Defense Integrated Antenna Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430428 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Defense Integrated Antenna Market Size

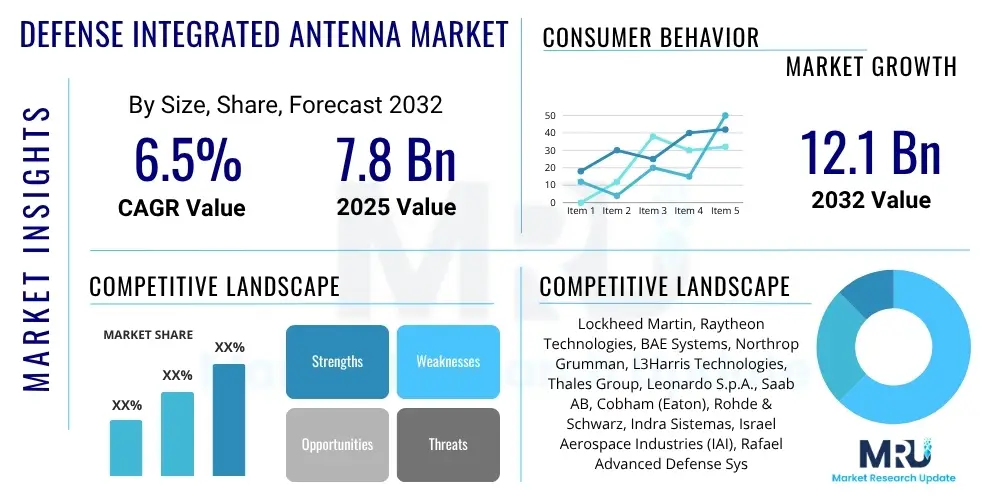

The Defense Integrated Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 7.8 billion in 2025 and is projected to reach USD 12.1 billion by the end of the forecast period in 2032.

Defense Integrated Antenna Market introduction

The Defense Integrated Antenna Market encompasses the design, development, manufacturing, and deployment of advanced antenna systems seamlessly integrated into military platforms and systems for a wide array of defense applications. These antennas are critical components for modern warfare, facilitating communication, radar, electronic warfare, navigation, and intelligence gathering. Product descriptions typically highlight multi-functionality, reduced size, weight, and power (SWaP), and enhanced performance across diverse frequency bands and environmental conditions. Major applications span airborne platforms such as fighter jets and UAVs, ground vehicles, naval vessels, and space-based assets, providing indispensable capabilities for C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance).

The primary benefits of integrated antennas include improved stealth characteristics due to conformal designs, enhanced operational efficiency through reduced electromagnetic interference, and lower logistical burdens. Their ability to combine multiple functions into a single aperture minimizes structural modifications and optimizes platform performance. Driving factors for market growth include escalating global defense expenditures, a pervasive trend toward military modernization across nations, and the ever-increasing demand for sophisticated C4ISR systems that require resilient and high-bandwidth connectivity. Furthermore, the imperative for advanced electronic warfare capabilities and robust threat detection systems significantly propels the adoption of integrated antenna solutions. These factors collectively underscore the strategic importance and sustained growth trajectory of this specialized market segment.

Defense Integrated Antenna Market Executive Summary

The Defense Integrated Antenna Market is experiencing robust expansion, driven by continuous advancements in military technology and a global emphasis on enhancing defense capabilities. Key business trends indicate a strong focus on miniaturization, multi-functionality, and the integration of Artificial Intelligence and Machine Learning for adaptive antenna systems. Strategic partnerships between defense contractors and technology providers are becoming increasingly common to accelerate innovation and address complex system integration challenges. Companies are investing heavily in research and development to offer solutions that meet stringent SWaP requirements while delivering superior performance in contested electromagnetic environments. The market is also characterized by a shift towards phased array and electronically steerable antennas, offering greater agility and precision in signal management.

Regional trends reveal North America as a dominant market, fueled by significant defense spending and a strong industrial base, particularly in the United States. Europe and Asia Pacific are also exhibiting substantial growth, with countries like China, India, and several European nations actively modernizing their defense infrastructures and increasing their procurement of advanced integrated antenna systems. Geopolitical tensions and regional conflicts further stimulate demand in these areas as countries seek to bolster their defensive and offensive capabilities. In Latin America, the Middle East, and Africa, while smaller, the market is gradually expanding due to rising security concerns and limited, targeted defense procurements.

Segmentation trends highlight the increasing demand for integrated antennas across all major platforms, including airborne, ground, naval, and space applications. The airborne segment, particularly for UAVs and next-generation fighter aircraft, leads in innovation for conformal and low-profile designs. By application, communication, radar, and electronic warfare remain the largest segments, with electronic warfare showing accelerated growth due to the evolving nature of threats. The market is also witnessing a demand for wider frequency coverage, pushing innovation in ultra-wideband and cognitive radio antenna solutions. The emphasis on network-centric warfare is further driving the need for highly efficient and secure integrated antenna systems across all operational domains.

AI Impact Analysis on Defense Integrated Antenna Market

Common user questions regarding AI's impact on the Defense Integrated Antenna Market frequently revolve around how artificial intelligence can enhance antenna performance, streamline decision-making in complex electromagnetic environments, and improve system resilience against sophisticated threats. Users often inquire about the potential for AI to enable adaptive beamforming, cognitive electronic warfare, and predictive maintenance for antenna arrays. There is also significant interest in AI's role in optimizing spectrum usage, facilitating real-time threat detection and mitigation, and automating the configuration of multi-function integrated antenna systems. The key themes that emerge are centered on achieving higher levels of autonomy, efficiency, and intelligence in defense communication and sensing capabilities, with concerns also touching on data security and the ethical implications of autonomous systems.

- AI enables cognitive electronic warfare by autonomously analyzing and adapting to complex signal environments.

- AI enhances real-time beamforming and null-steering capabilities, improving signal integrity and jamming resistance.

- Predictive maintenance for antenna systems is facilitated by AI algorithms, reducing downtime and extending operational life.

- AI optimizes spectrum management, allowing for more efficient use of limited electromagnetic resources.

- Machine learning algorithms contribute to faster and more accurate threat detection and classification through antenna arrays.

- Autonomous mission planning and re-configuration of integrated antenna parameters are possible with AI integration.

- AI aids in sensor fusion from multiple antenna inputs, providing a more comprehensive operational picture.

- Development of self-healing and resilient antenna networks is propelled by AI-driven fault detection and recovery.

DRO & Impact Forces Of Defense Integrated Antenna Market

The Defense Integrated Antenna Market is propelled by several significant drivers, chief among them being the escalating global defense budgets and a widespread military modernization agenda across numerous nations. The incessant demand for advanced C4ISR capabilities, which rely heavily on sophisticated communication and sensing technologies, forms a critical foundation for growth. Furthermore, the evolving landscape of electronic warfare, necessitating highly adaptable and resilient antenna systems to counter emerging threats, acts as a powerful catalyst. Opportunities in this market are abundant, particularly with the advent of cognitive electronic warfare systems, the ongoing trend of miniaturization enabling smaller and more capable platforms, and the increasing integration of AI and Machine Learning to create smarter, adaptive antennas. The push for multi-band and multi-function antennas that can handle diverse communication and sensing tasks simultaneously also presents substantial growth avenues for manufacturers and developers.

Despite these driving forces and opportunities, the market faces notable restraints. The exceptionally high costs associated with research and development for cutting-edge antenna technologies pose a significant barrier, particularly for smaller entities. Stringent regulatory approvals and certification processes for defense-grade equipment often lead to prolonged development cycles and increased expenses. The inherent complexity of integrating advanced antenna systems into existing or new military platforms, requiring precise calibration and compatibility, presents substantial technical challenges. Moreover, strict export control regulations on sensitive defense technologies can limit market reach and impede global expansion for some manufacturers. These factors collectively require strategic planning and substantial investment to navigate successfully, impacting market accessibility and competitive dynamics.

Impact forces on the Defense Integrated Antenna Market are multifaceted and exert considerable influence. Rapid technological advancements, particularly in metamaterials, advanced signal processing, and semiconductor technologies, continuously redefine what is possible in antenna design and performance, pushing the boundaries of integration and capability. Geopolitical tensions and ongoing conflicts worldwide directly influence defense spending priorities and the urgent demand for state-of-the-art military equipment, including advanced antenna systems. Global defense budget allocations, subject to economic conditions and political shifts, play a crucial role in shaping procurement cycles and investment in new technologies. Lastly, disruptions within the global supply chain for critical electronic components and rare earth minerals can significantly impact manufacturing schedules, costs, and the overall availability of integrated antenna solutions, highlighting the need for resilient and diversified sourcing strategies.

Segmentation Analysis

The Defense Integrated Antenna Market is extensively segmented to reflect the diverse applications, technological requirements, and operational environments within the defense sector. These segmentations provide a granular view of market dynamics, allowing for a detailed analysis of growth drivers, competitive landscapes, and emerging trends across different product types, platforms, applications, and frequency bands. Understanding these segments is crucial for stakeholders to identify specific market niches, tailor product development, and formulate targeted business strategies to meet the specialized needs of military customers globally.

- By Type

- Planar Array Antennas

- Conformal Antennas

- Omnidirectional Antennas

- Directional Antennas

- Electronically Steerable Antennas (ESA)

- Reflector Antennas

- Patch Antennas

- By Platform

- Airborne

- Aircraft (Fighter Jets, Bombers, Transport Aircraft)

- Unmanned Aerial Vehicles (UAVs)

- Ground

- Vehicles (Tanks, Armored Personnel Carriers)

- Soldier Systems

- Fixed Installations

- Naval

- Surface Vessels (Frigates, Destroyers, Aircraft Carriers)

- Submarines

- Space

- Satellites

- Spacecraft

- Airborne

- By Application

- Communication

- Satellite Communication (SATCOM)

- Tactical Communication

- Data Links

- Radar

- Surveillance Radar

- Fire Control Radar

- Ground Penetrating Radar

- Electronic Warfare (EW)

- Electronic Support Measures (ESM)

- Electronic Countermeasures (ECM)

- Electronic Protection (EP)

- Navigation

- GPS/GNSS

- Inertial Navigation Systems (INS) Integration

- Signal Intelligence (SIGINT)

- Counter-UAS (C-UAS)

- Communication

- By Frequency Band

- L-band

- S-band

- C-band

- X-band

- Ku-band

- Ka-band

- Millimeter Wave (MMW)

- Ultra-High Frequency (UHF)

- Very High Frequency (VHF)

Value Chain Analysis For Defense Integrated Antenna Market

The value chain for the Defense Integrated Antenna Market is complex and multi-layered, beginning with upstream activities focused on raw material procurement and component manufacturing. This initial stage involves sourcing specialized materials such as high-performance ceramics, composite substrates, and semiconductor components, which are crucial for developing robust and efficient antenna systems capable of operating in extreme defense environments. Key upstream players include material science companies and specialized electronic component manufacturers who provide critical inputs like RF integrated circuits, filters, amplifiers, and connectors. The quality and availability of these foundational components directly impact the performance, reliability, and cost-effectiveness of the final integrated antenna product. Strong supplier relationships and robust supply chain management are essential to mitigate risks associated with specialized material sourcing and ensure consistent production.

Midstream activities involve the design, development, and manufacturing of integrated antenna systems. This phase requires significant investment in research and development, leveraging advanced engineering capabilities in electromagnetics, mechanical design, and software development. Antenna manufacturers and defense primes focus on integrating various components into cohesive, high-performance units, adhering to stringent military specifications and certifications. This often includes sophisticated testing and validation processes to ensure compliance with operational requirements such as stealth characteristics, environmental resilience, and electromagnetic compatibility. The complexity of these systems often necessitates close collaboration between design teams, material suppliers, and end-users to ensure optimal performance and seamless integration into diverse military platforms. This stage is characterized by high intellectual property intensity and specialized manufacturing processes.

Downstream activities involve the distribution, integration, and post-sales support of integrated antenna systems to defense ministries and military contractors worldwide. Distribution channels are predominantly direct, with defense original equipment manufacturers (OEMs) and prime contractors working directly with government agencies and armed forces. Indirect channels may involve specialized integrators or system providers who incorporate these antennas into larger defense platforms or C4ISR systems. Post-sales support, including installation, maintenance, repair, and upgrades, is a critical component of the value chain, ensuring the long-term operational readiness and effectiveness of these vital defense assets. The long lifecycle of defense platforms necessitates ongoing support and technology refresh programs, which contribute significantly to the overall market value. Relationship management and adherence to long-term contracts are paramount in this highly specialized and regulated market segment.

Defense Integrated Antenna Market Potential Customers

The primary potential customers for the Defense Integrated Antenna Market are national defense ministries, armed forces, and government agencies responsible for national security and intelligence. These entities are the ultimate end-users and decision-makers for procurement of military equipment, including advanced antenna systems for their respective air, land, naval, and space forces. Their buying decisions are driven by strategic defense requirements, geopolitical assessments, budget allocations, and the need to maintain a technological edge against potential adversaries. They seek solutions that offer superior performance, reliability, and integration capabilities to enhance their C4ISR, electronic warfare, and precision targeting capabilities. Contracts are typically large-scale, long-term, and often involve complex bidding and evaluation processes, emphasizing performance specifications, security clearances, and interoperability.

Beyond direct government procurement, a significant segment of potential customers includes prime defense contractors and aerospace manufacturers. These companies act as system integrators, developing and producing large-scale military platforms such as fighter jets, naval vessels, ground combat vehicles, and satellites. They procure integrated antenna systems as critical sub-components to be integrated into their larger weapon systems and platforms. These customers prioritize suppliers who can deliver technically advanced, customizable, and reliable antenna solutions that seamlessly integrate with their overall platform architecture, meeting strict performance and certification standards. Long-term partnerships and collaborative development efforts are common with these prime contractors, as they often seek specialized expertise and assured supply for their multi-year programs. Their requirements often involve meeting strict Size, Weight, and Power (SWaP) constraints, as well as specific electromagnetic compatibility standards to ensure system integrity and performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.8 Billion |

| Market Forecast in 2032 | USD 12.1 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman, L3Harris Technologies, Thales Group, Leonardo S.p.A., Saab AB, Cobham (Eaton), Rohde & Schwarz, Indra Sistemas, Israel Aerospace Industries (IAI), Rafael Advanced Defense Systems, General Dynamics, Mitsubishi Electric, Airbus Defence and Space, TTM Technologies, Analog Devices, RUAG International, Roke Manor Research. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Defense Integrated Antenna Market Key Technology Landscape

The Defense Integrated Antenna Market is characterized by a dynamic and rapidly evolving technology landscape, with continuous innovation driven by the demanding requirements of military applications. Key technological advancements are focused on achieving higher performance, greater agility, and reduced Size, Weight, and Power (SWaP) consumption. Phased array antennas, particularly active electronically scanned arrays (AESA), are at the forefront, offering instantaneous beam steering, multi-target tracking, and multi-function capabilities for radar, communication, and electronic warfare applications. These systems leverage advanced semiconductor technologies, such as Gallium Nitride (GaN), to achieve higher power output and efficiency, enabling more compact and capable designs. Furthermore, the development of ultra-wideband (UWB) antennas is crucial for supporting diverse frequency bands and enhancing broadband communication and sensing capabilities in a single aperture.

Another significant area of technological focus involves the development of conformal and embedded antenna solutions. These antennas are designed to seamlessly integrate into the structures of platforms like aircraft, vehicles, and naval vessels, minimizing their radar cross-section (RCS) and maintaining aerodynamic profiles. Advances in metamaterials and metasurfaces are enabling the creation of novel antenna designs with unprecedented control over electromagnetic waves, facilitating highly compact, low-profile, and multi-functional antennas. Cognitive radio and AI/ML-driven antenna systems are emerging as critical technologies, allowing antennas to intelligently adapt their characteristics and operational modes to the surrounding electromagnetic environment, optimizing performance, countering interference, and enhancing stealth. This cognitive capability significantly improves resilience and effectiveness in contested and congested spectral landscapes.

The integration of advanced signal processing techniques directly at the antenna element level is also transforming the market, enabling sophisticated beamforming, nulling, and interference cancellation capabilities. Miniaturization techniques, often driven by additive manufacturing (3D printing) and advanced packaging, are crucial for reducing the physical footprint of integrated antenna systems without compromising performance. Moreover, secure and jam-resistant communication protocols are being embedded into antenna designs to ensure robust data transfer in hostile environments. The convergence of these technologies is leading to the development of highly agile, intelligent, and multi-role integrated antenna systems that are indispensable for future defense operations, supporting everything from high-bandwidth data links to advanced electronic warfare countermeasures and precise target acquisition.

Regional Highlights

- North America: Dominant market share due to substantial defense budgets, extensive R&D investments, and the presence of leading defense contractors in the United States and Canada. Strong demand for advanced C4ISR, electronic warfare, and missile defense systems.

- Europe: Significant market growth driven by military modernization efforts, rising geopolitical tensions, and collaborative defense programs within NATO. Key countries like the UK, France, Germany, and Italy are major contributors, focusing on secure communications and advanced radar systems.

- Asia Pacific (APAC): Fastest-growing region, fueled by increasing defense spending from countries like China, India, Japan, and South Korea amidst regional territorial disputes and security concerns. High demand for surveillance, maritime patrol, and airborne early warning systems.

- Latin America: Moderate growth, primarily driven by border security needs, counter-narcotics operations, and limited military modernization programs in countries like Brazil and Mexico. Emphasis on surveillance and tactical communication systems.

- Middle East and Africa (MEA): Steady market expansion due to ongoing conflicts, counter-terrorism efforts, and significant defense procurements by countries such as Saudi Arabia, UAE, and Israel. Focus on air defense, electronic warfare, and secure communication systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Defense Integrated Antenna Market.- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Northrop Grumman

- L3Harris Technologies

- Thales Group

- Leonardo S.p.A.

- Saab AB

- Cobham (now part of Eaton)

- Rohde & Schwarz

- Indra Sistemas

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- General Dynamics

- Mitsubishi Electric

- Airbus Defence and Space

- TTM Technologies

- Analog Devices

- RUAG International

- Roke Manor Research

Frequently Asked Questions

What is the projected growth rate of the Defense Integrated Antenna Market?

The Defense Integrated Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032, reaching USD 12.1 billion by 2032.

Which applications are driving the demand for defense integrated antennas?

Key applications driving demand include communication (SATCOM, tactical data links), radar (surveillance, fire control), and electronic warfare (ESM, ECM, EP) due to the increasing need for advanced C4ISR capabilities and threat response.

How is AI impacting the Defense Integrated Antenna Market?

AI is significantly impacting the market by enabling cognitive electronic warfare, adaptive beamforming, predictive maintenance, and optimized spectrum management, leading to more intelligent and resilient antenna systems.

Which regions are key contributors to the Defense Integrated Antenna Market?

North America holds a dominant market share, while Asia Pacific is the fastest-growing region. Europe also shows substantial growth, with all regions contributing due to global military modernization and rising defense spending.

What are the primary technological advancements in defense integrated antennas?

Key advancements include active electronically scanned arrays (AESA), conformal antennas, metamaterials, ultra-wideband (UWB) designs, and the integration of AI/ML for cognitive capabilities and enhanced signal processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager