Dental Suction Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429972 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Dental Suction Systems Market Size

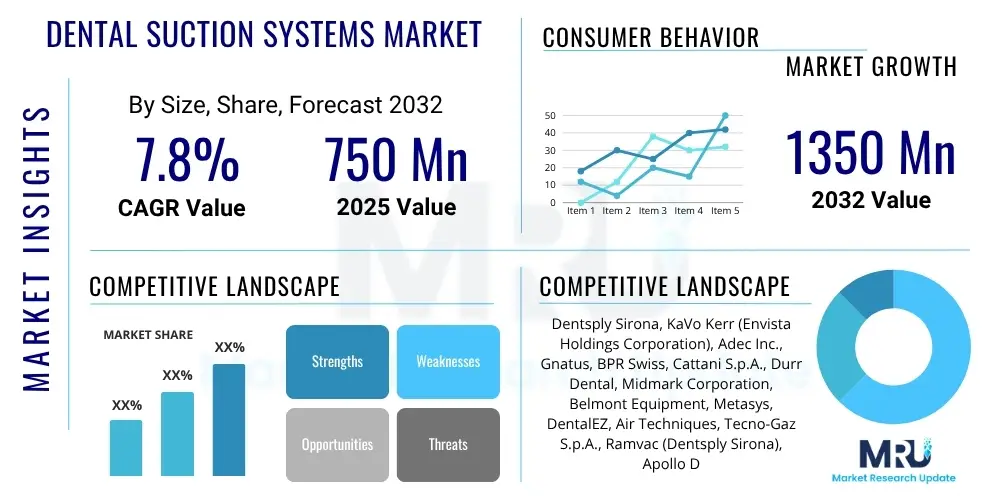

The Dental Suction Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 750 Million in 2025 and is projected to reach USD 1350 Million by the end of the forecast period in 2032.

Dental Suction Systems Market introduction

The dental suction systems market encompasses a range of specialized equipment crucial for maintaining a dry, clear, and sterile environment within the oral cavity during various dental procedures. These systems are indispensable tools for dentists, oral surgeons, orthodontists, and hygienists, effectively removing saliva, blood, debris, and water that accumulate during treatments. The continuous innovation in product design focuses on enhancing efficiency, reducing noise levels, improving patient comfort, and ensuring stringent infection control, making them fundamental to modern dental practice.

Products within this market typically include high-volume evacuator (HVE) systems and low-volume evacuator (LVE) systems, which can be further categorized by their operational mechanics into wet suction, dry suction, and semi-wet suction units. HVE systems are vital during procedures involving significant aerosols and fluids, such as drilling and scaling, while LVE systems are employed for less intensive fluid removal. The primary objective is to provide a clear field of vision for the dental practitioner, thereby improving the precision and safety of procedures, alongside significantly enhancing patient comfort by preventing aspiration and minimizing discomfort from fluid buildup.

The major applications of dental suction systems span across general dentistry, oral and maxillofacial surgery, orthodontics, periodontics, and endodontics. Their benefits are manifold, including superior infection control by minimizing airborne pathogens, enhanced procedural efficiency through unobstructed views, increased patient safety by preventing the swallowing or aspiration of materials, and improved overall operational ergonomics for dental professionals. Key driving factors propelling market growth include the escalating global prevalence of oral diseases, the expanding geriatric population requiring extensive dental care, increasing aesthetic dentistry demands, rising awareness of oral hygiene, and the continuous technological advancements in dental equipment aiming for greater efficiency and sustainability.

Dental Suction Systems Market Executive Summary

The Dental Suction Systems Market is experiencing robust growth, driven by an confluence of evolving business trends, significant regional dynamics, and innovative segment-specific developments. Business trends indicate a strong emphasis on integrating digital technologies, such as IoT and AI, to enhance system automation, predictive maintenance capabilities, and energy efficiency. There is also a notable shift towards ergonomically designed, quieter, and more compact suction units that optimize clinic space and improve the working environment for dental professionals. Mergers and acquisitions are playing a strategic role, allowing key players to expand their product portfolios and geographical reach, consolidating market presence and fostering innovation through combined R&D efforts. Furthermore, the market is witnessing a surge in demand for systems that comply with stricter environmental regulations, particularly concerning amalgam separation and waste disposal, pushing manufacturers towards greener solutions.

Regional trends highlight North America and Europe as mature markets characterized by high adoption rates of advanced suction technologies and stringent regulatory frameworks for dental practices and waste management. These regions demonstrate a consistent demand for premium, high-performance systems and are often early adopters of innovative solutions. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market due to increasing dental tourism, expanding healthcare infrastructure, rising disposable incomes, and a burgeoning middle class demanding better dental care. Countries like China, India, and South Korea are becoming pivotal growth hubs, attracting significant investments. Latin America and the Middle East & Africa (MEA) are also showing promising growth potential, fueled by improving access to dental services and increasing awareness regarding oral health, albeit with challenges related to infrastructure development and affordability.

Segment trends reveal a significant preference for centralized wet suction systems in larger dental facilities and hospitals, owing to their efficiency and comprehensive waste management capabilities. However, standalone and portable dry suction systems are gaining traction among smaller clinics and specialized practices due to their flexibility, ease of installation, and cost-effectiveness. The application segment is seeing heightened demand from oral and maxillofacial surgery, where high-volume evacuation is critical, and from general dentistry, which constitutes the largest user base. End-user analysis indicates that private dental clinics remain the largest segment, but dental hospitals and academic institutions are also significant contributors to market revenue, driven by their high patient volumes and advanced procedural requirements. The focus on improved infection control and patient safety continues to drive innovation across all segments, leading to enhanced filtration and sterilization features.

AI Impact Analysis on Dental Suction Systems Market

The integration of Artificial Intelligence (AI) into the dental suction systems market is a nascent yet promising development, sparking considerable interest among users regarding its potential to revolutionize dental practice efficiency and safety. Common user questions often revolve around whether AI can automate suction processes, how it might improve system maintenance, and what practical benefits it offers for patient care and practice management. Users are particularly keen to understand how AI can move beyond simple automation to predictive analytics, anticipating issues before they arise and optimizing system performance dynamically. Concerns also include the cost implications of integrating AI, the complexity of implementation, and the necessity for specialized training, alongside questions about data privacy and system reliability in a clinical setting.

- Predictive Maintenance: AI algorithms can analyze usage patterns and sensor data to predict potential equipment failures, enabling proactive maintenance and minimizing downtime. This translates to fewer unexpected disruptions in dental practice operations.

- Optimized Suction Power: AI-powered sensors could detect real-time fluid and debris levels in the oral cavity, automatically adjusting suction power to maintain optimal clearance without excessive energy consumption or unnecessary noise.

- Enhanced Infection Control: AI can monitor filter status and fluid disposal systems, alerting staff when maintenance is required or when hazardous waste levels are reached, thereby bolstering infection control protocols and ensuring regulatory compliance.

- Integration with Smart Dental Chairs: AI could enable seamless communication between the suction system and other smart dental equipment, allowing for synchronized operation and a more cohesive digital workflow in the operatory.

- Energy Efficiency: By learning optimal usage patterns and minimizing unnecessary power consumption, AI can help reduce energy costs associated with dental suction systems, contributing to more sustainable dental practices.

- Automated Diagnostics: AI-driven diagnostic tools could quickly identify and troubleshoot operational issues within the suction system, reducing the need for manual inspection and speeding up repair times.

- Training and Simulation: AI can be utilized in virtual reality or augmented reality training modules for dental staff, simulating various scenarios for efficient and safe operation of advanced suction systems.

DRO & Impact Forces Of Dental Suction Systems Market

The dental suction systems market is significantly influenced by a dynamic interplay of driving factors, inherent restraints, and emerging opportunities, all shaped by various impact forces. Key drivers include the escalating global prevalence of oral diseases such as caries, periodontal disease, and oral cancer, which necessitate frequent dental interventions and consequently, the use of efficient suction systems for clinical procedures. The rapidly expanding geriatric population worldwide is another crucial driver, as older adults often require more complex and prolonged dental treatments, increasing the demand for sophisticated and reliable suction equipment. Furthermore, the growing awareness and demand for aesthetic dentistry procedures, alongside increasingly stringent infection control regulations and patient safety standards mandated by health organizations globally, compel dental practitioners to invest in advanced and highly effective suction solutions.

Despite the strong growth drivers, the market faces several notable restraints. The high initial investment cost associated with advanced dental suction systems, particularly centralized units and those incorporating new technologies, can be a significant barrier for smaller dental clinics or those in developing regions with limited capital budgets. Additionally, the ongoing maintenance costs, including regular filter replacements, pump servicing, and energy consumption, contribute to the total cost of ownership, potentially deterring some buyers. A lack of skilled dental professionals capable of operating and maintaining sophisticated modern dental equipment in certain geographical areas also presents a challenge, impacting the adoption rate of technologically advanced systems. Moreover, the complex regulatory landscape surrounding medical devices, waste management, and environmental protection can create hurdles for manufacturers in introducing new products and for practitioners in ensuring compliance.

Nevertheless, the market is rife with significant opportunities that promise future expansion and innovation. Emerging economies, particularly in Asia Pacific and Latin America, represent largely untapped markets with rapidly improving dental healthcare infrastructure and rising disposable incomes, offering substantial growth potential. The ongoing integration of IoT and AI into dental equipment presents an opportunity for developing smart suction systems with enhanced automation, predictive maintenance, and energy efficiency features. There is also a growing demand for portable and compact suction systems suitable for mobile dentistry and smaller clinics, alongside an increasing emphasis on eco-friendly and sustainable solutions, such as amalgam separators and systems designed for lower water and energy consumption. The expansion of dental tourism globally further fuels the demand for high-quality dental services and associated equipment.

Segmentation Analysis

The dental suction systems market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation facilitates targeted market analysis, allowing stakeholders to identify key growth areas, competitive landscapes, and evolving consumer preferences across various product types, technologies, applications, and end-user categories. Each segment plays a crucial role in shaping the overall market trajectory, reflecting the varied needs of dental practices, from small, independent clinics to large university hospitals and specialized surgical centers, influencing purchasing decisions and technological advancements within the industry.

- By Product Type:

- Wet Suction Systems: Primarily use water for vacuum creation and waste disposal.

- Dry Suction Systems: Rely on air for vacuum and separate waste collection.

- Semi-Wet Suction Systems: Combine aspects of both wet and dry systems for flexibility.

- Portable Suction Systems: Compact, mobile units for smaller spaces or mobile dentistry.

- By Technology:

- Centralized Suction Systems: Integrated into the entire dental facility, serving multiple operatories.

- Standalone Suction Systems: Independent units serving one or two dental chairs.

- By Application:

- General Dentistry: Routine check-ups, fillings, and basic restorative procedures.

- Oral and Maxillofacial Surgery: Procedures involving extensive fluid and tissue removal.

- Orthodontics: Braces, aligners, and related adjustments.

- Periodontics: Treatment of gum diseases and associated surgical interventions.

- Endodontics: Root canal treatments and related procedures.

- Others: Pediatric dentistry, cosmetic dentistry, etc.

- By End User:

- Dental Hospitals: Large facilities with multiple departments and high patient volumes.

- Dental Clinics: Private practices, group practices, and specialized clinics.

- Ambulatory Surgical Centers: Outpatient surgical facilities performing dental procedures.

- Academic and Research Institutes: Dental schools and research centers for training and innovation.

Value Chain Analysis For Dental Suction Systems Market

The value chain for the dental suction systems market commences with upstream activities involving the sourcing and manufacturing of raw materials and specialized components, crucial for the quality and performance of the final product. This stage includes suppliers of high-grade plastics, metals (such as stainless steel and aluminum), advanced electronic components for motors and control units, and specialized materials for filters and amalgam separators. Key players in this segment focus on ensuring material quality, cost-effectiveness, and adherence to medical device standards. The efficiency and reliability of these upstream suppliers directly impact the manufacturing process and the overall quality of the dental suction systems, driving innovation in material science and component design to meet the evolving demands for durability, quiet operation, and energy efficiency.

The core manufacturing stage involves assembling these components into complete dental suction systems, including the integration of pumps, motors, separation units, and control interfaces. Manufacturers prioritize advanced engineering to produce systems that are powerful, quiet, reliable, and compliant with international health and safety regulations. This stage also includes rigorous quality control and testing processes to ensure the systems meet performance specifications and durability standards. Post-manufacturing, the products move into various distribution channels. Direct distribution involves manufacturers selling directly to large dental hospitals, government institutions, or large dental clinic chains, often accompanied by direct installation and service agreements. This approach allows for closer customer relationships and direct feedback, enabling faster product improvements and tailored solutions.

Conversely, indirect distribution plays a significant role through a network of wholesalers, distributors, and dental equipment dealers. These intermediaries are vital for reaching a broader customer base, particularly small to medium-sized private dental clinics, across diverse geographical locations. They often provide localized sales support, installation services, and after-sales maintenance, which are critical for customer satisfaction and market penetration. Downstream activities involve the end-users, primarily dental hospitals, private dental clinics, and academic institutions, which utilize these systems in their daily operations. The effectiveness of the distribution channels, coupled with robust after-sales support including technical assistance, spare parts availability, and training, significantly influences customer loyalty and repeat purchases, thereby completing the value chain by ensuring seamless product delivery and sustained operational performance for dental professionals.

Dental Suction Systems Market Potential Customers

The primary potential customers for dental suction systems are diverse end-users within the dental and medical healthcare sectors, all of whom require efficient and reliable fluid and debris removal during patient care. Private dental clinics represent the largest segment of potential customers. These clinics range from solo practices to multi-dentist group practices, all requiring robust suction capabilities for a wide array of general dentistry, restorative, and minor surgical procedures. Their purchasing decisions are often influenced by factors such as system reliability, noise levels, ease of maintenance, and the overall return on investment, particularly as they seek to enhance patient comfort and comply with stringent hygiene standards.

Dental hospitals and large university-affiliated dental departments constitute another significant customer base. These institutions typically handle high patient volumes and a broader range of complex procedures, including oral and maxillofacial surgeries, necessitating centralized, high-capacity suction systems. Their procurement processes often involve stringent specifications, competitive bidding, and a focus on durability, advanced features, and comprehensive service contracts. Academic and research institutes also represent key customers, purchasing systems for training future dental professionals and for use in clinical research, where the latest technologies and robust performance are often prioritized to facilitate cutting-edge studies and educational programs.

Furthermore, specialized dental practices such as orthodontics, periodontics, and endodontics, as well as ambulatory surgical centers that perform outpatient dental procedures, also constitute a vital segment of potential customers. These specialized practices often require suction systems tailored to their specific procedural needs, such as quieter systems for orthodontics or more powerful units for surgical interventions. The growing trend of mobile dentistry and community health centers in underserved areas also broadens the customer landscape, driving demand for portable and easy-to-install suction solutions that can maintain clinical standards in non-traditional settings, emphasizing flexibility and ease of transport.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 750 Million |

| Market Forecast in 2032 | USD 1350 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, KaVo Kerr (Envista Holdings Corporation), Adec Inc., Gnatus, BPR Swiss, Cattani S.p.A., Durr Dental, Midmark Corporation, Belmont Equipment, Metasys, DentalEZ, Air Techniques, Tecno-Gaz S.p.A., Ramvac (Dentsply Sirona), Apollo Dental Equipment, Fimet Oy, CATTANI Group, EKOM, Dentamerica, Sirona Dental Systems GmbH (Dentsply Sirona) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Suction Systems Market Key Technology Landscape

The dental suction systems market is characterized by a dynamic technology landscape continually evolving to meet the demands for enhanced efficiency, improved hygiene, and greater patient comfort. High-volume evacuation (HVE) and low-volume evacuation (LVE) remain foundational technologies, with ongoing innovations focusing on optimizing their ergonomic design, reducing noise levels through advanced motor and pump isolation, and enhancing suction power while minimizing energy consumption. A critical technological advancement is the widespread integration of amalgam separators, which are now often mandated by environmental regulations. These separators efficiently filter out amalgam particles from wastewater before it enters the public sewage system, demonstrating a commitment to environmental protection and regulatory compliance, and are becoming a standard feature in modern suction units.

Further technological progress is evident in the development of sophisticated vacuum pump technologies, transitioning from traditional wet ring pumps to more efficient and maintenance-friendly dry vacuum pumps. Dry vacuum systems offer advantages such as reduced water consumption, lower operating costs, and often quieter operation, making them increasingly popular in contemporary dental practices. Many systems now incorporate automatic drainage and self-cleaning features, significantly reducing the manual effort and time required for maintenance, thus improving clinic workflow and hygiene standards. The adoption of advanced filtration systems, including HEPA filters for air exhaust, is also on the rise, particularly in light of increased awareness regarding airborne pathogen transmission and the need for superior infection control within the clinical environment.

The advent of smart technologies is also beginning to transform the landscape. This includes the integration of intelligent sensors that monitor filter saturation, fluid levels, and system performance, providing real-time data and alerts to dental staff. These smart features facilitate predictive maintenance, optimize system operation, and can even connect with central clinic management systems for seamless data exchange and operational oversight. Additionally, there is a growing focus on modular designs that allow for easier upgrades, repairs, and customization, enhancing the longevity and adaptability of suction systems. The continuous pursuit of energy-efficient motors and components also reflects a broader industry trend towards sustainability and reduced operational costs for dental practices, ensuring that modern suction systems are not only effective but also environmentally responsible.

Regional Highlights

- North America: This region holds a significant share in the dental suction systems market, primarily driven by a highly developed healthcare infrastructure, substantial spending on dental care, and widespread adoption of advanced dental technologies. Stringent infection control guidelines and a high prevalence of oral diseases further boost market growth. The United States and Canada are leading countries, characterized by a large number of dental professionals and an emphasis on patient safety and comfort, fostering continuous innovation and market demand for high-performance and technologically sophisticated suction systems.

- Europe: Europe represents a mature market with a strong emphasis on regulatory compliance, environmental sustainability, and technological innovation. Countries such as Germany, the UK, France, and Italy are key contributors, benefiting from advanced dental practices, robust research and development activities, and a high awareness of oral hygiene. The region's focus on ergonomic design, energy efficiency, and noise reduction in dental equipment, coupled with strict waste management protocols, particularly concerning amalgam separation, drives the demand for premium and compliant suction systems.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for dental suction systems, propelled by rapidly expanding dental tourism, increasing healthcare expenditure, and a growing geriatric population. Emerging economies like China, India, Japan, and South Korea are experiencing significant market expansion due to improving access to dental services, rising disposable incomes, and the modernization of dental clinics. This region offers immense opportunities for market players seeking to expand their geographical footprint, driven by a burgeoning demand for both basic and advanced dental care solutions.

- Latin America: This region demonstrates steady growth in the dental suction systems market, primarily due to improving economic conditions, increasing awareness of oral health, and the expansion of dental care infrastructure. Countries like Brazil, Mexico, and Argentina are leading the regional market, benefiting from a rising middle-class population and increased government initiatives to enhance public health. While facing challenges related to affordability and infrastructure development, the region presents growing opportunities for cost-effective and reliable dental equipment.

- Middle East and Africa (MEA): The MEA region is an evolving market with promising growth potential, driven by increasing investments in healthcare infrastructure, growing medical tourism, and a rising prevalence of oral health issues. Countries in the Gulf Cooperation Council (GCC) such as UAE and Saudi Arabia are investing heavily in modernizing their dental facilities, leading to an increased demand for advanced dental equipment, including suction systems. Challenges such as political instability and varying levels of economic development across the region mean growth rates differ, but overall, the market is on an upward trajectory as dental care becomes more accessible.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Suction Systems Market.- Dentsply Sirona

- KaVo Kerr (Envista Holdings Corporation)

- Adec Inc.

- Gnatus

- BPR Swiss

- Cattani S.p.A.

- Durr Dental

- Midmark Corporation

- Belmont Equipment

- Metasys

- DentalEZ

- Air Techniques

- Tecno-Gaz S.p.A.

- Ramvac (Dentsply Sirona)

- Apollo Dental Equipment

- Fimet Oy

- CATTANI Group

- EKOM

- Dentamerica

- Sirona Dental Systems GmbH (Dentsply Sirona)

Frequently Asked Questions

What are the primary types of dental suction systems?

The primary types of dental suction systems include wet suction systems, which use water to create a vacuum; dry suction systems, which rely on air; semi-wet systems, combining aspects of both; and portable systems, designed for mobility and smaller spaces. Each type is suited for different clinical needs and practice setups.

How do dental suction systems contribute to infection control?

Dental suction systems are crucial for infection control by effectively removing aerosols, saliva, blood, and debris from the patient's mouth, thereby minimizing the spread of airborne pathogens. Modern systems often include advanced filtration (like HEPA filters) and amalgam separators to enhance safety for both patients and staff, and to ensure environmental compliance.

What factors are driving the growth of the dental suction market?

Key growth drivers include the rising global prevalence of oral diseases, an expanding geriatric population requiring extensive dental care, increasing demand for cosmetic dentistry, stringent infection control regulations, and continuous technological advancements in dental equipment focusing on efficiency and sustainability.

What are the key technological advancements in dental suction systems?

Key technological advancements include the widespread integration of amalgam separators for environmental compliance, the adoption of energy-efficient dry vacuum pumps, automatic drainage and self-cleaning features, advanced noise reduction technologies, and the nascent integration of smart sensors and AI for predictive maintenance and optimized performance.

Which regions offer significant opportunities for market expansion?

The Asia Pacific (APAC) region, particularly countries like China and India, offers significant opportunities for market expansion due to increasing dental tourism, rapidly improving healthcare infrastructure, and a growing middle class. Latin America and the Middle East & Africa also present promising growth potential as dental care access improves.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager