Crypto Payment Gateways Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427792 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Crypto Payment Gateways Market Size

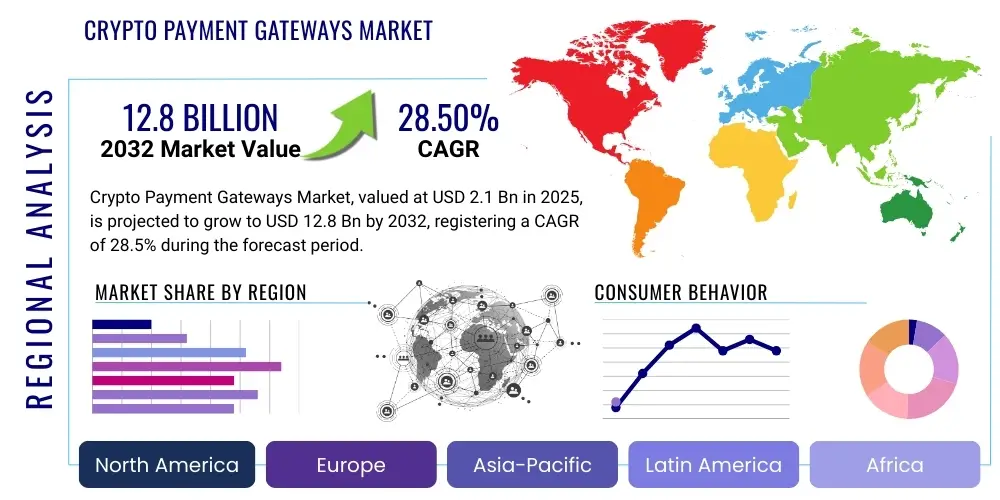

The Crypto Payment Gateways Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at USD 2.1 billion in 2025 and is projected to reach USD 12.8 billion by the end of the forecast period in 2032.

This substantial growth is primarily driven by the escalating global adoption of cryptocurrencies as a legitimate payment method, coupled with the increasing demand for secure, transparent, and efficient transaction processing solutions. Businesses are recognizing the benefits of integrating crypto payment options to cater to a digitally savvy customer base and to expand into new, underserved markets. The inherent advantages of blockchain technology, such as reduced transaction fees and faster settlement times compared to traditional payment systems, further contribute to this positive market trajectory.

Crypto Payment Gateways Market introduction

The Crypto Payment Gateways Market encompasses platforms and services that facilitate the acceptance of various cryptocurrencies by merchants and businesses for goods and services. These sophisticated solutions bridge the gap between volatile digital assets and traditional fiat economies, enabling seamless conversion, secure transaction processing, and often, instant settlement. Products in this market include API-based integration tools, hosted payment pages, and point-of-sale (POS) systems that abstract the complexities of blockchain transactions from both merchants and consumers, ensuring a user-friendly experience.

Major applications of crypto payment gateways span across a diverse range of industries, including e-commerce, gaming, travel, hospitality, and subscription services. They are particularly beneficial for cross-border transactions, reducing high international transfer fees and eliminating delays associated with traditional banking rails. For businesses operating globally, these gateways offer a cost-effective and efficient method to reach a wider customer base, especially in regions with limited access to conventional financial infrastructure, thereby fostering financial inclusion.

The primary benefits driving the adoption of these gateways include enhanced security through cryptographic protocols, significantly lower transaction fees compared to credit card processors, faster settlement times, and the ability to access a global customer base without geographical restrictions. Furthermore, they offer increased transparency with immutable transaction records on public ledgers and provide merchants with protection against chargebacks, a common issue in traditional online payments. These factors collectively contribute to the robust growth and increasing relevance of crypto payment gateways in the evolving digital economy.

Crypto Payment Gateways Market Executive Summary

The Crypto Payment Gateways Market is experiencing dynamic growth, propelled by several converging business trends. A significant trend is the increasing institutional adoption of cryptocurrencies, leading to a demand for robust, compliant, and scalable payment infrastructure. Businesses are increasingly integrating crypto payment solutions to mitigate high transaction fees associated with traditional payment processors, enhance security against fraud, and offer innovative payment options that attract a younger, tech-savvy demographic. The expansion of Web3 applications and the metaverse also necessitates native crypto payment solutions, further fueling market expansion.

Regionally, North America and Europe currently dominate the market due to higher cryptocurrency adoption rates, established regulatory frameworks, and a strong presence of technology innovators and early adopters. However, the Asia-Pacific region, particularly emerging economies like India and Southeast Asian nations, is poised for rapid growth. This surge is driven by a large unbanked population seeking alternative financial services, increasing mobile penetration, and supportive government initiatives for digital payments. Latin America and Africa are also showing promising potential as cryptocurrency usage rises as a hedge against inflation and a means for remittances, driving the need for accessible payment infrastructure.

In terms of segmentation, the market observes notable trends across various dimensions. Solutions catering to enterprise-level businesses, demanding high transaction volumes and complex integration capabilities, are gaining significant traction. Concurrently, the proliferation of payment options beyond Bitcoin and Ethereum, including stablecoins and altcoins, is expanding the versatility of these gateways. The rise of DeFi and NFT ecosystems also creates new opportunities for specialized payment processing, while the increasing focus on regulatory compliance and user-friendly interfaces is shaping product development and market competitiveness.

AI Impact Analysis on Crypto Payment Gateways Market

Common user questions regarding AIs impact on the Crypto Payment Gateways Market frequently revolve around enhanced security, fraud detection, personalization, and operational efficiency. Users are concerned about how AI can bolster defenses against increasingly sophisticated cyber threats and crypto-specific scams, while also hoping for more seamless and tailored user experiences. There is significant interest in AIs role in automating compliance processes, managing price volatility, and optimizing transaction routing to minimize costs and maximize speed. Expectations are high for AI to transform the scalability and reliability of these platforms, ensuring they can handle future growth and complex transaction patterns.

Artificial intelligence is set to profoundly revolutionize crypto payment gateways by introducing advanced capabilities that enhance their core functions and user experience. AI algorithms can analyze vast datasets of transaction histories, user behavior, and network patterns to identify and flag suspicious activities with greater precision than traditional rule-based systems. This proactive fraud detection significantly reduces financial losses for both merchants and consumers, thereby increasing trust in crypto transactions. Furthermore, AI can predict market fluctuations with a certain degree of accuracy, enabling gateways to offer better real-time exchange rates and hedging strategies, protecting parties from the inherent volatility of digital assets.

Beyond security and risk management, AI will also play a critical role in optimizing the operational efficiency of crypto payment gateways. Machine learning models can automate customer support by handling routine inquiries, personalizing user interfaces based on individual preferences and past transaction behavior, and streamlining the onboarding process. AI-driven analytics can provide merchants with deeper insights into their customer base and payment trends, allowing for more informed business decisions and tailored marketing strategies. This integration of AI not only streamlines backend operations but also elevates the overall value proposition of crypto payment gateway services, making them more attractive and indispensable for modern businesses.

- Enhanced Fraud Detection: AI algorithms analyze transaction patterns in real-time to identify and prevent fraudulent activities, reducing chargebacks and securing funds.

- Dynamic Risk Management: AI models assess and manage the risk associated with cryptocurrency price volatility, offering optimized exchange rates and hedging mechanisms.

- Personalized User Experiences: AI customizes payment interfaces, recommendations, and support based on individual user behavior and preferences.

- Automated Compliance and KYC: AI streamlines Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, ensuring regulatory adherence and reducing operational overhead.

- Optimized Transaction Routing: AI identifies the most efficient and cost-effective blockchain networks or payment channels for each transaction, improving speed and reducing fees.

- Predictive Analytics for Market Volatility: AI provides insights into potential price movements, aiding merchants and users in making informed decisions about crypto acceptance and conversion.

- Improved Customer Support: AI-powered chatbots and virtual assistants offer instant, accurate support, resolving common queries and enhancing user satisfaction.

DRO & Impact Forces Of Crypto Payment Gateways Market

The Crypto Payment Gateways Market is significantly shaped by a combination of powerful drivers, inherent restraints, and compelling opportunities that collectively dictate its growth trajectory and impact forces. Among the key drivers is the burgeoning global adoption of cryptocurrencies by both individuals and businesses, fueled by a desire for financial autonomy, lower transaction costs, and faster cross-border payments. The increasing digitalization of commerce, the proliferation of e-commerce platforms, and the emergence of Web3 technologies further necessitate robust crypto payment infrastructure. Additionally, growing awareness regarding the security and transparency benefits of blockchain technology, coupled with the rising demand for alternative payment methods, actively propels market expansion.

Despite these strong tailwinds, the market faces several significant restraints. Regulatory uncertainty and the fragmented legal landscape across different jurisdictions pose considerable challenges for payment gateway providers, requiring constant adaptation and compliance efforts. The inherent volatility of cryptocurrencies, while offering opportunities for some, deters mainstream adoption by merchants wary of price fluctuations that could impact their revenue. Technical complexities associated with integrating blockchain technologies, ensuring scalability, and managing different token standards also present hurdles. Furthermore, security concerns related to potential hacks, scams, and the irreversible nature of blockchain transactions remain a psychological barrier for many potential users and businesses.

Opportunities for growth are abundant, particularly in emerging markets where traditional banking infrastructure is often limited, making crypto payments a viable alternative for financial inclusion and remittances. The development of stablecoins offers a solution to volatility concerns, potentially accelerating merchant adoption. Integration with decentralized finance (DeFi) ecosystems and non-fungible tokens (NFTs) presents new avenues for specialized payment services. Innovation in user experience, enhanced security features, and the development of more scalable and interoperable blockchain networks are crucial for capitalizing on these opportunities. Ultimately, the markets impact forces are a balance between the transformative potential of blockchain and digital assets against the need for regulatory clarity, technological maturity, and widespread user trust.

Segmentation Analysis

The Crypto Payment Gateways Market is comprehensively segmented across various dimensions to reflect its diverse applications, technological underpinnings, and operational models. These segmentations provide a granular understanding of market dynamics, enabling stakeholders to identify specific growth areas and tailor strategies effectively. Key categories often include the type of cryptocurrency supported, the deployment model, the end-use industry, and the geographical region. Analyzing these segments helps illuminate consumer preferences, technological advancements, and the varying regulatory environments influencing adoption rates across different market niches.

- By Cryptocurrency Type:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Stablecoins (e.g., USDT, USDC)

- Other Altcoins

- By Deployment Model:

- Cloud-based

- On-premise

- By End-use Industry:

- E-commerce & Retail

- Gaming & Entertainment

- Travel & Hospitality

- Software & SaaS

- Media & Publishing

- Donations & Fundraising

- Others (e.g., Real Estate, Healthcare)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Crypto Payment Gateways Market Value Chain Analysis

The value chain for the Crypto Payment Gateways Market is intricate, involving several critical stages from fundamental blockchain infrastructure to the end-user interaction, with each component contributing to the overall service delivery and value proposition. At the upstream level, the chain begins with core blockchain technology developers who create the underlying distributed ledger protocols and smart contracts that facilitate cryptocurrency transactions. This foundational layer is complemented by cryptocurrency exchanges and liquidity providers, who ensure that a sufficient supply of digital assets is available for conversion and trading, thereby enabling the real-time settlement capabilities of payment gateways. Miners and validators also form a crucial part of this upstream segment, securing the network and processing transactions, which directly impacts the speed and reliability of payments.

Moving downstream, the value chain encompasses the crypto payment gateway providers themselves, who integrate with various blockchains, develop APIs, SDKs, and user interfaces that simplify crypto acceptance for merchants. These providers often incorporate features like fraud detection, multi-currency support, accounting tools, and regulatory compliance solutions. Further down are the merchants and businesses across various sectors, such as e-commerce, gaming, and travel, who adopt these gateways to accept crypto payments from their customers. This segment represents the direct beneficiaries of the payment gateway services, translating the underlying blockchain technology into tangible business utility by expanding their customer reach and optimizing payment processes.

Distribution channels for crypto payment gateways are predominantly digital, leveraging direct and indirect approaches. Direct channels include providers offering their services directly through their websites, sales teams, and developer portals, targeting businesses looking for integrated payment solutions. Indirect channels involve partnerships with e-commerce platforms, payment service providers (PSPs), independent software vendors (ISVs), and system integrators who embed or resell crypto payment gateway functionalities as part of a broader suite of services. This multifaceted distribution strategy ensures widespread market penetration, reaching diverse businesses from small online stores to large multinational corporations, thereby maximizing the accessibility and adoption of crypto payment solutions.

Crypto Payment Gateways Market Potential Customers

The potential customers for Crypto Payment Gateways are incredibly diverse, spanning across various industries and organizational sizes, all united by the need for modern, efficient, and globally accessible payment solutions. At the forefront are e-commerce businesses, ranging from small online retailers to large multinational corporations, seeking to tap into the growing base of cryptocurrency holders and reduce processing fees associated with traditional credit card transactions. Online gaming platforms, which often deal with microtransactions and cross-border payments, also represent a significant customer segment, benefiting from the speed and lower costs offered by crypto payments. Additionally, businesses in the travel and hospitality sectors are increasingly exploring crypto acceptance to cater to international tourists and digital nomads, offering a seamless booking and payment experience.

Beyond these traditional digital commerce sectors, innovative industries like those in the Web3 space, including NFT marketplaces, decentralized applications (dApps), and metaverse platforms, are natural adopters, as their entire ecosystem is built on blockchain technology and requires native crypto payment solutions. Charities and fundraising organizations also find value in crypto payment gateways, leveraging the transparency and global reach of digital assets for donations. Furthermore, businesses operating in regions with underdeveloped banking infrastructure or high inflation rates often turn to crypto payments as a more stable and accessible alternative, making them key potential customers for providers looking to expand into emerging markets. The overarching appeal lies in the promise of reduced costs, enhanced security, faster settlements, and the ability to attract a forward-thinking customer base.

Crypto Payment Gateways Market Key Technology Landscape

The Crypto Payment Gateways Market is underpinned by a sophisticated array of technologies that ensure the secure, efficient, and seamless processing of digital asset transactions. At its core, blockchain technology is paramount, providing the decentralized ledger infrastructure for recording all cryptocurrency movements. This includes support for various blockchain protocols, such as Bitcoins UTXO model, Ethereums account-based system, and various Layer 2 solutions, enabling gateways to process transactions across multiple networks. Cryptographic algorithms are fundamental for securing transactions and wallets, while smart contracts automate payment logic, conditional releases, and multi-signature requirements, adding programmability and trust to the payment process. These foundational elements form the bedrock upon which all subsequent gateway functionalities are built, ensuring the integrity and immutability of every transaction.

Beyond the core blockchain layer, payment gateways leverage a suite of advanced software and integration technologies. Application Programming Interfaces (APIs) and Software Development Kits (SDKs) are crucial for enabling merchants to integrate crypto payment functionalities into their existing websites, e-commerce platforms, and point-of-sale systems with minimal development effort. These tools provide abstract layers that simplify complex blockchain interactions. Security protocols such as Secure Socket Layer (SSL) and Transport Layer Security (TLS) are essential for protecting data in transit, while multi-factor authentication (MFA) and cold storage solutions are employed to safeguard user funds and private keys. Fraud detection systems, often powered by AI and machine learning, analyze transaction patterns to identify and prevent suspicious activities, adding another layer of security and trust to the ecosystem.

Furthermore, the technology landscape includes robust backend infrastructure designed for scalability, high availability, and real-time processing. This involves cloud computing platforms for flexible deployment, database management systems for storing transaction data, and distributed ledger technology (DLT) aggregators that allow for simultaneous interaction with multiple blockchain networks. Real-time fiat-to-crypto and crypto-to-fiat conversion engines are also vital, often integrated with liquidity providers and exchanges to offer competitive rates and instant settlements. As the market evolves, continuous innovation in areas like atomic swaps for cross-chain transactions, decentralized identity solutions, and enhanced interoperability protocols will further shape the key technology landscape, making crypto payments more versatile, secure, and user-friendly for a global audience.

Regional Highlights

- North America: This region stands as a dominant force in the Crypto Payment Gateways Market, driven by high cryptocurrency adoption rates, robust technological infrastructure, and a significant presence of innovative fintech companies. Favorable regulatory developments in some states, coupled with increasing institutional interest in digital assets, accelerate the integration of crypto payment solutions across various sectors, especially e-commerce and gaming.

- Europe: Europe represents a mature market with a strong emphasis on regulatory compliance and consumer protection, shaping the development of secure and transparent crypto payment gateways. Countries like the UK, Germany, and Switzerland are at the forefront, benefiting from a tech-savvy population and proactive governmental approaches towards digital asset integration, fostering innovation and widespread adoption across diverse industries.

- Asia Pacific: The Asia Pacific region is poised for exponential growth, fueled by a large and rapidly expanding digital-first population, increasing smartphone penetration, and a burgeoning e-commerce sector. Emerging economies such as India, Vietnam, and the Philippines are witnessing a surge in cryptocurrency usage for remittances and as an alternative to traditional banking, driving demand for accessible and low-cost payment solutions.

- Latin America: This region is increasingly adopting cryptocurrencies as a hedge against inflation and as a practical solution for cross-border payments, making it a high-potential market for crypto payment gateways. Countries like Argentina, Brazil, and Mexico are experiencing significant growth, with businesses and individuals embracing digital assets for everyday transactions, necessitating efficient and reliable payment infrastructure.

- Middle East & Africa: The MEA region presents a burgeoning market for crypto payment gateways, driven by a young, digitally-native population and a growing need for innovative financial services. Governments are exploring blockchain technology for various applications, and the increasing inflow of venture capital into fintech startups is accelerating the development and adoption of crypto payment solutions, particularly for international trade and remittances.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crypto Payment Gateways Market.- Coinbase Commerce

- BitPay

- CoinPayments

- ALFAcoins

- CoinGate

- NOWPayments

- TripleA

- GoURL

- Blockonomics

- Cryptomus

- PayOp

- OpenNode

- BTCPay Server

- SpectroCoin

- Stripe (potential future integration)

Frequently Asked Questions

What is a Crypto Payment Gateway and how does it benefit businesses?

A Crypto Payment Gateway is a service that enables businesses to accept cryptocurrencies like Bitcoin or Ethereum as payment for goods and services. It converts crypto payments into fiat currency, if desired, and deposits them into the merchants bank account, often at lower fees and faster speeds than traditional payment processors. Key benefits for businesses include access to a global customer base, reduced transaction costs, protection against chargebacks, enhanced security, and rapid settlement times.

Are crypto payments secure and reliable for mainstream transactions?

Yes, crypto payments processed through reputable gateways are designed with robust security features. They leverage blockchains inherent cryptographic security, making transactions highly secure and immutable. Advanced gateways often include fraud detection systems, multi-factor authentication, and cold storage for funds, ensuring a reliable and safe transaction environment for both merchants and consumers. The irreversibility of blockchain transactions also provides a layer of security against chargeback fraud for merchants.

What are the primary challenges associated with implementing a Crypto Payment Gateway?

The main challenges include navigating the evolving regulatory landscape, managing cryptocurrency price volatility, and integrating the gateway with existing business infrastructure. Regulatory uncertainty can impact compliance requirements, while price fluctuations can affect revenue stability for merchants. Technical integration requires careful planning, although many gateways offer user-friendly APIs and SDKs to simplify the process. User adoption rates and education about crypto payments also remain a factor.

How do Crypto Payment Gateways handle cryptocurrency volatility?

Crypto Payment Gateways mitigate volatility through several mechanisms. Many platforms offer instant conversion services, where the received cryptocurrency is immediately converted into a stablecoin or fiat currency at the point of transaction. This protects merchants from price fluctuations. Some also provide options for merchants to hold crypto assets if they prefer to speculate or benefit from potential gains. Advanced gateways may use AI-driven tools to predict market movements and optimize exchange rates.

What types of businesses can most benefit from integrating a Crypto Payment Gateway?

Businesses that can benefit most include e-commerce platforms with an international customer base, online gaming and entertainment industries, travel and hospitality sectors, and any business dealing with cross-border payments. Additionally, companies in the Web3 space, subscription services, and charitable organizations find significant advantages due to reduced fees, faster processing, and access to a digitally native customer demographic. Essentially, any business seeking modern, efficient, and globally accessible payment solutions stands to gain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager