Container Handling Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429214 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Container Handling Equipment Market Size

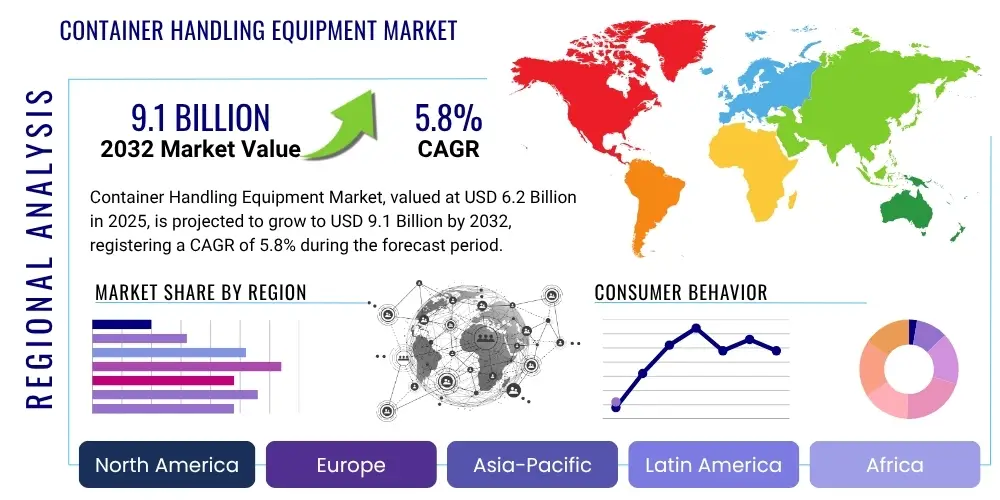

The Container Handling Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $6.2 Billion in 2025 and is projected to reach $9.1 Billion by the end of the forecast period in 2032.

Container Handling Equipment Market introduction

The Container Handling Equipment Market is a critical segment within the global logistics and supply chain industry, dedicated to the efficient movement, stacking, and transfer of intermodal containers across various transportation nodes. This market encompasses a broad spectrum of specialized machinery designed to manage the immense volume of goods transported via standard shipping containers, from their arrival at ports to their distribution at inland depots and warehouses. The essential function of this equipment is to ensure swift turnaround times for vessels and trucks, thereby optimizing the entire container logistics chain and minimizing operational bottlenecks.

Products within this market range from large-scale port cranes like Ship-to-Shore (STS) and Gantry Cranes to mobile equipment such as Reach Stackers, Straddle Carriers, Forklifts, and Terminal Tractors. Each piece of equipment is engineered for specific tasks, whether it is lifting containers from ships, moving them within a terminal yard, or loading them onto railcars or trucks. The applications are predominantly found in bustling seaports and maritime terminals, which serve as crucial gateways for international trade. Beyond maritime operations, container handling equipment is indispensable in inland container depots (ICDs), freight stations, and large logistics hubs, where containers are deconsolidated or prepared for further distribution.

The benefits derived from advanced container handling equipment are multi-faceted, including significantly enhanced operational efficiency, reduced labor costs through automation, improved safety for personnel and cargo, and increased throughput capacity. Driving factors for market growth include the relentless expansion of global trade, particularly fueled by e-commerce, continuous investments in port infrastructure modernization, the adoption of automation technologies to meet growing demand and overcome labor shortages, and increasing efforts towards sustainability through electrification and hybridization of equipment. These factors collectively underscore the vital role this market plays in facilitating international commerce and supporting economic development worldwide.

Container Handling Equipment Market Executive Summary

The Container Handling Equipment Market is experiencing dynamic shifts, characterized by several key business trends, regional developments, and segment-specific transformations. Globally, the industry is moving towards increased automation and digitalization, driven by the imperative to enhance operational efficiency, reduce costs, and improve safety standards in increasingly complex logistical environments. Manufacturers are focusing on developing smart, interconnected equipment capable of real-time data exchange and remote operation, paving the way for fully autonomous terminals. There is also a pronounced trend towards electrification and hybridization of machinery, aligning with global sustainability initiatives and stringent environmental regulations aimed at reducing carbon emissions and noise pollution at ports and logistics centers.

Regionally, Asia Pacific continues to dominate the market, largely due to robust economic growth, substantial investments in port expansion and modernization, and booming manufacturing and export activities in countries like China, India, and Southeast Asian nations. North America and Europe are pivotal regions for technological innovation, with a strong emphasis on integrating advanced automation, IoT, and AI solutions into existing infrastructure to optimize throughput and operational workflows. These regions are also leading the charge in adopting electric and hybrid models, driven by strong regulatory frameworks and corporate sustainability commitments. Latin America, the Middle East, and Africa are showing significant growth potential, fueled by ongoing infrastructure development projects, increasing trade volumes, and the establishment of new logistics hubs.

Within the market segments, Rubber-Tyred Gantry (RTG) Cranes and Ship-to-Shore (STS) Cranes remain foundational elements, consistently seeing demand due to their indispensable roles in high-volume container handling. However, there is a growing demand for advanced Reach Stackers and Straddle Carriers that offer greater maneuverability and speed, especially in congested terminals. The propulsion segment is witnessing a significant shift from traditional diesel-powered equipment towards electric and hybrid alternatives, reflecting both environmental mandates and operational cost-saving incentives. Software and services, including terminal operating systems (TOS) and predictive maintenance solutions, are also gaining prominence as vital components of modern container handling operations, driving the overall market towards more integrated and intelligent systems.

AI Impact Analysis on Container Handling Equipment Market

Common user questions regarding AI's impact on the Container Handling Equipment Market often revolve around how artificial intelligence can enhance operational efficiency, improve safety, enable predictive maintenance, and facilitate autonomous operations. Users are keen to understand the practical applications of AI in real-time decision-making, optimizing container flow, and mitigating risks. There are also frequent inquiries about the integration challenges, data security implications, and the potential for job displacement or skill transformation within the workforce. The overarching theme is an expectation that AI will revolutionize traditional container handling by creating smarter, more resilient, and highly automated logistics ecosystems, though with a degree of apprehension about the transition.

- AI enables predictive maintenance by analyzing sensor data to forecast equipment failures, minimizing downtime.

- Optimizes container placement and movement within terminals through advanced algorithms, improving throughput.

- Facilitates autonomous operation of equipment like RTGs, STS cranes, and terminal tractors, enhancing safety and efficiency.

- Enhances security and surveillance by processing video feeds for anomaly detection and access control.

- Powers intelligent traffic management systems to reduce congestion and improve flow inside port areas.

- Supports real-time decision-making for resource allocation and workload management in dynamic environments.

- Improves energy efficiency by optimizing operational patterns and power consumption of electric and hybrid equipment.

- Streamlines administrative tasks and documentation processes through AI-driven automation.

- Aids in workforce training and simulation by creating realistic operational scenarios for operators.

DRO & Impact Forces Of Container Handling Equipment Market

The Container Handling Equipment Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and inherent impact forces. Key drivers propelling market expansion include the unwavering growth of global trade, bolstered by increasing digitalization and e-commerce penetration, which continuously drives up container traffic volumes. Substantial investments in modernizing and expanding port infrastructure worldwide, particularly in emerging economies, are also creating robust demand for advanced handling solutions. The pervasive trend towards automation and digitalization across industrial sectors, coupled with a focus on enhancing operational efficiency and reducing labor costs in logistics, further fuels the adoption of sophisticated container handling equipment. Furthermore, governmental initiatives promoting smart port development and improved supply chain resilience provide significant impetus for market growth.

Conversely, several restraints pose challenges to market proliferation. The high initial capital expenditure required for purchasing and installing heavy-duty container handling equipment acts as a significant barrier, especially for smaller operators or developing regions with limited financial resources. The complex maintenance requirements and the associated high operational costs of these sophisticated machines can also deter potential buyers. A persistent shortage of skilled labor proficient in operating and maintaining advanced automated equipment presents an operational hurdle. Geopolitical tensions, trade protectionism, and fluctuating global economic conditions introduce uncertainties that can impact investment decisions and disrupt supply chains, thereby constraining market growth. Moreover, increasingly stringent environmental regulations necessitate costly upgrades and compliance measures, adding to operational complexities.

Despite these challenges, substantial opportunities exist within the market. The burgeoning concept of smart ports, integrating IoT, AI, and advanced analytics for optimized operations, offers a fertile ground for innovation and new deployments. The development and adoption of remote operation and autonomous equipment present opportunities to enhance safety, efficiency, and address labor shortages. Growing demand for electric and hybrid container handling equipment, driven by sustainability goals and regulatory pressures, opens new product development avenues. Furthermore, the untapped potential in developing economies, coupled with initiatives to improve intermodal connectivity and logistics infrastructure, provides significant expansion opportunities. Technology advancements in areas such as hydrogen fuel cells for cleaner operations also represent future growth prospects. These opportunities, coupled with the impact of technological advancements, evolving regulatory landscapes, and global economic shifts, will collectively shape the future trajectory of the container handling equipment market.

Segmentation Analysis

The Container Handling Equipment Market is comprehensively segmented by various operational characteristics, application areas, and propulsion methods to provide a detailed understanding of its dynamics. This segmentation allows for precise market analysis, highlighting growth patterns and technological preferences across different user bases and operational environments. Understanding these distinct segments is crucial for manufacturers to tailor their product offerings, for service providers to target specific needs, and for investors to identify lucrative sub-markets within the broader container logistics industry. Each segment represents a unique demand landscape influenced by factors such as container volume, infrastructure development, environmental regulations, and operational efficiency requirements.

- By Type:

- Ship-to-Shore (STS) Cranes

- Rubber-Tyred Gantry (RTG) Cranes

- Rail-Mounted Gantry (RMG) Cranes

- Reach Stackers

- Empty Container Handlers

- Heavy-duty Forklifts

- Straddle Carriers

- Terminal Tractors

- By Application:

- Seaports & Maritime Terminals

- Inland Container Depots (ICDs)

- Freight Stations

- Logistics & Distribution Hubs

- Manufacturing & Industrial Facilities

- By Propulsion:

- Diesel-powered

- Electric-powered

- Hybrid (Diesel-Electric)

- Hydrogen Fuel Cell (Emerging)

Value Chain Analysis For Container Handling Equipment Market

The value chain for the Container Handling Equipment Market is a complex network involving multiple stakeholders, spanning from raw material suppliers to the ultimate end-users and after-sales service providers. At the upstream stage, the value chain begins with the procurement of critical raw materials such as high-grade steel, various alloys, hydraulic components, engines, electrical systems, and advanced electronic controls from a diverse global supplier base. These materials and components are then supplied to equipment manufacturers, who specialize in designing, engineering, and assembling the intricate machinery. This stage also includes technology providers supplying automation software, IoT sensors, and AI components, which are increasingly integral to modern container handling solutions, driving innovation and product differentiation.

The core manufacturing process involves highly specialized fabrication, assembly, and rigorous testing of various equipment types, ensuring they meet stringent safety and operational standards. Following manufacturing, the distribution channel plays a pivotal role in delivering the equipment to end-users. This typically involves a mix of direct sales channels, where manufacturers engage directly with large port authorities or terminal operators for customized large-scale projects, and indirect channels, which involve a network of authorized distributors, dealers, and leasing companies. These indirect partners often provide localized sales, maintenance, and support services, facilitating market penetration and customer reach, particularly for smaller equipment or in geographically dispersed markets.

At the downstream end of the value chain, the equipment reaches its potential customers, primarily port authorities, terminal operating companies, major shipping lines, and large logistics and freight forwarding companies. These entities are responsible for the installation, operation, and ongoing maintenance of the equipment throughout its lifecycle. The after-sales service component is crucial, encompassing spare parts supply, routine maintenance, repairs, and technological upgrades, often provided by the original equipment manufacturers (OEMs) or their authorized service partners. This comprehensive value chain ensures the continuous functioning and modernization of global container logistics, with each stage adding value through specialized expertise and processes, ultimately contributing to the efficiency and reliability of global trade.

Container Handling Equipment Market Potential Customers

The primary potential customers and end-users of container handling equipment are diverse entities within the global logistics and transportation ecosystem, all of whom share a common need for efficient and reliable movement of intermodal containers. These customers are typically large-scale operators that manage significant cargo volumes and require robust, high-performance machinery to maintain seamless supply chain operations. Their purchasing decisions are heavily influenced by factors such as operational capacity, automation capabilities, environmental compliance, total cost of ownership, and the availability of comprehensive after-sales support.

Foremost among these potential customers are port authorities and maritime terminal operators. These entities manage the crucial interface between sea and land transportation, overseeing the loading, unloading, and staging of millions of containers annually. Their demand spans the entire range of equipment, from massive Ship-to-Shore cranes to a fleet of yard equipment like RTGs, Reach Stackers, and Terminal Tractors. Their investment strategies often align with global trade forecasts, port expansion plans, and the adoption of smart port technologies to enhance throughput and competitiveness.

Beyond the immediate port environment, other significant buyers include inland container depots (ICDs), freight stations, and large logistics and distribution hubs. These facilities handle containers once they move inland, often for consolidation, deconsolidation, or onward distribution via rail or road. Equipment such as Reach Stackers, Empty Container Handlers, and heavy-duty forklifts are essential for their operations. Additionally, major shipping lines and global freight forwarders, who often operate their own terminals or contract with dedicated facilities, also represent substantial potential customers. Manufacturing facilities and industrial complexes that deal directly with containerized raw materials or finished goods for export constitute another growing customer segment, highlighting the pervasive need for efficient container handling capabilities across the entire supply chain network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $6.2 Billion |

| Market Forecast in 2032 | $9.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Konecranes, Cargotec (Kalmar), Liebherr, Shanghai Zhenhua Heavy Industries (ZPMC), Terex Corporation, Mitsubishi Heavy Industries, SANY Group, Gottwald Port Technology, Hyundai Heavy Industries, Doosan Infracore, Hyster-Yale Materials Handling, Taylor Machine Works, CVS Ferrari, Anhui Heli Co., Ltd., Hangcha Group Co., Ltd., Combilift, Lonking Holdings, Clark Material Handling, Manitowoc Company (Grove), Sennebogen |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Container Handling Equipment Market Key Technology Landscape

The Container Handling Equipment Market is undergoing a profound transformation driven by rapid technological advancements, focusing primarily on automation, electrification, digitalization, and enhanced connectivity. Automation is at the forefront, with the development of remotely operated and fully autonomous equipment such as automated stacking cranes (ASCs), automated guided vehicles (AGVs), and autonomous terminal tractors. These technologies aim to minimize human intervention, thereby increasing operational speed, precision, and safety while optimizing resource utilization. Advanced sensor technologies, including LiDAR, radar, and high-resolution cameras, are integral to enabling autonomous navigation and collision avoidance, forming the backbone of smart terminal operations.

Electrification and hybrid propulsion systems represent another significant technological shift, driven by increasing environmental regulations and the desire for sustainable operations. Manufacturers are heavily investing in developing electric RTGs, hybrid STS cranes, and battery-powered terminal tractors that reduce emissions, lower fuel consumption, and decrease noise pollution. This transition necessitates advancements in battery technology, charging infrastructure, and energy management systems to ensure efficient and uninterrupted operations. The integration of IoT (Internet of Things) platforms, telematics, and cloud computing further enhances equipment capabilities, enabling real-time monitoring of performance, diagnostics, and operational data across entire fleets.

Moreover, the application of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing operational intelligence within the container handling sector. AI algorithms are used for predictive maintenance, analyzing vast amounts of sensor data to anticipate potential equipment failures and schedule maintenance proactively, thus minimizing downtime. AI also optimizes container stacking patterns, vessel loading sequences, and traffic flow within terminals, maximizing throughput and operational efficiency. Furthermore, augmented reality (AR) and virtual reality (VR) are finding applications in operator training and remote assistance, enhancing skill development and troubleshooting capabilities. Blockchain technology is also emerging as a tool for enhancing supply chain transparency and security, although its direct application to equipment operation is still in nascent stages, its role in overall logistics efficiency is growing.

Regional Highlights

- North America: Characterized by significant investments in port modernization, a strong focus on automation, and the adoption of electric and hybrid equipment. Key markets include the United States and Canada, driven by robust trade volumes and technological innovation.

- Europe: A mature market with stringent environmental regulations driving demand for sustainable and electric container handling solutions. Countries such as Germany, the Netherlands, and the UK are leaders in smart port initiatives and advanced logistics integration.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by booming manufacturing, increasing global trade, and extensive port development projects in China, India, Japan, South Korea, and Southeast Asian nations. This region is a major hub for both production and consumption of container handling equipment.

- Latin America: Emerging market with increasing investments in infrastructure development, port expansion, and the modernization of logistics capabilities. Brazil and Mexico are key growth economies.

- Middle East and Africa (MEA): Experiencing substantial growth due to strategic geographical locations, large-scale infrastructure projects, and increasing trade flows. Countries like UAE, Saudi Arabia, and South Africa are investing heavily in new ports and logistics hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Container Handling Equipment Market.- Konecranes

- Cargotec (Kalmar)

- Liebherr

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Terex Corporation

- Mitsubishi Heavy Industries

- SANY Group

- Gottwald Port Technology

- Hyundai Heavy Industries

- Doosan Infracore

- Hyster-Yale Materials Handling

- Taylor Machine Works

- CVS Ferrari

- Anhui Heli Co., Ltd.

- Hangcha Group Co., Ltd.

- Combilift

- Lonking Holdings

- Clark Material Handling

- Manitowoc Company (Grove)

- Sennebogen

Frequently Asked Questions

What defines the Container Handling Equipment market and its primary functions?

The Container Handling Equipment market encompasses specialized machinery used to lift, move, and stack intermodal containers in ports, terminals, and logistics hubs. Its primary functions include facilitating efficient cargo flow, reducing vessel turnaround times, and optimizing storage and distribution within global supply chains, thereby supporting international trade and commerce.

What are the key technological trends shaping the future of container handling?

Key technological trends include increased automation and remote operation capabilities, the widespread adoption of electrification and hybrid propulsion systems for sustainability, integration of IoT for real-time monitoring, and the application of AI and Machine Learning for predictive maintenance and operational optimization in smart ports.

How does automation and AI specifically impact operational efficiency and safety in container terminals?

Automation and AI significantly boost operational efficiency by enabling faster, more precise, and predictable container movements, reducing human error, and optimizing resource allocation. For safety, they minimize human exposure to hazardous environments, implement automated collision avoidance systems, and provide intelligent surveillance, leading to a safer working environment.

Which geographical regions are projected to experience the most significant growth in container handling equipment adoption?

The Asia Pacific region, particularly countries like China, India, and Southeast Asia, is projected to experience the most significant growth due to extensive port development projects, expanding manufacturing sectors, and increasing global trade volumes. North America and Europe will also see growth driven by technological upgrades and sustainability initiatives.

What are the major challenges faced by manufacturers and operators in the Container Handling Equipment market?

Major challenges include high initial capital investment costs, complex maintenance requirements, a persistent shortage of skilled labor, geopolitical trade uncertainties affecting demand, and stringent environmental regulations that necessitate costly technological upgrades and compliance measures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager