Dental Implants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430905 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Dental Implants Market Size

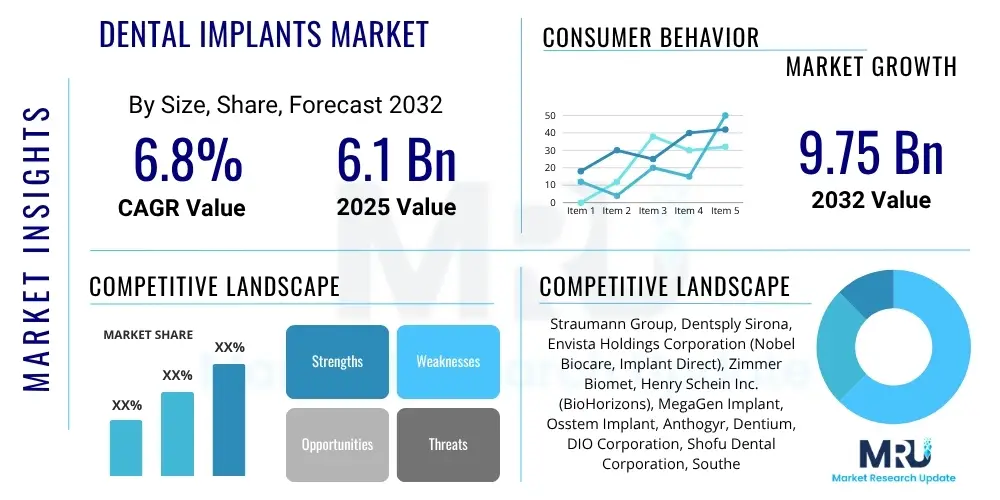

The Dental Implants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 6.1 Billion in 2025 and is projected to reach USD 9.75 Billion by the end of the forecast period in 2032.

Dental Implants Market introduction

The dental implants market encompasses the global industry dedicated to the development, manufacturing, and distribution of prosthetic devices used to replace missing teeth. Dental implants are artificial tooth roots, typically made of biocompatible materials such as titanium or zirconia, which are surgically placed into the jawbone beneath the gum line. These implants fuse with the bone through a process called osseointegration, providing a stable foundation for artificial teeth, commonly crowns, bridges, or dentures, that look and function like natural teeth. The primary aim of dental implants is to restore oral function, aesthetics, and overall quality of life for individuals suffering from tooth loss due to various factors including trauma, periodontal disease, or caries.

Major applications of dental implants span a wide range of restorative dentistry needs. They are extensively used for single tooth replacement, multiple tooth replacement via implant-supported bridges, and full arch rehabilitation using implant-supported dentures. Beyond mere aesthetics, dental implants offer significant benefits such as improved chewing efficiency, enhanced speech clarity, prevention of bone loss in the jaw, and superior long-term durability compared to traditional dentures or bridges. The natural feel and appearance of implants also contribute significantly to a patient's self-confidence and psychological well-being. These advantages are crucial driving factors propelling market expansion, alongside an increasing global aging population, rising incidence of dental diseases, and growing awareness regarding advanced dental restorative options.

Further driving the market are continuous technological advancements, including improvements in implant design, surface treatments that enhance osseointegration, and the integration of digital dentistry workflows. The demand for aesthetically pleasing and functional dental solutions is surging, particularly in developed regions where disposable incomes are higher and access to advanced dental care is widespread. Simultaneously, emerging economies are witnessing a gradual increase in dental implant adoption as healthcare infrastructure improves and awareness campaigns educate consumers on the benefits of these durable restorative options.

Dental Implants Market Executive Summary

The dental implants market is experiencing robust growth, driven by a confluence of business trends, regional dynamics, and significant advancements across various product segments. Business trends indicate a strong shift towards digital dentistry, with increased adoption of CAD/CAM systems, 3D printing, and guided surgery techniques that enhance precision, efficiency, and patient outcomes. Consolidation among key players and strategic collaborations aimed at expanding product portfolios and geographical reach are also prominent, fostering innovation in materials and implant designs. The market is also witnessing a trend towards personalized implant solutions and a focus on cost-effectiveness to broaden patient access, particularly in regions with developing healthcare systems.

Regionally, North America and Europe continue to be dominant markets due to high awareness, advanced healthcare infrastructure, and significant healthcare expenditure, alongside an aging population. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by increasing dental tourism, improving economic conditions, and a rapidly expanding middle class with greater access to and demand for advanced dental procedures. Latin America and the Middle East & Africa also present significant growth opportunities as healthcare spending rises and dental education becomes more widespread, leading to greater adoption of implant-based restorations.

Segment-wise, titanium implants maintain their market leadership due to their proven biocompatibility and mechanical strength, although zirconia implants are gaining traction as an aesthetic alternative for patients with metal sensitivities. The demand for mini-implants and immediate loading implants is also on the rise, catering to specific patient needs for less invasive procedures and faster rehabilitation times. Advancements in prosthetic components and biomaterials, such as bone graft substitutes and membranes, are integral to supporting successful implant placement and long-term stability, ensuring sustained growth across these crucial segments of the dental implants market.

AI Impact Analysis on Dental Implants Market

User questions regarding AI's impact on the dental implants market frequently revolve around its potential to enhance surgical precision, streamline treatment planning, and personalize patient care. Users are eager to understand how AI can reduce procedural risks, improve predictability of outcomes, and contribute to faster recovery times. There is also significant interest in AI's role in diagnostics, material selection, and even patient education, with concerns sometimes arising about data privacy, algorithmic bias, and the necessity of human oversight. The overarching themes reflect an expectation that AI will usher in a new era of efficiency and advanced capabilities within implant dentistry, while also prompting cautious queries about its ethical implementation and integration into established clinical workflows.

- AI enhances diagnostic accuracy through advanced image analysis of X-rays and CBCT scans.

- Predictive analytics powered by AI aids in determining optimal implant size, position, and angulation for improved success rates.

- AI-driven software assists in designing custom implant guides for highly precise, minimally invasive surgical procedures.

- Machine learning algorithms can analyze patient data to predict osseointegration success and identify potential complications.

- AI optimizes material selection by evaluating patient bone density and biomechanical forces.

- Automated scheduling and administrative tasks improve clinic efficiency, freeing up time for patient care.

- Virtual reality and augmented reality, often integrated with AI, assist in surgeon training and patient consultation.

- AI tools personalize patient education by providing tailored information on implant procedures and post-operative care.

- Development of AI-powered robotic systems for autonomous or semi-autonomous implant placement procedures.

- Facilitates research and development by rapidly processing vast datasets to identify new implant materials and designs.

DRO & Impact Forces Of Dental Implants Market

The dental implants market is significantly influenced by a dynamic interplay of driving forces, restraining factors, and emerging opportunities that collectively shape its growth trajectory. Key drivers include a rapidly aging global population, which naturally leads to an increased prevalence of tooth loss and a greater demand for restorative dental solutions. Concurrently, the rising incidence of dental diseases such as periodontitis and caries, along with traumatic injuries, further fuels the need for permanent tooth replacement options like implants. Aesthetic considerations also play a substantial role, as patients increasingly seek natural-looking and functional restorations to enhance their smiles and overall quality of life. Furthermore, continuous technological advancements in implant design, materials science, and digital dentistry techniques are making procedures safer, more predictable, and accessible, driving market expansion.

Despite the strong growth drivers, the market faces several significant restraints. The high cost associated with dental implant procedures, including the implant components, surgical fees, and prosthetic restorations, remains a major barrier for a considerable segment of the population, particularly in regions with limited insurance coverage or lower disposable incomes. The lack of comprehensive reimbursement policies in many countries further exacerbates this issue, shifting the financial burden directly onto patients. Additionally, the surgical nature of implant placement carries inherent risks of complications, and the requirement for highly skilled and specialized dental professionals for successful outcomes can limit access in underserved areas. Limited awareness in certain demographics about the long-term benefits of implants compared to conventional treatments also acts as a restraint.

Opportunities for market growth are abundant, particularly in emerging economies where dental healthcare infrastructure is developing, and a growing middle class can afford advanced treatments. The increasing adoption of digital dentistry, including CAD/CAM systems, 3D printing, and guided surgery, presents avenues for enhanced precision, reduced chairside time, and improved patient experience. Personalized implant solutions, leveraging advanced imaging and manufacturing technologies, offer tailored treatments that can optimize outcomes. Moreover, research into novel biomaterials, such as bio-active coatings and regenerative techniques, promises to further improve osseointegration and reduce healing times. The expansion of dental tourism also provides a unique opportunity for market players to reach a broader international patient base seeking affordable, high-quality implant procedures.

Segmentation Analysis

The dental implants market is comprehensively segmented across various dimensions, providing a granular view of its structure and dynamics. These segments help categorize the diverse product offerings, materials, procedural techniques, and end-user applications that collectively define the market landscape. Understanding these segmentations is critical for market players to identify specific growth areas, tailor their product development strategies, and optimize their market penetration efforts. The primary segmentation criteria include product type, material, procedure, and end-use, each reflecting distinct aspects of the dental implant ecosystem.

Within product types, the market distinguishes between the implant fixtures themselves, abutments which connect the implant to the prosthesis, and the various prosthetic components such as crowns, bridges, and dentures. Materials used in implant manufacturing primarily include titanium and zirconia, each with unique advantages. Procedural techniques range from single-stage to two-stage and immediate load implantations, catering to different clinical scenarios and patient preferences for treatment duration. Lastly, end-use segmentation differentiates between dental clinics, hospitals, and dental laboratories, highlighting where implant procedures are performed and where components are fabricated, collectively painting a detailed picture of market operations.

- Product Type

- Dental Implants (Fixtures)

- Abutments

- Prosthetics (Crowns, Bridges, Dentures)

- Healing Caps

- Dental Biomaterials (Bone Grafts, Membranes)

- Material

- Titanium Implants

- Zirconia Implants

- Procedure

- Single-Stage Implantation

- Two-Stage Implantation

- Immediate Load Implantation

- End-Use

- Dental Clinics

- Hospitals

- Dental Laboratories

- Design

- Tapered Implants

- Parallel-Walled Implants

- Surface Type

- Rough Surface (e.g., SLA, sandblasted, acid-etched)

- Smooth Surface

Value Chain Analysis For Dental Implants Market

The value chain for the dental implants market is a complex ecosystem involving multiple stages, from raw material sourcing to final patient treatment, each adding value and incurring costs. The upstream analysis primarily focuses on the procurement of high-quality raw materials, predominantly medical-grade titanium and zirconia, from specialized suppliers. These materials undergo stringent quality checks and processing to meet the exacting standards required for biocompatibility and mechanical strength. Key players in this stage include metal alloy manufacturers and ceramic producers who supply the foundational components for implant fabrication, heavily influencing the initial cost and quality of the final product. Research and development activities also sit upstream, driving innovation in implant design, surface treatments, and material science.

The midstream segment of the value chain involves the manufacturing and assembly of dental implants, abutments, and related prosthetic components. This stage includes precision machining, surface treatment processes (such as anodization, sandblasting, and acid-etching), and sterilization. Manufacturers develop a wide range of implant systems, often investing significantly in intellectual property and regulatory approvals. Distribution channels then connect these manufacturers to the downstream stakeholders. This typically involves a mix of direct sales forces employed by major implant companies, which allows for direct engagement with dental professionals, and indirect sales through a network of distributors and dealers. These intermediaries play a crucial role in market penetration, inventory management, and providing local support and training to dental practitioners, extending the reach of products globally.

The downstream analysis focuses on the delivery of dental implant solutions to the end-users. This involves dental clinics, hospitals, and dental laboratories. Dental clinics and hospitals are the primary points of patient interaction where diagnoses are made, treatment plans are formulated, and surgical implant placements are performed. Dental laboratories are critical for fabricating custom prosthetics, such as crowns, bridges, and dentures, that are fitted onto the implants. Patient consultation, follow-up care, and ongoing maintenance form the final crucial steps in the value chain, ensuring long-term success and patient satisfaction. Both direct sales to large dental groups and indirect sales through distributors to individual practitioners are vital for market access and efficiency.

Dental Implants Market Potential Customers

Potential customers for the dental implants market primarily consist of individuals experiencing tooth loss, irrespective of age, who are seeking durable, functional, and aesthetically pleasing tooth replacement solutions. This broad category includes patients who have lost teeth due to various factors such as advanced periodontal disease, severe dental caries that necessitate extraction, traumatic injuries to the mouth, or congenital conditions leading to tooth agenesis. As the global population ages, the prevalence of tooth loss increases significantly, making the elderly a substantial demographic for dental implant procedures. These individuals often prioritize long-term stability and improved quality of life over temporary solutions.

Beyond those with immediate tooth loss, another significant segment of potential customers includes individuals seeking to upgrade from traditional removable dentures or fixed bridges to more stable and comfortable implant-supported restorations. Patients who are dissatisfied with the discomfort, instability, or aesthetic limitations of conventional prosthetics represent a growing market for implant solutions that offer enhanced chewing ability, clearer speech, and a more natural appearance. Furthermore, cosmetic dentistry patients, though not necessarily experiencing severe tooth loss, may opt for implants to achieve a perfectly aligned and aesthetically appealing smile, often replacing teeth that are otherwise compromised or undesirable.

Accident victims who suffer facial or oral trauma resulting in tooth loss also form a crucial, albeit unpredictable, segment of the market. Similarly, individuals with certain medical conditions that can impact oral health and lead to tooth loss may also become candidates for implants, provided their overall health status permits the surgical procedure. The increasing awareness about the long-term benefits of implants, coupled with advancements in dental technology that make procedures safer and more accessible, continues to expand the pool of potential customers, encouraging a broader demographic to consider dental implants as a viable and superior tooth replacement option.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.1 Billion |

| Market Forecast in 2032 | USD 9.75 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Straumann Group, Dentsply Sirona, Envista Holdings Corporation (Nobel Biocare, Implant Direct), Zimmer Biomet, Henry Schein Inc. (BioHorizons), MegaGen Implant, Osstem Implant, Anthogyr, Dentium, DIO Corporation, Shofu Dental Corporation, Southern Implants, Cortex Dental Implants, C-Tech Implant, ADIN Dental Implant Systems, MIS Implants Technologies, Neodent (part of Straumann Group), Bicon Dental Implants, Ximplant GmbH, ACE Surgical Supply Co. Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Implants Market Key Technology Landscape

The dental implants market is significantly shaped by a dynamic and continuously evolving technological landscape, with innovations aimed at improving precision, efficiency, and patient outcomes. One of the most impactful technologies is Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM), which revolutionized the design and fabrication of custom prosthetics and surgical guides. This allows for highly accurate, patient-specific restorations and ensures optimal implant placement. Complementing CAD/CAM, 3D printing technologies are increasingly utilized to create customized surgical guides, models, and even implant prototypes, reducing lead times and enhancing the customization capabilities for both implants and prosthetic components. These digital workflows are integral to modern implant dentistry, offering a streamlined and predictable treatment process.

Guided surgery is another pivotal technological advancement, where pre-operative planning using CBCT scans and specialized software allows dentists to virtually plan the implant placement and then translate this plan precisely into the surgical field using custom-fabricated surgical guides. This approach minimizes invasiveness, reduces surgical time, and significantly lowers the risk of complications by avoiding critical anatomical structures. Furthermore, advancements in digital impressioning systems, replacing traditional physical impressions, contribute to greater patient comfort and improved accuracy in capturing intraoral data, which is then seamlessly integrated into the CAD/CAM and guided surgery workflows. These technologies collectively enable a more integrated, predictable, and patient-centric approach to dental implant procedures.

Beyond planning and placement, surface modification technologies for dental implants are crucial for enhancing osseointegration and long-term success. Techniques such as sandblasting, acid-etching, anodization, and laser treatment are employed to create micro- and nano-topographical features on implant surfaces, promoting faster and stronger bone-to-implant contact. Research into bio-active coatings and the incorporation of growth factors or antimicrobial agents onto implant surfaces is also ongoing, aiming to accelerate healing and reduce the risk of peri-implantitis. The integration of artificial intelligence and machine learning into diagnostics and treatment planning further refines these processes, offering predictive analytics and optimized treatment protocols, thus driving continuous innovation across the entire dental implant technology landscape.

Regional Highlights

- North America: This region consistently represents a significant share of the global dental implants market, driven by a high awareness of advanced dental care, sophisticated healthcare infrastructure, and substantial healthcare expenditure. The United States, in particular, leads in adopting innovative dental technologies and treatments, supported by a strong presence of key market players and a significant elderly population experiencing increased rates of tooth loss. Canada also contributes to this regional dominance with its robust healthcare system and a growing demand for cosmetic and restorative dentistry. High disposable incomes and a strong focus on aesthetics further propel market growth in this well-established region.

- Europe: Europe stands as another major contributor to the dental implants market, with countries like Germany, Italy, France, and the United Kingdom being key markets. This region benefits from advanced dental research, a high standard of living, and an aging demographic that requires extensive dental restorative procedures. Germany, for instance, is known for its technological prowess and innovation in dental manufacturing, while Scandinavian countries exhibit high per capita spending on dental care. Favorable reimbursement policies in some European countries and an increasing trend towards dental tourism also stimulate market growth.

- Asia Pacific (APAC): The Asia Pacific region is poised for the fastest growth in the dental implants market due to its large and growing population, improving economic conditions, and expanding healthcare infrastructure. Countries such as China, India, Japan, and South Korea are experiencing a surge in demand for dental implants, fueled by increasing disposable incomes, rising awareness about oral health, and a growing number of skilled dental professionals. Japan and South Korea are noted for their technological advancements and high adoption rates of digital dentistry, while China and India offer immense untapped potential due to their vast populations and increasing access to dental care.

- Latin America: This region presents considerable growth opportunities in the dental implants market, largely driven by increasing urbanization, improving economic stability, and a rising focus on healthcare infrastructure development. Brazil and Mexico are prominent markets, witnessing a growing demand for dental aesthetics and restorative procedures. Dental tourism is also a significant factor, attracting patients from North America seeking more affordable, high-quality dental treatments. However, challenges such as varying healthcare regulations and economic disparities across countries remain.

- Middle East and Africa (MEA): The MEA region is an emerging market for dental implants, characterized by increasing healthcare investments, a rising prevalence of dental diseases, and a growing demand for sophisticated medical and dental services, particularly in countries within the Gulf Cooperation Council (GCC) such as the UAE and Saudi Arabia. Improving economic conditions and a growing expatriate population contribute to the demand for advanced dental care. While the market is currently smaller compared to developed regions, it holds substantial potential due to ongoing infrastructure development and increasing awareness regarding advanced dental treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Implants Market.- Straumann Group

- Dentsply Sirona

- Envista Holdings Corporation

- Zimmer Biomet

- Henry Schein Inc.

- MegaGen Implant

- Osstem Implant

- Anthogyr

- Dentium

- DIO Corporation

- Shofu Dental Corporation

- Southern Implants

- Cortex Dental Implants

- C-Tech Implant

- ADIN Dental Implant Systems

- MIS Implants Technologies

- Neodent

- Bicon Dental Implants

- Ximplant GmbH

- ACE Surgical Supply Co. Inc.

Frequently Asked Questions

What are dental implants?

Dental implants are artificial tooth roots, usually made of titanium or zirconia, surgically placed into the jawbone to support a prosthetic tooth, such as a crown, bridge, or denture, restoring function and aesthetics.

How long do dental implants last?

With proper oral hygiene and regular dental check-ups, dental implants can last for several decades, often a lifetime, making them a highly durable and long-term tooth replacement solution.

Are dental implants painful to get?

The dental implant procedure is typically performed under local anesthesia, so patients generally experience minimal pain during the surgery. Post-operative discomfort is manageable with prescribed pain medication.

What are the benefits of choosing dental implants?

Benefits include improved chewing ability, enhanced speech, prevention of bone loss, a natural appearance and feel, superior comfort compared to dentures, and preservation of adjacent healthy teeth.

What is the cost of dental implants?

The cost of dental implants varies widely depending on factors like the number of implants, materials used, geographical location, additional procedures (e.g., bone grafting), and the specific dental professional. It can range from a few thousand to tens of thousands of dollars.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Titanium Dental Implants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dental Implants and Abutment Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Dental Implants and Prosthesis Market Size Report By Type (Dental Implants, Dental Prosthetics, Other), By Application (Hospital, Dental Clinic), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Implants Market Size Report By Type (Titanium Dental Implant, Titanium Alloy Dental Implant, Zirconia Dental Implant), By Application (Hospital, Dental Clinic), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Titanium Dental Implants Market Statistics 2025 Analysis By Application (Hospital, Dental Clinic), By Type (Endosteal Implants, Subperiosteal Implants), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager