Data Center Energy Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428126 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Data Center Energy Storage Market Size

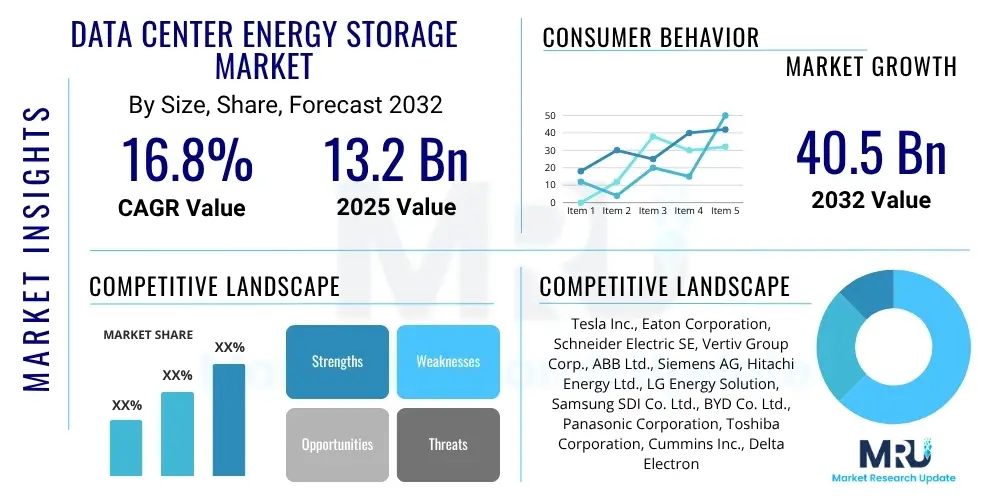

The Data Center Energy Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2025 and 2032. The market is estimated at USD 13.2 Billion in 2025 and is projected to reach USD 40.5 Billion by the end of the forecast period in 2032.

Data Center Energy Storage Market introduction

The Data Center Energy Storage Market encompasses a wide array of technologies and solutions designed to ensure uninterrupted power supply, optimize energy consumption, and enhance the overall resilience of modern data center infrastructure. At its core, data center energy storage involves sophisticated systems that store electrical energy and discharge it when needed, serving critical functions such as providing backup power during grid outages, enabling peak shaving to reduce electricity costs, and facilitating the integration of renewable energy sources. As data centers become increasingly vital for global digital operations, ranging from cloud computing and artificial intelligence to IoT and streaming services, the demand for robust and efficient energy storage solutions has surged. These systems are integral to maintaining uptime, protecting invaluable data, and supporting the continuous evolution of digital services, making them a cornerstone of modern data center design and operation.

The primary products within this market include advanced battery technologies, such as lithium-ion, lead-acid, and increasingly, emerging battery chemistries, alongside complementary components like Uninterruptible Power Supply (UPS) systems, flywheel energy storage, and power distribution units. Major applications span across various data center types, including hyperscale facilities, colocation centers, enterprise data centers, and the burgeoning segment of edge computing infrastructure. Each application leverages energy storage differently; hyperscale centers might prioritize massive scale and grid interaction, while edge data centers focus on compact, reliable, and localized power. The benefits of deploying these solutions are multifaceted, encompassing enhanced operational reliability, significant reductions in energy expenditure through demand-side management, lower carbon footprints by enabling renewable energy integration, and compliance with increasingly stringent environmental regulations. Furthermore, advanced energy storage systems contribute to grid stability by offering ancillary services, turning data centers into more active and responsible participants in the broader energy ecosystem.

Several key factors are driving the robust growth of the data center energy storage market. Foremost among these is the exponential increase in data generation and processing demands, fueling the expansion of data centers worldwide. This growth is intrinsically linked to the proliferation of cloud services, AI, machine learning, and the Internet of Things, all of which require continuous and reliable power. Additionally, the increasing frequency and intensity of power outages due to aging grid infrastructure and extreme weather events underscore the necessity for resilient backup power solutions. Regulatory pressures and corporate sustainability initiatives are also compelling data center operators to adopt cleaner energy sources and improve energy efficiency, making advanced storage solutions an attractive investment. Finally, technological advancements in battery chemistry, energy management software, and power conversion technologies are continually improving the performance, safety, and cost-effectiveness of these systems, further accelerating their adoption across the data center landscape.

Data Center Energy Storage Market Executive Summary

The Data Center Energy Storage Market is currently experiencing a period of significant dynamism, driven by converging technological advancements, escalating data consumption, and evolving environmental mandates. Business trends indicate a strong move towards modular and scalable energy storage solutions, allowing data center operators to expand capacity seamlessly and adapt to fluctuating power requirements. There is also a pronounced shift from traditional lead-acid batteries to more energy-dense and longer-lasting lithium-ion batteries, spurred by their improving cost-effectiveness and superior performance characteristics. Furthermore, the market is witnessing increased investment in intelligent energy management systems that integrate storage with renewable energy sources, optimizing power consumption and offering grid services. Strategic partnerships between energy storage providers, data center infrastructure developers, and utility companies are becoming more common, fostering innovative solutions for grid-tied and off-grid data center operations. The focus on total cost of ownership (TCO) over initial capital expenditure is also influencing purchasing decisions, with operators prioritizing systems that deliver long-term operational savings and enhanced reliability.

Regionally, the market exhibits diverse growth patterns and drivers. North America, particularly the United States, continues to dominate the market due to its mature data center industry, significant investment in hyperscale facilities, and strong emphasis on energy efficiency and grid resilience. Europe is experiencing substantial growth, propelled by stringent environmental regulations, ambitious decarbonization targets, and governmental incentives for green data centers. The Asia Pacific region, led by countries like China, India, and Japan, is emerging as a critical growth engine, characterized by rapid digital transformation, increasing internet penetration, and massive data center infrastructure development. These regions are seeing a surge in demand for energy storage solutions to support new builds and upgrades, often incorporating renewable energy components. Latin America, the Middle East, and Africa are also poised for growth, albeit at an earlier stage, driven by increasing digitalization, cloud adoption, and the need for reliable power infrastructure in developing economies.

Segmentation trends reveal that batteries, particularly lithium-ion, remain the largest and fastest-growing segment by component due to their high energy density, cycle life, and falling costs. Uninterruptible Power Supply (UPS) systems, often integrated with battery storage, form another crucial segment, essential for immediate power backup. By application, backup power remains the primary use case, crucial for maintaining uptime, but peak shaving and grid services are gaining significant traction as data centers look to monetize their energy assets and reduce operational expenses. Hyperscale and colocation data centers are the leading end-user segments, commanding the largest share due to their immense power demands and stringent reliability requirements. However, enterprise data centers and the rapidly expanding edge data centers are also increasingly investing in advanced energy storage solutions to ensure localized resilience and improve operational efficiency. The market is also seeing a growing emphasis on hybrid solutions that combine different storage technologies to optimize performance and cost for specific data center environments.

AI Impact Analysis on Data Center Energy Storage Market

The integration of Artificial Intelligence (AI) is poised to fundamentally reshape the Data Center Energy Storage Market, addressing critical user questions around efficiency, reliability, and cost optimization. Users are particularly concerned with how AI can mitigate the enormous power demands of AI workloads, prevent system failures, predict maintenance needs, and intelligently manage energy flow to reduce operational expenses. There is a strong expectation that AI will move beyond reactive power management to proactive, predictive energy strategies, making storage systems more responsive and efficient. Users are looking for AI-driven solutions that can forecast energy demand with greater accuracy, optimize charge and discharge cycles based on real-time grid conditions and energy prices, and enhance the longevity and performance of battery assets. The overarching theme is the pursuit of autonomous, highly optimized energy storage systems that can adapt dynamically to complex operational requirements and external factors, thereby maximizing uptime and minimizing total cost of ownership in an AI-dominated compute landscape.

- AI optimizes battery performance and extends lifespan by predicting degradation and fine-tuning charge/discharge cycles.

- Predictive analytics powered by AI anticipate power fluctuations and outages, enhancing grid stability and data center reliability.

- AI-driven energy management systems enable intelligent peak shaving and demand response, significantly reducing electricity costs.

- Real-time AI analysis of power consumption patterns allows for dynamic scaling of energy storage, matching supply precisely to demand.

- AI facilitates seamless integration of renewable energy sources by optimizing storage usage based on generation variability.

- Automated fault detection and diagnostic capabilities in AI systems minimize downtime and expedite maintenance processes.

- AI supports energy arbitrage by identifying optimal times to buy and sell electricity, maximizing economic returns from storage.

Segmentation Analysis

The Data Center Energy Storage Market is comprehensively segmented to address the diverse needs of data center operators, reflecting the various components, technologies, applications, and end-user types within this dynamic industry. These segmentations provide granular insights into market dynamics, enabling stakeholders to understand key growth areas and tailor solutions to specific demands. The primary categories for market analysis typically include segmentation by component (e.g., batteries, UPS systems, rack PDUs), by type of battery (e.g., lithium-ion, lead-acid, flow battery), by application (e.g., backup power, peak shaving, grid services), and by end-user (e.g., hyperscale, colocation, enterprise, edge data centers). This multi-faceted approach ensures that all aspects of the energy storage ecosystem are examined, highlighting trends in technology adoption, operational preferences, and strategic investments across the globe.

- By Component:

- Batteries:

- Lithium-ion Batteries

- Lead-acid Batteries

- Flow Batteries

- Nickel-Cadmium (Ni-Cd) Batteries

- Other Battery Chemistries (e.g., Solid-state, Sodium-ion)

- Uninterruptible Power Supply (UPS) Systems:

- Online UPS

- Line-Interactive UPS

- Offline/Standby UPS

- Modular UPS

- Rack Power Distribution Units (PDUs)

- Flywheel Energy Storage Systems

- Fuel Cells (e.g., Hydrogen Fuel Cells)

- Power Conversion Systems (PCS)

- Energy Management Systems (EMS)

- Batteries:

- By Application:

- Backup Power/Uptime Assurance

- Peak Shaving/Demand Charge Reduction

- Grid Services/Ancillary Services

- Energy Arbitrage

- Renewable Energy Integration/Stabilization

- Voltage and Frequency Regulation

- By End-User:

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge Data Centers

- Telecom Data Centers

- Government & Public Sector Data Centers

- By Power Rating:

- Below 100 kVA

- 100 kVA – 500 kVA

- 500 kVA – 1 MVA

- Above 1 MVA

Value Chain Analysis For Data Center Energy Storage Market

The value chain for the Data Center Energy Storage Market is a complex ecosystem involving multiple stages, from raw material extraction and component manufacturing to system integration, distribution, and end-user deployment and maintenance. Upstream analysis begins with the sourcing of critical raw materials such as lithium, cobalt, nickel, and graphite for battery manufacturing, alongside silicon for power electronics and metals for enclosures and racks. This segment is characterized by intense competition among raw material suppliers and is subject to geopolitical influences and commodity price volatility. Following raw material procurement, manufacturing processes involve the production of individual battery cells, modules, and packs, as well as the fabrication of UPS components, power converters, and control systems. This stage requires significant R&D investment for technological advancements and adherence to stringent quality and safety standards. Key players in this segment include specialized battery manufacturers, UPS vendors, and power electronics suppliers, often operating globally to leverage economies of scale and access to diverse supply chains.

Midstream activities primarily focus on system integration and assembly. This involves combining various components—batteries, inverters, power management software, cooling systems, and safety mechanisms—into complete, functional energy storage solutions tailored for data center applications. System integrators play a crucial role in designing bespoke solutions that meet the specific power requirements, space constraints, and redundancy needs of different data center environments, whether hyperscale, colocation, or edge. This stage also includes the development and integration of sophisticated energy management systems (EMS) and battery management systems (BMS) that optimize performance, monitor health, and ensure the safe operation of the storage infrastructure. The expertise in system design, engineering, and software integration is a key differentiator in this segment. The distribution channels for these integrated solutions are diverse, encompassing direct sales teams, value-added resellers (VARs), and strategic partnerships with data center builders and facility management companies. Direct sales are common for large-scale, complex projects, allowing for close collaboration with the end-user, while VARs extend market reach to smaller and mid-sized data centers by offering bundled solutions and localized support.

Downstream analysis covers the deployment, operation, and maintenance of data center energy storage systems. This final stage involves installation, commissioning, ongoing monitoring, and routine maintenance, including battery replacements and software updates, to ensure continuous optimal performance and longevity. End-users, ranging from large cloud providers to enterprise IT departments, are primarily concerned with reliability, efficiency, and total cost of ownership over the system's lifecycle. Post-sales support, including warranties, technical assistance, and repair services, is critical for customer satisfaction and long-term relationships. Additionally, the end-of-life management of battery components, including recycling and safe disposal, is an increasingly important aspect of the value chain, driven by environmental regulations and corporate sustainability goals. Indirect distribution channels, such as consultants and engineering firms, often influence purchasing decisions by recommending specific technologies and vendors to their clients. The entire value chain is becoming increasingly interconnected, with vertical integration and strategic alliances common as companies seek to control more aspects of the supply chain, enhance efficiency, and deliver comprehensive, turnkey solutions to the rapidly expanding data center market.

Data Center Energy Storage Market Potential Customers

The potential customers for data center energy storage solutions are diverse and span across various types of organizations and operational scales, all sharing a common need for reliable, efficient, and resilient power infrastructure. At the forefront are hyperscale cloud providers, such as Amazon Web Services (AWS), Google Cloud, Microsoft Azure, and Meta. These companies operate massive data centers requiring colossal amounts of power, and they seek advanced energy storage solutions to ensure uninterrupted services, optimize energy costs through peak shaving and renewable energy integration, and meet stringent sustainability targets. Their investment decisions are driven by the need for extreme uptime, scalability, and the ability to reduce operational expenses across their extensive global networks. For these giants, energy storage is not just a backup but a strategic asset that enhances grid interaction and energy independence.

Another significant segment of potential customers includes colocation data center providers like Equinix, Digital Realty, and CyrusOne. These companies offer shared data center space, power, and cooling to multiple tenants, ranging from small businesses to large enterprises. For colocation providers, the ability to guarantee continuous power and offer flexible power solutions is a core competitive advantage. Energy storage allows them to provide robust Service Level Agreements (SLAs) for power availability, attract diverse clients, and manage their utility costs effectively, which can be passed on as savings or competitive pricing to their tenants. Furthermore, the increasing demand for high-density compute environments in colocation facilities places greater emphasis on efficient power delivery and resilient backup systems, making energy storage an indispensable component of their offerings.

Enterprise data centers, operated by large corporations for their internal IT needs, also represent a substantial customer base. Industries such as finance, healthcare, manufacturing, and telecommunications rely heavily on their in-house data centers for critical business operations. For these enterprises, data center energy storage is crucial for business continuity, disaster recovery, and protecting sensitive data from power disruptions. While their scale might be smaller than hyperscale or colocation facilities, their need for uninterrupted operations is equally paramount. Finally, the rapidly expanding segment of edge data centers, which are smaller, distributed facilities located closer to data sources and end-users, represents a burgeoning market. These edge deployments, critical for applications like autonomous vehicles, IoT, and real-time analytics, demand compact, reliable, and often off-grid or hybrid energy storage solutions to ensure localized resilience and low-latency services in diverse geographical locations. As digital transformation permeates all sectors, virtually any organization with critical IT infrastructure becomes a potential buyer for data center energy storage solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 13.2 Billion |

| Market Forecast in 2032 | USD 40.5 Billion |

| Growth Rate | 16.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla Inc., Eaton Corporation, Schneider Electric SE, Vertiv Group Corp., ABB Ltd., Siemens AG, Hitachi Energy Ltd., LG Energy Solution, Samsung SDI Co. Ltd., BYD Co. Ltd., Panasonic Corporation, Toshiba Corporation, Cummins Inc., Delta Electronics Inc., Huawei Technologies Co. Ltd., Mitsubishi Electric Corporation, CATL (Contemporary Amperex Technology Co. Limited), General Electric (GE), Socomec, Piller Power Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Center Energy Storage Market Key Technology Landscape

The Data Center Energy Storage Market is defined by a dynamic and rapidly evolving technology landscape, where innovation is continuously driving enhanced performance, efficiency, and cost-effectiveness. Central to this landscape are battery technologies, with lithium-ion (Li-ion) batteries dominating due to their high energy density, longer cycle life, and decreasing costs. Advancements in Li-ion chemistry, such as NMC (nickel manganese cobalt) and LFP (lithium iron phosphate), are continually improving safety, thermal stability, and specific energy, making them ideal for high-power data center applications. Beyond Li-ion, research and development are actively exploring next-generation battery technologies like solid-state batteries, which promise even greater safety, energy density, and faster charging, though commercialization for large-scale data center use is still some years away. Flow batteries, offering long-duration storage capabilities and independent scaling of power and energy, are also gaining traction for certain applications where extended backup is crucial. Traditional lead-acid batteries still hold a niche, especially in smaller or legacy systems, due to their lower initial cost, but their market share is steadily declining.

Beyond chemical batteries, other energy storage technologies play a crucial role. Flywheel energy storage systems provide short-duration, high-power backup, often used in conjunction with batteries to bridge the gap during power transfer from grid to generator. These systems offer rapid response times and high reliability with fewer environmental concerns than chemical batteries, making them valuable for critical immediate power requirements. Uninterruptible Power Supply (UPS) systems are integral, acting as the interface between the grid, storage, and data center load. Modern UPS systems are becoming more intelligent, leveraging advanced power electronics, modular designs, and higher efficiencies, often integrating seamlessly with various battery types and energy management systems. Fuel cell technology, particularly hydrogen fuel cells, is also emerging as a promising solution for long-duration, emissions-free backup power, especially when coupled with green hydrogen production. While still in early adoption phases for data centers, their potential to provide sustained power without combustion-related emissions is a significant technological frontier.

The integration and control of these diverse storage technologies are facilitated by sophisticated energy management systems (EMS) and battery management systems (BMS). EMS platforms, increasingly powered by Artificial Intelligence (AI) and machine learning algorithms, are critical for optimizing the operation of energy storage systems by predicting loads, managing charge/discharge cycles based on energy prices, grid conditions, and renewable energy availability. These intelligent systems enable data centers to participate in demand response programs, engage in energy arbitrage, and actively contribute to grid stability, transforming them from passive consumers to active participants in the energy ecosystem. Furthermore, advancements in power conversion systems (PCS), including inverters and rectifiers, are enhancing the efficiency and flexibility of energy flow between AC and DC power systems, crucial for integrating various storage and generation sources. The ongoing trend towards modular and scalable system designs also allows data center operators to deploy storage solutions that can grow with their needs, reducing initial investment risks and improving adaptability. The collective evolution of these technologies ensures that data centers can meet ever-increasing power demands reliably, sustainably, and cost-effectively.

Regional Highlights

- North America: Dominates the market due to a mature data center industry, high concentration of hyperscale facilities, significant investments in cloud infrastructure, and strong emphasis on energy resilience and grid modernization. The U.S. leads in adoption, driven by large tech companies and favorable regulatory environments for energy efficiency.

- Europe: Experiencing robust growth, primarily fueled by stringent environmental regulations, ambitious carbon neutrality goals, and government incentives for green data centers. Countries like Germany, the UK, and the Nordics are at the forefront, focusing on renewable energy integration and operational efficiency.

- Asia Pacific (APAC): Emerging as the fastest-growing region, driven by rapid digital transformation, increasing internet penetration, widespread cloud adoption, and massive data center construction in economic powerhouses like China, India, Japan, and Southeast Asian nations. Urbanization and digitalization are key catalysts.

- Latin America: Showing nascent but significant growth, powered by increasing digitalization efforts, expanding cloud services, and the need for reliable power infrastructure in developing economies. Brazil and Mexico are key markets with growing investments in data center facilities.

- Middle East and Africa (MEA): Represents an developing market with increasing investment in data center infrastructure, particularly in countries like UAE, Saudi Arabia, and South Africa. Growth is spurred by digital transformation initiatives, smart city projects, and the need for energy security in grid-constrained regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Energy Storage Market.- Tesla Inc.

- Eaton Corporation

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd.

- Siemens AG

- Hitachi Energy Ltd.

- LG Energy Solution

- Samsung SDI Co. Ltd.

- BYD Co. Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Cummins Inc.

- Delta Electronics Inc.

- Huawei Technologies Co. Ltd.

- Mitsubishi Electric Corporation

- CATL (Contemporary Amperex Technology Co. Limited)

- General Electric (GE)

- Socomec

- Piller Power Systems Inc.

Frequently Asked Questions

Analyze common user questions about the Data Center Energy Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is data center energy storage and why is it essential?

Data center energy storage refers to systems that store electrical energy to provide backup power, manage energy costs, and integrate renewables. It's essential for ensuring continuous uptime, preventing data loss during power outages, and optimizing operational efficiency and sustainability in modern data centers.

What are the primary types of energy storage technologies used in data centers?

The primary technologies include lithium-ion batteries (most common due to density and cost), lead-acid batteries (cost-effective for some uses), flywheel energy storage (for immediate power), and increasingly, fuel cells for longer durations. Hybrid solutions combining these are also prevalent.

How does data center energy storage contribute to sustainability?

Energy storage enhances sustainability by enabling the integration of intermittent renewable energy sources, optimizing grid interaction to reduce reliance on fossil fuels, and facilitating peak shaving to lower overall energy consumption from the grid, thereby reducing carbon emissions.

What are the biggest challenges facing the adoption of data center energy storage?

Key challenges include high initial capital investment, space limitations within existing facilities, concerns regarding battery safety and thermal management, and the complexity of integrating diverse storage systems with existing power infrastructure and energy management software.

How is AI impacting the data center energy storage market?

AI is transforming the market by enabling predictive maintenance, optimizing battery charge/discharge cycles for efficiency and longevity, forecasting energy demand, and facilitating intelligent energy arbitrage. This leads to more reliable, cost-effective, and autonomously managed storage systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager