Construction Equipment Telematics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431290 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Construction Equipment Telematics Market Size

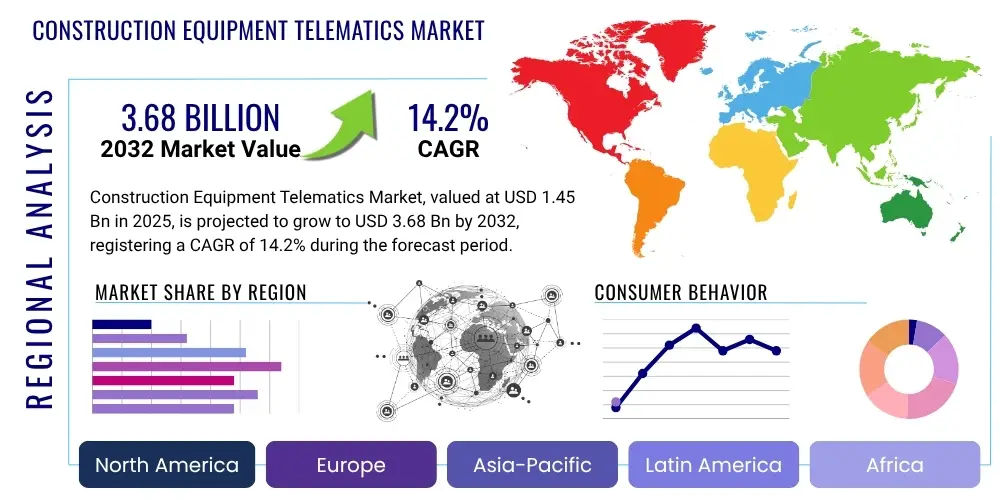

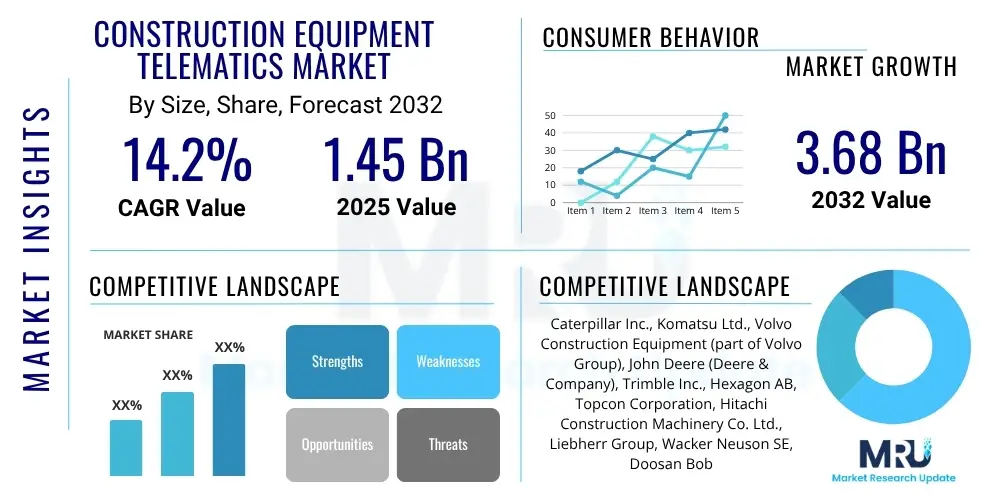

The Construction Equipment Telematics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.2% between 2025 and 2032. The market is estimated at $1.45 Billion in 2025 and is projected to reach $3.68 Billion by the end of the forecast period in 2032.

Construction Equipment Telematics Market introduction

The Construction Equipment Telematics Market represents the convergence of telecommunications and informatics to provide real-time data and insights from heavy machinery and vehicles used in construction operations. This sophisticated technology fundamentally involves the installation of telematics devices—comprising GPS modules, various sensors, and communication units—onto construction equipment such as excavators, bulldozers, cranes, and loaders. These devices gather critical operational data, including location, engine hours, fuel consumption, diagnostic codes, and performance metrics, transmitting it wirelessly via cellular or satellite networks to a central server or cloud-based platform. The core product is a comprehensive system that enables remote monitoring, management, and analysis of an entire fleet, transforming raw data into actionable intelligence for enhanced decision-making.

The major applications of construction equipment telematics are extensive and directly contribute to optimizing construction project lifecycles. Key applications include robust fleet management, which provides precise location tracking and geofencing capabilities to prevent unauthorized use and ensure equipment is deployed efficiently across multiple job sites. Asset utilization tracking is another critical application, allowing companies to monitor actual working hours versus idle time, thereby maximizing productivity and reducing wear and tear. Furthermore, telematics is indispensable for implementing effective predictive and preventive maintenance schedules by alerting managers to potential mechanical issues before they escalate, significantly reducing unplanned downtime and costly repairs. Fuel management, safety monitoring, and performance optimization are also vital functions, providing granular insights into operational efficiency and worker behavior.

The inherent benefits of adopting telematics solutions are substantial, leading to measurable improvements in profitability, operational safety, and sustainability for construction firms. Companies can achieve significant cost reductions through optimized fuel usage, minimized maintenance expenses due to predictive fault detection, and lower insurance premiums by mitigating risks of theft or damage. Enhanced productivity results from better resource allocation and reduced equipment downtime, while improved project management is facilitated by real-time data on project progress and resource availability. This technology also plays a crucial role in ensuring regulatory compliance regarding emissions and safety standards. The driving factors behind the market's robust growth include the increasing global demand for infrastructure development, escalating operational costs, stringent environmental regulations, and the pervasive adoption of digital technologies such such as the Internet of Things (IoT) and cloud computing, all compelling the construction industry towards smarter, data-driven operational models.

Construction Equipment Telematics Market Executive Summary

The Construction Equipment Telematics Market is experiencing significant expansion, primarily driven by the imperative for operational excellence and cost efficiency within the global construction industry. Key business trends indicate a paradigm shift towards data-centric fleet management, where real-time operational insights derived from telematics are becoming essential for competitive advantage. Construction companies are increasingly prioritizing investments in these solutions to combat rising fuel costs, reduce equipment downtime, enhance site safety, and optimize asset utilization. This trend fosters a dynamic market environment characterized by continuous innovation in telematics hardware and software, with a growing emphasis on integrated platforms that offer comprehensive analytics and seamless connectivity across diverse equipment types and brands.

Regional trends highlight distinct growth patterns across the globe. North America and Europe currently hold significant market shares, attributed to their early adoption of advanced construction technologies, well-established infrastructure, and stringent regulatory frameworks that encourage the use of telematics for safety and environmental compliance. These regions are also home to major telematics providers and equipment manufacturers, fostering a mature ecosystem for deployment. Conversely, the Asia Pacific region is projected to be the fastest-growing market during the forecast period, propelled by rapid urbanization, substantial government investments in infrastructure development, and increasing awareness among regional construction firms about the benefits of digital transformation. Latin America, the Middle East, and Africa are also emerging as promising markets, driven by ongoing large-scale construction projects and a gradual shift towards modern construction practices, although challenges such as infrastructure readiness and economic volatility may influence the pace of adoption.

Segmentation trends within the market underscore the evolving needs of end-users. While hardware components remain foundational, there is a clear upward trend in the demand for sophisticated software solutions and value-added services. Software platforms that offer advanced analytics, predictive modeling capabilities, and customizable dashboards are gaining prominence, as they enable deeper insights into equipment performance, maintenance requirements, and operational efficiencies. The adoption of OEM-embedded telematics solutions is growing due to their seamless integration and manufacturer support, yet the aftermarket segment continues to thrive, catering to a vast installed base of older equipment and providing specialized solutions. Furthermore, the market is seeing increased penetration across both heavy and light construction equipment, with a growing emphasis on telematics for smaller machinery and tools to achieve comprehensive site monitoring and management.

AI Impact Analysis on Construction Equipment Telematics Market

Common user questions regarding the influence of AI on the Construction Equipment Telematics Market frequently center on how artificial intelligence can amplify the capabilities of existing telematics systems, particularly in areas like advanced predictive maintenance, autonomous or semi-autonomous equipment operation, and enhanced safety protocols. Users are keen to understand AI's role in deriving deeper, more actionable intelligence from the colossal volumes of data generated by telematics, moving beyond descriptive analytics to prescriptive and predictive insights. Key themes emerging from these inquiries include the potential for AI to automate routine tasks, anticipate equipment failures with greater accuracy, optimize operational workflows, and contribute to more sustainable and efficient construction practices. While expectations are high for improved efficiency and reduced operational risks, there are also concerns about data privacy, the complexity and cost of integrating AI solutions, and the need for a skilled workforce to manage these advanced technologies effectively.

- Enhanced Predictive Maintenance: AI algorithms analyze real-time and historical telematics data, including engine parameters, sensor readings, and operational hours, to accurately predict potential equipment failures days or weeks in advance, enabling proactive maintenance and significantly minimizing unscheduled downtime.

- Optimized Fuel Efficiency: AI-driven analytics scrutinize operational patterns, driving behaviors, and site conditions to identify inefficiencies in fuel consumption, providing actionable recommendations for route optimization, idle time reduction, and efficient machine utilization.

- Autonomous and Semi-Autonomous Operations: AI plays a pivotal role in enabling the development and deployment of autonomous or semi-autonomous construction equipment, processing telematics data for navigation, task execution, and real-time decision-making, thereby increasing productivity and reducing human error.

- Improved Safety and Risk Management: AI systems monitor operator behavior, detect unsafe practices (e.g., harsh braking, excessive speeding), identify potential hazards on site, and provide real-time alerts or automated interventions to prevent accidents, enhancing overall workplace safety.

- Advanced Asset Utilization and Dispatch: AI algorithms evaluate equipment location, status, and project requirements to optimize asset allocation and dispatch across multiple job sites, ensuring the right equipment is available at the right time, maximizing productivity, and reducing logistics costs.

- Real-time Diagnostics and Troubleshooting: AI integrates with telematics to provide immediate and more accurate diagnostic insights into equipment malfunctions, often suggesting probable causes and guiding maintenance technicians toward faster and more effective troubleshooting solutions.

- Dynamic Project Scheduling and Resource Allocation: By analyzing telematics data in conjunction with project schedules and resource availability, AI can dynamically adjust plans, reallocate resources, and optimize workflows to keep projects on track and within budget.

- Environmental Impact Reduction: AI analyzes data on emissions and energy consumption, helping companies identify opportunities for more environmentally friendly operations, supporting compliance with increasingly stringent environmental regulations.

DRO & Impact Forces Of Construction Equipment Telematics Market

The Construction Equipment Telematics Market is propelled by a confluence of powerful drivers, tempered by significant restraints, and presents numerous opportunities, all interacting to create dynamic impact forces. A primary driver is the pervasive demand for enhanced operational efficiency and productivity across construction sites globally, as companies seek to maximize returns on their substantial equipment investments. This is coupled with the critical need for cost reduction, particularly in fuel consumption and maintenance expenses, where telematics offers tangible savings through optimized operations and predictive fault detection. Furthermore, increasingly stringent regulatory frameworks concerning environmental emissions, operator safety, and equipment utilization reporting compel construction firms to adopt telematics for compliance and transparent data management. The widespread adoption and continuous advancements in related technologies, such as the Internet of Things (IoT), cloud computing, and advanced analytics, also act as powerful accelerators, making telematics solutions more robust, accessible, and integral to modern construction management.

Despite these strong drivers, the market faces notable restraints that can impede its growth trajectory. The high initial capital investment required for telematics hardware, software licenses, and integration services can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) with limited financial resources. This upfront cost may deter adoption, despite the long-term return on investment. Another considerable challenge revolves around data security and privacy concerns; as telematics systems transmit and store vast amounts of sensitive operational data in cloud environments, robust cybersecurity measures are paramount, and any perceived vulnerability can hinder trust and adoption. Moreover, a lack of universal standardization across different telematics providers and original equipment manufacturers (OEMs) often results in interoperability issues, complicating the integration of mixed fleets and leading to fragmented data ecosystems, requiring custom solutions that add complexity and cost.

Nevertheless, the market is rich with opportunities that promise to drive future expansion and innovation. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities into telematics systems represents a transformative opportunity, enabling advanced predictive analytics, autonomous equipment operations, and highly optimized resource allocation that go beyond current capabilities. Expanding into emerging economies, particularly in the rapidly developing regions of Asia Pacific, Latin America, and Africa, where massive infrastructure projects are underway, offers vast untapped market potential as these regions modernize their construction practices. Furthermore, the development of more flexible and scalable business models, such as subscription-based services and device-as-a-service offerings, can help mitigate the initial investment barriers, making telematics more accessible to a broader range of construction firms. The potential for telematics data to integrate with broader digital construction platforms, like Building Information Modeling (BIM), also presents significant opportunities for holistic project management.

The overarching impact forces shaping the Construction Equipment Telematics Market are primarily technological advancements, continuously enhancing the sophistication, accuracy, and integration capabilities of telematics solutions. Regulatory pressures, especially those mandating greater environmental responsibility and worker safety, continue to push for the adoption of monitoring and reporting technologies. Economic growth, particularly in sectors such as infrastructure development, commercial construction, and mining, directly stimulates demand for heavy equipment and, consequently, telematics systems. The growing understanding and demonstrable return on investment (ROI) among construction stakeholders, regarding reduced operational costs, improved asset lifespan, and enhanced project oversight, further solidify telematics as an indispensable technology in the modern construction landscape, driving its pervasive adoption and innovation.

Segmentation Analysis

The Construction Equipment Telematics Market is meticulously segmented to provide a comprehensive and nuanced understanding of its intricate structure and diverse offerings. This segmentation is crucial for stakeholders to identify specific market niches, understand demand drivers, and formulate targeted strategies. The market is typically analyzed across several dimensions, including the type of components that constitute a telematics system, the deployment models adopted by users, the specific applications that telematics addresses, the categories of equipment it monitors, and the various end-user industries that leverage these solutions. Each segment offers distinct characteristics, technological preferences, and growth trajectories, collectively illustrating the broad utility and specialization within the telematics ecosystem across the global construction sector.

- Component: This segment analyzes the distinct technological elements that form a complete telematics solution.

- Hardware: Includes the physical devices installed on equipment, such as GPS Modules (for location tracking), Telematics Control Units (TCUs, the central processing unit), various Sensors (e.g., fuel level, engine hours, temperature, pressure, impact), and Communication Devices (cellular modems, satellite transceivers).

- Software: Encompasses the platforms and applications used to collect, process, analyze, and visualize telematics data. This includes Fleet Management Software (for overall fleet oversight), Asset Tracking Software (for location and status monitoring), Diagnostic & Reporting Software (for machine health and performance insights), and Cloud-based Platforms (for data storage and analytics infrastructure).

- Services: Covers the support and expert assistance provided throughout the telematics lifecycle, including Installation (physical setup of devices), Maintenance & Support (ongoing technical assistance and updates), Consulting & Training (guidance on system utilization and data interpretation), and Data Analytics as a Service (specialized insights from telematics data).

- Deployment: This refers to how telematics systems are integrated and acquired by the end-user.

- OEM (Original Equipment Manufacturer) Solutions: Telematics systems pre-installed by the equipment manufacturer during the production process, offering seamless integration and often proprietary features.

- Aftermarket Solutions: Telematics devices and software installed on existing equipment by third-party providers or the end-user, providing flexibility for mixed fleets and older machinery.

- Application: This segment categorizes the specific functions and benefits derived from telematics.

- Fleet Management & Monitoring: Real-time tracking of equipment location, status, and operational parameters for efficient deployment and management.

- Asset Tracking & Inventory Management: Detailed monitoring of asset location, movement, and utilization to prevent loss, optimize inventory, and ensure availability.

- Maintenance & Diagnostics: Predictive and preventive scheduling based on machine health data, fault code alerts, and engine diagnostics to minimize downtime.

- Safety & Security: Features like geofencing, remote immobilization, theft prevention, operator behavior monitoring, and crash detection to enhance workplace safety and asset protection.

- Performance Optimization & Productivity Enhancement: Analysis of equipment usage, idle times, and operational metrics to improve efficiency and maximize output.

- Fuel Management & Emissions Monitoring: Tracking fuel consumption, identifying inefficiencies, and monitoring emissions for cost savings and environmental compliance.

- Equipment Type: This distinguishes the categories of construction machinery equipped with telematics.

- Heavy Construction Equipment: Includes large machinery like Excavators, Loaders (wheel, backhoe), Dozers, Cranes, Graders, Articulated Dump Trucks, and Paving Equipment.

- Light Construction Equipment: Encompasses smaller machinery such as Skid Steer Loaders, Compactors, Forklifts, Telehandlers, and various power tools.

- Industry: This segment focuses on the various sectors within the construction domain that utilize telematics.

- Commercial Construction: Projects involving office buildings, retail spaces, and other commercial structures.

- Residential Construction: Development of housing units, apartments, and residential complexes.

- Infrastructure Development: Large-scale public works projects like Roads, Bridges, Railways, Dams, and Utilities (water, power).

- Mining: Operations involving excavation and extraction of minerals, often in remote and challenging environments.

- Oil & Gas: Construction and maintenance of pipelines, rigs, and related infrastructure.

- Material Handling: Operations involving the movement and storage of materials within construction sites or related facilities.

Value Chain Analysis For Construction Equipment Telematics Market

The value chain for the Construction Equipment Telematics Market is characterized by a sequential flow of activities that transform raw technological components into comprehensive, actionable solutions for end-users in the construction sector. Upstream activities primarily involve the foundational research and development, as well as the manufacturing of core technological components. This segment includes specialized semiconductor companies producing GPS chips, various sensor manufacturers (e.g., accelerometers, gyroscopes, engine diagnostics sensors), and communication module providers (cellular modems, satellite transceivers). These technology suppliers are crucial for delivering the high-precision and robust components necessary for reliable data acquisition and transmission, often requiring significant investment in R&D to stay ahead of technological advancements and meet stringent industry standards for ruggedness and environmental tolerance.

Midstream activities in the value chain encompass the integration, assembly, and software development performed by telematics solution providers and Original Equipment Manufacturers (OEMs). Telematics solution companies design and engineer the Telematics Control Units (TCUs) or gateways, integrating various hardware components into a single device. Simultaneously, they develop proprietary software platforms and cloud-based infrastructures for data ingestion, processing, analytics, and user interface creation. OEMs, on the other hand, increasingly integrate these telematics systems directly into their construction equipment during the manufacturing process, offering pre-installed solutions that benefit from seamless integration and manufacturer-backed support. This stage involves complex engineering, software development, and quality control to ensure that the integrated systems function flawlessly in demanding construction environments, translating raw data into meaningful insights.

Downstream activities focus on the distribution, sales, installation, and ongoing support of telematics solutions to the ultimate end-users. Distribution channels are diverse, including direct sales forces from major OEMs and telematics providers, as well as indirect channels through authorized dealerships, value-added resellers (VARs), and specialized system integrators who customize and install solutions for specific client needs. These channels are responsible for market penetration, customer acquisition, and providing essential services such as system installation, configuration, initial training, and continuous technical support. Post-sales support and ongoing data analytics services are critical for ensuring customer satisfaction and maximizing the value derived from telematics investments. This segment is driven by customer relationships, service quality, and the ability to effectively translate complex data insights into tangible operational improvements for construction companies, equipment rental firms, and other stakeholders.

Construction Equipment Telematics Market Potential Customers

The Construction Equipment Telematics Market targets a broad spectrum of potential customers and end-users, all sharing a common need for enhanced operational oversight, efficiency, and safety in their equipment fleets. Large-scale construction companies, particularly those involved in complex infrastructure projects, commercial developments, or managing extensive, geographically dispersed fleets, represent a primary customer segment. These firms require comprehensive telematics solutions for granular fleet management, precise asset tracking across multiple sites, optimizing equipment utilization, and implementing sophisticated predictive maintenance programs to mitigate costly downtime. Their demand often extends to integrated solutions that can seamlessly interface with existing enterprise resource planning (ERP) systems and provide robust reporting capabilities for compliance and project management.

Equipment rental companies constitute another significant and rapidly growing customer base. For these businesses, telematics is not just an advantage but a necessity for safeguarding their substantial capital investments and maximizing revenue. Telematics allows them to accurately track equipment location, monitor usage hours for precise billing, implement geofencing to prevent unauthorized movement, and remotely immobilize equipment in case of theft or non-payment. Real-time diagnostics enable proactive maintenance, extending the lifespan of their rented assets and ensuring higher equipment availability for clients. By providing transparent data on equipment performance and usage, rental companies can also enhance customer trust and differentiate their services in a competitive market.

Beyond these core segments, the market also caters to government agencies overseeing public works and infrastructure projects, mining operations seeking to optimize heavy machinery deployment in remote areas, and utilities companies managing their own fleets for maintenance and new installations. Furthermore, as telematics solutions become more accessible and scalable, small and medium-sized construction enterprises (SMEs) are increasingly becoming viable potential customers. These smaller firms are recognizing the competitive advantages offered by telematics in terms of cost savings, improved efficiency, and enhanced safety, allowing them to compete more effectively with larger industry players. The fundamental motivation for all these diverse customers is the pursuit of actionable insights into their equipment's operational status, location, and health, driving their investment in telematics to achieve greater profitability, security, and project success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.45 Billion |

| Market Forecast in 2032 | $3.68 Billion |

| Growth Rate | 14.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment (part of Volvo Group), John Deere (Deere & Company), Trimble Inc., Hexagon AB, Topcon Corporation, Hitachi Construction Machinery Co. Ltd., Liebherr Group, Wacker Neuson SE, Doosan Bobcat Inc., JLG Industries Inc. (an Oshkosh Corporation Company), Manitou Group, Konecranes Plc, ZF Friedrichshafen AG, Sierra Wireless Inc., Samsara Inc., Orbcomm Inc., Geotab Inc., Verizon Connect (part of Verizon Communications) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Equipment Telematics Market Key Technology Landscape

The Construction Equipment Telematics Market operates within a dynamic and sophisticated technology landscape, continually evolving with innovations that enhance data accuracy, connectivity, and analytical capabilities. At its core, the landscape is built upon Global Positioning System (GPS) and other Global Navigation Satellite Systems (GNSS), which provide the fundamental capability for precise real-time location tracking, geofencing, and route optimization. Advances in multi-constellation GNSS receivers are improving accuracy and reliability, even in challenging environments like urban canyons or dense construction sites. Complementing positioning technologies are a myriad of sensors—ranging from basic hour meters and fuel level sensors to advanced engine diagnostic modules, accelerometers, gyroscopes, and pressure sensors—that collect granular data on equipment health, performance, and operational parameters, providing a comprehensive digital footprint of each machine's activity.

Communication technologies form the indispensable bridge for transmitting the vast quantities of data collected by telematics devices from the equipment to central platforms. Cellular networks, primarily 4G LTE and increasingly 5G, dominate this space due to their widespread coverage, high bandwidth, and low latency, enabling real-time data streaming. For remote construction sites lacking terrestrial network access, satellite communication remains a critical technology, ensuring continuous connectivity for vital data transmission, albeit often at a higher cost. Furthermore, the emergence of Low Power Wide Area Networks (LPWAN) technologies, such as LoRaWAN and NB-IoT, is gaining significant traction. These technologies offer cost-effective, energy-efficient solutions for transmitting smaller data packets from numerous sensors and smaller tools, extending battery life and making telematics viable for a broader range of construction assets that previously were too expensive or impractical to monitor.

At the higher end of the technology stack, cloud computing platforms are fundamental for storing, processing, and analyzing the immense volumes of telematics data. These platforms offer unparalleled scalability, robust data security, and the computational power necessary to run complex algorithms. Data analytics and business intelligence tools are crucial for transforming raw data into actionable insights, presenting them through intuitive dashboards, customizable reports, and automated alerts. The cutting edge of this landscape is marked by the accelerating integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These advanced capabilities enable sophisticated predictive maintenance (forecasting failures before they occur), fuel optimization (identifying inefficiencies in real-time), and even paving the way for semi-autonomous or fully autonomous equipment operations, thereby revolutionizing fleet management from reactive to highly proactive and intelligent systems.

Regional Highlights

- North America: This region stands as a mature and leading market for construction equipment telematics, characterized by high adoption rates driven by stringent safety regulations, a strong emphasis on operational efficiency, and significant investments in infrastructure development and smart cities initiatives. The United States and Canada are at the forefront, benefiting from the strong presence of major equipment manufacturers, advanced technology providers, and a proactive approach to digital transformation in the construction sector. The market here is also influenced by sophisticated fleet management practices and a willingness to invest in technologies that offer clear ROI through cost savings and productivity gains.

- Europe: The European market demonstrates steady and robust growth, propelled by strict environmental norms, a pronounced emphasis on sustainable construction practices, and widespread digitalization initiatives across various industries. Countries such as Germany, the UK, France, and the Nordic nations are key players, showcasing strong OEM presence and a commitment to integrating advanced telematics solutions into their construction equipment fleets. The region benefits from governmental mandates for emissions monitoring and safety, alongside a strong drive towards efficient resource management and innovative construction methodologies, fueling continuous investment in telematics technologies.

- Asia Pacific (APAC): Positioned as the fastest-growing region in the global telematics market, APAC is fueled by rapid urbanization, extensive infrastructure development projects (such as China's Belt and Road Initiative and India's smart city programs), and a burgeoning awareness among construction companies about the long-term benefits of telematics. Emerging economies within this region are major growth drivers, adopting telematics to enhance project efficiency, manage large-scale construction activities, and improve competitive positioning. The increasing industrialization and rising investments in commercial and residential construction are significantly contributing to the expansion of telematics adoption across countries like China, India, Japan, and Australia.

- Latin America: This region is demonstrating emerging potential for the construction equipment telematics market, with increasing investments in key sectors such as mining, oil and gas, and infrastructure development. Brazil and Mexico are leading the adoption curve, driven by the pressing need to optimize resource management, enhance equipment security, and improve operational efficiency in challenging and often remote environments. While the market is still developing, growing awareness of the benefits of telematics for cost control and asset protection, coupled with regional economic growth, is paving the way for wider acceptance and implementation of these solutions among local construction firms.

- Middle East and Africa (MEA): The MEA region represents a nascent but rapidly expanding market for construction equipment telematics. This growth is primarily attributed to ambitious mega-projects in countries like the UAE, Saudi Arabia, and Qatar, which are heavily investing in infrastructure, real estate, and tourism developments. Concurrently, growing construction activities in developing African nations are also contributing to market expansion. The region's focus on enhancing project efficiency, mitigating operational risks, preventing equipment theft, and optimizing large capital investments in construction machinery is driving the demand for advanced telematics solutions, marking it as a significant future growth hub.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Equipment Telematics Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment (part of Volvo Group)

- John Deere (Deere & Company)

- Trimble Inc.

- Hexagon AB

- Topcon Corporation

- Hitachi Construction Machinery Co. Ltd.

- Liebherr Group

- Wacker Neuson SE

- Doosan Bobcat Inc.

- JLG Industries Inc. (an Oshkosh Corporation Company)

- Manitou Group

- Konecranes Plc

- ZF Friedrichshafen AG

- Sierra Wireless Inc.

- Samsara Inc.

- Orbcomm Inc.

- Geotab Inc.

- Verizon Connect (part of Verizon Communications)

Frequently Asked Questions

What is construction equipment telematics and its primary function?

Construction equipment telematics is a system that integrates telecommunications and informatics to remotely monitor and manage construction machinery. Its primary function is to collect, transmit, and analyze real-time data on equipment location, performance, health, and utilization, providing actionable insights for operational efficiency and informed decision-making.

How do telematics systems enhance operational efficiency on construction sites?

Telematics systems enhance operational efficiency by providing real-time data on equipment utilization, fuel consumption, and operational parameters. This enables optimized fleet deployment, reduction of idle times, improved maintenance scheduling, and better resource allocation, all contributing to faster project completion and cost savings.

What are the key technological components of a typical telematics solution?

A typical telematics solution comprises key technological components including Global Positioning System (GPS) modules for location, various sensors for data collection (e.g., engine diagnostics, fuel level), communication modules (cellular or satellite) for data transmission, and cloud-based software platforms for data processing, analytics, and user interfaces.

What are the main challenges faced by companies adopting construction telematics?

The main challenges in adopting construction telematics often include high initial investment costs for hardware and software, concerns regarding data security and privacy, complexities in integrating diverse systems from different manufacturers, and a potential need for workforce training to effectively utilize the technology.

How is Artificial Intelligence (AI) impacting the construction telematics market?

AI is significantly impacting the construction telematics market by enabling advanced predictive maintenance, optimizing fuel efficiency through data analysis, facilitating autonomous equipment operations, and enhancing safety protocols through operator behavior monitoring. AI transforms raw telematics data into more profound, actionable intelligence for strategic decision-making.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager