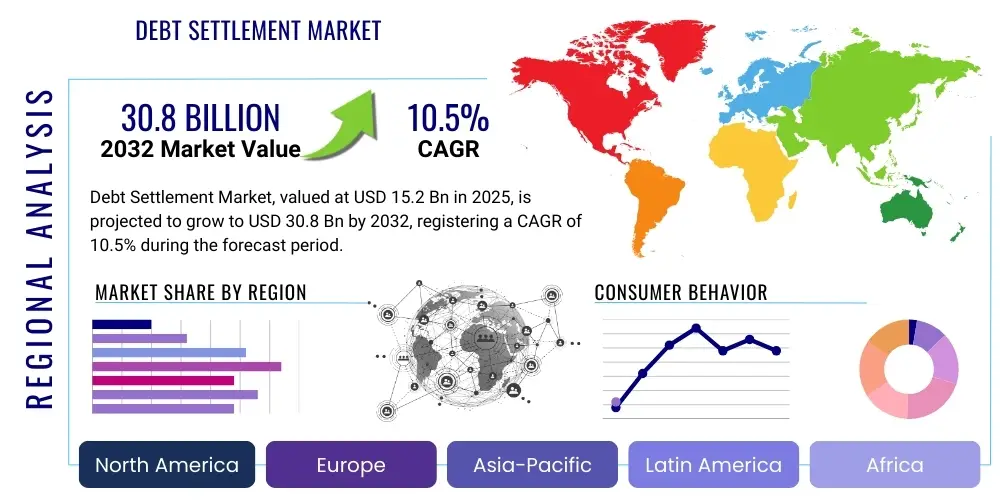

Debt Settlement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427546 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Debt Settlement Market Size

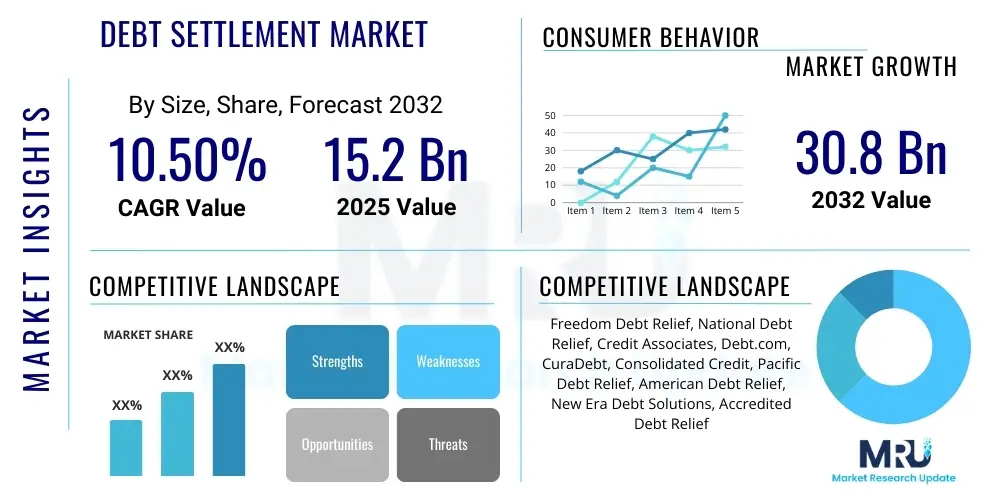

The Debt Settlement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 15.2 Billion in 2025 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2032. This robust growth is primarily driven by escalating consumer debt levels, persistent economic uncertainties, and an increasing awareness among individuals and small businesses regarding viable alternatives to bankruptcy for managing overwhelming financial obligations. The expanding accessibility of digital platforms and personalized financial advisory services further contributes to this upward trajectory, making debt settlement a more attractive and streamlined option for a broader demographic facing financial hardship. The markets expansion reflects a societal shift towards seeking proactive and structured solutions for debt relief, moving beyond traditional methods, as consumers become more educated about their financial options and the long-term implications of various debt management strategies. The evolving regulatory landscape, while presenting challenges, also fosters greater transparency and consumer protection, indirectly bolstering confidence in legitimate debt settlement services.

Debt Settlement Market introduction

The debt settlement market encompasses a range of financial services designed to help consumers and businesses resolve their unsecured debts by negotiating with creditors for a reduced lump-sum payment. This process typically involves a third-party debt settlement company acting on behalf of the debtor, accumulating funds in a special savings account, and then presenting a settlement offer to creditors once a sufficient amount is saved. The primary goal is to achieve a significant reduction in the total amount owed, often preventing bankruptcy and offering a pathway to financial stability for individuals grappling with credit card debt, medical bills, personal loans, and other forms of unsecured liabilities. These services cater to a critical need in an economy characterized by fluctuating employment, rising living costs, and an increasing reliance on credit, providing a structured solution for those who find themselves unable to meet their repayment obligations.

The product description within this market focuses on the negotiation and resolution of various unsecured debts, with service providers acting as intermediaries between debtors and creditors. Major applications span from individual consumers burdened by high-interest credit card balances and personal loans to small businesses struggling with commercial credit lines or vendor debts. The benefits for end-users are substantial, including the potential for significant debt reduction, avoidance of bankruptcy filings, a clear path to becoming debt-free, and an eventual improvement in credit scores once the settlement is successfully completed. Furthermore, debt settlement often provides psychological relief from constant creditor calls and the stress associated with unmanageable debt, allowing individuals to regain control over their financial lives and plan for a more secure future without the ongoing burden of excessive interest and late fees. This service offers a specialized and often more direct approach compared to other debt relief strategies.

Several critical driving factors propel the debt settlement markets growth. Foremost among these is the sustained increase in consumer debt levels across various economies, exacerbated by inflationary pressures and a high-interest rate environment that makes debt repayment more challenging. Economic uncertainties, including job market volatility and income stagnation for many households, further push individuals towards seeking debt relief solutions. Moreover, increased consumer awareness of debt settlement as a viable and often more affordable alternative to bankruptcy or traditional credit counseling plays a significant role. The proliferation of digital platforms and sophisticated marketing strategies by debt settlement companies has also enhanced accessibility and transparency, making it easier for distressed debtors to discover and engage with these services. Finally, evolving regulatory frameworks, while introducing compliance complexities, also lend legitimacy and structure to the industry, fostering greater trust among potential clients.

Debt Settlement Market Executive Summary

The debt settlement market is currently experiencing dynamic shifts driven by evolving business trends, distinct regional growth patterns, and the diversification of service segments. A pivotal business trend involves the increasing digitalization of debt settlement services, with a growing number of providers leveraging online platforms, artificial intelligence, and data analytics to streamline operations, enhance client acquisition, and personalize debt resolution strategies. This technological integration aims to improve efficiency, reduce operational costs, and offer more accessible and user-friendly experiences for consumers. Furthermore, the industry is witnessing a trend towards greater transparency and regulatory compliance, spurred by heightened scrutiny from consumer protection agencies, which is helping to legitimize reputable players and build consumer trust. Strategic partnerships between debt settlement firms and financial technology companies, as well as lead generation specialists, are also becoming more prevalent, expanding market reach and service offerings. This environment fosters innovation while demanding adherence to stringent ethical and legal standards.

Regional trends indicate a robust and mature market in North America, particularly the United States, which continues to be the largest contributor due to high consumer debt levels, established regulatory frameworks, and a strong awareness of debt relief options. Europe also presents a growing market, though fragmented by varying national regulations and economic conditions, with increasing demand in countries experiencing economic slowdowns or high personal insolvency rates. The Asia-Pacific region is emerging as a significant growth area, driven by a rapidly expanding middle class, rising credit penetration, and an increasing prevalence of consumer lending, which inevitably leads to a greater need for debt management solutions. Markets in Latin America, the Middle East, and Africa are still nascent but show considerable potential, as economic development and the expansion of financial services introduce new populations to credit, along with the associated risks of over-indebtedness. These regional variations necessitate tailored marketing and service delivery strategies to effectively penetrate and serve diverse client bases.

Segmentation trends reveal a persistent dominance of credit card debt as the primary type of liability addressed by debt settlement services, given its widespread use and often high-interest rates. However, there is a growing focus on other unsecured debts, including personal loans, medical bills, and even some types of student loan debt, as consumers accumulate diverse financial burdens. The service provider landscape is segmenting into large, established national players and smaller, more niche firms, with online-only platforms gaining significant traction due to their convenience and scalability. Furthermore, the market is observing a segmentation by client demographic, with specialized services emerging for individuals with extremely high debt loads, those on fixed incomes, or even small business owners. This granular approach allows providers to offer more targeted and effective solutions, catering to the specific needs and financial situations of various client segments and optimizing the debt resolution process for better outcomes. The emphasis on personalized plans underscores a shift from one-size-fits-all approaches to more bespoke financial solutions.

AI Impact Analysis on Debt Settlement Market

The integration of Artificial Intelligence (AI) within the debt settlement market is profoundly transforming operational efficiencies, client engagement, and strategic decision-making. Common user questions and concerns often revolve around whether AI will replace human interaction, the accuracy of AI-driven assessments, the ethical implications of data usage, and the potential for increased personalization. Users frequently inquire about how AI can accelerate the negotiation process with creditors, whether it can identify optimal settlement terms, and if their sensitive financial data will be securely managed. There is a strong expectation that AI should lead to faster resolution times, more favorable outcomes, and a more streamlined customer experience, reducing the emotional burden associated with debt. Conversely, concerns include algorithmic bias, the potential for reduced empathy in client interactions, and the "black box" nature of some AI models, which could make it difficult for users to understand how decisions are reached regarding their financial future. These expectations and concerns highlight a desire for both technological advancement and maintained human oversight and ethical considerations within the industry.

- AI-driven data analytics for enhanced client assessment and risk profiling, enabling more accurate predictions of settlement success.

- Automated lead generation and qualification, optimizing outreach to individuals most likely to benefit from debt settlement services.

- Intelligent chatbots and virtual assistants for 24/7 customer support, answering FAQs, and guiding clients through initial application processes.

- Predictive modeling for anticipating creditor responses and negotiating optimal settlement terms, maximizing savings for clients.

- Fraud detection and prevention through pattern recognition in financial data, enhancing security and trustworthiness.

- Personalized debt management plans, dynamically adjusted based on client financial behavior and changing market conditions.

- Automated compliance monitoring and reporting, reducing manual effort and ensuring adherence to complex regulatory requirements.

- Streamlined document processing and verification, accelerating the onboarding of new clients and the overall settlement timeline.

DRO & Impact Forces Of Debt Settlement Market

The debt settlement market is shaped by a complex interplay of drivers, restraints, opportunities, and powerful impact forces that influence its growth trajectory and operational landscape. Key drivers include the persistent rise in consumer debt levels globally, particularly unsecured credit, which creates a continuous demand for relief solutions. Economic volatility, such as periods of inflation, high-interest rates, and job market instability, pushes more individuals and small businesses into financial distress, making debt settlement an attractive alternative to bankruptcy. Furthermore, increasing consumer awareness about debt settlement as a viable option, facilitated by digital marketing and accessible online platforms, significantly contributes to market expansion. The desire among debtors to avoid the long-term stigma and credit impact of bankruptcy also fuels the adoption of these services, positioning debt settlement as a strategic choice for financial recovery. These factors collectively create a fertile ground for the industry to expand and innovate.

However, the market also faces significant restraints. A primary challenge is the complex and often varying regulatory environment across different states and countries, which necessitates substantial compliance efforts and can lead to increased operational costs for providers. Negative perceptions and past controversies surrounding predatory practices by some firms have also created a trust deficit, making it harder for legitimate companies to attract and retain clients. Competition from alternative debt relief solutions, such as credit counseling, debt consolidation, and personal bankruptcy, presents a constant challenge, as consumers weigh various options based on their unique financial situations and risk tolerance. Moreover, the inherent risk for debtors, where monthly payments are saved rather than directly paid to creditors during the negotiation phase, can sometimes lead to increased interest and fees if settlements are not successfully achieved, posing a psychological barrier for potential clients. These restraints demand continuous innovation in service delivery and transparent communication.

Despite the challenges, numerous opportunities exist for growth and innovation within the debt settlement market. The expanding adoption of financial technology (FinTech) offers avenues for enhancing service delivery through AI-driven analytics, automated client onboarding, and improved communication channels, leading to greater efficiency and personalization. Untapped markets, particularly in emerging economies where credit usage is rising rapidly but financial literacy and debt relief options are less developed, represent significant potential for expansion. Strategic partnerships with financial institutions, credit reporting agencies, and other financial service providers can create synergistic opportunities for lead generation and integrated service offerings. Additionally, a focus on improving consumer education and building transparent, ethical business models can help overcome historical trust issues and strengthen the industrys reputation, attracting a broader client base seeking legitimate and effective debt relief. The evolving digital landscape opens doors for scalable and cost-effective service provision.

Segmentation Analysis

The debt settlement market is multifaceted, characterized by various segmentation strategies that help understand its intricate dynamics and cater to diverse client needs. Analyzing the market through different lenses such as debt type, service provider, channel, and end-user provides crucial insights into the underlying demand, competitive landscape, and areas for strategic growth. This granular approach allows industry participants to tailor their services, marketing efforts, and operational models to specific segments, optimizing their reach and effectiveness. Understanding these distinctions is paramount for developing targeted solutions and navigating the complex regulatory and economic factors that influence each segment. The markets segmentation reflects the diverse financial challenges faced by consumers and businesses, requiring a bespoke approach to debt resolution.

- By Debt Type:

- Credit Card Debt: Dominant segment due to widespread usage, high-interest rates, and revolving nature.

- Personal Loan Debt: Growing segment, encompassing unsecured loans from banks, credit unions, and online lenders.

- Medical Debt: Significant and often unexpected burden, leading to an increasing need for settlement solutions.

- Student Loan Debt (Private): Specific niche, as federal student loans often have different relief programs.

- Other Unsecured Debts: Includes collection agency accounts, old utility bills, and some commercial debts for small businesses.

- By Service Provider:

- Independent Debt Settlement Companies: Specialized firms solely focused on debt settlement, often providing personalized services.

- Financial Institutions and Banks: Some offer in-house or affiliated debt relief programs, often alongside other financial services.

- Law Firms: Providing debt settlement as part of broader legal services, particularly for complex cases or high-value debts.

- Online/Digital Platforms: Technology-driven companies offering streamlined, often automated, debt settlement processes.

- By Channel:

- Online/Digital: Predominant and growing channel, offering convenience, accessibility, and scalability through web portals and mobile apps.

- Offline/Traditional: Includes physical offices, call centers, and face-to-face consultations, catering to clients who prefer direct interaction.

- Referral Networks: Services accessed through financial advisors, credit counselors, or other industry professionals.

- By End-User:

- Individuals/Consumers: The largest segment, including those with personal financial hardship.

- Small and Medium-sized Enterprises (SMEs): Businesses facing financial distress and seeking to resolve commercial debts without bankruptcy.

Debt Settlement Market Value Chain Analysis

The debt settlement markets value chain is a multi-tiered process encompassing various stages, from initial lead generation to the final settlement and post-settlement support. Understanding this chain involves analyzing the upstream activities, which include sourcing potential clients and verifying their eligibility, and downstream processes, focused on negotiating with creditors and managing funds. The efficiency and effectiveness of each stage are crucial for successful debt resolution and client satisfaction. Furthermore, the distribution channels, both direct and indirect, play a pivotal role in how clients access these services and how providers interact with the broader financial ecosystem. Each link in this chain adds value and contributes to the overall service delivery, impacting the cost, speed, and success rate of debt settlement for the end-user. Optimization at every stage is essential for competitive advantage and sustainable growth within the industry.

Upstream activities in the debt settlement value chain primarily revolve around client acquisition and initial assessment. This begins with robust lead generation, often utilizing digital marketing, affiliate partnerships, and referral networks from credit counseling agencies or financial advisors. Once potential clients are identified, the next critical step involves thorough due diligence, including financial qualification, verification of debt types, and assessment of the debtors financial hardship. This stage often involves sophisticated data analytics and credit reporting tools to determine the viability of debt settlement as a suitable option. Technology vendors supplying CRM systems, data processing software, and compliance tools are essential upstream partners, enabling efficient client management and ensuring adherence to regulatory requirements. The quality of these upstream processes directly impacts the operational efficiency and success rates of the subsequent settlement activities, as accurate client profiling leads to more realistic expectations and better negotiation outcomes for all parties involved.

Downstream analysis focuses on the core service delivery and post-settlement phases. Once a client is onboarded, the debt settlement company acts as an intermediary, collecting scheduled payments into a dedicated escrow or special purpose savings account, and then engaging in direct negotiations with creditors or their collection agencies. This negotiation phase requires expertise in understanding creditor policies, legal frameworks, and effective bargaining strategies to achieve a reduced settlement amount. Following a successful settlement, the lump sum is disbursed to the creditor, and the client receives documentation of the resolution. Post-settlement support involves advising clients on rebuilding credit, financial planning, and addressing any lingering creditor communications. Distribution channels vary; direct channels involve clients engaging directly with the debt settlement company through their website or call center. Indirect channels include referrals from financial advisors, legal professionals, or partnerships with credit repair services, expanding market reach and offering integrated financial solutions to a broader spectrum of individuals in need. The seamless execution of these downstream activities ensures client satisfaction and reinforces the providers reputation.

Debt Settlement Market Potential Customers

The debt settlement market primarily targets a specific demographic of individuals and small businesses that are experiencing significant financial hardship due to unmanageable unsecured debt. These potential customers are typically those who have exhausted other debt management options, such as budgeting, credit counseling, or debt consolidation, or for whom these options are simply insufficient given the scale of their financial obligations. They are often characterized by high levels of unsecured debt, such as credit card balances, personal loans, and medical bills, which have become overwhelming due to factors like job loss, illness, divorce, or unexpected financial emergencies. These individuals are seeking a structured and effective solution to alleviate their debt burden without resorting to bankruptcy, which they view as a last resort due to its severe and prolonged impact on credit and financial standing. Understanding this core demographic is crucial for tailoring services and communication strategies effectively to meet their specific needs and concerns.

Beyond the core consumer segment, the market also serves a growing number of small business owners. These entrepreneurs often use personal credit for business expenses or incur commercial debts that become unsustainable due to economic downturns, market shifts, or unforeseen operational challenges. For small businesses, debt settlement can provide a lifeline, allowing them to resolve outstanding liabilities, avoid business insolvency, and preserve their credit reputation, which is vital for future financing and operations. Both individual consumers and small business owners share a common desire for a practical, often quicker, resolution to their debt problems than long-term repayment plans might offer. They prioritize reducing the principal amount owed and achieving a clear, finite path to becoming debt-free, even if it entails a temporary negative impact on their credit score. This segment is highly motivated by the promise of a fresh financial start and the opportunity to rebuild their economic stability post-settlement. Providers must therefore emphasize both the short-term relief and long-term benefits in their client engagement.

Moreover, potential customers often include those who are proactive about their financial well-being but have found themselves in an unforeseen difficult situation, rather than those who are financially irresponsible. They are typically educated enough to seek out and evaluate different debt relief options, often performing extensive online research before engaging with a service provider. These clients value transparency, clear communication, and a service that demonstrates a strong track record of successful negotiations. They seek professional guidance from reputable firms that can navigate the complex negotiation process with creditors on their behalf, offering expert advice and support throughout the settlement journey. Therefore, building trust and demonstrating credibility through ethical practices and measurable results are paramount for attracting and retaining these potential customers. The emotional and psychological relief provided by a clear debt resolution plan is often as important as the financial savings for this key demographic, making empathy and effective communication vital components of service delivery.

Debt Settlement Market Key Technology Landscape

The debt settlement market is increasingly leveraging advanced technologies to enhance efficiency, improve client experience, and streamline complex operations. At the forefront of this technological evolution are sophisticated Customer Relationship Management (CRM) systems, which serve as the backbone for managing client interactions, tracking case progress, and ensuring seamless communication across all stages of the settlement process. These CRMs are often integrated with other platforms to provide a holistic view of the client journey, from initial inquiry to final debt resolution. Furthermore, data analytics tools, powered by machine learning algorithms, are becoming indispensable for assessing client eligibility, predicting negotiation outcomes, and identifying optimal settlement strategies. This technological shift is moving the industry towards more data-driven decision-making, reducing reliance on manual processes, and ultimately offering more precise and effective solutions to clients. The emphasis is on creating scalable and robust technological infrastructures that can handle increasing volumes of clients while maintaining high service quality and compliance.

Beyond foundational CRM and data analytics, the industry is seeing significant adoption of Artificial Intelligence (AI) and Machine Learning (ML) for more complex tasks. AI-powered chatbots and virtual assistants are being deployed to provide instant customer support, answer frequently asked questions, and guide potential clients through initial information gathering, thereby improving accessibility and reducing the workload on human agents. Robotic Process Automation (RPA) is being utilized to automate repetitive administrative tasks, such as document processing, data entry, and compliance reporting, leading to substantial reductions in operational costs and human error. Secure communication platforms, often encrypted and compliant with financial data regulations, are essential for protecting sensitive client information and facilitating secure interactions between clients, settlement companies, and creditors. These technologies collectively enable debt settlement firms to operate with greater agility and responsiveness, providing a competitive edge in a demanding market and ensuring that client data is managed with the utmost security and integrity.

Another critical area within the technology landscape involves tools for compliance and fraud detection. Given the stringent regulatory environment governing debt settlement, automated compliance software helps firms monitor adherence to consumer protection laws, track disclosure requirements, and manage licensing across various jurisdictions. This mitigates legal risks and strengthens the industrys reputation. Blockchain technology, while still in nascent stages of adoption, holds potential for creating immutable records of transactions and agreements, enhancing transparency and security in debt resolution processes. Cloud computing infrastructure provides the scalability and flexibility required to manage large datasets and run complex applications without significant upfront hardware investments, making advanced technology accessible even to smaller firms. The continuous evolution of these technologies ensures that debt settlement providers can offer more innovative, efficient, and secure services, keeping pace with client expectations and regulatory demands in an increasingly digital financial world. The integration of these various technologies forms a comprehensive ecosystem that supports the entire debt settlement lifecycle.

Regional Highlights

- North America: The largest and most mature market, primarily driven by the United States and Canada. High consumer debt levels, particularly credit card and personal loan debt, coupled with established regulatory frameworks and strong consumer awareness, fuel demand. Significant presence of major debt settlement companies and robust competition.

- Europe: A growing market, characterized by diverse national regulations and economic conditions. Countries like the UK, Germany, and Spain show increasing demand due to economic uncertainties and rising household debt. Regulatory harmonization efforts are slowly progressing, impacting market operations and expansion.

- Asia-Pacific: Emerging as a high-growth region, propelled by rapid economic development, increasing credit penetration, and a burgeoning middle class in countries such as China, India, and Australia. While awareness is lower than in Western markets, the rise in consumer lending is creating a substantial need for debt relief solutions.

- Latin America: A nascent but promising market. Economic fluctuations and growing access to credit, especially in Brazil and Mexico, are leading to an increase in over-indebtedness. The market is less developed but offers significant potential for growth as financial literacy and debt relief services expand.

- Middle East & Africa: In its early stages of development, with demand slowly increasing in urban centers and financially developing economies. Growing credit markets and evolving financial regulations present both opportunities and challenges for the expansion of debt settlement services in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Debt Settlement Market.- Freedom Debt Relief

- National Debt Relief

- Credit Associates

- Debt.com

- CuraDebt

- Consolidated Credit

- Pacific Debt Relief

- American Debt Relief

- New Era Debt Solutions

- Accredited Debt Relief

Frequently Asked Questions

What exactly is debt settlement and how does it work?

Debt settlement is a process where a third-party company negotiates with your creditors to reduce the total amount you owe on unsecured debts, such as credit cards and personal loans. You stop making payments to creditors and instead save money into a special account. Once enough funds accumulate, the settlement company offers a lump-sum payment to creditors, typically less than the original amount, to resolve the debt entirely.

How does debt settlement impact my credit score?

Debt settlement can initially have a negative impact on your credit score as you stop making payments to creditors, leading to missed payment notations and potentially charge-offs. However, once the debts are settled and reported as such, your credit score can begin to recover over time, often improving faster than if you were to declare bankruptcy or continue struggling with overwhelming debt.

Is debt settlement a better option than bankruptcy or credit counseling?

Debt settlement is a distinct option. Unlike bankruptcy, it avoids a federal court process and the severe, long-term credit implications. Compared to credit counseling, which focuses on managing and repaying the full debt amount, debt settlement aims to reduce the principal owed. The best option depends on your specific financial situation, debt amount, and ability to make regular payments to a settlement fund.

What types of debts can be included in a debt settlement program?

Debt settlement programs primarily target unsecured debts, which are not backed by collateral. This typically includes credit card balances, personal loans, medical bills, and some private student loans. Secured debts, such as mortgages or auto loans, and federal student loans are generally not eligible for debt settlement, as they have different repayment and relief structures.

How much does debt settlement cost, and how long does the process take?

The cost of debt settlement typically involves a fee, often a percentage of the enrolled debt or the amount saved, paid to the settlement company upon successful resolution. The duration of the process varies significantly, usually ranging from 24 to 48 months, depending on the total debt amount, the number of creditors, and your ability to save funds consistently. Its crucial to understand all fees and timelines upfront.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- AFCC Debt Settlement Market Statistics 2025 Analysis By Application (Open-end Loan, Closed-end Loan), By Type (Credit Card Loan, Medical Loan, Private Student Loan), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Debt Settlement Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Credit Card Debt, Student Loan Debt, Others), By Application (Private, Enterprise), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Debt Settlement Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Student Loan Debt, Consumer Debt, Others), By Application (Enterprise, Private, Government, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager