Cytokinins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429415 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Cytokinins Market Size

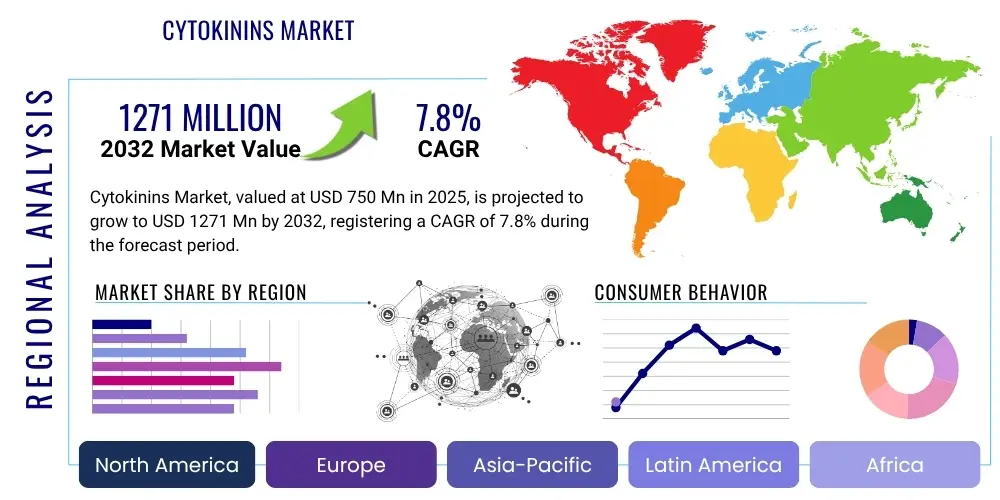

The Cytokinins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $750 million in 2025 and is projected to reach $1271 million by the end of the forecast period in 2032.

Cytokinins Market introduction

The Cytokinins market is centered around a vital group of plant hormones that play a crucial role in plant growth and development, primarily by promoting cell division and differentiation. These natural or synthetic compounds are instrumental in regulating various physiological processes within plants, including shoot and root development, bud dormancy, and senescence. Their widespread application stems from their ability to enhance crop yields, improve produce quality, and bolster plant resilience against environmental stressors, making them an indispensable component in modern agricultural and horticultural practices.

The core product within this market encompasses various types of cytokinins, such as Kinetin, Zeatin, and 6-Benzylaminopurine (6-BAP), available in different formulations like liquid concentrates, wettable powders, and granules. These products find major applications across agriculture for field crops, fruits, vegetables, and ornamentals, in horticulture for greenhouse cultivation and landscaping, and significantly in plant tissue culture for propagation and research. The inherent benefits of cytokinins, including accelerated growth, increased flowering and fruiting, delayed aging of plant tissues, and improved nutrient uptake, make them highly desirable for enhancing agricultural productivity and sustainability.

Driving factors for the cytokinins market include the escalating global demand for food, which necessitates higher agricultural output from limited arable land. Furthermore, the increasing adoption of sustainable farming practices, which seek to reduce reliance on traditional chemical inputs, positions bio-stimulants like cytokinins as preferred alternatives. Climate change-induced stresses, such as drought and salinity, also amplify the need for plant growth regulators that can enhance plant tolerance and maintain productivity under adverse conditions. Continued advancements in plant biotechnology and increasing research into novel cytokinin analogs further contribute to market expansion, promising innovative solutions for diverse agricultural challenges worldwide.

Cytokinins Market Executive Summary

The Cytokinins market is experiencing robust expansion, primarily driven by critical global trends such as the imperative for enhanced food security, the widespread embrace of sustainable agricultural methodologies, and the pressing need for crops resilient to the escalating impacts of climate change. Business trends indicate a strong focus on innovation in product formulation, with market players investing heavily in research and development to create more stable, effective, and environmentally benign cytokinin products. There is also a discernible trend towards strategic collaborations and mergers among agrochemical and biotechnology firms, aiming to consolidate market share, integrate complementary technologies, and leverage broader distribution networks to reach diverse agricultural communities globally. This strategic consolidation aims to streamline the development-to-market pipeline and offer comprehensive solutions to farmers, addressing multiple plant health and growth challenges simultaneously.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market for cytokinins, propelled by its vast agricultural land, rapidly increasing population, and the accelerating adoption of modern farming techniques and advanced agricultural inputs by farmers in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, are witnessing steady growth, largely due to stringent environmental regulations promoting bio-based solutions and the increasing demand for organic and high-quality produce. Latin America also presents significant growth opportunities, with its expanding agricultural sector and the growing export-oriented farming industry driving the demand for advanced crop enhancement products to boost productivity and quality. These regions are characterized by well-established agricultural research infrastructures that facilitate the uptake of new technologies and formulations, alongside government incentives that support the transition towards more sustainable farming practices.

In terms of segmentation trends, the agricultural application segment consistently holds the largest market share, predominantly driven by the cultivation of staple crops such as cereals, grains, fruits, and vegetables, where cytokinins are vital for improving yield and quality. The horticulture segment is also showing considerable growth, fueled by the rising demand for ornamental plants, flowers, and greenhouse-grown produce. Furthermore, the plant tissue culture segment continues to be a niche yet critical area, essential for clonal propagation of elite plant varieties and research purposes, benefiting from the precise control over plant development offered by cytokinins. The demand for specific cytokinin types, such as 6-Benzylaminopurine (6-BAP) and Zeatin, remains high due to their proven efficacy in various applications, while advancements in liquid formulations are making these products more convenient and effective for large-scale application, further solidifying their market position and driving segment growth across diverse agricultural landscapes.

AI Impact Analysis on Cytokinins Market

User inquiries frequently revolve around how Artificial Intelligence (AI) can revolutionize the application, efficacy, and discovery of cytokinins in agriculture. Key themes include the potential for AI-driven precision agriculture to optimize cytokinin dosage and timing, thereby reducing waste and maximizing impact. There is significant interest in AI's capability to predict the performance of various cytokinin formulations under diverse environmental conditions, helping farmers make informed decisions. Furthermore, users often express expectations regarding AI's role in accelerating the identification and synthesis of novel cytokinin analogs with enhanced properties, and addressing challenges such as off-target effects and environmental impact. Concerns also touch upon data privacy, the cost of AI integration, and the need for robust validation of AI-driven recommendations in real-world farming scenarios, highlighting a balanced outlook towards the transformative potential and practical challenges associated with AI adoption in this specialized market segment.

- Precision Application Optimization: AI algorithms can analyze vast datasets of soil conditions, weather patterns, crop types, and growth stages to recommend optimal cytokinin concentrations and application timings, ensuring resources are utilized efficiently and plant response is maximized. This capability minimizes overuse, reduces environmental impact, and enhances economic returns for farmers by providing highly tailored treatment plans, moving beyond traditional blanket applications.

- Efficacy Prediction and Validation: Machine learning models can predict the effectiveness of different cytokinin formulations on specific crops under various biotic and abiotic stresses. By leveraging historical data and real-time sensor inputs, AI can forecast yield improvements, stress tolerance, and quality enhancements, helping researchers and farmers select the most suitable cytokinin products for their particular needs and validate their performance prior to widespread deployment.

- Novel Cytokinin Discovery and Design: AI-powered computational chemistry and bioinformatics tools can accelerate the discovery of new cytokinin analogs or optimize existing ones by simulating molecular interactions and predicting biological activity. This significantly reduces the time and cost associated with traditional laboratory synthesis and screening processes, fostering innovation and leading to the development of more potent, specific, and environmentally friendly plant growth regulators with improved pharmacokinetic profiles.

- Disease and Stress Resistance Enhancement: AI can identify complex correlations between plant physiological responses, cytokinin treatments, and resistance to pathogens or environmental stresses. This insight enables the development of targeted cytokinin strategies that prime plants for defense, enhancing their natural immunity or resilience to challenges such as drought, salinity, or extreme temperatures, leading to healthier and more robust crops with reduced reliance on conventional pesticides.

- Yield and Quality Optimization: Through predictive analytics, AI can guide cytokinin application strategies to achieve superior crop yields and enhanced produce quality attributes, such as size, color, flavor, and shelf life. By understanding the intricate interplay of plant genetics, environmental factors, and hormonal treatments, AI helps fine-tune interventions that optimize metabolic pathways crucial for growth and development, delivering higher market value for agricultural output.

- Supply Chain and Inventory Management: AI can analyze demand forecasts, seasonal variations, and regional agricultural trends to optimize the production and distribution of cytokinin products. This ensures timely availability, reduces inventory waste, and streamlines logistics for manufacturers and distributors, leading to a more efficient and responsive supply chain that can adapt quickly to market fluctuations and farmer needs.

DRO & Impact Forces Of Cytokinins Market

The Cytokinins market is significantly influenced by a confluence of driving factors, primarily the escalating global demand for food, which exerts immense pressure on agricultural systems to increase productivity and efficiency. As the world population continues to grow, there is an urgent need to maximize crop yields from diminishing arable land, making plant growth regulators like cytokinins indispensable. Furthermore, the increasing adoption of sustainable agricultural practices and organic farming methods globally serves as a powerful driver, as cytokinins offer a bio-based solution to enhance plant growth and health with reduced environmental impact compared to conventional chemical fertilizers and pesticides. The persistent threat of climate change, leading to increased abiotic stresses such as drought, salinity, and extreme temperatures, also fuels the demand for cytokinins, which can help plants adapt and maintain productivity under challenging conditions, thereby contributing to agricultural resilience and stability in vulnerable regions.

Despite these strong drivers, the market faces several notable restraints. High research and development (R&D) costs associated with discovering new cytokinin analogs, optimizing formulations, and conducting extensive field trials pose a significant barrier, especially for smaller market entrants. The stringent and often complex regulatory frameworks governing plant growth regulators across different countries introduce delays and increase compliance costs, hindering market entry and product commercialization. Another restraint is the lack of widespread awareness and education among small-scale farmers, particularly in developing regions, regarding the proper application techniques and precise benefits of cytokinins, which limits their adoption despite potential advantages. Moreover, the product specificity and dosage sensitivity of cytokinins mean that incorrect application can lead to suboptimal or even adverse effects, requiring a high degree of technical knowledge and precision, which can be a deterrent for some users.

Conversely, numerous opportunities exist for market expansion and innovation. The burgeoning organic farming sector presents a substantial avenue for growth, as cytokinins align well with organic certification requirements and consumer preferences for natural food production. The integration of cytokinins with precision agriculture technologies, such as drone-based spraying and IoT-enabled sensors, offers the potential for highly targeted and efficient application, maximizing efficacy and minimizing waste. Emerging economies in Asia Pacific and Latin America, characterized by rapidly modernizing agricultural sectors and increasing government support for agricultural development, offer vast untapped market potential. Furthermore, continuous innovation in biotechnology, including the development of novel delivery systems like nano-encapsulation and slow-release formulations, promises to enhance the stability, bioavailability, and overall performance of cytokinin products, opening new application frontiers and expanding their utility beyond traditional uses into more specialized crop management strategies.

The market is also shaped by several critical impact forces. Regulatory shifts towards stricter environmental protection and bio-based product promotion can significantly influence market dynamics, favoring sustainable cytokinin solutions. The pace of technological innovation in plant science and formulation chemistry directly impacts the competitiveness and effectiveness of products, driving continuous improvement and differentiation among market participants. Evolving consumer preferences for organically grown, high-quality, and sustainably produced food items create a demand-pull effect for products like cytokinins that support these attributes. Global economic conditions, including agricultural commodity prices and farmers' purchasing power, can affect adoption rates. Lastly, agricultural policies and subsidies in various countries play a crucial role in shaping the market by influencing crop choices, farming practices, and the uptake of advanced agricultural inputs, ultimately dictating the market's trajectory and the investment landscape for cytokinin manufacturers and distributors.

Segmentation Analysis

The Cytokinins market is meticulously segmented to provide a comprehensive understanding of its diverse applications and product forms, enabling strategic insights into market dynamics. These segments allow for a detailed examination of how different types of cytokinins are utilized across various agricultural and horticultural contexts, reflecting the specific needs of diverse end-users. The primary segmentation is based on the Type of cytokinin, recognizing the distinct chemical structures and physiological effects of various compounds. Further segmentation occurs by Application, which delineates the primary industries and agricultural sectors where cytokinins are deployed, highlighting their broad utility in crop enhancement and plant propagation. Finally, the market is segmented by Form, distinguishing between the physical states in which these products are supplied, which impacts their ease of application, stability, and distribution methods, ensuring a thorough analytical framework for understanding market trends and opportunities.

- Type

- Kinetin: A synthetic cytokinin widely used in plant tissue culture to promote cell division and callus growth, as well as in agriculture for enhancing seed germination and delaying senescence in fruits and vegetables, contributing to extended shelf life.

- Zeatin: A naturally occurring cytokinin found in coconut milk and corn, known for its high biological activity in promoting cell division and shoot proliferation, particularly valued in high-value horticulture and organic farming due to its natural origin.

- 6-Benzylaminopurine (6-BAP): One of the most common synthetic cytokinins, extensively applied in agriculture to stimulate flowering, fruit set, and branching in various crops, and crucial for shoot regeneration in plant tissue culture protocols.

- Thidiazuron (TDZ): A phenylurea derivative with strong cytokinin-like activity, often used at very low concentrations to induce shoot formation and regeneration in recalcitrant plant species in research and specialized tissue culture applications.

- Isopentenyladenine (2iP): Another natural cytokinin, playing a key role in chloroplast development and leaf expansion, often employed in conjunction with auxins in plant growth media for its specific developmental effects.

- Others (including synthetic analogs and novel compounds): This category encompasses a range of less common or proprietary synthetic cytokinins and novel compounds currently under research and development, designed for specific crop needs or enhanced efficacy and stability.

- Application

- Agriculture: The largest segment, covering the extensive use of cytokinins in field crops, including cereals, grains, oilseeds, and pulses, to improve germination, plant vigor, stress tolerance, and ultimately, overall yield and quality for global food production.

- Cereal & Grains: Enhancing tillering, grain filling, and stress resilience in crops like wheat, rice, corn, and barley, crucial for staple food production.

- Fruits & Vegetables: Promoting fruit set, size, quality, and shelf life in a wide array of produce, from apples and grapes to tomatoes and lettuce, improving marketability.

- Oilseeds & Pulses: Boosting pod development, seed weight, and protein content in crops such as soybeans, sunflowers, and lentils, vital for food and feed industries.

- Turf & Ornamentals: Improving the aesthetic quality, density, and stress tolerance of lawns, golf courses, and decorative plants, enhancing their commercial value.

- Horticulture: Application in greenhouses, nurseries, and landscaping for ornamental plants, flowers, and high-value specialty crops, focusing on promoting branching, flowering, and overall plant architecture for aesthetic and commercial appeal.

- Plant Tissue Culture: Fundamental for in vitro plant propagation, micropropagation, and genetic transformation, where cytokinins are essential for inducing callus formation, shoot regeneration, and maintaining cell division in laboratory settings to produce disease-free and genetically identical plants.

- Research & Development: Use in academic and industrial laboratories for studying plant physiology, genetics, and biotechnology, serving as critical tools for understanding plant growth mechanisms and developing new crop varieties or agricultural solutions.

- Other Industrial Applications: Niche uses such as in forestry for tree propagation, in certain pharmaceutical applications involving plant-derived compounds, and in specialized bioreactors for plant cell culture.

- Agriculture: The largest segment, covering the extensive use of cytokinins in field crops, including cereals, grains, oilseeds, and pulses, to improve germination, plant vigor, stress tolerance, and ultimately, overall yield and quality for global food production.

- Form

- Liquid: Includes soluble concentrates, emulsifiable concentrates, and suspensions, favored for their ease of application through spraying or irrigation systems, offering uniform distribution and rapid uptake by plants, making them suitable for large-scale agricultural operations.

- Powder (Granules, Wettable Powders): Comprises wettable powders, soluble powders, and granular formulations, which are stable for storage and transportation, suitable for soil application or as seed treatments, providing a sustained release of cytokinins over time.

- Gel/Paste: Specialized formulations often used in horticulture and plant tissue culture for targeted application to specific plant parts, facilitating grafting, cutting propagation, or localized treatment for enhanced rooting and budding, offering precise control in sensitive operations.

Value Chain Analysis For Cytokinins Market

The value chain for the Cytokinins market is a complex network of activities that spans from the initial sourcing of raw materials to the final delivery and application of products to end-users, involving multiple stakeholders at each stage. At the upstream end, the process begins with the procurement of basic chemical precursors, which are essential for the synthesis of cytokinins, or the cultivation of specific microbial strains for fermentation-based production of natural cytokinins. This stage heavily relies on a robust supply chain for specialty chemicals and biological raw materials, where quality control and cost efficiency are paramount. Research and development activities, often conducted by specialized biotech firms, academic institutions, and large agrochemical companies, are also integral to the upstream segment, focusing on discovering novel cytokinin compounds, improving synthesis pathways, and developing advanced formulations that enhance efficacy and stability, laying the groundwork for product innovation and market differentiation.

Moving downstream, the value chain encompasses the formulation, manufacturing, and distribution of cytokinin products. Manufacturers take the synthesized or fermented cytokinin compounds and formulate them into commercial products, such as liquid concentrates, wettable powders, or granules, which are designed for specific applications and ease of use. This formulation stage is critical for ensuring product stability, bioavailability, and compatibility with other agricultural inputs. After manufacturing, products are then channeled through a robust distribution network, which can be both direct and indirect. Direct distribution involves manufacturers selling directly to large commercial farms, agricultural cooperatives, or government agricultural bodies, allowing for closer customer relationships and tailored service. Indirect distribution, which accounts for a significant portion of the market, involves wholesalers, regional distributors, and a vast network of agricultural retailers and garden centers that reach a broader base of small and medium-sized farmers, horticulturists, and individual consumers. These intermediaries play a crucial role in logistics, inventory management, and localized customer support, ensuring widespread market penetration and accessibility.

The final stage of the value chain involves the end-users and the actual application of cytokinins. This includes commercial farmers utilizing them for field crops, fruit orchards, and vegetable cultivation to boost yields and quality; horticulturists in nurseries and greenhouses enhancing the growth and aesthetics of ornamental plants; and research institutions and plant tissue culture laboratories employing them for scientific studies and clonal propagation. The effectiveness of the entire value chain hinges on efficient logistics, strong marketing and sales efforts, and comprehensive technical support and extension services provided by manufacturers and distributors. These services educate end-users on optimal application rates, timing, and methods, maximizing the benefits of cytokinin products. The interplay between these upstream and downstream activities, supported by effective distribution channels, ensures that the Cytokinins market continuously meets the evolving demands of a global agricultural sector focused on productivity, sustainability, and resilience.

Cytokinins Market Potential Customers

The primary potential customers for cytokinins are diverse and span across various segments of the agricultural and horticultural industries, reflecting the broad utility of these plant growth regulators. Large-scale commercial farms, which specialize in the production of staple crops such as cereals, grains, oilseeds, and commercial fruits and vegetables, represent a significant customer base. These operations often require bulk quantities of cytokinins to enhance yield, improve crop quality, and mitigate the effects of environmental stressors across extensive land areas, viewing these inputs as critical investments for maximizing profitability and ensuring consistency in their produce. Their sophisticated operational scales and often integrated supply chains allow for efficient adoption and application of advanced agricultural inputs, making them key drivers of market demand. Furthermore, the increasing pressure on these farms to adopt sustainable practices makes cytokinin-based solutions particularly attractive as alternatives or complements to traditional chemical inputs.

In addition to large commercial entities, small and medium-sized farms, particularly those specializing in high-value crops, organic produce, or specialty agriculture, also constitute a vital customer segment. These farmers often seek solutions that can significantly improve the quality and marketability of their niche products, where even marginal gains in growth or appearance can translate into substantial economic benefits. Greenhouses and nurseries, which focus on cultivating ornamental plants, flowers, and young plant starts, are another crucial customer group. In these controlled environments, precise control over plant growth and development is essential for producing uniform, healthy, and aesthetically pleasing plants. Cytokinins are widely used in these settings to promote branching, accelerate flowering, and enhance overall plant architecture, directly impacting their commercial success and operational efficiency. The controlled nature of these environments also allows for more precise application and monitoring, leading to optimized outcomes.

Beyond direct agricultural production, academic and research institutions, along with plant tissue culture laboratories, represent a specialized but essential customer segment. These entities utilize cytokinins as fundamental tools for scientific research, plant breeding, genetic studies, and the propagation of elite or endangered plant species in vitro. Their demand is driven by the need for high-purity and specific cytokinin types for experimental precision and successful clonal propagation. Agricultural cooperatives and government agricultural extension services also serve as indirect customers, often procuring cytokinins to distribute to their member farmers or to demonstrate best practices in sustainable agriculture. Lastly, landscaping companies and urban horticulture projects are emerging as potential customers, where cytokinins can be used to maintain healthy turf, promote lush growth in public spaces, and enhance the vitality of urban greenery, underscoring the versatile applications of these plant growth regulators across a wide spectrum of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $750 million |

| Market Forecast in 2032 | $1271 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, UPL Limited, Sumitomo Chemical Co. Ltd., FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Ltd., Valagro S.p.A., Koppert Biological Systems, Acadian Plant Health, Marrone Bio Innovations, Novozymes A/S, Plant Health Care plc, Borregaard AS, Biovert S.A., Haifa Group, ILSA S.p.A., Tradecorp International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cytokinins Market Key Technology Landscape

The Cytokinins market is underpinned by a dynamic technological landscape, encompassing both the synthesis and application of these plant growth regulators, driving innovation and efficiency across the agricultural sector. At the core, advanced chemical synthesis techniques are continuously being refined to produce various synthetic cytokinins, such as 6-Benzylaminopurine (6-BAP) and Kinetin, with higher purity, greater yield, and reduced production costs. These chemical engineering advancements enable manufacturers to offer more economically viable and consistently effective products. Simultaneously, biotechnological methods, particularly fermentation processes, are gaining prominence for the production of naturally occurring cytokinins like Zeatin, leveraging microbial platforms to create sustainable and environmentally friendly alternatives. This dual approach to production ensures a diverse portfolio of cytokinin products catering to different market demands and regulatory preferences, balancing synthetic efficacy with natural sustainability to optimize both economic and environmental outcomes in modern agriculture.

Beyond raw material production, the technological landscape extends to sophisticated formulation and delivery systems designed to optimize the performance of cytokinins. Nano-encapsulation technology is emerging as a critical innovation, allowing for the precise encapsulation of cytokinin molecules within nanoscale carriers. This not only protects the active compounds from degradation due to environmental factors like UV radiation and microbial activity but also enables controlled and slow release, ensuring a prolonged and consistent effect on plants, thereby maximizing efficacy and minimizing the frequency of application. Similarly, controlled-release formulations, which include specialized coatings and matrices, are being developed to regulate the release rate of cytokinins, providing sustained availability to plant tissues over extended periods. These advanced delivery mechanisms significantly improve the bioavailability of cytokinins, reduce wastage, and enhance their overall effectiveness, contributing to more efficient resource utilization and better plant health outcomes across diverse farming systems and challenging environmental conditions.

Furthermore, the application of cytokinins is increasingly integrated with cutting-edge digital agriculture technologies, transforming how these plant growth regulators are deployed and managed. Precision agriculture tools, such as drones equipped with multispectral sensors and variable-rate sprayers, enable highly targeted application of cytokinins based on real-time plant health data and localized crop needs. This data-driven approach ensures that the right amount of cytokinin is applied to the right plant at the right time, minimizing overspray and optimizing plant response. IoT (Internet of Things) sensors and sophisticated analytical techniques, including high-performance liquid chromatography (HPLC) and mass spectrometry, are crucial for monitoring cytokinin levels in plants and soil, as well as for quality control during manufacturing. These technologies collectively contribute to a smarter, more efficient, and data-informed approach to cytokinin application, enhancing productivity, reducing environmental impact, and enabling personalized plant nutrition strategies that are essential for the future of sustainable and high-yield agriculture, creating a synergistic effect between chemical, biological, and digital advancements in the market.

Regional Highlights

- North America: This region represents a mature yet robust market for cytokinins, characterized by the widespread adoption of advanced agricultural practices, significant investments in agricultural research and development, and a strong focus on high-value specialty crops. The United States and Canada are key contributors, driven by a demand for increased crop yields and quality, alongside a growing emphasis on sustainable and precision agriculture. Regulatory frameworks also play a role, promoting the use of bio-stimulants and environmentally friendly inputs, further stimulating market growth for cytokinins in diverse applications ranging from large-scale commercial farming to horticultural industries and turf management, where efficacy and environmental safety are paramount.

- Europe: The European market for cytokinins is highly influenced by stringent environmental regulations and a strong inclination towards organic farming and sustainable agricultural practices. Countries such as Germany, France, and Spain are leading the adoption of bio-based solutions to enhance crop performance while minimizing ecological footprint. The region benefits from significant government support for research into biological crop protection and nutrition, fostering innovation in cytokinin formulations and applications. Demand is particularly strong in horticulture, viticulture, and the cultivation of high-value specialty crops, where quality and adherence to strict environmental standards are critical for market access and consumer acceptance across the continent.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market for cytokinins globally, propelled by its vast agricultural land, rapidly increasing population, and the imperative to ensure food security. Countries like China, India, Japan, and Australia are major contributors, driven by the accelerating adoption of modern farming techniques, increasing mechanization, and significant government initiatives aimed at enhancing agricultural productivity. The demand for cytokinins in this region is high across major cereal and grain crops, fruits, and vegetables, as farmers seek to improve yields and quality under varying climatic conditions, making the region a critical hub for both consumption and production of these vital plant growth regulators.

- Latin America: This region offers substantial growth opportunities for the cytokinins market, primarily due to its expansive and rapidly developing agricultural sector, which is a major global exporter of commodities such as soybeans, corn, coffee, and fruits. Brazil, Argentina, and Mexico are key markets, where the increasing adoption of intensive farming practices and the need to boost crop productivity for export-oriented agriculture are driving demand for advanced agricultural inputs. Farmers in Latin America are increasingly recognizing the benefits of cytokinins in improving crop resilience to stress and enhancing overall yield, making it a region with considerable untapped potential for market expansion and increased product penetration, particularly in large-scale commercial farming operations.

- Middle East and Africa (MEA): The MEA region is characterized by a growing agricultural sector, albeit one often challenged by water scarcity, harsh climatic conditions, and underdeveloped infrastructure. Despite these challenges, the demand for cytokinins is steadily increasing as governments and agricultural entities prioritize food security and sustainable farming solutions. Countries like South Africa, Egypt, and Saudi Arabia are showing increased interest in plant growth regulators to enhance crop productivity and resilience in arid and semi-arid environments. Investments in modern irrigation techniques and protected cultivation are also creating opportunities for cytokinin applications, aiming to optimize growth and yield under resource-constrained conditions, marking the region as an emerging market with significant long-term growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cytokinins Market.- BASF SE

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- UPL Limited

- Sumitomo Chemical Co. Ltd.

- FMC Corporation

- ADAMA Agricultural Solutions Ltd.

- Nufarm Ltd.

- Valagro S.p.A.

- Koppert Biological Systems

- Acadian Plant Health

- Marrone Bio Innovations

- Novozymes A/S

- Plant Health Care plc

- Borregaard AS

- Biovert S.A.

- Haifa Group

- ILSA S.p.A.

- Tradecorp International

Frequently Asked Questions

What are cytokinins primarily used for in agriculture?

Cytokinins are primarily utilized in agriculture to stimulate cell division and differentiation, promoting enhanced shoot development, leaf expansion, and overall plant growth. They are also crucial for improving fruit set, increasing crop yields, delaying senescence (aging) in harvested produce to extend shelf life, and boosting plant resistance to various environmental stresses like drought and salinity, thereby contributing significantly to agricultural productivity and quality across a wide range of crops.

How do cytokinins differ from other plant hormones?

Cytokinins differ from other plant hormones by their unique role in promoting cell division, a function not as pronounced in auxins, gibberellins, or abscisic acid. While auxins primarily regulate cell elongation and root development, and gibberellins promote stem elongation and seed germination, cytokinins specifically counteract apical dominance by stimulating lateral bud growth and often work in antagonism with auxins to regulate the shoot-to-root ratio, playing a central role in organogenesis and overall plant architecture.

What are the main types of cytokinins available in the market?

The main types of cytokinins available in the market include both naturally occurring and synthetic compounds. Key examples are Kinetin, a widely used synthetic cytokinin known for its stability; Zeatin, a potent natural cytokinin found in plants; and 6-Benzylaminopurine (6-BAP), a highly effective synthetic cytokinin frequently employed in commercial agriculture and plant tissue culture. Other types include Thidiazuron (TDZ) and Isopentenyladenine (2iP), each with specific applications and physiological effects on plants, tailored for diverse agricultural and horticultural needs.

Are cytokinins safe for the environment and human consumption?

When used according to recommended guidelines and at appropriate concentrations, cytokinins are generally considered safe for the environment and for crops destined for human consumption. Many cytokinins are naturally occurring plant hormones, and their synthetic counterparts are designed to mimic these natural effects without posing undue risks. However, excessive or improper application can lead to unintended plant responses or off-target effects. Regulatory bodies worldwide impose strict guidelines on their use, and continuous research ensures their safe and effective integration into sustainable agricultural practices, emphasizing responsible application to minimize any potential ecological or health impacts.

What is the future outlook for the cytokinin market?

The future outlook for the cytokinin market is highly positive, driven by persistent global demand for food, increasing adoption of sustainable and organic farming practices, and the imperative to enhance crop resilience against climate change. Ongoing advancements in biotechnology, including novel formulation developments like nano-encapsulation and controlled-release systems, are expected to improve efficacy and application efficiency. The integration with precision agriculture technologies and the expansion into emerging economies will further fuel market growth, making cytokinins a crucial component in modern agricultural strategies aimed at maximizing productivity while minimizing environmental footprint, fostering continuous innovation and broader adoption in the coming years.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager