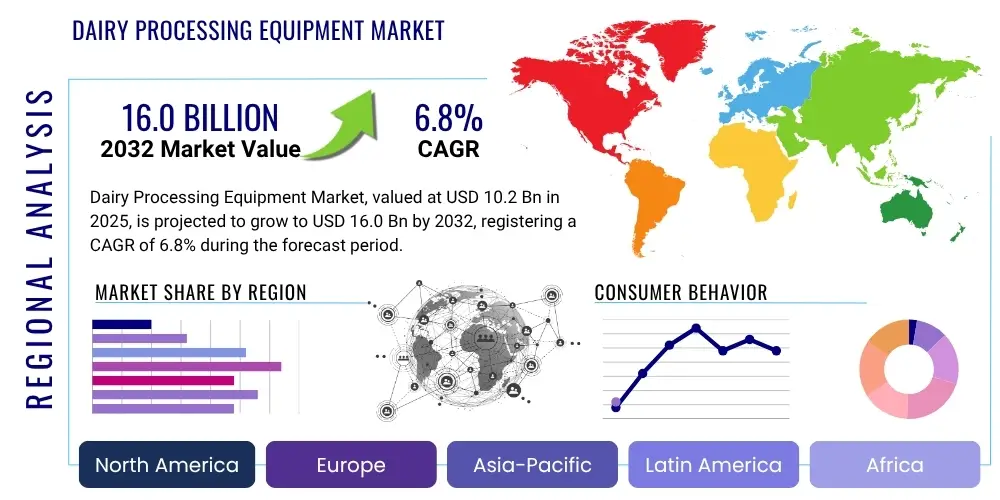

Dairy Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430360 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Dairy Processing Equipment Market Size

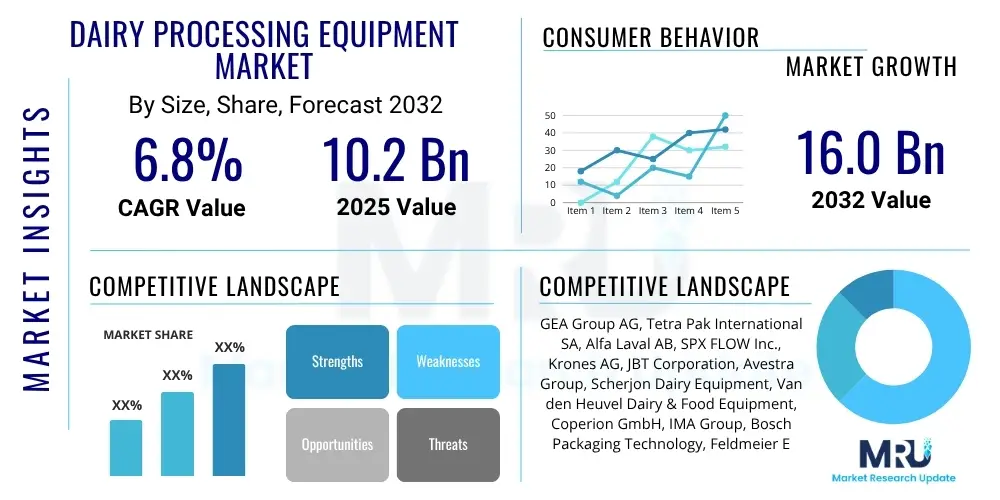

The Dairy Processing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 10.2 Billion in 2025 and is projected to reach USD 16.0 Billion by the end of the forecast period in 2032.

Dairy Processing Equipment Market introduction

The Dairy Processing Equipment Market encompasses a broad range of machinery and systems essential for transforming raw milk into various dairy products suitable for consumption and retail. This equipment is pivotal in ensuring the safety, quality, and extended shelf life of dairy items, catering to diverse consumer preferences globally. The market's foundational role lies in supporting the dairy industry's operational demands, from small-scale artisanal producers to large multinational corporations.

These sophisticated machines perform crucial operations such as pasteurization, homogenization, separation, filtration, fermentation, and packaging. They are designed to process different dairy product categories including liquid milk, cheese, yogurt, butter, ice cream, and powdered milk. The primary benefits derived from the adoption of advanced dairy processing equipment include enhanced production efficiency, strict adherence to global food safety and hygiene standards, improved product consistency, and reduced operational costs through automation and energy-efficient designs. The market is propelled by a confluence of factors, including the escalating global demand for dairy products, continuous technological innovations aimed at improving processing capabilities, and increasingly stringent food safety regulations that mandate high-quality equipment.

Dairy Processing Equipment Market Executive Summary

The Dairy Processing Equipment Market is characterized by robust growth driven by evolving consumer dietary habits, global population expansion, and a rising preference for packaged and processed dairy products. Key business trends indicate a strong emphasis on automation, the integration of smart technologies like IoT and AI for enhanced operational efficiency and predictive maintenance, and a significant push towards sustainable processing solutions. Manufacturers are increasingly focusing on developing modular and flexible equipment that can adapt to varying production scales and product innovations, addressing the dynamic demands of the dairy industry. The competitive landscape is marked by continuous product development and strategic collaborations aimed at expanding market reach and technological capabilities.

Regionally, the Asia Pacific market is witnessing accelerated growth, primarily fueled by rising disposable incomes, urbanization, and the adoption of Western dietary patterns in countries like China and India, leading to increased dairy consumption and investment in processing infrastructure. North America and Europe, while mature markets, continue to drive innovation in high-tech, energy-efficient, and sustainable equipment, with a strong focus on regulatory compliance and advanced quality control. Segment-wise, liquid milk processing equipment remains a dominant category due to universal consumption, but segments like cheese, yogurt, and specialized dairy ingredients are exhibiting the fastest growth rates, spurred by product diversification and premiumization trends. The market's overall trajectory is positive, supported by global efforts to enhance food security and improve dairy processing standards.

AI Impact Analysis on Dairy Processing Equipment Market

User inquiries concerning AI's influence on the Dairy Processing Equipment Market frequently revolve around improvements in operational efficiency, precision quality control, predictive maintenance capabilities, and overall automation. Users are keen to understand how AI can optimize milk processing lines, minimize waste, and ensure compliance with stringent food safety standards. There is a clear expectation that AI will lead to smarter, more autonomous dairy processing plants, reducing human intervention and potential errors, while also seeking insights into the return on investment and potential challenges associated with AI implementation, such as data security and the need for specialized skills.

- AI-driven sensors enhance real-time quality control for milk composition and product integrity.

- Predictive maintenance algorithms reduce equipment downtime and extend machinery lifespan by anticipating failures.

- Automated process optimization through AI adjusts parameters for energy efficiency and yield improvement.

- Robotics and AI streamline packaging and logistics, improving speed and accuracy in dairy facilities.

- Supply chain optimization using AI analytics for ingredient sourcing and product distribution.

- Enhanced food safety traceability and recall management systems powered by AI.

- Data analytics from AI systems provide insights for product innovation and market demand forecasting.

DRO & Impact Forces Of Dairy Processing Equipment Market

The Dairy Processing Equipment Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. A primary driver is the persistent increase in global dairy consumption, fueled by population growth, rising disposable incomes, and the recognition of dairy products as essential nutritional components. This demand necessitates robust and efficient processing capabilities, pushing dairy manufacturers to invest in advanced equipment. Concurrently, stringent food safety regulations imposed by various international and national bodies compel processors to adopt high-standard, hygienic equipment that can ensure product safety and quality, thereby acting as a powerful impetus for market growth and technological upgrades. The continuous evolution in dairy product diversification, including lactose-free, fortified, and organic options, further drives demand for flexible and specialized processing machinery. Technological advancements, particularly in automation, IoT, and AI integration, are transforming processing plants into smart facilities, improving efficiency, reducing labor costs, and minimizing waste.

However, the market faces notable restraints that can impede its expansion. The most significant is the high capital investment required for acquiring and installing sophisticated dairy processing equipment, which can be a substantial barrier for small and medium-sized enterprises (SMEs) and new entrants. Additionally, the operational and maintenance costs associated with these complex machines, along with the need for skilled labor to manage them, add to the financial burden. Environmental concerns regarding energy consumption and waste generation during dairy processing also present challenges, urging manufacturers to invest in more sustainable, albeit often more expensive, solutions. Supply chain disruptions, often exacerbated by global events, can affect the availability of raw materials and components, leading to production delays for equipment manufacturers.

Despite these challenges, substantial opportunities exist within the market that could unlock significant growth. Emerging economies, particularly in Asia Pacific, Latin America, and Africa, present vast untapped potential due to rapidly growing populations, increasing urbanization, and evolving consumer preferences towards processed dairy products. The growing consumer demand for plant-based dairy alternatives also opens new avenues for equipment manufacturers to adapt their technologies or develop specialized lines for these products. Furthermore, the increasing adoption of sustainable and energy-efficient processing technologies, coupled with the rising interest in customized and modular equipment solutions, offers innovative manufacturers a competitive edge. The integration of advanced analytics, cloud computing, and cybersecurity measures into processing equipment for enhanced operational intelligence and data protection represents a significant area for future growth and differentiation. The collective impact of these forces dictates the pace and direction of innovation and investment within the global dairy processing equipment sector.

Segmentation Analysis

The Dairy Processing Equipment Market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics and growth prospects. These segmentations allow for a granular analysis of market trends, consumer preferences, and technological adoptions across different product types, operational scales, and application areas. Understanding these segments is crucial for manufacturers to tailor their product offerings, for dairy processors to make informed investment decisions, and for market analysts to accurately forecast future growth. Each segment reflects specific needs and demands within the diverse dairy industry ecosystem.

- By Type

- Pasteurizers (Plate, Tubular, Scraped Surface)

- Homogenizers (High Pressure, Low Pressure)

- Separators (Centrifugal, Membrane Filtration)

- Heat Exchangers (Plate, Shell and Tube, Tubular)

- Mixers and Blenders (Batch, Continuous, High Shear)

- Fillers and Packaging Equipment (Bottle Fillers, Cup Fillers, Pouch Fillers, Carton Fillers, Form-Fill-Seal Machines)

- Fermentation Equipment (Fermentation Tanks, Fermenters)

- Drying Equipment (Spray Dryers, Freeze Dryers)

- Cleaning-in-Place (CIP) Systems

- Material Handling Equipment

- Others (Evaporators, Crystallizers)

- By Operation

- Automatic

- Semi-Automatic

- Manual

- By Application

- Liquid Milk Processing (UHT Milk, Pasteurized Milk, Flavored Milk)

- Cheese Processing (Hard Cheese, Soft Cheese, Processed Cheese)

- Yogurt Processing (Set Yogurt, Stirred Yogurt, Drinking Yogurt)

- Butter Processing

- Ice Cream Processing

- Powdered Milk Processing (Skim Milk Powder, Whole Milk Powder)

- Cream Processing

- Specialty Dairy Products (Whey Protein, Casein)

- By Material

- Stainless Steel

- Other Alloys

- By Capacity

- Small Scale (Up to 10,000 Liters/Day)

- Medium Scale (10,000 - 50,000 Liters/Day)

- Large Scale (Above 50,000 Liters/Day)

Value Chain Analysis For Dairy Processing Equipment Market

The value chain for the Dairy Processing Equipment Market begins with the upstream activities involving the sourcing of raw materials and components. This segment includes suppliers of high-grade stainless steel, industrial plastics, specialized electronic components, sensors, motors, and automation software crucial for equipment manufacturing. Precision engineering firms and technology providers also play a significant role here, offering advanced designs, intellectual property, and specialized manufacturing processes that ensure the durability, hygiene, and efficiency of the final equipment. Strong relationships with reliable and quality-focused component suppliers are paramount for equipment manufacturers to maintain product standards and manage production costs effectively.

Further down the chain, the manufactured dairy processing equipment moves through various distribution channels to reach its end-users. These channels can be broadly categorized into direct and indirect methods. Direct sales typically involve equipment manufacturers selling directly to large-scale dairy processors, multinational food and beverage corporations, and government-backed dairy projects. This approach allows for direct communication, customization, and comprehensive after-sales support, fostering long-term client relationships. Indirect distribution involves a network of authorized distributors, sales agents, and resellers who cater to a wider range of customers, including small and medium-sized dairy units, and provide regional market penetration. These intermediaries often offer installation, maintenance, and local technical support, playing a vital role in market accessibility, especially in diverse geographical areas with varying logistical complexities.

The downstream segment primarily consists of the end-users of the equipment, which are the dairy processors themselves. These include large corporate dairies, cooperative dairy plants, independent milk and cheese producers, and specialized dairy product manufacturers. The operational efficiency and product quality of these processors are directly dependent on the performance of the acquired equipment. Beyond the initial sale, the value chain extends to after-sales services, including installation, commissioning, maintenance, spare parts supply, and technical training. These services are critical for ensuring optimal equipment functionality, minimizing downtime, and enhancing customer satisfaction, thereby contributing significantly to the overall lifecycle value of the equipment. The continuous interaction and feedback loops between equipment manufacturers and dairy processors are essential for product improvement and innovation.

Dairy Processing Equipment Market Potential Customers

The primary potential customers and end-users of dairy processing equipment span a diverse spectrum of entities within the global dairy and food industry, each with unique requirements and operational scales. At the forefront are large-scale multinational dairy corporations that operate extensive production facilities, demanding high-capacity, automated, and technologically advanced equipment to handle massive volumes of milk and produce a wide range of dairy products for global distribution. These entities prioritize efficiency, reliability, and adherence to international food safety standards, often seeking customized solutions and comprehensive service contracts.

Beyond the major players, the market caters significantly to small and medium-sized dairy processing units, including regional dairies, local cooperatives, and artisanal producers. These customers often seek modular, flexible, and cost-effective equipment that can be scaled according to their production needs and budgets. The demand from this segment is often driven by a focus on local markets, specialty products, and a desire to enhance product quality and extend shelf life through modern processing techniques. Emerging markets, characterized by increasing urbanization and shifting dietary patterns, represent a growing customer base as new dairy processing plants are established to meet rising domestic demand.

Furthermore, entities involved in the production of specific dairy derivatives, such as whey protein manufacturers, casein producers, and companies specializing in lactose-free products or fortified milk, also constitute a significant customer segment, requiring highly specialized and precise processing equipment. Food and beverage companies expanding into dairy or dairy-alternative product lines are also potential buyers, seeking equipment that can offer versatility and quick integration into existing production systems. Government-backed dairy development projects, particularly in developing countries, represent another crucial segment, often focused on improving local dairy infrastructure and ensuring food security through modern processing capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10.2 Billion |

| Market Forecast in 2032 | USD 16.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEA Group AG, Tetra Pak International SA, Alfa Laval AB, SPX FLOW Inc., Krones AG, JBT Corporation, Avestra Group, Scherjon Dairy Equipment, Van den Heuvel Dairy & Food Equipment, Coperion GmbH, IMA Group, Bosch Packaging Technology, Feldmeier Equipment Inc., IDMC Limited, A&B Process Systems, Admix Inc., Barry-Wehmiller Companies Inc., Optima Packaging Group GmbH, Hosokawa Micron Corporation, Catta 27 S.r.l. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dairy Processing Equipment Market Key Technology Landscape

The Dairy Processing Equipment Market is undergoing a significant technological transformation, driven by the need for increased efficiency, enhanced food safety, and sustainable operations. One of the most prominent technological advancements is the widespread adoption of automation and robotics across various processing stages, from raw milk handling to packaging. This includes robotic arms for precise ingredient mixing, automated cleaning-in-place (CIP) systems for thorough sanitation, and fully integrated production lines that minimize human intervention, thereby reducing the risk of contamination and improving operational consistency. The integration of advanced sensors and control systems allows for real-time monitoring of critical parameters such as temperature, pressure, flow rates, and product composition, ensuring optimal processing conditions and consistent product quality. These sophisticated monitoring capabilities are crucial for maintaining hygiene standards and meeting stringent regulatory requirements globally.

The rise of Industry 4.0 principles, particularly the Internet of Things (IoT) and Artificial Intelligence (AI), is profoundly impacting the design and functionality of dairy processing equipment. IoT-enabled sensors embedded within machinery collect vast amounts of data on equipment performance, energy consumption, and operational metrics. This data is then analyzed by AI algorithms to facilitate predictive maintenance, anticipating equipment failures before they occur, thus significantly reducing downtime and maintenance costs. AI also plays a role in optimizing processing parameters, improving yield, and enhancing traceability throughout the supply chain. Furthermore, there is a growing emphasis on aseptic processing and ultra-high-temperature (UHT) treatment technologies, which extend the shelf life of liquid dairy products without refrigeration, opening new markets and reducing logistical complexities. These technologies require highly specialized equipment designed for sterile environments and precise temperature control.

Sustainability and energy efficiency are also major technological drivers, leading to the development of equipment with reduced water and energy consumption. This includes highly efficient heat exchangers, water recovery systems, and motors designed for lower power usage. Modular and flexible equipment designs are gaining traction, allowing dairy processors to easily adapt their production lines to accommodate various product types, batch sizes, and future expansions, thereby offering greater operational agility. Additionally, advancements in membrane filtration technologies, such as microfiltration, ultrafiltration, and nanofiltration, are becoming increasingly vital for milk protein fractionation, lactose reduction, and other specialized dairy ingredient productions, offering high-value outputs and new product development opportunities. These technological shifts are collectively pushing the dairy processing equipment market towards more intelligent, efficient, and environmentally responsible solutions.

Regional Highlights

- North America: A mature market characterized by high adoption of automation, advanced processing technologies, and a strong focus on premium and functional dairy products. Strict food safety regulations and consumer demand for diverse dairy options drive innovation and investment in high-efficiency equipment.

- Europe: A key hub for dairy innovation, particularly in sustainable and energy-efficient processing solutions. Countries like Germany, France, and the Netherlands lead in equipment manufacturing and export, driven by high R&D investments and stringent environmental standards. Demand for organic and specialty dairy products is also significant.

- Asia Pacific (APAC): The fastest-growing market due to increasing population, rising disposable incomes, urbanization, and a shift towards processed and packaged dairy products. Countries like China and India are experiencing significant investment in modern dairy processing infrastructure, creating substantial demand for new equipment.

- Latin America: Demonstrates steady growth fueled by expanding dairy industries, particularly in Brazil, Argentina, and Mexico. There is a growing demand for cost-effective, efficient equipment to cater to local consumption and export markets, with an increasing focus on improving hygiene standards.

- Middle East and Africa (MEA): An emerging market with considerable growth potential. Investment in dairy processing facilities is driven by government initiatives to enhance food security, diversify economies, and meet the rising demand for dairy products due to population growth and Westernization of diets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dairy Processing Equipment Market.- GEA Group AG

- Tetra Pak International SA

- Alfa Laval AB

- SPX FLOW Inc.

- Krones AG

- JBT Corporation

- Avestra Group

- Scherjon Dairy Equipment

- Van den Heuvel Dairy & Food Equipment

- Coperion GmbH

- IMA Group

- Bosch Packaging Technology

- Feldmeier Equipment Inc.

- IDMC Limited

- A&B Process Systems

- Admix Inc.

- Barry-Wehmiller Companies Inc.

- Optima Packaging Group GmbH

- Hosokawa Micron Corporation

- Catta 27 S.r.l.

Frequently Asked Questions

What is the projected growth rate for the Dairy Processing Equipment Market?

The Dairy Processing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032, reaching USD 16.0 Billion by the end of the forecast period.

What are the primary drivers for the Dairy Processing Equipment Market?

Key drivers include increasing global dairy consumption, stringent food safety regulations, continuous technological advancements in automation and efficiency, and growing demand for diversified dairy products.

How is AI impacting the Dairy Processing Equipment Market?

AI impacts the market through enhanced real-time quality control, predictive maintenance, optimized processing parameters, improved supply chain management, and advanced automation, leading to greater efficiency and reduced downtime.

Which regions are key contributors to the Dairy Processing Equipment Market growth?

The Asia Pacific region is expected to be the fastest-growing market, while North America and Europe remain significant contributors due to technological innovation and high demand for advanced equipment.

Who are the leading manufacturers in the Dairy Processing Equipment Market?

Leading manufacturers include GEA Group AG, Tetra Pak International SA, Alfa Laval AB, SPX FLOW Inc., Krones AG, JBT Corporation, and Avestra Group, among others.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dairy Processing Equipment Market Size Report By Type (Homogenizers, Membrane filtration equipment, Separators, Mixing & blending equipment, Evaporators & dryer equipment, Pasteurizers, Others), By Application (Cheese, Processed Milk, Yogurt, Protein Ingredients, Milk Powder, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Dairy Processing Equipment Market Statistics 2025 Analysis By Application (Liquid Dairy Industry, Powdery Dairy Industry), By Type (Pasteurizers, Homogenizers, Separators, Filters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager