, which they then lease to smaller or medium-sized contractors who may lack the substantial capital required for outright purchase, or who require specialized machinery only for the duration of specific projects. Rental companies cater to a wide range of clients, from those working on residential streets and parking lots to contractors undertaking smaller commercial developments, offering cost flexibility, reduced maintenance burdens, and access to the latest technologies without a large upfront commitment. Additionally, specialized contractors focusing on niche applications such as curb and gutter installation, industrial flooring, or decorative concrete form another segment of potential customers, often seeking compact, precise, and highly maneuverable equipment tailored to their unique operational demands. This diverse customer base ensures a continuous and diversified market for concrete paving solutions, driven by a spectrum of project requirements and financial considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.5 Billion |

| Market Forecast in 2032 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wirtgen Group (John Deere), Caterpillar Inc., Terex Corporation, Fayat Group (Bomag, Dynapac), Volvo Construction Equipment, Zoomlion Heavy Industry Science and Technology Co., Ltd., Sany Heavy Industry Co., Ltd., GOMACO Corporation, Power Curbers Inc., CMI Roadbuilding Inc., Astec Industries, Ltd., LiuGong Machinery Co., Ltd., Ammann Group, XCMG Group, Sumitomo Heavy Industries Construction Crane Co., Ltd., Mecalac Group, Shantui Construction Machinery Co., Ltd., ABG (Volvo Construction Equipment subsidiary), GEHL (Manitou Group), Case Construction Equipment (CNH Industrial N.V.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Concrete Paving Equipment Market Key Technology Landscape

The concrete paving equipment market is undergoing a profound technological transformation, characterized by innovations aimed at achieving unparalleled precision, enhanced automation, superior operational efficiency, and heightened sustainability. A cornerstone of this evolution is the integration of advanced sensor systems, including sophisticated LiDAR, ultrasonic sensors, and laser-guided technologies. These systems provide real-time, highly accurate data on ground contours, material thickness, and surface elevation, which is crucial for achieving exact paving specifications and minimizing material overrun. Coupled with GPS-guided steering and 3D machine control systems, these technologies enable machines to operate without the need for traditional string lines, significantly accelerating project timelines, reducing manual labor, and ensuring superior consistency and flatness across large paving areas. The digital integration allows for design models to be directly translated into machine movements, ensuring precise execution of complex pavement designs and maximizing operational accuracy.

Automation stands as a pivotal trend within the technology landscape, driving the development of increasingly intelligent and autonomous paving machines. From semi-autonomous features that assist operators in maintaining optimal speed and material flow to fully autonomous systems capable of executing entire paving sequences, AI and machine learning are revolutionizing operational capabilities. Telematics and IoT (Internet of Things) connectivity are becoming standard, enabling remote monitoring of equipment performance, diagnostics, fuel consumption, and asset utilization. This connectivity facilitates predictive maintenance, allowing for proactive servicing and reducing unexpected downtime, thereby maximizing equipment uptime and operational efficiency. Furthermore, advanced engine technologies, particularly those complying with Tier 4 Final/Stage V emission standards, are being widely adopted, leading to more fuel-efficient operations and a substantial reduction in environmental impact, aligning with global sustainability goals and regulatory pressures for greener construction practices across all major markets.

Beyond core paving functions, technological advancements extend to material optimization and data management. Intelligent vibrator systems adjust frequencies based on real-time concrete consistency, ensuring optimal compaction and preventing segregation, which is critical for pavement durability and strength. The emergence of data analytics platforms processes the vast streams of operational data collected from integrated sensors and telematics systems, providing actionable insights for project managers to optimize workflows, resource allocation, and overall project efficiency. Building Information Modeling (BIM) is increasingly integrated with paving equipment, facilitating seamless information exchange from design to construction and maintenance, fostering better collaboration and reducing errors throughout the project lifecycle. Collectively, these technological innovations are not only enhancing the quality and speed of concrete paving but are also fostering a safer, more sustainable, and data-driven approach to infrastructure development, fundamentally reshaping the future of the market and setting new benchmarks for construction excellence and environmental stewardship.

Regional Highlights

The global concrete paving equipment market exhibits significant regional variations, driven by distinct economic landscapes, infrastructure development priorities, and regulatory environments. These regional dynamics are crucial for understanding market demand, competitive intensity, and the strategic opportunities available to manufacturers and service providers. Emerging economies, particularly in Asia Pacific, are experiencing exponential growth due to massive investments in new infrastructure, while mature markets like North America and Europe focus more on maintenance, rehabilitation, and the adoption of advanced, high-precision technologies to optimize existing networks. Each region presents a unique set of drivers and challenges that shape market demand and the types of equipment sought by contractors and government bodies, necessitating tailored market penetration strategies for global players seeking sustainable growth.

The pace of urbanization and industrialization largely dictates regional market performance. In regions with rapid urban expansion, such as parts of Asia and Africa, there is an urgent need for new roads, bridges, and commercial facilities, directly stimulating demand for high-capacity paving equipment capable of efficient, large-scale deployment. Conversely, in regions with well-established infrastructure, the emphasis shifts towards efficiency, precision, and environmental compliance, driving demand for technologically advanced and sustainable machinery for repair and upgrade projects that minimize disruption. Government policies, availability of funding for infrastructure, and the prevalence of public-private partnership (PPP) models also play a pivotal role in shaping regional market sizes and growth trajectories, underscoring the complex interplay of economic, political, and technological factors that define the global concrete paving equipment landscape, influencing investment decisions and market segment prioritization.

- North America: A mature market characterized by significant ongoing investment in upgrading and maintaining aging infrastructure, with a strong demand for high-precision, automated, and environmentally compliant equipment. Emphasis is often on highway rehabilitation, airport runway modernization, and bridge deck paving, driven by federal and state funding.

- Europe: Driven by strict environmental regulations and a strong focus on sustainable construction practices, leading to widespread adoption of fuel-efficient and low-emission equipment. Demand for advanced machinery for extensive road networks and urban infrastructure projects, complemented by a robust equipment rental market catering to diverse project scales and specialized needs.

- Asia Pacific (APAC): The largest and fastest-growing market globally, fueled by massive government investments in new infrastructure development, rapid urbanization, and industrialization across countries like China, India, and Southeast Asian nations. This region sees high demand for a wide range of paving equipment for extensive new road networks, new airport construction, and ambitious smart city projects.

- Latin America: Experiencing steady growth due to increasing investments in urban development, resource extraction infrastructure, and improving inter-regional connectivity. Market growth is sensitive to regional economic stability, commodity prices, and supportive government policies for construction, with an increasing focus on modernizing transportation arteries.

- Middle East & Africa (MEA): Growth spurred by ambitious development projects in urban centers, commercial hubs, and transportation corridors, especially in GCC countries and parts of Africa. There is significant demand for robust equipment capable of operating efficiently in harsh environmental conditions, often driven by large-scale, government-led infrastructure initiatives and diversification efforts away from oil economies.

- Global South: Characterized by increasing demand for basic and mid-range paving equipment as nations focus on establishing foundational infrastructure and enhancing connectivity. Gradual adoption of advanced technologies is observed as economies develop and construction standards evolve, with a focus on cost-effectiveness and durability for long-term projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Concrete Paving Equipment Market.- Wirtgen Group (John Deere)

- Caterpillar Inc.

- Terex Corporation

- Fayat Group (Bomag, Dynapac)

- Volvo Construction Equipment

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Sany Heavy Industry Co., Ltd.

- GOMACO Corporation

- Power Curbers Inc.

- CMI Roadbuilding Inc.

- Astec Industries, Ltd.

- LiuGong Machinery Co., Ltd.

- Ammann Group

- XCMG Group

- Sumitomo Heavy Industries Construction Crane Co., Ltd.

- Mecalac Group

- Shantui Construction Machinery Co., Ltd.

- ABG (Volvo Construction Equipment subsidiary)

- GEHL (Manitou Group)

- Case Construction Equipment (CNH Industrial N.V.)

Frequently Asked Questions

What are the primary factors driving the growth of the Concrete Paving Equipment Market?

The market is primarily driven by extensive government investments in infrastructure development globally, rapid urbanization leading to increased construction activities, and a growing preference for durable concrete pavements due to their longevity and lower maintenance costs. Technological advancements, particularly in automation and precision guidance, also play a significant role in boosting market growth by enhancing operational efficiency and quality.

How is Artificial Intelligence (AI) influencing concrete paving equipment?

AI is transforming the concrete paving equipment market by enabling autonomous operations, predictive maintenance, and real-time quality control. It optimizes material usage, enhances safety through advanced detection systems, and provides data-driven insights for improved project management, leading to higher efficiency, superior pavement quality, and reduced environmental impact.

What are the main types of concrete paving equipment available?

The main types include high-volume slipform pavers for continuous road construction, specialized curb and gutter machines for urban landscaping, various concrete screeds (vibratory, roller, laser) for precise leveling and finishing, and road wideners. Auxiliary equipment such as texture curing machines, concrete spreaders, and placers also form part of the comprehensive product portfolio addressing diverse paving needs.

Which regions are expected to show the most significant growth in the market?

The Asia Pacific region is anticipated to exhibit the most substantial growth, driven by massive infrastructure projects, rapid urbanization, and industrialization in countries like China, India, and Southeast Asian nations. North America and Europe will see steady demand focused on infrastructure rehabilitation, modernization, and the adoption of technologically advanced, sustainable paving solutions.

What are the key challenges faced by the Concrete Paving Equipment Market?

Key challenges include the high initial capital investment required for advanced machinery, volatility in raw material prices impacting manufacturing and project costs, stringent environmental regulations necessitating costly technological upgrades and compliance, and a persistent shortage of skilled labor to operate and maintain sophisticated equipment effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager