Construction Accounting Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430145 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Construction Accounting Software Market Size

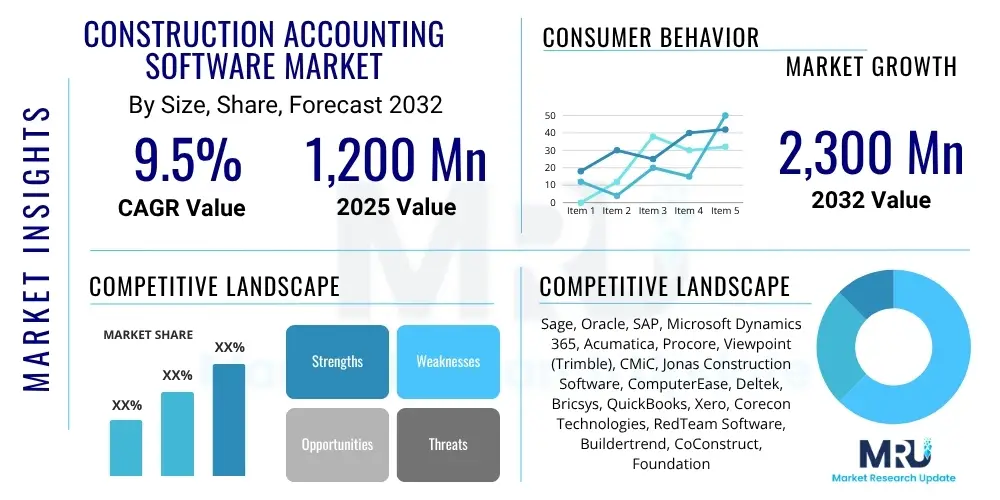

The Construction Accounting Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 1,200 Million in 2025 and is projected to reach USD 2,300 Million by the end of the forecast period in 2032.

Construction Accounting Software Market introduction

The Construction Accounting Software market encompasses specialized financial management solutions designed to meet the unique requirements of the construction industry. These solutions go beyond generic accounting by integrating project costing, job management, contract administration, payroll for diverse workforces, and compliance with industry-specific regulations. The primary product offering involves robust platforms that streamline complex financial processes, from bidding and budgeting to progress billing, change order management, and final project closeout. Major applications include tracking project expenses against budgets, managing subcontractor payments, facilitating payroll for varying hourly rates and benefits, handling equipment depreciation, and ensuring financial transparency across multiple projects. The core benefits derived from adopting these systems include enhanced financial accuracy, improved project profitability analysis, better cash flow management, reduced administrative overhead, and superior decision-making capabilities through real-time data access. Key driving factors propelling market growth include the increasing complexity of construction projects, the growing need for digital transformation within the industry, stringent regulatory compliance, and a strong demand for integrated solutions that offer end-to-end financial visibility and control, ultimately leading to greater operational efficiency and competitive advantage for construction firms.

Construction Accounting Software Market Executive Summary

The Construction Accounting Software market is experiencing robust growth, driven by a confluence of evolving business trends, significant regional expansion, and diversification across key segments. Business trends indicate a strong shift towards cloud-based solutions, offering greater accessibility, scalability, and collaboration capabilities for geographically dispersed project teams. There is also an increasing demand for integrated platforms that combine accounting with project management, human resources, and supply chain functions, providing a holistic view of operations and improving data consistency. Furthermore, the imperative for real-time financial insights to manage complex project costs and mitigate risks is accelerating adoption rates among construction companies of all sizes. The industry is also witnessing a greater focus on automation of routine financial tasks, such as invoicing and reconciliation, to enhance efficiency and reduce human error, thereby allowing finance teams to focus on strategic analysis rather than manual data entry.

Regional trends reveal North America and Europe as mature markets with high adoption rates, primarily due to established infrastructure, early technological adoption, and a strong regulatory environment driving compliance needs. However, the Asia Pacific region is emerging as a significant growth hub, propelled by rapid urbanization, substantial infrastructure development projects, and increasing awareness among local contractors regarding the benefits of digital accounting solutions. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as construction activities increase and companies seek to modernize their financial operations to compete more effectively on a global scale. Government initiatives promoting digitalization and foreign investments in infrastructure projects are further catalyzing market expansion in these developing regions, leading to a diversified geographical spread of market opportunities and competitive landscapes.

Segment trends underscore the dominance of small and medium enterprises (SMEs) as a major growth engine, as these businesses increasingly recognize the value of specialized software for scaling operations and improving financial control, often opting for user-friendly, cloud-based solutions. Large enterprises, conversely, continue to invest in comprehensive, often customized, enterprise resource planning (ERP) systems that include sophisticated construction accounting modules to handle complex multi-project environments. The market is also segmented by deployment type, with cloud-based solutions gaining significant traction due to their flexibility and lower upfront costs, while on-premise solutions remain vital for organizations with specific data security and customization requirements. Functionally, demand is high for modules focusing on project costing, payroll, and sub-contractor management, reflecting the core operational needs of the construction industry. This dynamic interplay of trends positions the market for sustained expansion, fostering innovation in product development and service delivery across the global construction landscape.

AI Impact Analysis on Construction Accounting Software Market

Users frequently inquire about how Artificial Intelligence will revolutionize efficiency, accuracy, and strategic insights within construction accounting, often expressing concerns about job displacement versus augmentation, data security, and the practicality of integration. Key themes revolve around leveraging AI for predictive analytics, automating repetitive tasks, improving risk management, and enhancing overall financial transparency. Users expect AI to move beyond basic data processing to offer proactive recommendations for cost optimization, identify potential project overruns before they occur, and streamline complex compliance processes. There is a strong expectation that AI will transform financial reporting into a more dynamic and less labor-intensive activity, providing real-time, actionable intelligence to project managers and executives, ultimately leading to more informed decision-making and improved project profitability. The integration of AI is seen as a crucial step towards creating more intelligent, self-optimizing financial systems tailored to the specific demands of the construction industry, addressing its inherent complexities with advanced analytical capabilities.

- Automated Data Entry and Reconciliation: AI algorithms can significantly reduce manual effort by automatically classifying transactions, reconciling bank statements, and flagging discrepancies, leading to higher accuracy and efficiency.

- Predictive Analytics for Cost Overruns: AI can analyze historical project data, identify patterns, and predict potential cost overruns or budget variances in real-time, allowing proactive intervention and better financial planning.

- Enhanced Risk Management: AI tools can assess project risks by analyzing contracts, supplier performance, and market conditions, providing early warnings and supporting informed decision-making to mitigate financial exposures.

- Optimized Cash Flow Forecasting: Machine learning models can process vast amounts of financial data to generate more accurate cash flow predictions, helping construction firms manage liquidity and working capital more effectively.

- Intelligent Audit and Compliance: AI can automate parts of the auditing process by identifying anomalies and ensuring adherence to complex regulatory standards and contract terms, reducing compliance costs and increasing assurance.

- Improved Subcontractor and Vendor Management: AI can evaluate subcontractor performance, payment terms, and compliance history, optimizing selection processes and facilitating smoother payment cycles.

- Automated Invoice Processing: AI-powered optical character recognition (OCR) and natural language processing (NLP) can automate the extraction of data from invoices, accelerating processing times and reducing errors in accounts payable.

- Personalized Financial Insights: AI can tailor financial dashboards and reports to specific user roles, providing relevant and actionable insights for project managers, finance officers, and executive leadership.

- Smart Budgeting and Bidding: AI can assist in creating more accurate project budgets and competitive bids by analyzing historical costs, market data, and resource availability, leading to more profitable contracts.

DRO & Impact Forces Of Construction Accounting Software Market

The Construction Accounting Software market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that collectively dictate its growth trajectory and competitive landscape. A primary driver is the escalating complexity of modern construction projects, which demand precise financial tracking, intricate cost management, and meticulous compliance with ever-evolving regulatory frameworks. Construction companies, regardless of size, are increasingly recognizing that generic accounting software is inadequate for their specialized needs, pushing them towards industry-specific solutions that offer functionalities like job costing, progress billing, and equipment management. The widespread digital transformation initiatives across industries, coupled with a growing emphasis on real-time data for informed decision-making, further accelerate the adoption of advanced accounting platforms. Moreover, the imperative to enhance operational efficiency, reduce administrative overheads, and improve overall project profitability also serves as a strong impetus for investment in sophisticated construction accounting software, as it provides tools to streamline financial workflows, automate repetitive tasks, and minimize errors, thereby driving demand significantly across all market segments.

Despite these robust drivers, the market faces several significant restraints. High initial implementation costs, especially for comprehensive enterprise-level solutions, can be a major barrier for smaller construction firms or those with limited IT budgets. The complexity of integrating new accounting software with existing legacy systems, which are prevalent in the traditionally conservative construction industry, often poses technical and operational challenges, leading to reluctance in adoption. Furthermore, the steep learning curve associated with specialized software and a shortage of skilled personnel proficient in managing and utilizing these advanced systems can hinder smooth transitions and optimal utilization. Data security concerns, particularly with cloud-based solutions, also act as a restraint, as construction firms handle sensitive financial information and are wary of potential breaches. Resistance to change among employees accustomed to traditional methods and a lack of awareness regarding the specific benefits of advanced construction accounting software further contribute to market limitations, requiring extensive educational efforts from vendors to overcome these ingrained obstacles and facilitate broader market penetration.

Opportunities within this market are abundant and varied, particularly stemming from the rapid advancements in cloud computing, which enable flexible, scalable, and cost-effective deployment options, making sophisticated solutions accessible to a wider range of companies, including small and medium-sized enterprises (SMEs). The integration of emerging technologies like Artificial Intelligence (AI), Machine Learning (ML), and Business Intelligence (BI) into accounting software presents substantial opportunities for offering predictive analytics, automated insights, and enhanced decision support capabilities, moving beyond traditional record-keeping to proactive financial management. The increasing global investment in infrastructure projects, particularly in developing economies, opens up new geographical markets for software vendors. Moreover, the trend towards offsite construction, modular building, and sustainable practices introduces new accounting complexities that specialized software can address, creating niche opportunities. Developing user-friendly interfaces, offering tailored solutions for specific construction niches (e.g., residential, commercial, heavy civil), and providing comprehensive training and support services also represent significant avenues for market expansion and competitive differentiation, allowing providers to capture new market shares and foster long-term customer relationships by addressing evolving industry needs effectively.

Segmentation Analysis

The Construction Accounting Software market is comprehensively segmented to provide a detailed understanding of its diverse landscape and to identify specific opportunities within various sub-sectors. This segmentation allows for a targeted analysis of customer needs, technological preferences, and operational requirements across different types of construction businesses and deployment models. The primary segmentation dimensions include deployment type, enterprise size, application, and end-user, each offering unique insights into market dynamics and growth potential. Analyzing these segments helps vendors tailor their product offerings, marketing strategies, and service delivery to better serve specific client demographics, leading to more effective market penetration and sustained business growth. Understanding these distinctions is critical for both market players and stakeholders seeking to make informed decisions regarding investment, product development, and strategic partnerships, ensuring that solutions are precisely aligned with the evolving demands of the global construction industry. This granular approach to market analysis ensures that all critical factors influencing adoption and utilization are considered.

- Deployment Type:

- Cloud-based: Solutions hosted on remote servers and accessed via the internet, offering scalability, flexibility, and reduced upfront IT infrastructure costs.

- On-premise: Software installed and run on local servers within a company's own IT infrastructure, providing greater control over data and customization capabilities.

- Enterprise Size:

- Small and Medium Enterprises (SMEs): Companies with smaller workforces and revenue, often seeking cost-effective, user-friendly solutions with essential accounting functionalities.

- Large Enterprises: Major construction firms with complex operations, multiple projects, and high revenue, requiring comprehensive, integrated solutions with advanced features and customization.

- Application:

- Project Management: Features for tracking project progress, scheduling, resource allocation, and job costing.

- Financial Management: Core accounting functions including general ledger, accounts payable, accounts receivable, and financial reporting.

- Payroll Management: Handling wages, benefits, taxes, and compliance for diverse construction workforces.

- Equipment Management: Tracking usage, maintenance, depreciation, and costs of construction equipment.

- Inventory Management: Managing materials, supplies, and tools across projects and warehouses.

- Service Management: For companies offering maintenance or post-construction services, managing work orders and client contracts.

- End-User:

- General Contractors: Firms responsible for the overall management and execution of construction projects.

- Specialty Contractors: Companies focusing on specific trades like electrical, plumbing, HVAC, or roofing.

- Heavy Construction: Businesses involved in large-scale infrastructure projects such as roads, bridges, and dams.

- Real Estate Developers: Entities involved in acquiring land, financing, constructing, and selling properties.

Value Chain Analysis For Construction Accounting Software Market

The value chain for the Construction Accounting Software market begins with upstream activities primarily focused on research and development (RD) and technology infrastructure. This initial phase involves software developers, data scientists, and industry experts collaborating to design, build, and continually enhance the core software functionalities, incorporating advanced features like AI, cloud capabilities, and robust data security protocols. Key upstream suppliers include providers of operating systems, database management systems, cloud infrastructure services (such as AWS, Azure, Google Cloud), and various programming language tools and frameworks. Strategic partnerships with these technology providers are crucial for ensuring the scalability, reliability, and innovation of the accounting software solutions. The quality and security of these foundational components directly impact the performance and trustworthiness of the final product, influencing subsequent stages of the value chain. Continuous investment in RD is vital to keep pace with technological advancements and evolving industry demands.

The midstream activities encompass software development, testing, and deployment. This stage involves the actual coding, quality assurance, bug fixing, and the creation of user interfaces that are intuitive and industry-specific. Marketing and sales efforts also play a critical role here, as vendors engage in lead generation, product demonstrations, and crafting compelling value propositions to attract potential customers. Deployment and implementation services, which often involve customizing the software to meet specific client requirements, data migration from legacy systems, and integration with other enterprise tools, are also central to this phase. These services are typically delivered by the software vendors themselves or through their certified implementation partners. Training and support services are equally important, ensuring that end-users can effectively utilize the software and maximize its benefits. The efficiency and effectiveness of these midstream processes directly influence customer satisfaction and the overall success of the software adoption, contributing significantly to the perceived value of the solution in the marketplace.

Downstream activities primarily involve distribution channels and direct engagement with end-users. Distribution channels for construction accounting software can be broadly categorized into direct and indirect methods. Direct distribution involves vendors selling their software directly to construction companies through their in-house sales teams, online portals, or dedicated account managers. This approach allows for direct communication, deeper understanding of client needs, and more personalized service. Indirect channels involve partnerships with value-added resellers (VARs), system integrators, and independent software vendors (ISVs) who bundle the accounting software with other services or solutions, offering a more comprehensive package to clients. These partners often have existing relationships with construction firms and can provide localized support and expertise. Post-sales support, maintenance, and ongoing updates are also critical downstream activities, ensuring long-term customer retention and fostering a loyal user base. Effective downstream strategies are vital for reaching a broad customer base, ensuring widespread adoption, and sustaining market presence in a competitive environment, ultimately concluding the value delivery to the construction firms.

Construction Accounting Software Market Potential Customers

The potential customers for Construction Accounting Software are broadly categorized by their operational scale, specialization, and specific financial management needs within the construction industry. These end-users are primarily construction companies of all sizes, ranging from small, family-owned businesses to multinational conglomerates managing large-scale infrastructure projects. Small and medium-sized enterprises (SMEs) represent a significant customer segment, as they often seek integrated, easy-to-use, and affordable solutions to manage their financials without the need for extensive IT departments. They typically require features like basic job costing, subcontractor payment tracking, and simple payroll, focusing on improving efficiency and accuracy to compete effectively with larger firms. For these businesses, the ability to gain clear financial visibility and streamline administrative tasks is paramount, driving their adoption of cloud-based or modular software solutions that offer scalability as they grow.

Large enterprises, on the other hand, including major general contractors, heavy civil construction firms, and large specialty contractors, constitute another critical segment. These organizations operate complex financial ecosystems, often managing hundreds of projects simultaneously with diverse funding sources, multiple legal entities, and extensive supply chains. Their requirements extend to advanced functionalities such as sophisticated project cost control, complex contract management, multi-company consolidation, robust compliance reporting, and deep integration with ERP systems, project management tools, and HR platforms. These customers often opt for comprehensive, highly customizable on-premise or private cloud solutions that can handle their vast data volumes and intricate workflows, ensuring stringent financial control and providing strategic insights for large-scale operations and investment decisions. The need for real-time, consolidated financial reporting across global operations is a key driver for this segment, ensuring transparency and accountability.

Beyond general and large contractors, the market also serves various specialized end-users. Specialty contractors, such as electricians, plumbers, HVAC installers, roofers, and landscapers, require software that can manage specific aspects of their trade, including material tracking, service calls, and specialized billing practices. Real estate developers are also key potential customers, needing robust accounting software to manage property acquisition costs, development expenses, tenant billing, and property management financials. Government agencies and public works departments involved in infrastructure development also utilize specialized accounting software for budget tracking, grant management, and compliance with public procurement regulations. These diverse customer profiles highlight the broad applicability of construction accounting software, emphasizing the need for flexible, scalable, and customizable solutions that can cater to the distinct operational and financial demands across the entire construction ecosystem, from ground-up builds to specialized installations and long-term maintenance contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1,200 Million |

| Market Forecast in 2032 | USD 2,300 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sage, Oracle, SAP, Microsoft Dynamics 365, Acumatica, Procore, Viewpoint (Trimble), CMiC, Jonas Construction Software, ComputerEase, Deltek, Bricsys, QuickBooks, Xero, Corecon Technologies, RedTeam Software, Buildertrend, CoConstruct, Foundation Software, Explorer Software |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Accounting Software Market Key Technology Landscape

The technological landscape of the Construction Accounting Software market is rapidly evolving, driven by the demand for more efficient, integrated, and intelligent financial management solutions. Cloud computing stands as a foundational technology, enabling Software-as-a-Service (SaaS) delivery models that offer unparalleled scalability, accessibility, and cost-effectiveness. This allows construction firms to access their financial data from any location, fostering collaboration among distributed project teams and reducing the need for significant upfront IT infrastructure investments. Cloud platforms also facilitate automatic updates and maintenance, ensuring that users always have access to the latest features and security patches without manual intervention. The adoption of robust cloud infrastructure ensures high availability, disaster recovery, and data security, which are critical considerations for handling sensitive financial information, further solidifying its role as a core technology in the market's progression and wide-scale adoption among diverse construction businesses looking to modernize their operations and improve financial agility.

Beyond cloud infrastructure, Artificial Intelligence (AI) and Machine Learning (ML) are becoming increasingly pivotal, transforming traditional accounting processes into intelligent, predictive operations. AI-powered features are utilized for automating repetitive tasks such as invoice processing through optical character recognition (OCR), bank reconciliation, and expense categorization, significantly reducing manual effort and minimizing human error. ML algorithms contribute to predictive analytics, enabling software to forecast cash flows, identify potential project cost overruns, and detect anomalies in financial transactions, thereby enhancing risk management and supporting proactive decision-making. Business Intelligence (BI) and advanced analytics tools are also integral, providing users with customizable dashboards and real-time reporting capabilities. These tools allow construction executives and project managers to gain deep insights into project profitability, budget adherence, and overall financial performance, facilitating strategic planning and operational adjustments in a timely and data-driven manner, thus moving beyond retrospective analysis to forward-looking strategic management.

Furthermore, the integration of enterprise resource planning (ERP) systems is a critical technological trend, as construction accounting software is increasingly becoming a module within broader ERP suites. This integration facilitates a seamless flow of data between accounting, project management, human resources, supply chain, and customer relationship management (CRM) functionalities, providing a holistic view of the construction enterprise. Mobile technology also plays a crucial role, with dedicated mobile applications allowing field personnel to track labor hours, expenses, and materials directly from job sites, ensuring real-time data capture and improving accuracy. Blockchain technology is emerging as a disruptive force, offering potential for enhanced transparency and security in managing payments, contracts, and supply chain transactions, reducing fraud and disputes. Application Programming Interfaces (APIs) are essential for enabling interoperability between different software solutions, allowing construction firms to build a customized tech stack that meets their specific needs, thereby fostering an ecosystem of interconnected tools and streamlining complex workflows across the entire construction project lifecycle.

Regional Highlights

- North America: As a mature market, North America exhibits high adoption rates driven by a strong focus on digital transformation, robust regulatory compliance, and a competitive landscape pushing for operational efficiency. The presence of numerous key players and early technology adopters contributes to continuous innovation and demand for advanced integrated solutions. The region benefits from substantial investments in both residential and commercial infrastructure, compelling construction firms to utilize sophisticated accounting tools for stringent financial control and project profitability.

- Europe: Europe showcases consistent growth, with increasing digitalization initiatives and a strong emphasis on sustainability and energy efficiency in construction, which adds complexity to financial tracking. Western European countries are early adopters, while Eastern European nations are rapidly catching up, driven by infrastructure development and foreign investments. The demand for cloud-based solutions is particularly high due to their flexibility and scalability, supporting cross-border projects and varied regulatory environments across the EU.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, significant government spending on infrastructure projects (e.g., China's Belt and Road Initiative, India's smart cities), and a burgeoning middle class driving residential and commercial construction. Increasing awareness of the benefits of specialized software among local contractors, coupled with a growing number of tech-savvy construction firms, fuels demand. Lower adoption costs for cloud solutions make them particularly appealing in this diverse and dynamic region.

- Latin America: The Latin American market is characterized by increasing foreign direct investment in infrastructure and a gradual shift towards modern construction practices. Economic stabilization in some countries and a rising middle class contribute to construction growth, thereby increasing the need for professional financial management tools. While adoption is still in early stages compared to more mature markets, the potential for growth is substantial as awareness and digital literacy improve across the region's construction sector.

- Middle East and Africa (MEA): MEA is witnessing significant construction booms, particularly in the GCC countries (e.g., UAE, Saudi Arabia) driven by mega-projects and diversification efforts away from oil economies. This region presents substantial opportunities for construction accounting software as firms seek to manage large, complex projects efficiently and transparently. African nations are also showing promising growth as urbanization and infrastructure development gain momentum, though challenges like internet penetration and IT infrastructure still need to be addressed for widespread adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Accounting Software Market.- Sage

- Oracle

- SAP

- Microsoft Dynamics 365

- Acumatica

- Procore

- Viewpoint (Trimble)

- CMiC

- Jonas Construction Software

- ComputerEase

- Deltek

- Bricsys

- QuickBooks

- Xero

- Corecon Technologies

- RedTeam Software

- Buildertrend

- CoConstruct

- Foundation Software

- Explorer Software

Frequently Asked Questions

What is Construction Accounting Software?

Construction Accounting Software is specialized financial management software designed to meet the unique needs of the construction industry, integrating features like job costing, project management, payroll, and equipment tracking to streamline financial operations and improve profitability.

How does Construction Accounting Software benefit my business?

It provides benefits such as enhanced financial accuracy, real-time insights into project profitability, better cash flow management, reduced administrative costs, improved compliance with regulations, and superior decision-making through comprehensive financial data.

What are the key features to look for in Construction Accounting Software?

Essential features include robust job costing, progress billing, accounts payable/receivable, payroll management, subcontractor management, equipment tracking, financial reporting, and integration capabilities with other project management tools.

Is cloud-based or on-premise software better for construction accounting?

Cloud-based software offers flexibility, scalability, remote access, and lower upfront costs, ideal for SMEs and distributed teams. On-premise solutions provide greater data control and customization, often preferred by large enterprises with specific IT requirements and security needs.

How is AI impacting the Construction Accounting Software market?

AI is significantly impacting the market by automating data entry, enhancing predictive analytics for cost overruns, improving cash flow forecasting, and streamlining audit and compliance processes, leading to greater efficiency and strategic insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager