Cryptocurrency Payment Apps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428266 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cryptocurrency Payment Apps Market Size

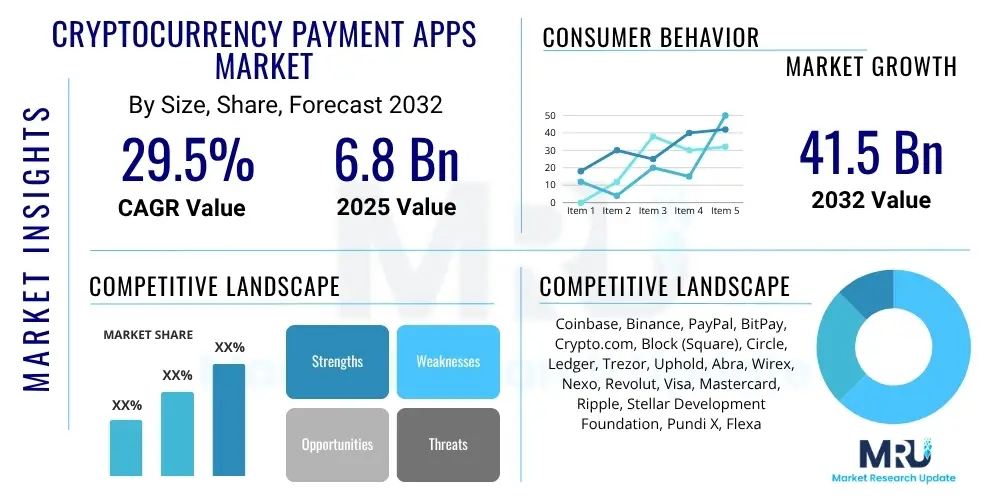

The Cryptocurrency Payment Apps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 29.5% between 2025 and 2032. The market is estimated at USD 6.8 billion in 2025 and is projected to reach USD 41.5 billion by the end of the forecast period in 2032.

Cryptocurrency Payment Apps Market introduction

The Cryptocurrency Payment Apps Market encompasses software applications designed to facilitate transactions using various digital currencies. These innovative platforms allow users to store, send, and receive cryptocurrencies, enabling payments for goods and services, peer-to-peer transfers, and remittances with enhanced speed and often lower fees compared to traditional banking systems. Major applications span from everyday retail purchases and e-commerce transactions to cross-border payments and B2B settlements. The primary benefits include increased transaction transparency, reduced reliance on intermediaries, enhanced security through cryptographic protocols, and greater financial inclusion for unbanked populations. Key driving factors propelling market growth include the escalating global adoption of cryptocurrencies, the increasing demand for faster and more cost-effective payment solutions, advancements in blockchain technology, and the continuous expansion of merchant acceptance globally. The market is also heavily influenced by the push for digital transformation across various economic sectors and the growing investor confidence in digital assets as a viable alternative to fiat currencies for transactional purposes, fostering a robust ecosystem for these specialized payment applications.

Cryptocurrency Payment Apps Market Executive Summary

The Cryptocurrency Payment Apps Market is currently experiencing a dynamic phase characterized by significant business trends, evolving regional landscapes, and distinct segment shifts. Business trends indicate a strong move towards regulatory clarity in several jurisdictions, which is attracting institutional investors and fostering greater enterprise adoption of crypto payment solutions. Strategic partnerships between traditional financial institutions and blockchain companies are becoming more prevalent, signaling a broader integration of digital assets into mainstream finance. Additionally, there is a clear trend towards enhancing user experience through intuitive app interfaces, robust security features, and seamless integration with existing payment infrastructure. Regionally, North America and Europe are leading in technological innovation and regulatory framework development, driving significant market expansion, while the Asia Pacific region, particularly Southeast Asia and India, is emerging as a critical growth hub due to high mobile penetration and a large unbanked population seeking alternative financial services. Latin America and parts of Africa also show substantial potential, driven by high inflation rates and the need for efficient cross-border remittance solutions. Segment-wise, merchant payment apps are witnessing accelerated adoption as businesses increasingly recognize the benefits of accepting cryptocurrencies, including reduced transaction fees and chargeback risks. Peer-to-peer (P2P) payment apps remain foundational, especially in emerging economies, facilitating direct transfers between individuals. The market is further segmented by technology, with QR code and NFC payments gaining traction for in-store transactions, and by operating systems, with both Android and iOS platforms seeing continuous development and user engagement, collectively painting a picture of a rapidly maturing and expanding global market.

AI Impact Analysis on Cryptocurrency Payment Apps Market

User inquiries concerning AI's influence on the Cryptocurrency Payment Apps Market frequently revolve around how artificial intelligence can enhance the security, efficiency, and overall user experience of these platforms. Common questions include whether AI can prevent fraud more effectively, personalize payment experiences, manage volatility risks, and streamline compliance processes. Users are keenly interested in understanding how AI might make crypto payments safer from cyber threats, easier for less tech-savvy individuals, and more integrated into their daily financial lives. There is also a significant interest in AI's role in analyzing market trends to offer predictive insights, optimizing transaction routing, and improving customer support through intelligent chatbots, indicating a broad expectation for AI to solve existing challenges and unlock new functionalities within the crypto payment ecosystem.

The integration of Artificial Intelligence (AI) into cryptocurrency payment applications is poised to revolutionize several critical aspects of the market, addressing both current challenges and opening new avenues for innovation. One of the foremost impacts of AI is in bolstering security measures. AI-powered fraud detection systems can analyze transaction patterns in real-time, identify anomalies, and flag suspicious activities with greater precision and speed than traditional methods. This capability is crucial in a decentralized environment where chargebacks are difficult, significantly reducing the risk of unauthorized transactions and malicious attacks, thereby enhancing user trust and protecting digital assets. Furthermore, AI algorithms can contribute to predictive analytics, anticipating potential security vulnerabilities and proactively implementing preventative measures, creating a more resilient payment infrastructure. This proactive security stance is vital for the long-term sustainability and widespread adoption of cryptocurrency payment solutions.

Beyond security, AI's influence extends to optimizing operational efficiency and enhancing user experience. AI algorithms can analyze vast amounts of blockchain data to optimize transaction routing, identifying the fastest and most cost-effective pathways for cryptocurrency transfers, which is particularly beneficial for cross-chain transactions and reducing network congestion. Moreover, AI-driven personalization engines can tailor payment experiences, offering users customized recommendations for cryptocurrencies, investment strategies, or even merchant deals based on their spending habits and preferences. Customer support is also being transformed by AI, with intelligent chatbots capable of resolving common queries, guiding users through complex transactions, and providing instant assistance 24/7, thereby improving satisfaction and reducing the operational burden on human support teams. AI is also instrumental in ensuring regulatory compliance by automating the monitoring of transactions for anti-money laundering (AML) and know-your-customer (KYC) requirements, adapting to evolving regulations and providing a scalable solution for complex legal frameworks, which is critical for the legitimization and mainstream acceptance of cryptocurrency payments.

- Enhanced Fraud Detection and Prevention: AI-powered algorithms analyze transaction data for anomalies, identifying and mitigating fraudulent activities in real-time.

- Improved Security Protocols: Machine learning models predict and prevent cyber threats, reinforcing the security of digital wallets and transactions.

- Personalized User Experience: AI customizes app interfaces, payment suggestions, and financial insights based on individual user behavior and preferences.

- Optimized Transaction Routing: AI algorithms find the most efficient and cost-effective pathways for cryptocurrency transfers across different networks.

- Automated Compliance and Regulatory Adherence: AI assists in real-time monitoring for Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, adapting to regulatory changes.

- Predictive Analytics for Market Volatility: AI models analyze market trends to provide users with insights into potential price fluctuations, aiding in informed payment decisions.

- Intelligent Customer Support: AI-powered chatbots and virtual assistants offer instant, 24/7 support, resolving queries and guiding users through the payment process.

- Streamlined Onboarding Processes: AI can expedite identity verification and account setup, making it easier for new users to enter the crypto payment ecosystem.

DRO & Impact Forces Of Cryptocurrency Payment Apps Market

The Cryptocurrency Payment Apps Market is significantly shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute its Impact Forces. Key drivers propelling the market forward include the accelerating global adoption of cryptocurrencies as a legitimate asset class and transactional medium, driven by increasing public awareness and institutional interest. The inherent benefits of crypto payments, such as significantly faster transaction speeds, lower processing fees, especially for cross-border remittances, and enhanced transparency compared to traditional banking systems, are powerful incentives for both consumers and merchants. Furthermore, the growing global push for financial inclusion, particularly in underserved regions, positions cryptocurrency payment apps as a viable alternative for accessing financial services. However, several restraints temper this growth. Regulatory uncertainty and the evolving, often fragmented, legal frameworks across different jurisdictions create significant challenges for market participants, hindering widespread adoption and innovation. The notorious price volatility of many cryptocurrencies poses a substantial risk for both users and merchants, making budgeting and pricing difficult. Security concerns, including the risk of hacks, scams, and loss of private keys, remain a significant barrier for mainstream users. Additionally, the technical complexity associated with understanding and using cryptocurrencies deters a large segment of the population. Despite these hurdles, the market is rife with opportunities. The expansion into emerging markets, where traditional banking infrastructure is often lacking, presents a massive growth avenue for crypto payment solutions. The burgeoning integration with decentralized finance (DeFi) and Web3 ecosystems promises to unlock new functionalities and use cases for payment apps. The development and increasing stability of stablecoins offer a solution to volatility concerns, making crypto payments more appealing for everyday transactions. Strategic partnerships between crypto companies and traditional financial institutions or e-commerce giants can bridge the gap between legacy and digital finance, accelerating mainstream acceptance. These impact forces collectively dictate the trajectory of the cryptocurrency payment apps market, demanding agile innovation and strategic adaptation from all stakeholders to navigate its dynamic landscape.

Segmentation Analysis

The Cryptocurrency Payment Apps Market is segmented across various dimensions, providing a granular view of its diverse landscape and growth opportunities. This segmentation helps in understanding user behavior, technological preferences, and application-specific demands, allowing market players to tailor their strategies and product offerings more effectively. The market is primarily segmented by type, differentiating between applications primarily used for peer-to-peer transfers and those focused on merchant payments. Further segmentation includes operating systems, categorizing apps available on Android, iOS, and other platforms, reflecting the pervasive mobile-first approach. Technological segmentation covers the underlying mechanisms for payments, such as QR code, NFC, and web-based solutions, as well as integration with hardware wallets. Lastly, end-user segmentation breaks down the market into individuals, various business sizes (SMEs, large enterprises), retail and e-commerce sectors, and specific use cases like remittances.

- By Type:

- P2P Payment Apps

- Merchant Payment Apps

- By Operating System:

- Android

- iOS

- Others (e.g., Web-based, Desktop applications)

- By Technology:

- QR Code Payments

- NFC Payments

- Web-Based Payments

- Hardware Wallet Integration

- Biometric Authentication

- By End-User:

- Individuals/Consumers

- Retail & E-commerce

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Remittance Users

Value Chain Analysis For Cryptocurrency Payment Apps Market

A comprehensive Value Chain Analysis for the Cryptocurrency Payment Apps Market reveals a complex ecosystem of interconnected participants, extending from the foundational blockchain infrastructure to the end-users. The upstream analysis primarily involves the core technologies and service providers that enable the existence and functionality of cryptocurrency payments. This includes blockchain developers and protocol maintainers (e.g., Bitcoin, Ethereum, Solana), cryptocurrency exchanges that provide liquidity and conversion services, and wallet infrastructure providers who secure and manage digital assets. These upstream entities are crucial for the creation, distribution, and secure storage of cryptocurrencies. Downstream analysis focuses on the entities that directly interact with the end-user and facilitate the final payment transaction. This segment includes the cryptocurrency payment app developers themselves, payment gateways and processors that enable merchants to accept crypto, and the merchants and service providers who integrate these payment options into their offerings. Direct distribution channels primarily involve app stores (Google Play, Apple App Store) where users download the payment applications, as well as direct partnerships between payment app companies and e-commerce platforms or physical retailers. Indirect distribution often includes collaborations with traditional financial institutions, fintech companies, or even referral networks that introduce merchants and users to crypto payment solutions. This multi-layered value chain underscores the collaborative nature of the market, where efficiency and security at each stage are paramount for the overall success and adoption of cryptocurrency payment apps.

Cryptocurrency Payment Apps Market Potential Customers

The Cryptocurrency Payment Apps Market caters to a diverse range of potential customers, spanning individual consumers to large enterprises, all seeking more efficient, secure, and globally accessible payment solutions. Individual users represent a significant segment, particularly those who are tech-savvy, early adopters of digital technologies, and individuals living in regions with high inflation or limited access to traditional banking services. This also includes a substantial population of cryptocurrency investors who wish to spend their digital assets directly rather than converting them to fiat currency. E-commerce platforms and online retailers are increasingly becoming key buyers, as they aim to reduce transaction fees, minimize chargebacks, and attract a growing demographic of crypto-holders. Small and Medium-sized Enterprises (SMEs) are another critical customer base, often looking for cost-effective payment processing options for both domestic and international transactions, where traditional bank fees can be prohibitive. For large enterprises, crypto payment apps offer solutions for faster global payroll, supply chain financing, and large-volume international settlements, reducing reliance on slow and expensive SWIFT transfers. Furthermore, a substantial segment comprises remittance users, individuals sending money across borders who benefit immensely from the lower fees and faster transfer times offered by cryptocurrency payment applications compared to conventional money transfer services. This broad spectrum of end-users underscores the versatile appeal and expanding utility of cryptocurrency payment solutions across various economic activities and demographic groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.8 Billion |

| Market Forecast in 2032 | USD 41.5 Billion |

| Growth Rate | 29.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coinbase, Binance, PayPal, BitPay, Crypto.com, Block (Square), Circle, Ledger, Trezor, Uphold, Abra, Wirex, Nexo, Revolut, Visa, Mastercard, Ripple, Stellar Development Foundation, Pundi X, Flexa |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cryptocurrency Payment Apps Market Key Technology Landscape

The Cryptocurrency Payment Apps Market is underpinned by a sophisticated and rapidly evolving technological landscape that combines foundational blockchain innovations with cutting-edge advancements in security, interoperability, and user experience. At its core, the technology relies on various blockchain protocols, such as Bitcoin, Ethereum, Solana, and other layer-2 solutions, which provide the decentralized, immutable, and transparent ledger for recording transactions. Smart contracts, particularly prevalent on platforms like Ethereum, automate and enforce transaction terms without intermediaries, enabling complex functionalities within payment apps like escrow services or conditional payments. Cryptographic techniques, including public-key cryptography and secure multi-party computation (MPC), are fundamental for securing digital wallets, private keys, and transaction authentication, ensuring the integrity and confidentiality of user assets. Biometric authentication (e.g., fingerprint, facial recognition) is increasingly integrated to enhance security and convenience, offering a more user-friendly alternative to traditional passwords. Application Programming Interfaces (APIs) play a crucial role in enabling seamless integration of crypto payment functionalities into existing e-commerce platforms, point-of-sale systems, and traditional financial applications. The development of stablecoins, cryptocurrencies pegged to fiat currencies or other stable assets, addresses the volatility concerns of traditional cryptocurrencies, making them more suitable for everyday transactions. Furthermore, advancements in interoperability protocols and cross-chain solutions are vital for allowing different blockchains to communicate, thereby expanding the range of cryptocurrencies supported and enhancing the versatility of payment apps. Decentralized Identifiers (DIDs) and verifiable credentials are also emerging as key technologies for managing digital identities securely and privately, streamlining KYC/AML compliance while preserving user privacy. This dynamic technological ecosystem is continuously innovating to overcome scalability challenges, improve transaction speeds, and enhance the overall user experience, driving the mainstream adoption of cryptocurrency payment apps.

Regional Highlights

- North America: This region is a powerhouse of innovation and adoption, particularly in the United States and Canada. High levels of technological literacy, substantial venture capital investments in blockchain startups, and a progressive, albeit evolving, regulatory environment contribute to robust market growth. The region sees significant institutional interest and a growing number of merchants accepting cryptocurrency payments, alongside widespread individual adoption of payment apps.

- Europe: Europe exhibits strong market traction, driven by proactive regulatory frameworks such as MiCA (Markets in Crypto-Assets) which aim to provide clarity and foster innovation. Countries like the UK, Germany, France, and Switzerland are at the forefront, with a high concentration of fintech companies and a tech-savvy population. Cross-border payments and remittance services using crypto apps are gaining considerable traction across the continent.

- Asia Pacific (APAC): APAC is a rapidly expanding market, fueled by immense population sizes, increasing mobile penetration, and a burgeoning digital economy. Countries such as India, Vietnam, Indonesia, and the Philippines show strong potential due to a large unbanked population and high remittance inflows. Regulatory approaches vary significantly, from restrictive to highly permissive, shaping localized market dynamics and driving diverse adoption patterns.

- Latin America: This region is experiencing significant growth in cryptocurrency payment app adoption, largely driven by economic volatility, high inflation rates, and the need for more efficient remittance solutions. Countries like Argentina, Brazil, El Salvador, and Mexico are embracing crypto payments as an alternative to unstable local currencies and expensive traditional banking services, fostering a fertile ground for market expansion.

- Middle East and Africa (MEA): The MEA region is emerging as a promising market, particularly in countries with large expatriate populations and high remittance flows. Financial inclusion initiatives and the desire for faster, cheaper payment options are key drivers. Governments in some Gulf nations are exploring blockchain technology for various applications, signaling future growth potential for crypto payment apps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cryptocurrency Payment Apps Market.- Coinbase

- Binance

- PayPal

- BitPay

- Crypto.com

- Block (Square)

- Circle

- Ledger

- Trezor

- Uphold

- Abra

- Wirex

- Nexo

- Revolut

- Visa

- Mastercard

- Ripple

- Stellar Development Foundation

- Pundi X

- Flexa

Frequently Asked Questions

Analyze common user questions about the Cryptocurrency Payment Apps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using cryptocurrency payment apps?

Cryptocurrency payment apps offer several key advantages, including faster transaction speeds, significantly lower fees for cross-border payments, enhanced transparency through blockchain ledgers, and increased financial inclusion for unbanked populations. They also provide greater control over funds without reliance on traditional banking intermediaries.

How secure are cryptocurrency payment apps?

Cryptocurrency payment apps employ advanced cryptographic security measures, including encryption and secure private key management, to protect transactions and user assets. Many also integrate multi-factor authentication and AI-powered fraud detection. However, security ultimately depends on user practices, such as safeguarding private keys and using reputable apps.

What regulatory challenges do cryptocurrency payment apps face?

The main regulatory challenges include evolving and often inconsistent legal frameworks across different jurisdictions, concerns about anti-money laundering (AML) and know-your-customer (KYC) compliance, and varying taxation rules for cryptocurrency transactions. Regulatory uncertainty can hinder widespread adoption and innovation.

Can I use cryptocurrency payment apps for everyday purchases?

Yes, an increasing number of merchants, both online and in physical stores, are accepting cryptocurrency payments through these apps. The growing adoption of stablecoins, which mitigate price volatility, further enhances their viability for routine purchases, making them more practical for daily use.

What is the future outlook for the Cryptocurrency Payment Apps Market?

The future outlook is highly positive, driven by continuous innovation in blockchain technology, growing merchant acceptance, and increasing global cryptocurrency adoption. Integration with DeFi, Web3, and traditional financial systems, coupled with ongoing regulatory clarity, is expected to fuel substantial market expansion and mainstream integration of crypto payment solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager