Credit Risk Rating Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428076 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Credit Risk Rating Software Market Size

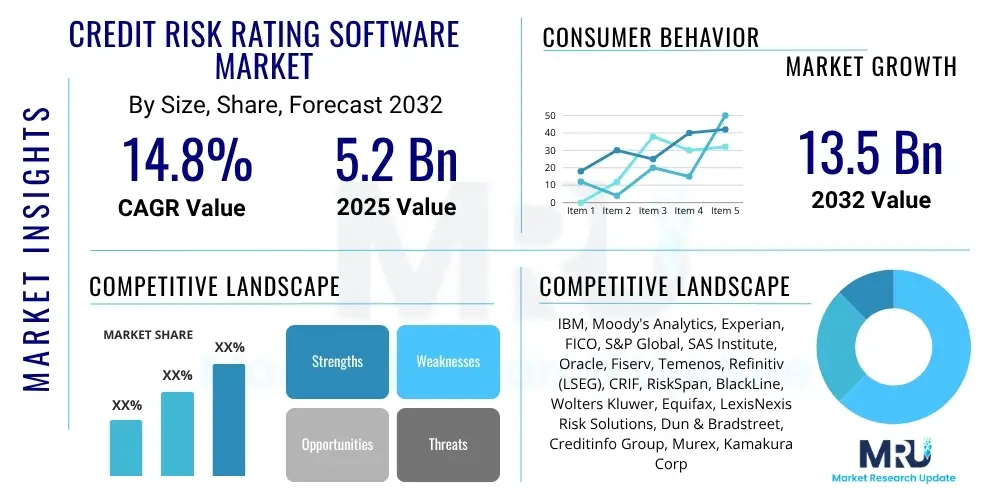

The Credit Risk Rating Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2025 and 2032. The market is estimated at USD 5.2 Billion in 2025 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2032.

Credit Risk Rating Software Market introduction

The Credit Risk Rating Software Market encompasses advanced technological solutions designed for the comprehensive assessment, measurement, and management of credit risk across diverse financial portfolios. These sophisticated platforms leverage intricate algorithms, statistical methodologies, and extensive datasets to evaluate the creditworthiness of individuals, corporations, and governmental entities. Primarily adopted by financial institutions such as banks, credit unions, and investment firms, the software provides critical insights into potential borrower defaults, quantifies expected losses, and optimizes lending decisions. Its core utility lies in supporting robust underwriting processes, strategic portfolio management, and ensuring stringent regulatory compliance in an increasingly complex global financial landscape, thereby minimizing financial exposure and enhancing operational efficiency for market participants.

The product offerings within this market range from automated credit scoring systems for consumer finance to highly specialized enterprise-level solutions for intricate corporate and structured finance risk. These systems seamlessly integrate with existing banking infrastructure, data warehouses, and external data sources to deliver a unified view of credit exposure. Key functionalities include the aggregation and synthesis of vast amounts of internal and external data, the development and rigorous validation of predictive models, comprehensive scenario analysis, stress testing capabilities, and dynamic reporting tools. Such software is indispensable for maintaining capital adequacy ratios, adhering to international frameworks like Basel III and IFRS 9, and fostering sustainable, risk-adjusted growth. Its application extends across the entire credit lifecycle, from initial loan origination and approval to continuous performance monitoring and effective debt recovery strategies.

Major applications of credit risk rating software span retail banking, corporate and investment banking, and the insurance sector. In retail, these tools facilitate rapid and accurate credit assessments for personal loans, mortgages, and credit cards. For corporate clients, they enable a thorough evaluation of business financial health, industry-specific risks, and the viability of project financing. The tangible benefits derived from deploying these solutions are manifold: they significantly enhance the precision of lending decisions, substantially reduce the operational overhead associated with manual risk assessments, improve overall portfolio performance by actively managing and mitigating non-performing assets, and ensure unwavering adherence to evolving regulatory mandates. Key driving factors propelling market growth include the exponential increase in global credit transactions, the rising complexity of financial products, the constant evolution of regulatory frameworks, and the accelerating integration of artificial intelligence and machine learning technologies to augment predictive analytics and automate risk assessment processes, thereby providing a competitive edge to adopters.

Credit Risk Rating Software Market Executive Summary

The Credit Risk Rating Software Market is experiencing significant expansion, propelled by transformative business trends, distinct regional growth dynamics, and continuous innovation across its various segments. Business trends highlight a pronounced industry-wide shift towards advanced data-driven and automated risk management practices, as financial institutions worldwide prioritize operational efficiencies, superior predictive accuracy, and enhanced decision-making capabilities. There is a burgeoning demand for highly integrated platforms that can offer a holistic perspective on credit exposure, consolidating disparate data sources and applying sophisticated analytical models. Furthermore, the necessity for real-time risk assessment, crucial for agile trading environments and instant credit decisions in consumer lending, is a powerful catalyst for innovation. The market is also witnessing a robust uptake of cloud-based solutions, which offer unparalleled scalability, flexibility, and reduced infrastructure costs, making advanced risk analytics more accessible to a broader spectrum of financial entities, including small and medium-sized enterprises (SMEs).

Regional trends reveal varied yet compelling growth trajectories and adoption rates across different geographies. North America and Europe continue to hold dominant market positions, primarily attributed to their mature and highly regulated financial sectors, well-established technological infrastructures, and high rates of early adoption for advanced risk management solutions. These regions demonstrate a consistent demand for compliance-driven analytics and highly sophisticated risk models. Concurrently, the Asia Pacific (APAC) region is rapidly emerging as the fastest-growing market, driven by robust economic expansion, increasing financial inclusion initiatives, and the ongoing modernization of banking and financial services infrastructure in key economies such as China, India, and Southeast Asian nations. Latin America, the Middle East, and Africa (MEA) are also exhibiting promising growth, albeit from a smaller foundational base, as financial digitalization efforts intensify and local regulatory bodies progressively implement more stringent risk management frameworks. Each region presents unique challenges and significant opportunities, influenced by prevailing economic conditions, regulatory environments, and competitive landscapes.

Segment trends underscore the dynamic nature of the market. By component, the software segment commands the larger revenue share, reflecting the foundational need for robust analytical engines and platforms. However, the services segment, encompassing critical aspects like implementation, consulting, and ongoing maintenance, is projected to achieve substantial growth as institutions increasingly seek expert guidance to effectively deploy, customize, and optimize these complex systems. The cloud-based deployment model is gaining significant traction and is progressively displacing on-premises solutions, aligning with a broader industry shift towards agile, scalable, and cost-efficient IT architectures. While large enterprises, particularly global banks and financial conglomerates, remain the primary consumers of high-end, bespoke credit risk rating software due to their extensive portfolios and intricate regulatory requirements, the SME segment is anticipated to demonstrate strong growth. This growth is largely fueled by the increasing availability of more affordable, often cloud-delivered, and tailored solutions specifically designed to meet their unique operational needs. The banking and financial institutions segment continues to be the predominant end-user, but other sectors, including insurance and government entities, are increasingly recognizing the strategic value of robust credit risk assessment tools, thereby expanding the market's overall application scope.

AI Impact Analysis on Credit Risk Rating Software Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Credit Risk Rating Software Market frequently center on its potential to significantly enhance the accuracy of risk prediction, automate labor-intensive analytical tasks, and process vast and diverse datasets with unprecedented efficiency. Users are particularly interested in how AI can transcend the limitations of traditional statistical methods to uncover subtle, non-linear relationships and nuanced patterns within credit data that indicate potential default, especially when dealing with unstructured information. There is substantial anticipation concerning AI's capacity to facilitate real-time risk assessments, enable dynamic adjustments to credit portfolios, and improve regulatory compliance through automated reporting and sophisticated scenario generation. However, these high expectations are tempered by critical concerns surrounding the explainability of AI models, often referred to as the "black box" problem, ensuring fairness and preventing algorithmic bias against specific demographic groups, and addressing the broader ethical implications of AI-driven credit decisions. The imperative for establishing robust model validation and comprehensive governance frameworks for AI-powered systems remains a paramount and recurring theme among all stakeholders within the financial sector.

- Enhanced Predictive Accuracy: AI/ML models process more diverse data types, including alternative data, to identify complex patterns, leading to more precise and forward-looking credit risk predictions compared to traditional models.

- Automation of Processes: AI automates critical data collection, cleansing, and model execution, significantly reducing manual effort and accelerating the entire risk assessment lifecycle from application to monitoring.

- Dynamic Risk Monitoring: Machine learning algorithms enable continuous, real-time analysis of market fluctuations and borrower behavior, facilitating proactive adjustments to risk exposure and portfolio strategies.

- Improved Data Handling Capabilities: AI excels at efficiently managing and extracting insights from massive volumes of structured and unstructured data, such as financial statements, social media sentiment, and transaction histories.

- Personalized Risk Assessment: AI can tailor credit risk evaluations to individual borrowers or specific business contexts, allowing for more nuanced, granular, and individualized lending decisions.

- Advanced Fraud Detection: AI's superior pattern recognition capabilities are highly effective in identifying anomalies and potential fraud indicators within credit applications and ongoing transaction data, bolstering security.

- Challenges in Explainability and Bias: A significant impact and ongoing challenge involves ensuring the interpretability of complex AI models (Explainable AI - XAI) and proactively mitigating algorithmic bias to ensure equitable and ethical lending practices.

- Regulatory Compliance Assistance: AI tools can significantly aid in meeting evolving regulatory requirements by automating compliance checks, generating complex regulatory reports, and performing extensive stress testing scenarios with enhanced efficiency and accuracy.

DRO & Impact Forces Of Credit Risk Rating Software Market

The Credit Risk Rating Software Market is vigorously driven by a powerful combination of factors. Foremost among these is the escalating need for financial institutions to comply with an increasingly intricate web of global and regional regulatory frameworks, including Basel III, IFRS 9, CECL (Current Expected Credit Losses), and CCAR (Comprehensive Capital Analysis and Review). These regulations strictly mandate sophisticated, transparent, and auditable risk assessment methodologies, robust capital adequacy standards, and extensive reporting, rendering advanced software solutions absolutely indispensable for adherence. Furthermore, the sheer volume, velocity, and inherent complexity of financial transactions globally have grown exponentially, necessitating automated and highly accurate tools to efficiently manage diverse and constantly evolving credit portfolios. The persistent global economic uncertainties and the imperative for lenders to actively mitigate the risk of non-performing assets (NPAs) also serve as a compelling impetus for the widespread adoption of advanced credit risk management software. The overarching drive towards digital transformation within the financial services sector, which compels institutions to embrace automation and advanced data analytics for competitive advantage and enhanced operational efficiency, significantly contributes to the continuous expansion of this market. The ongoing evolution of data sources, including a wealth of alternative data, and the intrinsic desire to derive deeper, more actionable insights from these diverse datasets further fuel the demand for sophisticated analytical capabilities seamlessly embedded within modern credit risk software solutions.

Despite the strong growth drivers, the market also contends with considerable restraints that moderate its overall expansion. The substantial initial implementation costs and the ongoing, often high, maintenance expenses associated with deploying enterprise-grade credit risk rating software can be a significant deterrent, particularly for smaller financial institutions or those burdened with outdated, legacy IT infrastructures. The inherent complexity of integrating these new, technologically advanced systems with existing, often diverse and antiquated IT environments presents a formidable technical and operational challenge, frequently leading to prolonged deployment timelines, interoperability issues, and the creation of isolated data silos. Furthermore, data security and privacy concerns, especially with the increasing reliance on cloud-based platforms and the processing of highly sensitive financial information, represent a major hurdle; institutions must ensure the implementation of robust cybersecurity measures and strict compliance with evolving data protection regulations such as GDPR. Additionally, a persistent scarcity of skilled personnel proficient in both the intricate domain of financial risk management and advanced analytical technologies poses a significant challenge for the effective deployment, optimization, and ongoing management of these sophisticated tools. Lastly, ingrained organizational resistance to change, where traditional manual processes are deeply entrenched, can also impede adoption rates and hinder the full realization of the benefits offered by such transformative software, requiring extensive change management strategies.

Conversely, significant opportunities are continuously emerging within the Credit Risk Rating Software Market. The relentless advancement and seamless integration of pioneering technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics are actively creating new avenues for even more accurate, dynamic, and extensively automated risk assessment capabilities. AI/ML technologies possess the unique ability to process colossal amounts of alternative data, uncover non-obvious correlations, and provide predictive capabilities far surpassing traditional statistical models, thereby opening doors for innovative product offerings, refined customer segmentation, and enhanced risk pricing. The strategic expansion into untapped and rapidly growing emerging markets, particularly across Asia Pacific, Latin America, and Africa, where financial digitalization is accelerating and regulatory frameworks are maturing, presents substantial and lucrative growth prospects for software vendors. Moreover, the increasing global emphasis on integrating environmental, social, and governance (ESG) factors into lending decisions is creating a distinct and growing niche for software solutions that can effectively integrate comprehensive ESG risk assessment into traditional credit models, catering to a burgeoning demand for sustainable finance products. The prevailing trend towards hyper-personalization in financial services also offers a compelling opportunity for software that can provide highly granular and individualized credit risk profiles, enabling truly tailored lending products and services, thereby significantly enhancing customer experience and loyalty while simultaneously managing risk more effectively and proactively.

Segmentation Analysis

The Credit Risk Rating Software Market is meticulously segmented based on several critical attributes, designed to reflect the diverse operational needs and structural variations within the expansive financial services ecosystem. These segmentations are instrumental in providing a granular and nuanced understanding of prevailing market dynamics, pinpointing specific demand drivers, and mapping the competitive landscape across different product types, deployment models, organizational sizes, and end-user applications. A comprehensive analysis of these distinct segments enables market players to strategically tailor their product offerings and refine their market penetration strategies to align precisely with specific client requirements, ensuring maximum relevance and efficacy. The intricate interplay among these segments frequently dictates the pace of technological adoption and influences the evolution of compliance standards within the broader financial industry, thereby stimulating the development of highly specialized and innovative software solutions that address precise industry demands and regulatory mandates.

- By Component:

- Software: Core credit risk rating platforms, advanced analytical modules, robust scoring engines, comprehensive reporting tools, and predictive modeling functionalities.

- Services: Professional services encompassing full-cycle implementation, expert consulting, ongoing maintenance, dedicated support, specialized training, and critical system integration services.

- By Deployment:

- On-premises: Software solutions hosted, managed, and fully controlled within the financial institution's proprietary IT infrastructure, offering maximum data control.

- Cloud-based: Software delivered as a service (SaaS) over the internet, hosted and managed by the vendor or a trusted third-party provider, offering scalability and flexibility.

- By Enterprise Size:

- Large Enterprises: Global banks, major financial institutions, and large insurance companies characterized by extensive and complex credit portfolios and diverse operations.

- Small and Medium-sized Enterprises (SMEs): Credit unions, regional banks, and agile fintech startups requiring scalable, cost-effective, and often more standardized solutions.

- By End-User:

- Banks: Commercial banks, retail banks, and investment banks utilizing software for diverse lending products, portfolio management, and regulatory compliance.

- Financial Institutions: Credit unions, specialized mortgage lenders, wealth management firms, and asset managers assessing various forms of credit and counterparty risk.

- Credit Unions: Cooperative financial institutions focused on member-centric lending, requiring efficient and compliant credit risk assessment and management tools.

- Non-Banking Financial Companies (NBFCs): Specialized lending institutions, housing finance companies, and microfinance providers with unique business models and risk profiles.

- Others: Government agencies, regulatory bodies, independent credit rating agencies, insurance companies, and corporate treasuries managing their own financial risks.

Value Chain Analysis For Credit Risk Rating Software Market

The value chain for the Credit Risk Rating Software Market is a sophisticated network, spanning several distinct stages from upstream foundational data sourcing and advanced technology development to downstream distribution and critical end-user implementation. The upstream segment is primarily defined by crucial providers of core technologies and indispensable data infrastructure. This includes innovative vendors offering highly advanced analytical engines, cutting-edge artificial intelligence and machine learning frameworks, robust big data platforms, and scalable cloud computing services, all of which form the essential foundational layers for the development of sophisticated credit risk software. Critically, this segment also encompasses providers of raw, fundamental data, such as established credit bureaus, specialized financial information services, and increasingly, innovative alternative data providers (ee.g., social media data, transactional data, utility payment histories). These upstream entities supply the vital ingredients – both technological components and critical information – that empower software developers to build resilient, intelligent, and highly accurate risk assessment solutions. The quality, reliability, and accessibility of these upstream inputs directly and profoundly influence the ultimate sophistication and predictive accuracy of the final software product, thus highlighting the deeply symbiotic relationships embedded within this intricate value chain.

In the midstream segment, the value chain is predominantly shaped by the credit risk rating software developers and solution providers themselves. These specialized companies meticulously acquire the necessary upstream technologies and comprehensive data, subsequently developing, rigorously customizing, and seamlessly integrating specialized algorithms, advanced statistical models, and intuitive user interfaces to engineer comprehensive credit risk management platforms. Their core activities involve extensive and continuous research and development to incorporate the very latest advancements in predictive analytics, evolving regulatory compliance modules, and enhanced reporting functionalities, ensuring their offerings remain cutting-edge. This crucial stage also includes highly skilled system integrators and expert consultants who specialize in meticulously adapting these generic software solutions to the unique operational environments and specific regulatory requirements of diverse financial institutions. The paramount focus at this stage is on transforming raw technological capabilities and disparate data into a deployable, highly effective, and user-friendly software product that precisely addresses the complex and multifaceted needs of financial risk managers. The ability to continually innovate, seamlessly integrate various complex data sources, and consistently ensure robust regulatory compliance are unequivocally critical success factors at this pivotal stage of the value chain.

The downstream segment primarily encompasses the various distribution channels and the ultimate end-users of the credit risk rating software. Distribution channels are varied and strategic, including direct sales by specialized software vendors, synergistic partnerships with leading consulting firms, value-added resellers (VARs), and, increasingly, dynamic cloud marketplaces for Software-as-a-Service (SaaS) offerings. Direct sales often cater to large enterprises that require highly customized solutions and direct, dedicated vendor support for complex integrations. Indirect channels, facilitated through strategic partners and VARs, are crucial for expanding market reach, particularly to small and medium-sized enterprises (SMEs) and in specific regions where localized expertise and presence are vital. End-users are the financial institutions that deploy and actively utilize the software to meticulously manage their credit portfolios. This extensive group includes major commercial banks, investment banks, credit unions, specialized mortgage lenders, and non-banking financial companies. Comprehensive post-sales services, such as ongoing technical support, proactive maintenance, regular software updates, and continuous training, are absolutely vital components of the downstream value chain, ensuring the long-term effectiveness, optimal performance, and sustained user satisfaction with the implemented software. The efficiency of these distribution channels and the exceptional quality of post-sales support significantly impact market penetration rates and ultimately, long-term customer retention.

Credit Risk Rating Software Market Potential Customers

The Credit Risk Rating Software Market serves an expansive and highly diverse array of potential customers, predominantly concentrated within the global financial services sector. These entities universally share a fundamental and critical need for accurate, efficient, and fully compliant tools to meticulously assess and proactively manage credit risk across their extensive and varied portfolios. At the forefront of this customer base are commercial and retail banks, which collectively represent the largest segment of end-users. These institutions demand sophisticated software capabilities to rigorously evaluate loan applications for individuals (covering mortgages, personal loans, and credit cards) and corporations (including business loans and lines of credit), effectively manage vast existing loan portfolios, conduct rigorous stress tests, and ensure unwavering adherence to intricate national and international banking regulations such as the various Basel accords. Their extensive client bases and complex product offerings necessitate comprehensive, scalable, and highly integrated solutions that can seamlessly connect with their core banking systems, providing a holistic and real-time view of credit risk exposure, thereby informing critical lending decisions while optimizing capital allocation and minimizing potential losses from defaults.

Beyond the traditional banking sector, a substantial portion of potential customers includes a wide range of other financial institutions such as credit unions, specialized mortgage lenders, investment banks, wealth management firms, and prominent asset management companies. Credit unions, for example, strategically leverage these advanced tools to efficiently and fairly assess the creditworthiness of their members and effectively manage their loan books while steadfastly upholding their cooperative ethos. Mortgage lenders rely heavily on credit risk software to meticulously evaluate property loans, accurately assess borrower repayment capacity, and adeptly manage market risks inherently associated with their vast portfolios. Investment banks and asset managers utilize these sophisticated platforms for rigorous counterparty risk assessment, meticulously evaluating the credit quality of counterparties involved in derivatives, bond markets, and other complex financial instruments, thereby ensuring the implementation of prudent and risk-adjusted investment strategies. These diverse financial entities are all actively seeking to significantly enhance their decision-making processes, substantially reduce operational costs, and consistently comply with sector-specific financial regulations, driving their persistent demand for highly specialized and robust credit risk rating software solutions that can precisely address their unique operational requirements and intricate risk profiles.

Furthermore, the market's reach extends significantly to non-banking financial companies (NBFCs), agile fintech startups, major insurance companies, and even influential governmental or regulatory bodies. NBFCs, which offer highly specialized lending products (e.g., microfinance, vehicle finance, housing finance), often operate under distinct regulatory frameworks and therefore require flexible software solutions that can readily adapt to their specific business models and effectively leverage alternative data sources. Fintech startups, rapidly innovating in the lending and payment services arena, require agile and often cloud-based credit risk assessment tools to quickly launch new products and efficiently scale their operations while diligently managing inherent risks. Insurance companies strategically employ these tools to assess the credit risk of policyholders and counterparties within their substantial investment portfolios. Lastly, governmental and regulatory bodies frequently utilize such sophisticated software for essential macro-prudential surveillance, rigorously stress testing the broader financial system, and closely monitoring the financial health of institutions under their purview, thereby ensuring overall market stability and systemic resilience. The continuously evolving landscape of digital finance and the increasing interconnectedness of global markets inexorably continue to expand the scope of potential customers for these indispensable and increasingly vital risk management tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.2 Billion |

| Market Forecast in 2032 | USD 13.5 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Moody's Analytics, Experian, FICO, S&P Global, SAS Institute, Oracle, Fiserv, Temenos, Refinitiv (LSEG), CRIF, RiskSpan, BlackLine, Wolters Kluwer, Equifax, LexisNexis Risk Solutions, Dun & Bradstreet, Creditinfo Group, Murex, Kamakura Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Credit Risk Rating Software Market Key Technology Landscape

The technological landscape of the Credit Risk Rating Software Market is exceptionally dynamic and constantly evolving, characterized by the continuous integration of cutting-edge innovations meticulously aimed at profoundly enhancing accuracy, operational efficiency, and real-time analytical capabilities. At its core, advanced statistical modeling and sophisticated econometric techniques remain absolutely fundamental, forming the bedrock for precise credit scoring, robust probability of default (PD) estimation, accurate loss given default (LGD) calculation, and comprehensive exposure at default (EAD) quantification. These foundational, traditional models are now being significantly augmented and transformed by the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. AI/ML, encompassing methodologies like neural networks, deep learning, support vector machines, and random forests, enables the efficient processing of vast and highly diverse datasets, including complex unstructured text and innovative alternative data, to identify intricate, non-linear patterns that traditional models might otherwise overlook. This strategic integration leads to more precise risk predictions, substantially improved fraud detection mechanisms, and an unparalleled ability to rapidly adapt to evolving market conditions with greater agility. The widespread adoption of these intelligent algorithms is undeniably pivotal for developing next-generation risk engines that offer predictive power far beyond historical trends, facilitating truly forward-looking and proactive risk assessments.

Furthermore, robust Big Data analytics platforms have become utterly indispensable for adeptly handling the ever-increasing volume, rapid velocity, and immense variety of both financial and non-financial data. Advanced technologies like Hadoop and Spark facilitate the scalable storage, efficient processing, and in-depth analysis of colossal datasets, providing the essential computational infrastructure necessary for highly sophisticated risk modeling and the extraction of real-time, actionable insights. Cloud computing, particularly through Software-as-a-Service (SaaS) models, has emerged as a transformative technology, offering unparalleled scalability, immense flexibility, and significant cost-effectiveness. Cloud-based solutions empower financial institutions to effortlessly access powerful risk analytics tools without the burdensome upfront capital investment typically associated with on-premises infrastructure. This effectively democratizes access to advanced credit risk management capabilities for a much wider array of market participants, including small and medium-sized enterprises (SMEs) and agile fintech startups. Distributed ledger technologies (DLT), while still in nascent stages for mainstream adoption within credit risk, hold considerable potential for profoundly enhancing data security, transparency, and the immutable integrity of credit information through inherently tamper-proof records, potentially simplifying complex data sharing protocols and significantly reducing fraud in the long term, though substantial regulatory and interoperability challenges presently remain.

The contemporary technology landscape also critically encompasses sophisticated data visualization and powerful business intelligence (BI) tools, which are absolutely crucial for effectively transforming complex analytical outputs into clear, actionable insights for senior risk managers, executive leadership, and regulatory bodies. These indispensable tools provide intuitive, interactive dashboards, generate meticulously detailed reports, and offer robust scenario analysis capabilities, enabling users to comprehend complex risk exposures at a glance and make profoundly informed strategic decisions. Seamless integration capabilities, strategically leveraging APIs (Application Programming Interfaces) and flexible microservices architectures, are paramount for achieving frictionless connectivity between credit risk software and existing core banking systems, comprehensive CRM platforms, and a multitude of external data sources. This ensures a unified, consistent view of customer data and financial transactions across the enterprise, effectively eliminating data silos and significantly improving overall operational efficiency. Moreover, state-of-the-art cybersecurity technologies are intrinsically and inextricably linked to the credit risk software market, as robust encryption protocols, stringent access control mechanisms, and advanced threat detection systems are absolutely essential to safeguard highly sensitive financial data and maintain the unwavering trust of customers and regulatory authorities alike, thereby forming a critical and impenetrable protective layer around the entire, sophisticated technology stack.

Regional Highlights

- North America: Exhibits a dominant market share driven by a highly developed financial infrastructure, rigorous regulatory compliance demands (e.g., Dodd-Frank Act, CCAR), and high rates of adopting advanced technologies in its mature banking sector. The presence of major global financial hubs and leading software vendors further solidifies its market leadership.

- Europe: Represents a significant market propelled by comprehensive and intricate regulatory frameworks (e.g., Basel III, IFRS 9, GDPR) and a strong, pervasive emphasis on robust risk management across its diverse economies. Western European countries, particularly the UK, Germany, and France, are at the forefront of adoption, with growing demand emanating from Central and Eastern Europe.

- Asia Pacific (APAC): Identified as the fastest-growing region, fueled by rapid and sustained economic expansion, increasing financial inclusion initiatives, and the ongoing modernization of banking and financial services across emerging economies like China, India, Japan, and the dynamic Southeast Asian nations. Digital transformation efforts and evolving regulatory landscapes are key accelerators.

- Latin America: An emerging market experiencing growing adoption, significantly propelled by ongoing financial sector reforms, increasing digitalization of banking services, and the critical need for improved risk assessment capabilities amidst varying economic fluctuations. Brazil and Mexico are notably leading the regional adoption curve.

- Middle East and Africa (MEA): A gradually expanding market, primarily driven by strategic government initiatives aimed at economic diversification, modernizing local financial sectors, and enhancing regulatory oversight and transparency. The Gulf Cooperation Council (GCC) countries are prominent early adopters, with nascent yet promising growth observed across various parts of Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Credit Risk Rating Software Market.- IBM

- Moody's Analytics

- Experian

- FICO

- S&P Global

- SAS Institute

- Oracle

- Fiserv

- Temenos

- Refinitiv (LSEG)

- CRIF

- RiskSpan

- BlackLine

- Wolters Kluwer

- Equifax

- LexisNexis Risk Solutions

- Dun & Bradstreet

- Creditinfo Group

- Murex

- Kamakura Corporation

Frequently Asked Questions

What is credit risk rating software and why is it important for financial institutions?

Credit risk rating software is an advanced technological solution that enables financial institutions to systematically assess, quantify, and manage the creditworthiness of borrowers and counterparties. It analyzes a multitude of data points using sophisticated statistical models and algorithms to predict the likelihood of default, estimate potential financial losses, and inform more precise lending and investment decisions. Its paramount importance stems from its capacity to significantly enhance decision-making accuracy, ensure stringent regulatory compliance (e.g., Basel III, IFRS 9), effectively mitigate financial losses arising from non-performing assets, optimize capital allocation strategies, and ultimately improve overall portfolio performance. By automating and standardizing intricate risk assessments, the software not only reduces operational costs but also fosters more efficient and sustainable lending practices across a diverse range of financial products and customer segments, thereby critically safeguarding the financial stability of individual institutions and the broader economy.

How is Artificial Intelligence transforming the credit risk rating software market?

Artificial Intelligence (AI) is profoundly transforming the credit risk rating software market by dramatically enhancing predictive accuracy, enabling dynamic real-time monitoring, and automating highly complex analytical tasks previously requiring extensive manual intervention. AI and Machine Learning (ML) algorithms possess the unique capability to process vast amounts of both traditional and alternative data (e.g., behavioral data, social media insights, transaction patterns) to identify subtle, non-linear relationships and emerging patterns indicative of credit risk that traditional statistical models might easily overlook. This capability facilitates more precise risk segmentation, allows for hyper-personalized lending decisions tailored to individual profiles, and significantly improves fraud detection mechanisms. Furthermore, AI fosters continuous learning and rapid adaptation to constantly changing market conditions and evolving borrower behaviors, making risk models more resilient and forward-looking. While improving efficiency and offering deeper insights, AI's continued integration will also focus intensely on addressing critical challenges related to model explainability, ensuring inherent fairness, and meticulously mitigating algorithmic bias to uphold ethical and compliant lending practices, alongside developing robust governance frameworks for all AI-driven risk management systems.

What are the primary drivers propelling the growth of the Credit Risk Rating Software Market?

The Credit Risk Rating Software Market's robust growth is primarily propelled by several powerful drivers. Firstly, the increasing stringency of global financial regulations, such as Basel III, IFRS 9, and CECL, which mandate comprehensive and transparent credit risk management practices and extensive reporting from financial institutions, creates an indispensable demand for such software. Secondly, the escalating volume and inherent complexity of global financial transactions, coupled with pervasive economic volatility, necessitate advanced tools to accurately assess and mitigate potential losses from loan defaults and counterparty risks across diverse portfolios. Thirdly, the ongoing and widespread digital transformation within the financial services sector is a crucial catalyst, compelling institutions to embrace automation, sophisticated data analytics, and advanced artificial intelligence to gain competitive advantages, significantly enhance operational efficiencies, and respond with greater agility to rapid market changes. Lastly, the increasing availability of diverse data sources, including innovative alternative data, and the strong imperative to extract deeper, more actionable insights from these vast datasets further fuel the demand for sophisticated credit risk rating software, enabling more precise, adaptive, and proactive lending strategies.

What are the key challenges faced by providers and users in the Credit Risk Rating Software Market?

The Credit Risk Rating Software Market faces several notable challenges for both providers and users. A significant barrier is the high initial implementation costs and substantial ongoing maintenance expenses associated with deploying enterprise-grade software, particularly for smaller financial institutions or those burdened with legacy IT infrastructures. Integrating complex new systems with existing disparate and often antiquated IT environments presents a major technical and operational hurdle, frequently leading to data silos, interoperability issues, and prolonged deployment timelines. Data security and privacy concerns are paramount, given the highly sensitive nature of financial information processed; institutions must invest heavily in robust cybersecurity and strictly comply with evolving data protection regulations like GDPR. Furthermore, a persistent scarcity of skilled professionals with dual expertise in financial risk management and advanced analytical technologies, including AI/ML, constrains effective deployment and optimization. Finally, inherent organizational resistance to change and deeply entrenched manual processes can significantly impede adoption rates and the full realization of benefits, necessitating comprehensive change management strategies.

Which deployment model is experiencing the most significant growth in the Credit Risk Rating Software Market?

The cloud-based deployment model is currently experiencing the most significant growth and gaining substantial traction within the Credit Risk Rating Software Market. This accelerating shift is primarily driven by the inherent advantages of cloud solutions, including unparalleled scalability, which allows financial institutions to dynamically adjust computing resources based on fluctuating demand without the need for significant upfront hardware investments. Cloud-based platforms offer superior flexibility, enabling secure access to advanced analytics tools from virtually anywhere, thereby efficiently supporting remote workforces and distributed operational models. Critically, these solutions typically entail a lower total cost of ownership (TCO) compared to traditional on-premises deployments, by reducing capital expenditures and mitigating operational burdens related to infrastructure management and ongoing maintenance. This enhanced accessibility effectively democratizes sophisticated credit risk management capabilities, making them available to a much broader spectrum of entities, including small and medium-sized enterprises (SMEs) and agile fintech startups. While on-premises solutions continue to be preferred by institutions with stringent data sovereignty and regulatory requirements, the overarching market trend unmistakably points towards a sustained increase in cloud adoption due to its agility, cost-efficiency, and immense innovation potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager