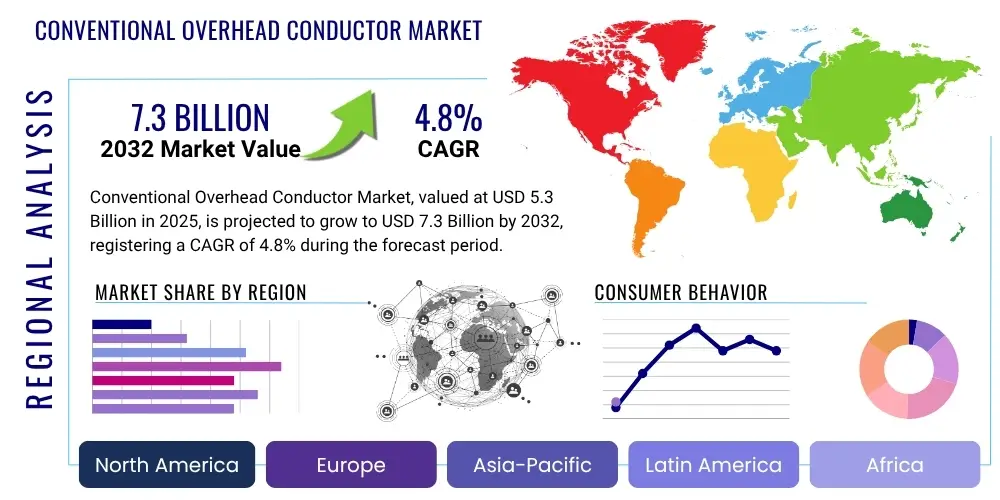

Conventional Overhead Conductor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429037 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Conventional Overhead Conductor Market Size

The Conventional Overhead Conductor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 5.3 Billion in 2025 and is projected to reach USD 7.3 Billion by the end of the forecast period in 2032.

Conventional Overhead Conductor Market introduction

The Conventional Overhead Conductor Market encompasses the manufacturing, distribution, and utilization of traditional conductors employed in electrical power transmission and distribution systems worldwide. These conductors, primarily made of aluminum or copper and often reinforced with steel, are fundamental components of overhead power lines, facilitating the efficient transfer of electricity from generation sources to end-users. Their widespread adoption is due to their proven reliability, cost-effectiveness, and ease of installation and maintenance compared to underground cabling in many scenarios.

Products within this market range from All Aluminum Conductors (AAC) and All Aluminum Alloy Conductors (AAAC) to the ubiquitous Aluminum Conductor Steel Reinforced (ACSR), designed to meet diverse voltage and capacity requirements. Major applications span across national grids, regional distribution networks, industrial power supply, and rural electrification projects, playing a critical role in expanding access to electricity and supporting industrial growth. The inherent benefits of conventional overhead conductors include their high thermal capacity, robust mechanical strength, and relatively lower material and installation costs, making them the preferred choice for vast sections of global power infrastructure. The market is propelled by a confluence of factors including burgeoning global electricity demand, continuous expansion and modernization of power grids, rapid urbanization, and industrial development, particularly in emerging economies. Additionally, the necessity to replace aging infrastructure in developed regions further contributes to sustained demand.

These conductors are essential for connecting diverse energy sources, including a growing share of renewable energy installations, to load centers. Their design and material composition are optimized for long-distance power transfer, balancing electrical conductivity with mechanical integrity under various environmental conditions. As global economies continue to develop, the demand for reliable and affordable power transmission solutions ensures the conventional overhead conductor market remains a vital segment of the broader electrical infrastructure industry.

Conventional Overhead Conductor Market Executive Summary

The Conventional Overhead Conductor Market is experiencing steady growth driven by global electrification initiatives, grid expansion, and the ongoing modernization of existing power infrastructure. Business trends indicate a strong focus on cost-efficiency, enhanced material properties, and the integration of these traditional components into more intelligent grid systems. Key industry players are increasingly investing in manufacturing process optimization and supply chain resilience to meet fluctuating material costs and dynamic project demands. The market is characterized by a balance between established manufacturers leveraging decades of expertise and new entrants focusing on specialized products or regional niches. Strategic partnerships and mergers and acquisitions are observed as companies seek to expand their geographical footprint and product portfolios.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market segment, primarily due to rapid industrialization, urbanization, and ambitious electrification programs in countries like China and India. North America and Europe, while mature, exhibit consistent demand driven by infrastructure replacement, grid hardening against extreme weather events, and the integration of renewable energy sources. Latin America, the Middle East, and Africa are also showing considerable potential, fueled by new infrastructure projects and efforts to expand electricity access to underserved populations. Each region presents unique opportunities and challenges, from regulatory landscapes to specific climate considerations affecting conductor selection and deployment.

Segment-wise, the market sees continued dominance of Aluminum Conductor Steel Reinforced (ACSR) due to its high strength-to-weight ratio and cost-effectiveness for transmission lines, while All Aluminum Conductors (AAC) and All Aluminum Alloy Conductors (AAAC) find extensive use in distribution networks. The demand for higher voltage and higher capacity conductors is increasing, reflecting the trend towards more efficient and bulk power transmission. The overarching trend points towards a robust and essential market, underpinning the foundational elements of global electrical grids, with gradual evolutionary improvements in materials and integration capabilities rather than revolutionary shifts.

AI Impact Analysis on Conventional Overhead Conductor Market

User inquiries regarding AI's impact on the Conventional Overhead Conductor Market frequently revolve around optimizing grid operations, predicting conductor failures, enhancing maintenance efficiency, and potentially influencing future conductor design and deployment strategies. Users are keen to understand how artificial intelligence can extend the lifespan of existing infrastructure, reduce operational expenditures, and improve the reliability of power transmission and distribution without necessarily altering the fundamental physical properties of conventional conductors. There's a particular interest in AI's role in predictive analytics for aging infrastructure, intelligent asset management, and real-time monitoring to prevent outages and optimize power flow across vast networks. Concerns often include the feasibility of integrating AI with legacy systems, data privacy, and the skills gap required for effective AI deployment.

- AI-powered predictive maintenance reduces conductor failures and extends asset life.

- Optimized grid management through AI enhances power flow efficiency and reduces losses.

- AI facilitates real-time monitoring and anomaly detection for overhead lines.

- Improved asset management and inventory optimization for conductor components via AI.

- AI-driven network planning and design for optimal conductor routing and capacity.

- Enhanced safety protocols through AI analysis of environmental and operational data.

- Better forecasting of electricity demand and supply, impacting conductor load requirements.

- AI assists in identifying areas for grid hardening and infrastructure upgrades.

- Data analytics from sensors on or near conductors can inform maintenance schedules.

- AI can aid in post-fault analysis to understand causes of conductor stress or damage.

DRO & Impact Forces Of Conventional Overhead Conductor Market

The Conventional Overhead Conductor Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces that dictate its growth trajectory and operational dynamics. Key drivers include the relentless growth in global electricity demand, fueled by increasing populations, rapid urbanization, and industrial expansion, particularly in developing nations. The continuous need for new power transmission and distribution infrastructure, alongside the critical requirement to replace aging conventional conductors in developed economies, provides a robust foundation for market expansion. Furthermore, the integration of renewable energy sources, often situated in remote locations, necessitates extensive grid expansion and reinforcement, driving demand for efficient and reliable overhead conductors to transmit power to load centers. Government initiatives and investments in rural electrification and smart grid projects also act as significant accelerators, pushing the deployment of new and upgraded conductor systems.

However, the market faces several restraints. High initial capital investment required for extensive overhead transmission and distribution projects can be a barrier, especially in financially constrained regions. Environmental concerns, such as the visual impact of power lines, potential impact on bird populations, and challenges in land acquisition for new corridors, sometimes lead to public opposition and regulatory hurdles. The volatility of raw material prices, primarily aluminum and steel, directly impacts manufacturing costs and profit margins for conductor producers. Moreover, increasing competition from alternative technologies, such as underground cables, particularly in urban and environmentally sensitive areas, poses a threat, despite the higher cost of the latter. Regulatory complexities and the need for stringent compliance with national and international standards also add to the operational challenges within the industry.

Opportunities for growth are abundant, notably in the form of smart grid initiatives that require intelligent integration of conventional conductors with advanced monitoring and control systems to improve grid resilience and efficiency. The ongoing technological advancements in conductor materials, while still conventional in basic design, offer enhanced performance, such as high-temperature low-sag (HTLS) conductors, which allow for increased capacity without significant structural modifications. The massive infrastructure development plans in emerging economies present long-term growth prospects. Additionally, retrofitting existing grids with higher capacity and more resilient conductors to handle peak loads and withstand extreme weather events offers a continuous stream of projects. The collective impact forces, including economic cycles, geopolitical stability affecting raw material supply, and evolving energy policies, constantly influence investment decisions and project timelines, making the market dynamic and responsive to global trends in energy and infrastructure development.

Segmentation Analysis

The Conventional Overhead Conductor Market is meticulously segmented based on various technical and application-specific criteria to provide a granular understanding of its diverse components and market dynamics. This comprehensive segmentation allows for a detailed analysis of demand patterns, technological preferences, and regional variations in product adoption. The primary segmentation criteria include conductor type, voltage level, and end-user application, each representing critical dimensions that shape the competitive landscape and strategic decision-making within the industry. Understanding these segments is crucial for manufacturers, utilities, and investors to identify lucrative opportunities and address specific market needs efficiently.

- By Type

- All Aluminum Conductor (AAC)

- All Aluminum Alloy Conductor (AAAC)

- Aluminum Conductor Steel Reinforced (ACSR)

- Aluminum Conductor Aluminum Alloy Reinforced (ACAR)

- Other Conventional Conductors (e.g., Copper Conductors, Galvanized Steel Conductors for grounding)

- By Voltage Level

- Low Voltage (LV)

- Medium Voltage (MV)

- High Voltage (HV)

- Extra High Voltage (EHV)

- By Application

- Transmission Lines

- Distribution Lines

- Rural Electrification

- Industrial Power Supply

- Railways and Other Infrastructure

- By End-User

- Power Utilities

- Industrial Sector

- Commercial Sector

- Residential Sector

- Government and Infrastructure

Value Chain Analysis For Conventional Overhead Conductor Market

The value chain for the Conventional Overhead Conductor Market begins with the upstream activities of raw material procurement, primarily focusing on aluminum, steel, and zinc. These raw materials are sourced from mining companies and metal refineries, where they undergo initial processing to produce ingots, rods, or wires. This stage is crucial as the quality and cost of these primary materials significantly impact the final product's performance and market price. Manufacturers then process these materials through drawing, stranding, and twisting processes to form various types of conductors like ACSR, AAC, or AAAC. This manufacturing phase involves significant capital investment in machinery and skilled labor to ensure conductors meet specific industry standards for conductivity, strength, and durability. Research and development activities also occur at this stage, focusing on material enhancements and manufacturing efficiencies to improve conductor performance within conventional frameworks.

Further down the value chain, the manufactured conductors are moved through distribution channels to reach end-users. Direct distribution channels involve manufacturers selling directly to large national power utilities, major EPC (Engineering, Procurement, and Construction) contractors, and government agencies undertaking large-scale infrastructure projects. This direct approach often involves long-term contracts, custom specifications, and direct logistical arrangements. Indirect distribution channels, on the other hand, involve a network of wholesalers, distributors, and regional suppliers who cater to smaller utilities, industrial clients, private developers, and maintenance service providers. These intermediaries play a vital role in providing readily available stock, localized support, and smaller order fulfillment, extending the market reach of manufacturers. Both direct and indirect channels are critical for market penetration and ensuring a consistent supply to diverse customer segments, balancing the needs for large project execution with routine maintenance and expansion requirements.

The downstream segment of the value chain primarily involves installation, testing, and ongoing maintenance services. Power utilities and their contractors are the major players in this segment, responsible for the deployment of conductors, connection to the grid, and ensuring operational reliability. Post-installation, regular inspections, repairs, and eventual replacement of aging conductors form a continuous service demand. The efficiency and safety of these downstream operations are paramount to the overall performance of the electrical grid. This interconnected flow, from raw material extraction to final operational use and maintenance, highlights the collaborative nature of the conventional overhead conductor industry, where each stage adds value and contributes to the reliable delivery of electricity.

Conventional Overhead Conductor Market Potential Customers

The primary potential customers and end-users of conventional overhead conductors are entities responsible for the generation, transmission, and distribution of electrical power. This includes national and regional power utilities, which form the backbone of the electrical grid infrastructure and are consistently engaged in expanding their networks, maintaining existing lines, and integrating new power sources. These utilities often operate across diverse landscapes, from dense urban areas requiring high-capacity distribution to vast rural regions needing extensive transmission lines, making them the largest and most consistent purchasers of conventional conductors.

Beyond traditional power companies, the industrial sector represents a significant segment of potential customers. Large industrial complexes, such as manufacturing plants, mining operations, and refineries, require dedicated and robust overhead lines for their internal power distribution or to connect directly to the main grid. These industries prioritize reliable and uninterrupted power supply, driving demand for durable and high-performing conductors. Additionally, government agencies involved in large-scale infrastructure projects, including railways, urban development authorities, and rural electrification programs, are crucial buyers. These projects often necessitate extensive overhead cabling for new transport systems, public utilities, and community electrification initiatives.

Finally, Engineering, Procurement, and Construction (EPC) companies that specialize in power transmission and distribution projects act as significant indirect customers. They procure conductors on behalf of their clients, which could be any of the aforementioned end-users. Their role is to deliver turnkey solutions, integrating various components, including overhead conductors, into complete grid systems. Therefore, the market's potential customer base is broad, encompassing both direct consumers for operational use and project-based intermediaries responsible for new installations and major upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2032 | USD 7.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, Sumitomo Electric Industries, LS Cable & System, Southwire Company, ZTT Group, Apar Industries, Sterlite Power, KEI Industries, Finolex Cables, Riyadh Cables, Elsewedy Electric, NKT A/S, TCC (Taiwan Conductor Co. Ltd.), Ducab, Lamifil, Polycab India, KEC International, Qingdao Hanhe Cable Co., Ltd., Encore Wire Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conventional Overhead Conductor Market Key Technology Landscape

The key technology landscape within the Conventional Overhead Conductor Market primarily revolves around material science, advanced manufacturing processes, and quality assurance methodologies rather than disruptive digital innovations directly within the conductor itself. While the core concept of overhead conductors remains traditional, continuous advancements focus on enhancing their physical and electrical properties to meet evolving grid requirements. Material technology involves the development of new aluminum alloys and steel core compositions that offer improved strength-to-weight ratios, enhanced conductivity, and greater resistance to corrosion and fatigue. Innovations in aluminum alloys, for instance, aim to increase current carrying capacity at higher operating temperatures without significant sag, thereby improving transmission efficiency and line capacity. The choice of materials directly impacts the conductor's mechanical robustness, thermal performance, and lifespan under various environmental stresses.

Manufacturing technologies are crucial for ensuring the precision and integrity of conductor strands and the overall conductor structure. Modern stranding machines allow for tighter tolerances, more uniform tension, and greater consistency in the finished product, which translates to better electrical and mechanical performance. Technologies for corrosion protection, such as specialized greases and coatings, are continually refined to extend the service life of conductors in harsh atmospheric conditions. Furthermore, quality control and testing technologies, including advanced non-destructive testing (NDT) methods, are integral to verifying compliance with stringent international standards and ensuring the reliability and safety of installed conductors. These technologies ensure that even conventional conductors can adapt to increasing demands for grid reliability and capacity without requiring fundamental changes to their overhead deployment.

While the conductors themselves remain conventional, the ecosystem around them is evolving with the integration of smart grid technologies. This includes the development and deployment of sensor technologies and communication infrastructure that can monitor conductor parameters such as temperature, sag, and current flow in real-time. Although these are external technologies, they profoundly impact the operational efficiency and maintenance strategies for conventional overhead conductors. The focus is on making these conductors "smarter" through external augmentation, enabling predictive maintenance, dynamic line rating, and improved fault detection. This synergy ensures that conventional conductors remain a viable and efficient component of modern, intelligent power grids, by providing the physical pathway for electricity while leveraging digital intelligence for optimal performance and management.

Regional Highlights

- North America: This region is characterized by an aging infrastructure requiring significant investment in replacement and modernization of overhead conductors. Grid hardening initiatives against extreme weather events and the integration of substantial renewable energy capacity drive steady demand. Key markets include the United States and Canada, focusing on efficiency upgrades and smart grid compatibility.

- Europe: Driven by ambitious renewable energy targets and grid interconnection projects, Europe shows consistent demand for conventional conductors. Emphasis is placed on upgrading existing infrastructure to enhance resilience and accommodate fluctuating renewable inputs, alongside robust environmental and regulatory standards influencing material choices and installation practices. Countries like Germany, France, and the UK are prominent.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid urbanization, industrialization, and massive electrification programs in countries such as China, India, and Southeast Asian nations. Extensive grid expansion to meet soaring electricity demand and connect remote regions drives significant new installations of overhead conductors.

- Latin America: This region is witnessing steady growth due to ongoing infrastructure development, rural electrification projects, and efforts to improve grid reliability and expand access to electricity. Countries like Brazil, Mexico, and Argentina are investing in transmission and distribution network upgrades.

- Middle East and Africa (MEA): Characterized by substantial investments in new power generation and transmission projects, particularly in Saudi Arabia, UAE, and parts of Africa. Increased demand stems from industrial growth, population expansion, and initiatives to enhance energy access and reliability across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conventional Overhead Conductor Market.- Prysmian Group

- Nexans

- Sumitomo Electric Industries

- LS Cable & System

- Southwire Company

- ZTT Group

- Apar Industries

- Sterlite Power

- KEI Industries

- Finolex Cables

- Riyadh Cables

- Elsewedy Electric

- NKT A/S

- TCC (Taiwan Conductor Co. Ltd.)

- Ducab

- Lamifil

- Polycab India

- KEC International

- Qingdao Hanhe Cable Co., Ltd.

- Encore Wire Corporation

Frequently Asked Questions

What are conventional overhead conductors?

Conventional overhead conductors are electrical wires, typically made of aluminum or copper and often reinforced with steel, used to transmit and distribute electricity through overhead power lines. They are a foundational component of global electrical grids due to their cost-effectiveness and proven reliability.

Why are overhead conductors still widely used despite alternatives?

Overhead conductors remain widely used due to their lower installation and maintenance costs compared to underground cables, easier fault location, and superior cooling capabilities. Their established infrastructure and robustness make them suitable for extensive power networks, especially in rural and less densely populated areas.

What are the main types of conventional overhead conductors?

The primary types include All Aluminum Conductor (AAC), All Aluminum Alloy Conductor (AAAC), and Aluminum Conductor Steel Reinforced (ACSR). Each type is selected based on specific requirements for conductivity, mechanical strength, and application (e.g., transmission vs. distribution lines).

How does renewable energy integration affect the demand for conventional overhead conductors?

The integration of renewable energy sources, often located remotely, significantly drives demand for conventional overhead conductors. These conductors are essential for transmitting power from renewable generation sites to existing grids and load centers, necessitating new transmission lines and grid reinforcements.

What are the key environmental concerns associated with conventional overhead conductors?

Environmental concerns include the visual impact of power lines, potential risks to bird populations (bird collisions and electrocution), electromagnetic fields (EMF), and the challenge of land acquisition for new right-of-ways. Regulations and design improvements often address these impacts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager