Construction Power Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430174 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Construction Power Rental Market Size

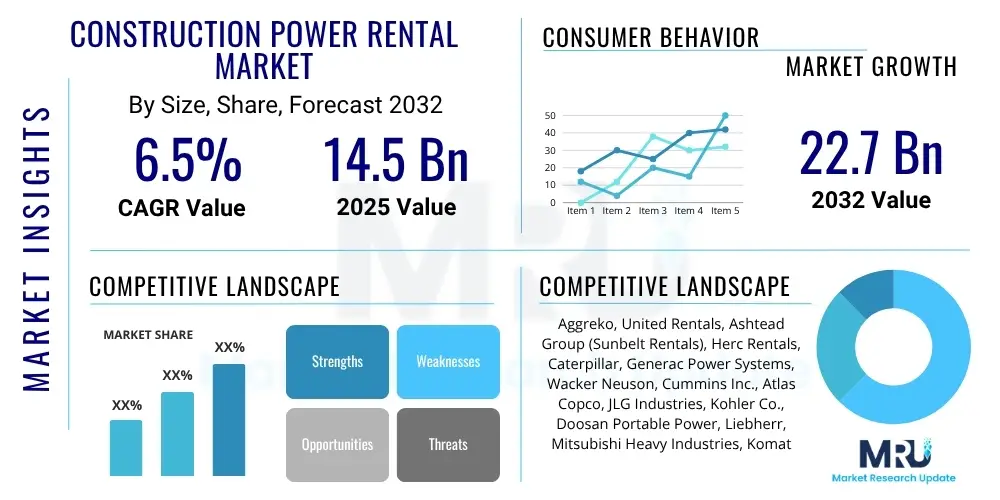

The Construction Power Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $14.5 Billion in 2025 and is projected to reach $22.7 Billion by the end of the forecast period in 2032.

Construction Power Rental Market introduction

The Construction Power Rental Market encompasses the provision of temporary power generation solutions for various construction activities, ranging from small-scale residential projects to large-scale infrastructure developments. This market offers a diverse array of products, primarily consisting of diesel and gas generators, but increasingly including hybrid and battery storage systems, designed to meet the fluctuating and often immediate power demands of construction sites. These rental services provide critical energy supply for operating machinery, lighting, offices, and tools in locations where grid power is unavailable, insufficient, or unreliable.

Major applications for construction power rental services span across commercial building construction, residential development, industrial facilities, and significant infrastructure projects such as roads, bridges, tunnels, and utilities. The benefits of utilizing power rental services are numerous, including reduced capital expenditure for construction companies, enhanced operational flexibility, access to the latest and most efficient equipment without ownership burdens, and compliance with stringent environmental regulations through modern, well-maintained units. These offerings allow companies to scale their power capacity according to project phases and specific needs, ensuring continuous operation and avoiding costly downtime.

The market is primarily driven by escalating global infrastructure spending, rapid urbanization, and an increasing number of construction projects worldwide, particularly in developing economies. The inherent need for temporary and mobile power solutions on construction sites, coupled with the desire to avoid large upfront investments in equipment, further propels market growth. Additionally, the growing emphasis on energy efficiency, reduced emissions, and the adoption of advanced power solutions are shaping the demand landscape, encouraging innovation and diversification within the rental fleet.

Construction Power Rental Market Executive Summary

The Construction Power Rental Market is experiencing robust growth driven by a confluence of global infrastructure development, urbanization trends, and the inherent efficiencies offered by rental models. Business trends indicate a strong shift towards more sustainable and technologically advanced power solutions, with providers investing in hybrid generators, battery storage, and remote monitoring capabilities to meet evolving client demands and environmental regulations. Companies are increasingly seeking cost-effective, flexible, and reliable power sources, favoring rental over outright purchase to manage project-specific power requirements and mitigate operational risks.

Regional trends reveal significant market expansion across Asia Pacific due to rapid industrialization and extensive infrastructure projects, while North America and Europe continue to be strong markets, characterized by demand for advanced, eco-friendly rental equipment and a focus on operational efficiency. Latin America and the Middle East and Africa also present lucrative opportunities, spurred by burgeoning construction sectors and energy transition initiatives. The competitive landscape is marked by both large multinational rental corporations and regional specialists, all striving to differentiate through service quality, equipment diversity, and technological integration.

Segmentation trends highlight the continued dominance of diesel generators due to their reliability and power output, though there is a perceptible increase in demand for cleaner alternatives such as natural gas and hybrid systems, especially in environmentally sensitive regions. The 100-500 kVA power output segment remains a cornerstone, catering to a broad range of medium to large construction projects, while smaller units serve niche applications and larger units address major infrastructure or industrial construction needs. End-use industries like commercial building, infrastructure development, and industrial construction are the primary demand generators, each with specific power requirements influencing rental equipment choices.

AI Impact Analysis on Construction Power Rental Market

Common user questions regarding AI's impact on the Construction Power Rental Market frequently revolve around how AI can enhance operational efficiency, optimize resource allocation, and improve equipment uptime. Users are keen to understand AI's role in predictive maintenance, smart energy management, and logistical improvements for rental fleets. Concerns also emerge regarding data security, the initial investment required for AI integration, and the training needed for personnel. Expectations generally point towards AI leading to reduced fuel consumption, minimized breakdowns, better inventory management, and more accurate demand forecasting, ultimately driving down operational costs and increasing customer satisfaction in power rental services.

- Enhanced Predictive Maintenance: AI algorithms analyze operational data from generators to predict potential failures, allowing for proactive maintenance and reducing unexpected downtime.

- Optimized Fuel Management: AI can monitor fuel consumption patterns, suggest optimal refueling schedules, and even identify inefficiencies, leading to significant cost savings and reduced emissions.

- Demand Forecasting: AI-powered analytics improve the accuracy of forecasting equipment demand based on project pipelines, regional construction activity, and historical data, optimizing fleet utilization.

- Remote Monitoring and Control: AI integrates with IoT sensors to provide real-time performance data, enabling remote diagnostics, troubleshooting, and even autonomous adjustments to power output.

- Fleet Management and Logistics: AI can optimize the routing and scheduling of equipment delivery and collection, improving logistics efficiency and reducing transportation costs.

- Automated Pricing and Tendering: AI can analyze market conditions, competitor pricing, and equipment availability to suggest optimal rental rates and assist in bid preparation.

- Safety Enhancements: AI can monitor operational parameters to detect unsafe conditions or practices, potentially preventing accidents on site.

- Energy Management on Site: AI can intelligently manage power distribution across a construction site, allocating power dynamically to different tools and machinery based on real-time needs, minimizing waste.

DRO & Impact Forces Of Construction Power Rental Market

The Construction Power Rental Market is significantly shaped by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, all under the influence of broader impact forces. Key drivers propelling this market forward include the accelerating pace of global urbanization and the resultant surge in commercial, residential, and industrial construction projects. Governments worldwide are investing heavily in infrastructure development, such as roads, railways, and utilities, which inherently requires flexible and temporary power solutions. The economic advantage of renting over purchasing heavy power equipment, offering reduced capital expenditure and maintenance responsibilities, further incentivizes adoption. Additionally, stringent environmental regulations are pushing demand for more efficient, cleaner, and quieter rental units, including hybrid and natural gas options, aligning with sustainability goals.

However, the market also faces considerable restraints. The high initial capital investment required for power rental companies to acquire and maintain a diverse, modern fleet can be substantial, impacting profitability and market entry for smaller players. Logistical challenges associated with transporting heavy and often large power units to remote or congested construction sites, coupled with the need for specialized personnel for installation and maintenance, present operational hurdles. Fluctuations in fuel prices directly affect the operational costs of diesel and gas generators, potentially leading to price volatility for rental services. Intense market competition among numerous local and international players can also exert downward pressure on rental rates, impacting profit margins.

Despite these challenges, significant opportunities abound. The increasing integration of IoT and telematics into power rental equipment offers new avenues for remote monitoring, predictive maintenance, and optimized performance, enhancing service value. The growing demand for hybrid power solutions and battery energy storage systems provides rental companies with a chance to expand their offerings and cater to eco-conscious clients and projects in noise-sensitive areas. Moreover, expansion into untapped or rapidly developing emerging markets, particularly in Asia Pacific and Africa, promises substantial growth. The development of specialized rental solutions for niche applications, such as emergency power, disaster relief, or specific industrial construction needs, also presents lucrative segments for market diversification. These factors collectively illustrate a vibrant and evolving market landscape.

Segmentation Analysis

The Construction Power Rental Market is segmented to provide a granular understanding of its diverse components, offering insights into varying demands based on equipment specifications, fuel types, and end-user applications. This segmentation allows for targeted market strategies and helps stakeholders identify specific growth areas and customer needs. Understanding these distinct segments is crucial for manufacturers to tailor their product offerings and for rental companies to optimize their fleet composition and service delivery.

- By Power Output:

- Less than 100 kVA: Typically used for smaller construction sites, residential projects, temporary lighting, and powering hand tools.

- 100-500 kVA: The most common segment, suitable for medium to large commercial and infrastructure projects, powering heavy machinery and site offices.

- More than 500 kVA: Employed for large-scale industrial construction, mining operations, major infrastructure works, and peak shaving applications requiring significant power.

- By Fuel Type:

- Diesel: Dominant segment due to high power output, reliability, and widespread availability, particularly for heavy-duty applications.

- Natural Gas: Gaining traction due to lower emissions, quieter operation, and potentially lower fuel costs in regions with gas infrastructure.

- Hybrid: Combines conventional generators with battery storage, offering fuel efficiency, reduced emissions, and silent operation during low-load periods.

- Others: Includes specialized solutions such as propane, solar-hybrid, or pure battery-electric systems for specific environmental or operational requirements.

- By End-Use Industry:

- Commercial: Includes office buildings, retail spaces, hotels, and other non-residential structures.

- Residential: Encompasses single-family homes, multi-unit dwellings, and housing complexes.

- Industrial: Covers factories, plants, warehouses, and other manufacturing or processing facilities.

- Infrastructure: Involves roads, bridges, tunnels, airports, seaports, and public utility projects.

- Road & Bridge Construction: Specific focus on transportation infrastructure development and maintenance.

- Mining: Powering equipment and facilities at open-pit or underground mining sites.

- By Application:

- Peak Shaving: Providing supplementary power during periods of high demand to avoid exceeding grid capacity or higher tariffs.

- Base Load: Supplying continuous, primary power where grid connection is absent or unreliable.

- Standby Power: Emergency power backup in case of grid failure, ensuring critical operations continue.

- Temporary Power: General use for various construction phases, events, or short-term projects.

Value Chain Analysis For Construction Power Rental Market

The value chain for the Construction Power Rental Market is intricate, involving several distinct stages from the manufacturing of power generation equipment to its final deployment and servicing at construction sites. The upstream segment primarily consists of original equipment manufacturers (OEMs) who design and produce the core power generation units, including diesel engines, alternators, control systems, and associated components. These manufacturers focus on innovation in fuel efficiency, power output, durability, and compliance with emission standards. Suppliers of raw materials such as steel, copper, and specialized electronic components also form a crucial part of this upstream segment, influencing the quality and cost of the final products.

Moving downstream, the value chain involves the procurement of these power generation units by rental companies, followed by their customization, maintenance, and deployment. Rental companies acquire a diverse fleet of generators, invest in their upkeep, and manage complex logistics for transport, installation, and decommissioning. This stage also includes value-added services such as fuel management, remote monitoring, and technical support. The distribution channel plays a vital role in connecting the rental fleet to the end-users. Direct distribution occurs when rental companies lease equipment directly to construction firms or project managers through their own sales teams and depots, fostering strong customer relationships and offering tailored solutions.

Indirect distribution, while less prevalent for primary power rental, can involve partnerships with equipment brokers or broader equipment rental platforms that include power solutions as part of a wider offering. Both direct and indirect channels are critical for market penetration and accessibility. The final stage involves the end-users, namely construction companies across various sub-sectors (commercial, residential, industrial, infrastructure), who utilize the rented power equipment for their projects. The efficiency and reliability of the rental services at this stage directly impact project timelines and operational costs, highlighting the critical role of robust after-sales support and responsive service in the overall value proposition.

Construction Power Rental Market Potential Customers

The Construction Power Rental Market serves a broad spectrum of end-users and buyers, all united by their need for flexible, reliable, and often temporary power solutions on their project sites. These customers span various segments of the construction industry, each with unique power requirements and operational scales. The primary demographic for these services includes general contractors involved in commercial and residential building, who require power for everything from basic site lighting and temporary offices to operating heavy machinery and specialized tools. Their demand often fluctuates with project phases, making rental an ideal solution for scalability and cost management.

Beyond traditional building construction, significant demand originates from infrastructure developers undertaking large-scale public and private projects. This includes companies engaged in constructing roads, bridges, railways, airports, dams, and utility networks. These projects often occur in remote locations lacking grid access or require supplementary power for intensive operations, making robust and high-capacity rental generators indispensable. Mining operations, both surface and underground, also represent a substantial customer base, needing continuous, heavy-duty power for extraction equipment, ventilation systems, and on-site processing units, often under challenging environmental conditions.

Industrial construction, involving the development of factories, processing plants, and manufacturing facilities, also heavily relies on power rental for initial site setup, temporary operations, and backup power during commissioning. Furthermore, specialized construction projects such as those in the oil and gas sector, renewable energy installations, and even disaster recovery efforts, frequently utilize rental power to ensure uninterrupted operations. Event organizers, while not strictly "construction," often require temporary power for large-scale outdoor events that are set up like construction sites, thus occasionally falling under this umbrella due to similar logistical and power demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $14.5 Billion |

| Market Forecast in 2032 | $22.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aggreko, United Rentals, Ashtead Group (Sunbelt Rentals), Herc Rentals, Caterpillar, Generac Power Systems, Wacker Neuson, Cummins Inc., Atlas Copco, JLG Industries, Kohler Co., Doosan Portable Power, Liebherr, Mitsubishi Heavy Industries, Komatsu, Point of Rental Software, HSS Hire Group, Rental Solutions & Services (RSS), Byrne Equipment Rental, Nishio Rent All Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Power Rental Market Key Technology Landscape

The Construction Power Rental Market is undergoing a significant technological transformation, driven by demands for greater efficiency, sustainability, and operational intelligence. A pivotal technology enabling this evolution is the Internet of Things (IoT), which involves embedding sensors and connectivity into power rental equipment. These IoT devices collect real-time data on performance metrics such as fuel consumption, power output, engine hours, and operational status. This data is then transmitted to cloud-based platforms, providing rental companies and users with immediate insights into equipment health and usage patterns. This capability is foundational for remote monitoring, allowing operators to oversee multiple units from a central location, diagnose issues proactively, and even perform minor adjustments remotely, thereby enhancing uptime and reducing on-site service calls.

Complementing IoT, telematics systems are widely adopted to track the location and movement of rental assets, ensuring efficient logistics and preventing theft. Advanced control systems, often integrated with sophisticated software, allow for optimized generator performance, automatic load balancing, and seamless transitions between multiple power sources (e.g., grid and generator). Hybrid power solutions, combining diesel generators with battery energy storage systems, represent a significant technological advancement. These systems reduce fuel consumption, lower emissions, and provide silent power during off-peak hours or low-load conditions, making them ideal for urban construction sites or projects with strict noise regulations.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) is becoming increasingly prevalent. AI-powered analytics can process the vast amounts of data collected via IoT to predict maintenance needs, optimize fuel delivery schedules, and forecast demand more accurately. This leads to predictive maintenance strategies that minimize unexpected breakdowns and extend equipment lifespan. Other emerging technologies include advanced emission control systems to meet increasingly stringent environmental standards, and the exploration of alternative fuels like hydrogen or advanced biofuels. The focus remains on developing smarter, cleaner, and more autonomous power solutions that provide unparalleled reliability and cost-efficiency to construction projects.

Regional Highlights

- North America: A mature market characterized by significant infrastructure investments, a strong emphasis on technological adoption, and a growing demand for eco-friendly and smart power solutions. The United States and Canada lead in adopting advanced rental fleets and integrated digital services for construction projects.

- Europe: Driven by strict environmental regulations, robust construction activity, and a push towards sustainable practices. Countries like Germany, the UK, and France are investing in hybrid and low-emission generators, along with advanced remote monitoring technologies to optimize operational efficiency and comply with green initiatives.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, massive infrastructure development projects, and industrial expansion in countries such as China, India, and Southeast Asian nations. This region presents immense opportunities due to increasing construction spending and a rising need for reliable temporary power solutions.

- Latin America: Exhibiting steady growth, primarily influenced by investments in commercial and industrial infrastructure, particularly in countries like Brazil and Mexico. The market is developing with an increasing shift from equipment ownership to rental models, driven by economic efficiencies and project flexibility.

- Middle East and Africa (MEA): Marked by large-scale mega-projects in the construction and infrastructure sectors, especially in the GCC countries. The region demonstrates strong demand for high-capacity generators for substantial developments, coupled with a growing focus on energy efficiency and reliable power supply in remote areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Power Rental Market.- Aggreko

- United Rentals

- Ashtead Group (Sunbelt Rentals)

- Herc Rentals

- Caterpillar

- Generac Power Systems

- Wacker Neuson

- Cummins Inc.

- Atlas Copco

- JLG Industries

- Kohler Co.

- Doosan Portable Power

- Liebherr

- Mitsubishi Heavy Industries

- Komatsu

- Point of Rental Software

- HSS Hire Group

- Rental Solutions & Services (RSS)

- Byrne Equipment Rental

- Nishio Rent All Co. Ltd.

Frequently Asked Questions

What drives the construction power rental market growth?

The market's growth is primarily fueled by increasing global infrastructure development, rapid urbanization, the cost-effectiveness of rental models over ownership, and a growing demand for flexible and temporary power solutions on diverse construction sites.

What are the primary types of equipment rented?

The market primarily involves the rental of diesel and natural gas generators. Increasingly, hybrid power solutions, battery energy storage systems, and specialized power distribution units are also becoming significant components of rental fleets.

How does power rental benefit construction projects?

Power rental offers significant benefits including reduced capital expenditure, enhanced operational flexibility, access to modern and efficient equipment without maintenance burdens, and the ability to scale power capacity according to project phases and specific needs, ensuring continuous operation.

What technological advancements are influencing this market?

Key technological advancements include the widespread adoption of IoT for remote monitoring and telematics, advanced control systems for optimized performance, the integration of hybrid and battery storage solutions, and the emerging application of AI for predictive maintenance and demand forecasting.

Which regions show significant growth potential?

Asia Pacific is identified as the fastest-growing region due to extensive infrastructure and urbanization projects. North America and Europe also maintain strong demand, driven by technological adoption and sustainability mandates. Latin America and MEA offer emerging opportunities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager