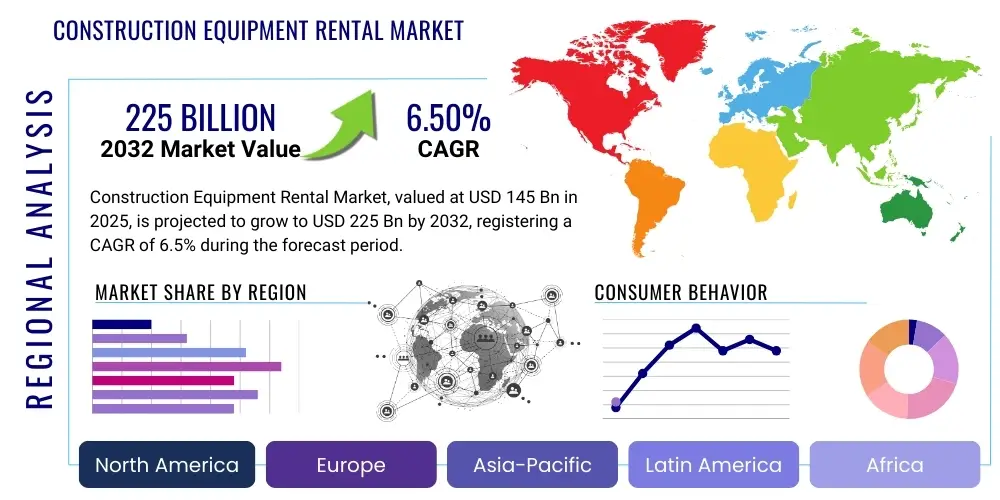

Construction Equipment Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427723 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Construction Equipment Rental Market Size

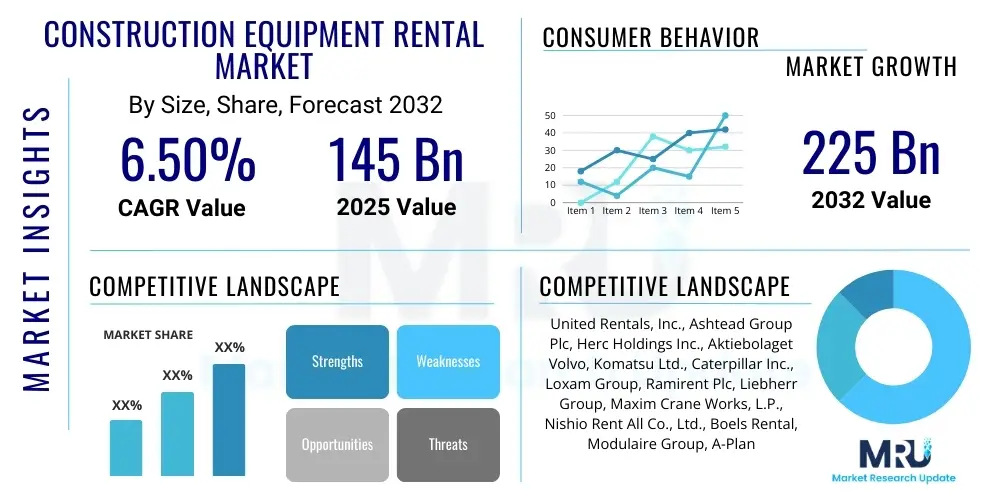

The Construction Equipment Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 145 Billion in 2025 and is projected to reach USD 225 Billion by the end of the forecast period in 2032.

Construction Equipment Rental Market introduction

The Construction Equipment Rental Market encompasses the leasing of heavy machinery and tools essential for various construction activities, ranging from earthmoving and material handling to concrete and road building. This service model allows construction companies, contractors, and individuals to access advanced equipment without the significant capital expenditure associated with purchasing and maintaining such assets. The primary product offering includes a diverse fleet of machinery such as excavators, bulldozers, loaders, cranes, scaffolding, aerial work platforms, and specialized tools, available for short-term or long-term lease agreements, often bundled with maintenance and operational support services.

Major applications for construction equipment rental span across commercial, residential, infrastructure, and industrial projects. In commercial construction, rented equipment facilitates the rapid erection of office buildings and retail complexes. Residential developments heavily rely on rental services for site preparation and foundation work, while extensive infrastructure projects like highways, bridges, and utilities frequently utilize specialized heavy equipment on a project-by-project basis. The flexibility and scalability offered by rental services make them indispensable across diverse project sizes and complexities, ensuring efficient resource allocation and project execution.

The benefits of utilizing rental services are manifold, including reduced upfront costs, elimination of maintenance expenses, access to the latest technology, and enhanced operational flexibility. Renting allows companies to avoid depreciation, storage costs, and the need for a dedicated service team, thereby optimizing their balance sheets and operational budgets. Driving factors for market growth include accelerating urbanization trends globally, robust government investments in infrastructure development, increasing focus on cost efficiency and asset utilization by construction firms, and the growing demand for specialized equipment that might not be economical to purchase outright. Furthermore, the rapid pace of technological advancements in construction equipment, such as telematics and automation, makes renting an attractive option for companies seeking to leverage cutting-edge tools without long-term commitment.

Construction Equipment Rental Market Executive Summary

The Construction Equipment Rental Market is currently experiencing dynamic growth, driven by a confluence of favorable business trends globally. A significant shift towards capital preservation and operational flexibility among construction firms is bolstering the adoption of rental models. Companies are increasingly recognizing the economic advantages of renting, including lower capital expenditure, reduced maintenance costs, and access to a wider array of specialized and technologically advanced equipment on demand. The ongoing modernization of construction practices, coupled with a renewed focus on project efficiency and sustainability, further contributes to this growth. Additionally, the fluctuating nature of project pipelines and the need for scalable solutions are compelling businesses to opt for rental services over outright procurement, thereby optimizing resource allocation and mitigating financial risks associated with equipment ownership.

Regional trends reveal varied growth trajectories and market characteristics. North America and Europe, as mature markets, are characterized by high technological adoption, stringent safety regulations, and a strong emphasis on fleet modernization and sustainable practices. These regions are seeing significant investments in telematics, automation, and electric equipment within rental fleets. Conversely, the Asia-Pacific region, led by rapidly developing economies such as China and India, presents the most robust growth opportunities, fueled by extensive infrastructure development projects, burgeoning urbanization, and increasing foreign direct investment in the construction sector. Latin America, the Middle East, and Africa are also witnessing substantial growth, albeit at different paces, driven by commodity-led investments, expanding urban centers, and ambitious national development plans, including large-scale energy and transportation projects.

Segment trends within the market indicate a rising demand for earthmoving equipment, such as excavators and loaders, driven by large-scale infrastructure and mining activities. Material handling equipment, including cranes and forklifts, also maintains a strong demand due to diverse construction and logistics needs. The growing emphasis on safety and efficiency is spurring demand for aerial work platforms and specialized access equipment. Furthermore, the market is witnessing a notable trend towards digitalized rental experiences, with online platforms, mobile applications, and advanced telematics systems becoming standard offerings. Equipment rental companies are increasingly investing in data analytics to optimize fleet management, predict maintenance needs, and enhance customer service, transforming the traditional rental landscape into a more technologically integrated and service-oriented industry.

AI Impact Analysis on Construction Equipment Rental Market

User inquiries regarding the impact of Artificial Intelligence on the Construction Equipment Rental Market frequently revolve around themes of operational efficiency, predictive maintenance capabilities, autonomous operations, safety enhancements, and the potential for new service offerings. There is a strong interest in understanding how AI can optimize fleet utilization, reduce downtime, improve decision-making through data analytics, and transform traditional rental processes. Concerns often include the initial investment required for AI integration, data security and privacy, the need for skilled personnel to manage AI systems, and the implications for job roles within the rental sector. Overall, users anticipate that AI will fundamentally reshape how equipment is managed, maintained, and deployed, leading to more intelligent and cost-effective rental solutions.

- AI-driven predictive maintenance forecasts equipment failures, reducing unplanned downtime and optimizing service schedules.

- Enhanced fleet management through AI algorithms optimizes equipment allocation, delivery logistics, and utilization rates.

- AI-powered telematics provide real-time performance data, enabling data-driven decision-making for pricing and asset management.

- Automation of rental processes, from booking to invoicing, streamlines operations and improves customer experience.

- Development of autonomous or semi-autonomous equipment in rental fleets enhances operational efficiency and safety on job sites.

- Improved safety protocols through AI monitoring of operator behavior and site conditions, reducing accidents.

- Personalized rental recommendations and dynamic pricing models based on AI analysis of customer usage patterns and market demand.

- AI facilitates advanced analytics for market trends, competitive intelligence, and identifying new growth opportunities.

- Integration of AI into virtual training and simulation platforms for equipment operators, improving skill development and safety.

DRO & Impact Forces Of Construction Equipment Rental Market

The Construction Equipment Rental Market is propelled by several key drivers, primarily the burgeoning global demand for infrastructure development, including roads, bridges, and utilities, particularly in emerging economies. Rapid urbanization and industrialization further escalate the need for efficient construction solutions, encouraging companies to opt for rental services to manage project demands without heavy capital investment. Technological advancements, such as telematics, IoT integration, and equipment electrification, are making rental fleets more attractive by offering access to cutting-edge, efficient machinery. Moreover, the increasing focus on operational efficiency and cost management among construction firms, coupled with a preference for asset-light business models, significantly fuels market growth. The flexibility to scale equipment needs up or down based on project requirements also acts as a strong incentive for renting.

However, the market also faces notable restraints. The substantial capital investment required for rental companies to acquire and maintain a diverse, modern fleet can be a barrier to entry and expansion, particularly for smaller players. Economic downturns and fluctuations in construction spending can directly impact demand for rental equipment, leading to reduced utilization rates and profitability. Additionally, stringent environmental regulations regarding emissions and noise pollution often necessitate continuous fleet upgrades, adding to operational costs for rental providers. The shortage of skilled operators and maintenance technicians capable of handling advanced equipment also presents a challenge, affecting both the rental companies and their clients. Intense competition within the market can lead to price wars, impacting profit margins for rental service providers.

Opportunities within the Construction Equipment Rental Market are abundant, especially with the growing adoption of digital platforms and e-commerce for equipment booking and management, which enhances accessibility and convenience for customers. The expansion into niche markets, such as specialized equipment for renewable energy projects or smart city infrastructure, offers significant growth avenues. Furthermore, the integration of advanced data analytics and AI for predictive maintenance and optimized fleet management presents a substantial opportunity for improving operational efficiencies and customer satisfaction. The increasing demand for sustainable and eco-friendly equipment, including electric and hybrid models, also opens doors for rental companies to differentiate their offerings and appeal to environmentally conscious clients. Strategic partnerships and mergers and acquisitions are also viable paths for market expansion and consolidation.

Impact forces on the market are diverse and interconnected. Economic stability or instability directly influences construction activity and, consequently, equipment rental demand. Technological advancements act as a double-edged sword: while they drive demand for modern equipment, they also necessitate continuous investment from rental companies to keep their fleets competitive. Regulatory changes, particularly concerning environmental standards and safety, impose compliance costs and influence equipment specifications. The competitive landscape, characterized by the presence of both global giants and numerous regional players, dictates pricing strategies and service innovation. Shifting customer preferences towards flexible, technology-enabled, and sustainable rental solutions are also profoundly impacting service offerings and business models across the industry.

Segmentation Analysis

The Construction Equipment Rental Market is broadly segmented based on equipment type, application, and end-user, providing a granular view of market dynamics and demand patterns. Understanding these segmentations is crucial for market players to tailor their strategies, optimize fleet composition, and identify high-growth areas. Each segment exhibits unique characteristics and growth drivers, reflecting the diverse needs of the global construction industry. This segmentation analysis helps in identifying which types of equipment are in high demand across different project types and by various client categories, allowing rental companies to make informed decisions about their investments and service offerings to maximize market penetration and profitability.

- By Equipment Type:

- Earthmoving Equipment (e.g., Excavators, Loaders, Backhoes, Bulldozers)

- Material Handling Equipment (e.g., Cranes, Forklifts, Telehandlers)

- Concrete Equipment (e.g., Concrete Mixers, Pumps, Pavers)

- Road Building Equipment (e.g., Rollers, Asphalt Pavers, Graders)

- Aerial Work Platforms (e.g., Scissor Lifts, Boom Lifts)

- Power & HVAC Equipment (e.g., Generators, Heaters, Air Conditioners)

- Other Specialized Equipment (e.g., Trenchers, Lighting Towers, Pumps)

- By Application:

- Commercial Construction (e.g., Office Buildings, Retail Spaces)

- Residential Construction (e.g., Housing, Apartments)

- Infrastructure Development (e.g., Roads, Bridges, Utilities, Airports)

- Industrial Construction (e.g., Factories, Power Plants, Warehouses)

- Mining & Quarrying

- Landscaping & Forestry

- By End-User:

- Construction Companies (General Contractors, Specialized Contractors)

- Government & Public Sector

- Mining Companies

- Oil & Gas Sector

- Utilities

- Private Individual Renters

Construction Equipment Rental Market Value Chain Analysis

The value chain for the Construction Equipment Rental Market begins with upstream activities involving the sourcing of raw materials and components, followed by the manufacturing of construction equipment. This segment includes suppliers of steel, engines, hydraulic systems, and advanced electronics, as well as the original equipment manufacturers (OEMs) like Caterpillar, Komatsu, and Volvo Construction Equipment. These manufacturers design, produce, and assemble the machinery that will eventually enter the rental fleet. The quality, reliability, and technological sophistication of the equipment at this initial stage are paramount, as they directly impact the rental companys offerings and the end-users operational efficiency. Strong relationships between rental companies and equipment manufacturers are crucial for securing favorable purchasing terms, access to the latest models, and technical support.

Moving downstream, the value chain encompasses the rental companies themselves, which acquire, maintain, and manage the equipment fleet. These companies invest heavily in purchasing equipment, setting up maintenance facilities, and developing logistics networks for delivery and collection. Their operations involve inventory management, equipment tracking, regular servicing, repairs, and ensuring compliance with safety and environmental standards. Marketing and sales efforts are directed towards attracting construction firms, contractors, and other end-users. The distribution channel in this market can be direct, where rental companies lease equipment directly to end-users through their own branches or online platforms, or indirect, involving brokers or larger construction project management firms that sub-rent equipment to smaller contractors. The efficiency of the distribution network, including proximity to construction sites and rapid response times, is a key competitive differentiator.

The value chain concludes with the end-users who utilize the rented equipment for their projects, and the associated support services. These end-users span a wide array, from large general contractors handling extensive infrastructure projects to small-scale independent builders working on residential renovations. Post-rental activities involve the return of equipment, inspection, and preparation for the next rental cycle. Both direct and indirect channels play a significant role in market penetration. Direct interaction allows rental companies to build strong customer relationships, offer tailored solutions, and gather direct feedback. Indirect channels, while adding a layer to the transaction, can expand reach into new markets or segments that a rental company might not directly serve, often leveraging existing relationships of intermediary firms. The provision of comprehensive support services, including operator training, on-site maintenance, and technical assistance, adds substantial value throughout the entire customer journey, enhancing satisfaction and fostering repeat business.

Construction Equipment Rental Market Potential Customers

The Construction Equipment Rental Market serves a diverse array of potential customers, primarily encompassing entities engaged in various aspects of construction, development, and infrastructure. General contractors form a significant customer segment, requiring a wide range of equipment for large-scale commercial, residential, and public works projects. These contractors often manage multiple projects simultaneously and benefit from the flexibility of renting specialized equipment as needed, optimizing their capital expenditure and operational workflows. They look for reliability, diverse fleet options, and prompt service from rental providers to ensure project timelines are met efficiently. The ability to access advanced or specialized machinery without the long-term commitment of ownership is a key driver for this group.

Beyond general contractors, the market caters to specialized contractors focusing on specific trades such as electrical, plumbing, HVAC, landscaping, and demolition. These firms often require highly specialized tools and machinery that might only be used intermittently, making rental a far more economical and practical solution than outright purchase. For instance, a landscaping firm might rent a mini-excavator for a particular project, while a demolition company might require specialized breakers or loaders. Government agencies and public sector entities involved in infrastructure development, road maintenance, and public utility projects also represent a substantial customer base. These organizations frequently engage in large-scale, long-term projects that necessitate a broad spectrum of heavy equipment, often under specific procurement guidelines and environmental standards.

Furthermore, smaller independent builders, remodelers, and even private individual renters undertaking home improvement projects constitute a growing segment. For these customers, the primary benefit of renting lies in the accessibility to professional-grade equipment that would be prohibitively expensive to buy for one-off or infrequent use. Mining companies, oil and gas firms, and industrial clients also lease heavy equipment for site preparation, material extraction, and plant maintenance. These sectors often require robust, high-capacity machinery suitable for demanding environments. The utility sector, including electricity, water, and telecommunications companies, also relies on rented equipment for maintenance, repair, and expansion of their networks, utilizing everything from trenchers to aerial work platforms for critical operations.

Construction Equipment Rental Market Key Technology Landscape

The Construction Equipment Rental Market is undergoing a profound technological transformation, driven by innovations aimed at enhancing efficiency, safety, and sustainability. Telematics and the Internet of Things (IoT) are at the forefront, integrating sensors and communication devices into equipment to collect real-time data on location, operational hours, fuel consumption, and performance metrics. This data enables rental companies to monitor fleet utilization, track assets, and manage maintenance schedules proactively, leading to improved operational efficiency and reduced downtime. For end-users, telematics provides transparency into equipment usage and performance, aiding in project management and cost control. The insights derived from telematics data are also instrumental in optimizing equipment deployment and pricing strategies.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being integrated into rental operations, primarily for predictive maintenance, demand forecasting, and fleet optimization. AI algorithms analyze historical data from telematics and other sources to anticipate potential equipment failures, allowing for timely servicing and minimizing unexpected breakdowns. This proactive approach significantly reduces maintenance costs and improves equipment availability. Furthermore, AI-driven analytics help rental companies predict future demand patterns based on seasonal trends, economic indicators, and project pipelines, enabling more strategic inventory management and pricing. The application of augmented reality (AR) is also emerging, particularly for operator training and remote diagnostics, providing immersive learning experiences and enabling technicians to troubleshoot issues more effectively on-site.

Beyond data-driven technologies, the market is witnessing a significant shift towards electrification and automation of construction equipment. Electric and hybrid models of excavators, loaders, and aerial work platforms are gaining traction due to their lower emissions, reduced noise levels, and often lower operating costs, aligning with global sustainability goals and stringent environmental regulations. While fully autonomous construction equipment is still in its nascent stages for widespread rental, semi-autonomous features like automated grading and precision controls are becoming more common, enhancing accuracy and productivity on job sites. Digital platforms, including online booking systems, mobile applications, and virtual marketplaces, are revolutionizing the customer experience, making it easier for clients to browse, rent, and manage equipment, thereby streamlining the entire rental process and improving accessibility.

Regional Highlights

- North America: A mature market characterized by high adoption rates of advanced technology like telematics and predictive analytics. Strong emphasis on safety, sustainability, and efficiency drives demand for modern, often electric or hybrid, equipment. Significant investments in infrastructure and robust residential construction contribute to steady growth.

- Europe: Driven by stringent environmental regulations and a focus on circular economy principles, leading to demand for eco-friendly and energy-efficient equipment. The market benefits from ongoing urban regeneration projects and increasing public spending on infrastructure, with a strong presence of both global and regional rental players.

- Asia-Pacific: The fastest-growing region, propelled by rapid urbanization, massive infrastructure development projects, and industrial expansion in countries like China, India, and Southeast Asia. Characterized by increasing foreign direct investment and a growing middle class, leading to sustained demand for diverse construction equipment.

- Latin America: Experiencing growth fueled by commodity-driven investments, expanding urban centers, and development in sectors like mining, oil and gas, and agriculture. The market is increasingly adopting advanced rental solutions as economic conditions stabilize and construction activities gain momentum.

- Middle East & Africa: Significant growth opportunities due to ambitious mega-projects in urban development, tourism, and energy diversification initiatives. The region is seeing substantial investment in advanced equipment and digital solutions to support rapid development goals, often driven by government-backed visions like Saudi Arabias Vision 2030.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Equipment Rental Market.- United Rentals, Inc.

- Ashtead Group Plc (Sunbelt Rentals)

- Herc Holdings Inc. (Herc Rentals)

- Aktiebolaget Volvo (Volvo Construction Equipment)

- Komatsu Ltd.

- Caterpillar Inc.

- Loxam Group

- Ramirent Plc

- Liebherr Group

- Maxim Crane Works, L.P.

- Nishio Rent All Co., Ltd.

- Boels Rental

- Modulaire Group (Algeco Scotsman)

- A-Plant (VP plc)

- Kanamoto Co., Ltd.

Frequently Asked Questions

What are the primary benefits of renting construction equipment over purchasing it?

Renting construction equipment offers significant benefits including reduced upfront capital expenditure, elimination of maintenance and storage costs, access to the latest technology and specialized machinery on demand, and enhanced financial flexibility. It allows companies to scale their equipment needs according to project requirements without long-term commitments, optimizing operational budgets and mitigating depreciation risks.

How is technology impacting the Construction Equipment Rental Market?

Technology is profoundly impacting the market through telematics and IoT for real-time data tracking, AI and Machine Learning for predictive maintenance and fleet optimization, and digital platforms for streamlined booking and management. These innovations enhance efficiency, reduce downtime, improve safety, and provide data-driven insights for both rental providers and end-users, making rental services more intelligent and accessible.

Which regions are driving the growth of the Construction Equipment Rental Market?

The Asia-Pacific region, particularly countries like China and India, is a primary driver of market growth due to extensive infrastructure development, rapid urbanization, and industrial expansion. North America and Europe continue to contribute with steady growth, fueled by technological adoption and ongoing construction activities, while the Middle East and Africa also show significant potential with large-scale development projects.

What are the key challenges faced by construction equipment rental companies?

Key challenges include high capital investment requirements for fleet acquisition and upgrades, economic uncertainties impacting construction spending, intense market competition leading to pricing pressures, and the shortage of skilled labor for equipment operation and maintenance. Compliance with evolving environmental regulations also necessitates continuous investment in eco-friendly equipment.

What types of construction equipment are most commonly rented?

The most commonly rented types of construction equipment include earthmoving equipment such as excavators, loaders, and bulldozers, which are essential for site preparation and material movement. Material handling equipment like cranes and forklifts, and aerial work platforms such as scissor lifts and boom lifts, are also in high demand across various commercial and industrial projects due to their versatility and necessity for vertical access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Construction Equipment Rental Market Size Report By Type (Earth Moving Machinery, Material Handling Machinery, Concrete and Road Construction Machinery), By Application (Excavation and Mining, Material Handling, Earthmoving, Concrete), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Construction Equipment Rental Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Crane, Diesel Generator, Excavator, Wheel Loader, Bulldozer, Motor Grader & Telescopic Handler), By Application (Residential, Transportation, Hospitality sectors, Industrial, Oil & gas sectors.), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager