Dental Matrix Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427187 | Date : Oct, 2025 | Pages : 244 | Region : Global | Publisher : MRU

Dental Matrix Systems Market Size

The Dental Matrix Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.0% between 2025 and 2032. The market is estimated at USD 415 million in 2025 and is projected to reach USD 665 million by the end of the forecast period in 2032.

This steady growth is primarily attributed to the increasing prevalence of dental caries and periodontal diseases globally, alongside a rising demand for aesthetic dental restorations. Dental matrix systems are indispensable tools in restorative dentistry, enabling practitioners to achieve accurate anatomical contours and proper contact points when placing filling materials. The markets expansion is further fueled by advancements in dental materials and techniques, which necessitate precise isolation and shaping during complex restorative procedures, ensuring optimal clinical outcomes and patient satisfaction.

Moreover, the growing geriatric population, often prone to dental issues requiring restorative interventions, contributes significantly to market demand. Increased awareness regarding oral health and hygiene, coupled with rising disposable incomes in developing economies, encourages more individuals to seek professional dental care, including restorative treatments. The continuous innovation in matrix system designs, offering improved ease of use, enhanced adaptability, and better patient comfort, also plays a crucial role in driving market adoption and expansion over the forecast period.

Dental Matrix Systems Market introduction

The Dental Matrix Systems Market encompasses a range of dental devices specifically designed to facilitate the accurate and efficient restoration of tooth anatomy during various restorative procedures, primarily in direct fillings. These systems create a temporary wall or boundary around the prepared tooth, allowing the dental material, such as composite resin or amalgam, to be securely packed and contoured to restore the tooths natural shape and function. The market includes diverse product types, from traditional circumferential bands to modern sectional matrices and automated systems, each catering to specific clinical requirements and preferences of dental practitioners. Their primary function is to establish correct proximal contacts and anatomical contours, preventing overhangs and ensuring the longevity of restorations.

Major applications of dental matrix systems span a wide spectrum of restorative dentistry, including Class I, II, III, IV, and V restorations in both anterior and posterior teeth. They are particularly crucial for Class II restorations, where the interproximal surface of a tooth is involved, necessitating a precise contact point with the adjacent tooth. These systems are extensively utilized in general dental practices, specialized restorative clinics, and dental hospitals for routine restorative procedures, ensuring that the final restoration closely mimics the natural tooth structure, thereby enhancing both function and aesthetics for the patient.

The benefits of employing dental matrix systems are substantial, contributing to superior clinical outcomes and practice efficiency. They ensure accurate tooth contours, facilitate the establishment of proper contact points, minimize the risk of marginal overhangs, and significantly improve the marginal integrity of restorations. These advantages collectively lead to enhanced longevity of dental fillings, reduced chair time for dentists, and improved patient comfort. Driving factors for this market include the escalating global incidence of dental caries, the increasing demand for aesthetically pleasing dental solutions, continuous technological advancements in matrix materials and designs, a burgeoning elderly population with higher rates of tooth decay, and greater emphasis on preventive and restorative oral healthcare.

Dental Matrix Systems Market Executive Summary

The Dental Matrix Systems Market is characterized by robust business trends driven by a growing global demand for restorative dental procedures and ongoing technological innovations. The market is witnessing a shift towards more sophisticated and user-friendly systems, such as sectional matrix systems and automated tensioning devices, which offer superior clinical outcomes, including enhanced anatomical accuracy and reliable contact points. Furthermore, the increasing adoption of aesthetic composite resins over traditional amalgam fillings is propelling the demand for transparent and light-curing compatible matrix bands. Strategic partnerships, mergers, and acquisitions among key market players are also prevalent, aimed at expanding product portfolios, enhancing distribution networks, and gaining a competitive edge in a dynamic market landscape. Investment in research and development remains a cornerstone, focusing on materials that offer better flexibility, ease of handling, and improved biocompatibility.

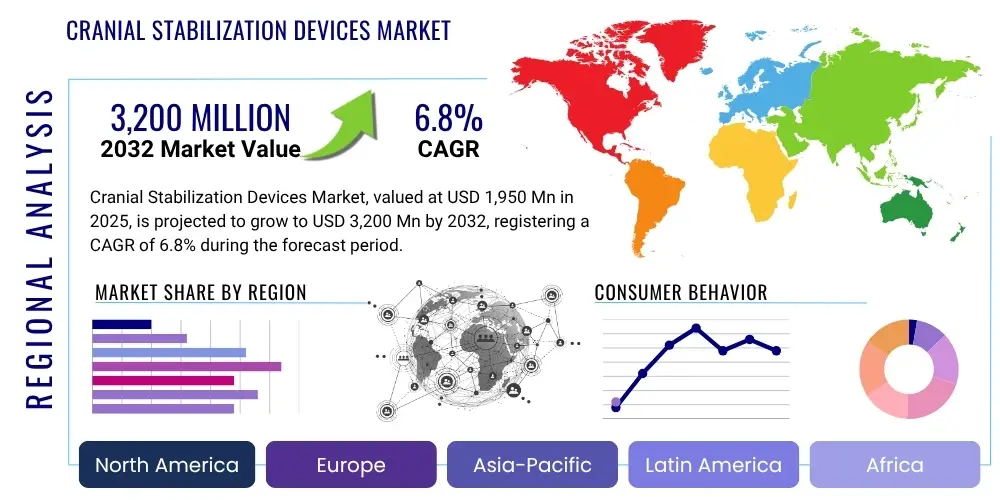

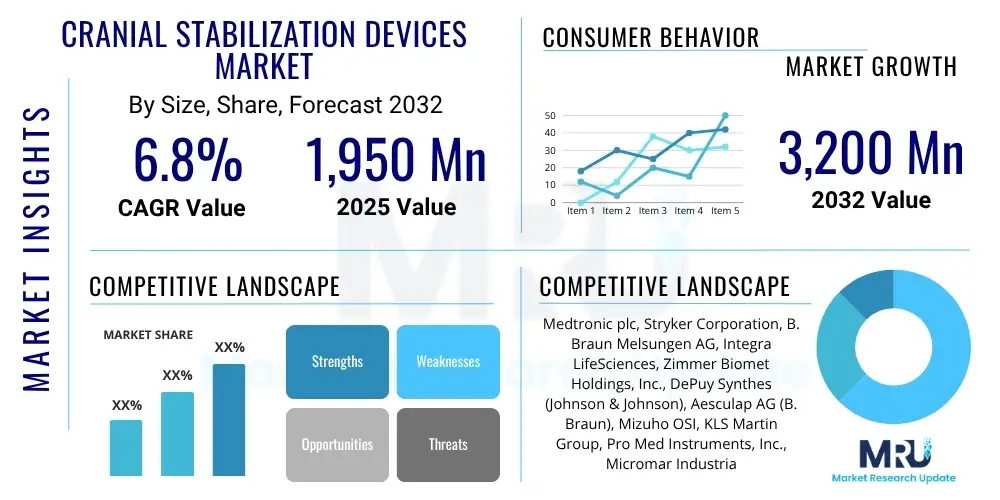

Regional trends indicate North America and Europe as dominant markets, primarily due to well-established dental healthcare infrastructures, high patient awareness, and significant adoption rates of advanced dental technologies. These regions benefit from a high per capita expenditure on dental care and a strong presence of leading market players. However, the Asia-Pacific region is emerging as the fastest-growing market, propelled by its large and aging population, increasing disposable incomes, improving access to dental care, and a rising prevalence of dental diseases. Countries like China and India are experiencing rapid market expansion due to expanding dental tourism, government initiatives to improve oral health, and a growing number of dental professionals. Latin America and the Middle East and Africa also show promising growth potential, driven by developing healthcare infrastructure and increasing oral health awareness.

Segmentation trends highlight the dominance of sectional matrix systems due to their superior ability to recreate natural tooth contours and tight contact points, particularly in Class II restorations. Metal matrices, often preferred for their durability and precise shaping, continue to hold a significant share, while transparent matrices are gaining traction for aesthetic procedures involving light-cured composites. Dental clinics represent the largest end-user segment, driven by the high volume of routine restorative procedures performed. The market is also seeing increased demand for specialized matrix accessories, such as wedges and rings, which complement the primary matrix bands to achieve optimal restoration quality. Innovations targeting specific applications, like pediatric dentistry or complex multi-surface restorations, are further refining segment dynamics.

AI Impact Analysis on Dental Matrix Systems Market

Common user questions regarding AIs impact on the Dental Matrix Systems Market often revolve around how artificial intelligence could enhance precision, efficiency, and clinical decision-making. Users are keen to understand if AI can personalize matrix selection, predict optimal matrix placement for complex restorations, or even automate aspects of the restorative procedure. Concerns frequently surface about the potential for AI to reduce the need for skilled manual input, its integration challenges with existing dental workflows, and the data privacy implications of incorporating AI-driven diagnostic and planning tools. Expectations are high for AI to streamline treatment planning, reduce procedural errors, and ultimately improve patient outcomes through more accurate and predictable restorations, while also offering training and simulation tools for dental students and professionals.

The integration of AI in dentistry is poised to significantly influence the design, application, and overall market dynamics of dental matrix systems. AI algorithms can analyze vast datasets of dental scans, patient anatomies, and successful restoration outcomes to recommend the most suitable matrix system and technique for specific clinical scenarios, leading to personalized treatment approaches. This capability could minimize trial and error, reduce chair time, and enhance the predictability of restoration quality. Furthermore, AI could play a role in quality assurance, by evaluating the fit and contour of restorations immediately post-placement, potentially identifying marginal discrepancies or contact point deficiencies that might otherwise go unnoticed, thereby improving the longevity and success rate of dental work.

Beyond direct application, AIs influence extends to the manufacturing and supply chain of dental matrix systems. Predictive analytics powered by AI can optimize inventory management for dental practices and distributors, forecasting demand based on patient demographics, common dental issues, and historical usage patterns. In product development, AI-driven simulations can accelerate the design of new, more anatomically adaptive, and user-friendly matrix systems, reducing R&D cycles and costs. Educational platforms incorporating AI could also provide interactive training for dentists on optimal matrix placement and manipulation, enhancing professional skill sets. While full automation of matrix placement remains a distant prospect, AIs role in augmenting precision, planning, and quality control is expected to be transformative.

- AI-driven precision in matrix selection and placement for complex anatomies.

- Predictive analytics for optimizing inventory and supply chain management of matrix systems.

- Enhanced quality control through AI analysis of restoration contours and contact points.

- Personalized treatment planning based on patient-specific data, improving restorative outcomes.

- Development of advanced matrix designs through AI-powered simulation and material science.

- AI-assisted training and simulation tools for dental professionals on matrix techniques.

- Potential for reduced chair time and improved patient satisfaction through optimized procedures.

- Data-driven insights for manufacturers to innovate and address specific market needs.

DRO & Impact Forces Of Dental Matrix Systems Market

The Dental Matrix Systems Market is significantly influenced by a confluence of driving factors, restraints, and opportunities that collectively shape its trajectory and impact forces. A primary driver is the pervasive global burden of dental diseases, particularly dental caries, which necessitates a high volume of restorative procedures. The increasing demand for aesthetically pleasing, natural-looking restorations, largely driven by composite resin fillings, also fuels the need for precise matrix systems that ensure excellent anatomical contours and contact points. Furthermore, the growing geriatric population, inherently more susceptible to dental issues, alongside rising awareness of oral hygiene and greater access to dental care in emerging economies, are substantial market stimulants. Continuous advancements in dental materials and restorative techniques further underscore the essential role of sophisticated matrix systems in achieving optimal clinical results.

Despite robust growth drivers, the market faces certain restraints. The relatively high cost associated with advanced dental matrix systems and their accompanying accessories can be a barrier to adoption, particularly in price-sensitive markets or smaller dental practices with limited budgets. Additionally, the availability and accessibility of skilled dental professionals capable of effectively utilizing the more intricate matrix systems can vary regionally, posing a challenge to wider market penetration. Limited reimbursement policies for certain dental procedures in some healthcare systems may also indirectly impact the demand for high-end matrix systems. The presence of alternative restorative techniques, though often less precise, can also exert a competitive pressure on the market for specialized matrix products.

Opportunities within the Dental Matrix Systems Market are abundant, particularly in emerging economies where dental healthcare infrastructure is rapidly developing and per capita spending on dental care is on the rise. The burgeoning trend of digital dentistry, including CAD/CAM technologies and intraoral scanning, presents avenues for integration with matrix system planning and customization, promising enhanced precision and efficiency. Furthermore, ongoing research and development into novel, biocompatible, and user-friendly matrix materials, potentially incorporating smart features or advanced ergonomics, offer significant growth prospects. The expansion of dental tourism and increasing investments in dental research and education also present fertile ground for market players to innovate and expand their reach, addressing unmet clinical needs and refining existing solutions to align with evolving dental practices.

Segmentation Analysis

The Dental Matrix Systems Market is comprehensively segmented based on various factors including product type, material, application, and end-user, providing a detailed understanding of market dynamics and consumer preferences. This granular segmentation allows for a precise analysis of demand patterns and technological advancements within each category, highlighting the areas of most significant growth and investment. The markets diverse offerings cater to a broad spectrum of dental restorative needs, from simple single-surface fillings to complex multi-surface reconstructions, making segmentation crucial for both market players and dental professionals in identifying appropriate solutions.

Key segments are defined by the specific characteristics and utility of the matrix systems. Product types differentiate between sectional, circumferential, retainer-based, and automated systems, each designed for distinct restorative challenges. Materials used, such as metal or transparent plastic, influence the systems adaptability for different filling materials and curing methods. Application-based segmentation addresses the specific tooth classes or types of restorations, while end-user categorization distinguishes between major consumption points like dental clinics, hospitals, and academic institutions, reflecting their unique purchasing patterns and volume requirements. Understanding these segments is vital for strategic market positioning and product development.

The continuous evolution in dental materials and restorative techniques directly impacts the prominence and growth of various segments. For instance, the increasing preference for composite resins has boosted the demand for transparent matrices that allow for effective light curing. Similarly, the drive for highly anatomical and tight contact points in posterior restorations has propelled the sectional matrix segment. Manufacturers are increasingly focusing on developing versatile systems that offer improved aesthetics, functionality, and ease of use across different segments, driving innovation and competitive differentiation within the market.

- By Product Type:

- Sectional Matrix Systems

- Circumferential Matrix Systems (e.g., Tofflemire)

- Automatic Matrix Systems (e.g., Automatrix)

- Transparent Matrix Systems

- Matrix Bands

- Matrix Retainers

- Wedges

- Rings

- Other Accessories

- By Material:

- Metal Matrices (e.g., Stainless Steel, Titanium)

- Plastic/Polymer Matrices (e.g., Mylar, Clear Plastic)

- By Application:

- Class I Restorations

- Class II Restorations

- Class III Restorations

- Class IV Restorations

- Class V Restorations

- Core Build-up

- By End-User:

- Dental Clinics

- Hospitals

- Academic and Research Institutes

- Dental Laboratories

Dental Matrix Systems Market Value Chain Analysis

The value chain for the Dental Matrix Systems Market begins with upstream activities involving the sourcing and processing of raw materials. This includes specialty metals like stainless steel and titanium for metal matrices and retainers, as well as various polymers and plastics for transparent and disposable matrix bands and wedges. Key suppliers in this stage are manufacturers of medical-grade raw materials, ensuring compliance with strict biocompatibility and quality standards. Research and development efforts at this stage focus on enhancing material properties, such as flexibility, strength, and light transmissibility, which are critical for the functionality and performance of the final dental matrix products. Innovation in material science directly contributes to the development of next-generation matrix systems that offer improved clinical outcomes and user experience.

Further along the value chain are the manufacturing processes, where raw materials are transformed into finished dental matrix systems and accessories. This stage involves precision engineering, molding, stamping, and assembly, often utilizing advanced automated machinery to ensure consistency and accuracy. Manufacturers of dental matrix systems invest heavily in quality control to meet international regulatory standards for medical devices. Following manufacturing, products move into the distribution phase, which is bifurcated into direct and indirect channels. Direct distribution involves manufacturers selling directly to large dental hospital groups, academic institutions, or large-scale dental supply chains. This approach allows for direct communication, bulk purchasing, and often tailored support services.

Indirect distribution forms a significant part of the downstream analysis, where manufacturers leverage a network of authorized distributors, wholesalers, and dental supply companies. These intermediaries play a crucial role in reaching a broad base of individual dental clinics, smaller practices, and independent practitioners. They manage inventory, provide logistics, and offer local customer support and sales services, making dental matrix systems readily accessible across diverse geographical regions. The effectiveness of the distribution channel is paramount, as it ensures timely delivery and competitive pricing. Ultimately, the end-users, comprising dental professionals in clinics and hospitals, procure these systems to perform restorative procedures, completing the value chain by delivering essential oral healthcare services to patients. The efficiency of this entire chain, from raw material sourcing to patient application, directly impacts market penetration and overall industry growth.

Dental Matrix Systems Market Potential Customers

The primary potential customers and end-users of dental matrix systems are dental professionals engaged in restorative dentistry across various settings. This includes general dentists, prosthodontists, endodontists, and pediatric dentists who routinely perform direct restorative procedures. Dental clinics, ranging from single-practitioner offices to large multi-specialty group practices, represent the largest segment of end-users. These clinics rely heavily on dental matrix systems for daily operations, given the high incidence of dental caries and the continuous demand for aesthetically pleasing and functionally sound dental restorations. Their purchasing decisions are influenced by factors such as product versatility, ease of use, cost-effectiveness, and the clinical outcomes achieved with different systems.

Dental hospitals and academic and research institutes also constitute significant potential customers. In hospital settings, dental departments utilize matrix systems for treating a wide array of patients, including those with complex medical histories or extensive dental needs, often requiring a diverse range of matrix options. Academic institutions, on the other hand, serve as crucial training grounds for future dental professionals, incorporating matrix systems into their curriculum for hands-on instruction and research. These institutions often require bulk purchases for student clinics and laboratories, and their adoption patterns can influence the preferences of new practitioners entering the field, making them important targets for manufacturers and distributors.

Additionally, specialized cosmetic dental centers and dental laboratories that work closely with clinicians on direct restorations or mock-ups may also be considered potential customers, particularly for advanced or specialized matrix systems designed for aesthetic purposes. The increasing focus on precision and natural contours in cosmetic dentistry drives the demand for high-quality, anatomically precise matrix systems. Ultimately, the market for dental matrix systems is driven by the global need for effective and durable tooth restorations, positioning any entity involved in providing or training for restorative dental care as a potential customer, with an emphasis on those prioritizing clinical excellence and patient satisfaction.

Dental Matrix Systems Market Key Technology Landscape

The technology landscape of the Dental Matrix Systems Market is characterized by a continuous evolution aimed at enhancing precision, ease of use, and adaptability to diverse clinical situations. Modern systems have moved beyond basic circumferential bands to include sophisticated sectional matrix systems, which are highly favored for their ability to create accurate proximal contacts and natural anatomical contours, particularly in Class II restorations. These systems often utilize specialized rings or tensioning devices that separate adjacent teeth slightly, allowing for the precise placement of matrix bands and ensuring tight contact points upon removal. Innovations in material science have led to the development of thinner, more flexible, and transparent matrix bands that facilitate light curing and improve visibility during restorative procedures.

Further technological advancements include automated matrix systems, such as self-tightening bands, which simplify the placement process and reduce chair time. These systems are designed to offer consistent tension and fit without the need for traditional retainers, thus streamlining the restorative workflow. The integration of advanced polymer composites in transparent matrices allows for superior light transmission, crucial for efficient curing of composite resins, while also providing excellent contouring capabilities. Additionally, the development of specialized wedges, made from various materials like wood, plastic, or light-transmitting composites, complements matrix systems by providing necessary tooth separation and preventing gingival overhangs, further enhancing restoration quality.

The future technology landscape is expected to lean towards even greater precision and integration with digital dentistry workflows. This could involve matrix systems designed for compatibility with CAD/CAM technology, allowing for custom matrix designs based on intraoral scans, or materials that offer enhanced bio-compatibility and antimicrobial properties. Research is also focused on developing "smart" matrix systems that could potentially sense tooth anatomy or curing conditions, offering real-time feedback to the clinician. The emphasis remains on improving ergonomic design, reducing procedural steps, and ultimately delivering more predictable, durable, and aesthetically superior dental restorations, ensuring that dental matrix systems remain at the forefront of restorative dental technology.

Regional Highlights

- North America: This region holds a significant share of the Dental Matrix Systems Market, driven by a well-established dental healthcare infrastructure, high awareness regarding oral health, and considerable expenditure on dental care. The presence of leading market players, rapid adoption of advanced dental technologies, and a growing aging population further contribute to its dominance.

- Europe: The European market is mature and characterized by high demand for aesthetic and restorative dentistry. Countries like Germany, the UK, and France show robust growth due to increasing incidence of dental caries, an aging demographic, and strong governmental support for healthcare innovation.

- Asia-Pacific: Emerging as the fastest-growing region, Asia-Pacific presents substantial market opportunities. Factors such as a large and expanding population base, rising disposable incomes, improving access to dental care, and increasing dental tourism in countries like China, India, and Japan are propelling market expansion.

- Latin America: This region demonstrates steady growth, driven by increasing investment in healthcare infrastructure, growing awareness about oral hygiene, and rising demand for affordable dental treatments. Brazil and Mexico are key contributors to market development in this area.

- Middle East & Africa: The market in the MEA region is developing, supported by increasing healthcare expenditure, growing medical tourism, and a rising prevalence of dental diseases. However, market growth is slower compared to other regions due to varying levels of healthcare access and economic development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Matrix Systems Market.- Dentsply Sirona Inc.

- 3M Company

- Ivoclar Vivadent AG

- Ultradent Products Inc.

- Garrison Dental Solutions LLC

- Tor VM

- Voco GmbH

- COLTENE Holding AG

- Kerr Corporation (Envista Holdings Corporation)

- Henry Schein Inc.

- Integra LifeSciences Holdings Corporation

- Shofu Inc.

- Septodont Holding

- DenMat Holdings LLC

Frequently Asked Questions

What are dental matrix systems primarily used for?

Dental matrix systems are primarily used in restorative dentistry to create a temporary wall or boundary around a prepared tooth, facilitating the precise placement and contouring of filling materials like composite resin or amalgam to restore the tooths natural anatomy and contact points.

What is the projected growth rate of the Dental Matrix Systems Market?

The Dental Matrix Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.0% between 2025 and 2032, driven by increasing dental caries prevalence and demand for aesthetic restorations.

How does AI impact the Dental Matrix Systems Market?

AI impacts the market by enhancing precision in matrix selection, optimizing placement for complex anatomies, streamlining treatment planning, and improving quality control through analysis of restoration contours, leading to more predictable and personalized outcomes.

Which factors are driving the demand for dental matrix systems?

Key drivers include the high global incidence of dental caries, increasing demand for aesthetic dental restorations, advancements in dental materials and techniques, a growing geriatric population, and rising awareness of oral hygiene.

What are the main types of dental matrix systems available?

The main types include sectional matrix systems, circumferential matrix systems (e.g., Tofflemire), automatic matrix systems, and transparent matrix systems, along with various accessories like wedges and rings, each designed for specific restorative needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager