Construction Equipment Engines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430004 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Construction Equipment Engines Market Size

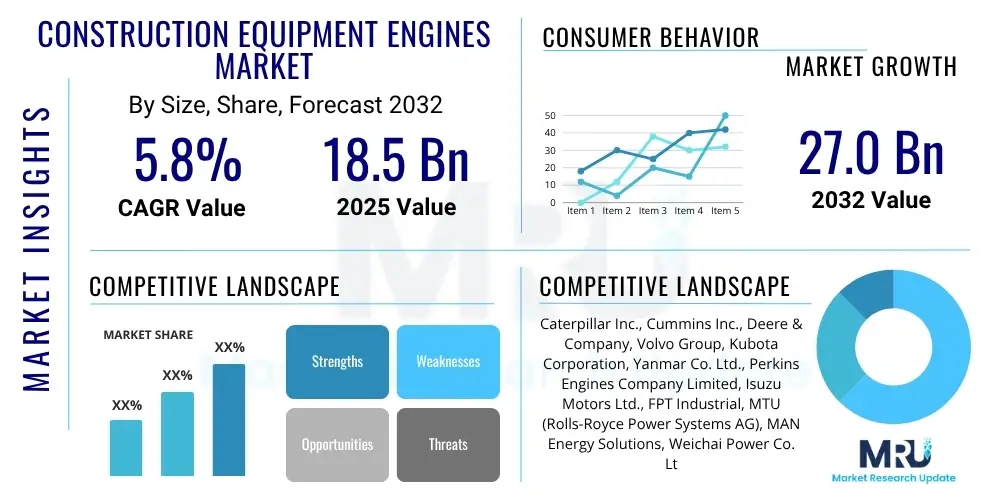

The Construction Equipment Engines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $27.0 Billion by the end of the forecast period in 2032.

Construction Equipment Engines Market introduction

The Construction Equipment Engines Market encompasses the design, manufacturing, and distribution of power units specifically engineered for various heavy machinery used in the construction sector. These engines are the core power source for equipment ranging from excavators, loaders, dozers, and cranes to compact utility machines. Product descriptions typically highlight attributes such as horsepower, torque, fuel efficiency, emissions compliance, and durability under harsh operating conditions. Major applications span residential, commercial, and industrial construction, road building, infrastructure development, and mining. The primary benefits include enabling powerful and efficient operation of heavy machinery, contributing significantly to project timelines and operational productivity. Key driving factors for this market include global infrastructure investments, increasing urbanization, and the continuous demand for advanced, fuel-efficient, and low-emission engine technologies.

Construction Equipment Engines Market Executive Summary

The Construction Equipment Engines Market is experiencing dynamic shifts driven by evolving business trends, significant regional developments, and distinct segment transformations. Business trends indicate a strong move towards sustainability, with manufacturers heavily investing in cleaner engine technologies, including hybrid and electric powertrains, to meet stringent global emission standards. There is also a growing emphasis on digital integration, suchetics, and predictive maintenance solutions, enhancing operational efficiency and reducing downtime for construction fleets. Regionally, Asia Pacific continues to be the primary growth engine, fueled by extensive infrastructure projects and rapid urbanization, while North America and Europe demonstrate a consistent demand for advanced, high-performance engines amidst strict regulatory landscapes. Segment-wise, diesel engines maintain dominance due to their robust performance, but alternative fuel and electric options are gaining traction, particularly in compact and urban equipment. The market is also witnessing a trend towards modular engine designs, offering greater flexibility and easier maintenance for equipment manufacturers.

AI Impact Analysis on Construction Equipment Engines Market

Common user questions regarding the impact of AI on the Construction Equipment Engines Market frequently revolve around how artificial intelligence can enhance engine performance, optimize maintenance schedules, and contribute to the autonomy of heavy machinery. Users are keen to understand AI's role in improving fuel efficiency, reducing emissions through smarter engine management, and extending engine lifespans via predictive analytics. Furthermore, there is significant interest in how AI can enable self-diagnostics, remote monitoring, and ultimately, autonomous or semi-autonomous operation of construction equipment, leading to increased safety and productivity on job sites. Concerns often include the cost of AI integration, data security, the need for skilled personnel to manage AI-driven systems, and the reliability of these advanced technologies in harsh construction environments. The overarching expectation is that AI will revolutionize engine operation, maintenance, and overall equipment management, making construction operations more efficient, sustainable, and intelligent.

- Enhanced predictive maintenance and diagnostics, reducing downtime.

- Optimized fuel efficiency through real-time engine parameter adjustments.

- Integration with autonomous systems for improved operational precision and safety.

- Data analytics for performance monitoring and operational insights.

- Smarter engine control to meet stringent emission standards more effectively.

- Remote monitoring and fault detection capabilities.

- Personalized operator assistance and training systems.

DRO & Impact Forces Of Construction Equipment Engines Market

The Construction Equipment Engines Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and competitive forces that shape its growth trajectory and operational landscape. Key drivers include accelerating global infrastructure development, rapid urbanization, significant government investments in public works, and the continuous demand for higher productivity and efficiency in construction operations. These factors fuel the need for robust, reliable, and technologically advanced engines capable of enduring demanding conditions. However, the market faces significant restraints, primarily stringent global emission regulations that necessitate substantial R&D investments in cleaner engine technologies, alongside the volatile pricing of raw materials and the high initial capital expenditure associated with modern, compliant engines. Opportunities arise from the burgeoning demand for hybrid and electric powertrains, the integration of advanced telematics and IoT solutions for enhanced engine management, and the expansion into emerging markets. The impact forces manifest through intense competition among leading manufacturers, the bargaining power of major equipment OEMs, the influence of component suppliers, the threat of alternative power sources, and regulatory pressures.

Drivers for market expansion are predominantly centered on the global economic outlook and governmental policies. Infrastructure projects, particularly in developing nations, represent a massive underlying demand for construction machinery and, consequently, their engines. The push for smart cities and sustainable development also necessitates modern equipment with advanced engines. Restraints present ongoing challenges for manufacturers. Adhering to standards such as EPA Tier 4 Final and EU Stage V requires constant innovation, which adds to manufacturing costs and can impact market pricing. The supply chain for critical engine components can also be susceptible to global disruptions, affecting production schedules and profitability. Furthermore, the specialized nature of these engines means a high barrier to entry for new players, but established manufacturers must continuously innovate to retain market share and address environmental concerns.

The opportunities within the market are substantial, particularly concerning technological advancements. The shift towards electrification and hybridization is not merely a regulatory compliance issue but a significant growth area, driven by fuel cost savings and reduced environmental impact. Smart engines equipped with IoT capabilities offer new avenues for service, maintenance, and operational efficiency improvements, creating value-added propositions for end-users. Impact forces such as the competitive landscape compel companies to focus on product differentiation through superior performance, durability, and after-sales service. The power dynamics within the value chain, from raw material suppliers to original equipment manufacturers (OEMs) and rental companies, also play a crucial role in pricing, innovation cycles, and market penetration strategies. Manufacturers must adeptly navigate these forces to secure a sustainable competitive advantage and capitalize on emerging market trends.

Segmentation Analysis

The Construction Equipment Engines Market is segmented across various critical parameters, providing a detailed understanding of market dynamics and consumer preferences. These segments categorize engines based on their core technological principles, power output capabilities, fuel consumption characteristics, and the specific types of construction machinery they power. This granular segmentation allows for targeted market analysis, identifying high-growth areas, and understanding the specific requirements of different end-user applications. The primary segmentation criteria include engine type, horsepower, fuel type, and application, each offering distinct insights into market demand and technological evolution.

- By Engine Type:

- Diesel Engines

- Gasoline Engines

- Natural Gas Engines

- Electric/Hybrid Engines

- By Horsepower (HP):

- Less than 100 HP

- 100-400 HP

- Above 400 HP

- By Fuel Type:

- Diesel

- Gasoline

- CNG/LPG

- Electric

- Hybrid

- By Application:

- Excavators

- Loaders (Wheel Loaders, Skid Steer Loaders)

- Dozers

- Graders

- Cranes

- Compactors

- Material Handlers

- Other Construction Equipment

Value Chain Analysis For Construction Equipment Engines Market

The value chain for the Construction Equipment Engines Market is a multifaceted network encompassing several stages, from the procurement of raw materials to the final deployment and aftermarket support. Upstream analysis involves raw material suppliers providing components such as engine blocks, crankshafts, pistons, and fuel injection systems, alongside specialized component manufacturers producing turbochargers, filters, and electronic control units. These suppliers are critical for ensuring the quality, reliability, and performance of the finished engine. The core of the value chain involves engine manufacturers who assemble these components, conduct rigorous testing, and integrate advanced technologies like emissions control systems and engine management software. Downstream analysis focuses on the distribution channels, which include direct sales to Original Equipment Manufacturers (OEMs) of construction machinery, independent dealers, and a network of distributors that provide engines to smaller equipment manufacturers or for replacement purposes. The final stage involves the end-users, such as construction companies, rental fleets, and infrastructure developers, who utilize the equipment powered by these engines, followed by extensive aftermarket services including maintenance, repairs, and spare parts supply, which are vital for ensuring equipment longevity and performance.

Construction Equipment Engines Market Potential Customers

The potential customers for Construction Equipment Engines are diverse and represent a broad spectrum of industries heavily reliant on heavy machinery for their operations. These end-users typically include large-scale construction companies involved in major infrastructure projects, residential and commercial building contractors, and specialized firms engaged in road construction, bridge building, and public works. Furthermore, rental equipment companies form a significant customer segment, as they invest in a wide range of machinery to lease out to various project sites, requiring durable and efficient engines that can withstand continuous use across multiple operators. Mining companies and quarry operators also represent a crucial customer base, demanding robust engines for their excavators, haul trucks, and drilling equipment operating in challenging environments. Local government bodies and municipalities, through their public works departments, often purchase equipment for maintenance and development projects. Manufacturers of original construction equipment are also direct buyers, integrating these engines into their finished products before sale to end-users. The continuous need for equipment upgrades, expansion of existing fleets, and replacement of older machinery drives consistent demand from these various customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $27.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Cummins Inc., Deere & Company, Volvo Group, Kubota Corporation, Yanmar Co. Ltd., Perkins Engines Company Limited, Isuzu Motors Ltd., FPT Industrial, MTU (Rolls-Royce Power Systems AG), MAN Energy Solutions, Weichai Power Co. Ltd., Shanghai Diesel Engine Co. Ltd., Hyundai Doosan Infracore, Hatz Diesel, Kohler Co., Mitsubishi Heavy Industries Ltd., Scania AB, JCB Ltd., Liebherr Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Equipment Engines Market Key Technology Landscape

The Construction Equipment Engines Market is continuously evolving with significant technological advancements aimed at improving performance, fuel efficiency, and environmental sustainability. A prominent area of innovation is in emissions control systems, driven by increasingly strict global regulations such as EPA Tier 4 Final and EU Stage V. This includes advanced exhaust after-treatment technologies like Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), and Exhaust Gas Recirculation (EGR), which significantly reduce harmful pollutants. Furthermore, advancements in fuel injection systems, such as common rail direct injection, are enhancing combustion efficiency and power output while minimizing fuel consumption. The integration of electronic engine management systems (ECUs) is crucial for optimizing engine operation, enabling real-time diagnostics, and facilitating connectivity with telematics systems. These telematics solutions allow for remote monitoring of engine performance, predictive maintenance, and operational data analysis, leading to improved fleet management and reduced downtime. There is also a growing focus on alternative power sources, including hybrid electric powertrains that combine internal combustion engines with electric motors and battery packs, offering reduced fuel consumption and emissions, particularly in stop-start urban operations. Full electric powertrains are also emerging for compact equipment, driven by battery technology improvements. Finally, the development of engines compatible with alternative and renewable fuels, such as HVO (Hydrotreated Vegetable Oil) and other biofuels, represents another key technological frontier for sustainability.

Regional Highlights

- North America: A mature market characterized by stringent emission standards and a strong demand for high-performance, technologically advanced engines. Significant investments in infrastructure and robust construction activities continue to drive market growth, with a growing emphasis on fuel efficiency and digital integration. The region is also a key adopter of hybrid and electric construction equipment.

- Europe: This region is at the forefront of adopting environmentally friendly engine technologies, driven by rigorous EU Stage V emission regulations. There is a strong focus on compact and urban construction equipment, propelling demand for smaller, more efficient, and often electric or hybrid engines. Innovation in engine design and manufacturing processes is a continuous trend.

- Asia Pacific (APAC): The largest and fastest-growing market, fueled by massive infrastructure development projects, rapid urbanization, and increasing industrialization in countries like China, India, and Southeast Asia. The demand is high across all horsepower segments, with a growing shift towards more fuel-efficient and less polluting engines as regional regulations tighten.

- Latin America: An emerging market with significant growth potential, driven by investments in mining, oil and gas, and public infrastructure projects. The region presents opportunities for both new and refurbished equipment, with a gradual adoption of more advanced engine technologies as economic conditions improve and environmental awareness increases.

- Middle East and Africa (MEA): Characterized by large-scale construction and development projects, particularly in the Gulf Cooperation Council (GCC) countries, supporting a steady demand for robust construction equipment engines. Growth is influenced by oil price stability and government-backed infrastructure initiatives, with a rising interest in durable and high-performing diesel engines capable of operating in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Equipment Engines Market.- Caterpillar Inc.

- Cummins Inc.

- Deere & Company

- Volvo Group

- Kubota Corporation

- Yanmar Co. Ltd.

- Perkins Engines Company Limited

- Isuzu Motors Ltd.

- FPT Industrial

- MTU (Rolls-Royce Power Systems AG)

- MAN Energy Solutions

- Weichai Power Co. Ltd.

- Shanghai Diesel Engine Co. Ltd.

- Hyundai Doosan Infracore

- Hatz Diesel

- Kohler Co.

- Mitsubishi Heavy Industries Ltd.

- Scania AB

- JCB Ltd.

- Liebherr Group

Frequently Asked Questions

What are the primary factors driving the growth of the Construction Equipment Engines Market?

The market growth is primarily driven by global infrastructure development projects, rapid urbanization, significant government investments in public works, and the continuous demand for increased productivity and efficiency in construction operations worldwide.

How are emission regulations impacting the Construction Equipment Engines Market?

Strict emission regulations like EPA Tier 4 Final and EU Stage V are a major restraint, forcing manufacturers to invest heavily in advanced emissions control technologies and cleaner engine designs, including hybrid and electric powertrains, to comply with environmental standards.

What role do hybrid and electric engines play in the future of construction equipment?

Hybrid and electric engines are emerging as significant opportunities, offering reduced fuel consumption, lower emissions, and quieter operation. They are particularly gaining traction in urban construction and compact equipment, driven by sustainability goals and operational cost savings.

Which geographical region is expected to lead the Construction Equipment Engines Market in terms of growth?

The Asia Pacific (APAC) region is projected to lead the market in terms of growth, fueled by extensive infrastructure development, rapid urbanization, and industrial expansion in key countries like China and India.

What key technologies are shaping the Construction Equipment Engines Market?

Key technologies include advanced emissions control systems (SCR, DPF, EGR), sophisticated fuel injection systems, electronic engine management units (ECUs), telematics for remote monitoring and diagnostics, and the ongoing development of hybrid and electric powertrain solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager