Dental Burs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430711 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dental Burs Market Size

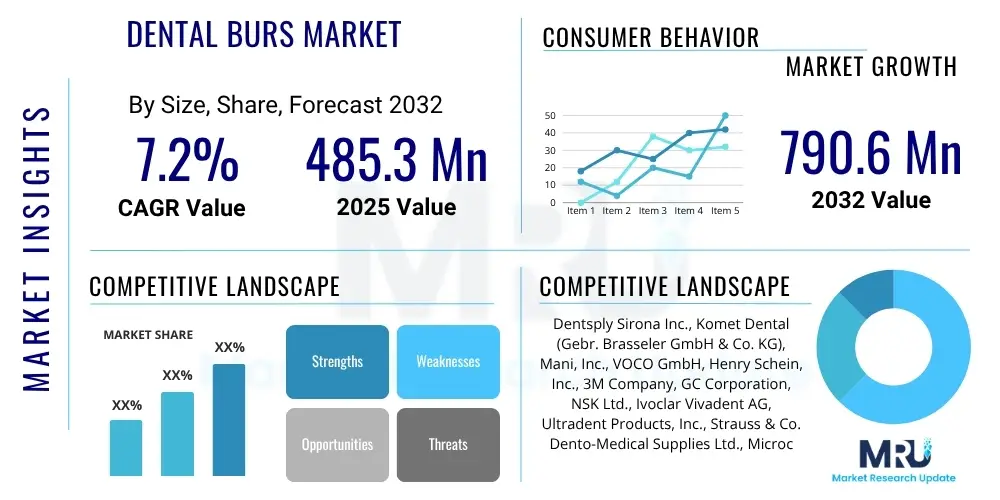

The Dental Burs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $485.3 million in 2025 and is projected to reach $790.6 million by the end of the forecast period in 2032.

Dental Burs Market introduction

The dental burs market plays a critical role in modern dentistry, providing essential tools for a wide array of dental procedures. Dental burs are small, rotating instruments designed for precise cutting, grinding, and polishing of dental tissues and materials. These highly specialized tools are indispensable for preparing cavities, removing old fillings, shaping teeth for crowns, and performing various surgical and restorative tasks, thereby forming the backbone of efficient and effective dental care delivery worldwide. The market encompasses a diverse range of burs, differentiated by their material composition, head shape, and grit size, each optimized for specific clinical applications.

The product description of dental burs varies significantly based on their intended use, but common types include carbide burs, diamond burs, ceramic burs, and steel burs. Carbide burs, known for their sharp cutting edges, are ideal for rapidly removing tooth structure and amalgam fillings. Diamond burs, featuring industrial diamond particles bonded to a steel shank, offer superior cutting efficiency and fine finishing for enamel, porcelain, and composites. Major applications span restorative dentistry, prosthodontics, orthodontics, oral surgery, and cosmetic dentistry, addressing conditions from simple cavity preparation to complex bone reshaping. The primary benefits of advanced dental burs include enhanced precision, reduced chair time for patients, improved patient comfort due to smoother operations, and the ability to achieve superior clinical outcomes. The market is significantly driven by the increasing global prevalence of dental diseases, a growing aging population requiring extensive dental work, and the rising demand for aesthetic dental procedures, all contributing to a sustained need for high-quality and technologically advanced dental burs.

Dental Burs Market Executive Summary

The dental burs market is experiencing robust growth, primarily propelled by evolving business trends that emphasize innovation, efficiency, and patient-centric care. Manufacturers are increasingly focusing on research and development to introduce burs with enhanced cutting properties, improved durability, and specialized designs for emerging dental techniques such as minimally invasive dentistry and digital workflow integration. Consolidation activities, including mergers and acquisitions, are also observed as key players seek to expand their product portfolios, strengthen distribution networks, and gain a competitive edge in a dynamic market landscape. Furthermore, there is a distinct trend towards sustainable manufacturing practices and the development of reusable or more environmentally friendly disposable options, reflecting a broader industry commitment to ecological responsibility.

Regionally, the market exhibits varied growth trajectories, with established markets in North America and Europe demonstrating steady growth driven by high healthcare expenditure, advanced dental infrastructure, and a strong emphasis on oral health awareness. These regions are characterized by the early adoption of innovative dental technologies and a demand for premium, specialized burs. Conversely, the Asia Pacific region is emerging as a significant growth engine, fueled by a rapidly expanding middle class, increasing disposable incomes, burgeoning medical tourism, and improving access to dental care. Latin America and the Middle East and Africa also present considerable opportunities, albeit with slower adoption rates, as dental infrastructure develops and awareness campaigns gain traction. Government initiatives and investments in healthcare infrastructure development in these emerging economies are expected to further stimulate regional market expansion.

Segmentation trends indicate a strong demand for diamond and carbide burs due to their versatility and effectiveness across a wide range of procedures. Diamond burs, in particular, are witnessing increased adoption for precision work and cosmetic dentistry applications, reflecting the growing patient preference for aesthetic dental treatments. The end-user segment is dominated by dental clinics, which represent the primary point of service for routine and specialized dental procedures, followed by hospitals and academic institutions. There is a growing inclination towards specialized burs designed for specific applications like endodontics or periodontics, driven by the increasing complexity of dental treatments and the need for highly tailored instruments. The market also observes an increasing demand for single-use, sterile burs to enhance infection control and patient safety, aligning with stringent regulatory standards and evolving clinical best practices.

AI Impact Analysis on Dental Burs Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the dental burs market primarily revolve around automation, precision, diagnostic support, and potential shifts in manufacturing and clinical applications. There is keen interest in how AI could enhance the efficiency and accuracy of dental procedures involving burs, particularly in areas like treatment planning, cavity preparation, and prosthetic fabrication. Concerns often touch upon the initial investment costs for AI-integrated systems, the need for specialized training for dental professionals, and the ethical implications of autonomous decision-making in dental care. Users also seek clarity on how AI might influence material selection for burs, optimize bur design for specific clinical scenarios, and contribute to predictive maintenance of dental equipment to ensure optimal performance. The overarching expectation is that AI will streamline workflows, improve patient outcomes, and potentially reduce the incidence of human error, ultimately transforming the practice of dentistry where burs are a fundamental tool.

- AI-driven diagnostic software can assist in precise lesion detection, guiding dental professionals on optimal bur selection and preparation angles, reducing invasiveness.

- Integration of AI with CAD/CAM systems enables highly accurate and personalized restoration designs, optimizing bur pathways for automated milling and grinding processes, enhancing precision and consistency.

- Predictive analytics powered by AI can monitor the wear and tear of dental burs and equipment, recommending timely replacements or maintenance, thereby extending tool life and ensuring operational efficiency.

- AI algorithms can analyze vast datasets of clinical outcomes, identifying patterns that inform the development of next-generation bur designs tailored for improved efficacy and patient comfort.

- Virtual reality and AI-powered simulation platforms can offer enhanced training for dental students and practitioners, allowing them to practice complex bur-based procedures in a controlled environment, refining their skills and reducing learning curves.

- Automated quality control systems leveraging AI vision can inspect manufactured burs for defects at a much higher speed and accuracy than manual methods, ensuring superior product quality.

- AI can optimize inventory management for dental practices by predicting bur usage based on patient flow and treatment types, reducing waste and ensuring availability of necessary instruments.

- Advanced robotics, guided by AI, could potentially automate certain repetitive bur-based procedures, such as initial cavity preparation, allowing dentists to focus on more complex aspects of patient care.

DRO & Impact Forces Of Dental Burs Market

The dental burs market is significantly shaped by a confluence of driving factors, critical restraints, and substantial opportunities, all influenced by various impact forces. A primary driver is the escalating global prevalence of dental diseases, including caries, periodontal issues, and other oral health conditions, which necessitate frequent dental interventions. This is further amplified by the growth in the geriatric population, a demographic prone to tooth loss and the need for prosthetic restorations, demanding a continuous supply of various dental burs. The rising global demand for cosmetic dentistry procedures, such as veneer preparation, teeth reshaping, and smile makeovers, also acts as a strong market impetus, requiring specialized and high-precision burs. Furthermore, ongoing technological advancements in dental materials and equipment, including the integration of CAD/CAM systems and advanced restorative materials, consistently spur the demand for compatible and high-performance burs. The increasing trend of dental tourism, where patients travel for more affordable or specialized dental treatments, also contributes to market expansion in certain regions by boosting the volume of dental procedures performed.

Despite these drivers, the market faces several notable restraints. The high cost associated with advanced dental procedures, often involving the use of premium dental burs, can be a significant barrier to access for patients in lower-income demographics or regions without robust healthcare insurance systems. This cost factor can limit patient adoption of comprehensive dental treatments. Another critical restraint is the persistent shortage of skilled dental professionals in many parts of the world, which directly impacts the capacity for dental service delivery and, consequently, the demand for dental instruments. Moreover, the stringent regulatory approval processes for new dental burs and materials, particularly in developed markets, can delay product launches and increase research and development costs for manufacturers. Finally, challenges related to reimbursement policies for dental treatments can limit the financial viability for both patients and practitioners, indirectly affecting the procurement of advanced dental burs.

Opportunities within the dental burs market are abundant, particularly in untapped emerging markets where dental infrastructure is rapidly developing and awareness about oral hygiene is growing. These regions represent significant potential for market penetration and expansion. The increasing adoption of advanced dental technologies, such as CAD/CAM systems, digital impression scanners, and laser dentistry, creates new niches for specialized burs compatible with these innovations. Moreover, ongoing research and development efforts aimed at creating novel bur materials, coatings, and ergonomic designs for enhanced performance and patient comfort present significant avenues for product differentiation and market growth. The development of specialized burs for niche applications, such as endodontic treatment, implantology, and periodontal surgery, also offers lucrative prospects for manufacturers seeking to cater to highly specific clinical requirements. Impact forces, including the bargaining power of buyers (dental clinics and hospitals demanding cost-effective yet high-quality products) and suppliers (raw material providers), the threat of new entrants (innovative startups challenging established players) and substitutes (alternative dental technologies like lasers), and the intense competitive rivalry among existing manufacturers, continuously shape the market dynamics, necessitating strategic adaptations from all stakeholders.

Segmentation Analysis

The dental burs market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation facilitates targeted strategies for manufacturers, distributors, and dental professionals by identifying key areas of demand and technological advancements. The market can be dissected based on various attributes, including the material composition of the burs, their application in different dental procedures, the specific end-user facilities, and the distinct shapes designed for particular functions. Each segment represents a unique demand landscape influenced by clinical requirements, technological progress, and evolving patient needs. Understanding these segments is crucial for stakeholders to tailor their product offerings, marketing efforts, and investment decisions effectively.

- By Product Type

- Diamond Burs

- Carbide Burs

- Ceramic Burs

- Steel Burs

- By Application

- Restorative Dentistry

- Prosthodontics

- Orthodontics

- Oral Surgery

- Endodontics

- Cosmetic Dentistry

- Periodontics

- By End-User

- Hospitals

- Dental Clinics

- Academic & Research Institutes

- Ambulatory Surgical Centers

- By Material

- Tungsten Carbide

- Natural Diamond

- Synthetic Diamond

- Stainless Steel

- Ceramic (Zirconia)

- Others

- By Shape

- Round Burs

- Inverted Cone Burs

- Pear Burs

- Straight Fissure Burs

- Tapered Fissure Burs

- Flame Burs

- Wheel Burs

- Finishing Burs

- Surgical Burs

- Others (e.g., specialized cutting, trimming, or polishing shapes)

Value Chain Analysis For Dental Burs Market

The value chain for the dental burs market begins with a critical upstream analysis, focusing on the procurement of raw materials essential for bur manufacturing. This initial stage involves sourcing high-quality tungsten carbide, industrial diamonds (both natural and synthetic), stainless steel, and ceramic materials such as zirconia. Key suppliers in this segment are often specialized chemical and metallurgical companies that produce these materials to stringent specifications. The quality and purity of these raw materials directly impact the performance, durability, and safety of the final dental bur products. Relationships with these suppliers are often long-term and strategic, ensuring a consistent supply chain and adherence to quality standards. Manufacturers often invest in rigorous quality control measures at this stage to prevent defects that could propagate through the production process.

Moving downstream, the value chain encompasses the manufacturing, distribution, and end-user engagement. After the raw materials are acquired, manufacturers process them into various bur types through complex processes including sintering, diamond bonding, shaping, and precision grinding. This stage involves significant technological investment in machinery, skilled labor, and quality assurance protocols. Once manufactured, dental burs enter the distribution channel, which can be direct or indirect. Direct distribution involves manufacturers selling directly to large dental clinic chains, hospital groups, or academic institutions, often leveraging dedicated sales teams and online platforms. This approach allows for greater control over pricing and customer relationships but requires substantial infrastructure.

Indirect distribution is more common and involves the use of third-party distributors, wholesalers, and dental supply dealers who reach a broader network of individual dental practices, smaller clinics, and independent dentists. These intermediaries play a crucial role in logistics, inventory management, and providing local support and product availability. E-commerce platforms are also gaining prominence as a significant distribution channel, offering convenience and broader market reach for both direct and indirect sales. Finally, at the end of the value chain are the potential customers, primarily dental practitioners in various settings who utilize these burs for patient care. The effectiveness of the value chain is determined by the seamless flow of materials, products, and information, ensuring that high-quality dental burs are efficiently produced and made available to dental professionals worldwide.

Dental Burs Market Potential Customers

The potential customers for the dental burs market are diverse and encompass a wide range of end-users within the dental healthcare ecosystem. Primarily, individual dental practitioners form the largest segment of buyers, including general dentists, oral surgeons, orthodontists, prosthodontists, periodontists, and endodontists. These professionals routinely utilize dental burs for everyday procedures ranging from basic restorative work to complex surgical interventions. Their purchasing decisions are often influenced by factors such as product quality, brand reputation, material durability, cutting efficiency, and cost-effectiveness, alongside the specific requirements of their patient demographic and practice specialization. The growing emphasis on specialized dental care often leads practitioners to invest in a variety of burs tailored for specific procedures, highlighting the need for a comprehensive product portfolio from manufacturers.

Beyond individual practitioners, larger organizational entities represent significant purchasing power. Dental clinics, ranging from small private practices to multi-specialty group practices and large corporate dental chains, are major consumers of dental burs. These clinics often purchase in bulk, prioritizing supply reliability, consistent quality, and competitive pricing. Hospitals with dental departments or oral and maxillofacial surgery units also constitute key customers, particularly for surgical burs and those used in more complex, in-patient procedures. Their procurement processes are often more formalized and involve tenders or long-term contracts with preferred suppliers, emphasizing regulatory compliance and sterile packaging. The growing trend of corporate dental groups and dental service organizations (DSOs) further consolidates purchasing power, making them influential buyers in the market.

Academic and research institutes, including dental schools and universities, are also important end-users. These institutions purchase dental burs for training dental students, conducting research into new materials and techniques, and providing patient care in their teaching clinics. Their demand is often driven by educational curriculum requirements and research objectives, making them early adopters of innovative bur technologies. Furthermore, dental laboratories, which play a crucial role in fabricating crowns, bridges, and other prosthetics, may also procure specialized burs for shaping and finishing these restorations, although their primary focus is typically on laboratory-grade milling and grinding tools. The evolving landscape of dental education and research continuously influences the demand for state-of-the-art dental burs that support advanced learning and scientific discovery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $485.3 million |

| Market Forecast in 2032 | $790.6 million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona Inc., Komet Dental (Gebr. Brasseler GmbH & Co. KG), Mani, Inc., VOCO GmbH, Henry Schein, Inc., 3M Company, GC Corporation, NSK Ltd., Ivoclar Vivadent AG, Ultradent Products, Inc., Strauss & Co. Dento-Medical Supplies Ltd., Microcopy Dental, Hu-Friedy Mfg. Co., LLC (A Cantel Medical Company), Coltene Holding AG, Medin Co. Ltd., DFS-Diamon GmbH, Prime Dental Manufacturing Inc., Kerr Dental (Envista Holdings Corporation), Edenta AG, American Eagle Instruments Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Burs Market Key Technology Landscape

The dental burs market is continuously influenced by advancements in manufacturing processes and material science, leading to the development of highly specialized and efficient tools. A significant technological trend is the integration of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems, not only for designing and producing dental restorations but also for optimizing bur designs. This allows for the creation of burs with highly precise geometries and cutting angles, tailored for specific materials and clinical procedures, enhancing both efficiency and patient safety. Advanced coating technologies, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), are increasingly being applied to burs. These coatings, often incorporating titanium nitride or zirconium nitride, enhance the hardness, lubricity, and wear resistance of burs, thereby extending their lifespan and improving cutting performance, particularly when working with tough restorative materials or ceramics.

Another crucial technological development lies in the materials science of the burs themselves. Manufacturers are exploring new alloys and composite materials that offer superior strength, durability, and biocompatibility. For instance, high-performance tungsten carbide alloys with finer grain structures provide enhanced sharpness and fracture resistance. Similarly, improvements in diamond bonding techniques ensure that diamond particles remain securely attached to the bur shank, even under intense operational stress, leading to more consistent and effective cutting. The push towards minimally invasive dentistry has also driven innovation, leading to the development of smaller, more precise burs that allow for maximal preservation of healthy tooth structure, aligning with modern conservative treatment philosophies. This includes the creation of micro-burs for intricate procedures and those designed for use with magnification tools.

Furthermore, the ergonomic design of burs is also a key area of technological focus. Innovations in shank design and head configurations aim to minimize vibration, improve tactile feel for the clinician, and reduce heat generation during high-speed operation, which collectively contribute to enhanced patient comfort and reduced operator fatigue. The adoption of laser etching for precise grit size classification and identification on diamond burs, as well as advancements in sterilizable and single-use bur technologies, further underscore the dynamic technological landscape. These innovations are critical for maintaining aseptic conditions, preventing cross-contamination, and meeting stringent regulatory standards in dental practices worldwide, reflecting a holistic approach to improving both clinical efficacy and safety in dental procedures involving burs.

Regional Highlights

- North America: This region, comprising the United States and Canada, holds a substantial share of the dental burs market due to advanced healthcare infrastructure, high dental care expenditure, significant technological adoption, and a strong presence of key market players. The rising awareness about oral health, coupled with a growing geriatric population and high demand for cosmetic dentistry, drives continuous growth in this mature market.

- Europe: Countries such as Germany, the United Kingdom, France, Italy, and Spain contribute significantly to the European market. High disposable incomes, well-established healthcare systems, and increasing demand for advanced dental treatments, including orthodontics and prosthodontics, fuel market expansion. Strict regulatory standards also ensure high-quality product offerings.

- Asia Pacific (APAC): The APAC region, including countries like China, India, Japan, South Korea, and Australia, is poised for rapid growth. This growth is attributable to an expanding patient pool, increasing healthcare expenditure, improving access to dental care, and the rising prevalence of dental tourism. Economic development, particularly in emerging economies, is leading to enhanced dental infrastructure and greater adoption of modern dental technologies.

- Latin America: Countries like Brazil and Mexico are key contributors in Latin America. The market here is driven by improving economic conditions, government initiatives to enhance oral health, and a growing middle-class population seeking better dental care. While still developing, this region presents significant opportunities for market penetration and expansion.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, primarily driven by increasing awareness about oral hygiene, rising healthcare investments, and the development of modern dental facilities in urban areas. Countries such as Saudi Arabia, UAE, and South Africa are leading the adoption of advanced dental technologies, though challenges related to access and affordability persist in certain parts of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Burs Market.- Dentsply Sirona Inc.

- Komet Dental (Gebr. Brasseler GmbH & Co. KG)

- Mani, Inc.

- VOCO GmbH

- Henry Schein, Inc.

- 3M Company

- GC Corporation

- NSK Ltd.

- Ivoclar Vivadent AG

- Ultradent Products, Inc.

- Strauss & Co. Dento-Medical Supplies Ltd.

- Microcopy Dental

- Hu-Friedy Mfg. Co., LLC (A Cantel Medical Company)

- Coltene Holding AG

- Medin Co. Ltd.

- DFS-Diamon GmbH

- Prime Dental Manufacturing Inc.

- Kerr Dental (Envista Holdings Corporation)

- Edenta AG

- American Eagle Instruments Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Burs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of dental burs and their applications?

The primary types of dental burs include diamond burs for precise cutting and finishing on enamel and porcelain, carbide burs for rapid tooth structure and amalgam removal, ceramic burs for heat reduction and aesthetic finishing, and steel burs primarily for denture adjustments. Each type is optimized for specific dental procedures, from restorative work to oral surgery.

What factors are driving the growth of the dental burs market?

The dental burs market is driven by increasing global prevalence of dental diseases, a growing aging population requiring extensive dental treatments, rising demand for cosmetic dentistry, continuous technological advancements in dental materials and equipment, and expanding dental tourism, all contributing to a sustained need for high-quality dental instruments.

How does AI impact the manufacturing and clinical use of dental burs?

AI impacts the dental burs market by enhancing precision in manufacturing through CAD/CAM optimization, enabling AI-driven diagnostics for optimal bur selection, facilitating predictive maintenance for dental equipment, and improving training via simulation. This leads to more efficient procedures, better patient outcomes, and extended bur lifespan.

Which regions are key contributors to the dental burs market growth?

North America and Europe are significant contributors due to advanced dental infrastructure and high healthcare spending. The Asia Pacific region is rapidly emerging as a major growth engine, fueled by increasing disposable incomes and improving access to dental care. Latin America and MEA also show promising growth potential.

What are the main challenges faced by the dental burs market?

The dental burs market faces challenges such as the high cost of advanced dental procedures limiting patient access, a persistent shortage of skilled dental professionals, stringent regulatory approval processes for new products, and complexities in reimbursement policies, all of which can hinder broader market adoption and innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager