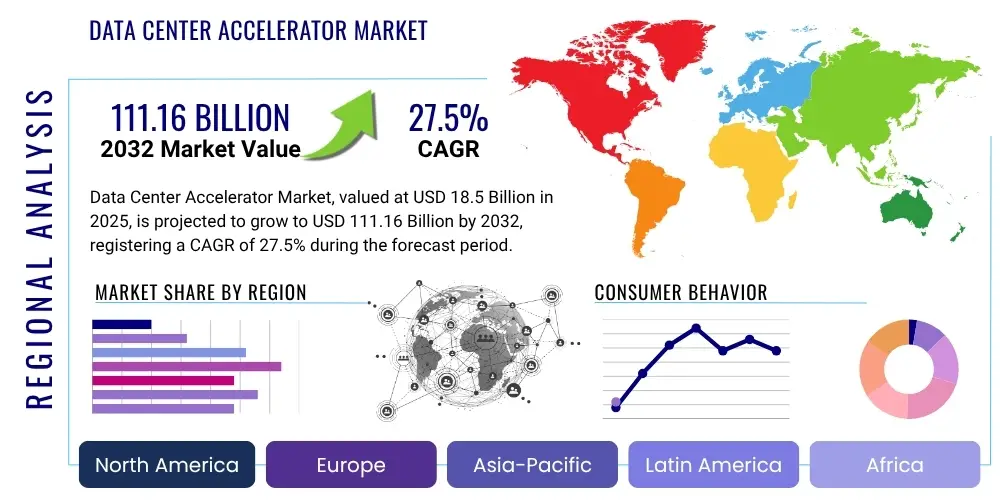

Data Center Accelerator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428641 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Data Center Accelerator Market Size

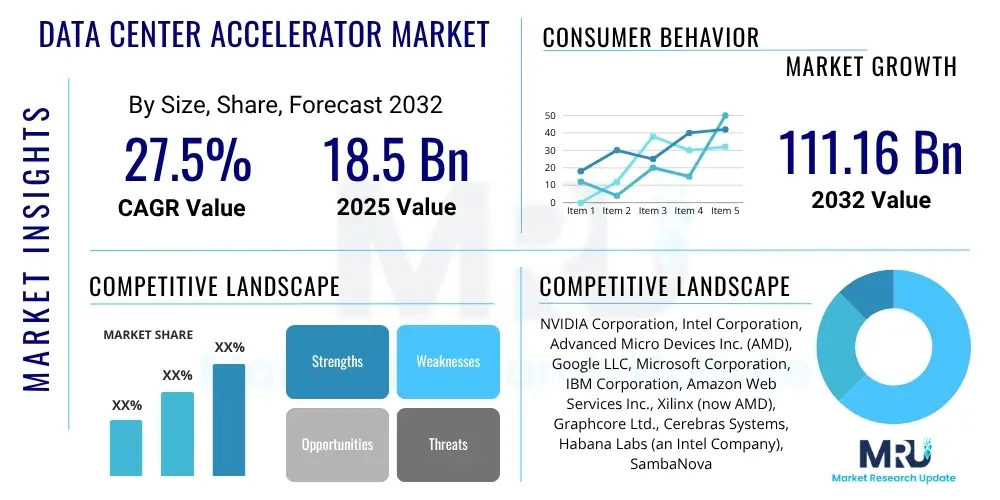

The Data Center Accelerator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 27.5% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 111.16 Billion by the end of the forecast period in 2032.

Data Center Accelerator Market introduction

The Data Center Accelerator Market encompasses specialized hardware components designed to significantly boost the performance of specific computational tasks within data centers, far exceeding the capabilities of general-purpose central processing units (CPUs). These accelerators are critical for handling the explosive growth of data and the increasing complexity of modern applications, particularly in artificial intelligence and high-performance computing. The primary products in this market include Graphics Processing Units (GPUs), Field-Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), each offering distinct advantages in terms of programmability, flexibility, and raw computational power for particular workloads.

Major applications of data center accelerators span a wide array of demanding computational environments, including deep learning training and inference, big data analytics, scientific simulations, financial modeling, and content delivery networks. These solutions enable faster processing of vast datasets, reduce latency in real-time applications, and optimize resource utilization within data centers. The tangible benefits derived from deploying these accelerators include substantially improved computational throughput, significant energy efficiency gains per operation, and ultimately, a reduced total cost of ownership for high-intensity workloads, facilitating innovation and quicker time-to-insight for businesses and research institutions.

The market is predominantly driven by several macroeconomic and technological factors. The unparalleled expansion of artificial intelligence and machine learning initiatives across all industry verticals is arguably the foremost driver, necessitating unparalleled processing capabilities. Furthermore, the relentless increase in global data volumes, the escalating demand for real-time data processing, and the widespread adoption of cloud computing services by enterprises are all contributing to the accelerated demand for these specialized hardware solutions. These factors collectively underscore the indispensable role of data center accelerators in shaping the future of digital infrastructure.

Data Center Accelerator Market Executive Summary

The Data Center Accelerator Market is experiencing robust expansion, propelled by transformative business trends such as the relentless pursuit of digital transformation, the proliferation of artificial intelligence, and the increasing reliance on cloud-native architectures. Key business trends include substantial investments by hyperscale cloud providers in advanced hardware infrastructure, the emergence of customized silicon solutions tailored for specific AI workloads, and a growing emphasis on energy efficiency and sustainability within data center operations. Enterprises are increasingly integrating accelerators to optimize their analytics and machine learning pipelines, driving demand beyond traditional research and development sectors into mainstream business applications.

Regionally, North America maintains its leadership position, primarily due to the concentration of major technology companies, extensive cloud infrastructure, and significant research and development investments in AI. The Asia Pacific region is demonstrating the fastest growth, fueled by rapid digitalization initiatives, expanding data center footprints, and strong government support for technological advancements in countries like China and India. Europe is also witnessing considerable adoption, driven by stringent data regulations and growing enterprise demand for localized processing capabilities. These regional dynamics reflect varied levels of technological maturity and investment priorities, but a universal trend towards enhanced computational infrastructure is evident.

Segmentation trends highlight the continued dominance of GPUs, especially for deep learning training, while ASICs are gaining traction for highly optimized inference tasks due to their superior performance-per-watt and cost efficiency at scale. FPGAs continue to serve niche applications requiring reconfigurability and low-latency processing. Cloud-based deployment of accelerators is accelerating, offering flexibility and scalability for users without large upfront capital expenditures, although on-premise solutions remain critical for highly sensitive or proprietary workloads. The market is also seeing a diversification of applications, moving beyond traditional HPC into enterprise-grade analytics, smart cities, and autonomous systems, indicating a broad and sustained demand for specialized acceleration technologies.

AI Impact Analysis on Data Center Accelerator Market

User questions regarding the impact of AI on the Data Center Accelerator Market frequently revolve around how AI's exponential growth is fueling the demand for specialized hardware, what types of accelerators are best suited for different AI workloads, whether traditional CPUs can keep pace, and the energy consumption implications of these powerful systems. There is significant interest in understanding how advanced AI models, particularly generative AI, are influencing accelerator design and deployment strategies. Users also seek clarity on the long-term sustainability and cost-effectiveness of these high-performance solutions in an AI-dominated landscape. These themes reflect a keen industry interest in the practical and strategic implications of AI’s hardware demands.

- AI drives exponential demand for parallel processing capabilities, far exceeding CPU limits.

- Necessitates a fundamental shift from general-purpose CPUs to specialized hardware like GPUs, FPGAs, and ASICs.

- Emphasis on high computational throughput for AI model training and rapid inference.

- Accelerates the development of custom AI chips (ASICs) optimized for specific neural network architectures.

- Increases focus on energy efficiency to manage the substantial power requirements of AI workloads.

- Promotes innovation in memory technologies (HBM) and high-speed interconnects (NVLink, CXL).

- Drives the need for robust software ecosystems and programming frameworks for AI development on accelerators.

- Supports the emergence of generative AI and large language models, requiring massive scale-out acceleration.

- Influences cloud service providers to significantly expand their accelerator-as-a-service offerings.

- Creates opportunities for new market entrants specializing in AI hardware innovation.

DRO & Impact Forces Of Data Center Accelerator Market

The Data Center Accelerator Market is propelled by significant drivers including the exponential growth of Artificial Intelligence and Machine Learning applications, which demand immense computational power for training and inference processes. The ever-increasing volume of data generated globally necessitates faster processing capabilities, further boosting the demand for accelerators. The pervasive adoption of cloud computing services by enterprises and individuals alike contributes significantly, as cloud providers seek to optimize performance and reduce operational costs. Additionally, the emergence of edge computing, which requires localized, high-speed processing, creates new opportunities for accelerator deployment closer to data sources.

Despite robust growth, the market faces notable restraints. The high upfront investment costs associated with acquiring and deploying advanced accelerator hardware can be prohibitive for smaller enterprises. The inherent complexity in designing, integrating, and programming these specialized systems often requires highly skilled personnel, leading to a shortage of expertise. Furthermore, the substantial power consumption and subsequent cooling requirements of high-performance accelerators pose significant operational challenges for data center managers. Concerns about vendor lock-in, where dependence on a single provider's proprietary architecture and software ecosystem restricts flexibility, also act as a deterrent for some potential adopters.

Opportunities for market expansion are abundant, particularly with the continuous emergence of new and more complex AI applications, such as generative AI and large language models, which are constantly pushing the boundaries of computational demand. The expansion into new industry verticals like healthcare for drug discovery and diagnostics, and the automotive sector for autonomous driving, represents untapped potential. Ongoing advancements in hardware architecture, including chiplet designs and novel interconnect technologies, promise further performance gains and efficiency improvements. The development of open standards and frameworks could also mitigate vendor lock-in concerns and foster broader adoption.

The impact forces shaping this market are multifaceted, encompassing rapid technological advancements that continually introduce more powerful and efficient accelerators, thereby driving performance expectations upwards. The intensely competitive landscape among semiconductor giants and specialized startups fosters innovation but also puts pressure on pricing and differentiation. Regulatory environments, particularly those concerning data privacy and energy consumption, can influence data center design and operational strategies. Lastly, global economic conditions, including capital expenditure cycles and investment in digital infrastructure, play a crucial role in determining the pace of market growth and adoption rates.

Segmentation Analysis

The Data Center Accelerator Market is extensively segmented to provide a granular view of its diverse landscape and to identify specific growth drivers and opportunities within various sub-sectors. These segments are primarily defined by the type of accelerator technology employed, the specific applications they cater to, the end-user industries utilizing them, and their deployment model. This multi-dimensional segmentation helps in understanding the complex interplay of technological innovation, market demand, and strategic investments that shape the industry's trajectory. Each segment reflects unique performance characteristics, cost structures, and integration challenges, thereby appealing to different market needs and operational requirements.

- By Type:

- Graphics Processing Units (GPUs)

- Field-Programmable Gate Arrays (FPGAs)

- Application-Specific Integrated Circuits (ASICs)

- CPU-based Accelerators (e.g., Vector Processors, Specialized CPU Extensions)

- Others (e.g., Quantum Accelerators, Neuromorphic Chips)

- By Application:

- Deep Learning Training

- Deep Learning Inference

- High-Performance Computing (HPC)

- Enterprise Data Centers (e.g., Big Data Analytics, Database Acceleration)

- Scientific Research

- Financial Modeling

- Video Processing & Content Delivery

- By End-User:

- Cloud Service Providers (CSPs)

- Enterprises (e.g., IT & Telecom, BFSI, Retail & E-commerce, Manufacturing, Healthcare & Life Sciences)

- Government & Defense

- Research & Academic Institutions

- By Deployment:

- On-premise

- Cloud-based

Value Chain Analysis For Data Center Accelerator Market

The value chain for the Data Center Accelerator Market begins with the upstream segment, which involves fundamental research, intellectual property (IP) core design, and semiconductor manufacturing. This segment includes companies specializing in electronic design automation (EDA) tools that enable complex chip layouts, material suppliers providing critical components such as silicon wafers and rare-earth elements, and semiconductor foundries like TSMC and Samsung, which are responsible for the fabrication of these highly intricate chips. These foundational activities are capital-intensive and require significant technological expertise, forming the bedrock upon which the entire market operates.

Moving downstream, the value chain encompasses the integration, deployment, and utilization of these accelerators. This involves Original Equipment Manufacturers (OEMs) who integrate accelerators into their servers and systems, and system integrators who customize solutions for specific enterprise needs. Hyperscale cloud service providers (CSPs) like Amazon, Google, and Microsoft represent a crucial downstream segment, as they procure vast quantities of accelerators for their infrastructure to offer AI and HPC services to their customers. Enterprise data centers also form a significant downstream component, deploying accelerators for their internal computational demands, ranging from complex analytics to sophisticated AI model training and inference.

The distribution channel for data center accelerators primarily operates through both direct and indirect routes. Direct sales are common for hyperscale cloud providers and large enterprises, where manufacturers engage directly with these major customers to provide tailored solutions, often involving significant negotiation and custom integration. Indirect channels involve a network of third-party distributors, value-added resellers (VARs), and system integrators who package accelerator hardware with software, support services, and integration expertise for a broader range of enterprise clients. Cloud marketplaces also act as a significant indirect channel, offering accelerator instances as a service, making high-performance computing accessible to a wider user base without the need for physical hardware procurement or management, thereby democratizing access to powerful computational resources.

Data Center Accelerator Market Potential Customers

Potential customers and end-users of data center accelerators span a broad spectrum of industries and organizations, all united by a critical need for high-performance computing capabilities to process vast amounts of data and execute complex algorithms efficiently. The primary buyers are hyperscale cloud service providers (CSPs) such as Amazon Web Services, Google Cloud, Microsoft Azure, and Alibaba Cloud, who integrate these accelerators into their vast infrastructures to offer compute-intensive services like AI training, inference, and high-performance computing as a utility to their global clientele. These organizations represent the largest segment of demand due to their scale and the diversity of workloads they support for millions of users.

Beyond the hyperscalers, large enterprises across various sectors constitute a significant customer base. This includes financial services firms utilizing accelerators for high-frequency trading, risk modeling, and fraud detection, where speed and precision are paramount. Retail and e-commerce companies leverage accelerators for personalized recommendations, supply chain optimization, and sophisticated analytics to understand consumer behavior. In the media and entertainment industry, accelerators are vital for video rendering, content creation, and real-time streaming services. Furthermore, IT and telecommunications companies deploy them for network optimization, cybersecurity analytics, and developing next-generation communication technologies, all benefiting from accelerated data processing.

Research and academic institutions, including universities and national laboratories, are also crucial buyers, utilizing accelerators for scientific simulations, climate modeling, drug discovery, and fundamental AI research. The government and defense sectors employ these technologies for intelligence analysis, secure communication, and defense simulations, requiring robust and high-performance systems. Emerging sectors such as autonomous driving and smart cities are rapidly increasing their demand for accelerators to process sensor data, run sophisticated AI models for navigation, and manage complex urban infrastructures in real time, indicating a continuous expansion of the customer base into diverse and innovative application domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 111.16 Billion |

| Growth Rate | CAGR 27.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NVIDIA Corporation, Intel Corporation, Advanced Micro Devices Inc. (AMD), Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services Inc., Xilinx (now AMD), Graphcore Ltd., Cerebras Systems, Habana Labs (an Intel Company), SambaNova Systems, Groq Inc., Huawei Technologies Co. Ltd., Baidu Inc., Alibaba Group Holding Ltd., Tencent Holdings Ltd., Mythic Inc., Tenstorrent Inc., Blaize Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Center Accelerator Market Key Technology Landscape

The Data Center Accelerator Market is characterized by a rapidly evolving technological landscape driven by the incessant demand for higher performance and greater efficiency. Central to this evolution are advancements in chip architecture and manufacturing processes, moving towards specialized designs that excel at parallel processing and matrix computations crucial for AI and HPC workloads. This includes the widespread adoption of heterogeneous computing, where CPUs work in concert with GPUs, FPGAs, or ASICs, each optimized for different computational tasks, thereby maximizing overall system throughput and responsiveness.

Key technologies defining this market include sophisticated packaging innovations like chiplets and High Bandwidth Memory (HBM), which allow for greater integration density and significantly faster data access, circumventing traditional memory bottlenecks. Advanced cooling solutions, such as liquid cooling, are becoming imperative to manage the substantial heat generated by these powerful accelerators, ensuring sustained performance and system reliability. Furthermore, high-speed interconnects like NVIDIA's NVLink and the industry-standard Compute Express Link (CXL) are crucial for enabling seamless and low-latency communication between accelerators and CPUs, as well as between multiple accelerators within a server or across nodes in a cluster, facilitating large-scale distributed computing.

On the software front, the landscape is shaped by comprehensive optimization frameworks and programming models. Platforms like NVIDIA's CUDA, OpenCL, TensorFlow, and PyTorch provide the necessary tools and libraries for developers to effectively utilize the underlying hardware, abstracting much of the complexity of parallel programming. The development of custom instruction sets and domain-specific architectures further tailors accelerators for particular algorithms, pushing the boundaries of what is achievable in terms of raw performance and energy efficiency. These technological synergistic advancements across hardware and software are continually redefining the capabilities and potential applications of data center accelerators, ensuring their critical role in the future of computing.

Regional Highlights

- North America: This region stands as the dominant force in the Data Center Accelerator Market, primarily driven by the presence of a vast ecosystem of hyperscale cloud service providers, leading technology companies, and extensive research and development initiatives focused on artificial intelligence and high-performance computing. The United States, in particular, showcases robust investments from tech giants in advanced data center infrastructure and a high adoption rate of AI across various industries. Canada also contributes significantly with its growing cloud sector and AI research clusters. The region benefits from substantial private and public funding for innovation, fostering a highly competitive environment for accelerator development and deployment.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate, fueled by rapid digital transformation initiatives, aggressive expansion of data center capacities, and increasing government support for AI and indigenous semiconductor manufacturing. Countries like China, Japan, South Korea, and India are key players, with China making massive investments in AI infrastructure and developing its own accelerator technologies. The burgeoning digital economy, large populations, and a strong manufacturing base for electronic components contribute to APAC's dynamic market expansion and its pivotal role in both supply and demand for data center accelerators.

- Europe: The European market is characterized by steady growth, driven by increasing enterprise adoption of cloud services, strict data privacy regulations encouraging localized data processing, and significant governmental investments in high-performance computing initiatives across the continent. Countries such as Germany, the UK, France, and the Nordics are at the forefront of deploying accelerators for scientific research, industrial automation, and financial services. The focus on sustainability and energy efficiency within European data centers also influences the adoption of advanced, power-efficient accelerator solutions, fostering innovation in green computing practices.

- Latin America: As an emerging market, Latin America is experiencing growing adoption of data center accelerators, primarily influenced by increasing cloud service penetration and digital transformation efforts across various industries. Countries like Brazil and Mexico are leading the charge with expanding internet penetration and investment in modernizing IT infrastructure. While still nascent compared to more developed regions, the market here is poised for gradual growth as local enterprises and cloud providers recognize the benefits of accelerated computing for competitive advantage and operational efficiency.

- Middle East and Africa (MEA): The MEA region is witnessing significant investment in digital infrastructure as part of broader economic diversification strategies, particularly in the Gulf Cooperation Council (GCC) countries. Initiatives for smart cities, digital government services, and expanding telecommunication networks are driving demand for advanced data center capabilities, including accelerators. Countries like UAE, Saudi Arabia, and South Africa are key contributors, with increasing focus on localized cloud services and the establishment of new data centers to cater to rising computational needs across various sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Accelerator Market.- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices Inc. (AMD)

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services Inc.

- Xilinx (now AMD)

- Graphcore Ltd.

- Cerebras Systems

- Habana Labs (an Intel Company)

- SambaNova Systems

- Groq Inc.

- Huawei Technologies Co. Ltd.

- Baidu Inc.

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Mythic Inc.

- Tenstorrent Inc.

- Blaize Inc.

Frequently Asked Questions

What is a data center accelerator?

A data center accelerator is a specialized hardware component, such as a GPU, FPGA, or ASIC, designed to significantly speed up specific computational tasks within a data center, surpassing the performance of general-purpose CPUs for those particular workloads.

Why are data center accelerators important for AI?

Accelerators are crucial for AI because they provide the massive parallel processing power required to efficiently train and run complex machine learning models, drastically reducing computation time and enabling advancements in AI research and applications.

What are the main types of data center accelerators?

The primary types include Graphics Processing Units (GPUs) for general-purpose parallel computing, Field-Programmable Gate Arrays (FPGAs) for reconfigurable hardware acceleration, and Application-Specific Integrated Circuits (ASICs) for highly optimized, fixed-function tasks.

How do data center accelerators improve performance?

Accelerators improve performance by offloading specific computationally intensive tasks from the CPU, executing them in parallel or with highly specialized circuitry, leading to faster data processing, lower latency, and greater throughput for demanding applications like AI and HPC.

What is the future outlook for data center accelerators?

The future outlook is highly positive, driven by the continuous growth of AI, machine learning, and big data. Expect further innovation in custom silicon, increased integration into cloud infrastructure, and advancements in energy efficiency to meet escalating computational demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager