Corn Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427975 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Corn Oil Market Size

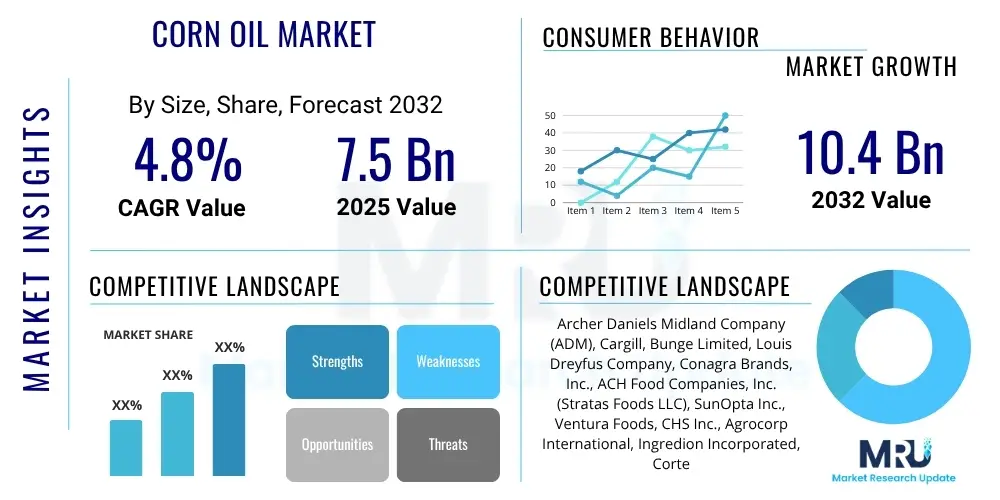

The Corn Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 7.5 Billion in 2025 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2032.

Corn Oil Market introduction

The Corn Oil Market encompasses the global production, distribution, and consumption of corn oil, a versatile vegetable oil extracted from the germ of corn (maize) kernels. Renowned for its high smoke point and neutral flavor, corn oil is a staple in various culinary applications, including frying, baking, and salad dressings, offering a trans-fat-free alternative that appeals to health-conscious consumers. Its composition, rich in polyunsaturated fatty acids like linoleic acid and naturally occurring antioxidants such as tocopherols (Vitamin E), contributes to its widespread acceptance in both household kitchens and commercial food processing industries, promoting its perceived health benefits. The extraction process typically involves wet milling, which separates the corn germ from other components, followed by pressing and solvent extraction to yield crude corn oil, which is then refined to remove impurities and enhance its stability and shelf life, ensuring it meets stringent quality standards for diverse uses.

Beyond its significant role in the food sector, corn oil also finds substantial application in industrial domains, serving as a raw material for the production of biodiesel, a renewable energy source that aids in reducing reliance on fossil fuels and mitigating greenhouse gas emissions. Its lubricant properties make it valuable in various industrial processes, while its emollient characteristics are leveraged in the formulation of personal care products, including soaps, cosmetics, and skin moisturizers. The global demand for corn oil is consistently driven by factors such as population growth, increasing disposable incomes, evolving dietary preferences, and the expanding biofuel industry. Moreover, advancements in agricultural practices, coupled with innovations in processing technologies, continually optimize the efficiency and sustainability of corn oil production, ensuring a steady supply to meet diverse market needs. Its multifaceted utility across consumer and industrial segments underscores its strategic importance within the broader vegetable oils market.

The market benefits from several inherent advantages, including the widespread cultivation of corn, making it a readily available and relatively cost-effective raw material. Its neutral taste profile ensures it does not overpower the flavor of prepared foods, making it ideal for a broad range of culinary applications, from deep-frying to light sautéing. The relatively high smoke point of corn oil, often exceeding 450°F (232°C), renders it suitable for high-temperature cooking, minimizing oxidative degradation and extending the life of frying oil in commercial settings. Furthermore, ongoing research into the nutritional aspects of corn oil, particularly its phytosterol content known for cholesterol-lowering effects, continues to bolster its appeal among consumers seeking healthier cooking oil options. These combined attributes, from its practical culinary benefits to its industrial versatility, firmly establish corn oil as a key player in the global edible oils and industrial raw materials landscape.

Corn Oil Market Executive Summary

The Corn Oil Market is currently navigating a dynamic landscape characterized by evolving business trends, significant regional shifts, and diverse segmental performance. Key business trends include an intensified focus on sustainable sourcing and production practices, driven by increasing consumer and regulatory pressures for environmentally responsible products. There is a noticeable shift towards non-GMO and organic corn oil variants, reflecting a premiumization trend and a growing demand for transparency in food origins. Companies are also investing in technological advancements to improve extraction efficiency, reduce waste, and enhance the nutritional profile of corn oil, alongside developing novel applications to broaden its market reach beyond traditional food and biofuel uses. Consolidation within the industry, through mergers and acquisitions, is also a prominent trend as major players seek to achieve economies of scale and strengthen their market positions against a backdrop of fluctuating raw material prices and intense competition from alternative edible oils.

From a regional perspective, the market exhibits considerable variance. Asia Pacific, particularly countries like China and India, is emerging as a dominant growth engine, propelled by burgeoning populations, rising disposable incomes, rapid urbanization, and an increasing adoption of Western dietary habits that incorporate more fried foods. North America, while a mature market, continues to be a significant consumer and producer, driven by established food processing industries and a growing biofuel sector. Europe is characterized by stringent regulatory frameworks regarding food safety and environmental impact, leading to a focus on sustainably produced and traceable corn oil, with demand influenced by both culinary and industrial applications, especially in renewable energy. Latin America shows promise with expanding agricultural output and increasing domestic consumption, while the Middle East and Africa represent smaller but growing markets, largely dependent on imports, with demand influenced by tourism and evolving culinary traditions.

Segmental trends reveal a robust performance in the food service and retail sectors, fueled by consistent consumer demand for cooking and baking. The industrial application segment, particularly biodiesel production, is experiencing steady growth, supported by governmental mandates and incentives for renewable energy. However, this segment remains susceptible to global crude oil price fluctuations, which can impact the economic viability of biodiesel. The feed segment, where corn oil is used as a high-energy additive for livestock, also contributes substantially to market volume, driven by the expanding animal husbandry industry. Within the food segment, there's a growing inclination towards branded and value-added corn oil products, such as fortified oils or those marketed with specific health claims, offering manufacturers opportunities for higher profit margins. Overall, the market is balancing the stable demand from traditional applications with the innovative potential of new uses and the imperative for sustainable practices across all segments.

AI Impact Analysis on Corn Oil Market

User inquiries regarding AI's impact on the Corn Oil Market frequently center on its potential to revolutionize efficiency, sustainability, and market predictability. Common themes include how AI can optimize corn cultivation for better yields, enhance the oil extraction and refining processes, improve supply chain logistics to reduce waste, and provide deeper insights into consumer preferences and market trends. There is also considerable interest in AI's role in quality control, ensuring product consistency and safety, and its potential to facilitate sustainable practices, from precise resource management in farming to energy efficiency in processing. Concerns often surface about the initial investment costs, the need for specialized skills, data privacy, and potential job displacement, highlighting a desire to understand the balance between technological advancement and socio-economic implications. Overall, users anticipate AI to be a transformative force, driving operational excellence and fostering a more responsive and resilient corn oil industry.

- AI-powered predictive analytics can optimize corn crop yields by analyzing weather patterns, soil conditions, and historical data, leading to more efficient resource allocation and reduced agricultural waste.

- Automated quality control systems utilizing machine vision and AI algorithms can rapidly detect impurities or defects in corn kernels and during the oil refining process, ensuring consistent product quality and safety.

- AI-driven logistics and supply chain management optimize transportation routes, warehouse operations, and inventory levels, minimizing spoilage, reducing fuel consumption, and enhancing delivery efficiency.

- Precision agriculture, leveraging AI and IoT sensors, allows for targeted application of fertilizers and pesticides on corn fields, minimizing environmental impact and input costs.

- Machine learning models can analyze vast datasets of consumer purchasing behavior, social media trends, and economic indicators to forecast market demand for corn oil with greater accuracy, guiding production and marketing strategies.

- Robotics and automation, integrated with AI, can streamline oil extraction, purification, and packaging processes, increasing operational speed, reducing labor costs, and enhancing worker safety in processing plants.

- Blockchain technology, often coupled with AI for data analysis, can enhance traceability and transparency across the corn oil supply chain, verifying sustainable sourcing and combating counterfeiting.

- AI can optimize energy consumption in oil refineries by predicting maintenance needs and adjusting operational parameters in real-time, contributing to reduced carbon footprint and lower operational expenses.

- Development of smart sensors and AI-enabled diagnostics for processing equipment can predict potential breakdowns, facilitating proactive maintenance and minimizing costly downtime.

- Personalized marketing and product development can be tailored using AI insights, identifying niche consumer segments and customizing corn oil products or messaging to meet specific dietary or health preferences.

DRO & Impact Forces Of Corn Oil Market

The Corn Oil Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various Impact Forces that determine its growth trajectory and competitive landscape. Key drivers propelling the market include the increasing global demand for edible oils, especially in developing economies where population growth and rising disposable incomes fuel consumption. The versatility of corn oil, extending beyond culinary uses to industrial applications such as biodiesel production and cosmetic formulations, further broadens its market appeal. Growing health consciousness among consumers, leading to a preference for cholesterol-free and trans-fat-free cooking oils, also positions corn oil favorably due to its perceived health benefits, including a good fatty acid profile and Vitamin E content. Additionally, supportive government policies promoting biofuels in various regions provide a consistent demand floor for corn oil as a feedstock, indirectly stabilizing market volumes.

Conversely, several restraints impede the market's growth potential. The volatile nature of corn prices, influenced by weather patterns, geopolitical events, and global supply-demand dynamics, directly impacts the production costs of corn oil, leading to price fluctuations and affecting profitability for manufacturers. Intense competition from other widely available and often cheaper edible oils such as palm oil, soybean oil, and sunflower oil poses a significant challenge, requiring corn oil producers to differentiate their products effectively. Environmental concerns associated with intensive corn cultivation, including land use changes, water consumption, and pesticide use, are increasingly scrutinizing the industry, potentially leading to stricter regulations and public scrutiny. Furthermore, health misconceptions or negative publicity surrounding specific dietary fats can sometimes dampen consumer enthusiasm for all types of cooking oils, including corn oil, despite its beneficial properties.

Despite these challenges, numerous opportunities exist for market expansion and innovation. The burgeoning demand for sustainable and organic food products presents a lucrative niche for corn oil producers who can meet these specific consumer preferences and certifications. Technological advancements in corn processing and oil refining offer avenues for improving efficiency, reducing production costs, and enhancing product quality, potentially leading to novel applications or improved nutritional profiles. The exploration of new industrial applications beyond biodiesel, such as bio-lubricants, eco-friendly solvents, and advanced biochemicals, could unlock significant untapped market potential. Moreover, strategic market penetration in emerging economies with growing middle-class populations and evolving dietary patterns, coupled with targeted marketing campaigns highlighting corn oil's unique benefits, represents a substantial opportunity for future growth. The overall impact forces, including the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of competitive rivalry, perpetually shape the industry's profitability and strategic decisions.

Segmentation Analysis

The Corn Oil Market is comprehensively segmented to provide a detailed understanding of its diverse landscape, enabling stakeholders to identify specific growth areas and target audiences. This segmentation typically dissects the market based on several critical parameters, including application, distribution channel, end-use industry, and geographic region. Each segment reveals distinct market dynamics, consumer preferences, and growth drivers, reflecting the varied utility and commercial pathways of corn oil globally. Understanding these segments is crucial for strategic planning, product development, and effective market penetration, allowing companies to tailor their offerings and marketing efforts to specific demand pockets and optimize their value proposition across the entire supply chain. This granular analysis facilitates a more nuanced appreciation of market trends and competitive positioning.

- By Application:

- Food & Beverage Industry: Primarily used for cooking, frying, baking, salad dressings, margarine, and snack food production due to its high smoke point and neutral flavor.

- Industrial Applications: Includes biodiesel production, lubricants, paints, varnishes, and other chemical processes.

- Personal Care & Cosmetics: Utilized as an emollient, moisturizer, and carrier oil in soaps, lotions, and makeup formulations.

- Pharmaceuticals: Minor application as a carrier or excipient in certain medicinal products.

- Animal Feed: Used as a high-energy ingredient in livestock and poultry feed formulations to enhance nutritional value.

- By Distribution Channel:

- Supermarkets & Hypermarkets: Large retail outlets offering a wide variety of brands and sizes, dominating consumer sales.

- Convenience Stores: Smaller retail formats providing quick access to essential household items, including cooking oils.

- Online Retail: E-commerce platforms experiencing rapid growth, offering convenience and broader product selection, especially appealing to tech-savvy consumers.

- Specialty Stores: Retailers focusing on specific product categories, such as health food stores or gourmet shops, often stocking organic or premium corn oil.

- Business-to-Business (B2B) Sales: Direct sales to food manufacturers, industrial users, food service establishments, and biofuel producers.

- By End-Use Industry:

- Food Processing: Large-scale use by snack food companies, restaurants, fast-food chains, and packaged food manufacturers.

- Biodiesel: Manufacturers converting corn oil into biofuel for energy generation.

- Chemical & Allied Industries: Companies utilizing corn oil as a raw material for various chemical derivatives.

- Animal Husbandry: Farms and feed mills incorporating corn oil into animal diets.

- Household/Retail Consumers: Individual consumers purchasing corn oil for home cooking.

- By Type:

- Refined Corn Oil: The most common form, undergoing extensive processing to remove impurities, resulting in a clear, neutral-tasting oil with a high smoke point.

- Crude Corn Oil: Unprocessed oil, typically used for industrial applications or further refining.

- Organic Corn Oil: Produced from organically grown corn, adhering to specific certification standards for cultivation and processing.

- Non-GMO Corn Oil: Derived from corn that has not been genetically modified, catering to consumer preferences for non-GMO products.

Value Chain Analysis For Corn Oil Market

The value chain for the Corn Oil Market is an intricate network of interconnected stages, beginning with the cultivation of corn and culminating in the delivery of refined corn oil to end-users. This chain encompasses various activities, including agricultural production, primary processing (wet or dry milling), oil extraction, refining, packaging, distribution, and marketing. Understanding this value chain is crucial for identifying areas of efficiency improvement, cost optimization, and value addition at each step. It allows stakeholders to analyze the flow of materials, information, and value, thereby enhancing transparency and enabling strategic decision-making across the entire ecosystem, from farm to consumer, influencing profitability and market competitiveness. Each stage represents an opportunity for innovation, sustainability initiatives, and establishing competitive advantages within the global market.

The upstream segment of the corn oil value chain is dominated by corn cultivation and initial handling. This involves farmers growing corn, often utilizing advanced agricultural techniques, including precision farming and hybrid seed varieties, to maximize yields and quality. Following harvest, the corn kernels undergo preliminary processing, primarily through wet milling, which is the most common method for isolating the corn germ – the source of corn oil. During wet milling, corn is steeped in water and then mechanically separated into its constituent parts: starch, fiber, protein, and germ. The quality and availability of corn feedstock directly impact the entire value chain, as fluctuations in corn prices or crop yields can significantly influence the cost and supply of corn oil. Therefore, strong relationships with corn growers and effective supply chain management at this initial stage are paramount for ensuring a consistent and cost-effective raw material supply.

Further downstream, the separated corn germ is subjected to extraction processes, typically involving mechanical pressing followed by solvent extraction (e.g., using hexane) to maximize oil yield. The crude corn oil obtained at this stage undergoes a series of refining steps, including degumming, neutralization, bleaching, and deodorization, to remove impurities, free fatty acids, color pigments, and undesirable odors, resulting in a clear, stable, and palatable refined corn oil suitable for various applications. Once refined, the corn oil is packaged into various formats, from bulk containers for industrial clients to retail-sized bottles for consumer markets. The distribution channel plays a vital role here, connecting manufacturers to end-users through both direct and indirect networks. Direct channels involve manufacturers selling directly to large industrial customers or food service establishments. Indirect channels, which are more prevalent for consumer markets, leverage wholesalers, distributors, supermarkets, hypermarkets, and increasingly, online retail platforms to reach a broad customer base. Effective logistics and efficient channel management are critical for timely delivery, maintaining product quality, and ensuring market penetration.

Corn Oil Market Potential Customers

The Corn Oil Market serves a diverse array of potential customers, spanning multiple industries and consumer segments, each with distinct needs and purchasing behaviors. Identifying and understanding these end-users is fundamental for market players to tailor product offerings, marketing strategies, and distribution channels effectively. These customers range from large-scale industrial processors and commercial food service providers to individual households, reflecting corn oil's broad applicability. Its versatility and specific properties, such as a high smoke point and neutral flavor, make it an indispensable ingredient or component in various products and processes, thereby generating demand from a wide spectrum of buyers globally.

One of the largest segments of potential customers comprises the **Food and Beverage Industry**. This includes manufacturers of snack foods such as potato chips, corn chips, and popcorn, where corn oil's high smoke point and mild flavor make it ideal for frying without imparting undesirable tastes. Fast-food chains and restaurants also represent significant buyers, using corn oil extensively for deep-frying and general cooking. Furthermore, it is incorporated into various processed foods like margarines, salad dressings, and baked goods, valued for its functional properties and cost-effectiveness. The increasing demand for convenience foods and out-of-home dining globally continues to bolster consumption within this sector, making it a cornerstone for corn oil producers. Food processing companies seek consistent quality, competitive pricing, and reliable supply chains to meet their large-volume production requirements.

Beyond the culinary realm, the **Industrial Sector** forms another critical customer base. This primarily includes the **Biofuel Industry**, where corn oil is a significant feedstock for biodiesel production, driven by environmental regulations and government incentives for renewable energy sources. Other industrial applications involve manufacturers of lubricants, paints, varnishes, and printing inks, leveraging corn oil's chemical composition. The **Personal Care and Cosmetics Industry** also utilizes corn oil as a natural emollient, moisturizer, and carrier oil in products such as soaps, lotions, creams, and hair care formulations, catering to the growing consumer preference for natural ingredients. Additionally, the **Animal Feed Industry** is a substantial buyer, incorporating corn oil into livestock and poultry feeds as a high-energy dietary supplement to improve animal health and growth rates. Each of these industrial segments values corn oil for specific technical attributes, requiring suppliers to meet stringent quality specifications and provide bulk quantities, often under long-term contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.5 Billion |

| Market Forecast in 2032 | USD 10.4 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland Company (ADM), Cargill, Bunge Limited, Louis Dreyfus Company, Conagra Brands, Inc., ACH Food Companies, Inc. (Stratas Foods LLC), SunOpta Inc., Ventura Foods, CHS Inc., Agrocorp International, Ingredion Incorporated, Corteva Agriscience (formerly DowDuPont Agri. Div.), GrainCorp, Wilmar International, Richardson International, AGP (Ag Processing Inc.), COFCO Corporation, Goodman Fielder, Marico Limited, Ruchi Soya Industries Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corn Oil Market Key Technology Landscape

The Corn Oil Market's technological landscape is continuously evolving, driven by the imperative to enhance efficiency, sustainability, and product quality throughout the entire production cycle, from corn processing to oil refining and packaging. Key technological advancements and processes are instrumental in meeting stringent quality standards, reducing operational costs, and developing innovative applications for corn oil. These technologies primarily focus on optimizing extraction yields, improving oil purity, extending shelf life, and ensuring environmental compliance. The adoption of advanced machinery and sophisticated analytical tools underscores the industry's commitment to modernization and responding to consumer demands for high-quality, sustainably produced edible oils. This ongoing technological progression is vital for maintaining competitiveness and adapting to changing market dynamics.

At the initial stage of corn processing, the dominant technology is **wet milling**, an established process that efficiently separates the corn germ from other components. Modern wet milling plants incorporate advanced automation and energy-efficient systems to optimize the steeping, grinding, and separation stages, maximizing germ recovery and minimizing water and energy consumption. Following germ isolation, **oil extraction technologies** are critical. The traditional method involves mechanical pressing (expelling) to physically squeeze oil from the germ. This is often followed by **solvent extraction**, typically using hexane, to recover residual oil and achieve higher yields. Contemporary research focuses on developing greener extraction methods, such as supercritical fluid extraction (SFE) with CO2 or enzyme-assisted aqueous extraction, which aim to reduce reliance on chemical solvents, enhance product purity, and minimize environmental impact. These novel extraction technologies offer potential for cleaner labels and cater to the growing demand for natural and chemical-free food products, aligning with consumer health trends.

The **refining process** is another area of significant technological innovation, crucial for transforming crude corn oil into a palatable and stable product. This multi-step process includes **degumming** (removing phospholipids), **neutralization** (removing free fatty acids), **bleaching** (removing color pigments), and **deodorization** (removing volatile compounds responsible for undesirable flavors and odors). Modern refining facilities utilize advanced membrane filtration, enzymatic degumming, and physical refining techniques to improve efficiency, reduce chemical usage, and minimize waste generation. Furthermore, **packaging technologies** play a vital role in preserving corn oil quality and extending its shelf life. Innovations include barrier packaging materials that prevent oxidation, inert gas blanketing during filling, and tamper-evident seals. The advent of **smart manufacturing technologies**, including IoT sensors for real-time monitoring of processing parameters, AI-driven predictive maintenance for machinery, and blockchain for enhanced supply chain traceability, is also transforming the industry, ensuring greater operational transparency, efficiency, and product integrity from farm to fork. These integrated technologies collectively contribute to a more robust, efficient, and sustainable corn oil market.

Regional Highlights

- North America: This region represents a mature and significant market for corn oil, driven by its large-scale corn production, advanced food processing industries, and substantial biofuel sector. The United States is a leading producer and consumer, where corn oil is a staple in households and extensively used by fast-food chains and snack manufacturers. Consumer preferences for healthier cooking oils and the growing demand for non-GMO options are influencing product development. Additionally, government mandates for renewable fuels continue to bolster demand for corn oil as a biodiesel feedstock, ensuring a consistent market volume despite high competition from other edible oils. Innovation in sustainable farming practices and processing efficiencies remains a key focus for regional players.

- Europe: Characterized by stringent food safety regulations and a strong emphasis on sustainability, the European corn oil market is driven by both culinary and industrial applications. While production is lower compared to North America, demand for corn oil in Central and Eastern Europe is robust for cooking and baking. Western Europe shows a growing preference for organic and sustainably sourced oils, influencing import patterns. The region's commitment to renewable energy also supports the use of corn oil in biodiesel production, particularly in countries with strong environmental policies. Market growth is also supported by increasing awareness of health benefits associated with polyunsaturated fats, though competitive pressure from rapeseed and sunflower oils is intense.

- Asia Pacific (APAC): This region is identified as the fastest-growing market for corn oil, propelled by rapid urbanization, rising disposable incomes, and evolving dietary habits that include more processed and fried foods. Countries like China and India are major contributors to this growth, driven by their large and expanding populations. The increasing adoption of Western-style cooking and a booming food service industry are key demand drivers. Furthermore, the region's expanding industrial sector, including biofuel production and personal care product manufacturing, is also contributing to the surge in corn oil consumption. Investment in new processing capacities and robust distribution networks are crucial for market players to capitalize on the immense potential in APAC.

- Latin America: The market in Latin America is marked by significant agricultural output, particularly in corn-producing countries like Brazil and Argentina. This ensures a readily available supply of raw material for domestic corn oil production. Consumption is steadily growing, supported by increasing population, economic development, and cultural preferences for corn-based foods. Both retail and industrial segments are expanding, with corn oil being widely used in local cuisines and increasingly finding applications in the burgeoning biofuel sector. Regional trade agreements and investments in agricultural technology are expected to further boost market growth and export potential within and beyond the continent.

- Middle East and Africa (MEA): The MEA region represents a nascent but promising market for corn oil. While domestic corn oil production is limited in many countries, there is a growing reliance on imports to meet increasing consumer demand. Urbanization, changing dietary patterns influenced by global trends, and growth in the hospitality and food service sectors are key factors driving consumption. Investment in local processing capabilities and infrastructure development could unlock significant opportunities. However, geopolitical instability and fluctuating economic conditions in some parts of the region can pose challenges, making supply chain reliability and cost-effectiveness critical for market success. The demand for healthier cooking alternatives is also slowly gaining traction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corn Oil Market.- Archer Daniels Midland Company (ADM)

- Cargill

- Bunge Limited

- Louis Dreyfus Company

- Conagra Brands, Inc.

- ACH Food Companies, Inc. (Stratas Foods LLC)

- SunOpta Inc.

- Ventura Foods

- CHS Inc.

- Agrocorp International

- Ingredion Incorporated

- Corteva Agriscience

- GrainCorp

- Wilmar International

- Richardson International

- AGP (Ag Processing Inc.)

- COFCO Corporation

- Goodman Fielder

- Marico Limited

- Ruchi Soya Industries Limited

Frequently Asked Questions

Analyze common user questions about the Corn Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary uses of corn oil?

Corn oil is primarily used for cooking, frying, and baking in the food industry due to its high smoke point and neutral flavor. It also finds significant application in industrial sectors for biodiesel production, as an ingredient in personal care products, and as a component in animal feed formulations.

Is corn oil considered a healthy cooking oil?

Corn oil is often considered a healthy cooking oil because it is cholesterol-free, trans-fat-free, and rich in polyunsaturated fatty acids, particularly linoleic acid, and Vitamin E. These components are associated with various health benefits, including supporting heart health when consumed as part of a balanced diet.

How does corn oil compare to other vegetable oils like soybean or palm oil?

Corn oil offers a neutral flavor and a high smoke point, making it versatile for diverse cooking methods. Compared to soybean oil, it has a similar fatty acid profile but may have a slightly higher smoke point. Palm oil, by contrast, is predominantly saturated fat and has a different textural profile, suitable for different applications. Each oil has distinct nutritional and functional properties.

What factors influence the price of corn oil?

The price of corn oil is significantly influenced by global corn crop yields, which are affected by weather conditions and agricultural policies. Other factors include crude oil prices (due to corn oil's use in biodiesel), demand from the food processing and industrial sectors, currency exchange rates, and competition from other vegetable oils.

What are the environmental considerations associated with corn oil production?

Environmental concerns for corn oil production primarily revolve around the intensive cultivation of corn, which can involve significant water usage, pesticide application, and potential land use changes. However, advancements in sustainable farming practices, such as precision agriculture and conservation tillage, are being adopted to mitigate these impacts and promote more environmentally friendly production methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Corn Oil Market Size Report By Type (Bulk Product, Bottled Product), By Application (Salad or Cooking Oils, Margarine, Baking or Frying Fats, Inedible Products, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pink Peppercorn Oil Market Statistics 2025 Analysis By Application (Aromatherapy, Perfumery, Cosmetic, Other), By Type (Organic, Non-Organic), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager