Contract Lifecycle Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428128 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Contract Lifecycle Management Software Market Size

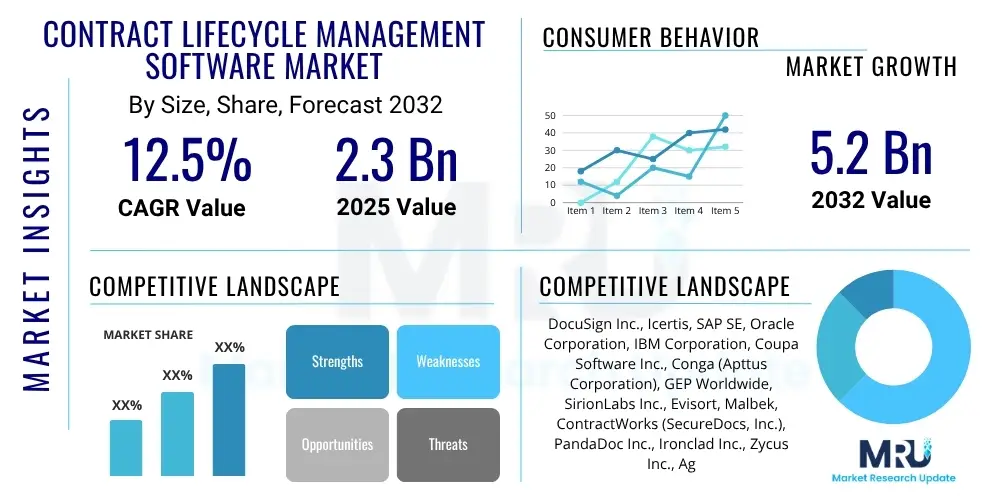

The Contract Lifecycle Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 2.3 Billion in 2025 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2032. This substantial growth is driven by increasing digital transformation initiatives across various industries, a heightened focus on regulatory compliance, and the imperative for businesses to streamline operational inefficiencies associated with manual contract management processes.

Contract Lifecycle Management Software Market introduction

The Contract Lifecycle Management (CLM) software market encompasses solutions designed to automate and streamline the entire contracting process, from initiation and drafting to negotiation, execution, ongoing management, and renewal or termination. These platforms serve as centralized repositories for contracts, ensuring consistency, visibility, and control over all contractual agreements within an organization. By standardizing workflows and providing robust analytical capabilities, CLM software empowers businesses to mitigate risks, enhance operational efficiency, and capture greater value from their contractual relationships. The core functionality revolves around eliminating manual errors, accelerating contract cycles, and ensuring adherence to legal and organizational policies.

CLM software offers a comprehensive suite of features, including automated contract generation using templates, intelligent clause libraries, collaborative negotiation tools, electronic signature integration, and powerful search and retrieval functionalities. It also provides advanced capabilities for obligation tracking, amendment management, and robust reporting and analytics. These functionalities collectively aim to reduce bottlenecks, improve turnaround times, and free up legal and business teams from tedious administrative tasks, allowing them to focus on strategic initiatives. The product is essentially a digital framework for managing the complete lifecycle of any contractual agreement, transforming what was once a disjointed, paper-intensive process into a cohesive, automated, and intelligent workflow.

Major applications of CLM software span across diverse business functions, most notably legal, procurement, sales, and finance departments. Its benefits are multifold, including significant improvements in efficiency by automating routine tasks, enhanced compliance with internal policies and external regulations, and substantial risk mitigation through better visibility and control over contract terms and obligations. The market's growth is primarily driven by the global push for digital transformation, the escalating complexity of regulatory landscapes, and the increasing demand for operational efficiency and cost reduction across enterprises of all sizes. Furthermore, the need for improved contract visibility, reduced legal exposure, and accelerated sales cycles are key factors propelling the adoption of these sophisticated solutions.

Contract Lifecycle Management Software Market Executive Summary

The Contract Lifecycle Management (CLM) software market is experiencing robust expansion, propelled by significant business trends such as the widespread adoption of digital transformation strategies, the shift towards cloud-based solutions, and the increasing integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML). Organizations are increasingly recognizing the strategic importance of efficient contract management in reducing operational costs, minimizing legal risks, and accelerating revenue generation. This translates into a growing demand for automated tools that can handle the intricacies of modern contracting, from complex vendor agreements to crucial customer contracts, ensuring compliance and optimizing business outcomes. The emphasis on data-driven decision-making further encourages the uptake of CLM platforms equipped with powerful analytics capabilities to derive insights from contractual data.

From a regional perspective, North America continues to dominate the CLM market, driven by a high concentration of technology providers, early adoption of advanced business solutions, and stringent regulatory environments that necessitate robust contract governance. Europe also represents a significant market, primarily fueled by the strong emphasis on data privacy regulations such as GDPR, which mandates meticulous contract management. The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, attributed to rapid digital infrastructure development, increasing enterprise digitalization, and a burgeoning number of small and medium-sized enterprises (SMEs) realizing the benefits of streamlined operations. Emerging markets in Latin America, the Middle East, and Africa are also showing promising signs of adoption, spurred by growing investment in IT infrastructure and the globalization of business operations.

In terms of segment trends, the market is observing a significant pivot towards cloud-deployed CLM solutions due to their scalability, flexibility, and lower upfront investment requirements compared to on-premises deployments. Large enterprises remain the primary consumers of comprehensive CLM suites, but the SME segment is rapidly expanding its adoption, driven by the availability of more affordable, modular, and user-friendly cloud-based offerings. Furthermore, industry-specific CLM solutions are gaining traction, catering to the unique contractual needs of sectors like legal, healthcare, BFSI (Banking, Financial Services, and Insurance), and manufacturing. The increasing demand for integrated solutions that seamlessly connect with existing enterprise resource planning (ERP), customer relationship management (CRM), and other business systems is also a prominent trend, enhancing end-to-end process automation and data flow.

AI Impact Analysis on Contract Lifecycle Management Software Market

Common user questions regarding AI's impact on the Contract Lifecycle Management Software Market often revolve around its ability to automate, analyze, and optimize contractual processes. Users frequently inquire about how AI can accelerate contract review and drafting, improve accuracy in clause identification, and enhance compliance monitoring. There is a strong interest in AI's potential to identify risks proactively, provide deeper insights into contract performance, and minimize manual effort. Concerns typically include data privacy, the accuracy of AI algorithms, and the complexity of integrating AI tools into existing CLM systems. The overarching expectation is that AI will transform CLM from a reactive administrative function into a proactive strategic asset, offering unprecedented levels of efficiency and risk intelligence, but also raising questions about necessary safeguards and implementation strategies.

The integration of AI into CLM software is revolutionizing how organizations manage their contracts, moving beyond simple automation to intelligent automation. AI algorithms, particularly those leveraging Natural Language Processing (NLP) and Machine Learning (ML), can rapidly analyze vast volumes of contract data, identifying key clauses, terms, and conditions with high precision. This capability significantly reduces the time and effort traditionally required for contract review, negotiation, and compliance checks. Furthermore, AI-powered CLM solutions can detect anomalies, flag potential risks, and highlight areas of non-compliance, thereby enhancing legal and financial oversight. The ability of AI to learn from historical contract data allows it to refine its performance over time, offering increasingly accurate predictions and recommendations, making the contract management process smarter and more efficient.

This technological evolution enables businesses to shift from labor-intensive, error-prone manual processes to highly efficient, data-driven contract workflows. AI-driven insights can empower legal teams to negotiate more favorable terms, procurement departments to optimize vendor relationships, and sales teams to accelerate deal closures. The proactive identification of expiring contracts or missed obligations through AI-powered alerts helps prevent revenue leakage and ensures business continuity. While challenges such as data quality requirements and the need for explainable AI persist, the benefits derived from AI integration, including substantial time savings, improved accuracy, and enhanced strategic decision-making, firmly position it as a critical transformative force within the Contract Lifecycle Management software market, driving both innovation and competitive advantage.

- Automated contract drafting and generation from pre-approved templates and clauses.

- Intelligent search and retrieval of specific clauses, terms, and metadata within large contract repositories.

- Risk assessment and anomaly detection by identifying unusual language, missing clauses, or non-standard terms.

- Predictive analytics for contract renewals, obligations, and potential disputes.

- Automated extraction of key data points, dates, and entities from unstructured contract text.

- Enhanced compliance monitoring by cross-referencing contract terms with regulatory requirements.

- Faster contract review and negotiation cycles through AI-powered insights and recommendations.

- Optimization of clause libraries and template management based on performance data.

- Improved visibility into contractual obligations and potential liabilities across the enterprise.

- Support for multilingual contract analysis and cross-jurisdictional compliance.

DRO & Impact Forces Of Contract Lifecycle Management Software Market

The Contract Lifecycle Management (CLM) software market is shaped by a confluence of powerful drivers, restraining factors, and emerging opportunities, all under the influence of various impact forces. A primary driver is the pervasive digital transformation trend, which mandates the modernization of all business processes, including contract management, to improve efficiency and reduce manual errors. The escalating complexity of global regulatory environments and the increasing need for robust compliance mechanisms also significantly boost CLM adoption. Furthermore, the imperative for organizations to achieve operational efficiency, reduce costs, and gain better visibility into their contractual obligations across distributed workforces further propels market growth. The desire to accelerate deal cycles in sales and improve vendor relationships in procurement are additional significant factors driving demand.

However, the market faces several notable restraints. High initial implementation costs, particularly for comprehensive enterprise-grade CLM suites, can be a barrier for smaller organizations or those with limited IT budgets. Concerns regarding data security and privacy, especially when handling sensitive contractual information in cloud environments, also present a challenge. Integration complexities with existing legacy systems, such as ERP or CRM platforms, can deter adoption, requiring significant time and resources. Additionally, a lack of widespread awareness among potential users about the full range of benefits and capabilities of modern CLM solutions, coupled with resistance to change from traditional manual processes, can slow market penetration. These factors necessitate robust change management strategies and clear ROI demonstrations from CLM vendors.

Despite these restraints, the CLM market is abundant with opportunities. The increasing integration of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and blockchain promises to revolutionize contract intelligence and automation, creating new avenues for value creation. The growing demand for industry-specific CLM solutions tailored to the unique needs of sectors like healthcare, life sciences, and manufacturing presents significant untapped potential. Furthermore, the expansion of the Small and Medium-sized Enterprise (SME) segment, driven by accessible cloud-based and subscription-model CLM offerings, represents a substantial growth opportunity. Geographically, emerging markets in Asia Pacific, Latin America, and the Middle East and Africa are poised for rapid adoption as they continue to invest in digital infrastructure. These opportunities, combined with the ongoing impact forces of technological advancements, evolving regulatory landscapes, and global economic shifts, will continue to mold the trajectory and expansion of the CLM software market, making it a dynamic and innovation-driven sector.

Segmentation Analysis

The Contract Lifecycle Management (CLM) software market is meticulously segmented to provide a granular understanding of its diverse components, deployment models, enterprise sizes, and end-use industry applications. This comprehensive segmentation allows market participants to identify specific demand patterns, target customer groups effectively, and tailor their offerings to address distinct market needs. The segmentation reflects the varied ways organizations consume and utilize CLM solutions, from comprehensive suites to specialized services, and across different scales of operations, contributing to a holistic view of the market landscape and its underlying dynamics.

- By Component

- Software (Core CLM Platforms, Analytics Modules, Integration Tools)

- Services (Implementation, Consulting, Training, Support, Maintenance)

- By Deployment Model

- On-premises (Installed and managed within the organization's infrastructure)

- Cloud-based (SaaS – Software as a Service, accessible via internet, managed by vendor)

- By Enterprise Size

- Small and Medium-sized Enterprises (SMEs) (Typically fewer than 1,000 employees)

- Large Enterprises (Typically 1,000+ employees)

- By Industry Vertical

- Legal (Law firms, in-house legal departments)

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences (Hospitals, pharmaceutical companies, medical device manufacturers)

- Manufacturing (Automotive, industrial equipment, consumer goods)

- Retail and E-commerce

- IT and Telecom

- Government and Public Sector

- Energy and Utilities

- Others (Real Estate, Education, Professional Services)

Value Chain Analysis For Contract Lifecycle Management Software Market

The value chain for the Contract Lifecycle Management (CLM) software market involves a series of interconnected activities that contribute to the creation and delivery of CLM solutions to end-users. At the upstream stage, this chain primarily involves software developers, technology providers supplying foundational components such as AI/ML engines, NLP capabilities, and cloud infrastructure, and legal domain experts who provide critical insights for compliance and contract intelligence. These entities are responsible for research and development, crafting the core software architecture, developing specialized modules, and ensuring the technological robustness and functional breadth of the CLM platform. Strategic partnerships with these upstream providers are crucial for innovation and maintaining a competitive edge in a rapidly evolving technological landscape.

Further along the value chain, the software development transitions into the integration and customization phases. This involves third-party system integrators and IT consultants who specialize in adapting CLM solutions to specific organizational needs, ensuring seamless integration with existing enterprise systems like ERP, CRM, and accounting software. These intermediaries play a vital role in enhancing the usability and overall value proposition of CLM software by tailoring it to unique business processes and industry requirements. Their expertise in implementation, configuration, and data migration is essential for successful deployment and maximizes the return on investment for end-users, transforming off-the-shelf software into a bespoke business tool that drives efficiency and strategic advantage.

The downstream analysis focuses on the distribution channels and the end-users. Distribution primarily occurs through direct sales channels by CLM vendors, leveraging their own sales teams and marketing efforts to reach enterprises. Indirect channels include a network of resellers, value-added resellers (VARs), and cloud marketplaces, which broaden market reach and provide localized support. The ultimate beneficiaries, or end-users/buyers, are organizations across various industries, including legal departments, procurement, sales, finance, and human resources, all seeking to manage their contracts more efficiently. The value chain also encompasses post-sales support, maintenance, training, and ongoing consultation services, which are critical for customer satisfaction and long-term client retention. This holistic chain ensures that CLM software not only reaches its intended users but also delivers sustained value throughout its operational lifecycle.

Contract Lifecycle Management Software Market Potential Customers

The Contract Lifecycle Management (CLM) software market serves a broad and diverse base of potential customers, spanning across virtually all industries and enterprise sizes due to the universal necessity of managing contractual agreements. Fundamentally, any organization that enters into legally binding agreements with employees, customers, vendors, partners, or other stakeholders stands to benefit significantly from a CLM solution. This includes in-house legal departments, which are constantly burdened with drafting, reviewing, negotiating, and archiving complex contracts, and are prime candidates for tools that automate these labor-intensive processes. The legal sector's need for compliance, risk mitigation, and efficient document management makes it a core demographic for CLM adoption, enhancing their strategic value within the organization.

Beyond legal teams, procurement departments represent a substantial segment of potential customers. These teams manage numerous vendor contracts, supplier agreements, and purchasing orders, where CLM software can provide crucial visibility into terms, obligations, and performance, leading to cost savings and optimized supplier relationships. Similarly, sales departments are significant beneficiaries, using CLM to accelerate proposal generation, contract negotiation, and electronic signature processes, thereby shortening sales cycles and improving revenue recognition. Finance departments also leverage CLM for managing financial agreements, tracking payment terms, and ensuring budgetary compliance, while human resources departments use it for employment contracts and non-disclosure agreements. This widespread applicability highlights CLM as an indispensable tool for operational excellence across the entire enterprise.

The scope of potential customers extends to a wide array of industry verticals, each with unique contractual complexities and regulatory requirements. This includes the BFSI sector, which deals with highly regulated financial instruments; healthcare and life sciences, managing patient data agreements, clinical trial contracts, and pharmaceutical licensing; manufacturing, handling supply chain contracts and distribution agreements; and IT and telecom, dealing with service level agreements (SLAs) and software licenses. Government agencies, retail enterprises, and energy companies also rely heavily on robust contract management. Moreover, the growing availability of scalable, cloud-based CLM solutions has made these powerful tools accessible not only to large corporations but also to Small and Medium-sized Enterprises (SMEs), democratizing sophisticated contract management capabilities and expanding the customer base significantly, making virtually any business a potential user.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.3 Billion |

| Market Forecast in 2032 | USD 5.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DocuSign Inc., Icertis, SAP SE, Oracle Corporation, IBM Corporation, Coupa Software Inc., Conga (Apttus Corporation), GEP Worldwide, SirionLabs Inc., Evisort, Malbek, ContractWorks (SecureDocs, Inc.), PandaDoc Inc., Ironclad Inc., Zycus Inc., Agiloft Inc., HighQ (Thomson Reuters), Wolters Kluwer N.V., Onit Inc., Precisely. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contract Lifecycle Management Software Market Key Technology Landscape

The Contract Lifecycle Management (CLM) software market is profoundly shaped by a dynamic and evolving technology landscape, continuously integrating cutting-edge innovations to enhance functionality, efficiency, and intelligence. At its core, modern CLM relies heavily on robust cloud computing architectures, predominantly Software as a Service (SaaS) models, which provide unparalleled scalability, accessibility, and cost-effectiveness. This cloud-native approach enables seamless updates, reduces IT overhead for clients, and facilitates remote access, aligning perfectly with contemporary global and distributed work environments. Furthermore, a strong emphasis is placed on highly secure data storage and transmission protocols to protect sensitive contractual information, often employing advanced encryption and multi-factor authentication, which is crucial for maintaining trust and compliance in regulated industries.

Artificial Intelligence (AI) and Machine Learning (ML) are unequivocally the most transformative technologies driving the CLM market forward. Natural Language Processing (NLP) is particularly critical, allowing CLM platforms to "understand" and interpret unstructured contract text, enabling automated clause identification, risk assessment, and data extraction. ML algorithms are trained on vast datasets of legal documents to recognize patterns, predict outcomes, and refine contract drafting suggestions, thus significantly reducing manual effort and improving accuracy. Robotic Process Automation (RPA) complements these AI capabilities by automating repetitive, rule-based tasks such as data entry, document routing, and notification triggers, further streamlining workflows and accelerating contract lifecycles, leading to substantial operational efficiencies across the entire contracting process.

Beyond AI and ML, other pivotal technologies include advanced data analytics and business intelligence tools that provide actionable insights into contract performance, obligations, and financial implications, empowering data-driven decision-making. Integration APIs (Application Programming Interfaces) are also fundamental, ensuring seamless interoperability with other critical enterprise systems like ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and e-signature platforms, creating a unified digital ecosystem. Emerging technologies such as blockchain are beginning to find niche applications in CLM for enhanced security, transparency, and immutability of contract records, particularly for smart contracts and distributed ledger technologies. This rich technological tapestry underscores the continuous innovation within the CLM market, aimed at delivering more intelligent, automated, and secure contract management solutions to enterprises worldwide.

Regional Highlights

- North America: The largest market share holder, driven by early adoption of advanced business technologies, a high concentration of key CLM vendors, and stringent regulatory compliance requirements across sectors like healthcare, finance, and legal. Strong investment in digital transformation and a mature IT infrastructure further bolster its leading position.

- Europe: A significant market characterized by strong emphasis on data protection regulations (e.g., GDPR) and a growing need for efficient contract management to ensure compliance. Countries like the UK, Germany, and France are prominent adopters, fueled by mature economies and increasing digitalization across industries.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate due to rapid digital transformation initiatives, increasing investments in IT infrastructure, and a burgeoning number of SMEs adopting cloud-based solutions. Emerging economies such as India, China, and Australia are key contributors to this growth, driven by globalization and a competitive business landscape.

- Latin America: An emerging market experiencing steady growth, propelled by increasing foreign investments, rising awareness of digital solutions, and efforts to modernize business processes. Countries like Brazil and Mexico are leading the adoption, albeit at a slower pace than developed regions, but with significant potential for future expansion.

- Middle East and Africa (MEA): This region is witnessing nascent but promising growth, primarily driven by government-led digital initiatives, diversification efforts away from oil economies, and growing enterprise adoption of cloud technologies. Countries in the GCC (Gulf Cooperation Council) are at the forefront of this digital shift, investing in smart cities and advanced business solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contract Lifecycle Management Software Market.- DocuSign Inc.

- Icertis

- SAP SE

- Oracle Corporation

- IBM Corporation

- Coupa Software Inc.

- Conga (Apttus Corporation)

- GEP Worldwide

- SirionLabs Inc.

- Evisort

- Malbek

- ContractWorks (SecureDocs, Inc.)

- PandaDoc Inc.

- Ironclad Inc.

- Zycus Inc.

- Agiloft Inc.

- HighQ (Thomson Reuters)

- Wolters Kluwer N.V.

- Onit Inc.

- Precisely

Frequently Asked Questions

What is Contract Lifecycle Management (CLM) software and why is it important?

Contract Lifecycle Management (CLM) software automates and streamlines the entire process of managing contracts, from creation and negotiation to execution, ongoing management, and renewal or termination. It is crucial because it significantly enhances operational efficiency, reduces manual errors, ensures regulatory compliance, minimizes legal and financial risks, and provides critical insights into contractual obligations and performance. By centralizing contract data and automating workflows, CLM software empowers organizations to accelerate business cycles, optimize relationships with customers and vendors, and achieve substantial cost savings, making it an indispensable tool in today's complex business environment.

How does CLM software benefit different departments within an organization?

CLM software offers tailored benefits across various departments. For legal teams, it ensures compliance, mitigates risks, and speeds up contract review and drafting. Procurement benefits from improved vendor relationship management, spend visibility, and optimized sourcing. Sales departments can accelerate deal closures through automated contract generation and e-signature integration. Finance teams gain better control over revenue recognition and budgetary compliance by tracking payment terms and obligations. HR departments streamline employment contracts and policy agreements. Overall, CLM fosters cross-departmental collaboration, provides a single source of truth for all agreements, and drives enterprise-wide efficiency and strategic decision-making by transforming contract management into a proactive business function rather than a reactive administrative task.

What role does Artificial Intelligence (AI) play in modern CLM solutions?

Artificial Intelligence (AI) is rapidly transforming CLM by introducing intelligent automation and advanced analytics. AI, particularly through Natural Language Processing (NLP) and Machine Learning (ML), enables automated extraction of key clauses and data points from contracts, rapid risk assessment by identifying non-standard language, and predictive analytics for contract renewals and obligations. It significantly accelerates contract review and negotiation, enhances compliance monitoring, and provides deeper insights into contractual performance. AI-powered CLM solutions reduce manual effort, improve accuracy, and allow legal and business teams to focus on strategic tasks rather than administrative ones, making the contract lifecycle more efficient, intelligent, and proactive. The integration of AI moves CLM beyond basic automation to truly smart contract management capabilities.

What are the primary challenges associated with implementing CLM software?

Implementing CLM software can present several challenges, including the high initial cost of investment, particularly for comprehensive enterprise-level solutions, which can be a barrier for some organizations. Data migration from existing legacy systems and disparate data sources into a new CLM platform can be complex and time-consuming, requiring meticulous planning. Integration challenges with other critical enterprise systems like ERP, CRM, and accounting software often arise, necessitating robust API capabilities and technical expertise. Furthermore, user adoption can be an obstacle if there is resistance to change from established manual processes or a lack of adequate training and change management strategies. Addressing data security and privacy concerns, especially with cloud deployments, also requires careful consideration and adherence to regulatory standards.

What is the future outlook for the Contract Lifecycle Management Software Market?

The future outlook for the Contract Lifecycle Management (CLM) software market is exceptionally promising, characterized by continued strong growth and rapid technological innovation. Key trends shaping this future include deeper integration of AI and Machine Learning for predictive analytics, smart contract capabilities, and hyper-automation across the entire contract lifecycle. The market will see an increased demand for specialized, industry-specific CLM solutions tailored to unique regulatory and business needs. Cloud-based deployments will continue to dominate, with a growing focus on accessibility for Small and Medium-sized Enterprises (SMEs). Furthermore, enhanced integration with broader digital ecosystems, leveraging technologies like blockchain for greater security and transparency, and advanced analytics for strategic insights, will drive market expansion. The increasing global focus on governance, risk, and compliance (GRC) will further solidify CLM as a critical enterprise system, making it an indispensable component of modern business operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager