Cosmetic Tube Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427616 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Cosmetic Tube Packaging Market Size

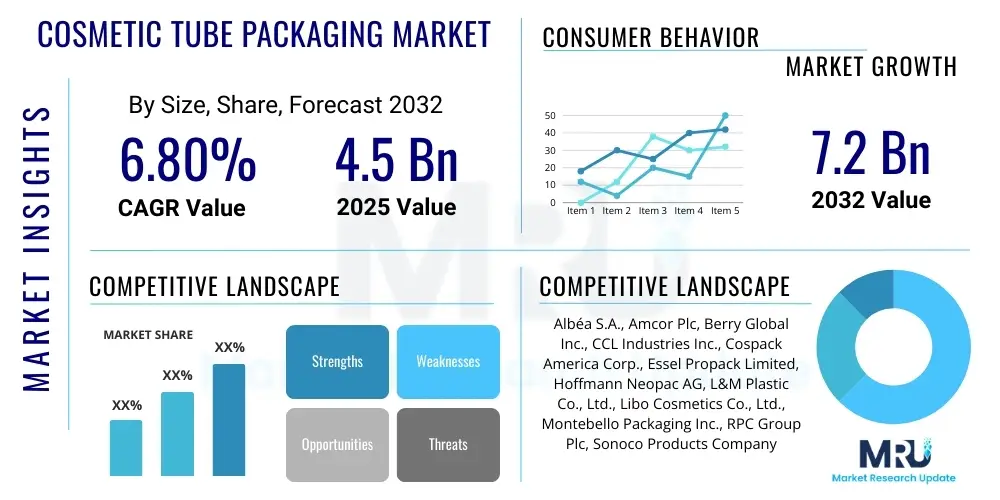

The Cosmetic Tube Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2032. This growth is underpinned by escalating demand across the personal care and cosmetic sectors, driven by increasing consumer awareness regarding product safety, convenience, and aesthetic appeal. The markets expansion is also significantly influenced by advancements in packaging materials and manufacturing technologies, alongside a growing emphasis on sustainable and eco-friendly solutions.

Cosmetic Tube Packaging Market introduction

The cosmetic tube packaging market plays a pivotal role in the global beauty and personal care industry, offering versatile and practical solutions for various product formulations. These tubes are primarily designed to protect products from external contamination, ensure dispensing control, and extend shelf-life, while also serving as a crucial branding element through sophisticated printing and decorative options. Their widespread adoption across segments like skincare, hair care, oral care, and makeup is a testament to their functional benefits and aesthetic adaptability. The market encompasses a broad range of materials, including plastics like polyethylene (PE), polypropylene (PP), and laminates, each chosen for specific product compatibility and consumer appeal.

Major applications of cosmetic tube packaging span a vast array of products, from everyday essentials such as toothpaste, hand creams, and lotions to specialized items like sunscreens, foundations, and hair conditioners. The inherent benefits of tube packaging, including its hygienic dispensing, portability, and resistance to breakage, make it a preferred choice for both manufacturers and consumers. The sealed nature of tubes minimizes product exposure to air and light, preserving ingredient integrity and efficacy. Furthermore, their squeeze functionality ensures maximum product utilization, reducing waste and enhancing consumer satisfaction, particularly for viscous or semi-solid formulations.

Several driving factors contribute to the sustained growth of this market. Foremost among these is the escalating global demand for personal care products, fueled by rising disposable incomes, urbanization, and increasing beauty consciousness across diverse demographics. The expansion of e-commerce platforms has also bolstered demand for durable and travel-friendly packaging solutions, where tubes excel. Additionally, the growing consumer preference for convenience and innovative product formats, coupled with a strong industry push towards sustainable packaging materials like post-consumer recycled (PCR) plastics and bio-based polymers, are further propelling market expansion and technological innovation within the cosmetic tube packaging sector. These combined forces create a dynamic landscape characterized by continuous product development and market penetration.

Cosmetic Tube Packaging Market Executive Summary

The cosmetic tube packaging market is currently experiencing robust growth, driven by key business trends focused on sustainability, customization, and technological innovation. Brands are increasingly investing in packaging that not only protects the product but also aligns with eco-conscious consumer values, leading to a surge in demand for recycled, recyclable, and bio-degradable materials. Furthermore, the emphasis on direct-to-consumer (DTC) models and personalized beauty products is necessitating more flexible and visually appealing packaging solutions, prompting manufacturers to offer a wider array of tube designs, printing techniques, and material finishes. Digital printing and advanced decorative processes are enabling brands to achieve intricate designs and limited-edition packaging runs, catering to evolving market demands for unique consumer experiences.

Regional trends indicate significant market expansion, particularly in the Asia-Pacific (APAC) region, which is witnessing rapid urbanization, a burgeoning middle class, and a strong cultural emphasis on personal grooming and beauty. Countries like China, India, and South Korea are at the forefront of this growth, driven by both domestic consumption and export activities. North America and Europe, while mature markets, continue to innovate through advanced material science and sustainable practices, maintaining a steady demand for high-quality, premium packaging solutions. Emerging economies in Latin America and the Middle East also present substantial growth opportunities, as awareness of personal hygiene and beauty products increases, fostering new market penetration and requiring adaptable packaging strategies from global and local players.

Segmentation trends reveal a clear shift towards specialized materials and application-specific designs. Plastic tubes, particularly those made from polyethylene and polypropylene, continue to dominate due to their cost-effectiveness and versatility, with a growing segment for high-barrier laminate tubes offering enhanced product protection. In terms of application, the skincare segment remains the largest consumer of tube packaging, followed closely by oral care and hair care, reflecting consistent daily use and product innovation in these categories. Moreover, there is an increasing demand for tubes with innovative cap and closure systems that enhance user experience, such as flip-top caps, pump applicators, and child-resistant closures, further diversifying the product offerings within the market. This intricate interplay of trends underscores a dynamic market poised for continued evolution and innovation.

AI Impact Analysis on Cosmetic Tube Packaging Market

The cosmetic tube packaging market is undergoing a transformative shift influenced by advancements in Artificial Intelligence (AI), which addresses common user questions regarding efficiency, customization, and sustainability. Users are keenly interested in how AI can streamline complex manufacturing processes, reduce waste, and enable highly personalized packaging solutions without significantly increasing costs. There is a strong expectation that AI will optimize material usage, predict demand fluctuations, and enhance the overall speed-to-market for new product introductions. Furthermore, questions often revolve around AIs capacity to integrate seamlessly with existing supply chains, offering predictive insights for inventory management and logistics, thereby minimizing delays and improving operational responsiveness across the value chain. This integration promises a more agile and data-driven approach to packaging production and distribution.

AIs influence is evident in several key areas, beginning with optimized design and development. Machine learning algorithms can analyze vast datasets of consumer preferences, market trends, and material properties to suggest innovative tube designs that are both aesthetically pleasing and functionally superior. This capability significantly reduces the time and resources traditionally spent on manual design iterations. Furthermore, AI-powered simulations allow manufacturers to test package performance under various conditions, such as temperature fluctuations or impact, ensuring product integrity before physical prototypes are even created. This predictive analysis capability enhances reliability and accelerates the product development lifecycle, addressing a core industry need for rapid innovation.

In manufacturing and supply chain management, AI offers unparalleled precision and efficiency. AI-driven systems can monitor production lines in real-time, detecting anomalies, predicting equipment failures, and optimizing machine parameters to minimize downtime and reduce material waste. Predictive analytics, fueled by AI, enables more accurate demand forecasting, allowing manufacturers to adjust production schedules and raw material procurement proactively. This not only prevents overproduction and inventory excess but also supports the industrys sustainability goals by minimizing resource consumption. From personalized printing to intelligent sorting and quality control, AI is poised to revolutionize every facet of cosmetic tube packaging, ushering in an era of smarter, more responsive, and environmentally conscious production processes.

- AI-powered design for optimal aesthetics and functionality.

- Predictive maintenance for manufacturing equipment, reducing downtime.

- Enhanced quality control through automated inspection systems.

- Optimized supply chain and logistics with AI-driven forecasting.

- Personalized packaging solutions through data analysis.

- Waste reduction and material optimization in production.

- Accelerated R&D cycles for new sustainable materials.

- Improved consumer engagement through smart packaging features.

DRO & Impact Forces Of Cosmetic Tube Packaging Market

The Cosmetic Tube Packaging Market is propelled by a confluence of robust drivers, notably the sustained expansion of the global personal care and beauty industry, which continuously demands innovative and reliable packaging solutions. The rising consumer emphasis on product hygiene, convenience, and portability significantly boosts the appeal of tube packaging, especially for on-the-go lifestyles and e-commerce distribution. Furthermore, advancements in packaging material science, particularly the development of sustainable options like post-consumer recycled (PCR) plastics, bio-based polymers, and mono-materials designed for easier recycling, are major growth catalysts. The increasing penetration of beauty and personal care products into emerging markets, alongside a growing awareness of self-care among diverse demographics, further amplifies the demand for versatile and protective tube formats.

Despite these drivers, several restraints pose challenges to market expansion. The volatile pricing of raw materials, primarily crude oil derivatives used in plastic production, can impact manufacturing costs and profit margins. Strict regulatory frameworks governing packaging materials, especially concerning food contact and cosmetic safety standards, necessitate continuous compliance and investment in research and development. Additionally, the initial high cost associated with adopting advanced sustainable materials and sophisticated manufacturing technologies can deter smaller manufacturers. The intense competitive landscape, characterized by numerous regional and international players, also exerts downward pressure on pricing, requiring constant innovation and efficiency improvements to maintain market share. These factors demand strategic planning and investment from market participants.

Opportunities within the market largely stem from the growing demand for personalized and premium packaging, allowing brands to differentiate their products through unique designs, textures, and decorative effects. The ongoing digital transformation and the rise of smart packaging technologies, incorporating QR codes, NFC tags, or even embedded sensors for product authenticity and consumer engagement, present significant avenues for innovation. Furthermore, the increasing focus on circular economy principles creates substantial opportunities for developing fully recyclable or compostable tube solutions, appealing to environmentally conscious consumers and brands alike. Emerging markets, with their expanding consumer bases and relatively untapped potential, also offer fertile ground for market penetration and long-term growth for manufacturers willing to adapt to local preferences and economic conditions.

The market is also shaped by several impact forces. Consumer preferences are highly influential, driving trends towards clean label products, minimalist designs, and sustainable packaging. Regulatory environments, varying significantly across regions, dictate material choices, manufacturing processes, and labeling requirements, pushing the industry towards safer and more eco-friendly practices. Technological advancements, including improvements in co-extrusion, injection molding, and digital printing, enable greater design flexibility, material efficiency, and production speed. Finally, global economic shifts, such as inflation, changes in disposable income, and geopolitical factors, can affect consumer spending patterns and supply chain stability, thus impacting overall market dynamics and investment decisions. Understanding these interconnected forces is crucial for navigating the evolving landscape of cosmetic tube packaging.

Segmentation Analysis

The Cosmetic Tube Packaging Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth trajectories. This segmentation allows for targeted strategic planning and market analysis, categorizing the market based on critical attributes such as material type, product type, application, and cap type. Each segment represents distinct market dynamics, driven by varying manufacturing processes, consumer preferences, and functional requirements of the cosmetic products they contain. Analyzing these segments helps stakeholders identify high-growth areas, understand competitive landscapes, and tailor their offerings to specific industry needs, ensuring a focused approach to market development and product innovation.

Material type segmentation highlights the predominant use of plastics, including polyethylene (PE), polypropylene (PP), and laminate tubes, each offering unique barrier properties, flexibility, and cost structures. The growing shift towards sustainable materials, such as post-consumer recycled (PCR) content and bio-based plastics, is rapidly influencing this segment. Product type often differentiates between single-layer, multi-layer, and extruded tubes, reflecting varying levels of product protection and aesthetic finishes required. Application segmentation, on the other hand, categorizes usage across major cosmetic categories like skincare, oral care, hair care, and make-up, which are all significant consumers of tube packaging due to its convenience and hygienic dispensing properties.

Furthermore, the market is also segmented by cap type, including screw caps, flip-top caps, and various dispensing systems such as pump applicators, which cater to different product viscosities and user experiences. This granular level of segmentation provides a holistic view of the market, revealing nuanced consumer demands and technological advancements that shape product development. Understanding these segments is paramount for manufacturers to effectively target specific niches, optimize their production capabilities, and maintain a competitive edge in a rapidly evolving global market landscape, driven by both functional needs and increasing aesthetic and sustainability expectations from consumers.

- By Material Type:

- Plastic (PE, PP, PET, etc.)

- Laminate (ABL, PBL)

- Aluminum

- Bio-based Plastics

- Post-Consumer Recycled (PCR) Content

- By Product Type:

- Squeeze Tubes

- Twist-Up Tubes

- Roll-On Tubes

- Dropper Tubes

- By Capacity:

- Less than 50 ml

- 50 ml to 100 ml

- 101 ml to 200 ml

- More than 200 ml

- By Application:

- Skincare (Moisturizers, Lotions, Sunscreens, Serums)

- Hair Care (Shampoos, Conditioners, Styling Gels)

- Oral Care (Toothpaste, Gels)

- Make-up (Foundations, Primers, Lip Gloss)

- Other Personal Care Products

- By Cap Type:

- Screw Caps

- Flip-Top Caps

- Stand-Up Caps

- Dispensing Caps (Pump, Orifice Reducer)

Cosmetic Tube Packaging Market Value Chain Analysis

The value chain for the Cosmetic Tube Packaging Market is a complex network involving multiple stages, from raw material procurement to end-user consumption. The upstream segment primarily involves suppliers of base polymers such as polyethylene (PE), polypropylene (PP), and other plastic resins, as well as aluminum for laminate layers, and various colorants, additives, and printing inks. These raw material providers form the foundational layer, dictating the quality, cost, and sustainability profile of the final packaging. Relationships in this segment often involve long-term contracts and strategic partnerships to ensure consistent supply and adherence to specific material specifications, particularly with the increasing demand for recycled and bio-based content.

Moving downstream, the value chain encompasses tube manufacturers and converters who transform these raw materials into finished cosmetic tubes. This stage involves sophisticated manufacturing processes like extrusion, co-extrusion, injection molding, and lamination, along with various printing, decorating, and capping operations. These manufacturers often specialize in particular tube types (e.g., mono-layer, multi-layer, aluminum laminate) and offer customization services to meet specific brand requirements regarding design, barrier properties, and dispensing mechanisms. Their efficiency, technological capabilities, and adherence to quality standards are crucial in delivering high-performance and aesthetically appealing packaging solutions to cosmetic brands.

The distribution channel for cosmetic tube packaging can be broadly categorized into direct and indirect methods. Direct distribution involves manufacturers supplying tubes directly to large cosmetic and personal care brands, often through bespoke contracts and just-in-time delivery systems. This approach allows for close collaboration on design and supply chain optimization. Indirect channels involve distributors, wholesalers, and packaging brokers who serve a wider range of clients, including smaller brands or those with less complex packaging needs. These intermediaries provide logistical support, inventory management, and market access, especially for global markets. Both channels play vital roles in ensuring efficient delivery of packaging solutions to the diverse and geographically dispersed cosmetic industry, catering to various scales of operations and brand requirements.

Cosmetic Tube Packaging Market Potential Customers

The potential customers for the Cosmetic Tube Packaging Market are predominantly found across the vast and diverse landscape of the personal care and beauty industry. This includes major multinational corporations that produce a wide array of cosmetic, dermatological, and personal hygiene products, often requiring large volumes of standardized yet customizable packaging. These large enterprises seek reliable, scalable, and often global suppliers capable of meeting stringent quality controls and consistent delivery schedules. Their demand often drives innovation in material science and high-speed manufacturing processes, as they prioritize efficiency, brand consistency, and sustainable packaging solutions to align with corporate social responsibility initiatives and consumer expectations.

Beyond the global giants, the market also serves a growing segment of small and medium-sized enterprises (SMEs), indie beauty brands, and private label manufacturers. These entities often focus on niche markets, specialized formulations, or natural and organic products, and therefore seek flexible packaging solutions that can accommodate smaller production runs, unique designs, and eco-friendly materials. They value suppliers who can offer design support, a wider variety of customizable options, and competitive pricing for smaller orders, often prioritizing speed-to-market and unique aesthetic appeal to stand out in a crowded marketplace. The rise of e-commerce has further empowered these smaller brands, making accessible and attractive packaging even more critical for their success.

Furthermore, other significant end-users include pharmaceutical companies, particularly for over-the-counter topical medications and dermatological creams, where hygienic dispensing, precise dosing, and product protection are paramount. Similarly, the oral care sector, encompassing toothpaste and mouthwash manufacturers, represents a consistent demand for tubes due to their functional advantages. The expansion of wellness and self-care categories, including specialized hand sanitizers, essential oil blends, and natural deodorants, also contributes to the customer base. Essentially, any industry requiring a hygienic, convenient, and protective container for semi-solid, viscous, or paste-like products, which also doubles as a branding tool, represents a potential customer for cosmetic tube packaging solutions, indicating a broad and dynamic market. These diverse customer segments underscore the versatility and indispensable nature of tube packaging in modern consumer goods.

Cosmetic Tube Packaging Market Key Technology Landscape

The cosmetic tube packaging market is characterized by a dynamic and evolving technology landscape, driven by the continuous demand for enhanced product protection, aesthetic appeal, and sustainability. Key manufacturing technologies such as co-extrusion, injection molding, and blow molding are fundamental to tube production. Co-extrusion allows for the creation of multi-layer tubes, which provide superior barrier properties against oxygen, moisture, and UV light, essential for preserving sensitive cosmetic formulations. Injection molding is widely used for producing high-precision components like caps and shoulders, offering design flexibility and efficient mass production. Blow molding techniques are employed for certain tube forms, particularly where specific shapes or larger capacities are required, contributing to structural integrity and diverse product offerings.

Material innovation stands at the forefront of technological advancements. The industry is rapidly adopting advanced polymers, including high-density polyethylene (HDPE), low-density polyethylene (LDPE), polypropylene (PP), and polyethylene terephthalate (PET), often incorporating barrier layers of EVOH (Ethylene Vinyl Alcohol) for extended shelf-life. A significant trend is the increasing integration of post-consumer recycled (PCR) plastics into tube formulations, reducing reliance on virgin plastics and supporting circular economy initiatives. Furthermore, the development of mono-material tubes, designed for easier recycling at end-of-life, and the exploration of bio-based plastics derived from renewable resources like sugarcane, are crucial innovations driving the market towards greater environmental responsibility and meeting brand sustainability targets.

Beyond core manufacturing and material science, advancements in printing and decoration technologies are pivotal for brand differentiation. Digital printing offers unparalleled flexibility for customization, short runs, and vibrant, complex graphics, allowing brands to quickly adapt to market trends and offer personalized packaging. Techniques like hot stamping, screen printing, flexography, and gravure printing provide a wide range of aesthetic effects, from metallic finishes to tactile textures. The emerging field of smart packaging, integrating QR codes, NFC tags, or even augmented reality experiences onto tubes, offers new avenues for consumer engagement, product authenticity verification, and supply chain traceability. These technological innovations collectively empower manufacturers to create high-performance, visually appealing, and sustainable packaging solutions that resonate with both brands and end-consumers in a competitive market.

Regional Highlights

- North America: A mature market characterized by high consumer awareness, strong demand for premium and natural cosmetic products, and significant adoption of sustainable packaging solutions. Innovation in design and materials is a key driver.

- Europe: Driven by stringent regulatory standards for packaging and a strong emphasis on sustainability and circular economy principles. Western European countries lead in the adoption of PCR and bio-based materials, alongside demand for sophisticated, high-barrier tubes.

- Asia-Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes, rapid urbanization, expanding middle-class populations, and a booming beauty and personal care industry. China, India, South Korea, and Japan are key markets, showing high demand for both mass-market and premium cosmetic tubes.

- Latin America: An emerging market with increasing consumption of personal care products, driven by economic growth and growing beauty consciousness. Brazil and Mexico are significant contributors, with a rising demand for cost-effective and visually appealing packaging.

- Middle East & Africa: Experiencing growth due to increasing urbanization, Westernization trends, and rising disposable incomes. The demand for cosmetic and personal care products, including Halal-certified options, is creating new opportunities for tube packaging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Tube Packaging Market.- Albéa S.A.

- Amcor Plc

- Berry Global Inc.

- CCL Industries Inc.

- Cospack America Corp.

- Essel Propack Limited (EPL Limited)

- Hoffmann Neopac AG

- L&M Plastic Co., Ltd.

- Libo Cosmetics Co., Ltd.

- Montebello Packaging Inc.

- RPC Group Plc (now a part of Berry Global)

- Sonoco Products Company

Frequently Asked Questions

What is cosmetic tube packaging used for?

Cosmetic tube packaging is primarily used for a wide range of personal care and beauty products including skincare creams, lotions, cleansers, sunscreens, hair conditioners, styling gels, toothpaste, and various makeup formulations like foundations and lip glosses. It provides hygienic dispensing, protection from contamination, and extends product shelf-life while offering convenience and portability for consumers.

What materials are commonly used for cosmetic tubes?

The most common materials for cosmetic tubes include various plastics such as polyethylene (PE) – high-density (HDPE) and low-density (LDPE), polypropylene (PP), and polyethylene terephthalate (PET). Laminate tubes, combining layers of plastic and sometimes aluminum, are also widely used for enhanced barrier properties. There is a growing trend towards sustainable options like post-consumer recycled (PCR) plastics and bio-based polymers.

How do sustainable packaging trends impact the market?

Sustainable packaging trends significantly impact the market by driving demand for eco-friendly materials and designs. Brands are increasingly seeking tubes made from PCR content, bio-based plastics, or mono-materials for easier recycling. This shift promotes innovations in material science, manufacturing processes, and circular economy initiatives, influencing consumer purchasing decisions and regulatory landscapes globally.

What are the key benefits of using tubes for cosmetic products?

Key benefits include hygienic dispensing that prevents contamination and reduces product waste, excellent portability and resistance to breakage, and effective protection against external elements like air, light, and moisture, which preserves product integrity. Tubes also offer versatile branding opportunities through various printing and decoration techniques, enhancing shelf appeal and consumer engagement.

Which regions are experiencing the most growth in cosmetic tube packaging?

The Asia-Pacific (APAC) region is currently experiencing the most significant growth in the cosmetic tube packaging market, driven by its large and expanding consumer base, increasing disposable incomes, and a rapidly evolving beauty and personal care industry. North America and Europe, while mature, continue to show steady demand, particularly for premium and sustainable packaging solutions, fueled by innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager