Connected Vehicle Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430307 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Connected Vehicle Services Market Size

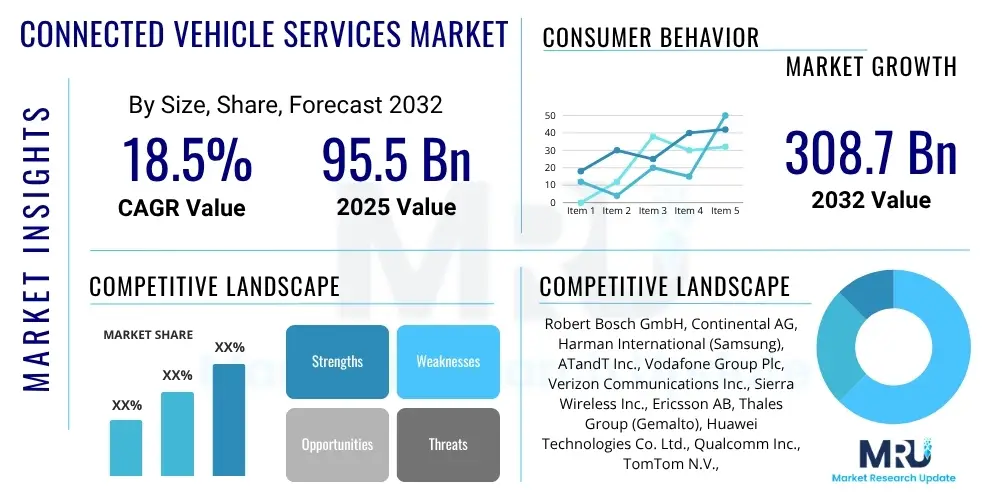

The Connected Vehicle Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 95.5 Billion in 2025 and is projected to reach USD 308.7 Billion by the end of the forecast period in 2032.

Connected Vehicle Services Market introduction

The Connected Vehicle Services Market encompasses a broad spectrum of in-car and external communication technologies designed to enhance driving experience, safety, and efficiency. These services leverage advanced telematics, infotainment systems, and vehicle-to-everything (V2X) communication to connect vehicles with other vehicles, infrastructure, mobile devices, and the cloud. The core product description involves integrating hardware, software, and connectivity solutions within vehicles to offer real-time data exchange, remote control capabilities, and a personalized user experience. This integration facilitates a new era of automotive functionality, moving beyond traditional vehicle capabilities to offer proactive, intelligent, and seamless interactions within the mobility ecosystem.

Major applications of connected vehicle services span across diverse areas, including advanced navigation systems providing real-time traffic updates, remote diagnostics enabling predictive maintenance, in-car infotainment delivering streaming media and internet access, and enhanced safety features such as emergency call services (eCall) and stolen vehicle recovery. Benefits for consumers and businesses are substantial, ranging from improved road safety through collision avoidance systems to increased operational efficiency for fleet management and logistics. The market is propelled by a confluence of driving factors, including the increasing penetration of smartphones, growing consumer demand for advanced connectivity features, stringent government regulations mandating certain safety systems, and significant advancements in 5G network infrastructure and artificial intelligence technologies. These elements collectively foster an environment conducive to robust market expansion.

Connected Vehicle Services Market Executive Summary

The Connected Vehicle Services Market is experiencing transformative business trends driven by the convergence of automotive, telecommunications, and IT industries. Key trends include the shift towards subscription-based service models, the increasing importance of data monetization strategies, and collaborative partnerships between Original Equipment Manufacturers (OEMs), technology providers, and telecom operators. OEMs are focusing on developing proprietary platforms and ecosystems to retain customer loyalty and capture recurring revenue streams, moving beyond traditional vehicle sales. The emphasis on cybersecurity and data privacy continues to grow as the volume and sensitivity of transmitted data increase, necessitating robust security protocols and compliance frameworks. Additionally, the integration of advanced analytics and artificial intelligence is enhancing the intelligence and personalization of these services, creating new value propositions for end-users.

Regional trends indicate North America and Europe as early adopters, characterized by high consumer awareness, robust digital infrastructure, and supportive regulatory environments for connected mobility. These regions are witnessing significant investment in 5G deployment and smart city initiatives, further accelerating market growth. Asia Pacific, particularly countries like China, Japan, and South Korea, is emerging as a dynamic market, driven by rapid urbanization, increasing disposable incomes, and the widespread adoption of digital technologies. Governments in APAC are actively promoting intelligent transportation systems, contributing to the expansion of connected vehicle services. Emerging markets in Latin America and the Middle East & Africa are also demonstrating considerable potential, albeit with slower adoption rates, influenced by nascent infrastructure development and varying regulatory landscapes. However, the increasing demand for enhanced safety and convenience features is expected to fuel growth in these regions over the forecast period.

Segmentation trends highlight the dominance of telematics and infotainment services, driven by strong consumer demand for connectivity and entertainment on the go. However, the remote diagnostics and Over-the-Air (OTA) updates segments are projected to exhibit the highest growth rates, reflecting the industry's shift towards proactive vehicle maintenance and continuous software improvement. In terms of communication type, Vehicle-to-Cloud (V2C) remains prevalent, while Vehicle-to-Everything (V2X) communication, encompassing V2V and V2I, is gaining traction due to its critical role in autonomous driving and intelligent transportation systems. The embedded connectivity solution holds a significant market share due to its reliability and seamless integration, while tethered and integrated solutions cater to diverse consumer preferences for smartphone-driven connectivity. Passenger cars constitute the largest vehicle type segment, though commercial vehicles are increasingly adopting connected services for fleet management and logistics optimization, signifying a diversifying application base across the automotive sector.

AI Impact Analysis on Connected Vehicle Services Market

Users frequently inquire about how artificial intelligence will fundamentally transform their driving experience, focusing on enhancements in vehicle autonomy, safety, and personalized convenience. Common concerns revolve around the reliability and ethical implications of AI systems, particularly concerning decision-making in critical situations, as well as robust data privacy measures. Expectations are high for AI to deliver predictive maintenance capabilities, seamless integration with smart home ecosystems, and more intuitive human-machine interfaces, ultimately making vehicles smarter, safer, and more responsive to individual needs while balancing technological advancement with security and ethical governance.

- Predictive Maintenance: AI algorithms analyze vehicle sensor data to forecast potential component failures, enabling proactive servicing and reducing downtime.

- Personalized User Experience: AI learns driver preferences for navigation, climate control, entertainment, and driving modes, offering tailored in-car environments.

- Enhanced Advanced Driver-Assistance Systems (ADAS): AI improves the accuracy and responsiveness of features like adaptive cruise control, lane-keeping assist, and automatic emergency braking, paving the way for higher levels of autonomy.

- Optimized Traffic Flow and Route Planning: AI processes real-time traffic, weather, and road condition data to suggest optimal routes, reduce congestion, and improve fuel efficiency.

- Advanced Natural Language Processing (NLP): AI-powered voice assistants offer intuitive control over vehicle functions, infotainment, and communication, minimizing driver distraction.

- Cognitive Security Systems: AI detects and responds to cyber threats in real-time, safeguarding connected vehicle systems from unauthorized access and malicious attacks.

- Fleet Management Optimization: AI enhances logistics, route optimization, driver behavior monitoring, and asset utilization for commercial vehicle fleets, leading to significant operational cost reductions.

DRO & Impact Forces Of Connected Vehicle Services Market

The Connected Vehicle Services Market is primarily driven by the escalating demand for enhanced convenience, safety, and efficiency in transportation. Key drivers include the rapid advancement of telecommunication infrastructure, particularly 5G networks, which enable high-speed and low-latency data transfer essential for real-time services and Vehicle-to-Everything (V2X) communication. Additionally, increasing consumer adoption of smartphones and digital services has raised expectations for seamless in-car connectivity and integration with personal devices. Regulatory mandates in various regions for emergency call systems (e.g., eCall in Europe) and other safety features further propel market growth. The ongoing development of autonomous driving technologies heavily relies on robust connected services for sensor data fusion, mapping, and communication with surrounding environments. Furthermore, the automotive industry's strategic shift towards providing software-defined vehicles and recurring revenue streams through subscription services significantly contributes to market expansion. The convergence of IoT, AI, and cloud computing also provides a fertile ground for innovation and the introduction of new value-added services.

Despite strong growth drivers, several restraints challenge the market. Cybersecurity concerns are paramount, as connected vehicles are susceptible to hacking and data breaches, potentially compromising vehicle control, occupant safety, and personal privacy. The complexity and fragmentation of the regulatory landscape across different countries, particularly concerning data ownership, privacy, and spectrum allocation, pose significant hurdles for global service providers. High initial investment costs for developing and implementing connected vehicle infrastructure, both within vehicles and externally (e.g., smart city infrastructure), can deter smaller players and slow adoption in developing regions. Issues surrounding data privacy, including how personal and vehicle data is collected, stored, and utilized, remain a critical concern for consumers and regulators alike. Moreover, the lack of standardized communication protocols and interoperability between different OEM platforms and service providers creates integration complexities and can hinder a unified user experience. The potential for information overload and driver distraction from an abundance of in-car services also presents a safety challenge that needs careful management.

Opportunities for growth are abundant within the Connected Vehicle Services Market, particularly with the widespread deployment of 5G networks which promise to unlock a new generation of ultra-reliable, low-latency applications such as advanced V2X communication for autonomous driving. The expansion of electric vehicles (EVs) creates opportunities for specialized connected services related to charging infrastructure management, battery optimization, and range prediction. The development of advanced artificial intelligence and machine learning capabilities can lead to more personalized, predictive, and proactive services, from intelligent navigation to personalized infotainment and proactive maintenance alerts. The untapped potential in emerging markets, characterized by rapid urbanization and increasing automotive sales, offers significant growth avenues for connected services as infrastructure improves. Furthermore, the increasing focus on smart cities and intelligent transportation systems (ITS) provides a synergistic ecosystem for connected vehicles, integrating them into broader urban mobility solutions. The potential for new business models, such as usage-based insurance, shared mobility services, and in-car commerce, represents lucrative opportunities for market players to diversify revenue streams and enhance customer value. These opportunities, coupled with ongoing technological innovation, are expected to shape the future trajectory of the market significantly.

Segmentation Analysis

The Connected Vehicle Services market is extensively segmented based on various attributes to provide a granular understanding of its diverse landscape. This segmentation allows for targeted strategies and a clear view of where growth and innovation are most pronounced. Key segments include the type of services offered, the underlying communication technologies, the connectivity solutions employed, the end-user demographics, and the specific vehicle types integrating these advanced services. Analyzing these segments helps in identifying distinct market niches, understanding competitive dynamics, and forecasting future trends more accurately within this rapidly evolving industry.

- Service Type:

- Telematics Services:

- Emergency Call (eCall)

- Roadside Assistance

- Stolen Vehicle Recovery

- Remote Diagnostics

- Vehicle Tracking and Monitoring

- Usage-Based Insurance

- Infotainment Services:

- Music and Video Streaming

- Internet Browsing

- Social Media Integration

- App Store Access

- Navigation and Location-Based Services:

- Real-time Traffic Information

- Point of Interest (POI) Search

- Parking Assistance

- Route Optimization

- Over-the-Air (OTA) Updates:

- Software Updates

- Firmware Updates

- Map Updates

- Fleet Management Services:

- Asset Tracking

- Driver Behavior Monitoring

- Fuel Management

- Geofencing

- Telematics Services:

- Communication Type:

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Cloud (V2C)

- Vehicle-to-Device (V2D)

- Vehicle-to-Grid (V2G)

- Vehicle-to-Everything (V2X)

- Connectivity Technology:

- Embedded Connectivity (e.g., built-in modem)

- Tethered Connectivity (e.g., smartphone integration)

- Integrated Connectivity (e.g., after-market solutions)

- End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket Service Providers

- Fleet Operators

- Individual Consumers

- Vehicle Type:

- Passenger Cars

- Commercial Vehicles:

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Electric Vehicles (EVs)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Connected Vehicle Services Market

The value chain for the Connected Vehicle Services Market is intricate, involving multiple layers from component manufacturing to end-user service delivery. At the upstream level, it begins with hardware component suppliers providing essential sensors, embedded modules, communication chips, and onboard computing units. Semiconductor manufacturers play a critical role, supplying the processing power and connectivity chipsets necessary for advanced telematics and infotainment systems. Software developers contribute operating systems, middleware, and application development kits, forming the foundational digital infrastructure. Furthermore, network infrastructure providers, including telecom operators, are vital for providing the cellular and wireless connectivity that underpins all connected services. These upstream activities are foundational, dictating the capabilities and performance of the entire connected vehicle ecosystem.

Moving downstream, Original Equipment Manufacturers (OEMs) integrate these components and software into vehicles, often developing proprietary platforms and user interfaces. Tier 1 suppliers collaborate closely with OEMs to provide integrated systems. Post-vehicle manufacturing, the value chain extends to service providers who deliver various connected services to end-users. This includes telematics service providers (TSPs), infotainment content providers, mapping and navigation solution providers, and IT service companies specializing in data analytics and cloud hosting. Distribution channels are primarily direct through vehicle sales by OEMs, where connected services are often bundled or offered as subscription add-ons. Indirect channels include aftermarket solution providers and third-party application developers who offer supplementary services and devices to existing vehicle owners. The complexity lies in managing data flow, ensuring security, and establishing interoperability across diverse platforms and stakeholders.

The distinction between direct and indirect distribution channels is significant. Direct channels primarily involve OEMs pre-installing or integrating connected services into new vehicles at the point of sale, often offering tiered subscription plans or bundled packages. This ensures a seamless user experience and leverages the vehicle's inherent capabilities. OEMs also maintain direct relationships with customers for updates and support, fostering brand loyalty. Indirect channels, on the other hand, encompass aftermarket solutions where third-party providers offer devices or applications that add connectivity features to older vehicles or supplement existing OEM services. This can include dongles that provide diagnostic data, standalone navigation units, or mobile applications that interact with the vehicle. Telecommunication companies often act as critical intermediaries in both direct and indirect channels by providing the network infrastructure and sometimes even developing their own connected car platforms in partnership with OEMs or directly for consumers. The effectiveness of these channels is heavily influenced by consumer awareness, technological adoption rates, and the evolving regulatory environment, particularly concerning data sharing and privacy.

Connected Vehicle Services Market Potential Customers

The primary potential customers and end-users of Connected Vehicle Services are broadly categorized into individual consumers and commercial entities, each seeking distinct benefits from these advanced technologies. Individual consumers represent a significant market segment, encompassing car buyers and existing vehicle owners who desire enhanced safety features, superior convenience, and a more integrated digital experience within their vehicles. These consumers are driven by factors such as the desire for real-time navigation updates, emergency assistance, in-car entertainment, remote vehicle control capabilities, and the seamless integration of their digital lives with their driving experience. Their purchasing decisions are often influenced by brand reputation, the breadth and quality of services offered, perceived value for money, and the ease of use of the connected features. As vehicle ownership continues to evolve with younger generations increasingly prioritizing technology and connectivity, this demographic is poised to drive sustained demand for comprehensive connected vehicle offerings.

On the commercial front, potential customers include a wide array of businesses and organizations, most notably fleet operators, logistics companies, ride-sharing services, and automotive dealerships. Fleet operators utilize connected vehicle services for crucial functions such as asset tracking, route optimization, fuel management, driver behavior monitoring, and predictive maintenance, all aimed at improving operational efficiency, reducing costs, and enhancing safety across their vehicle fleets. Logistics companies leverage these services to streamline supply chain management, ensure timely deliveries, and comply with regulatory requirements. Ride-sharing and car-sharing platforms integrate connected technologies to manage their vehicle inventory, monitor usage, and enhance the customer experience through features like remote unlocking and keyless access. Furthermore, automotive dealerships and service centers are increasingly becoming end-users of remote diagnostics and OTA update capabilities, allowing them to proactively identify and address vehicle issues, improve service efficiency, and enhance customer satisfaction. Government agencies and municipal bodies also represent potential customers for connected vehicle services, particularly in the context of smart city initiatives and intelligent transportation systems, where data from connected vehicles can be used for traffic management, infrastructure planning, and emergency response optimization. This diverse customer base underscores the broad applicability and transformative potential of connected vehicle technologies across various sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 95.5 Billion |

| Market Forecast in 2032 | USD 308.7 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Harman International (Samsung), ATandT Inc., Vodafone Group Plc, Verizon Communications Inc., Sierra Wireless Inc., Ericsson AB, Thales Group (Gemalto), Huawei Technologies Co. Ltd., Qualcomm Inc., TomTom N.V., Google LLC, Apple Inc., Daimler AG, BMW AG, Ford Motor Company, General Motors Company, Toyota Motor Corporation, Tesla Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connected Vehicle Services Market Key Technology Landscape

The Connected Vehicle Services Market is underpinned by a sophisticated array of technologies that enable seamless communication, data processing, and service delivery within and around the vehicle. Central to this landscape are advanced telematics control units (TCUs) and onboard diagnostic (OBD) systems, which serve as the primary interfaces for data collection and transmission. These units are equipped with embedded modems, GPS modules, and various sensors that gather critical vehicle parameters, location data, and driving behavior metrics. The evolution of semiconductor technology, particularly in high-performance computing chips and low-power communication modules, has been instrumental in making these in-vehicle systems more powerful and efficient. Furthermore, the increasing integration of sophisticated sensor arrays, including radar, lidar, and cameras, is crucial for supporting advanced driver-assistance systems (ADAS) and paving the way for autonomous driving capabilities, all of which rely heavily on real-time data processing and communication facilitated by connected services.

Communication technologies form the backbone of connected vehicle services. Cellular networks, primarily 4G LTE and increasingly 5G, provide the wide-area connectivity necessary for vehicle-to-cloud (V2C) communication, enabling services like remote diagnostics, infotainment streaming, and over-the-air (OTA) updates. The deployment of 5G is particularly transformative, offering ultra-low latency and high bandwidth that are critical for Vehicle-to-Everything (V2X) communication, including direct Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) interactions essential for collision avoidance and intelligent traffic management. Short-range communication technologies like Wi-Fi and Bluetooth facilitate in-car connectivity for passenger devices and enable localized data exchange. Beyond direct vehicle communication, cloud computing platforms are fundamental for processing and storing the vast amounts of data generated by connected vehicles. These platforms leverage big data analytics and artificial intelligence (AI) and machine learning (ML) algorithms to derive actionable insights, enabling predictive maintenance, personalized services, and advanced fleet management solutions. Secure software over-the-air (SOTA) and firmware over-the-air (FOTA) update capabilities are also crucial, ensuring vehicles remain up-to-date with the latest features, security patches, and performance enhancements throughout their lifecycle, effectively transforming vehicles into software-defined platforms.

Regional Highlights

- North America: This region stands as a prominent market for connected vehicle services, driven by high consumer purchasing power, significant investments in advanced digital infrastructure, and a strong presence of major automotive OEMs and technology providers. Strict government mandates regarding vehicle safety, such as the implementation of eCall-like systems, have further accelerated adoption. The United States and Canada lead in telematics and infotainment services, with a growing focus on V2X communication as autonomous driving technologies advance. Early adoption of 5G networks in urban centers is also stimulating innovation and the deployment of new, high-bandwidth services.

- Europe: Europe is a highly mature market, characterized by stringent environmental regulations, a strong emphasis on road safety, and pioneering smart city initiatives. Countries like Germany, the UK, and France are at the forefront, with significant R&D investments in autonomous driving and V2X technologies. The mandatory eCall system has significantly boosted the telematics segment. European consumers show a high willingness to adopt advanced in-car technologies that enhance safety, convenience, and sustainability, while data privacy regulations like GDPR heavily influence service development and data handling practices.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for connected vehicle services, fueled by rapid urbanization, increasing disposable incomes, and the burgeoning automotive industry, particularly in China, Japan, South Korea, and India. Governments in these countries are actively promoting intelligent transportation systems and smart infrastructure development. China, in particular, is a leader in 5G deployment and electric vehicle adoption, creating a fertile ground for connected services. The region also benefits from a technologically savvy consumer base eager for advanced infotainment and navigation solutions, alongside a growing commercial vehicle sector utilizing fleet management services.

- Latin America: This region presents an emerging market with significant growth potential, although adoption rates are currently slower compared to more developed regions. Brazil and Mexico are leading the adoption, driven by increasing smartphone penetration and the demand for basic telematics services like vehicle tracking and stolen vehicle recovery, primarily for security purposes. Infrastructure development and regulatory harmonization are key factors that will influence the pace of market expansion in the coming years, as consumers gradually embrace more advanced connectivity features.

- Middle East and Africa (MEA): The MEA region is also an emerging market, with growth primarily concentrated in affluent Gulf Cooperation Council (GCC) countries such as Saudi Arabia and the UAE. These nations are investing heavily in smart city projects and digital transformation, which provide a conducive environment for connected vehicle services. Demand for luxury vehicles equipped with advanced connectivity features is a significant driver. In other parts of Africa, the market is nascent, driven mainly by fleet management solutions for commercial vehicles and basic telematics for security, with considerable scope for future development as digital infrastructure improves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connected Vehicle Services Market.- Robert Bosch GmbH

- Continental AG

- Harman International (Samsung)

- ATandT Inc.

- Vodafone Group Plc

- Verizon Communications Inc.

- Sierra Wireless Inc.

- Ericsson AB

- Thales Group (Gemalto)

- Huawei Technologies Co. Ltd.

- Qualcomm Inc.

- TomTom N.V.

- Google LLC

- Apple Inc.

- Daimler AG

- BMW AG

- Ford Motor Company

- General Motors Company

- Toyota Motor Corporation

- Tesla Inc.

Frequently Asked Questions

Analyze common user questions about the Connected Vehicle Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Connected Vehicle Services?

Connected Vehicle Services refer to a suite of technologies and applications that enable vehicles to communicate with other vehicles, infrastructure, mobile devices, and the cloud. These services enhance safety, convenience, and efficiency through features like telematics, infotainment, navigation, and remote diagnostics, transforming the driving experience.

How does 5G technology impact Connected Vehicle Services?

5G technology significantly enhances Connected Vehicle Services by providing ultra-high bandwidth, extremely low latency, and increased network capacity. This enables more reliable V2X communication, real-time data exchange for autonomous driving, high-definition infotainment streaming, and faster Over-the-Air updates, unlocking new possibilities for advanced mobility solutions.

What are the main benefits of Connected Vehicle Services?

The primary benefits include improved road safety through emergency calling and collision avoidance, enhanced convenience via real-time navigation and remote control, greater efficiency with fleet management and predictive maintenance, and a superior in-car experience through advanced infotainment and personalized settings.

What are the key challenges facing the Connected Vehicle Services market?

Key challenges involve ensuring robust cybersecurity against hacking, addressing data privacy concerns regarding personal and vehicle data, managing complex and fragmented regulatory landscapes across different regions, and overcoming high initial investment costs for infrastructure and system integration.

How do Connected Vehicle Services ensure data privacy and security?

Connected Vehicle Services implement multi-layered security measures including encryption, secure boot processes, intrusion detection systems, and secure communication protocols to protect data in transit and at rest. Companies also adhere to strict data privacy regulations, offering transparent policies and user controls over data collection and usage to build consumer trust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager