Data Center Colocation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428058 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Data Center Colocation Market Size

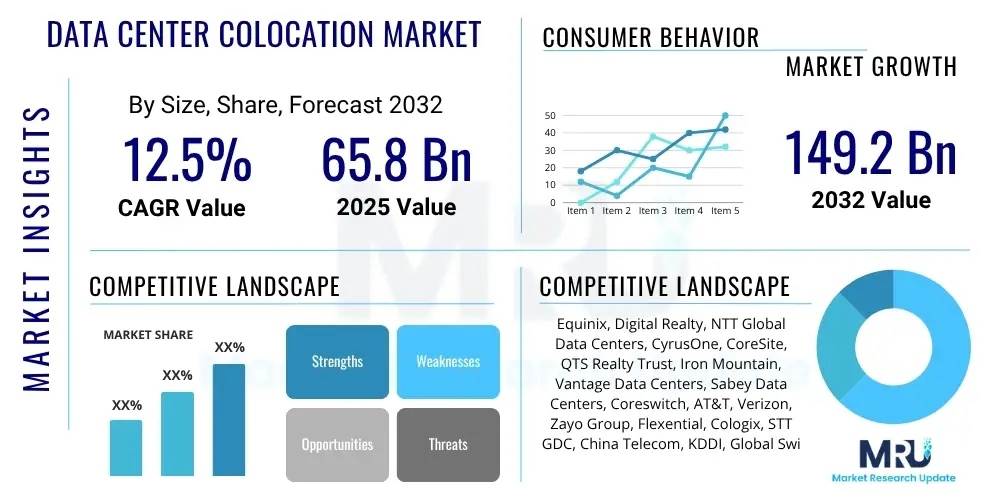

The Data Center Colocation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 65.8 Billion in 2025 and is projected to reach USD 149.2 Billion by the end of the forecast period in 2032.

Data Center Colocation Market introduction

The Data Center Colocation Market encompasses the provision of data center space, power, cooling, and network connectivity to third-party clients. This model allows businesses to house their servers and networking equipment within a colocation provider's facility, leveraging shared infrastructure while maintaining ownership and control over their IT assets. Colocation offers a crucial alternative to building and maintaining proprietary data centers, particularly for organizations seeking scalability, reliability, and cost efficiency without the substantial capital expenditure and operational complexities associated with self-owned facilities. It represents a fundamental layer in the modern digital economy, supporting everything from enterprise applications to cloud services and edge computing.

Major applications of data center colocation span a diverse range of industries, including financial services, telecommunications, healthcare, government, and media. Businesses utilize colocation for disaster recovery, hybrid cloud strategies, expanding geographic reach, and supporting high-performance computing workloads. The primary benefits include reduced operational costs, enhanced security, guaranteed uptime through robust infrastructure, flexible scalability to meet fluctuating demands, and access to a wide array of network connectivity options. Colocation providers invest heavily in cutting-edge power, cooling, and security systems, which individual companies might find prohibitive to replicate, thereby offering a superior and more resilient environment for critical IT infrastructure.

Driving factors for the continued expansion of the Data Center Colocation Market are deeply rooted in the accelerating pace of digital transformation across all sectors. The exponential growth in data generation, coupled with the increasing adoption of cloud computing, Big Data analytics, Artificial intelligence, and the Internet of Things (IoT), necessitates robust, scalable, and secure infrastructure. Enterprises are increasingly recognizing the strategic value of focusing on core competencies, delegating the complexities of physical data center management to specialized colocation providers. Furthermore, the rising need for low-latency connectivity, driven by real-time applications and edge computing demands, is propelling investments in strategically located colocation facilities, enhancing their role as critical hubs for digital commerce and communication.

Data Center Colocation Market Executive Summary

The Data Center Colocation Market is poised for significant expansion, driven by a confluence of business trends that emphasize digital resilience, operational efficiency, and scalable infrastructure. Enterprises are increasingly shifting away from capital-intensive on-premise data centers towards hybrid IT strategies, where colocation plays a pivotal role in housing critical applications and infrastructure that are not yet migrated to the public cloud. This movement is underpinned by the need for greater agility, reduced total cost of ownership, and access to sophisticated infrastructure management capabilities that colocation providers offer. The demand for high-density power and cooling solutions is also on the rise, particularly as organizations begin to deploy more powerful servers to support advanced analytics, AI, and machine learning workloads, requiring a robust physical environment that colocation facilities are uniquely positioned to deliver. Business continuity and disaster recovery remain core drivers, with colocation offering geographically diverse and highly resilient infrastructure options essential for maintaining uninterrupted operations in an increasingly unpredictable world.

From a regional perspective, North America and Europe continue to dominate the market in terms of installed capacity and mature adoption, characterized by robust regulatory frameworks and significant investments in hyperscale and enterprise colocation. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by rapid digitalization, expanding internet penetration, and increasing foreign direct investment in key economies like China, India, and Southeast Asia. Latin America and the Middle East & Africa (MEA) are also experiencing accelerated growth, albeit from a smaller base, as governments and private sectors in these regions prioritize digital infrastructure development to support economic diversification and modernization initiatives. These regional dynamics highlight a global shift towards distributed IT environments, with colocation facilities serving as vital nodes in a decentralized network architecture, addressing localized data sovereignty requirements and latency-sensitive applications.

Segmentation trends within the colocation market reveal a distinct divergence between retail and wholesale offerings. While wholesale colocation continues to attract hyperscale cloud providers and large enterprises needing massive, dedicated space, retail colocation remains crucial for small to medium-sized businesses (SMBs) and specific enterprise workloads requiring smaller footprints but robust connectivity and managed services. The market is also seeing increased specialization based on end-user industries, with tailored solutions for sectors such as BFSI (Banking, Financial Services, and Insurance) that demand stringent security and compliance, and healthcare, which requires adherence to data privacy regulations. Furthermore, the emphasis on sustainability and environmental responsibility is influencing design and operational choices, with providers investing in energy-efficient technologies, renewable energy sources, and innovative cooling systems to meet growing client expectations for green data centers. This multi-faceted growth across various segments underscores the adaptability and sustained relevance of the data center colocation model in the evolving digital landscape.

AI Impact Analysis on Data Center Colocation Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) workloads is profoundly transforming the demands placed on data center infrastructure, directly influencing the colocation market. Organizations deploying AI are grappling with an unprecedented need for high-density computing power, specialized cooling solutions, and extremely low-latency network connectivity. This trend is leading to a surge in demand for colocation facilities capable of supporting dense server racks, often equipped with powerful GPUs and specialized AI accelerators that consume significantly more power per rack than traditional IT equipment. Users are expressing concerns about the ability of existing data centers to accommodate these intense requirements, particularly regarding power availability, cooling efficiency, and the necessary network upgrades to handle massive data transfer volumes inherent in AI training and inference. There is also a keen interest in how colocation providers will adapt their offerings to become "AI-ready," including physical infrastructure modifications, energy management strategies, and the provision of specialized services tailored for AI deployments, while also addressing the complex security implications of housing sensitive AI models and proprietary data.

- Increased demand for high-density power and cooling solutions, particularly liquid cooling for GPU-intensive servers.

- Requirement for enhanced network infrastructure to support high-bandwidth, low-latency AI data transfer.

- Development of specialized "AI-ready" colocation spaces with optimized designs for AI workloads.

- Focus on energy efficiency and sustainability to manage the significantly higher power consumption of AI systems.

- Emergence of edge colocation for distributed AI inference, bringing processing closer to data sources.

- Enhanced security protocols and isolation measures to protect sensitive AI models and intellectual property.

- Increased need for automation and intelligent infrastructure management within colocation facilities to optimize AI deployments.

DRO & Impact Forces Of Data Center Colocation Market

The Data Center Colocation Market is profoundly shaped by a dynamic interplay of drivers, restraints, and opportunities, all underscored by various impact forces that continuously redefine its trajectory. Key drivers propelling market growth include the relentless pace of digital transformation across industries, compelling businesses to outsource their IT infrastructure to scalable and resilient environments. The exponential surge in data generation, driven by cloud adoption, IoT devices, Big Data analytics, and artificial intelligence, necessitates robust data storage and processing capabilities that colocation centers are ideally positioned to provide. Furthermore, the increasing complexity of IT management, coupled with the need for enhanced cybersecurity and regulatory compliance (such as GDPR, HIPAA), makes colocation an attractive option for organizations seeking specialized expertise and infrastructure without the burden of heavy capital expenditure and operational overhead. The demand for low-latency connectivity, especially for real-time applications and content delivery, also drives the strategic placement and utilization of colocation facilities, particularly at network peering points.

Despite the robust growth drivers, the market faces several significant restraints. High initial capital investment required for building and upgrading data centers, particularly for providers, can be a barrier to entry and expansion. The substantial power consumption of data centers, combined with rising energy costs and growing environmental concerns, poses operational and reputational challenges, pushing providers to invest in more energy-efficient and sustainable solutions. Security risks, including cyber threats and physical breaches, remain a constant concern for clients entrusting their critical data to third-party facilities, necessitating continuous investment in advanced security measures. Additionally, potential vendor lock-in and the complexities of migrating existing infrastructure to a colocation environment can deter some businesses from making the switch, while regulatory hurdles and varying data sovereignty laws across different regions add layers of complexity for global enterprises.

Opportunities within the Data Center Colocation Market are abundant and diverse, often stemming from technological advancements and evolving business needs. The proliferation of edge computing, which requires localized data processing closer to the source of data generation, presents a significant avenue for colocation providers to expand their footprint with smaller, distributed facilities. The burgeoning demand for Artificial Intelligence and Machine Learning workloads, necessitating high-density, specialized infrastructure, offers a premium segment for colocation providers capable of supporting these power-intensive applications. Hybrid cloud models, integrating on-premise infrastructure with public and private clouds, inherently leverage colocation as a foundational component, enabling seamless connectivity and workload orchestration. Furthermore, the increasing adoption of renewable energy sources and sustainable data center practices not only addresses environmental concerns but also creates opportunities for providers to differentiate themselves and attract environmentally conscious clients. Emerging markets, characterized by rapid digitalization and nascent IT infrastructure, represent vast untapped potential for colocation expansion, offering new growth frontiers for providers willing to invest in these developing regions.

Segmentation Analysis

The Data Center Colocation Market is meticulously segmented to provide a comprehensive understanding of its diverse landscape, catering to a wide array of business needs and operational scales. This segmentation allows for targeted service offerings and strategic market positioning, recognizing that different clients have distinct requirements regarding space, power, connectivity, and management services. By analyzing these segments, market participants can better identify growth opportunities, tailor their solutions, and optimize their infrastructure investments to meet the evolving demands of various end-users and technological applications across the globe.

- By Type:

- Retail Colocation

- Wholesale Colocation

- By End-User:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Healthcare

- Government & Public Sector

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Retail & E-commerce

- Others (Education, Research, etc.)

- By Tier Level:

- Tier I

- Tier II

- Tier III

- Tier IV

Value Chain Analysis For Data Center Colocation Market

The value chain of the Data Center Colocation Market is a complex ecosystem involving multiple stages, from initial infrastructure development to the delivery of integrated services to end-users. At the upstream end, the value chain begins with critical elements such as land acquisition and site selection, which are crucial for proximity to network infrastructure, power grids, and potential customer bases. This is followed by the intricate process of data center construction, involving civil engineering, architectural design, and the installation of specialized infrastructure components like power distribution units, uninterruptible power supplies (UPS), generators, and advanced cooling systems. Key suppliers in this phase include real estate developers, construction companies, and manufacturers of IT hardware (servers, networking equipment), power infrastructure (Schneider Electric, Eaton), and cooling technologies (Vertiv, Johnson Controls). The efficiency and cost-effectiveness at this stage directly impact the competitiveness of the colocation provider, emphasizing the importance of strategic partnerships and supply chain optimization for acquiring high-quality, reliable, and energy-efficient components.

Moving further along the value chain, the core operations of colocation providers involve the ongoing management and maintenance of these sophisticated facilities. This includes ensuring power continuity, optimizing cooling efficiency, managing network interconnectivity, and implementing robust physical and cyber security measures. Colocation providers invest heavily in skilled personnel, advanced Data Center Infrastructure Management (DCIM) software, and automation tools to deliver high uptime and operational excellence. At this stage, value is added through economies of scale, specialized expertise, and the ability to offer a highly resilient and compliant environment that individual enterprises would find challenging and costly to replicate. The emphasis is on delivering a service level agreement (SLA) that guarantees performance, availability, and security, forming the foundation of client trust and long-term relationships.

The downstream segment of the value chain focuses on delivering services to the end-user and the various distribution channels involved. Colocation providers offer space and power, but many also extend into value-added services such as cross-connects to a multitude of network carriers, cloud on-ramps for hybrid IT strategies, remote hands services, and sometimes even managed services or disaster recovery solutions. Direct distribution channels involve colocation providers selling directly to enterprises, hyperscalers, and telecommunications companies. Indirect channels include partnerships with system integrators, managed service providers (MSPs), and IT consultants who bundle colocation with their own services to offer comprehensive solutions to their clients. These channels are crucial for market reach and for providing integrated solutions that cater to specific customer segments, making the colocation offering more accessible and comprehensive. The effectiveness of the distribution strategy, combined with the quality and breadth of value-added services, significantly determines the colocation provider's market penetration and customer satisfaction.

Data Center Colocation Market Potential Customers

The Data Center Colocation Market serves a diverse and expansive base of potential customers, spanning nearly every sector of the modern economy that relies on digital infrastructure. At its core, any organization that requires secure, reliable, and scalable housing for its IT assets, but prefers not to undertake the significant capital expenditure and operational complexities of building and maintaining its own data center, is a prime candidate for colocation services. This includes a vast spectrum from small to medium-sized businesses (SMBs) seeking a professional environment for their critical servers, to large multinational corporations looking to augment or distribute their existing data center footprint, and even hyperscale cloud providers needing vast spaces for their global infrastructure deployments. The fundamental appeal lies in the ability to access institutional-grade facilities, robust connectivity, and specialized expertise without the direct burden of ownership.

Specific end-user segments that demonstrate high potential for colocation adoption include the Banking, Financial Services, and Insurance (BFSI) sector, which demands extremely high levels of security, uptime, and regulatory compliance (e.g., PCI DSS, SOX) for transaction processing and data storage. The IT and Telecommunications sector is another major customer base, utilizing colocation for network peering, content delivery networks (CDNs), and supporting various internet-based services. Healthcare organizations leverage colocation for secure storage of sensitive patient data (e.g., HIPAA compliance) and to power critical applications. Government agencies, educational institutions, and research facilities often use colocation for their computing needs due to its cost-effectiveness and security. Manufacturing firms, retail & e-commerce companies, and media & entertainment entities also rely heavily on colocation for their digital operations, from supply chain management to content streaming and customer engagement platforms.

Beyond these traditional enterprise segments, emerging demand from niche areas such as scientific research, artificial intelligence and machine learning development, and the burgeoning esports industry further broadens the customer base. These sectors often require highly specialized infrastructure, including high-density power, advanced cooling solutions, and ultra-low latency networks, which colocation providers are increasingly equipped to offer. The ongoing global trend of digital transformation, coupled with the increasing adoption of hybrid cloud strategies where colocation acts as a vital bridge between on-premise and public cloud environments, ensures a continuously expanding pool of potential customers. As businesses continue to generate and process more data, the value proposition of scalable, secure, and cost-efficient outsourced data center infrastructure offered by colocation providers becomes even more compelling across virtually all economic activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 65.8 Billion |

| Market Forecast in 2032 | USD 149.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Equinix, Digital Realty, NTT Global Data Centers, CyrusOne, CoreSite, QTS Realty Trust, Iron Mountain, Vantage Data Centers, Sabey Data Centers, Coreswitch, AT&T, Verizon, Zayo Group, Flexential, Cologix, STT GDC, China Telecom, KDDI, Global Switch, Keppel DC REIT |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Center Colocation Market Key Technology Landscape

The Data Center Colocation Market is continuously evolving, driven by an imperative for higher efficiency, greater scalability, and enhanced resilience, which in turn fuels the adoption of advanced technological solutions. A critical area of innovation lies in power and cooling infrastructure, where traditional air-cooling methods are being augmented or replaced by more efficient liquid cooling solutions, including direct-to-chip and immersion cooling. This shift is primarily driven by the increasing power density requirements of modern high-performance computing (HPC) and AI/ML workloads, which generate significantly more heat per rack than conventional servers. Providers are also integrating advanced power distribution units (PDUs) and uninterruptible power supplies (UPS) with greater energy efficiency and modularity, often coupled with renewable energy sources and intelligent power management systems to reduce operational costs and environmental impact, leading to greener data centers.

Connectivity and networking technologies form another cornerstone of the modern colocation landscape. High-speed, low-latency networking is paramount, with widespread adoption of 100G and 400G Ethernet, as well as advancements in Fibre Channel for storage area networks (SANs). Software-defined networking (SDN) and network functions virtualization (NFV) are enabling more agile and flexible network provisioning, allowing colocation providers to offer a diverse range of connectivity options, including direct access to major cloud providers (cloud on-ramps) and robust peering capabilities. This focus on diverse and high-performance interconnectivity is crucial for supporting hybrid cloud strategies, multi-cloud environments, and the demanding real-time data processing requirements of modern applications, positioning colocation facilities as vital hubs for digital ecosystems.

Furthermore, the technology landscape is characterized by sophisticated data center infrastructure management (DCIM) software, which provides real-time visibility and control over all aspects of data center operations, from power and cooling to asset management and security. DCIM solutions are becoming more intelligent, incorporating AI and machine learning for predictive analytics, automation of routine tasks, and optimizing resource utilization, thereby enhancing operational efficiency and reducing human error. Security technologies are also paramount, encompassing advanced physical access controls, comprehensive surveillance systems, and robust cybersecurity measures, including intrusion detection/prevention systems and multi-factor authentication, to protect sensitive client data and infrastructure. The continuous evolution and integration of these diverse technologies are essential for colocation providers to meet the growing demands for performance, reliability, and security in the digital age.

Regional Highlights

- North America: This region continues to be the largest market for data center colocation, driven by early and widespread adoption of cloud computing, a robust telecommunications infrastructure, and a high concentration of tech companies and financial institutions. Major hubs like Ashburn (Virginia), Dallas, Silicon Valley, and Chicago lead in capacity, characterized by significant hyperscale and enterprise colocation deployments. Strict data privacy regulations and the continuous demand for advanced digital services further fuel growth.

- Europe: The European market is mature and dynamic, with strong growth propelled by digital transformation initiatives, stringent data protection regulations (like GDPR), and a growing emphasis on sustainability. Major markets include Frankfurt, London, Amsterdam, and Paris (FLAP), along with emerging hubs in Dublin and the Nordics. The region sees significant investment in energy-efficient and renewable-powered data centers, reflecting a strong commitment to green IT.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by rapid digitalization, expanding internet penetration, increasing smartphone adoption, and a burgeoning e-commerce sector across countries like China, India, Japan, Australia, Singapore, and Southeast Asia. Government-led initiatives to build digital infrastructure and attract foreign investment are key drivers, resulting in a surge of new data center builds and expansions, particularly in hyperscale facilities.

- Latin America: This region is experiencing significant growth, albeit from a smaller base, as countries like Brazil, Mexico, Chile, and Colombia invest heavily in digital infrastructure. Increasing cloud adoption, local data residency requirements, and the expansion of global enterprises into Latin American markets are driving demand for colocation services. Improved connectivity and economic development are paving the way for further market penetration.

- Middle East and Africa (MEA): The MEA region is characterized by nascent but rapidly developing digital economies. Gulf Cooperation Council (GCC) countries, particularly the UAE and Saudi Arabia, are making substantial investments in data centers as part of their national digitalization visions and economic diversification strategies. Africa is also witnessing a rise in colocation demand, driven by increasing internet access, cloud adoption, and the need for localized content and services, often supported by government and international funding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Colocation Market.- Equinix

- Digital Realty

- NTT Global Data Centers

- CyrusOne

- CoreSite

- QTS Realty Trust

- Iron Mountain

- Vantage Data Centers

- Sabey Data Centers

- Coreswitch

- AT&T

- Verizon

- Zayo Group

- Flexential

- Cologix

- STT GDC

- China Telecom

- KDDI

- Global Switch

- Keppel DC REIT

Frequently Asked Questions

What is data center colocation?

Data center colocation is a service where businesses lease space, power, cooling, and network connectivity for their own servers and IT equipment within a third-party data center facility. It allows companies to leverage robust infrastructure without the capital expenditure and operational burden of building and maintaining their own data center.

What are the main benefits of using colocation services?

Key benefits include reduced operational costs, enhanced security, guaranteed uptime through professional-grade infrastructure, flexible scalability for IT growth, and access to diverse network carriers. It also frees up internal IT resources to focus on core business functions rather than infrastructure management.

How does data center colocation differ from cloud computing?

Colocation provides the physical space and infrastructure for a company's own hardware, offering full control over servers, operating systems, and applications. Cloud computing, conversely, involves using virtualized IT resources (servers, storage, databases) provided and managed by a third-party cloud provider, offering greater abstraction and pay-as-you-go flexibility, but less control over the underlying physical hardware.

What are the key trends shaping the colocation market?

Major trends include the increasing demand for high-density power and cooling for AI/ML workloads, the expansion of edge computing facilities to reduce latency, a strong focus on sustainability and green data centers, the growing adoption of hybrid cloud strategies, and the continuous need for robust security and compliance in a digital-first world.

How is AI impacting data center colocation demand?

AI is significantly impacting demand by driving the need for higher power densities per rack, specialized cooling solutions (like liquid cooling) for powerful GPUs, and enhanced network bandwidth to handle massive data processing. This leads to increased demand for "AI-ready" colocation facilities that can support these intensive and specialized infrastructure requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager