Crawler Excavator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428906 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Crawler Excavator Market Size

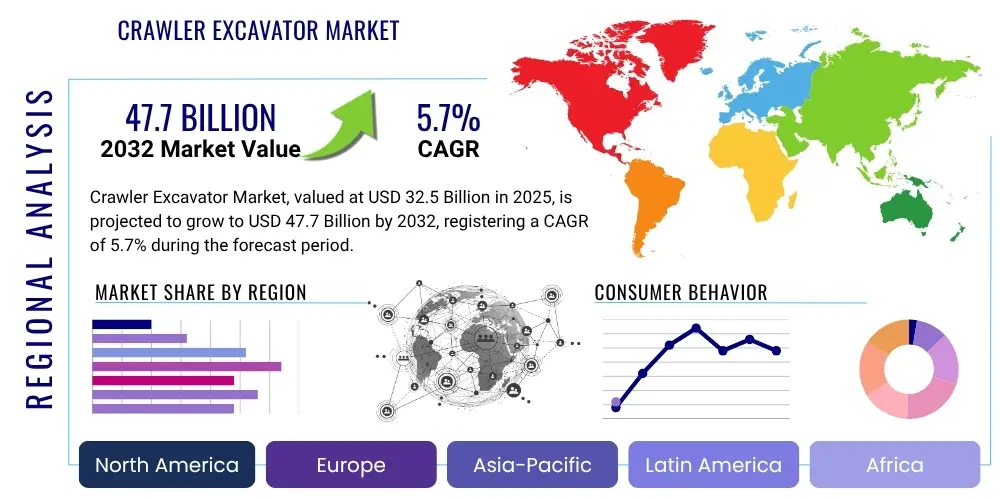

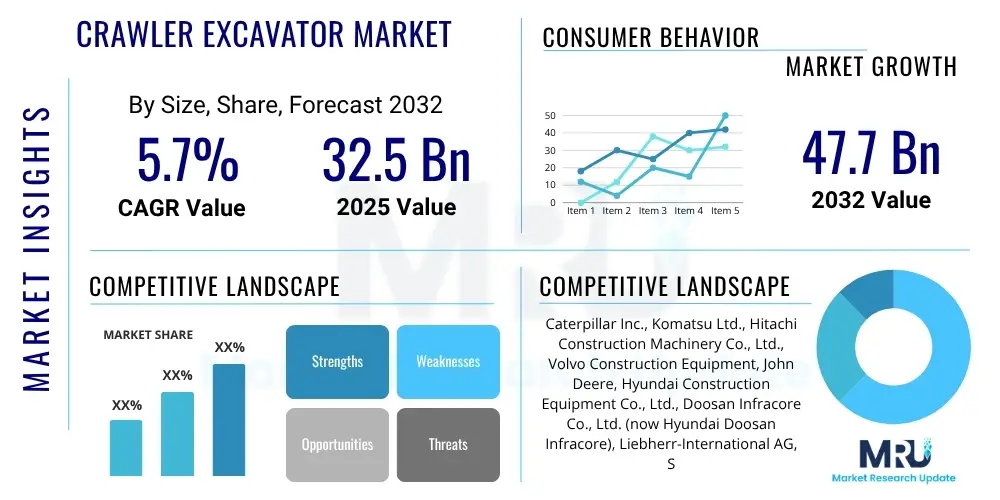

The Crawler Excavator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2025 and 2032. The market is estimated at USD 32.5 Billion in 2025 and is projected to reach USD 47.7 Billion by the end of the forecast period in 2032.

Crawler Excavator Market introduction

The Crawler Excavator Market is a significant segment within the heavy equipment industry, specializing in machines engineered for excavation, demolition, material handling, and various construction and mining tasks. These robust machines are distinguished by their tracked undercarriages, which provide exceptional stability and traction across diverse terrains, making them indispensable for operations in challenging conditions where wheeled excavators might struggle. The core functionality of a crawler excavator involves a powerful engine driving a hydraulic system, which in turn controls the movement of the boom, stick, and bucket, allowing for precise and forceful digging, lifting, and loading capabilities.

Crawler excavators are utilized across an extensive range of applications, including large-scale infrastructure projects such as road construction, bridge building, and pipeline installations, as well as in commercial and residential building, quarrying, mining operations for raw material extraction, and forestry for clearing land and managing timber. Their inherent design prioritizes high digging force, lifting capacity, and the ability to operate continuously for extended periods, contributing significantly to project efficiency and timely completion. The benefits of deploying crawler excavators include superior operational stability, enhanced power output, and exceptional maneuverability on uneven or soft ground, which are crucial for maintaining productivity and safety on demanding job sites.

The market's growth is predominantly driven by global urbanization trends, which necessitate continuous expansion of residential and commercial infrastructure, alongside substantial investments in public infrastructure development by governments worldwide. Furthermore, the robust activity in the mining sector, fueled by consistent demand for minerals and raw materials, continues to spur the acquisition of heavy-duty excavators. Technological advancements, particularly in areas like fuel efficiency, operator comfort, telematics, and automation, are also key driving factors, enhancing the appeal and operational viability of new excavator models, thereby fostering market expansion and renewal cycles.

Crawler Excavator Market Executive Summary

The Crawler Excavator Market is experiencing robust growth, driven primarily by an upturn in global construction activities, significant infrastructure development initiatives, and sustained demand from the mining sector. Key business trends indicate a strong emphasis on technological innovation, with manufacturers integrating advanced telematics, IoT solutions, and automation capabilities to enhance operational efficiency, reduce fuel consumption, and improve safety on job sites. The market is also seeing a shift towards more environmentally friendly solutions, including electric and hybrid models, particularly in regions with stringent emissions regulations. Rental fleets are increasingly becoming a vital component of the market, offering flexibility to companies that prefer operational leases over direct capital investment, further stimulating demand for new and technologically advanced machines.

Regional trends reveal Asia Pacific as the leading and fastest-growing market, propelled by rapid urbanization, extensive infrastructure projects in China, India, and Southeast Asian nations, and burgeoning mining operations. North America and Europe maintain steady demand, driven by public and private infrastructure spending and the replacement of aging fleets, coupled with a strong focus on advanced, efficient, and low-emission equipment. Emerging economies in Latin America, the Middle East, and Africa are also contributing to market expansion through investments in urban development, resource extraction, and transportation networks, though growth can be more volatile due to economic and political factors.

Segmentation trends highlight a diverse demand profile across various operating weights and applications. The compact excavator segment is witnessing substantial growth due to its versatility, ease of transport, and suitability for urban construction and utility work where space is limited. Conversely, heavy-duty excavators continue to dominate in large-scale mining, quarrying, and major infrastructure projects, where sheer power and capacity are paramount. The market is also observing increasing adoption of specialized attachments, allowing excavators to perform a wider array of tasks, thereby enhancing their utility and driving sales in niche applications. The ongoing development of electric and hybrid powertrains signifies a crucial segment trend, preparing the market for future regulatory and sustainability demands.

AI Impact Analysis on Crawler Excavator Market

The integration of Artificial Intelligence (AI) into the Crawler Excavator Market is a topic of significant interest and a primary area of development, with users frequently querying its practical applications, benefits, and potential disruptions. Common user questions revolve around how AI can enhance operational efficiency, safety, and productivity, specifically concerning features like autonomous operation, predictive maintenance, and intelligent machine control. Users are keen to understand the extent to which AI will transform traditional job roles, the skills required for future operators, and the potential for cost savings through optimized fuel consumption and reduced downtime. There are also concerns regarding data security, the reliability of AI systems in harsh operating environments, and the economic accessibility of these advanced technologies for smaller construction or mining companies.

The pervasive themes emerging from these inquiries highlight a strong expectation for AI to usher in a new era of smart excavation, characterized by greater precision, reduced human error, and enhanced overall project management. Users anticipate AI will empower excavators to perform complex tasks with minimal human intervention, leading to significant productivity gains and improved safety records on job sites. Furthermore, the promise of AI-driven data analytics for optimizing machine performance, scheduling maintenance, and managing logistics is a major point of interest, as it directly addresses critical operational pain points. While excitement surrounds these advancements, there is also a discernible caution regarding the readiness of the industry infrastructure, regulatory frameworks, and workforce for such a profound technological shift, underscoring the need for careful implementation and training.

- Enhanced autonomous operation: AI algorithms enable excavators to perform repetitive or complex tasks with high precision and consistency, potentially leading to fully autonomous or semi-autonomous operation on monitored sites.

- Predictive maintenance: AI-driven analytics monitor machine performance data in real-time, identifying potential failures before they occur, reducing unexpected downtime and maintenance costs.

- Optimized fuel efficiency: AI systems can analyze digging patterns and engine load to suggest or automatically implement the most fuel-efficient operating modes, significantly lowering operational expenses and emissions.

- Improved safety: AI-powered sensors and cameras provide enhanced situational awareness, detecting obstacles, personnel, and unsafe conditions, thereby minimizing accident risks on busy construction sites.

- Intelligent machine control: AI assists operators with real-time feedback and automated adjustments to bucket angles and boom positions, ensuring tasks like grading and trenching are completed with unparalleled accuracy.

- Advanced telematics and data analytics: AI processes vast amounts of operational data from excavators, providing valuable insights into performance, utilization, and project progress for better decision-making.

- Automated attachment recognition and optimization: AI can identify attached tools and automatically adjust machine settings for optimal performance, increasing versatility and efficiency across various tasks.

DRO & Impact Forces Of Crawler Excavator Market

The Crawler Excavator Market is shaped by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that collectively determine its trajectory. Key drivers propelling market expansion include aggressive global infrastructure spending, particularly in emerging economies focused on developing transportation networks, urban utilities, and smart cities. Rapid urbanization across Asia Pacific and parts of Africa necessitates continuous construction of residential, commercial, and industrial facilities, directly boosting demand for excavation equipment. Furthermore, sustained demand from the mining sector, driven by increasing consumption of raw materials, and the ongoing modernization of construction equipment fleets with more efficient and technologically advanced models, are significant contributors to market growth.

Despite robust drivers, several restraints pose challenges to the market. The high initial capital investment required for purchasing crawler excavators can be a barrier for smaller contractors or companies with limited financial resources. Volatility in raw material prices, particularly steel, can impact manufacturing costs and, consequently, the final product price. Environmental regulations, such as stringent emissions standards, necessitate significant R&D investments from manufacturers to comply, potentially increasing production costs. Additionally, the shortage of skilled operators and maintenance technicians capable of handling advanced machinery, coupled with the economic slowdowns and geopolitical uncertainties in various regions, can temper market growth.

Opportunities for growth are abundant and center around technological innovation and market diversification. The increasing adoption of electric and hybrid excavators presents a significant opportunity for manufacturers to cater to environmentally conscious markets and regulations, offering improved fuel efficiency and reduced emissions. The expansion of the equipment rental market provides flexibility and access to modern machinery for a broader customer base, minimizing upfront capital expenditure. Furthermore, the integration of advanced technologies like IoT, telematics, and semi-autonomous features offers opportunities to enhance machine performance, safety, and operational intelligence, creating new value propositions. Retrofitting older models with modern technology upgrades also opens a lucrative market segment, extending the life and capabilities of existing fleets.

Segmentation Analysis

The Crawler Excavator Market is broadly segmented to cater to the diverse requirements of various end-user industries and operational scales. This segmentation allows for a granular understanding of market dynamics, facilitating targeted product development, marketing strategies, and competitive positioning. Key segments typically include classification by operating weight, engine type, application, and end-user, each reflecting specific performance needs and market demands. The varying sizes and capabilities of crawler excavators, from compact models designed for urban environments to heavy-duty machines built for large-scale mining, underscore the necessity of a multifaceted segmentation approach.

Understanding these segments is crucial for stakeholders to identify lucrative niches and tailor their offerings effectively. For instance, the demand drivers and customer expectations for a mini-excavator used in landscaping differ significantly from those for a heavy excavator deployed in an open-pit mine. Technological advancements, regulatory pressures, and cost considerations also play a pivotal role in shaping the preferences within each segment. As the market evolves, driven by sustainability goals and operational efficiency, hybrid and electric variants within specific operating weight classes are gaining traction, indicating a shift in consumer preference towards greener and smarter solutions across all application areas.

- By Operating Weight:

- Mini (up to 6 tons): Ideal for residential construction, landscaping, utility work, and confined spaces.

- Compact (6-10 tons): Suitable for small to medium construction sites, urban development, and general utility tasks.

- Mid-sized (10-40 tons): Versatile for various construction projects, road building, and quarrying.

- Heavy (40+ tons): Primarily used in large-scale mining, major infrastructure projects, and heavy demolition.

- By Engine Type:

- Diesel: Dominant type, known for power and reliability.

- Electric: Emerging segment, driven by environmental regulations and demand for zero-emission operations.

- Hybrid: Combines diesel engine with electric motor for improved fuel efficiency and reduced emissions.

- By Application:

- Construction: Residential, commercial, infrastructure (roads, bridges, pipelines).

- Mining: Coal, metal, aggregates extraction.

- Forestry: Land clearing, timber handling, reforestation.

- Utility: Trenching for cables and pipes, municipal services.

- Others: Waste management, recycling, demolition.

- By End-User:

- Rental Companies: Purchase for leasing to various contractors.

- Construction Companies: Direct purchase for own projects.

- Mining Companies: Direct purchase for long-term extraction operations.

- Municipalities: For public works and urban maintenance.

- Others: Agriculture, port management, demolition contractors.

Value Chain Analysis For Crawler Excavator Market

The value chain for the Crawler Excavator Market is a complex network involving multiple stages, from raw material sourcing to the final end-user, encompassing design, manufacturing, distribution, and post-sales support. The upstream segment of the value chain is critical, involving the procurement and processing of essential raw materials such as high-strength steel, aluminum, and various polymers, alongside sophisticated components like engines, hydraulic pumps, cylinders, electrical systems, and electronic controls. Key suppliers in this phase include specialized manufacturers of diesel engines, hydraulic systems, and advanced electronic components, whose quality and innovation directly impact the final product's performance and reliability. Strong relationships with these upstream suppliers are vital for ensuring a stable supply chain and incorporating cutting-edge technologies into the excavator design, influencing both production costs and technological competitiveness.

Further down the value chain, the manufacturing process involves precision engineering, assembly, rigorous testing, and quality control to produce robust and efficient crawler excavators. Once manufactured, the distribution channel plays a crucial role in delivering these heavy machines to the end-users. This typically involves a multi-tiered approach comprising direct sales to large corporate clients, an extensive network of authorized dealerships for broader market reach, and third-party distributors for regional market penetration. These channels are responsible for sales, financing options, and initial technical support. The effectiveness of these distribution networks, including their geographical spread and service capabilities, significantly influences market penetration and customer satisfaction, acting as a direct interface between the manufacturer and the operational needs of various industries.

The downstream activities focus on the operational deployment and maintenance of the excavators throughout their lifecycle. This includes providing comprehensive after-sales services such as parts supply, scheduled maintenance, emergency repairs, and technical training for operators and service personnel. Direct distribution often caters to large construction or mining conglomerates that prefer direct engagement with manufacturers for bulk purchases and bespoke service contracts. Indirect distribution, facilitated by dealerships, targets a wider array of small to medium-sized contractors, rental companies, and municipalities, offering localized sales and support. Both direct and indirect channels are critical for ensuring customer loyalty, maximizing equipment uptime, and ultimately driving repeat business and market share in the highly competitive heavy equipment industry.

Crawler Excavator Market Potential Customers

The primary potential customers and end-users of crawler excavators span a diverse range of industries, all requiring powerful and versatile equipment for earthmoving, material handling, and demolition tasks. The largest segment of buyers typically includes general construction companies, encompassing firms involved in residential, commercial, and industrial building projects. These companies rely on excavators for foundational work, trenching, site preparation, and material loading, making these machines indispensable for the vast majority of their operational requirements. The demand from this segment is directly correlated with global construction spending and urban development trends, which remain strong drivers of equipment acquisition.

Beyond general construction, the mining sector represents another critical customer base, particularly for heavy-duty crawler excavators. Mining companies, involved in the extraction of coal, metals, minerals, and aggregates, utilize these machines for overburden removal, ore loading, and large-scale digging operations in quarries and open-pit mines. The robustness, high capacity, and endurance of crawler excavators are paramount in these demanding environments. Additionally, government agencies and public works departments are significant buyers, deploying excavators for infrastructure projects such as road construction, bridge building, water and sewerage system installations, and other municipal development initiatives crucial for public welfare and economic growth.

A rapidly expanding segment of potential customers includes equipment rental companies, which purchase large fleets of excavators to lease to various contractors who may not have the capital or the long-term need for direct ownership. This allows smaller businesses access to modern equipment without significant upfront investment. Furthermore, specialized contractors in areas like demolition, forestry, waste management, and utility installation also form important customer groups, requiring excavators tailored with specific attachments for their niche applications. As technology advances, these end-users increasingly seek machines that offer enhanced fuel efficiency, advanced telematics, and improved operator comfort, driving the demand for newer, more sophisticated models across all segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 32.5 Billion |

| Market Forecast in 2032 | USD 47.7 Billion |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, John Deere, Hyundai Construction Equipment Co., Ltd., Doosan Infracore Co., Ltd. (now Hyundai Doosan Infracore), Liebherr-International AG, SANY Group, XCMG Group, Zoomlion Heavy Industry Science and Technology Co., Ltd., JCB, Kubota Corporation, Case Construction Equipment (CNH Industrial), LiuGong Machinery Co., Ltd., Sumitomo Construction Machinery Co., Ltd., Takeuchi Mfg. Co., Ltd., Yanmar Holdings Co., Ltd., Kobelco Construction Machinery Co., Ltd., Terex Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crawler Excavator Market Key Technology Landscape

The Crawler Excavator Market is undergoing a profound technological transformation, driven by demands for enhanced efficiency, safety, and sustainability. A cornerstone of this evolution is the widespread adoption of telematics and IoT (Internet of Things) solutions. These technologies allow for real-time monitoring of machine performance, location, fuel consumption, and operational parameters, providing invaluable data for fleet management, predictive maintenance, and operational optimization. By connecting excavators to central systems, fleet managers can significantly improve asset utilization, reduce downtime, and enhance security, thus leading to substantial cost savings and improved project timelines. The integration of GPS and advanced sensor arrays further bolsters precision in digging and grading tasks, reducing rework and increasing accuracy on complex job sites.

Another pivotal area in the technology landscape is the development and increasing commercialization of electric and hybrid powertrains. With growing global pressure to reduce carbon emissions and meet stringent environmental regulations, particularly in urban areas and sensitive ecosystems, manufacturers are investing heavily in alternative fuel sources. Electric excavators, powered by batteries, offer zero direct emissions and significantly lower noise levels, making them ideal for indoor work, night operations, and densely populated urban construction sites. Hybrid models combine traditional diesel engines with electric motors or hydraulic accumulators to improve fuel efficiency and reduce emissions, providing a transitional solution as the industry moves towards full electrification. These innovations are not only environmentally beneficial but also offer operational advantages through reduced fuel costs and improved power management.

Furthermore, the market is witnessing rapid advancements in automation and operator assistance systems, paving the way for semi-autonomous and eventually fully autonomous excavators. Technologies such as 3D machine control, automated digging cycles, and sophisticated collision avoidance systems are enhancing precision, safety, and productivity. These systems leverage AI and advanced algorithms to assist operators in complex tasks, reducing fatigue and skill requirements while ensuring consistent, high-quality output. Remote control capabilities are also gaining traction, allowing operators to manage machines from a safe distance in hazardous environments. The convergence of these technologies – telematics, electrification, and automation – is fundamentally reshaping the design, operation, and environmental footprint of crawler excavators, driving the industry towards a smarter, safer, and more sustainable future.

Regional Highlights

The global Crawler Excavator Market exhibits distinct regional dynamics, influenced by varying economic conditions, infrastructure development priorities, regulatory landscapes, and rates of urbanization. Each major geographical region contributes uniquely to the overall market growth, with different segments and technological adoptions gaining prominence based on local requirements and investment trends. Understanding these regional highlights is crucial for manufacturers and stakeholders to tailor their market strategies effectively and capitalize on localized opportunities.

Asia Pacific continues to be the undisputed powerhouse of the crawler excavator market, largely driven by the colossal infrastructure projects and rapid urbanization in countries like China, India, and the ASEAN nations. These economies are undergoing unprecedented growth in residential, commercial, and industrial construction, coupled with massive investments in transportation networks, energy infrastructure, and smart city developments. The region's robust mining sector also significantly contributes to the demand for heavy-duty excavators. This sustained high demand, often paired with cost-effective manufacturing capabilities within the region, solidifies its position as the largest and fastest-growing market.

North America and Europe represent mature markets characterized by steady demand driven by the replacement of aging fleets, ongoing maintenance of existing infrastructure, and a strong emphasis on technological sophistication and environmental compliance. In North America, public and private investments in revitalizing infrastructure, coupled with a robust residential construction sector, maintain consistent demand. European markets, on the other hand, are at the forefront of adopting electric and hybrid excavators, fueled by stringent emissions regulations and a strong focus on sustainability and operational efficiency. Both regions prioritize advanced telematics, automation, and operator comfort, pushing manufacturers to innovate beyond conventional capabilities. Latin America, the Middle East, and Africa are emerging markets with significant potential. Latin America's growth is often tied to resource extraction and agricultural development, while the Middle East is witnessing a construction boom driven by ambitious mega-projects and diversification efforts. Africa's market is nascent but growing, spurred by increasing investment in basic infrastructure and mining, albeit often subject to greater economic and political volatility.

- Asia Pacific: Dominant market due to rapid urbanization, extensive infrastructure development (China, India, Southeast Asia), and strong mining sector growth. High demand across all weight classes.

- North America: Stable demand driven by infrastructure spending, residential and commercial construction, and fleet modernization. Focus on telematics and operator comfort.

- Europe: Mature market with steady demand, strong emphasis on sustainability, stringent emission standards, leading to higher adoption of electric and hybrid excavators.

- Latin America: Growth linked to commodity prices and resource extraction, with increasing investments in public infrastructure projects and urban development.

- Middle East & Africa (MEA): Emerging market propelled by mega-projects in GCC countries (Saudi Arabia, UAE), oil and gas sector investments, and foundational infrastructure development across Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crawler Excavator Market.- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- John Deere

- Hyundai Construction Equipment Co., Ltd.

- Doosan Infracore Co., Ltd. (now Hyundai Doosan Infracore)

- Liebherr-International AG

- SANY Group

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- JCB

- Kubota Corporation

- Case Construction Equipment (CNH Industrial)

- LiuGong Machinery Co., Lt

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager