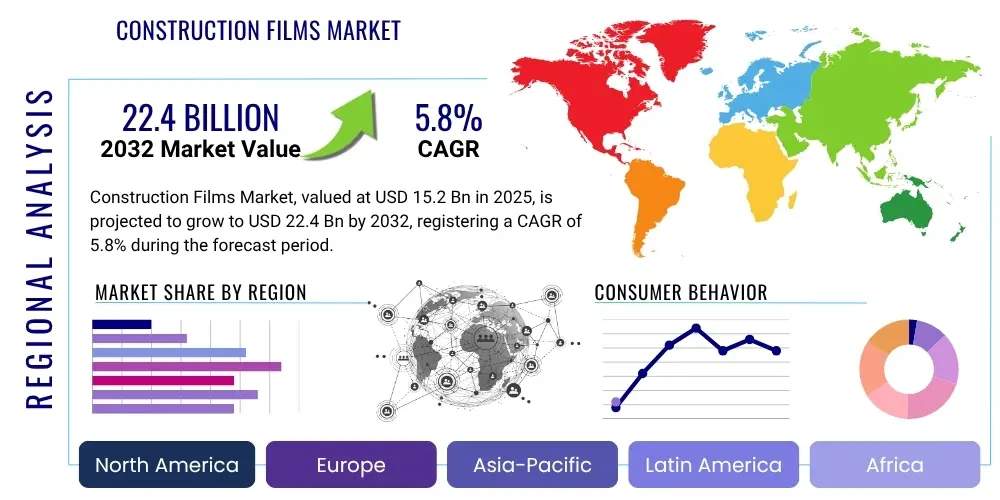

Construction Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429516 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Construction Films Market Size

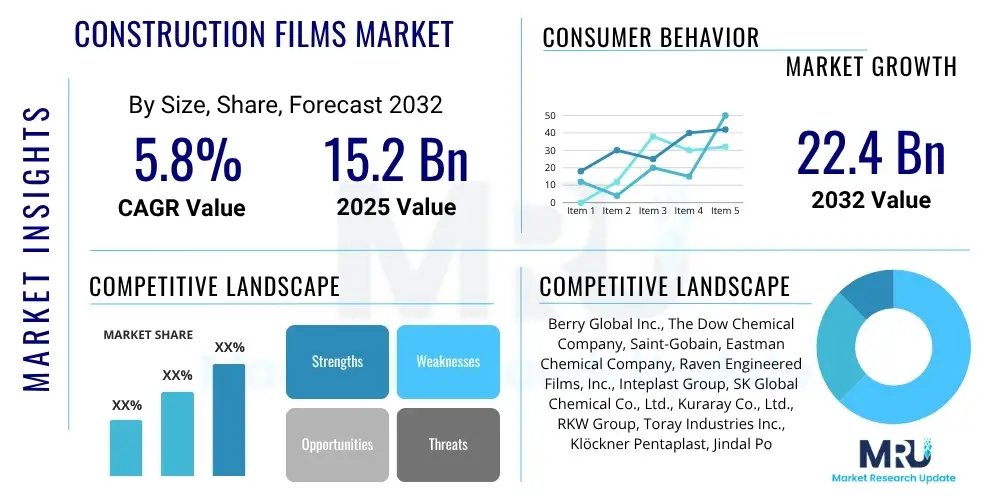

The Construction Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 15.2 Billion in 2025 and is projected to reach USD 22.4 Billion by the end of the forecast period in 2032.

Construction Films Market introduction

The construction films market encompasses a diverse range of polymer-based sheets and membranes specifically engineered for various applications within the building and infrastructure sectors. These films serve critical functions such as protection, insulation, moisture barriers, and decorative finishes, playing an indispensable role in modern construction practices. Products range from heavy-duty polyethylene sheeting used for ground cover and vapor barriers to advanced multi-layer films offering thermal insulation, solar control, and acoustic dampening. The inherent versatility and cost-effectiveness of construction films make them a preferred choice for enhancing structural integrity, improving energy efficiency, and expediting construction timelines across residential, commercial, and industrial projects.

The product portfolio within this market is extensive, featuring materials like polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and polyesters (PET), each tailored for specific performance requirements. Polyethylene films are widely utilized for their flexibility, moisture resistance, and chemical inertness, making them ideal for protective covers, temporary enclosures, and concrete curing. PVC films are favored for their durability, flame retardancy, and printability, finding applications in decorative laminates, waterproofing membranes, and window films. Benefits of employing construction films are numerous, including enhanced building longevity through superior moisture and pest protection, significant energy savings due to improved thermal performance, aesthetic versatility, and compliance with stringent building codes and environmental standards. Their lightweight nature and ease of installation also contribute to reduced labor costs and faster project completion.

Driving factors propelling the expansion of the construction films market include the escalating global demand for residential and commercial infrastructure, particularly in emerging economies undergoing rapid urbanization and industrialization. A strong emphasis on sustainable and energy-efficient building practices, coupled with stricter regulatory mandates for insulation and indoor air quality, further stimulates market growth. Furthermore, the continuous innovation in polymer science and film manufacturing technologies has led to the development of high-performance films with enhanced durability, UV resistance, and multi-functional properties, expanding their utility and appeal across diverse construction applications. These advancements enable films to cater to specialized needs, from smart windows to advanced protective barriers, continually broadening the market's scope and adoption.

Construction Films Market Executive Summary

The Construction Films Market is experiencing robust expansion, primarily driven by increasing global construction activities, a strong focus on sustainable building practices, and technological advancements in film manufacturing. Key business trends indicate a shift towards specialty films offering enhanced performance characteristics such as superior thermal insulation, UV resistance, and barrier properties. Manufacturers are increasingly investing in research and development to produce environmentally friendly and recyclable film solutions, aligning with global sustainability initiatives and consumer preferences. Customization and the development of application-specific films for unique construction challenges are also emerging as significant business trends, allowing for greater market penetration and differentiation among competitors. The market is characterized by intense competition, with players focusing on product innovation, strategic partnerships, and expanding their distribution networks to gain a competitive edge.

From a regional perspective, Asia Pacific continues to dominate the market, largely owing to rapid urbanization, significant investments in infrastructure development, and a booming residential and commercial construction sector in countries such as China, India, and Southeast Asian nations. North America and Europe represent mature markets, distinguished by stringent building codes, a strong emphasis on energy efficiency, and a high adoption rate of advanced and high-performance films. These regions are also at the forefront of adopting smart film technologies and sustainable materials. Latin America, the Middle East, and Africa are identified as emerging markets, poised for substantial growth due to planned mega-projects, improving economic conditions, and increasing foreign direct investments in construction, driving demand for modern building materials including specialized construction films.

Segmentation trends highlight a growing demand for protective films and insulating films, driven by the need for enhanced safety, structural integrity, and energy conservation in buildings. Polyethylene (PE) films remain the most widely used material due to their cost-effectiveness and versatile properties, though there is a discernible trend towards advanced materials like polypropylene (PP) and polyesters (PET) for high-performance applications. The residential and commercial construction sectors are expected to maintain their dominant share as end-users, while the infrastructure segment is projected to witness accelerated growth, fueled by government initiatives for road, bridge, and public utility development. The increasing preference for prefabrication and modular construction techniques is also boosting the demand for specialized films that integrate seamlessly into these modern building processes, further diversifying segment-specific growth trajectories.

AI Impact Analysis on Construction Films Market

Common user inquiries concerning Artificial Intelligence's influence on the Construction Films Market often revolve around optimizing material utilization, predicting potential material failures, integrating films into smart building ecosystems, enhancing manufacturing efficiency, and understanding the overall cost implications. Users are keen to know if AI can facilitate more precise material selection, reduce waste during production and installation, and proactively identify structural weaknesses in film-based applications. There is also significant interest in how AI can contribute to the development of 'smart' films capable of dynamic responses, such as self-healing or adaptive insulation, and how such advancements might be integrated into broader intelligent building management systems. Ultimately, the market seeks clarity on AI's potential to drive both innovation and operational cost efficiencies across the entire lifecycle of construction films, from design to end-use.

- AI-driven predictive analytics can optimize film thickness and composition for specific environmental conditions, reducing material overuse and improving performance.

- Machine learning algorithms can analyze historical performance data to predict potential failure points in construction films, enabling proactive maintenance and replacement strategies.

- AI can facilitate the integration of smart films with building automation systems, allowing for dynamic control over thermal properties, light transmission, and energy management.

- Automated quality control systems powered by AI in manufacturing lines can detect defects in real-time, significantly improving product consistency and reducing production waste.

- Generative design tools incorporating AI can explore novel film structures and material combinations, accelerating the development of advanced, multi-functional construction films.

- AI can optimize supply chain logistics for raw materials and finished film products, leading to cost reductions and improved delivery timelines for construction projects.

- Computer vision and AI can be used for site monitoring, ensuring correct installation of films and identifying potential issues before they become costly problems.

- AI-enabled systems can provide data-driven insights into the environmental impact of film materials, aiding in the development of more sustainable and circular economy solutions.

DRO & Impact Forces Of Construction Films Market

The Construction Films Market is significantly propelled by several robust drivers, primarily including the persistent growth in global construction activities, driven by rapid urbanization and increasing population densities, particularly in developing economies. Extensive infrastructure development projects, encompassing roads, bridges, public utilities, and commercial complexes, consistently generate substantial demand for various types of construction films for protective, insulating, and waterproofing purposes. Furthermore, the escalating global imperative for energy-efficient buildings, fueled by rising energy costs and environmental concerns, has amplified the adoption of advanced thermal and vapor barrier films. Regulatory frameworks mandating higher insulation standards and greener building practices also serve as a strong catalyst for market expansion, pushing innovation and product differentiation among manufacturers. The intrinsic benefits of construction films in providing effective protection against harsh weather, moisture, and debris during construction phases further solidify their indispensable role in the industry.

Despite the strong growth drivers, the market faces notable restraints that could temper its expansion. One significant challenge is the volatility in raw material prices, particularly for polymers like polyethylene and polyvinyl chloride, which are derivatives of crude oil. Fluctuations in petroleum prices directly impact manufacturing costs, potentially leading to increased product prices and affecting profit margins. Environmental concerns associated with plastic waste and the non-biodegradable nature of conventional films pose another significant restraint, prompting stricter regulations on plastic production and disposal. The availability of alternative building materials, such as rigid insulation boards, composite panels, and advanced concrete systems, which can sometimes offer similar functionalities, also presents a competitive pressure. Moreover, the lack of awareness about the full range of benefits and proper application techniques for specialized films in certain regions can hinder market adoption.

Opportunities within the Construction Films Market are substantial and diverse, centered around the development of sustainable and biodegradable films that address environmental concerns and meet evolving regulatory demands. The emergence of 'smart films' with integrated sensors for real-time monitoring of building performance, or electrochromic properties for dynamic light and heat control, presents a high-growth avenue. The increasing trend towards modular and prefabricated construction methods offers new application areas for pre-cut and customized films that streamline the building process. Emerging economies, with their burgeoning construction sectors and increasing adoption of modern building techniques, represent untapped markets for both basic and advanced film products. Additionally, the vast global market for renovation and retrofitting of existing structures provides a continuous demand for energy-efficient and protective film solutions, allowing for sustained growth even in mature construction markets.

Segmentation Analysis

The Construction Films Market is comprehensively segmented to provide a detailed understanding of its dynamics, distinguishing between various product types, raw materials, applications, and end-use sectors. This granular analysis allows stakeholders to identify specific growth drivers, competitive landscapes, and emerging opportunities within each niche. The segmentation reflects the diverse functional requirements and technical specifications demanded by modern construction, ranging from basic protective barriers to highly specialized performance films. Understanding these distinctions is crucial for manufacturers to tailor their product offerings, for suppliers to optimize their distribution strategies, and for investors to pinpoint high-potential market segments for future growth.

- By Type

- Protective Films: Used for temporary surface protection during construction, safeguarding finished surfaces from damage.

- Barrier Films: Designed to prevent the passage of moisture, gases, or contaminants, crucial for foundations, roofs, and walls.

- Decorative Films: Employed for aesthetic purposes, such as window tinting, privacy films, and surface laminates.

- Insulating Films: Enhance thermal performance of building envelopes, reducing heat transfer and improving energy efficiency.

- Reflective Films: Used for solar control, reflecting heat and UV radiation, often applied to windows and roofs.

- Vapour Retarders: Control the diffusion of moisture through building assemblies, preventing condensation and mold growth.

- By Material

- Polyethylene (PE) Films: Most common, known for flexibility, moisture resistance, and cost-effectiveness; includes LDPE, LLDPE, HDPE.

- Polyvinyl Chloride (PVC) Films: Offers durability, flame retardancy, and good weatherability; often used in waterproofing and decorative applications.

- Polypropylene (PP) Films: Valued for strength, stiffness, and chemical resistance, suitable for demanding protective uses.

- Polyesters (PET) Films: Provides high tensile strength, transparency, and thermal stability, utilized in window films and specialized barriers.

- Polyamide (PA) Films: Known for exceptional barrier properties against oxygen and moisture, often in high-performance applications.

- Others: Includes materials like Ethylene Vinyl Acetate (EVA) for sealants and Ethylene Tetrafluoroethylene (ETFE) for advanced roofing systems.

- By Application

- Roofing: Underlays, waterproofing membranes, and reflective layers to enhance roof longevity and energy performance.

- Walls: Vapor barriers, insulation facings, and protective sheathing for interior and exterior wall systems.

- Flooring: Underlays for moisture protection, temporary floor protection during construction, and decorative floor coverings.

- Windows and Glazing: Solar control films, security films, and decorative tints for glass surfaces.

- Waterproofing: Membranes for foundations, basements, and wet areas to prevent water ingress.

- Scaffolding and Demolition: Sheeting for containment, dust control, and weather protection on construction sites.

- Road Construction: Geotextile films for stabilization, separation, and drainage in road infrastructure.

- Landfill Liners: Impermeable films for containing waste and preventing pollutant leakage in environmental projects.

- By End-Use

- Residential Construction: Single-family homes, multi-family dwellings, and renovation projects.

- Commercial Construction: Office buildings, retail spaces, hospitality, and educational institutions.

- Industrial Construction: Factories, warehouses, and other industrial facilities requiring robust protective and barrier films.

- Infrastructure Development: Public works, transportation projects, water management, and environmental remediation.

Value Chain Analysis For Construction Films Market

The value chain for the Construction Films Market initiates with upstream activities involving the sourcing and processing of raw materials. This segment primarily consists of petrochemical companies and chemical manufacturers responsible for producing polymers such as polyethylene, polypropylene, PVC resins, and polyesters, along with various additives like UV stabilizers, flame retardants, and colorants. These suppliers play a crucial role in determining the quality, cost, and availability of the foundational components. Innovations in polymer chemistry, including the development of bio-based or recycled polymers, are increasingly influencing this stage, aligning with sustainability trends. Efficient procurement and strategic partnerships with raw material providers are essential for film manufacturers to maintain competitive pricing and ensure a consistent supply chain, minimizing disruptions.

Further along the chain, film manufacturers convert these raw materials into finished construction films through processes like extrusion, co-extrusion, lamination, and coating. This stage is capital-intensive, requiring specialized machinery and technical expertise to produce films with specific thicknesses, multi-layer structures, and performance properties. These manufacturers then engage in downstream activities, which involve distributing their products to a diverse customer base. The distribution channel is multifaceted, comprising direct sales to large construction companies, government agencies for infrastructure projects, and strategic partnerships with major building material suppliers. Indirect distribution channels include a network of wholesalers, distributors, and retailers who then supply smaller contractors, builders, and individual homeowners, ensuring broad market reach and accessibility.

Direct sales typically cater to large-scale projects or specialized applications where technical support and customized solutions are critical, fostering close relationships between manufacturers and end-users. Conversely, the indirect distribution model leverages the extensive networks of intermediaries, allowing manufacturers to penetrate fragmented markets and reach a wider array of customers without significant logistical overheads. This dual approach optimizes market coverage and efficiency. The end-users, including residential and commercial builders, infrastructure developers, architects, and independent contractors, form the final link in the value chain, utilizing these films in various stages of construction. Their feedback and evolving demands continuously influence product development and innovation upstream, making the value chain a dynamic and interconnected system focused on delivering functional and effective solutions to the construction industry.

Construction Films Market Potential Customers

The primary potential customers and end-users of construction films are diverse, encompassing a broad spectrum of participants within the global building and infrastructure sectors. Large-scale construction companies, particularly those involved in commercial, industrial, and major residential developments, represent a significant customer segment. These entities require high volumes of films for protective sheeting, vapor barriers, insulation, and waterproofing across extensive project sites. Their procurement decisions are often influenced by material performance, cost-effectiveness, regulatory compliance, and the ability of films to contribute to project efficiency and sustainability certifications. These companies frequently work directly with manufacturers or large distributors for customized orders and bulk supplies, valuing reliability and technical support.

Beyond the large contractors, independent builders and smaller contracting firms constitute another vital customer group, especially for residential and light commercial projects. These customers often purchase construction films through retail channels, building material suppliers, and local distributors. Their needs vary from basic ground covers and temporary enclosures to specialized films for roofing underlays, window protection, and interior finishing. Architects and interior designers also influence product selection, often specifying particular film types for aesthetic, performance, or environmental reasons in their designs, thereby driving demand for decorative, solar control, and high-performance insulation films. The push for green building certifications and energy-efficient designs further enhances the role of these influencers in advocating for advanced film solutions.

Furthermore, government agencies and infrastructure developers represent a substantial segment, requiring specialized films for public works such as road construction, bridge building, tunnels, and landfill projects. These applications demand films with superior durability, chemical resistance, and specific engineering properties, often adhering to strict quality and environmental standards. Homeowners engaging in DIY projects, renovations, or minor repairs also form a niche but significant customer base, primarily accessing films through retail hardware stores. Insulation contractors, roofing specialists, and waterproofing experts are highly specialized end-users who rely on precise film products tailored to their specific trade. The evolving needs of these varied customer segments drive ongoing product innovation and diversification within the construction films market, ensuring a constant demand for new and improved solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $15.2 Billion |

| Market Forecast in 2032 | $22.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berry Global Inc., The Dow Chemical Company, Saint-Gobain, Eastman Chemical Company, Raven Engineered Films, Inc., Inteplast Group, SK Global Chemical Co., Ltd., Kuraray Co., Ltd., RKW Group, Toray Industries Inc., Klöckner Pentaplast, Jindal Poly Films, Amcor plc, Sealed Air Corporation, Indupak S.A., Plastika Kritis S.A., Innovia Films, Mitsubishi Chemical Corporation, Avery Dennison Corporation, 3M Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Films Market Key Technology Landscape

The construction films market is continuously evolving, driven by significant advancements in material science and manufacturing processes, leading to the development of higher performance and more sustainable products. Multi-layer extrusion and co-extrusion technologies are foundational, enabling manufacturers to combine different polymer layers with distinct properties into a single film. This allows for the creation of composite films that offer superior barrier properties against moisture and gases, enhanced mechanical strength, and improved thermal insulation, all while optimizing material usage. Surface treatment techniques, such as corona treatment, plasma treatment, and specialized coatings, are crucial for enhancing adhesion, printability, and overall durability of films, enabling them to withstand harsh construction environments and extend their service life. These technological capabilities are vital for producing films that meet the stringent demands of modern building codes and diverse application requirements.

Beyond basic manufacturing, innovation in coating technologies plays a pivotal role in augmenting film functionality. Advanced coatings can impart properties such as anti-fog, anti-glare, self-cleaning, and UV protection, broadening the application scope of construction films, particularly for windows and exterior surfaces. Furthermore, the integration of smart film technologies represents a significant leap forward. This includes the development of electrochromic films for dynamic light control in windows, thermochromic films that react to temperature changes, and films embedded with sensors for monitoring structural integrity or environmental conditions within a building. These intelligent films contribute to energy efficiency, occupant comfort, and structural safety, aligning with the broader trend of smart building integration and automation. The ability to dynamically adjust properties based on real-time data makes these films highly desirable for high-performance buildings.

The industry is also witnessing a strong push towards sustainable manufacturing processes and materials. Technologies for producing films from recycled polymers, bio-based plastics, and biodegradable materials are gaining traction, addressing environmental concerns and regulatory pressures. Innovations in film recycling infrastructure and end-of-life solutions for construction films are also becoming increasingly important. Developments in nano-technology are also being explored to create films with enhanced properties such as improved thermal insulation, superior fire resistance, and advanced barrier capabilities at molecular levels. The ongoing research into highly specialized additives that can be incorporated into polymer matrices is continuously expanding the functional capabilities of construction films, making them more resilient, versatile, and environmentally responsible, thereby ensuring their continued relevance and growth in the global construction sector.

Regional Highlights

- Asia Pacific (APAC): This region is anticipated to be the largest and fastest-growing market for construction films, driven by extensive urbanization, burgeoning population growth, and substantial government investments in infrastructure development, particularly in countries like China, India, and Southeast Asian nations. Rapid industrialization and the expansion of residential and commercial construction projects create immense demand for protective, insulating, and waterproofing films. The region also benefits from lower manufacturing costs and increasing adoption of modern construction techniques.

- North America: A mature market characterized by stringent building codes, a high emphasis on energy efficiency, and a robust renovation sector. The demand for high-performance, technologically advanced films, including smart films and those with enhanced thermal and solar control properties, is significant. The region also leads in the adoption of sustainable building materials and practices, driving innovation in eco-friendly film solutions.

- Europe: This region showcases a strong commitment to sustainable construction and energy conservation, fueled by ambitious environmental regulations and targets for carbon neutrality. European countries exhibit high demand for advanced insulation films, vapor barriers, and specialized films that contribute to energy performance and indoor air quality. Innovation in material science and the circular economy principles heavily influence market trends here.

- Latin America: Expected to witness steady growth due to increasing foreign direct investments, urbanization, and a rise in both residential and commercial construction projects, especially in Brazil, Mexico, and Argentina. The market is driven by the need for basic protective and waterproofing films, with a gradual shift towards higher-performance solutions as economic conditions improve and construction standards evolve.

- Middle East and Africa (MEA): This region is poised for significant expansion, propelled by mega-projects in infrastructure, tourism, and residential development, particularly in GCC countries. Extreme climatic conditions necessitate robust protective and reflective films for heat management and durability. Increasing awareness of energy efficiency and the adoption of international building standards are also contributing to market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Films Market.- Berry Global Inc.

- The Dow Chemical Company

- Saint-Gobain

- Eastman Chemical Company

- Raven Engineered Films, Inc.

- Inteplast Group

- SK Global Chemical Co., Ltd.

- Kuraray Co., Ltd.

- RKW Group

- Toray Industries Inc.

- Klöckner Pentaplast

- Jindal Poly Films

- Amcor plc

- Sealed Air Corporation

- Indupak S.A.

- Plastika Kritis S.A.

- Innovia Films

- Mitsubishi Chemical Corporation

- Avery Dennison Corporation

- 3M Company

Frequently Asked Questions

What are construction films primarily used for in building projects?

Construction films are extensively used in building projects for a variety of critical functions, including providing moisture barriers to prevent water ingress, serving as protective coverings for materials and surfaces during construction, enhancing thermal insulation for energy efficiency, and offering decorative or solar control properties for windows and interiors. They are integral to improving structural longevity, safety, and overall building performance.

How do construction films contribute to sustainable building practices?

Construction films contribute significantly to sustainable building by improving energy efficiency through enhanced insulation and solar control, thereby reducing heating and cooling demands. Innovations in the market also include films made from recycled content or bio-based polymers, and those designed for durability and longevity, which minimize material replacement and waste. Their use helps meet green building certifications and reduces the environmental footprint of construction.

What are the most common types of materials used to manufacture construction films?

The most common materials used for construction films are polyethylene (PE), including LDPE, LLDPE, and HDPE, which offer excellent flexibility and moisture resistance. Other prevalent materials include polyvinyl chloride (PVC) for durability and waterproofing, polypropylene (PP) for strength and chemical resistance, and polyesters (PET) for high tensile strength and optical clarity, especially in window film applications.

What is the future outlook for the construction films market?

The future outlook for the construction films market is highly positive, driven by continued global construction growth, increasing urbanization, and a rising demand for energy-efficient and sustainable buildings. Innovations in smart films, biodegradable materials, and multi-functional barrier solutions are expected to expand application areas. Emerging economies will significantly contribute to market expansion, while mature markets will focus on high-performance and specialty film adoption.

How do regulations and building codes impact the construction films industry?

Regulations and building codes profoundly impact the construction films industry by mandating specific performance standards, particularly concerning energy efficiency, fire safety, and environmental impact. Stricter insulation requirements, vapor barrier standards, and restrictions on certain chemical additives drive manufacturers to innovate, develop compliant products, and focus on certifications. These regulations often accelerate the adoption of advanced and sustainable film technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Construction Films Market Size Report By Type (LDPE and LLDPE, High-Density Polyethylene (HDPE), Polypropylene (PP)/BOPP, PET/BOPET, Polyamide/BOPA, PVB, PVC, Others), By Application (Gas and moisture barrier, Vapor barriers, Curing blanket, Others, , Residential, Commercial, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Construction Films Market Size Report By Type (LDPE and LLDPE, High-Density Polyethylene (HDPE), Polypropylene (PP)/BOPP, PET/BOPET, Polyamide/BOPA, PVB, PVC, Others), By Application (Gas and moisture barrier, Vapor barriers, Curing blanket, Others, Residential, Commercial, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager