Construction Waste Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431156 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Construction Waste Market Size

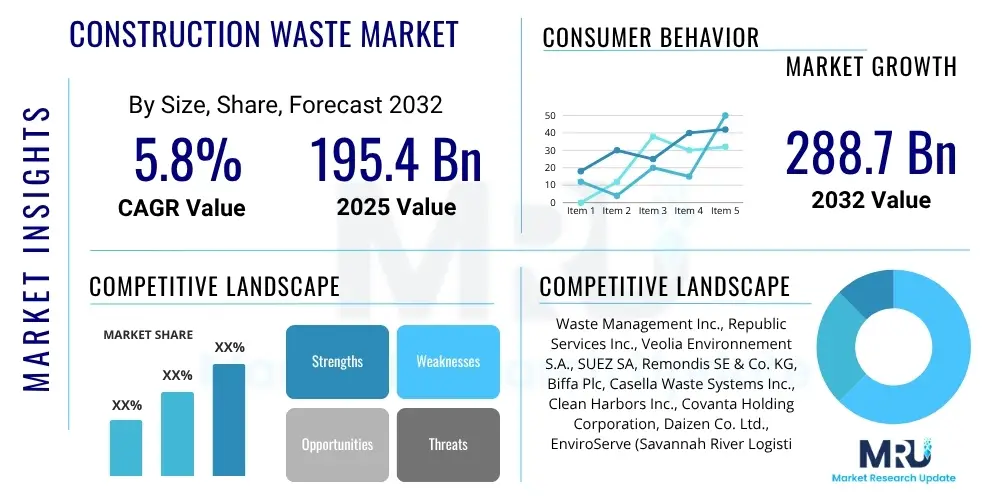

The Construction Waste Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 195.4 Billion in 2025 and is projected to reach USD 288.7 Billion by the end of the forecast period in 2032.

Construction Waste Market introduction

The construction waste market encompasses a broad range of activities related to the collection, transportation, processing, recycling, and disposal of debris generated during construction, renovation, and demolition activities. This includes materials such as concrete, wood, metal, asphalt, gypsum, bricks, and plastics. The primary objective of the market is to divert these materials from landfills, promoting resource efficiency and environmental sustainability. Effective construction waste management is crucial for mitigating environmental impact, conserving natural resources, reducing pollution, and creating economic value through the recovery and reuse of materials.

The core offerings within this market involve sophisticated sorting technologies, material recovery facilities, recycling plants, and specialized demolition services designed to separate and process mixed waste streams. These services aim to transform waste into valuable secondary raw materials for new construction projects or other industries. Major applications span across residential and commercial building construction, infrastructure development (roads, bridges, utilities), and extensive demolition projects. Benefits derived from robust construction waste management include significant reductions in greenhouse gas emissions, decreased demand for virgin resources, lower disposal costs for construction companies, and the creation of new industries and jobs in the recycling sector.

Key driving factors for the growth of this market include increasingly stringent environmental regulations mandating waste reduction and recycling targets, a global push towards sustainable construction practices and circular economy principles, the rising cost of virgin raw materials, and growing public and corporate awareness regarding environmental responsibility. Urbanization and rapid infrastructure development, particularly in emerging economies, further contribute to the volume of construction waste generated, simultaneously escalating the need for efficient management solutions. Technological advancements in sorting, processing, and recycling also play a pivotal role in enhancing recovery rates and expanding the range of recoverable materials.

Construction Waste Market Executive Summary

The Construction Waste Market is experiencing significant transformation, driven by a global shift towards sustainability and circular economy models. Business trends indicate a strong move towards integrated waste management solutions, where companies offer comprehensive services from on-site segregation to advanced processing and material recovery. Digitalization is playing a crucial role, with the adoption of Building Information Modeling (BIM) for waste estimation and management, and IoT-enabled tracking systems for efficient logistics. Furthermore, there is a growing emphasis on high-value recycling, converting what was once considered waste into valuable resources for new construction or other industrial applications, thereby reducing reliance on virgin materials and mitigating environmental footprints.

Regionally, Europe leads in regulatory advancements and sophisticated recycling infrastructure, particularly in countries like Germany and the Netherlands, which boast high diversion rates. North America is witnessing increasing investments in advanced material recovery facilities and innovation in waste-to-energy technologies, driven by both environmental concerns and economic incentives. The Asia Pacific region is projected to exhibit the highest growth, fueled by rapid urbanization, massive infrastructure projects, and a burgeoning awareness of sustainable practices, though challenges related to regulatory enforcement and adequate infrastructure development persist. Latin America, the Middle East, and Africa are gradually adopting better waste management practices, often with international collaboration and technological transfers, moving away from conventional landfill-centric approaches towards more sustainable solutions.

Segmentation trends reveal increasing demand for concrete and asphalt recycling, driven by their high volume in construction waste and their potential for reuse in road bases and new concrete mixtures. Wood waste is also gaining prominence for its use in engineered wood products or biomass energy. Service segments are seeing growth in demolition waste management and on-site sorting services, which aim to improve efficiency and purity of waste streams at the source. The market is also witnessing a rise in specialized services for hazardous construction waste, reflecting heightened safety and environmental compliance requirements. These trends collectively underscore a market evolving towards greater efficiency, resource optimization, and environmental stewardship across its various operational facets.

AI Impact Analysis on Construction Waste Market

Users frequently inquire about AI's potential to revolutionize construction waste management, focusing on areas like automated sorting, predictive analytics for waste generation, and optimizing logistics. The primary themes emerging from these questions involve enhancing operational efficiency, improving waste diversion rates, and achieving significant cost reductions. There is a strong expectation that AI will address the labor-intensive nature of waste sorting, provide smarter resource allocation, and offer data-driven insights for more sustainable construction practices. Concerns often center around the initial investment costs, the complexity of integrating AI systems into existing infrastructure, and the need for skilled personnel to operate and maintain these advanced technologies, alongside discussions about the accuracy and reliability of AI in distinguishing diverse waste materials.

- AI-powered robotic sorting systems enhance the speed and accuracy of waste segregation at material recovery facilities.

- Predictive analytics models leverage historical project data to forecast waste generation volumes and types, optimizing resource planning.

- Machine vision systems identify and classify different materials in mixed waste streams, improving recycling purity and efficiency.

- AI algorithms optimize logistics and transportation routes for waste collection, reducing fuel consumption and operational costs.

- Data analytics platforms provide insights into waste composition and generation patterns, supporting informed decision-making for waste reduction strategies.

- Automated quality control for recycled materials ensures consistent output, increasing market value and usability.

- Smart sensors and IoT devices, integrated with AI, monitor waste bins and compactors, enabling on-demand collection and preventing overflow.

- Generative design tools can minimize waste by optimizing material usage during the planning and design phases of construction projects.

- AI assists in identifying potential reuse opportunities for demolition materials, fostering a more circular economy approach.

DRO & Impact Forces Of Construction Waste Market

The Construction Waste Market is significantly shaped by a confluence of driving forces, formidable restraints, and emerging opportunities, all interacting with broader societal and economic impacts. Key drivers include increasingly stringent environmental regulations globally, which mandate higher recycling rates and impose penalties for landfilling, compelling construction firms to adopt sustainable waste management practices. The rising costs of virgin raw materials make recycled aggregates and other materials economically attractive alternatives. Furthermore, growing corporate social responsibility (CSR) initiatives and public demand for green building practices pressure developers to minimize environmental footprints, directly boosting demand for construction waste management services and recycled content.

However, the market faces several significant restraints. The high initial capital investment required for advanced sorting and recycling infrastructure, including specialized machinery and material recovery facilities, can be a barrier to entry or expansion for many companies. A lack of standardized waste classification and processing methodologies across different regions creates inefficiencies and complicates cross-border recycling efforts. Moreover, the presence of contaminants in mixed construction and demolition waste streams often reduces the quality and marketability of recycled materials, posing a challenge to achieving high-value recovery. Market fragmentation, with numerous small and regional players, can also hinder large-scale innovation and investment in advanced technologies.

Opportunities for growth are abundant, particularly with the global push towards circular economy models, which aim to keep resources in use for as long as possible. The expansion of green building certifications, such as LEED and BREEAM, incentivizes the use of recycled content, thereby driving demand for processed construction waste. Developing economies, undergoing rapid urbanization and infrastructure expansion, present vast untapped potential for implementing efficient waste management systems from the ground up. Technological advancements in areas such as artificial intelligence for sorting, waste-to-energy conversion, and innovative material science for incorporating recycled aggregates create new avenues for value creation. Furthermore, public-private partnerships can facilitate the necessary infrastructure development and regulatory frameworks to support robust construction waste ecosystems.

Segmentation Analysis

The Construction Waste Market is extensively segmented based on various critical parameters, providing a detailed view of its operational dynamics and strategic opportunities. These segmentations allow for a granular understanding of material flows, service demand, and technological adoption across the industry. Analyzing these segments helps stakeholders identify specific growth areas, develop targeted solutions, and optimize their value chain activities. The primary categories for segmentation typically include the type of waste generated, the source of the waste, the services offered for waste management, the applications of recycled materials, and the technologies employed in processing.

- By Waste Type:

- Concrete

- Wood

- Metals

- Asphalt

- Bricks and Tiles

- Plastics

- Gypsum

- Glass

- Soil and Stones

- Insulation Materials

- Hazardous Waste (e.g., asbestos, lead paint)

- By Source:

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Infrastructure (roads, bridges, airports, railways)

- Demolition Projects

- Renovation Projects

- New Construction Projects

- By Service:

- Collection and Transportation

- Sorting and Segregation (on-site and off-site)

- Recycling and Reuse

- Landfilling

- Incineration and Waste-to-Energy

- Hazardous Waste Management

- Site Clearance and Demolition

- Consulting and Auditing

- By Application of Recycled Material:

- Aggregates (for new concrete, road bases)

- Landfill Cover

- Soil Improvement

- Energy Generation

- Wood Products (mulch, engineered wood)

- Metal Scrap (for steel production)

- Plastic Pellets (for various plastic products)

- Glass Cullet (for new glass, abrasives)

- Gypsum Powder (for drywall production)

- By Technology:

- Crushing and Screening

- Magnetic Separation

- Optical Sorting

- Air Classification

- Robotic Sorting

- Compacting and Baling

- Shredding and Grinding

- Waste-to-Energy Incineration

Value Chain Analysis For Construction Waste Market

The value chain for the Construction Waste Market is intricate, involving multiple stages from waste generation to final material reuse or disposal, highlighting the complex interplay between various stakeholders. At the upstream level, the process begins with waste generation on construction and demolition sites. This stage involves construction companies, demolition contractors, and renovation service providers who are responsible for initial waste segregation and collection. Equipment manufacturers supplying machinery for on-site crushing, screening, and compaction, as well as suppliers of waste containers and logistics solutions, form a crucial part of the upstream segment, enabling efficient waste accumulation and initial processing.

Moving downstream, collected waste is transported to various facilities for processing. This includes material recovery facilities (MRFs), recycling plants, transfer stations, and specialized treatment centers for hazardous waste. These downstream operators play a critical role in sorting, cleaning, and processing the waste into reusable materials. Key players here include waste management companies that own and operate these facilities, as well as technology providers offering advanced sorting and processing equipment. The processed materials are then sold to a diverse range of buyers, such as manufacturers of new construction materials (e.g., concrete producers using recycled aggregates), landscaping companies using wood mulch, and industries utilizing metal scrap or plastic pellets.

Distribution channels in the construction waste market can be direct or indirect. Direct channels involve waste generators contracting directly with waste management companies for collection and processing services, or selling segregated waste directly to recyclers or end-users. This often occurs for high-volume, homogeneous waste streams like clean concrete or metals. Indirect channels involve intermediaries such as waste brokers or aggregators who consolidate waste from multiple smaller sites and then transport it to processing facilities or connect generators with recyclers. These intermediaries often manage complex logistics and market fluctuations. Both direct and indirect channels are essential for the efficient flow of materials and services, catering to the diverse needs of the market participants and optimizing resource recovery. The overall efficiency and profitability of the market heavily depend on strong collaboration and effective communication across all these stages and channels.

Construction Waste Market Potential Customers

The Construction Waste Market serves a diverse array of potential customers, primarily comprising entities involved in the built environment, who are both generators and potential consumers of construction and demolition waste services and recycled materials. These customers are driven by a combination of regulatory compliance, environmental sustainability goals, cost efficiency, and the desire to meet green building standards. Understanding these varied customer segments is crucial for service providers and material recyclers to tailor their offerings and maximize market penetration, ensuring that solutions align with specific needs and operational scales.

The primary end-users and buyers of construction waste management services are large-scale construction companies, general contractors, and developers responsible for residential, commercial, and industrial projects. These entities generate substantial volumes of mixed waste and require comprehensive solutions for collection, sorting, and disposal, often seeking partners who can help them achieve high diversion rates and comply with local regulations. Demolition contractors also represent a significant customer base, as their operations produce large quantities of specific waste streams like concrete, asphalt, and metal, necessitating efficient and often specialized removal and recycling services to clear sites for new development.

Beyond waste generators, potential customers also include municipalities and governmental bodies involved in public infrastructure projects such as road construction, bridge repairs, and utility expansions, which generate significant quantities of inert waste like asphalt and concrete. These public sector clients often prioritize sustainable practices and look for partners who can provide certified recycled aggregates. Furthermore, manufacturers of new construction materials, such as concrete producers, asphalt manufacturers, and steel mills, are key buyers of processed and recycled construction waste, utilizing these secondary raw materials to reduce production costs and enhance the sustainability profile of their products. Landscapers and agricultural businesses also purchase recycled wood products for mulch and soil enhancement, expanding the downstream market for processed waste materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 195.4 Billion |

| Market Forecast in 2032 | USD 288.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Waste Management Inc., Republic Services Inc., Veolia Environnement S.A., SUEZ SA, Remondis SE & Co. KG, Biffa Plc, Casella Waste Systems Inc., Clean Harbors Inc., Covanta Holding Corporation, Daizen Co. Ltd., EnviroServe (Savannah River Logistics), FCC Environment (UK) Ltd., Hitachi Zosen Corporation, Implenia AG, Renewi plc, WM EarthCare, European Metal Recycling (EMR), Recology, Advanced Disposal Services (now Waste Management), Stericycle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Waste Market Key Technology Landscape

The Construction Waste Market is increasingly shaped by a dynamic and evolving technology landscape, with innovations aimed at improving efficiency, maximizing material recovery, and reducing environmental impact. Modern waste management relies heavily on mechanical processes for crushing, screening, and separation, but advanced technologies are now integrating automation and intelligence to refine these traditional methods. These technological advancements are critical for overcoming challenges such as mixed waste streams, contamination, and the labor-intensive nature of traditional sorting, driving the industry towards more sustainable and economically viable practices.

Among the most impactful technologies is the application of Artificial Intelligence (AI) and Machine Learning (ML), particularly in optical and robotic sorting systems. AI-powered sensors and cameras can accurately identify and classify different materials in a mixed waste stream at high speeds, enabling robotic arms to sort them efficiently. This significantly increases the purity of recycled materials and reduces human error and exposure to hazardous substances. Furthermore, the Internet of Things (IoT) plays a crucial role by enabling real-time monitoring of waste bins, compactors, and facility operations, providing data for optimized collection routes, predictive maintenance of equipment, and overall operational efficiency.

Other significant technologies include advanced material recovery facilities (MRFs) that integrate multiple sorting technologies such as eddy current separators for non-ferrous metals, air classifiers for lightweight materials, and ballistic separators. Building Information Modeling (BIM) is also increasingly utilized during the design phase of construction projects to minimize waste generation and identify opportunities for material reuse or recycling before construction even begins. Innovations in waste-to-energy technologies are transforming non-recyclable construction waste into usable energy, offering a sustainable alternative to landfilling. The continuous development and integration of these diverse technologies are essential for the ongoing evolution and expansion of the construction waste management industry.

Regional Highlights

- North America: This region demonstrates a growing commitment to construction waste management, driven by increasing landfill costs and a rising focus on green building initiatives. The United States and Canada are witnessing significant investments in advanced material recovery facilities and technological innovations, including AI-powered sorting. Regulatory frameworks, such as those encouraging LEED certification, incentivize higher recycling rates, particularly for concrete, wood, and metals.

- Europe: Leading the global market in terms of robust regulatory frameworks and circular economy adoption. Countries like Germany, the Netherlands, and the UK have some of the highest construction waste recycling rates, largely due to strict directives from the European Union on waste diversion and resource efficiency. The region emphasizes high-value recycling, material reuse, and waste-to-energy solutions, fostering a mature and innovative market.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to rapid urbanization, extensive infrastructure development, and a booming construction sector in countries like China, India, and Southeast Asian nations. While waste generation is high, the market is characterized by varying levels of maturity in waste management infrastructure and regulatory enforcement. There is a strong potential for adopting advanced technologies and establishing new recycling facilities to meet the escalating demand for sustainable waste solutions.

- Latin America: This region is in an emerging phase of construction waste management, with increasing awareness and initial steps towards formalizing waste collection and recycling systems. Brazil and Mexico are showing progress, driven by environmental concerns and the need to reduce illegal dumping. The market offers significant opportunities for technology transfer and investment in basic and intermediate processing facilities, as regulations become more stringent.

- Middle East and Africa (MEA): Characterized by significant infrastructure and real estate development projects, particularly in the GCC countries. While historical practices often leaned towards landfilling, there is a growing recognition of the need for sustainable waste management. Government initiatives and large-scale urban development projects are stimulating the adoption of advanced recycling technologies and the establishment of comprehensive waste management systems, driven by sustainability visions and international best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Waste Market.- Waste Management Inc.

- Republic Services Inc.

- Veolia Environnement S.A.

- SUEZ SA

- Remondis SE & Co. KG

- Biffa Plc

- Casella Waste Systems Inc.

- Clean Harbors Inc.

- Covanta Holding Corporation

- Daizen Co. Ltd.

- EnviroServe (Savannah River Logistics)

- FCC Environment (UK) Ltd.

- Hitachi Zosen Corporation

- Implenia AG

- Renewi plc

- WM EarthCare

- European Metal Recycling (EMR)

- Recology

- Advanced Disposal Services (now Waste Management)

- Stericycle

Frequently Asked Questions

What is construction waste and why is its management important?

Construction waste comprises materials generated during building, renovation, and demolition. Its effective management is crucial for environmental protection, resource conservation, reducing landfill burden, and promoting a circular economy by recycling and reusing valuable materials.

What are the key drivers for the growth of the construction waste market?

Key drivers include stringent environmental regulations, rising costs of virgin raw materials, growing demand for sustainable construction, and technological advancements in waste processing and recycling techniques.

How does AI impact construction waste management?

AI significantly impacts the market by enabling precise robotic sorting of waste, predictive analytics for generation, optimizing logistics, and improving the purity and efficiency of material recovery, thereby enhancing sustainability and cost-effectiveness.

Which regions are leading in construction waste recycling?

Europe, particularly countries like Germany and the Netherlands, leads globally in construction waste recycling due to robust regulations and well-established infrastructure. North America is also making significant advancements.

What are the major challenges faced by the construction waste market?

Major challenges include high initial investment for advanced facilities, lack of standardized waste classification, contamination of waste streams, and fragmentation of the market, which can hinder large-scale adoption of innovative solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager