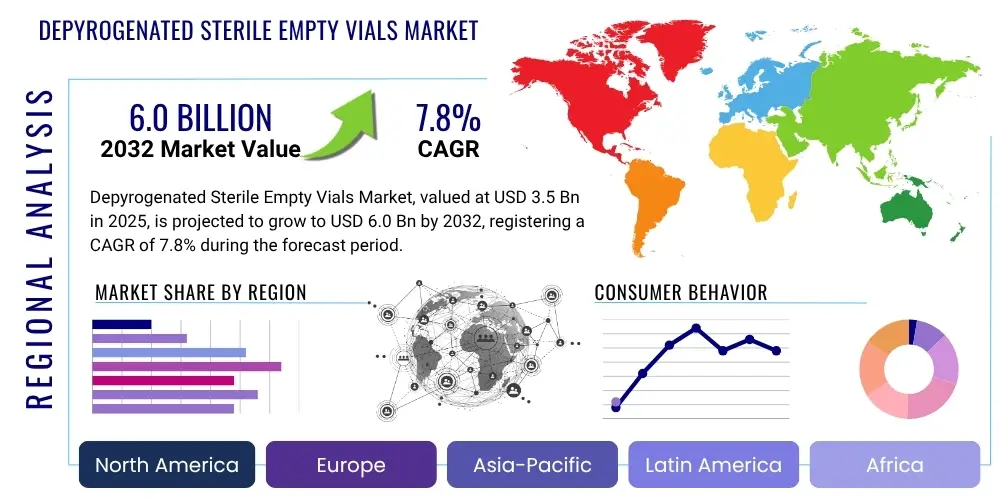

Depyrogenated Sterile Empty Vials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430228 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Depyrogenated Sterile Empty Vials Market Size

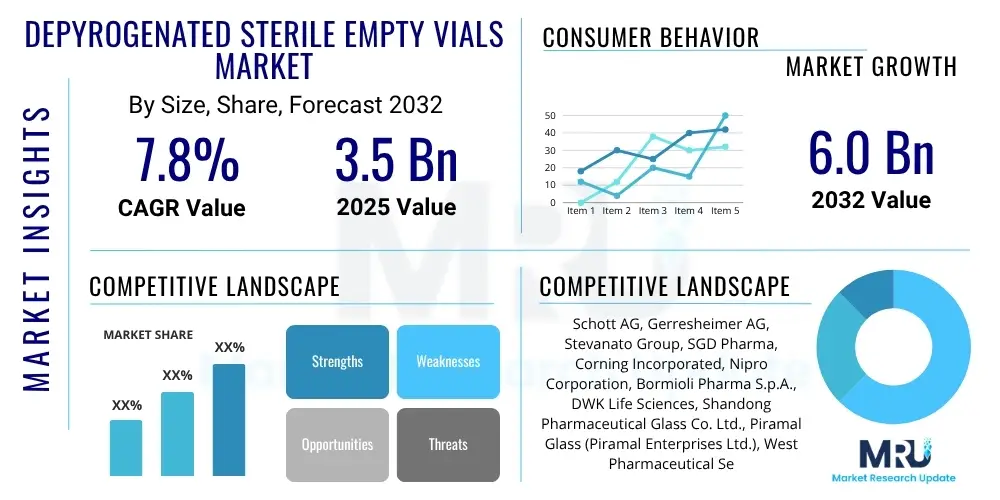

The Depyrogenated Sterile Empty Vials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $3.5 Billion in 2025 and is projected to reach $6.0 Billion by the end of the forecast period in 2032.

Depyrogenated Sterile Empty Vials Market introduction

The Depyrogenated Sterile Empty Vials Market constitutes a pivotal segment within the broader pharmaceutical packaging industry, providing indispensable containment solutions for a diverse spectrum of injectable drugs, complex biologics, and critical vaccines. These specialized vials undergo rigorous processing to achieve exceptionally high standards of sterility and depyrogenation, ensuring the uncompromising safety, stability, and therapeutic efficacy of sensitive pharmaceutical formulations. The increasingly stringent regulatory landscape imposed by global health authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), profoundly emphasizes the non-negotiable importance of these meticulously prepared primary packaging components, thereby stimulating continuous innovation in manufacturing processes and quality assurance protocols across the market.

The product description highlights an intricate manufacturing paradigm that typically involves several advanced steps. This includes meticulous washing procedures to remove particulates, precise siliconization to ensure smooth plunger movement and drug stability, and an exacting depyrogenation process, predominantly utilizing dry heat, to effectively eliminate heat-stable bacterial endotoxins. Following these steps, the vials undergo terminal sterilization, often achieved through validated methods such as vaporized hydrogen peroxide (VHP) or gamma irradiation, to eradicate all microbial life. These ready-to-fill (RTF) vials significantly optimize and streamline pharmaceutical manufacturing operations by obviating the need for extensive in-house vial preparation by drug manufacturers, consequently mitigating potential contamination risks, reducing operational expenditures, and accelerating time-to-market for novel therapeutic agents.

Major applications for depyrogenated sterile empty vials span across critical therapeutic areas, including but not limited to advanced oncology treatments, immunology, infectious disease management, and the burgeoning field of gene and cell therapies. The manifold benefits derived from their use are compelling: they significantly enhance patient safety by minimizing the risk of microbial and pyrogenic contamination, drastically improve manufacturing efficiency through the elimination of redundant preparatory steps, and unequivocally ensure robust compliance with rigorous global pharmacopeia standards (e.g., USP, EP, JP). Key driving factors underpinning the market's robust growth trajectory include the exponential expansion of the biopharmaceutical sector, the escalating global demand for sophisticated injectable drug delivery systems, and the imperative for pharmaceutical companies to rigorously adhere to evolving and increasingly demanding regulatory guidelines pertaining to product sterility, quality, and overall patient protection.

Depyrogenated Sterile Empty Vials Market Executive Summary

The Depyrogenated Sterile Empty Vials Market is currently undergoing a period of significant expansion, primarily propelled by the burgeoning global biopharmaceutical industry and the escalating worldwide demand for advanced injectable therapeutics and crucial vaccines. Current business trends conspicuously indicate a pronounced strategic emphasis on advanced automation, the comprehensive digitalization of manufacturing workflows, and the proactive adoption of next-generation materials designed to bolster vial integrity and enhance the stability of sensitive drug products. Pharmaceutical manufacturers are increasingly channeling investments into high-speed, aseptic filling lines specifically engineered for compatibility with ready-to-use vials, aiming to dramatically improve throughput capacities, optimize operational efficiencies, and drastically reduce the critical time-to-market for novel drug formulations. Concurrently, a growing imperative exists for developing sustainable packaging solutions and fortifying supply chain resilience, driven by both escalating environmental consciousness and the need to mitigate vulnerabilities exposed by geopolitical instabilities and global health crises.

An analysis of regional trends illuminates North America and Europe as historically established and leading markets, characterized by highly stringent regulatory frameworks, substantial investments in pharmaceutical research and development, and the concentrated presence of numerous global pharmaceutical and biotechnology industry leaders. These regions consistently spearhead innovation in vial technology, material science, and aseptic processing methodologies. Conversely, the Asia Pacific region is rapidly emerging as an exceptionally high-growth market, invigorated by the rapid expansion of healthcare infrastructure, escalating pharmaceutical manufacturing capabilities, and a rising incidence of chronic diseases across its vast populations. Key economies within APAC, such as China and India, are progressively evolving into pivotal global manufacturing hubs, attracting significant foreign direct investment in sterile packaging solutions due to their immense patient bases and burgeoning healthcare expenditures.

Segment-specific trends underscore the enduring dominance of glass vials, particularly those made from Type I borosilicate glass, owing to their superior chemical inertness, excellent barrier properties, and proven track record in drug containment. Nevertheless, polymer-based alternatives are steadily gaining market traction, especially for niche applications demanding enhanced break resistance, lighter weight, and greater design flexibility. Vials with capacities spanning from 1ml to 20ml are experiencing particularly robust demand, adeptly catering to the precise dosing requirements characteristic of sensitive biologics and high-value drug products. The oncology and vaccine segments are projected to be major catalysts for market growth, underpinned by relentless ongoing research into novel cancer therapies, breakthrough immunotherapies, and continuous, large-scale global vaccination initiatives. Furthermore, the increasing strategic outsourcing of pharmaceutical manufacturing activities to specialized Contract Manufacturing Organizations (CMOs) is profoundly boosting the sustained demand for high-quality, pre-processed and ready-to-fill vials.

AI Impact Analysis on Depyrogenated Sterile Empty Vials Market

User inquiries pertaining to the transformative impact of artificial intelligence (AI) on the Depyrogenated Sterile Empty Vials Market frequently center on how AI can fundamentally enhance manufacturing efficiency, dramatically improve quality control processes, strategically optimize complex supply chain logistics, and ultimately contribute to significant cost reductions across the entire production lifecycle. Common user questions often delve into AI's profound potential in implementing predictive maintenance protocols for sophisticated sterile filling lines, enabling highly accurate automated visual inspection of vials for microscopic defects, and its crucial role in ensuring rigorous compliance with an increasingly intricate and dynamic regulatory landscape. Furthermore, users are keenly interested in understanding how AI can accelerate the production throughput of these critically important components and how it might facilitate greater operational flexibility and responsiveness in effectively meeting fluctuating pharmaceutical demands, particularly during periods of unprecedented global public health crises or rapid market shifts.

- Enhanced Automated Optical Inspection: AI-powered vision systems are revolutionizing quality control by enabling ultra-high-speed and precise detection of microscopic defects, hairline cracks, cosmetic flaws, and particulate matter within empty vials. These advanced systems surpass human capabilities in consistency and accuracy, leading to superior quality assurance, drastically reduced rejection rates, and improved overall product conformity.

- Predictive Maintenance and Operational Uptime: AI algorithms meticulously analyze vast datasets gathered from manufacturing equipment sensors, including temperature, pressure, vibration, and throughput rates, to accurately predict potential mechanical failures or process deviations. This foresight allows for proactive, scheduled maintenance interventions, significantly minimizing unplanned downtime in critical sterile filling and processing lines, thereby ensuring uninterrupted and efficient production cycles.

- Supply Chain Optimization and Resilience: AI tools can leverage advanced analytics to forecast market demand for various vial types and capacities with unprecedented accuracy. This enables optimized inventory management for both raw materials and finished vials, streamlines logistics and distribution routing, and enhances overall supply chain transparency and resilience. The result is reduced lead times, lower warehousing costs, and a more robust ability to respond to market fluctuations or unexpected disruptions.

- Process Optimization and Yield Improvement: Machine learning models are being deployed to identify and fine-tune optimal parameters for critical vial processing steps, including washing, siliconization, depyrogenation, and sterilization. By continuously analyzing process data, AI can achieve superior consistency in quality, reduce energy consumption associated with high-temperature processes, minimize resource waste, and ultimately lead to significantly higher yields of compliant, ready-to-fill vials.

- Accelerated Drug Development Support and Market Responsiveness: While not directly impacting vial manufacturing, AI's transformative role in accelerating pharmaceutical research, drug discovery, and development of novel biologics and advanced therapies inherently amplifies the demand for specialized, high-quality sterile vials. This accelerated drug pipeline necessitates that vial manufacturers leverage AI to enhance their agility and responsiveness, enabling faster production cycles and more adaptable supply capabilities to meet the emergent needs of the rapidly evolving pharmaceutical landscape.

- Regulatory Compliance and Data Management: AI-driven systems can assist in real-time data collection, analysis, and reporting across manufacturing stages, ensuring continuous adherence to complex regulatory standards. This capability aids in generating comprehensive audit trails, identifying deviations proactively, and simplifying the preparation of regulatory submissions, thereby reducing the burden of compliance and improving data integrity.

DRO & Impact Forces Of Depyrogenated Sterile Empty Vials Market

The Depyrogenated Sterile Empty Vials Market is profoundly influenced by a dynamic confluence of drivers, inherent restraints, emergent opportunities, and overarching external impact forces. Foremost among the significant drivers is the relentless and expansive growth of the global biopharmaceutical industry, which inherently necessitates high-quality, sterile, and inert primary packaging solutions for its increasingly complex and sensitive drug products, including novel biologics and advanced therapies. The escalating worldwide prevalence of chronic and infectious diseases, concurrently leading to a surge in demand for sophisticated injectable medications and a global emphasis on robust vaccination programs, further acts as a powerful catalyst for market expansion. Furthermore, the extremely stringent regulatory mandates promulgated by authoritative bodies such as the U.S. FDA, EMA, and other national pharmacopeias for sterile drug packaging rigorously compel pharmaceutical manufacturers to exclusively utilize meticulously pre-processed vials, thereby unequivocally ensuring paramount product safety, stability, and therapeutic efficacy. These synergistic factors collectively cultivate a robust and continuously expanding demand environment for depyrogenated sterile empty vials.

However, the market also navigates a landscape punctuated by several considerable restraints that temper its growth potential. The inherently high manufacturing costs, which encompass substantial capital investments in specialized processing equipment, the maintenance of ultra-controlled cleanroom environments, and exhaustive quality control measures, represent a significant financial challenge for market participants. The intricate and often globally dispersed supply chain, which typically encompasses multiple complex stages from the sourcing of specialized raw materials to the meticulously controlled final product delivery, introduces inherent logistical hurdles, potential vulnerabilities to disruptions, and challenges in maintaining consistent quality. Furthermore, the market faces increasing competitive pressure from innovative alternative drug delivery systems, notably pre-filled syringes, cartridges, and auto-injectors, which can potentially limit market penetration and expansion for traditional vials in specific therapeutic applications. Additionally, volatility in the prices of critical raw materials, particularly for specialized borosilicate glass, directly impacts production costs and profit margins for vial manufacturers, necessitating agile pricing strategies and efficient procurement.

Despite these aforementioned challenges, numerous compelling opportunities are emerging that promise to fuel substantial market expansion. Rapidly developing economies, characterized by their burgeoning healthcare infrastructure and expanding patient populations, represent largely untapped or under-penetrated markets ripe for the adoption of sophisticated sterile packaging solutions. The burgeoning fields of personalized medicine, targeted therapies, and the development of highly potent, small-batch drug products are opening entirely new avenues for highly specialized, smaller-capacity, and customized vials. Concurrent advancements in material science are leading to the development of enhanced glass formulations with superior hydrolytic resistance and reduced delamination potential, as well as novel polymer-based alternatives offering improved break resistance and thermal performance. Moreover, continuous technological advancements in automated inspection systems and advanced aseptic processing lines consistently promise to significantly enhance manufacturing efficiency, elevate product quality, and further solidify the market's robust growth trajectory. The imperative for resilient and secure packaging supply chains, particularly highlighted during public health crises, will also fundamentally underscore the intrinsic value and critical importance of depyrogenated sterile empty vials in global healthcare delivery.

- Drivers:

- Surging growth and expansion within the global biopharmaceutical and biotechnology industries, driving demand for advanced packaging.

- Increasing global prevalence of chronic diseases (e.g., diabetes, autoimmune disorders, cancer) necessitating regular injectable drug administration.

- Rising demand for vaccines worldwide, including for infectious disease prevention, seasonal flu, and emergent global pandemics.

- Strict and continuously evolving global regulatory requirements from health authorities for sterile pharmaceutical packaging, mandating high quality.

- Heightened emphasis on patient safety and the absolute reduction of drug contamination risks during manufacturing and administration.

- Significant advantages offered by ready-to-fill (RTF) vials in streamlining and optimizing complex pharmaceutical manufacturing processes, reducing operational burden.

- Technological advancements leading to improved vial performance, such as enhanced barrier properties and reduced drug interaction.

- Restraints:

- High capital investment and substantial operational costs associated with specialized manufacturing, cleanroom maintenance, and stringent quality control of sterile vials.

- Complex and often globally fragmented supply chains, susceptible to geopolitical disruptions, raw material shortages, and logistical challenges.

- Intense competition from sophisticated alternative drug delivery systems, including pre-filled syringes, auto-injectors, and cartridges, which offer convenience.

- Potential for significant raw material price fluctuations, particularly for Type I borosilicate glass, impacting production economics and profitability.

- Challenges inherent in effectively managing, mitigating, and minimizing sub-visible and visible particulate contamination throughout the manufacturing and handling processes.

- The energy-intensive nature of depyrogenation and sterilization processes contributing to operational costs and environmental footprint concerns.

- Opportunities:

- Significant expansion potential into rapidly developing emerging markets with burgeoning healthcare sectors and increasing pharmaceutical consumption.

- The burgeoning development of advanced therapies, such as gene therapy, cell therapy, and mRNA vaccines, which require highly specialized and premium packaging.

- Continuous technological advancements in vial materials, surface coatings, smart packaging features, and manufacturing automation for enhanced efficiency and quality.

- Increasing strategic outsourcing of pharmaceutical manufacturing and packaging operations to specialized Contract Manufacturing Organizations (CMOs) and CDMOs.

- Growing demand for customized vial solutions tailored for personalized medicine approaches and niche therapeutic applications requiring unique specifications.

- Leveraging digitalization and data analytics to optimize production and supply chain management for greater responsiveness.

- Impact Forces:

- Evolving global regulatory landscape and dynamic changes in pharmacopeia standards, necessitating continuous adaptation by manufacturers.

- Rapid technological innovations in aseptic filling and finishing processes within pharmaceutical companies, influencing vial design requirements.

- Prevailing global economic conditions, including GDP growth, healthcare spending, and R&D investment levels, directly impacting market demand.

- Public health emergencies, pandemics, and disease outbreaks driving urgent and often unprecedented demand for vaccines and therapeutics.

- Escalating environmental concerns and corporate social responsibility (CSR) initiatives pushing for more sustainable and eco-friendly packaging solutions.

- Geopolitical stability or instability impacting global supply chains and trade dynamics for pharmaceutical components.

Segmentation Analysis

The Depyrogenated Sterile Empty Vials Market undergoes extensive segmentation to furnish a granular and comprehensive understanding of its multifaceted components, thereby enabling strategic and informed decision-making for all market stakeholders. These robust segmentations meticulously classify the market based on several critical criteria, including the primary material utilized for vial construction, the specific volumetric capacity of the vials, the diverse range of therapeutic applications they are intended to serve, and the distinct end-user industries that actively procure and consume these essential packaging solutions. This detailed and granular analytical framework facilitates an in-depth examination of prevailing demand patterns, technological adoption preferences, and the anticipated growth trajectories across various discrete sub-markets, effectively highlighting lucrative market niches and identifying emergent industry trends. A profound comprehension of these intricate segments is unequivocally crucial for manufacturers to precisely tailor their product portfolios and innovation strategies, and equally vital for pharmaceutical companies to meticulously select optimal and compliant primary packaging solutions that align with their specific drug product requirements and regulatory obligations.

- By Material:

- Glass Vials: Predominantly Type I Borosilicate Glass, known for exceptional chemical resistance and thermal stability.

- Polymer Vials: Includes materials like Cyclic Olefin Polymer (COP) and Cyclic Olefin Copolymer (COC), valued for break resistance and lightweight properties.

- By Type:

- Clear Vials: Standard transparent vials suitable for most drug products, allowing visual inspection.

- Amber Vials: Opaque vials designed specifically for packaging light-sensitive drug formulations, providing UV protection.

- By Capacity:

- 1ml - 5ml: Small capacity vials often used for high-value biologics, vaccines, and pediatric formulations.

- 5ml - 20ml: Medium capacity vials widely utilized across a broad range of injectable drugs and multi-dose applications.

- 20ml - 50ml: Larger capacity vials for specialized applications, often including infusions or bulk drug products.

- >50ml: Very large capacity vials for specific bulk pharmaceutical intermediates or hospital compounding.

- By Application:

- Biologics: Encompasses monoclonal antibodies, recombinant proteins, and advanced therapeutic medicinal products (ATMPs).

- Vaccines: Includes preventative vaccines for infectious diseases, seasonal flu, and emerging pandemic-related vaccines.

- Oncology Drugs: Packaging for cytotoxic drugs, targeted cancer therapies, and supportive care injectables.

- Antibiotics: Sterile vials for various injectable antibiotic formulations.

- Other Injectable Drugs: Covers a wide array of therapeutics such as anesthetics, corticosteroids, cardiovascular drugs, and hormonal therapies.

- By End User:

- Pharmaceutical & Biotechnology Companies: Major consumers for in-house manufacturing and packaging of their drug pipelines.

- Contract Manufacturing Organizations (CMOs) & Contract Development and Manufacturing Organizations (CDMOs): Providers of outsourced manufacturing and packaging services to multiple pharma clients.

- Research & Academic Institutions: Utilize vials for drug discovery, preclinical studies, and clinical trial material preparation.

- Hospitals & Clinics: For pharmacy compounding, specific patient treatments, and emergency drug preparedness.

Value Chain Analysis For Depyrogenated Sterile Empty Vials Market

The intricate value chain for the Depyrogenated Sterile Empty Vials Market commences with a comprehensive upstream analysis, which primarily focuses on the critical procurement of foundational raw materials. This initial stage predominantly involves specialized glass manufacturers that supply ultra-high-quality Type I borosilicate glass tubing, recognized globally as the indispensable foundational material for the vast majority of pharmaceutical vials due to its unparalleled chemical inertness, exceptional thermal shock resistance, and minimal extractables. Complementary upstream suppliers also include those specializing in the provision of precision-engineered rubber stoppers, hermetic aluminum caps, and pharmaceutical-grade siliconization agents, all of which represent crucial secondary packaging components that engage in direct contact with the drug product and therefore necessitate equally rigorous quality and sterility standards. The inherent quality, compositional consistency, and stringent compliance of these procured raw materials directly and profoundly influence the ultimate integrity, performance, and regulatory acceptance of the final depyrogenated sterile empty vial product.

Midstream activities encapsulate the core manufacturing and specialized processing of the vials, representing the most technologically intensive segment of the value chain. This phase typically commences with advanced glass forming and molding processes to create the basic vial structure, which is then followed by a meticulously choreographed series of highly specialized and validated steps: thorough washing to remove any residual particulate matter, precise siliconization to facilitate optimal stopper glide and minimize drug adsorption, followed by robust depyrogenation. Depyrogenation is usually achieved through specialized dry heat tunnels operating at extremely high temperatures (ee.g., typically ranging from 300°C to 350°C) to effectively destroy and eliminate bacterial endotoxins. Subsequent to this, terminal sterilization techniques, often employing validated methods such as vaporized hydrogen peroxide (VHP), gamma irradiation, or electron beam (E-beam) sterilization, are meticulously applied to ensure the complete and unequivocal elimination of all microbial life, thereby rendering the vials truly sterile and ready for demanding aseptic filling operations. All these intricate processes are rigorously conducted within certified ISO-compliant cleanroom environments, adhering strictly to cGMP (current Good Manufacturing Practice) standards, with relentless in-process quality control and comprehensive inspection being absolutely integral at every stage.

The downstream analysis comprehensively addresses the various distribution channels and the ultimate end-users of the depyrogenated sterile empty vials. Once manufactured, these meticulously processed vials are carefully packaged within robust sterile barrier systems to maintain their integrity and then transported to their primary destinations: leading pharmaceutical and biotechnology companies, specialized contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs), and advanced research laboratories globally. The distribution paradigm can operate through both direct sales channels, where prominent vial manufacturers establish direct relationships and supply agreements with major pharmaceutical clients, and through indirect channels involving specialized distributors and expert third-party logistics (3PL) providers. These intermediaries perform a crucial function in managing complex inventory, handling specialized transport requirements for sterile goods, and effectively reaching a broader and more geographically diverse base of smaller and medium-sized end-users. The final, critical stage involves the seamless integration of these high-quality vials into pharmaceutical companies' high-speed, aseptic filling and finishing lines for the final packaging of sensitive drug products, underscoring the vial's role as a critical component in ensuring drug product safety and delivery.

Depyrogenated Sterile Empty Vials Market Potential Customers

The primary end-users and key buyers of depyrogenated sterile empty vials are predominantly entities operating within the highly regulated and quality-driven pharmaceutical and biotechnology sectors, where the integrity, sterility, and uncompromised safety of injectable drug products are of paramount importance. Pharmaceutical companies, ranging extensively from established multinational corporations with vast product portfolios to innovative emerging biotech startups at the forefront of medical advancements, constitute the most significant and consistent customer base. These diverse companies universally require meticulously pre-processed vials for their sophisticated in-house manufacturing operations, encompassing a vast array of therapeutic categories, including small molecule injectables, complex biologics, life-saving vaccines, and cutting-edge advanced therapies like gene and cell therapies. The inherent convenience, combined with the substantially reduced risk of contamination offered by ready-to-use vials, aligns seamlessly with their stringent quality control protocols, efficiency objectives, and accelerated time-to-market strategies.

Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) represent another critically important and rapidly expanding segment of potential customers for depyrogenated sterile empty vials. As pharmaceutical companies increasingly opt to strategically outsource their manufacturing, filling, and packaging operations to specialized, third-party service providers, CMOs and CDMOs have consequently emerged as major, high-volume procurers of depyrogenated sterile empty vials. These specialized organizations serve a multitude of clients simultaneously, frequently necessitating a flexible and consistently high-volume supply of diverse vial types, capacities, and specifications to adeptly accommodate a wide array of drug formulations, therapeutic indications, and unique client requirements. Their collective demand for sterile vials is directly and positively correlated with the overarching growth in pharmaceutical outsourcing trends and the continuously expanding global pipeline of novel drug candidates entering clinical development and commercialization.

Furthermore, distinguished research and academic institutions, particularly those intensely involved in various stages of preclinical and clinical drug development, as well as fundamental pharmaceutical research, also serve as significant potential customers. These entities require a steady supply of sterile vials for a multitude of research applications, intricate small-batch formulation studies, stability testing, and the preparation of investigational new drug (IND) submissions for regulatory bodies. While the individual procurement volumes from these institutions might be comparatively lower when contrasted with large-scale pharmaceutical manufacturers, their collective and consistent demand contributes meaningfully to the overall market. Moreover, specialized vaccine manufacturers, in particular, constitute a dedicated and continuously growing customer segment, especially given the ongoing global health initiatives, the rapid pace of vaccine development, and the critical need for efficient and secure deployment of extensive vaccination programs that fundamentally rely on sterile, high-quality vial packaging for effective global distribution and administration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $3.5 Billion |

| Market Forecast in 2032 | $6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schott AG, Gerresheimer AG, Stevanato Group, SGD Pharma, Corning Incorporated, Nipro Corporation, Bormioli Pharma S.p.A., DWK Life Sciences, Shandong Pharmaceutical Glass Co. Ltd., Piramal Glass (Piramal Enterprises Ltd.), West Pharmaceutical Services Inc., Aptar Pharma, Datwyler Holding AG, Ompi (Stevanato Group), ARTEK, Nuova Ompi S.r.l., Thermo Fisher Scientific Inc., Merck KGaA, Avantor Inc., Kimble Chase (DWK Life Sciences), Pacific World Corporation, Consol Glass, Origin Pharma Packaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Depyrogenated Sterile Empty Vials Market Key Technology Landscape

The manufacturing ecosystem for depyrogenated sterile empty vials is underpinned by a highly sophisticated and continuously evolving technology landscape, engineered to consistently deliver unparalleled levels of quality, assured sterility, and operational efficiency. Central to this landscape are advanced automated optical inspection systems, which frequently incorporate cutting-edge high-resolution cameras integrated with artificial intelligence (AI)-powered image recognition algorithms. These systems are absolutely crucial for detecting even minute defects, sub-visible particulate matter, and subtle cosmetic imperfections in empty vials at exceptionally high throughput speeds. This technological prowess is vital for meticulously maintaining product integrity, ensuring robust compliance with increasingly stringent pharmacopeial requirements, and minimizing costly batch rejections within the pharmaceutical production environment. Furthermore, sophisticated robotic handling systems are extensively deployed throughout the entire manufacturing process, from initial vial washing and subsequent processing to final sterile packaging, thereby significantly minimizing human intervention and concomitantly reducing the inherent risk of contamination while maximizing overall production throughput and consistency.

Cleanroom technology forms the fundamental backbone of sterile vial production, with purpose-built facilities meticulously designed, constructed, and rigorously maintained to stringently meet international standards such as ISO 14644-1 and adhere to the demanding current Good Manufacturing Practice (cGMP) regulations. These highly controlled environments meticulously regulate airborne particulate matter, temperature, humidity, and pressure differentials, thereby creating optimal conditions essential for aseptic processing and preventing microbial ingress. Specialized depyrogenation tunnels, a core component of this technology landscape, utilize precisely controlled dry heat at exceptionally high temperatures (typically ranging, for example, from 300°C to 350°C) for a validated duration to effectively destroy and eliminate bacterial endotoxins (pyrogens), which is an absolutely critical step for ensuring the unwavering safety of any injectable pharmaceutical product. Subsequent to this thermal depyrogenation, a range of terminal sterilization techniques, including validated methods such as vaporized hydrogen peroxide (VHP), gamma irradiation, or electron beam (E-beam) sterilization, are meticulously employed to ensure the complete and irrefutable elimination of all microbial life, thereby rendering the vials unequivocally sterile and flawlessly ready for demanding aseptic filling operations.

Further technological advancements actively shaping this market include the development and implementation of innovative barrier isolation technologies, which provide an enhanced and robust protective shield during vial preparation, loading, and filling processes, thereby further minimizing contamination risks. The evolution of lyophilization-compatible vial designs is also significant, engineered to withstand the extreme temperature fluctuations and pressure differentials inherent in freeze-drying processes without compromising the vial's structural integrity, closure system, or drug stability. Ongoing research and development are also focused on advanced glass formulations, such as those exhibiting superior hydrolytic resistance and a reduced propensity for delamination, which contribute significantly to the overall technological evolution. Furthermore, continuous refinements in siliconization techniques and the application of advanced internal coatings are meticulously engineered to ensure optimal gliding properties for stoppers, minimize potential drug product interaction or adsorption, and prevent protein aggregation, thereby contributing synergistically to both manufacturing efficiency and the long-term stability and efficacy of the contained drug product. The comprehensive integration and continuous refinement of these diverse technologies ensure that depyrogenated sterile empty vials consistently meet and exceed the increasingly complex and evolving demands of the global pharmaceutical industry, addressing both current challenges and future therapeutic innovations.

Regional Highlights

- North America: North America commands a leading and substantial share in the Depyrogenated Sterile Empty Vials Market, predominantly propelled by its exceptionally robust pharmaceutical and biotechnology sectors, which consistently allocate significant investments into research and development initiatives. The region benefits from the stringent and globally recognized regulatory frameworks enforced by the U.S. FDA, which necessitate the uncompromising utilization of ultra-high-quality sterile packaging solutions. Continuous innovation in advanced drug development, particularly within the burgeoning fields of biologics, personalized medicine, and oncology, further acts as a powerful catalyst for sustained market expansion. The presence of a highly advanced healthcare infrastructure and consistently high healthcare expenditures also substantially contribute to a strong and unwavering demand for ready-to-use injectable drug containers across various therapeutic areas.

- Europe: Europe represents another highly mature, prominent, and influential market within the depyrogenated sterile empty vials landscape. This region is distinguished by its advanced pharmaceutical manufacturing capabilities, world-class research institutions, and an unwavering emphasis on rigorous regulatory compliance, expertly overseen by agencies such as the European Medicines Agency (EMA) and various national bodies. Key countries within Europe, including Germany, France, Switzerland, and Italy, are home to a concentration of leading global pharmaceutical companies and highly specialized packaging manufacturers, collectively driving relentless innovation in vial technology, material science, and state-of-the-art aseptic processing methodologies. The region's aging demographic profile and the increasing prevalence of chronic diseases contribute significantly to a sustained and growing demand for injectable therapies and vaccines, consequently reinforcing the robust market for high-quality depyrogenated sterile empty vials. There is also a pronounced and growing trend towards investing in sustainable and environmentally responsible manufacturing practices within the European pharmaceutical packaging sector.

- Asia Pacific (APAC): The Asia Pacific (APAC) region is unequivocally projected to exhibit the highest and most dynamic growth rate in the Depyrogenated Sterile Empty Vials Market throughout the forecast period. This rapid expansion is primarily attributable to the swift development and modernization of healthcare infrastructure across the region, significant increases in pharmaceutical manufacturing outsourcing activities, and the presence of a burgeoning and vast patient population. Major economies within APAC, such as China, India, Japan, and South Korea, are experiencing substantial and strategic investments in biotechnology and pharmaceutical production capabilities, leading directly to a significant surge in demand for high-quality sterile packaging solutions. The rising incidence of both infectious and chronic diseases, coupled with proactive government initiatives aimed at enhancing healthcare access and affordability, further catalyzes profound market expansion in this incredibly dynamic and strategically important region. Local manufacturing capacities are also rapidly expanding to meet both domestic healthcare needs and international export demands.

- Latin America: Latin America is experiencing a steady and consistent growth trajectory in the depyrogenated sterile empty vials market, a trend influenced by improving public healthcare access, increasing domestic pharmaceutical production capacities, and growing strategic investments in localized manufacturing facilities across the region. Prominent countries such as Brazil, Mexico, and Argentina are actively expanding their capabilities for pharmaceutical drug production, which, in turn, directly stimulates and sustains the demand for high-quality sterile packaging solutions. The region's strategic focus on the manufacturing of generic drug products and the expansion of vaccine production initiatives contributes significantly to market consumption, albeit with a recognition of varying regulatory landscapes and economic conditions that exist across different nations within Latin America.

- Middle East and Africa (MEA): The Middle East and Africa (MEA) region is gradually but steadily expanding its footprint within the depyrogenated sterile empty vials market. This nascent growth is primarily driven by rising healthcare expenditure across the region, concerted government efforts aimed at diversifying economies beyond traditional oil reliance, and increasing governmental support and investment for the domestic pharmaceutical sector. Countries such as Saudi Arabia, the UAE, and South Africa are leading these developmental efforts, actively investing in pharmaceutical manufacturing infrastructure and bolstering local research and development capabilities. While the current market size in MEA remains comparatively smaller than other established regions, the ongoing establishment of new local drug production facilities, combined with increasing health awareness and improving access to modern medicine, is expected to foster a significant and sustained demand for sterile empty vials in the coming years, positioning the region for future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Depyrogenated Sterile Empty Vials Market.- Schott AG

- Gerresheimer AG

- Stevanato Group

- SGD Pharma

- Corning Incorporated

- Nipro Corporation

- Bormioli Pharma S.p.A.

- DWK Life Sciences

- Shandong Pharmaceutical Glass Co. Ltd.

- Piramal Glass (Piramal Enterprises Ltd.)

- West Pharmaceutical Services Inc.

- Aptar Pharma

- Datwyler Holding AG

- Ompi (Stevanato Group)

- ARTEK Group

- Nuova Ompi S.r.l.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantor Inc.

- Kimble Chase (DWK Life Sciences)

- Pacific World Corporation

- Consol Glass (Pty) Ltd.

- Origin Pharma Packaging

- ACG Group

- Drug Plastics & Glass Co., Inc.

Frequently Asked Questions

What are depyrogenated sterile empty vials and why are they essential for pharmaceuticals?

Depyrogenated sterile empty vials are specialized glass or polymer containers that have undergone rigorous processes of cleaning, depyrogenation (elimination of bacterial endotoxins), and terminal sterilization, ensuring they are entirely free from microbial contaminants and pyrogens. They are absolutely essential for the safe and compliant packaging of injectable pharmaceutical products, critical vaccines, and complex biologics, as they eliminate the necessity for extensive in-house preparation by drug manufacturers, thereby significantly reducing contamination risks, enhancing manufacturing efficiency, and ensuring compliance with global regulatory standards for patient safety.

How does the depyrogenation process ensure the safety of injectable drug products?

Depyrogenation primarily involves exposing vials to high, precisely controlled dry heat, typically maintained at temperatures exceeding 300°C for a validated duration. This intense thermal treatment is highly effective in destroying and oxidizing pyrogens, particularly bacterial endotoxins, which are heat-stable lipopolysaccharides capable of inducing fever and severe adverse reactions if introduced into the human bloodstream. This critical processing step rigorously ensures that the vials consistently meet the most stringent regulatory standards for the safety of injectable drugs, thereby safeguarding patient health and preventing complications.

What are the primary drivers propelling the growth of the Depyrogenated Sterile Empty Vials Market?

The market's robust growth is primarily driven by the dynamic expansion of the global biopharmaceutical industry, which demands high-quality sterile packaging for new drug products. Additionally, the escalating worldwide demand for vaccines and injectable drugs, spurred by the rising prevalence of chronic and infectious diseases, plays a significant role. Stringent global regulatory requirements for sterile packaging, coupled with the operational efficiencies and reduced contamination risks offered by ready-to-fill vial solutions, also act as powerful catalysts for sustained market expansion.

What impact do alternative drug delivery systems have on the traditional vials market?

Alternative drug delivery systems, such as pre-filled syringes, specialized cartridges, and user-friendly auto-injectors, present a notable competitive restraint on the traditional depyrogenated sterile empty vials market. While these alternatives offer enhanced convenience and ease of administration for specific applications, particularly in patient self-administration, depyrogenated sterile empty vials retain their critical importance for multi-dose formulations, highly specialized biologics, complex reconstitutions, and large-volume parenteral applications. Their continued relevance and growth are ensured within these specific therapeutic and logistical domains, adapting to evolving drug product characteristics and administration needs.

Which geographical regions are the most significant contributors to the Depyrogenated Sterile Empty Vials Market?

North America and Europe currently represent the most significant and established contributors to the market, driven by their highly developed pharmaceutical industries, extensive investments in research and development, and exceptionally stringent regulatory environments. However, the Asia Pacific (APAC) region is rapidly emerging as the fastest-growing market, propelled by its expanding healthcare infrastructure, increasing pharmaceutical manufacturing capabilities, and substantial investments in biotechnology. This makes APAC a crucial region for future market expansion and innovation in sterile packaging solutions, attracting global players seeking growth opportunities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager