Defense Cybersecurity Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427877 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Defense Cybersecurity Market Size

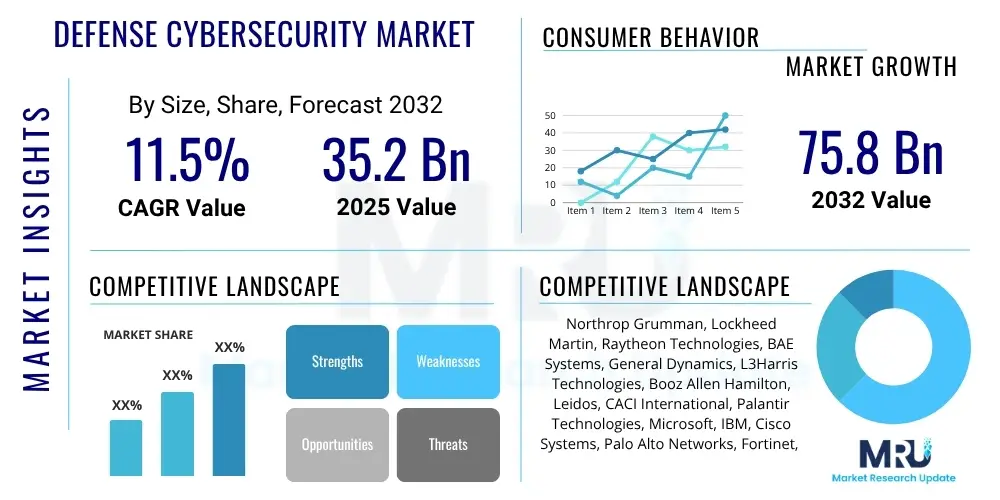

The Defense Cybersecurity Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 35.2 Billion in 2025 and is projected to reach USD 75.8 Billion by the end of the forecast period in 2032. This substantial growth is primarily driven by escalating geopolitical tensions, the increasing sophistication of cyber threats from state-sponsored actors and cybercriminal groups, and the imperative for defense organizations to protect critical national infrastructure and sensitive military data from espionage, sabotage, and disruption.

Defense Cybersecurity Market introduction

The Defense Cybersecurity Market encompasses a specialized segment of the broader cybersecurity industry, focusing on the unique and rigorous requirements of national defense organizations, military branches, and intelligence agencies. It involves the deployment of advanced technologies, strategies, and services designed to protect critical military networks, weapon systems, command and control infrastructure, intelligence assets, and sensitive data from cyberattacks. These attacks can range from data breaches and intellectual property theft to direct operational disruptions and sabotage of critical defense systems, necessitating a robust and adaptive cybersecurity posture.

The products and services within this market are characterized by their high levels of security, resilience, and compliance with stringent defense-specific standards. Key offerings include advanced threat intelligence platforms, identity and access management (IAM) solutions, data loss prevention (DLP), security information and event management (SIEM), next-generation firewalls, intrusion detection/prevention systems (IDS/IPS), encryption technologies, endpoint detection and response (EDR), cloud security, and network security solutions. These components work in concert to create a multi-layered defense against persistent and evolving threats, ensuring the integrity, confidentiality, and availability of defense assets.

Major applications of defense cybersecurity span across various military domains, including protecting strategic communication networks, safeguarding intelligent weapon systems, securing critical infrastructure like military bases and supply chains, and defending operational technology (OT) in defense manufacturing. The benefits derived from robust defense cybersecurity are paramount: it ensures national security, maintains military superiority, protects sensitive intelligence, prevents financial losses from cyber espionage, and preserves public trust in defense capabilities. Driving factors include the continuous evolution of sophisticated cyber threats, increased digitalization of military operations, the growing reliance on interconnected systems, and the imperative to comply with stringent government regulations and international cybersecurity frameworks.

Defense Cybersecurity Market Executive Summary

The Defense Cybersecurity Market is experiencing robust expansion driven by a confluence of escalating geopolitical tensions, an increasingly sophisticated threat landscape, and the rapid digitalization of military operations worldwide. Business trends indicate a strong emphasis on integrating artificial intelligence (AI) and machine learning (ML) into defensive capabilities, moving towards proactive threat hunting and predictive security analytics. There is also a significant push towards zero-trust architectures, cloud security adoption for enhanced flexibility and scalability, and the development of quantum-resistant cryptographic solutions to prepare for future threats. Companies are focusing on strategic partnerships and mergers to consolidate expertise and offer comprehensive, integrated security suites to defense clients.

Regionally, North America continues to dominate the market due to substantial defense budgets, advanced technological infrastructure, and the presence of leading cybersecurity innovators and defense contractors, particularly within the United States. Europe is also a significant market, driven by collective defense initiatives, national cybersecurity strategies, and investments in modernizing military IT infrastructure, with key contributions from countries like the UK, Germany, and France. The Asia Pacific region is emerging as a high-growth market, propelled by increasing defense spending, rising cyber threats from state-sponsored actors, and a growing focus on indigenous cybersecurity development in countries such as China, India, Japan, and South Korea, which are rapidly expanding their digital defense capabilities.

Segment-wise, the solutions segment, particularly advanced threat intelligence, endpoint security, and cloud security, is witnessing significant uptake due to the need for comprehensive and adaptive defenses against evolving cyber-physical threats. Services, including managed security services and consulting, are also experiencing substantial growth as defense organizations seek external expertise to navigate complex security challenges and bridge internal skill gaps. By deployment type, hybrid cloud solutions are gaining traction, offering a balance between the security of on-premise systems and the agility of cloud environments. The end-user segments, including Air Force, Army, and Navy, are all investing heavily in tailored cybersecurity solutions to protect their distinct operational technology and information technology infrastructures.

AI Impact Analysis on Defense Cybersecurity Market

Common user questions regarding AI's impact on the Defense Cybersecurity Market frequently revolve around the dual nature of AI: its potential as a formidable defensive tool versus its capacity to empower advanced adversaries. Users are keen to understand how AI can enhance threat detection, automate responses, and bolster predictive capabilities, particularly against sophisticated, rapidly evolving threats that traditional methods might miss. Simultaneously, there are significant concerns about the security of AI systems themselves, the ethical implications of autonomous cyber warfare, the potential for AI-driven misinformation campaigns, and the challenge of defending against AI-powered attacks from state-sponsored actors. Expectations center on AI's ability to revolutionize intelligence gathering, optimize resource allocation, and provide a decisive advantage in the cyber domain, while also acknowledging the critical need for human oversight and robust validation frameworks to prevent unintended consequences or adversarial manipulation.

- AI significantly enhances threat detection capabilities by analyzing vast datasets for anomalous patterns, indicators of compromise (IoCs), and sophisticated attack vectors that human analysts might overlook.

- Predictive analytics powered by AI allows defense organizations to anticipate potential cyberattacks, identify vulnerabilities before exploitation, and proactively strengthen defenses against emerging threats.

- Automation of routine security tasks, such as log analysis, incident triage, and patch management, reduces response times and frees human analysts to focus on more complex strategic challenges.

- AI-driven deception technologies can create convincing decoys and honeypots, diverting adversaries from critical assets and gathering crucial intelligence on their tactics, techniques, and procedures (TTPs).

- Autonomous response systems, while ethically contentious, offer the potential for near real-time mitigation of attacks, especially in high-speed, machine-driven cyber warfare scenarios where human intervention is too slow.

- AI can optimize the allocation of scarce cybersecurity resources by identifying the most critical assets and vulnerabilities, ensuring that defensive efforts are concentrated where they are most effective.

- Adversarial AI poses a significant challenge, enabling attackers to develop more sophisticated malware, launch highly targeted phishing campaigns, and evade traditional security measures, necessitating robust counter-AI defenses.

- The development of secure AI systems is paramount, as compromised AI models could be manipulated to introduce backdoors, misclassify threats, or facilitate supply chain attacks within defense infrastructure.

- AI also plays a role in enhancing intelligence gathering and analysis, helping to process and interpret massive amounts of data from open-source intelligence (OSINT), signals intelligence (SIGINT), and human intelligence (HUMINT) to inform strategic defense decisions.

- Continuous learning capabilities of AI systems allow defense cybersecurity solutions to adapt and evolve alongside the threat landscape, ensuring long-term resilience against novel attack methodologies.

DRO & Impact Forces Of Defense Cybersecurity Market

The Defense Cybersecurity Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, all contributing to a dynamic operational environment. A primary driver is the escalating global geopolitical instability, leading to increased state-sponsored cyber espionage and sabotage, which necessitates advanced defensive capabilities for military and critical national infrastructure. The rapid digitalization of modern warfare, including the integration of IoT, AI, and cloud technologies into defense systems, expands the attack surface significantly, making robust cybersecurity indispensable. Furthermore, the continuous evolution of sophisticated persistent threats (APTs) and zero-day vulnerabilities from diverse adversarial groups compels defense organizations to invest heavily in cutting-edge security solutions to protect sensitive data and operational integrity.

However, the market also faces significant restraints. The substantial capital expenditure required for implementing and maintaining advanced defense cybersecurity systems can be prohibitive for some nations, leading to potential gaps in global defense postures. A critical shortage of skilled cybersecurity professionals within defense sectors globally hampers the effective deployment and management of complex security technologies, creating an ongoing talent gap. Additionally, the challenge of integrating new, advanced security solutions with existing legacy IT and OT infrastructure within defense organizations often creates compatibility issues and operational complexities, slowing down modernization efforts and increasing vulnerability. The highly stringent regulatory and compliance frameworks, while necessary, can also introduce bureaucratic hurdles and slow down procurement and deployment processes.

Opportunities within the Defense Cybersecurity Market are abundant, especially with the accelerated adoption of artificial intelligence and machine learning for predictive threat intelligence, automated response, and anomaly detection, offering a significant leap in defensive capabilities. The emergence of quantum computing necessitates research and development into quantum-safe cryptography, presenting a long-term opportunity for secure communication and data protection. Increased international collaborations and information sharing among allied nations offer avenues for collective defense strategies and shared intelligence against common adversaries. Furthermore, the growing demand for cloud-based security solutions and managed security services allows defense agencies to leverage specialized expertise and scalable infrastructure without the burden of in-house development and maintenance, fostering market growth and innovation. These forces collectively shape the competitive landscape and strategic direction of the defense cybersecurity industry.

Segmentation Analysis

The Defense Cybersecurity Market is rigorously segmented across various dimensions to provide a detailed understanding of its complex landscape and evolving dynamics. This segmentation helps in identifying specific needs, technological preferences, and operational requirements across different defense entities and their unique operational environments. By analyzing the market through these distinct lenses, stakeholders can better understand investment priorities, technological adoption trends, and regional disparities in cybersecurity posture. The granularity of these segments allows for targeted strategy development, product innovation, and resource allocation to address the multifaceted challenges faced by defense organizations in safeguarding their digital and physical assets.

- By Component

- Solutions

- Threat Intelligence

- Identity and Access Management (IAM)

- Data Loss Prevention (DLP)

- Security Information and Event Management (SIEM)

- Firewall

- Intrusion Detection/Prevention Systems (IDS/IPS)

- Encryption

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Data Security

- Zero Trust Architecture (ZTA)

- Security Orchestration, Automation, and Response (SOAR)

- Vulnerability Management

- Services

- Consulting Services

- Implementation Services

- Support & Maintenance Services

- Managed Security Services (MSS)

- Training and Education

- Penetration Testing & Red Teaming

- Incident Response

- Solutions

- By Deployment Type

- On-premise

- Cloud (Public, Private, Hybrid)

- Hybrid

- By Security Type

- Network Security

- Endpoint Security

- Cloud Security

- Application Security

- Data Security

- Mobile Security

- IoT Security (for military IoT/IoMT)

- Operational Technology (OT) Security

- By End User

- Air Force

- Army

- Navy

- Other Defense Organizations (e.g., Intelligence Agencies, Special Forces, Defense Research & Development)

Value Chain Analysis For Defense Cybersecurity Market

The value chain for the Defense Cybersecurity Market is intricate, involving multiple specialized stages from foundational research and development to final deployment and ongoing maintenance. Upstream activities are dominated by fundamental research, often conducted by government-funded defense labs, academic institutions, and specialized technology companies, focusing on breakthroughs in cryptography, secure hardware design, AI for cybersecurity, and quantum computing defense. This stage also includes the development of core components such as secure microprocessors, specialized operating systems, and advanced sensor technologies, which form the bedrock of robust cybersecurity solutions. Specialized software vendors and hardware manufacturers contribute to these upstream segments by producing highly secure, tamper-resistant technologies tailored for defense applications, adhering to strict government specifications and certifications.

Midstream activities involve the integration and assembly of these core technologies into comprehensive cybersecurity solutions. This phase is typically managed by large defense contractors and specialized cybersecurity firms who design, develop, and customize platforms like SIEM, EDR, IDS/IPS, and encrypted communication systems. System integrators play a crucial role here, ensuring that various hardware and software components work seamlessly together within complex defense IT and OT environments. Extensive testing, validation, and certification processes, often involving government agencies and independent security labs, are critical during this stage to meet stringent military-grade security requirements and operational effectiveness standards before deployment.

Downstream activities focus on the delivery, deployment, and continuous management of these cybersecurity solutions to end-users within defense organizations. Distribution channels are predominantly direct, involving direct contracts between defense contractors/solution providers and military branches or government agencies due to the sensitive nature and customization requirements of the products. Indirect channels are less common but may involve specialized resellers or value-added partners for specific niche components or support services. Post-deployment, the value chain extends to ongoing support, maintenance, threat intelligence updates, incident response services, and continuous training provided by solution vendors or specialized managed security service providers (MSSPs). This continuous engagement ensures that defense cybersecurity systems remain effective against evolving threats and operate optimally throughout their lifecycle, highlighting the long-term, relationship-driven nature of this market.

Defense Cybersecurity Market Potential Customers

The primary potential customers and end-users of defense cybersecurity products and services are national defense organizations across the globe, each with unique operational environments and security requirements. This includes the various branches of the military – the Army, Navy, and Air Force – which have distinct infrastructure, ranging from ground-based command centers and combat vehicles to naval vessels and sophisticated aerial platforms. Each branch requires tailored cybersecurity solutions to protect their specific IT and operational technology (OT) systems, ensuring mission critical functionality and safeguarding sensitive intelligence data from infiltration, disruption, or destruction by adversarial forces. The complexity of these systems necessitates highly specialized security measures that go beyond commercial-grade offerings, designed to withstand advanced persistent threats (APTs) from state-sponsored actors.

Beyond the core military branches, other significant end-users include national intelligence agencies responsible for collecting, analyzing, and disseminating critical intelligence to inform national security decisions. These agencies require top-tier cybersecurity to protect their highly classified networks, data repositories, and communication channels from foreign intelligence services and terrorist groups. Furthermore, defense research and development organizations, which are at the forefront of developing next-generation military technologies, are prime targets for intellectual property theft and require robust cybersecurity to safeguard sensitive R&D blueprints and prototypes. Government entities involved in critical national infrastructure protection, such as those overseeing defense manufacturing, strategic energy grids, and transportation systems, also constitute a vital customer segment, as their compromise could have severe national security implications.

In addition to direct government and military entities, the supply chain for defense industries represents a growing segment of potential customers. This includes defense contractors, aerospace companies, and technology providers that develop, manufacture, and maintain components and systems for military use. These private sector entities are increasingly targeted by cyber adversaries seeking to exploit vulnerabilities in the defense supply chain to gain access to classified information or disrupt national defense capabilities. Consequently, they require sophisticated cybersecurity solutions that align with government security mandates, encompassing everything from secure software development lifecycle practices to supply chain risk management tools and compliance with frameworks like CMMC (Cybersecurity Maturity Model Certification) and NIST standards. The imperative for comprehensive security across the entire defense ecosystem expands the customer base significantly, fostering a collaborative security environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 35.2 Billion |

| Market Forecast in 2032 | USD 75.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman, Lockheed Martin, Raytheon Technologies, BAE Systems, General Dynamics, L3Harris Technologies, Booz Allen Hamilton, Leidos, CACI International, Palantir Technologies, Microsoft, IBM, Cisco Systems, Palo Alto Networks, Fortinet, Check Point Software Technologies, CrowdStrike, Mandiant (Google Cloud), Tenable, Zscaler. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Defense Cybersecurity Market Key Technology Landscape

The Defense Cybersecurity Market is characterized by a rapidly evolving technological landscape, driven by the need to counter increasingly sophisticated threats and secure complex military systems. Artificial intelligence (AI) and machine learning (ML) stand at the forefront, revolutionizing threat detection, predictive analytics, and automated response capabilities. These technologies enable defense systems to analyze vast amounts of data, identify anomalous patterns indicative of cyberattacks in real-time, and even learn from past incidents to improve future defensive postures. AI-powered behavioral analytics, for example, can detect subtle deviations from normal system activity that may signal an advanced persistent threat (APT), offering a proactive defense mechanism against stealthy adversaries. The integration of AI extends to natural language processing (NLP) for threat intelligence analysis and deep learning for advanced malware detection, enhancing the speed and accuracy of cybersecurity operations.

Beyond AI/ML, the adoption of zero-trust architectures (ZTA) is becoming a foundational principle for defense cybersecurity. Unlike traditional perimeter-based security, ZTA operates on the principle of "never trust, always verify," requiring strict identity verification for every user and device attempting to access network resources, regardless of their location. This approach significantly reduces the risk of insider threats and lateral movement by adversaries who have breached the perimeter. Secure cloud computing, encompassing private, public, and hybrid cloud models, is also a critical technology as defense organizations increasingly leverage cloud environments for data storage, processing, and application deployment. This requires advanced cloud security posture management (CSPM), cloud workload protection platforms (CWPP), and secure access service edge (SASE) solutions to extend robust security controls to distributed cloud infrastructures.

Further integral technologies include advanced encryption and post-quantum cryptography (PQC) development, which is crucial for protecting sensitive communications and data against the future threat posed by quantum computers capable of breaking current cryptographic standards. Blockchain technology is being explored for its potential in secure data integrity, identity management, and supply chain security within defense applications, offering immutable ledgers for verifiable transactions and asset tracking. Operational Technology (OT) security, encompassing industrial control systems (ICS) and SCADA systems found in military infrastructure and weapon platforms, is also a rapidly expanding technological focus. This requires specialized solutions to protect against cyber-physical attacks that could disrupt critical defense operations. The convergence of these technologies, coupled with robust cybersecurity training and awareness programs, forms the comprehensive defense cybersecurity ecosystem.

Regional Highlights

- North America: This region consistently dominates the Defense Cybersecurity Market, primarily driven by the United States. The U.S. has the largest defense budget globally, coupled with a robust technological infrastructure and a strong ecosystem of defense contractors and cybersecurity innovators. Significant investments are channeled into securing critical national infrastructure, military networks, and advanced weapon systems. The presence of agencies like the Department of Defense (DoD), NSA, and CISA, along with stringent regulatory frameworks and continuous R&D initiatives, fuels market growth. Canada also contributes to regional growth, focusing on modernizing its military's cyber defenses and participating in international cybersecurity collaborations.

- Europe: Europe represents a substantial and growing market for defense cybersecurity. Countries like the United Kingdom, Germany, and France are leading contributors, driven by increasing awareness of cyber threats from state-sponsored actors and a push towards collective defense strategies through NATO and the EU. Investments are concentrated on securing national military assets, critical infrastructure, and enhancing cyber warfare capabilities. The region benefits from strong domestic cybersecurity industries and collaborative research efforts, aimed at developing resilient cyber defenses against a diverse threat landscape. Eastern European nations are also ramping up their cybersecurity spending in response to regional geopolitical tensions.

- Asia Pacific (APAC): The APAC region is projected to be one of the fastest-growing markets, fueled by escalating geopolitical rivalries, rapid military modernization programs, and significant increases in defense spending, particularly in countries like China, India, Japan, and South Korea. These nations face complex cybersecurity challenges, including sophisticated state-sponsored attacks and industrial espionage targeting defense technologies. The market is characterized by a strong focus on developing indigenous cybersecurity capabilities, adopting advanced technologies like AI/ML for defense, and securing rapidly expanding digital military infrastructures. Australia also plays a key role, investing heavily in cyber defense to protect its national interests.

- Latin America: The Defense Cybersecurity Market in Latin America is in a nascent but growing phase. While defense budgets are generally smaller compared to other regions, there is an increasing recognition of the importance of cybersecurity for national security, particularly in countries like Brazil and Mexico. The focus is primarily on protecting critical government infrastructure, improving intelligence capabilities, and enhancing the cybersecurity posture of their respective armed forces. International collaborations and technology transfers from more advanced nations often play a crucial role in the development and adoption of cybersecurity solutions in this region.

- Middle East and Africa (MEA): The MEA region is experiencing significant growth in defense cybersecurity investments, driven by ongoing geopolitical conflicts, the need to protect vital oil and gas infrastructure, and heightened concerns over cyber terrorism and state-sponsored attacks. Countries such as Saudi Arabia, UAE, and Israel are leading this charge, investing heavily in advanced cybersecurity technologies and building robust cyber defense capabilities. Israel, in particular, is a global leader in cybersecurity innovation, contributing both as a consumer and a provider of advanced defense solutions. South Africa is also a key player in the African market, focusing on modernizing its defense infrastructure and strengthening its cybersecurity posture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Defense Cybersecurity Market.- Northrop Grumman

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- General Dynamics

- L3Harris Technologies

- Booz Allen Hamilton

- Leidos

- CACI International

- Palantir Technologies

- Microsoft

- IBM

- Cisco Systems

- Palo Alto Networks

- Fortinet

- Check Point Software Technologies

- CrowdStrike

- Mandiant (Google Cloud)

- Tenable

- Zscaler

Frequently Asked Questions

Analyze common user questions about the Defense Cybersecurity market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Defense Cybersecurity Market?

The market's growth is primarily driven by escalating geopolitical tensions, the increasing sophistication of cyber threats from state-sponsored actors, the rapid digitalization of military operations, and the critical need to protect sensitive national defense infrastructure and data.

How is AI impacting defense cybersecurity strategies?

AI significantly enhances threat detection, enables predictive analytics for anticipating attacks, automates routine security tasks, and offers potential for autonomous responses. However, it also introduces challenges related to adversarial AI and the security of AI systems themselves.

What are the biggest challenges faced by the Defense Cybersecurity Market?

Key challenges include high implementation costs, a severe global shortage of skilled cybersecurity professionals, difficulties in integrating new technologies with legacy defense systems, and navigating complex regulatory and compliance environments.

Which geographical region holds the largest share in the Defense Cybersecurity Market?

North America, particularly the United States, currently holds the largest market share due to its substantial defense budget, advanced technological infrastructure, and the presence of leading defense and cybersecurity companies.

What emerging technologies are critical for future defense cybersecurity?

Critical emerging technologies include post-quantum cryptography (PQC), advanced AI/ML for threat intelligence and response, zero-trust architectures, secure cloud computing solutions, and specialized operational technology (OT) security for military systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager